Support aur resistance levels in forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

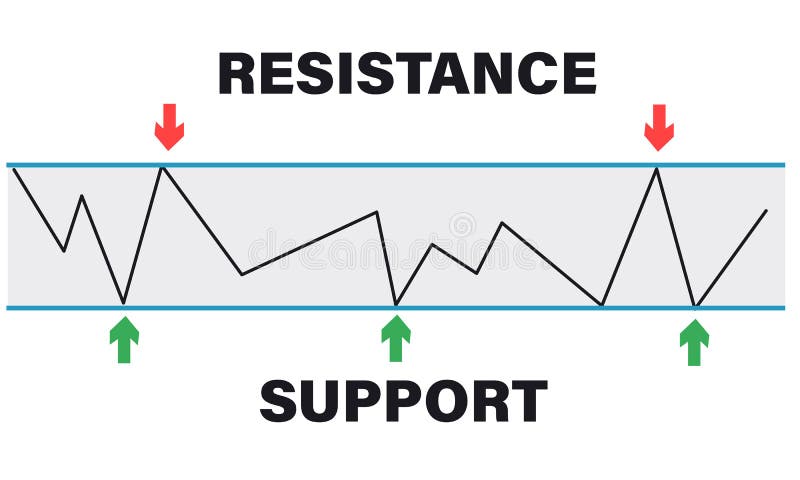

Support and resistance levels technical analysis mein important concepts hai, jo traders aur investors price movement aur trend ka analysis karne ke liye istemal karte hain. Support aur resistance levels price chart par horizontal lines ya zones ke form mein represent kiye jaate hain.Support Level: Support level price chart par ek level ya zone hota hai, jahan par price movement mein selling pressure kam hoti hai aur buyers ka interest increase hota hai. Support level price decline ke baad price ko hold karta hai, jisse price trend reverse ho sakta hai. Support level par traders buy positions lete hain ya existing sell positions ko close karte hain. Support level break hone par price further decline kar sakta hai. Resistance Level: Resistance level price chart par ek level ya zone hota hai, jahan par price movement mein buying pressure kam hoti hai aur sellers ka interest increase hota hai. Resistance level price rise ke baad price ko hold karta hai, jisse price trend reverse ho sakta hai. Resistance level par traders sell positions lete hain ya existing buy positions ko close karte hain. Resistance level break hone par price further rise kar sakta hai. Support aur resistance levels ka istemal karne se pehle, traders ko in levels ko identify karna zaruri hota hai. Support level ko identify karne ke liye, traders previous price lows, trend lines, moving averages, Fibonacci retracements, ya pivot points ka istemal karte hain. Resistance level ko identify karne ke liye, traders previous price highs, trend lines, moving averages, Fibonacci retracements, ya pivot points ka istemal karte hain. Support aur resistance levels traders ko entry points, exit points, aur stop loss levels provide karte hain. Support level par buy positions lete waqt stop loss level support level ke neeche set kiya ja sakta hai. Resistance level par sell positions lete waqt stop loss level resistance level ke upar set kiya ja sakta hai. Support aur resistance levels market psychology aur supply-demand dynamics par based hote hain. Jab price support level ya resistance level tak pahunchta hai, traders aur investors ke behavior mein change hota hai, jisse price trend mein reversal ya consolidation dekhne ko milta hai.Support aur resistance levels ka istemal karne se pehle, aapko market conditions aur dusre technical analysis tools ko samajhna zaruri hai. Price action analysis, volume analysis, aur trend line breaks ka istemal karke support aur resistance levels ko confirm kiya ja sakta hai. Demo account par practice karein aur apne trading strategy ko backtest karein, taaki aapko levels ke performance ka idea mil sake. Risk management ka dhyan rakhein aur apne goals aur risk tolerance ke hisaab se strategy ko customize karein.

-

#3 Collapse

Support and Resistance:

Forex market mein support aur resistance levels price action analysis ke through identify kiye jaate hain. Support level ek price level hota hai jahan se price down jaane ki possibility kam hoti hai aur buyers active ho sakte hain. Resistance level ek price level hota hai jahan se price up jaane ki possibility kam hoti hai aur sellers active ho sakte hain.

Identify Support and Resistance:

Support level ko identify karne ke liye aap previous price lows, trend lines, moving averages, aur chart patterns jaise ki double bottoms ya ascending triangles ka istemal kar sakte hain. Resistance level ko identify karne ke liye aap previous price highs, trend lines, moving averages, aur chart patterns jaise ki double tops ya descending triangles ka istemal kar sakte hain. Support aur resistance levels ko samajhna aur identify karna trading mein bahut zaroori hai, kyunki ye levels entry aur exit points ko decide karne mein madad karte hain. Isliye, price action analysis aur technical analysis ke saath practice karein aur apne trading strategy ko refine karte rahein.

1. Entry aur exit points ko decide karein:

Support aur resistance levels ko istemal karke aap entry aur exit points ko decide kar sakte hain. Support level par buy karein aur resistance level par sell karein. Isse aapko price reversals aur trend continuations ke opportunities mil sakte hain.

2. Stop loss aur target levels set karein:

Har trade mein stop loss aur target levels set karna bahut zaroori hai. Stop loss aapko loss control karne mein madad karta hai aur target levels aapko profit booking karne mein madad karte hain. Support aur resistance levels ke pass stop loss aur target levels set karein. -

#4 Collapse

Assalamu Alaikum Dosto!

Support and Resistance Levels

Support aur resistance levels supply aur demand ki maujoodgi ke zarye price ko rukne ya reverse hone ki taraf le jane wale levels hote hain. Is article mein hum support aur resistance levels ko tafseel se samjhenge aur batayenge ke traders inhe kaise pehchan sakte hain aur apni trading strategies mein inhe kaise istemal kar sakte hain. Is article ko char mukhtalif sarparastiyon mein bataya gaya hai ke is concept ko behtar tareeqe se samajha ja sake.

Support aur resistance levels wo points hote hain jahan price rukne ya reverse hone ki taraf jane lagti hai. Support levels wo levels hote hain jahan price ko buying support milti hai aur jahan price girna band ho jati hai. Resistance levels wo levels hote hain jahan price ko selling pressure milti hai aur jahan price barhna band ho jati hai. Support aur resistance levels market mein supply aur demand ki maujoodgi ki wajah se banaye jate hain.

Support aur Resistance Levels Ki Pehchan

Traders Forex trading mein support aur resistance levels ko pehchanne ke liye alag alag tools aur techniques ka istemal kar sakte hain. Kuch aam tareeqe hain:

- Price action analysis: Traders price action analysis ka istemal karke support aur resistance levels ko pehchan sakte hain. Wo chart par areas ko dekh sakte hain jahan price ne pehle apni taraf rukh badla tha ya phir significant period ke liye consolidate kiya tha. Ye areas future mein support ya resistance levels ki tarah kaam kar sakte hain.

- Trend lines: Traders chart par trend lines draw karke support aur resistance levels ko pehchan sakte hain. Ek upward sloping trend line support level ki tarah kaam kar sakti hai, jabki downward sloping trend line resistance level ki tarah kaam kar sakti hai.

- Moving averages: Traders chart par moving averages ka istemal karke support aur resistance levels ko pehchan sakte hain. Moving averages support aur resistance levels ke liye useful hote hain kyunke ye average price ki trend ko show karte hain. Agar price moving average ke upar se nikalti hai to ye resistance level ki tarah kaam kar sakti hai, jabki agar price moving average ke niche se girati hai to ye support level ki tarah kaam kar sakti hai.

- Fibonacci retracements: Traders Fibonacci retracements ka istemal karke bhi support aur resistance levels ko pehchan sakte hain. Fibonacci retracements Fibonacci sequence ke numbers ko istemal karte hain aur ye levels batate hain jahan price ka trend change ho sakta hai.

Support aur Resistance Levels ka Istemal

Traders support aur resistance levels ko trading strategies mein istemal kar sakte hain. Ye levels price ke reversal aur trend change ko indicate karte hain, isliye traders inhe trading signals ke liye use karte hain. Traders support aur resistance levels ke saath apni entry aur exit points ka faisla bhi kar sakte hain. Kuch tareeqe hain jinhe traders support aur resistance levels ka istemal kar sakte hain:

- Breakout trading: Jab price support ya resistance level ko break karta hai to ye breakout trading signal ban jata hai. Traders in breakout trading ka istemal karke apni positions ko enter karte hain. Agar price support level ko break karta hai to ye buy signal hai aur agar price resistance level ko break karta hai to ye sell signal hai.

- Range trading: Jab price support aur resistance levels ke beech mein trade karta hai to ye range trading ka signal hai. Traders range trading ka istemal karke apni positions ko enter karte hain. Jab price support level ke taraf jata hai to ye buy signal hai aur jab price resistance level ke taraf jata hai to ye sell signal hai.

- Trend trading: Agar price trend line ke upar badh raha hai to ye uptrend ka signal hai aur agar price trend line ke niche gir raha hai to ye downtrend ka signal hai. Traders trend trading ka istemal karke apni positions ko enter karte hain. Jab price uptrend mein hai to ye buy signal hai aur jab price downtrend mein hai to ye sell signal hai.

- Stop loss placement: Traders support aur resistance levels ka istemal apni stop loss placement ke liye bhi kar sakte hain. Agar traders long position mein hain to wo support level ke niche apni stop loss rakh sakte hain aur agar traders short position mein hain to wo resistance level ke upar apni stop loss rakh sakte hain.

Support aur Resistance Levels ki Limitations

Support aur resistance levels Forex trading mein useful hote hain, lekin inke kuch limitations bhi hote hain. Ye limitations hain:- Support aur resistance levels ke exact values ka pata lagana mushkil hota hai. Support aur resistance levels ko market mein supply aur demand ki wajah se banaya jata hai aur ye values time ke saath badalte rehte hain.

- Market mein koi bhi unexpected event ho sakta hai jis ki wajah se support aur resistance levels break ho jate hain. Traders ko in events ke liye alert rehna chahiye aur apni positions ko manage karte hue in events se bachna chahiye.

- Support aur resistance levels trading signals provide karte hain lekin ye signals kisi bhi waqt wrong bhi ho sakte hain. Traders ko in signals par puri tarah se rely nahi karna chahiye.

Conclusion

Support aur resistance levels Forex trading mein ahem pahlu hote hain. Ye levels supply aur demand ki maujoodgi ki wajah se bante hain aur price ko rukne ya reverse hone ki taraf le jate hain. Traders support aur resistance levels ko trading strategies mein istemal kar sakte hain aur inhe pehchanne ke liye chart analysis, trend lines, moving averages aur Fibonacci retracements ka istemal kar sakte hain. Lekin traders ko in levels ki limitations ke baare mein bhi pata hona chahiye aur in signals par puri tarah se rely nahi karna chahiye.

- CL

- Mentions 0

-

سا0 like

-

#5 Collapse

Support aur resistance levels in forex

Forex market mein, support aur resistance levels technical analysis ka important concept hai. Ye levels traders ko market movements samajhne aur trading decisions lene mein madad karte hain. Chaliye dono concepts ko detail mein samjhe:- Support Level:

- Support level wo price level hota hai jahan par market mein buying interest strong hoti hai aur prices ka fall rok jata hai.

- Agar price support level tak gir jata hai aur wahan se reverse ho kar upar jaata hai, toh ye indicate karta hai ki market mein buyers ka dominance hai aur woh level strong support hai.

- Support levels horizontal lines ki form mein ho sakte hain, ya phir trendlines ke form mein bhi dikhe sakte hain.

- Resistance Level:

- Resistance level wo price level hota hai jahan par selling interest strong hoti hai aur prices ka rise rok jata hai.

- Agar price resistance level tak pahunch jata hai aur wahan se neeche jaata hai, toh ye indicate karta hai ki market mein sellers ka dominance hai aur woh level strong resistance hai.

- Resistance levels bhi horizontal lines ya trendlines ke form mein ho sakte hain.

Traders in levels ko analyze karte hain taki woh potential entry points, exit points, aur stop-loss levels decide kar sakein. Agar price support level se upar jaata hai, toh traders ko lag sakta hai ki ab market mein bullish trend hai aur woh long position le sakte hain. Similarly, agar price resistance level se neeche jaata hai, toh traders ko lag sakta hai ki market mein bearish trend hai aur woh short position le sakte hain.

Yeh important hai ki support aur resistance levels sirf ek tool hain aur inka use kisi bhi ek indicator ke saath kiya jata hai. Market dynamics bahut complex hote hain aur sirf ek indicator par depend karna risky ho sakta hai. Isliye, traders ko market analysis ke liye multiple tools ka use karna chahiye aur risk management bhi dhyan mein rakhna chahiye.

- Support Level:

-

#6 Collapse

What are support and resistaresistan clevels in forex trading?

Support qeemat ke chart ka woh ilaqa hai jo taajiron ki kharidne ki razamandi ki nishandahi karta hai. doosri taraf, muzahmat is waqt hoti hai jab qeemat ke chart par talabb ki satah rasad se barh jati hai. support is waqt hoti hai jab forex market mein gravt hoti hai jis ke nateejay mein neechay ki taraf rujhan hota hai jab kam qeematein taajiron ke taweel ya' kharidne' ki position lainay ke imkanaat ko barha deti hain. aik baar jab talabb barh jati hai aur market mein supply ki satah ke barabar ho jati hai, to forex ki qeemat girna band ho jaye gi. jab market ki qeematein barh jati hain aur supply demand se barh jati hai to is baat ka bohat ziyada imkaan hota hai ke aap lambi ya' kharidne' ki bajaye mukhtasir ya' farokht' position lena chahain ge. yeh tab hota hai jab muzahmat hoti hai. is ki wajah yeh ho sakti hai ke forex market mein tijarat karne walay taajiron ne faisla kya hai ke qeemat bohat ziyada hai ya woh apni matlooba satah par pahonch chuke hain. aap support ko farsh aur muzahmat ko forex ki qeemat ki had ke tor par soch satke hain. tareekhi qeematein ghair mulki currency mein himayat aur muzahmat ke sab se qabil aetmaad zaraye hain. qabil zikar sthin aam tor par qeematon ke charts par waqt ke sath jama honay wali ahem chotyon ya se aati hain. un ki shanakht amoodi mehwar par zonal ilaqon ke tor par ki jati hai. jaisay jaisay market ki qeematein forex mein Sabiqa himayat ya muzahmat tak pahonch jati hain, woh ya to pehlay jaisi qeemat ki satah par jari reh sakti hain ya un se daur ho sakti hain jab tak ke yeh' chhatain' aur' neechay' dobarah waqay nah hon.

How to identify and trade trendlines: -

Bunyadi asasa ke iftitahi aur ikhtitami qeemat ke sath sath infiradi mom btyon ki tijarti range ki nigrani karkay rujhan linon ki shanakht ki ja sakti hai. trained lines traders takneeki tajzia mein istemaal karte hain. yeh chart par qeematon ko aapas mein jornay wali linon ko khech kar kya jata hai, jo ya to oopar ki taraf ya neechay ka namona day sakta hai jo market ke jazbaat ki nishandahi karta hai. muzahmat ki satah is waqt hoti hai jab market mein oopar ka rujhan hota hai aur qeemat kam hoti hai aur trained line ki taraf barh jati hai. doosri taraf, support level is waqt bantaa hai jab market mein neechay ka rujhan ho aur qeematein trained line ki taraf barheen. teen trained trading hikmat e amli hain - oopar ki taraf, neechay ki taraf aur side way trained lines. yeh kuch daur andeshi faraham kar satke hain jo aap ko rujhanaat ki ibtidayi shanakht mein madad kar satke hain taakay aap ghair mulki currency ki market se bahar nikal saken is se pehlay ke yeh aik ulti raftaar par jayeمنسلک شدہ فائلیں -

#7 Collapse

Support aur resistance levels: -

supply aur demand ki maujoodgi ke zarye price ko rukne ya reverse hone ki taraf le jane wale levels hote hain. Is article mein hum support aur resistance levels ko tafseel se samjhenge aur batayenge ke traders inhe kaise pehchan sakte hain aur apni trading strategies mein inhe kaise istemal kar sakte hain. Is article ko char mukhtalif sarparastiyon mein bataya gaya hai ke is concept ko behtar tareeqe se samajha ja sake. Support aur resistance levels wo points hote hain jahan price rukne ya reverse hone ki taraf jane lagti hai. Support levels wo levels hote hain jahan price ko buying support milti hai aur jahan price girna band ho jati hai. Resistance levels wo levels hote hain jahan price ko selling pressure milti hai aur jahan price barhna band ho jati hai. Support aur resistance levels market mein supply aur demand ki maujoodgi ki wajah se banaye jate hain.

Support aur Resistance Levels Ki Pehchan

Traders Forex trading mein support aur resistance levels ko pehchanne ke liye alag alag tools aur techniques ka istemal kar sakte hain.

Kuch aam tareeqe hain:

Price action analysis: -

Traders price action analysis ka istemal karke support aur resistance levels ko pehchan sakte hain. Wo chart par areas ko dekh sakte hain jahan price ne pehle apni taraf rukh badla tha ya phir significant period ke liye consolidate kiya tha. Ye areas future mein support ya resistance levels ki tarah kaam kar sakte hain.

Trend lines: Traders chart par trend lines draw karke support aur resistance levels ko pehchan sakte hain. Ek upward sloping trend line support level ki tarah kaam kar sakti hai, jabki downward sloping trend line resistance level ki tarah kaam kar sakti hsakt

hsak.

Moving averages: -

Traders chart par moving averages ka istemal karke support aur resistance levels ko pehchan sakte hain. Moving averages support aur resistance levels ke liye useful hote hain kyunke ye average price ki trend ko show karte hain. Agar price moving average ke upar se nikalti hai to ye resistance level ki tarah kaam kar sakti hai, jabki agar price moving average ke niche se girati hai to ye support level ki tarah kaam kar sakti hai.

Fibonacci retraceretracement:

Traders Fibonacci retracements ka istemal karke bhi support aur resistance levels ko pehchan sakte hain. Fibonacci retracements Fibonacci sequence ke numbers ko istemal karte hain aur ye levels batate hain jahan price ka trend change ho sakta hai.

Support aur Resistance Levels ka Istemal

Traders support aur resistance levels ko trading strategies mein istemal kar sakte hain. Ye levels price ke reversal aur trend change ko indicate karte hain, isliye traders inhe trading signals ke liye use karte hain. Traders support aur resistance levels ke saath apni entry aur exit points ka faisla bhi kar sakte hain. Kuch tareeqe hain jinhe traders support aur resistance levels levelka istemal kar sakte hain:

Breakout trading:

Jab price support ya resistance level ko break karta hai to ye breakout trading signal ban jata hai. Traders in breakout trading ka istemal karke apni positions ko enter karte hain. Agar price support level ko break karta hai to ye buy signal hai aur agar price resistance level ko break karta hai to ye sell signal hai.

Range trading:

Jab price support aur resistance levels ke beech mein trade karta hai to ye range trading ka signal hai. Traders range trading ka istemal karke apni positions ko enter karte hain. Jab price support level ke taraf jata hai to ye buy signal hai aur jab price resistance level ke taraf jata hai to ye sell signal hai.

Trend trading:

Agar price trend line ke upar badh raha hai to ye uptrend ka signal hai aur agar price trend line ke niche gir raha hai to ye downtrend ka signal hai. Traders trend trading ka istemal karke apni positions ko enter karte hain. Jab.

-

#8 Collapse

Support aur resistance levels in forex

Forex mein support aur resistance levels ahem hote hain, jo ke market analysis mein istemal hotay hain taake traders ko market ke future movements ka andaza lagaya ja sake. Support level woh price hoti hai jahan se currency pair ka price girne se rokta hai aur resistance level woh price hoti hai jahan se price barhne mein rukawat aati hai.

Support level market mein aik invisible safety net ki tarah kaam karta hai. Jab price us level tak pohanchti hai, toh wahan se gir kar neeche nahi jaati aur yeh level ek tarah ka psychological barrier ban jata hai. Traders is level ko dekhtay hain aur is par rely karte hain ke yeh unko loss se bachaayega. Agar price is level se neeche jaata hai, toh yeh indicate karta hai ke market mein bearish sentiment hai aur future mein aur girawat ho sakti hai.

Wahi resistance level woh point hota hai jahan se price ko roka jata hai. Jab price is level tak pohanchti hai, toh wahan se upar jane mein mushkil hoti hai aur yeh level traders ke liye ek selling point ban jata hai. Agar price is level ko paar karna sakta hai, toh yeh bullish signal ho sakta hai aur traders is par amal kar ke profit kamane ki koshish karte hain.

Support aur resistance levels ka sahi tarah se istemal kar ke traders market trends ko samajh sakte hain aur apne trades ko sahi waqt par enter aur exit kar sakte hain. Yeh levels market ki instability ko samajhne mein bhi madad karte hain aur traders ko market ke movements ke liye tayyar rakhte hain. Is liye, forex trading mein support aur resistance levels ka ahem kirdar hota hai jo traders ko market ke dynamics ko samajhne mein madad karte hain.

-

#9 Collapse

Support aur resistance levels in forex

Support aur resistance levels forex trading mein technical analysis ka ek ahem hissa hain. Ye levels market mein price movements ko samajhne aur future trends ko predict karne mein madad karte hain.

Yeh do mukhtalif levels hain:- Support Level:

- Support level ek aisi price hoti hai jahan ek currency pair ya koi aur financial instrument ki price girne se rok jati hai, aur wahan se wapas upar ki taraf ja sakti hai.

- Yeh ek area ko represent karta hai jahan buying interest bohot strong hoti hai, jo price ko aur girne se bacha sakti hai.

- Traders support levels ko potential buying opportunities ke roop mein dekhte hain, aur ummeed karte hain ki price us level se hold hogi ya fir wapas upar jaegi.

- Resistance Level:

- Resistance level ek aisi price hai jahan ek financial instrument ki price badhne se rok sakti hai, aur wahan se gir sakti hai.

- Yeh ek area ko represent karta hai jahan selling interest itni strong hoti hai ki price ko aur upar jane se rok sakti hai.

- Traders resistance levels ko potential selling opportunities ke roop mein dekhte hain, aur ummeed karte hain ki price us level se guzar kar neeche jaegi.

Practical taur par, ye levels kaise kaam karte hain:- Support se Resistance (aur ulta):

- Jab support level toota jata hai, to ye resistance level ban sakta hai. Usi tarah, jab resistance level toota jata hai, to ye support level ban sakta hai.

- Role Reversal:

- Ek support level jab toota jata hai, to ye sentiment mein badlav dikhata hai, aur jo pehle price ke liye neeche ka floor tha, wahi ab upar ka ceiling ban sakta hai. Ulta, jab ek resistance level toota jata hai, to ye ek naya support level ban sakta hai.

Traders support aur resistance levels ka istemal kar ke ye decisions lete hain:- Support pe Kharidari:

- Trader ek currency pair ko tab kharid sakta hai jab wo ek historical support level ke qareeb hota hai, ummeed karte hue ki price wahan se upar jaegi.

- Resistance pe Bech Dena:

- Barabar ke viprit, trader ek currency pair ko tab bech sakta hai jab wo ek resistance level ke qareeb hota hai, in ummeedon ke sath ki price wahan se neeche jaegi.

Yeh yaad rakhna zaroori hai ke support aur resistance levels ke alawa bhi market analysis ke aur tajaweezat aur risk management ke tariqay hote hain, aur market ko samajhne ke liye comprehensive approach zaroori hai. Keemati currencies aur financial instruments market mein bohot se factors par depend karte hain, aur koi bhi single indicator trading mein kamyabi ka guarantee nahi deta.

- Support Level:

-

#10 Collapse

Support aur resistance levels in forex

Forex trading mein support aur resistance levels ahem technical concepts hain jo traders ke liye market analysis aur trading decisions ke liye ahem hote hain. In levels ko samajhna aur unka istemal karna forex trading mein kamyabi ke liye zaroori hai.

Support aur Resistance Levels Kya Hote Hain?- Support Level (سہارا سطح): Support level woh price point hota hai jahan se market ki tendency hoti hai ke price neeche girne se rok jati hai aur phir se upar uthne lagti hai. Yeh aksar woh level hota hai jahan traders ko buying interest nazar aati hai aur woh price ko support karte hain.

- Resistance Level (مزیداری سطح): Resistance level woh price point hota hai jahan se market ki tendency hoti hai ke price upar jane se rok jati hai aur phir se neeche girne lagti hai. Yeh aksar woh level hota hai jahan traders ko selling interest nazar aati hai aur woh price ko control karne ki koshish karte hain.

Support aur Resistance Levels Ka Istemal:- Trend Analysis (رجحان تجزیہ): Support aur resistance levels ka istemal trend analysis mein hota hai. Agar price ek uptrend mein hai aur resistance level ko break kar raha hai, toh yeh indicate karta hai ke uptrend jari hai. Isi tarah, agar price ek downtrend mein hai aur support level ko break kar raha hai, toh yeh indicate karta hai ke downtrend jari hai.

- Entry aur Exit Points (داخلہ اور خروج نقاط): Traders support aur resistance levels ko entry aur exit points ke taur par istemal karte hain. Agar price ek support level ke qareeb aa raha hai aur reversal signs dikh rahi hain, toh traders support level par buy orders place karte hain. Similarly, agar price ek resistance level ke qareeb aa raha hai aur reversal signs dikh rahi hain, toh traders resistance level par sell orders place karte hain.

- Risk Management (خطرہ انتظام): Support aur resistance levels ko samajh kar traders apni risk management strategies ko improve karte hain. Stop-loss orders aur take-profit orders ko set karte waqt, traders support aur resistance levels ko consideration mein lete hain taki unka risk minimize ho aur unka profit maximize ho.

Support aur Resistance Levels Ke Fayde:- Price Action Ko Samajhna: Support aur resistance levels ko samajh kar traders price action ko better understand kar sakte hain aur market trends ko anticipate kar sakte hain.

- Trading Decisions Mein Madad: Support aur resistance levels ke istemal se traders apne trading decisions ko validate kar sakte hain aur trading strategies ko improve kar sakte hain.

- Risk Management: Support aur resistance levels ko samajh kar traders apni risk management ko optimize kar sakte hain aur apne trades ko control kar sakte hain.

To conclude, support aur resistance levels forex trading mein ahem tools hain jo traders ko market analysis mein madadgar hotay hain. In levels ko samajh kar, traders apne trading strategies ko improve kar sakte hain aur apne trades ko safalta ki taraf le ja sakte hain. Magar hamesha yaad rakhein ke support aur resistance levels ke saath confirmatory indicators ka istemal karna zaroori hai trading decisions banane ke liye.

-

#11 Collapse

Support aur Resistance level:

Forex trading mein, support aur resistance levels ahem hain. Ye levels traders ko market ke trend aur price movement ka andaza lagane mein madadgar hote hain. Support level woh price point hota hai jahan se asset ka price girne ke baad ruk jata hai ya phir wapas upar jaane lagta hai. Isay samjha ja sakta hai ke yeh woh level hai jahan traders ko asset ki keemat girte hue support milti hai.

Aam tor par, support level asset ki keemat ke nichle hisse mein hota hai aur traders isay asset ki keemat ke further girne se rokne ka point samajhte hain. Jab ke resistance level woh point hota hai jahan asset ki keemat ka barhav ruk jata hai ya phir isay neeche jaane se rokta hai. Yeh level traders ke liye woh mark hota hai jahan asset ki keemat ka barhav rokta hai ya phir ise nicha gira sakta hai.

Support aur resistance levels traders ko trading decisions mein madad dete hain. Support level ko traders buying opportunities ke liye dekhte hain jabke resistance level ko selling opportunities ke liye dekha jata hai. In levels ka istemal market trends ko samajhne aur trading strategies ko banane mein hota hai.

Forex Trading Mein Support aur Resistance Levels ka Ahmiyat:

Forex trading mein, support aur resistance levels ka istemal karna ahem hota hai. Ye levels market analysis mein istemal hotay hain taake traders ko market ki movement ka andaza lagaya ja sake aur unka trading strategy banaya ja sake. Support aur resistance levels trading mein mukhtalif tools aur techniques istemal karke tay kiye jate hain, jaise ki technical analysis, price action analysis, aur Fibonacci retracements.

Support Level Kya Hai?

Support level woh price point hota hai jahan se expected hai ke market ki downward movement ko roka jaega. Yeh woh area hota hai jahan se traders ko lagta hai ke price girne ke baad dobara upar uthne ka chance hai. Jab price support level tak pohanchta hai, toh traders ko umeed hoti hai ke wahan se price phir se upar jaegi. Support level ko identify karne ke liye traders price charts par previous lows ko dekhte hain, aur wahan se ek trend line ya horizontal line draw karte hain.

Resistance Level Kya Hai?

Resistance level woh price point hota hai jahan se expected hai ke market ki upward movement ko roka jaega. Yeh woh area hota hai jahan se traders ko lagta hai ke price barhne ke baad dobara neeche aane ka chance hai. Jab price resistance level tak pohanchta hai, toh traders ko umeed hoti hai ke wahan se price neeche jaegi. Resistance level ko identify karne ke liye traders price charts par previous highs ko dekhte hain, aur wahan se ek trend line ya horizontal line draw karte hain.

Support aur Resistance Levels Ka Istemal:

Support aur resistance levels ka istemal karke traders market ki trend aur price movement ka analysis karte hain. Jab price support level tak aata hai, toh traders ko buy karne ka mauka milta hai, aur jab price resistance level tak aata hai, toh traders ko sell karne ka mauka milta hai. Is tarah se, support aur resistance levels traders ko entry aur exit points provide karte hain.

Conclusion:

Forex trading mein support aur resistance levels ka istemal karna trading strategy ko mazboot banata hai. Ye levels traders ko market ki direction aur price movement ka andaza lagane mein madad karte hain. Lekin, support aur resistance levels ka istemal karne se pehle traders ko market ki aur baki factors ka bhi analysis karna chahiye taake sahi trading decisions liya ja sake.

Forex mein support aur resistance levels bohot ahem hote hain. Yeh levels traders ko market ka trend aur price movement samajhne mein madad dete hain.

Support Level: Support level woh price point hota hai jahan se traders ko lagta hai ke price girne ke baad ruk sakta hai aur wahan se phir se upar ja sakta hai. Yeh level market mein buyers ka strong presence dikhata hai. Agar price support level tak gir jata hai toh traders ko lag sakta hai ke ab market neeche jaane ke bajaye upar jaayega.

Resistance Level: Resistance level woh price point hota hai jahan se traders ko lagta hai ke price barhne ke baad ruk sakta hai aur wahan se phir se neeche ja sakta hai. Yeh level market mein sellers ka strong presence dikhata hai. Agar price resistance level tak pohanch jata hai toh traders ko lag sakta hai ke ab market upar jaane ke bajaye neeche jaayega.

In levels ko samajh kar traders apni trading strategies banate hain. Support aur resistance levels ko identify kar ke traders entry aur exit points decide karte hain, jisse unka trading kaafi sahi tareeke se ho. Iske alawa, in levels ko monitor kar ke traders market trend ko bhi samajh sakte hain aur apni trades ko accordingly adjust kar sakte hain.

-

#12 Collapse

Support aur Resistance Levels in Forex:

1. Ta'aruf (Introduction):

Support aur Resistance levels, forex trading mein ahem hai. Ye levels market mein price movements ko analyze karne aur trading decisions ko make karne mein madad karte hain.

2. Support Level (Tasdeeqi Level):- Tasdeeqi level wo price hai jahan se asset ki keemat neeche jaati hai aur phir se upar uth kar ruk jaati hai.

- Ye level traders ke liye important hota hai kyunki jab price is level par aata hai, toh buyers strong hote hain aur price ko upar le ja sakte hain.

- Rokne wala level wo price hai jahan se asset ki keemat upar jaati hai aur phir se neeche aakar ruk jaati hai.

- Ye level traders ke liye crucial hota hai kyunki jab price is level ko touch karta hai, toh sellers active hote hain aur price ko neeche le ja sakte hain.

- Candlestick Patterns: Traders candlestick patterns ka istemal karke support aur resistance levels ko identify karte hain.

- Trend Lines: Trend lines ko draw karke bhi traders in levels ko detect karte hain.

- Breakout Strategies: Agar price kisi support ya resistance level ko break karta hai, toh traders isse breakout signal samajhte hain aur uske mutabiq trading karte hain.

- Range-bound Strategies: Jab price kisi specific range ke andar move karti hai, toh traders is range ke support aur resistance levels ko istemal karke trading strategies bana sakte hain.

- Har trading decision ke sath risk management ka tawajju dena chahiye. Stop-loss orders ka istemal karke apne positions ko protect karna important hai.

Support aur Resistance levels, traders ko market dynamics samajhne mein madad karte hain aur unhein trading decisions lene mein guide karte hain. In levels ka sahi taur par istemal karke, traders apne trades ko refine kar sakte hain.

Yeh humein batati hai ke Support aur Resistance levels kya hote hain aur kaise traders in levels ko istemal karke forex market mein trading decisions le sakte hain. Ismein trend analysis aur price action ki samajh hona zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

#13 Collapse

Support aur Resistance Levels in Forex

1. Ta'aruf (Introduction):

Support aur Resistance levels, forex trading mein ahem hote hain. Ye levels traders ko market ke mizaj aur price movements samajhne mein madad karte hain.

2. Support Level (Support Pemane):- Support level wo price level hota hai jahan se market mein buying interest barh jati hai aur price neeche girne mein mushkil hoti hai.

- Agar price support level tak gir gayi hai, toh traders expect karte hain ke wahan se price reverse hogi aur upar ki taraf jaegi.

- Resistance level wo price level hota hai jahan se market mein selling interest barh jati hai aur price upar jane mein mushkil hoti hai.

- Agar price resistance level ko touch karta hai, toh traders expect karte hain ke wahan se price reverse hogi aur neeche ki taraf jaegi.

- Price Reversals: Support aur resistance levels, price reversals ko indicate karte hain. Ye levels market ke psychological points hote hain jahan traders ka focus hota hai.

- Trend Identification: In levels ka istemal trend ko identify karne mein hota hai. Agar price support level ko break karta hai, toh ye bearish signal ho sakta hai. Jab price resistance level ko break karta hai, toh ye bullish signal ho sakta hai.

- Entry Aur Exit Points: Traders in levels ka istemal apne trades ke liye behtareen entry aur exit points tay karne mein karte hain.

- Breakout Trading: Agar price support ya resistance level ko break karta hai, toh traders us direction mein trade karna shuru karte hain.

- Bounce Trading: Agar price support ya resistance level tak pohanchti hai aur wahan se reverse hoti hai, toh traders opposite direction mein trade karte hain.

- Support aur resistance levels ke saath trading karte waqt, risk management ka tawajju dena zaroori hai. Stop-loss orders ka istemal karke apne positions ko protect karna important hai.

Support aur resistance levels, traders ke liye market analysis mein ahem role play karte hain. In levels ka sahi taur par istemal karke, traders apne trading strategies ko optimize kar sakte hain.

Yeh humein batati hai ke Support aur Resistance levels kya hote hain aur traders inko kaise istemal karke forex market mein behtareen trading decisions le sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#14 Collapse

Support aur Resistance Levels in Forex: Ahem Tafseeliyat

Forex trading mein safalta paane ke liye, traders ko market ke support aur resistance levels ko samajhna aur inko sahi taur par istemal karna zaroori hai. Yeh article "Support aur Resistance Levels in Forex: Ahem Tafseeliyat" is mudda par tafseeli charcha karta hai aur traders ko support aur resistance levels ke mahatva ko samajhne mein madad karta hai.

Introduction:

Support aur resistance levels forex trading mein do ahem technical concepts hain jo traders ko market analysis mein madad karte hain. In levels ko samajh kar, traders price movements ko samajh sakte hain aur sahi samay par trading decisions le sakte hain.

Support Level:

Support level ek price point hai jahan se price neeche girne se rokta hai aur wapas upar badh sakta hai. Yeh ek imaginary line hoti hai jo traders ke liye ek mahatvapurn reference point hai. Support level par traders long positions lete hain, ummid hai ki price wahan se phir se badhega.

Resistance Level:

Resistance level ek price point hai jahan se price upar badhne se rokta hai aur wapas neeche gir sakta hai. Yeh bhi ek imaginary line hoti hai aur traders ke liye ek mahatvapurn reference point hai. Resistance level par traders short positions lete hain, ummid hai ki price wahan se neeche girayega.

Kyun Hote Hain Yeh Levels Ahem:

Support aur resistance levels market psychology aur supply-demand dynamics par mabni hote hain. Traders ke sentiment, market mein available liquidity, aur historic price points in levels ko influence karte hain. In levels ko samajh kar, traders future price movements ka anuman laga sakte hain.

Trading Strategies:

Support aur resistance levels ke istemal se traders apni trading strategies develop karte hain. Breakout strategies, range-bound trading, aur trend reversal strategies in levels par adharit hote hain. Traders in levels ko istemal karke entry aur exit points tay karte hain.

Risk Management:

Support aur resistance levels ka sahi istemal karne ke liye, risk management ka bhi dhyan rakhna zaroori hai. Stop-loss orders lagana aur position sizes ko control karna in levels par adharit trading mein mahatvapurna hota hai.

Akhiri Kathan:

Support aur resistance levels forex trading mein mahatva purna hai aur inke sahi taur par istemal se traders market movements ko samajh sakte hain. Yeh levels trading decisions ko madad karte hain aur traders ko market ke mukable mein behtar taur par taiyar karte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Support aur resistance levels in forex

Forex Mein Support aur Resistance Levels: Trading Mein Ahmiyat

Forex trading, ya Foreign Exchange trading, aik bohot hi dilchasp aur aham tajziya hai jo ke duniya bhar ke traders ke darmiyan hota hai. Forex market, dunia ka sab se bara aur sab se active market hai jahan har din karoron dollars ki transaction hoti hai. Yeh market kabhi bhi band nahi hoti aur 24 ghantay chalti hai. Forex trading mein, support aur resistance levels ka buhat ahmiyat hai, kyunki yeh levels traders ko market ke movements ko samajhnay mein madad dete hain aur unhe trading decisions banane mein guide karte hain.

Support aur Resistance Kya Hota Hai?

Support aur resistance levels, market mein price movements ko analyze karne ke liye istemal kiye jane wale mukhtalif points hote hain. In levels ko samajhna aur pehchan'na trading ke liye zaroori hai. Yeh levels traders ko market trends aur price action ke bare mein samajhne mein madad karte hain.- Support Level: Support level woh price point hota hai jahan se market ki tendency hoti hai ke price neeche nahi giraygi. Yani, jab price support level tak aati hai, toh yeh wahan se phir se upar ja sakti hai.

- Resistance Level: Resistance level woh price point hota hai jahan se market ki tendency hoti hai ke price agey nahi barh sakti. Yani, jab price resistance level tak aati hai, toh yeh wahan se neeche ja sakti hai.

Forex Trading Mein Support aur Resistance Levels Ki Ahmiyat

Forex trading mein support aur resistance levels ka buhat bara role hota hai. In levels ko samajh kar, traders market ke trend ko samajhte hain aur apni trading strategies banate hain. Yeh kuch wajohat hain ke support aur resistance levels forex trading mein kyun ahmiyat rakhte hain:- Price Prediction: Support aur resistance levels traders ko price ka behavior samajhne mein madad karte hain. Jab price support level tak aati hai, toh traders expect karte hain ke price upar ja sakegi. Jab price resistance level tak aati hai, toh traders expect karte hain ke price neeche ja sakegi.

- Entry aur Exit Points: Support aur resistance levels traders ko entry aur exit points provide karte hain. Traders support level par long positions enter karte hain aur resistance level par short positions enter karte hain.

- Stop Loss aur Take Profit Orders: Traders support aur resistance levels ka istemal kar ke apne stop loss aur take profit orders set karte hain. Stop loss orders support level ke neeche aur take profit orders resistance level ke upar set kiye jate hain.

- Market Psychology: Support aur resistance levels market psychology ko reflect karte hain. Jab price support level tak aati hai, toh traders buy orders place karte hain aur jab price resistance level tak aati hai, toh traders sell orders place karte hain.

- Trend Identification: Support aur resistance levels traders ko market trends identify karne mein madad karte hain. Agar price support level ko break karta hai aur neeche jaata hai, toh yeh bearish signal hai. Agar price resistance level ko break karta hai aur upar jaata hai, toh yeh bullish signal hai.

Conclusion

Forex trading mein support aur resistance levels ka buhat bara role hota hai. In levels ko samajh kar, traders market trends ko samajhte hain aur apni trading strategies banate hain. Support aur resistance levels traders ko price behavior samajhne mein madad karte hain aur unhe trading decisions banane mein guide karte hain. Yeh levels market psychology aur trend identification mein bhi madadgar sabit hote hain. Is liye, har forex trader ko support aur resistance levels ko samajhna aur istemal karna zaroori hai taake woh successful trading kar sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:49 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим