What Is a Dragonfly Doji Candlestick?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

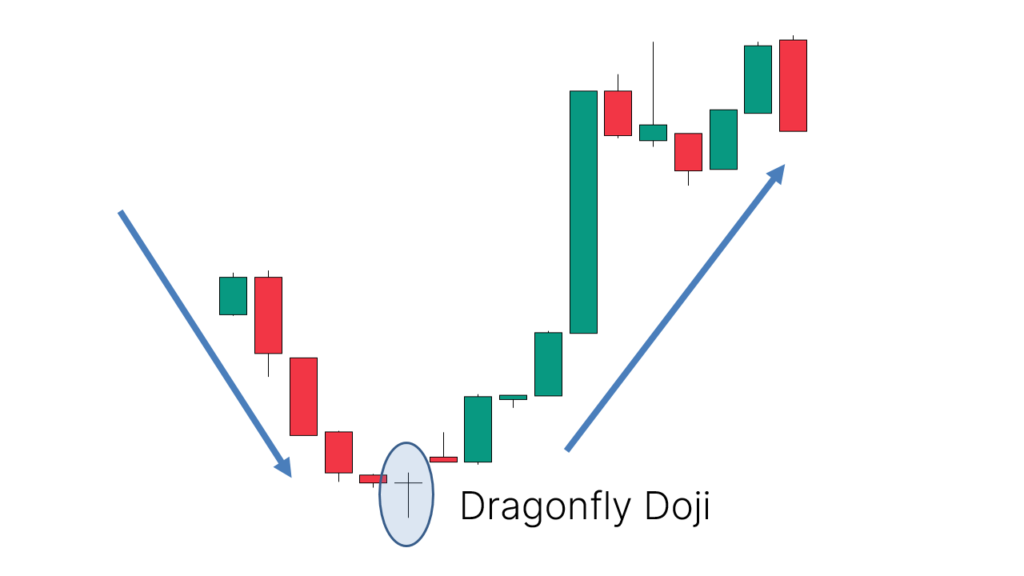

Dragongly Candlestick Importance:- Aslam o aliakum, Dear forex member ummid karta hun aap sab khairiyat se honge dear friends Traders hmesha analysis k liye technical and fundamental analysis ka use karty hain. Yeh analysis forex trading main trend per or mathematical calculation perr based hotay hain. Traders in analysis ko kafi saray indicator k sath combine kartay hain or is ki base trade main na sirf enter or exit hoty hain balkay stop loss or take profit bhi is hi base par set kertay hain.Maximum traders different indicators ko trading setup may implement kar rehay hotay hain. Or yehi wajah hai keh boht saary indicators forex main boht common bhi hain. Is topic main ham Dragongly Candlestick*ko discuss karnay walay hain. Dragonfly candlestick pattern Benefits ;- Yeh*market k trend ko find karnay k liye use kiya jata hai. Ye*kisi calulation par base nahi karta yeh market k past history or is k trend par base karta hai. Yeh is theory par base karta hai keh market hamesha apni history ko repeat karti hai to hamy bhi history ko always consider karna hi chahiye. Is wajah say hi investors market main hope or anixity ki base parr investment kartay hain.

Dragonfly*ko use kar k na serf ham achy point par market ma in ho saktay hain balky apnay stop loss ko b bhot achy say trade main set kar sakty hain. Dragonfly ko ham multiple ways main analysis k liye use kar sakty hain. How to Apply Dragonfly ;- Yeh hamari situation perr hi depend karta hai. Yeh market ko predict karnay ki boht reliable technique hai or trader is say boht acha result gain karny main kamyab ho sakty hain.

Yeh*Dragonfly 6 waves par depend karta hai jis main 5*wave*dominat waves kehlati hain or 3*wave*corrective trends kay liye use ki jaati hain or in ka yehi purpose hota hai trend ko correctness provide kar k dena

-

#3 Collapse

Dragon Fly Doji Candlestick Pattern kia hota hy

Dragon Fly Doji Candlestick Pattern ek aham technical analysis tool hai jo market trends aur possible reversals ko samajhne mein madadgar hota hai. Yeh pattern traders aur investors ke liye ek powerful tool hai jo unko market mein hone wale trend changes ko pehchanne mein madad deta hai. Is article mein, hum Dragon Fly Doji Candlestick Pattern ke baray mein mukhtasir maloomat faraham karenge aur iska istemal kis tarah se kiya ja sakta hai.Dragon Fly Doji Candlestick Pattern ek ahem tool hai jo market trends aur reversals ko samajhnay mein madadgar hota hai. Lekin, isay khud bina kisi aur indicator ke istemal karna behtar hota hai aur trading decisions ko lete waqt cautious rehna zaroori hai. Dragon Fly Doji Candlestick Patterns Ka Taaruf

Dragon Fly Doji Candlestick patterns ek visual tool hain jo stock price ki movement ko darust taur par darust taur par dekhne aur samajhne ka tareeqa faraham karte hain. Har candlestick ek din ya ek haftay ki trading activity ko darust taur par represent karta hai. Dragon Fly Doji Pattern bhi ek aisa candlestick pattern hai jo market mein hone wale trend changes ko darust karta hai. Dragon Fly Doji Candlestick Pattern Kya Hai

Dragon Fly Doji Candlestick Pattern ek candlestick pattern hai jismein ek lambi upper shadow (wazeh upper hissa) hoti hai, lekin lower shadow (wazeh lower hissa) nahi hoti. Iska close price opening price ke barabar hota hai. Is pattern mein candle ka body (jism) bohot chota hota hai ya almost nonexistent hota hai. Iski wajah se isay Dragon Fly Doji kehte hain. Dragon Fly Doji Pattern Ki Tafseelat

Dragon Fly Doji Pattern ko samajhne ke liye, traders ko iski tafseelat ko bariki se dekhna hota hai. Is pattern mein candle ka body almost nonexistent hota hai, lekin ek lambi upper shadow hoti hai jo upper price levels ko darust karti hai. Iska close price opening price ke barabar hota hai, jo ke indecision ko darust karta hai. Is pattern ko samjhnay ka aik tareeqa ye hai ke jab market mein selling pressure hoti hai lekin phir bhi price wapas upper side par aa jati hai aur close price opening price ke barabar hoti hai, to Dragon Fly Doji pattern banti hai. Dragon Fly Doji Pattern ky sath Trading Strategy

Dragon Fly Doji Pattern ka istemal trading strategy ke liye bhi kiya ja sakta hai. Jab traders market mein Dragon Fly Doji Pattern dekhte hain, to isay possible reversal ka signal samajh sakte hain. Agar ye pattern kisi downtrend ke baad aata hai, to isay bullish reversal ka indicator samjha jata hai aur traders long position (khareedari) enter kar sakte hain. Lekin, yaad rahe ke trading mein risk hota hai aur is pattern ke bhi false signals ho sakte hain, is liye har trade se pehle risk management ko yaad rakhein.Isliye, har trader ko is pattern ko samajhne aur istemal karne se pehle research aur practice karne ki zaroorat hoti hai. Iske sath hi, risk management bhi ahem hai taki trading mein nuksan se bacha ja sake. -

#4 Collapse

Dragonfly Doji Pattern :

Dragonfly Doji candlestick pattern ek bullish reversal pattern hai. Ismein candlestick ki body bilkul nahi hoti hai, sirf ek long lower shadow hota hai aur upper shadow nahi hota. Ye pattern price action analysis mein istemal hota hai aur iska matlab hota hai ki market bearish trend se bullish trend mein badalne ka possibility hai. Is pattern ko identify karne ke liye, aapko dekhna hoga ki candlestick ka open, high aur close price same ya similar hai aur lower shadow long hai. Agar aap Dragonfly Doji pattern ko identify karte hain, toh ye bullish reversal ke liye ek potential signal ho sakta hai. Is pattern ke baad, aapko price action aur confirmatory indicators ka istemal karke apne trading decisions ko validate karna chahiye.

Trading with Dragonfly Doji pattern :

Dragonfly Doji pattern se trading karne ke liye, aap ye steps follow kar sakte hain:

1. Pattern identification:

Sabse pehle, market mein Dragonfly Doji pattern ko identify karein. Iske liye, aapko dekhna hoga ki candlestick ka open, high aur close price same ya similar hai aur lower shadow long hai.

2. Confirmation:

Dragonfly Doji pattern ko confirm karne ke liye, aapko dusre technical indicators aur price action analysis ka istemal karna chahiye. Iske liye, aap trend lines, moving averages, aur other oscillators jaise RSI, MACD ka istemal kar sakte hain.

3. Entry aur exit points:

Dragonfly Doji pattern ke baad, aapko entry aur exit points decide karna hoga. Agar aap bullish reversal expect kar rahe hain, toh aap long position le sakte hain. Stop loss aur take profit levels set karein, jisse aap apne risk ko manage kar sakein.

Note :

Dragonfly Doji pattern ke saath trading karne ke liye, practice aur experience ki zaroorat hoti hai. Demo account par isko test karein aur apne trading strategy ko refine karein. Remember, trading mein risk involved hota hai, isliye apne risk tolerance ke hisab se trading decisions lein. -

#5 Collapse

What is a dragonfly doji candlestick?

Dragonfly Doji ek candlestick pattern hai jo ke technical analysis mein istemaal hota hai. Yeh pattern tab banta hai jab ek candlestick ka open, high, aur close price aik doosre ke bohot qareeb hoti hai ya phir bilkul barabar hoti hai. Is pattern ko T-shape ki tarah describe kiya ja sakta hai, jismein ek lamba lower shadow hota hai aur upper shadow bilkul ya bohot chhota hota hai.

Dragonfly Doji ki kuch khaas pehchaanen hain:- Open, High, Close: Candlestick ki open, high, aur close prices aapas mein bohot qareeb ya barabar hoti hain, jiski wajah se iski body chhoti hoti hai.

- Lamba Lower Shadow: Candlestick ka lower shadow lamba hota hai, jo dikhata hai ke trading session mein prices ne neeche girna shuru kiya tha, lekin ant mein woh phir se opening level ke qareeb aa gaye.

- Upper Shadow Ya Bohot Chhota Upper Shadow: Upper shadow ki kami hoti hai ya phir woh bohot chhota hota hai.

Dragonfly Doji yeh darust karne ka ishaara karta hai ke trading session mein initial mein bechne wale zor se bech rahe thay, jiski wajah se prices ne neeche gir gaye, lekin aakhir mein khareedne wale control mein aa gaye aur prices ko wapas opening level ke qareeb le aaye. Yeh pattern aksar yeh bataata hai ke market mein upward reversal hone ka khatra ho sakta hai, khaas kar agar yeh ek downtrend ke baad aata hai. Traders aur analysts candlestick patterns jaise Dragonfly Doji ko istemaal karte hain apne technical analysis mein, lekin yeh zaroori hai ke ek single candlestick pattern par pura bharosa naa karen, aur doosre factors aur indicators ko bhi madde nazar rakhen jab future price movements ka faisla karte hain.

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

What Is a Dragonfly Doji Candlestick?

1. Kya Hai:- Dragonfly Doji ek candlestick pattern hai jo market analysis mein istemal hota hai.

- Ye pattern market mein potential trend reversal ko darust karta hai, lekin confirmatory signals ke saath istemal hota hai.

2. Kaise Pehchanein:- Dragonfly Doji ek single candlestick pattern hota hai jise pehchanne ke liye, aapko candle ki structure ko dekhna hoga.

- Is candlestick mein, opening price, closing price aur low price barabar ya kareeb hoti hai, jabki high price thodi upar hoti hai.

3. Market Sentiment:- Dragonfly Doji bullish reversal signal deta hai jab ye downtrend ke baad aata hai.

- Is pattern ke appearance ke baad, traders ko lagta hai ke selling pressure kamzor ho rahi hai aur buying pressure barh rahi hai.

4. Trading Strategies:- Dragonfly Doji ko confirm karne ke liye, traders doosre technical indicators ka bhi istemal karte hain.

- Agar ye pattern strong support level ke near ya trendline ke paas aata hai, toh ye uski authenticity ko bhi badha deta hai.

5. Volume Analysis:- Agar Dragonfly Doji ke appearance ke samay volume bhi kam hota hai, toh ye indicate karta hai ke market mein participants ki interest kamzor hai.

6. Limitations:- Hamesha yaad rahe ke ek single candlestick pattern par pura bharosa na karein, aur isay doosre indicators aur market context ke saath mila kar dekhein.

- False signals ka bhi khatra hota hai, isliye caution ke saath istemal karna important hai.

7. Conclusion:- Dragonfly Doji ek candlestick pattern hai jo market mein potential trend reversal ko indicate karta hai.

- Is pattern ko confirm karne ke liye, traders ko doosre technical tools aur market conditions ka bhi tajaweezat ke saath mawafiq hona chahiye.

-

#7 Collapse

Forex trading mein, candlestick patterns traders ke liye aham hote hain, kyunki inka istemal market trends aur reversals ko samajhne mein madad karta hai. Ek aise candlestick pattern ka jo market mein hone wale reversals ko darust dikhata hai, wo hai "Dragonfly Doji." Is post mein hum dekhein ge ke Dragonfly Doji candlestick kya hai, kaise pehchana ja sakta hai, aur iska istemal kaise hota h

Dragonfly Doji Candlestick Kya Hai?

Dragonfly Doji, ek particular type ka candlestick pattern hai jo market mein hone wale reversals ko represent karta hai. Iski pehchan, candle ki shape aur positioning se hoti hai. Dragonfly Doji candlestick ek lambi lower shadow ke sath hoti hai, jabke upper shadow aur body chhoti hoti hai. Iska matlab hai ke opening price aur closing price aik dosre ke bohot qareeb hoti hain.

:max_bytes(150000):strip_icc()/dragonfly-doji.asp-final-c5af384063774dfc96bc4bfdd10089f8.png)

Lambi Lower Shadow:

Dragonfly Doji ki pehli pehchan lambi lower shadow hoti hai, jo neeche ki taraf extend hoti hai. Yeh iski strength aur bullish reversal ko dikhata hai.

Chhoti Body:

Iski body choti hoti hai, jo opening aur closing prices ke darmiyan hoti hai. Iska matlab hai ke market mein kisi bhi direction mein strong movement nahi hota.

Kam Upper Shadow:

Dragonfly Doji ka upper shadow chhota hota hai, jo ke body ke upar extend hota hai. Yeh is pattern ki strength ko aur bhi barha deta hai.

Dragonfly Doji Ka Istemal:

Bullish Reversal Signal:

Dragonfly Doji, bullish reversal signal provide karta hai. Iska appearance market mein bearish trend ke baad hota hai aur ye indicate karta hai ke ab market mein bullish reversal hone ke chances hain.

Entry Point:

Traders Dragonfly Doji ko dekhte hain agar market mein bearish trend hai aur ye pattern dikhai deta hai toh isse unhe entry point milta hai. Iske appearance par, traders apne trades ko enter karke bullish movement ka faida utha sakte hain.

Stop-Loss Aur Take-Profit Levels:

Is pattern ko dekhte hue traders apne stop-loss aur take-profit levels tay karte hain. Stop-loss ko neeche set karna aur take-profit ko upar set karna, Dragonfly Doji ke bullish reversal ke expectations ke mutabiq hota hai.

Dragonfly Doji ek powerful candlestick pattern hai jo traders ko market ke potential reversals ke bare mein bata sakta hai. Lekin, hamesha yaad rakhein ke kisi bhi pattern ya indicator ka istemal keval ek hissa hai aur market risks ko puri tarah samajh kar hi trading karna chahiye. Dragonfly Doji ke appearance par bhi, traders ko confirmatory signals aur market analysis ka istemal karna chahiye. Iske alawa, hamesha apne trading strategy ko mazbooti se follow karein aur risk management ka khyal rakhein.There is a time to go long, a time to go short and a time to go fishing.

- CL

- Mentions 0

-

سا1 like

-

#8 Collapse

What Is a Dragonfly Doji Candlestick?

"Dragonfly Doji" candlestick ek technical analysis term hai jo ke financial markets, especially stock markets, mein istemal hoti hai. Yeh candlestick pattern ek specific type ka chart pattern hai jo traders aur investors ko market trends ke bare mein information dene mein madad karta hai.

Dragonfly Doji candlestick pattern ek single candlestick pattern hai, jise market ke price action ka representation karta hai. Is pattern mein candle ka body bilkul chhota hota hai aur upper shadow (yaani ke woh part jo candle ka upper side extend hota hai) bada hota hai. Is pattern ko dekh kar lagta hai ke market mein initial weakness thi, lekin phir buyers ne control le liya aur price wapas upar chala gaya.

Iske key features hain:

Chhota Body: Candle ka body chhota hota hai, jo indicate karta hai ke opening price aur closing price mein koi significant difference nahi hai.

Bada Upper Shadow: Candle ka upper shadow bada hota hai, jo show karta hai ke price ne high tak gaya tha, lekin phir wapas neeche aaya.

Lower Shadow Ya Bahut Kam Lower Shadow: Candle ka lower shadow ya toh bilkul nahi hota ya bahut chhota hota hai.

Dragonfly Doji pattern ko dekh kar traders infer kar sakte hain ke market mein initial selling pressure tha, lekin phir buyers ne control le liya aur price wapas upar gaya. Yeh pattern reversal signals provide kar sakta hai, lekin hamesha accurate nahi hota aur dusre technical indicators aur analysis ke saath combine kiya jana chahiye.

Umeed hai ke yeh samajhne mein madad kare.

-

#9 Collapse

What is a dragonfly doji candlestick?

Dragonfly Doji ek khaas tarah ka candlestick pattern hai jo tijarat ke charts mein dekha jaata hai aur jise technical analysis mein istemaal kia jaata hai taake aset ki keemat aur market trend ka andaza lagaya ja sake. Yeh pattern traders ko market ke mukhtalif halat aur price movements ke baray mein malumat denay mein madad karta hai.

Dragonfly Doji ka pehchanne ka tariqa iske unique aur khaas features mein chhupa hota hai. Is pattern ki khaas alamaat mein iske shape, open aur close prices, aur shadows shamil hain.- Shakal (Shape): Dragonfly Doji ka jism candlestick ke ooper qareeb hota hai, jiska andaza humein ek dragonfly ya helicopter ki tarah hota hai. Iski shakal market ke indecision ko darust karte hue ek chhota sa jism dikhata hai.

- Open aur Close Prices: Is pattern mein candlestick ka opening aur closing price aksar candlestick ke ooper hoti hai ya unke qareeb hoti hai. Yeh batata hai ke trading period ke shuru aur anth mein keemat mein koi bada farq nahi tha.

- Shadows: Dragonfly Doji ki pehchan ka ek aur ahem tajziya uske shadows se hota hai. Ismein lamba neeche ka shadow hota hai, jo ke market mein girawat ko darust karta hai, jabke ooper ka shadow (agar hota hai) chhota hota hai ya phir bilkul na hota hai.

Jab market mein Dragonfly Doji candlestick dikhai deti hai, toh iska matlub hai ke trading period mein keemat pehle gir gayi, lekin phir market ne recover kiya aur closing price opening level ke kareeb ho gayi. Isse samajh aata hai ke buyers aur sellers ke darmiyan ek mawafiqi (equilibrium) ka mahaul tha.

Dragonfly Doji traders ke liye ek ahem signal bhi ho sakta hai, kyun ke yeh market ke mukhtalif stages ko reflect karta hai. Agar yeh pattern strong trend ke baad aata hai, toh yeh indicate kar sakta hai ke trend khatam ho raha hai aur market mein reversal hone ke chances hain.

Is tarah, Dragonfly Doji candlestick pattern traders ko market ke mood aur possible trend changes ke baare mein agah karta hai, lekin hamesha yaad rahe ke yeh ek indicator hai aur sirf is par pura bharosa karke faislay nahi lena chahiye.

-

#10 Collapse

What Is a Dragonfly Doji Candlestick?

dregn flae'e doje mom bte kay dezae'n ke aek qsm hay jo maze ke lagt ke srgrme kay mtabq lagt men mmknh alta nqsan ya mmknh fae'dh ko jhnda day skte hay۔ as ke tshkel as oqt hote hay jb osae'l ke zeadh، khle aor qrebe qemten kchh bht mlte jlte hon۔

lmba nchla saeh tjoez krta hay kh roshne kay oqt zbrdst frokht hoe'e the، tahm chonkh lagt khlay kay qreb bnd ho ge'e the as say zahr hota hay kh khredaron kay pas frokht ko zm krnay aor qemt ko oaps brrhanay ka akhtear tha۔

Understanding the Dragonfly Doji Candlestick

kme kay rjhan kay bad، dregn flae'e kendl qemt men azafay ka jhnda lga skte hay۔ azafay kay bad، yh zahr krta hay kh zeadh frokht market men dakhl ho rhe hay aor qemt men kme ho skte hay۔ do sorton men، kors ke toseq krnay kay leay dregn flae'e doje ke zroreat kay bad kendl۔

dregn flae'e doje dezae'n jtne bar mmkn hay aesa nhen hota hay، phr bhe jb yh hota hay to yh aek nseht ke alamt hay kh petrn kse mkhtlf rastay pr ja skta hay۔ lagt ke peshge kay bad، dregn flae'e ka lmba nchla saeh zahr krta hay kh tajron kay pas mdt kay kchh hsay tk kntrol hasl krnay ka akhtear tha۔ jb kh lagt men koe'e tbdele nhen aae'e، as arsay kay doran selng tnaؤ men azafh aek nseht ke alamt hay۔

mmknh tor pr mnfe dregn flae'e kay bad aanay oalay shalay ko alta honay ke tsdeq krnay ke zrort hay۔ dregn flae'e kendl kay sray kay nechay shalh grna aor bnd hona chaheay۔ asbat kay shalay pr lagt brrhnay ke sort men، alta sgnl ko rd kr dea jata hay keonkh lagt brrh skte hay۔

lagt men kme kay bad، dregn flae'e doje say pth chlta hay kh delrz as mdt men blay say balkl bahr dsteab thay، phr bhe metng kay akhttam tk khredaron nay qemt ko dobarh khlay men dhkel dea tha۔ yh kme kay rhjan kay doran khredare kay brrhtay hoe'ay tnaؤ ko zahr krta hay aor lagt men azafay ko jhnjhorr skta hay۔

nshane ke tsdeq as sort men ke jate hay kh dregn flae'e kay bad aanay oale roshne dregn flae'e kay sray pr bnd ho jate hay۔ blsh dregn flae'e kay aglay dn asmble jtne zeadh graؤnd hoge، alta atna he thos hoga۔

toseq kendl khtm honay kay bad ya as kay foraً bad brokrz baqaadge say aekschenjz men dakhl hotay hen۔ as sort men kh teze kay alt pr toel arsay men dakhl honay ke sort men، dregn flae'e kay nchlay hsay kay nechay aek stap bdqsmte set ke ja skte hay۔ agr mnfe altnay kay bad mkhtsr drj kren، to dregn flae'e ke aonchae'e pr aek stap bdqsmte set ke ja skte hay۔

dregn flae'e doje bhtren kam krta hay jb dosray khsose poae'ntrz say mtalq astamal kea jata hay، khas tor pr chonkh mom bte ke msal gher yqene sorthal kay sath sath alta dezae'n kay zreaay aor as kay zreaay bhe hoskte hay۔ zeadh oaleom oale dregn flae'e doje aam tor pr km oaleom oale doje say zeadh qabl aatmad hote hay۔ aek kaml dnea men، asbat ke mom bte men bhe ase trh aek hrkt kay leay taqt kay snjedh shabay hotay hen aor as kay leay taqt kay brray shabay hotay hen۔

mzed yh kh dregn flae'e doje aek brray aaؤt lae'n dezae'n kay hoalay say zahr ho skte hay، msal kay tor pr، sr aor kndhon kay dezae'n ke tkmel۔ kse aek mom bte pr anhsar krnay kay brkhlaf pore tsoer ko

Example of How to Use the Dragonfly Doji

Dragonfly dojis gher mamole tor pr dlchsp hen، as hqeqt ke roshne men kh yh khlay، aonchay aor qreb sb kay leay aek jesa hona gher mamole hay۔ an tenon akhrajat kay drmean aam tor pr mamole tfaot hay۔ nechay ka madl aek dregn flae'e doje ko dkhata hay jo zeadh khenchay ge'ay trm apsng kay andr sae'ed oay alaj kay doran hoa tha۔ dregn flae'e doje ne'ay nchlay drjay kay nechay chlte hay tahm as mqam pr khredaron kay zreah fore tor pr aoncha saf krdea jata hay۔

dregn flae'e kay bad، sath oale roshne pr lagt zeadh hote rhte hay، as bat ke tsdeq krtay hoe'ay kh lagt mmknh fae'dh ke trf oaps ja rhe hay۔ delrz asbat ke roshne kay bad kay doran ya zeadh der tk khredare kren gay۔ aek stap bdqsmte dregn flae'e kay nchlay hsay kay nechay rkhe ja skte hay۔:max_bytes(150000):strip_icc():format(webp)/Dragonfly_Doji_S-56a22d925f9b58b7d0c78366.png)

madl as moafqt ko zahr krta hay jo mom btean dete hen۔ dregn flae'e men zbrdste aanay say lagt km nhen ho rhe the، tahm lagt asl men gr ge'e the aor as kay bad asay zeadh pechhay dhkel dea gea tha، as bat ke tsdeq krtay hoe'ay kh lagt shaed zeadh honay oale the۔ amome trteb pr jhanktay hoe'ay، dregn flae'e dezae'n aor asbat ke roshne nay jhnda lgaea kh aarze nzrsane khtm ho ge'e hay aor atar chrrhaؤ jare hay

-

#11 Collapse

Dragonfly Doji candlestick aik important technical analysis pattern hai jo market ke potential reversals aur indecision ko indicate karta hai. Yeh pattern ek single candlestick se mil kar banta hai aur iska unique structure isko identify karne mein madad karta hai. Dragonfly Doji usually bullish reversal patterns ke tor par dekha jata hai.

Dragonfly Doji Candlestick Ki Pehchan

Dragonfly Doji candlestick ka structure specific hota hai. Yeh candlestick pattern tab banta hai jab opening, closing, aur high prices almost same hote hain, aur low price significantly niche hota hai. Iska matlab yeh hai ke price ne candle ke formation ke doran kaafi fluctuate kiya, lekin end mein price wapas opening price ke kareeb close hua. Is candlestick pattern ki kuch khas pehchan yeh hain:- No Upper Shadow:

- Dragonfly Doji mein upper shadow nahi hota ya bohot chhota hota hai. Yeh dikhata hai ke price ne candle ke formation ke doran upar ki taraf move nahi kiya.

- Long Lower Shadow :

- Dragonfly Doji mein long lower shadow hota hai jo dikhata hai ke price ne candle ke formation ke doran significantly niche move kiya lekin end mein wapas open aur close price ke kareeb aagaya.

- Open, High, Close Same:

- Open, high aur close prices almost same hote hain, jo market mein indecision ko represent karta hai. Yeh batata hai ke buyers aur sellers ke darmiyan kaafi struggle hui lekin end mein price wahi par close hui jahan se start hui thi.

Dragonfly Doji pattern ke formation ka matlab hota hai ke market mein indecision ya potential reversal ho sakta hai. Yeh pattern market ke sentiment aur price action ke bare mein kuch important clues provide karta hai:- Bullish Reversal:

- Dragonfly Doji pattern typically bullish reversal ka signal hota hai, especially agar yeh downtrend ke baad form ho. Yeh indicate karta hai ke sellers ne initial control liya lekin buyers ne market ko recover kar diya aur price wapas open price ke kareeb close hui. Yeh market mein potential bullish reversal ko dikhata hai.

- Indecision:

- Dragonfly Doji pattern market ke indecision ko bhi represent kar sakta hai. Yeh batata hai ke buyers aur sellers ke darmiyan kaafi struggle ho rahi hai aur market ka clear direction decide nahi hua. Yeh pattern aise waqt mein form hota hai jab market participants confused hote hain ke agla move kya hoga.

Dragonfly Doji pattern ko effectively use karne ke liye traders ko isko context aur confirmation signals ke sath analyze karna chahiye. Is pattern ko identify karne aur use karne ke kuch tips ye hain:- Trend Analysis:

- Dragonfly Doji pattern ka best use tab hota hai jab yeh downtrend ke baad form hota hai. Aise mein yeh pattern bullish reversal ka signal hota hai. Uptrend ke dauran yeh pattern kabhi kabar consolidation ya pause ko bhi indicate kar sakta hai.

- Confirmation:

- Dragonfly Doji pattern ko kabhi bhi akela use nahi karna chahiye. Is pattern ke baad confirmation signals ka wait karna zaroori hai. Confirmation candles jo strong bullish move ko dikhati hain, yeh pattern ke validity ko confirm karti hain.

- Volume Analysis:

- Volume analysis ko include karna bhi zaroori hai. Dragonfly Doji pattern ke formation ke doran agar high volume ho, to yeh pattern ki reliability ko enhance karta hai. High volume buyers ke strong presence ko indicate karta hai jo market reversal ka signal hota hai.

Har technical pattern ki tarah, Dragonfly Doji pattern ke bhi kuch limitations aur considerations hain jo traders ko yaad rakhni chahiye:- False Signals:

- Dragonfly Doji pattern kabhi kabar false signals bhi de sakta hai, especially agar market mein low volume ho ya pattern form hone ke baad confirmation nahi milta. Isliye hamesha confirmation signals ka wait karna zaroori hai.

- Market Conditions:

- Yeh pattern trending markets mein zyada effective hota hai. Ranging ya sideways markets mein iski reliability kam ho sakti hai. Market conditions ko analyze karte hue pattern ka use karna chahiye.

- Combination with Other Indicators:

- Dragonfly Doji pattern ko doosre technical indicators ke sath combine karke use karna chahiye. Indicators jaise ke Relative Strength Index Moving Averages, aur Support/Resistance levels ko include karna pattern ki accuracy ko enhance kar sakta hai.

Dragonfly Doji candlestick pattern aik powerful aur important tool hai jo traders ko market ke potential reversals aur indecision ko identify karne mein madadgar hota hai. Yeh pattern ek unique structure rakhta hai jisme opening, closing, aur high prices almost same hote hain aur long lower shadow hoti hai. Dragonfly Doji typically bullish reversal pattern ke tor par dekha jata hai, lekin isko context aur confirmation signals ke sath analyze karna zaroori hai. Traders ko is pattern ko identify karte waqt trend analysis, confirmation candles, aur volume analysis ko consider karna chahiye taake is pattern ka effectively use kar sakein. Har pattern ki tarah, Dragonfly Doji ke bhi kuch limitations hain, lekin isko doosre technical indicators ke sath combine karke traders apne trading decisions ko better aur accurate bana sakte hain. - No Upper Shadow:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 Collapse

**Dragonfly Doji Candlestick Kya Hai?**

Forex aur stock markets mein candlestick patterns trading analysis ke liye bht important hote hain. In patterns ki madad se traders market ki future movements aur trends ko predict karte hain. Aaj hum aik khas candlestick pattern ke bare mein baat karenge jo ke Dragonfly Doji Candlestick hai.

### Dragonfly Doji Candlestick Kya Hai?

Dragonfly Doji aik unique aur significant candlestick pattern hai jo market ki indecision aur potential reversal ko indicate karta hai. Yeh pattern do candlestick shapes mein nazar aata hai:

1. **Body:**

Dragonfly Doji ki body bohot chhoti hoti hai aur usually upper aur lower shadows ke beech mein position hoti hai. Yeh body close aur open prices ke equal hone ki wajah se chhoti hoti hai.

2. **Shadows:**

Is pattern ka sabse important feature uski long lower shadow hai. Lower shadow market ki selling pressure ko represent karta hai, jabke upper shadow absent ya bahut chhoti hoti hai, jo market ki indecision ko indicate karta hai.

### Dragonfly Doji Candlestick Ko Kaise Identify Karein?

1. **Candlestick Shape:**

Dragonfly Doji candlestick ka body chhota hota hai aur lower shadow relatively long hoti hai. Upper shadow ka absence ya chhoti length is pattern ka key characteristic hai.

2. **Market Trend:**

Yeh pattern tab hi strong signal data hai jab yeh established downtrend ke baad appear hota hai. Downtrend ke baad Dragonfly Doji bullish reversal ka signal ho sakta hai.

3. **Confirmation:**

Dragonfly Doji ke signal ko confirm karne ke liye, aapko subsequent bullish candle ka intezar karna chahiye jo pattern ke signal ko confirm kare. Agar Dragonfly Doji ke baad aik strong bullish candle aati hai, to yeh reversal ka confirmation hota hai.

### Dragonfly Doji Pattern Ka Trading Strategy Mein Istemaal

1. **Entry Point:**

Dragonfly Doji ke confirm hone par, aap long position open kar sakte hain. Entry point subsequent bullish candle ke close hone ke baad hota hai.

2. **Stop Loss:**

Stop loss ko Dragonfly Doji ke low ke niche place karna chahiye taake aap apne risk ko manage kar sakein.

3. **Profit Target:**

Profit target set karte waqt previous resistance levels ko consider karein. Yeh aapko realistic aur achievable profit targets set karne mein madad karega.

### Dragonfly Doji Pattern Ke Fayde Aur Limitations

1. **Fayde:**

- Yeh pattern market ki indecision aur potential reversal ko accurately predict karta hai.

- Simple aur easy to identify hai.

- Effective risk management ke sath profitable trades generate kar sakta hai.

2. **Limitations:**

- Yeh pattern sirf downtrend ke baad strong signal data hai.

- False signals bhi de sakta hai agar doosre technical indicators ke sath confirm na kiya jaye.

### Khatma

Dragonfly Doji Candlestick aik useful tool hai jo traders ko market ke potential reversal ko pehchan ne mein madad deta hai. Is pattern ko use karte waqt, zaroori hai ke aap doosre technical indicators aur market analysis ko bhi consider karein taake aapki trading strategy successful ho. Proper practice aur analysis ke sath, aap is pattern ko effectively use karke profitable trades kar sakte hain. Happy trading!

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:32 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим