Renko Chart Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

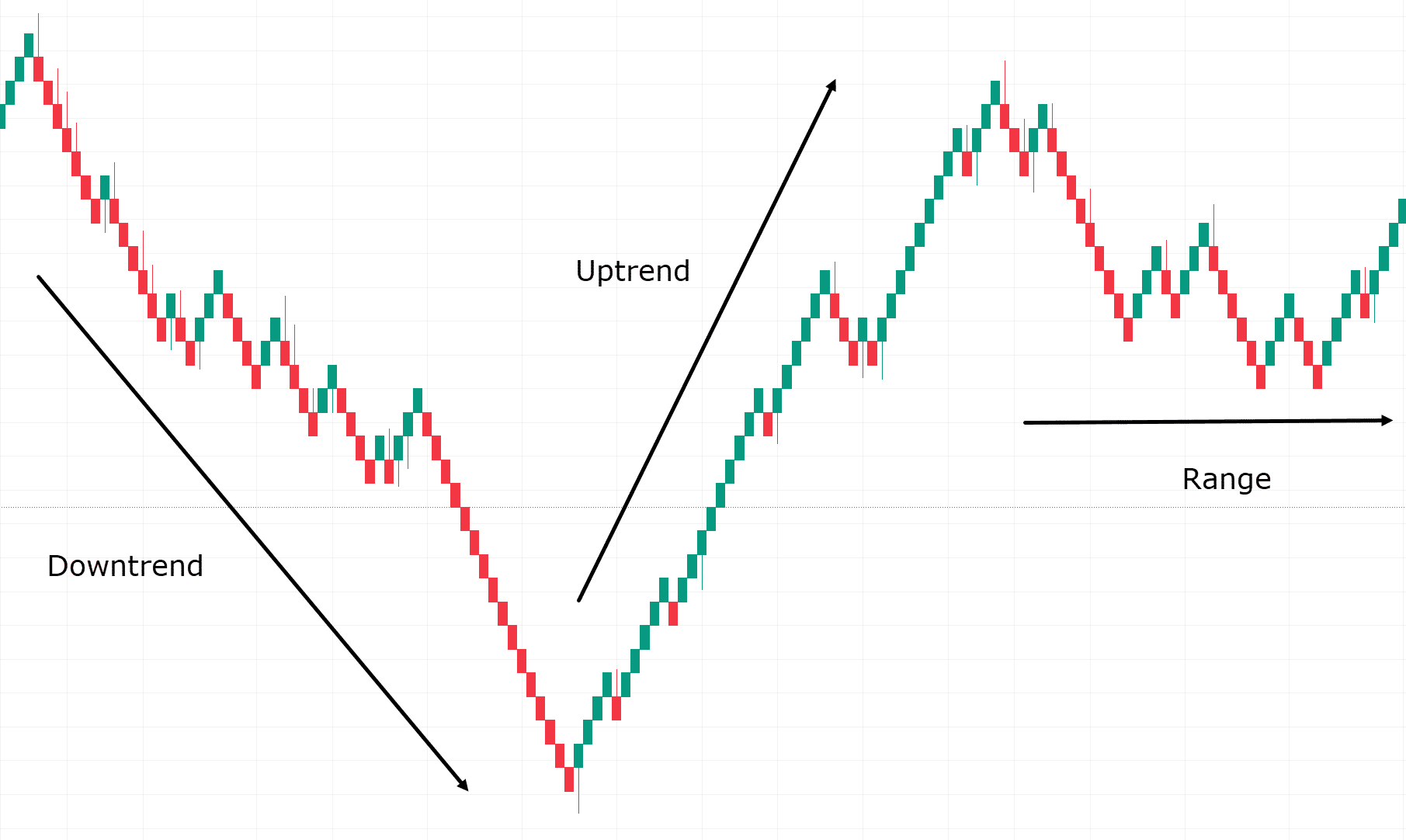

Introduction to Renko Charts Renko charts financial markets mein price movements ko dikhanay ka aik khaas tareeqa hain, jis mein forex market bhi shamil hai. Traditional candlestick ya bar charts ki tarah, jo ke price ko waqt ke sath plot karte hain, Renko charts sirf price movements par tawajju dete hain aur waqt ke asalay ko nikal dete hain. Ye charting ka tareeqa Japan se shuru hua hai aur is ka naam renga se liya gaya hai, jo ke Japanese zaban mein bricks ka matlab rakhta hai. Renko charts price movements ko specified size ki bricks ya blocks se represent karte hain, aur ye traders ko market trends aur potential trading opportunities ke liye ahem wazehatein faraham kar sakte hain.Renko Chart Construction Renko chart mein har brick aik khaas price movement ko represent karta hai, aur ye bricks aik dosray ke sath 45-degree ke angle par plot kiye jate hain. Agar price predefined value ke paray mein chali jati hai, toh ek naya brick usi direction mein add kiya jata hai. Agar price pichlay brick ke upper edge se oopar chali jati hai, toh aik naya bullish (up) brick banaya jata hai. Umgeer, agar price pichlay brick ke lower edge se neeche chali jati hai, toh aik naya bearish (down) brick banaya jata hai. Ye bricks ki size trader dwara tay ki jati hai aur isay price movements ke liye chahiye wazehgi ke level par adjust kiya ja sakta hai.

Advantages of Renko Charts Renko charts ki aik bari faida ye hai ke ye market ki shorat ko filter kar ke sirf ahem price movements par tawajju dene mein madad karte hain. Traditional candlestick charts kabhi kabhi choti price fluctuations se bhari hote hain, jiski wajah se ahem patterns ko pehchanana mushkil ho jata hai. Renko charts on the other hand, traders ko overall trend ko zyada wazeh tor par dekhne mein madad karte hain. Jab aik series of bricks consistent direction mein move hoti hai, toh ye aik strong trend ko indicate karta hai, jo ke bricks ki direction ke mutabiq bullish ya bearish hota hai. Renko charts ka aik faida ye bhi hai ke ye chart par waqt ka asar ko khatam kar dete hain. Ye traders ke liye bohot faida mand ho sakta hai jo sirf price action par tawajju dena chahte hain aur waqt ke asalay ke disturbances se bachna chahte hain. Time element ko remove kar ke, Renko charts market trends ka zyada wazeh tasweer faraham kar sakte hain aur traders ko ziada soch samajh ke decisions lene mein madad karte hain. Renko Chart Strategies Traders Renko charts ka analyze karne ke liye mukhtalif strategies istemal karte hain. Aik common approach ye hai ke woh potential trend reversals ya continuation ko indicate karne wale patterns aur formations ko dhundte hain. For example, aik reversal pattern tab hota hai jab aik series of bullish bricks ke baad aik bearish brick aata hai, jo ke market sentiment mein aik shift hone ki indication de sakta hai. Umgeer, aik continuation pattern tab paya jata hai jab aik series of bricks ek hi direction mein continue hoti hai, jis se ye zahir hota hai ke existing trend zyada dair tak qaim rahega. Aik aur popular strategy ye hai ke Renko charts ko dosri technical indicators ke sath combine kiya jaye takay entry aur exit points ko confirm kiya ja sake. Traders indicators jaise ke moving averages, relative strength index (RSI), ya stochastic oscillator ka istemal Renko charts ke sath kar ke entry aur exit points ko verify karne ke liye kar sakte hain. Multiple sources se aane wale signals ko cross-reference kar ke, traders apne trading decisions ki reliability ko barha sakte hain. Yaad rakha jaye ke jabke Renko charts ahem insights faraham karte hain, woh foolproof nahi hote. Ye kisi aur technical analysis tool ki tarah limitations rakhte hain aur inka sahi istemal aur risk management strategies ke sath istemal kiya jana chahiye. Iske ilawa, brick size ka intikhab Renko charts dawara generate kiye jane wale signals par bohot asar andaaz hota hai. Smaller brick sizes zyada sensitive signals faraham kar sakte hain lekin in mein zyada noise bhi ho sakti hai, jabke larger brick sizes zyada smooth trends offer karte hain lekin chand choti price movements ko miss kar sakte hain.

Advantages of Renko Charts Renko charts ki aik bari faida ye hai ke ye market ki shorat ko filter kar ke sirf ahem price movements par tawajju dene mein madad karte hain. Traditional candlestick charts kabhi kabhi choti price fluctuations se bhari hote hain, jiski wajah se ahem patterns ko pehchanana mushkil ho jata hai. Renko charts on the other hand, traders ko overall trend ko zyada wazeh tor par dekhne mein madad karte hain. Jab aik series of bricks consistent direction mein move hoti hai, toh ye aik strong trend ko indicate karta hai, jo ke bricks ki direction ke mutabiq bullish ya bearish hota hai. Renko charts ka aik faida ye bhi hai ke ye chart par waqt ka asar ko khatam kar dete hain. Ye traders ke liye bohot faida mand ho sakta hai jo sirf price action par tawajju dena chahte hain aur waqt ke asalay ke disturbances se bachna chahte hain. Time element ko remove kar ke, Renko charts market trends ka zyada wazeh tasweer faraham kar sakte hain aur traders ko ziada soch samajh ke decisions lene mein madad karte hain. Renko Chart Strategies Traders Renko charts ka analyze karne ke liye mukhtalif strategies istemal karte hain. Aik common approach ye hai ke woh potential trend reversals ya continuation ko indicate karne wale patterns aur formations ko dhundte hain. For example, aik reversal pattern tab hota hai jab aik series of bullish bricks ke baad aik bearish brick aata hai, jo ke market sentiment mein aik shift hone ki indication de sakta hai. Umgeer, aik continuation pattern tab paya jata hai jab aik series of bricks ek hi direction mein continue hoti hai, jis se ye zahir hota hai ke existing trend zyada dair tak qaim rahega. Aik aur popular strategy ye hai ke Renko charts ko dosri technical indicators ke sath combine kiya jaye takay entry aur exit points ko confirm kiya ja sake. Traders indicators jaise ke moving averages, relative strength index (RSI), ya stochastic oscillator ka istemal Renko charts ke sath kar ke entry aur exit points ko verify karne ke liye kar sakte hain. Multiple sources se aane wale signals ko cross-reference kar ke, traders apne trading decisions ki reliability ko barha sakte hain. Yaad rakha jaye ke jabke Renko charts ahem insights faraham karte hain, woh foolproof nahi hote. Ye kisi aur technical analysis tool ki tarah limitations rakhte hain aur inka sahi istemal aur risk management strategies ke sath istemal kiya jana chahiye. Iske ilawa, brick size ka intikhab Renko charts dawara generate kiye jane wale signals par bohot asar andaaz hota hai. Smaller brick sizes zyada sensitive signals faraham kar sakte hain lekin in mein zyada noise bhi ho sakti hai, jabke larger brick sizes zyada smooth trends offer karte hain lekin chand choti price movements ko miss kar sakte hain. Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

What is shutting cost Shutting Value Job in Forex Forex exchanging mein ikhtitami qeemat maloomat ka aik ahem hissa hai jo taajiron ko qeemti baseerat faraham kar sakti hai. yahan chand tareeqay hain jin se yeh taajiron ki madad kar sakta hai Perdiction of Benefit and Misfortune Poke tajir tijarat ko band karte hain to ikhtitami qeemat tijarat standard honay walay munafe ya nuqsaan ka hisaab laganay ke liye istemaal hoti hai. ikhtitami qeemat ko jaan kar, tajir is baat ka taayun kar satke hain ke unhon ne tijarat standard kitna munafe ya nuqsaan kya hai. Effeciency and Anylesis Ikhtitami qeemat ka istemaal tijarat ya tijarti hikmat e amli ki karkardagi ka jaiza lainay ke liye kya ja sakta hai. mukhtaliq exchanging ya hikmat amlyon ki ikhtitami qeematon ka mawazna kar ke, tajir is baat ki nishandahi kar satke hain ke kon si ziyada munafe bakhash hain aur is ke mutabiq apne nuqta nazar ko change kar satke hain . Tracking down Patterns ikhtitami qeemat taajiron ko market mein rujhanaat ki nishandahi karne mein bhi madad kar sakti hai. waqt ke sath band honay wali qeematon ko dekh kar, tajir yeh dekh satke hain ke aaya market oopar ya neechay ka rujhan hai aur is ke mutabiq apni tijarti hikmat amlyon ko change kar satke hain . Make Arrangement of Exchanging tajir mustaqbil ki tijarat ki mansoobah bandi ke liye ikhtitami qeemat ka bhi istemaal kar satke hain. mukhtalif money joron ki ikhtitami qeematon ka tajzia karkay, tajir mumkina tijarti mawaqay ki nishandahi kar satke hain aur is ke mutabiq apni tijarat ki mansoobah bandi kar satke hain. majmoi pinnacle standard, forex exchanging mein ikhtitami qeemat maloomat ka aik ahem hissa hai jisay tajir bakhabar tijarti faislay karne aur market mein apni karkardagi ko behtar bananay ke liye istemaal kar satke hain . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Renko Chart Pattern (Renko ChÄrt PÄá¹*arn) : Renko Chart Pattern, ek technical analysis ka aik tareeqa hai jo khas tor par price movement ko dekhne aur samajhne ke liye istemal hota hai. Yeh ek unik pattern hai jo candlesticks ya bar charts se mukhtalif hai. Renko charts ki pehchan un small rectangular blocks se hoti hai, jo "bricks" ke naam se jaani jaati hain. In bricks ki size, price movement par mabni hoti hai, is liye yeh ek aise tarika hai jis mein sirf price changes ko dekha jata hai, aur time ka koi ahmiyat nahi hoti. Renko charting technique, Japan mein develop hui aur "Renko" shabd ka matlab hota hai "renga" ya "brick." Har brick ka size user ke pasand ya trading style ke mutabiq set kiya ja sakta hai. Agar price movement ek specific amount se zyada hojati hai, toh ek naya brick banti hai, lekin agar movement isse kam hoti hai, toh koi naya brick nahi banega. Is charting technique ka sabse bada faida yeh hai ke yeh noise aur market volatility ko kam kar deta hai, aur traders ko clear aur precise signals provide karta hai. Renko charts par trading karne ke liye, traders ko price trends aur reversals ko samajhna hota hai. Renko charts ka istemal trend identification ke liye kafi acha hai. Agar bricks upar ki taraf bante hain, toh yeh bullish trend ko darust karta hai, jabke agar bricks neeche ki taraf bante hain, toh yeh bearish trend ko darust karta hai. Jab price direction change hoti hai, Renko charts par new bricks ka pattern banta hai, jisse trend reversal ko indicate kiya ja sakta hai. Renko charts mein trading signals ko identify karne ke liye traders different technical indicators jaise ke moving averages, RSI, aur MACD ka bhi istemal karte hain. In indicators ki madad se traders ko buy aur sell signals milte hain, jo unko trading decisions mein madadgar hoti hain. Lekin yaad rahe ke Renko charts ki kuch limitations bhi hain. Yeh charts short-term trading ke liye adhik upyogi hote hain, lekin long-term analysis ke liye kam mufeed hote hain. Iske alawa, market mein choppy ya sideways movement ke doran Renko charts ki accuracy kam ho sakti hai. In conclusion, Renko charts ek powerful technical analysis tool hain jo traders ko price trends aur reversals ko samajhne mein madadgar hote hain. In charts ka istemal noise ko kam karne aur trading signals ko improve karne ke liye hota hai. Lekin traders ko yeh yaad rakhna chahiye ke Renko charts ke saath bhi risk hota hai, aur unko apni trading strategy ko carefully design karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:44 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим