Trade piercing line candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction piercing line candlestick pattern aik best candlestick pattern hota hey jo keh forex market mein pattern os time banta hey jab gerta hova assert aik long bearish pattern banata hey jes kay bad aik chote bullish candlestick ban sakte hey jo keh pechle bearish candlestick kay 50% say oper par aa kar close ho jate hey yeh trader kay ley basree tareka kar bana sakta hey jes par assert buy/sell keya ja sakta hey zail ka chart dekhata hey keh yeh assert kes tarah buy ya sell keya ja sakta hey piercing line chart pattern ke pehchan piercing line pattern ke pehchan aam tor par asan hote hey ap ko es bat ko yaqene banana ho ga keh assert ke price kahan par ja rehe hote hey ager forex market mein assert ke price nechay kay trend mein hote hey to ap jes pattern ko note karen gau woh piercing line pattern nahi ho ga dosra bain taraf bearish pattern ban sakta hey to es ke zyada tar body bare ho sakte hey or forex market mein upper or lower shadow ho saktay hein es candlestick ke lambai note karnay kay ley important bhe ho sakte hey pattern ko note karna chihay dosra bain taraf aik bearish candlestick hote hey jes ke body bare hote hey upper or lower shadow hotay hein es candlestick ke lambai note karnay kay ley important ho sakte hey kunkeh es ko thorasa long hona zaroore ho sakta hey tesara bearish candlestick kay bad aik bullish candlestick bhe ban sakte hey jo pechle candlestick kay qareeb 50% say oper close ho jate hey es candlestick mein ak chota sa gap ho sakta hey jaisa keh oper dekhaya ja choka hey yeh aik bullish candlestick hote hey jokeh aam tor par dosree candlestick say nechay open hote hey Trading Example nechay deya geya chart piercing pattern ke aik ache mesal paish karta hey es ko forex chart mein hum daikh saktay hein keh piercing line pattern crude oil strong bearish kay trend mein rehe hey or forex market mein yeh bhe daikh saktay hein keh commodity aik strong bearish kay trend ko indicate karte hey es kay bad es nay aik strong gap pattern banya hey bad mein yeh price taqreban 50% say oper close ho jata hy jaisa keh ap daikh saktay hein keh es timekay doran aik short wapceho sakte hey dosree mesal forex market mein natural gas ke hote hey jo keh zabardast bearish ka trend tha jes kay bad bullish candlestick ban jate hey jes kay bad price aik chote bullish trend line bananay heyدیتے جائیںThanksحوصلہ افزائی کے لیے -

#3 Collapse

Assalamu Alaikum Dosto!Piercing Line Candlestick Pattern

"Piercing pattern" ek do-din ka candlestick price pattern hai jo pehle din average ya usse bhi zyada trading range ke saath aata hai, jiska opening high ke qareeb hota hai aur closing low ke qareeb hota hai. Piercing pattern ek potential short-term change ko indicate karta hai, jisme ek upward trend se downward trend ki taraf jaane ka ishara hota hai. Ye pattern bullish engulfing pattern se kaafi milta julta hai, jo ek do-candle pattern hai aur uska appearance bhi kuch aisa hi hota hai.

Steve Nison ne pehli baar piercing candlestick pattern ko 1991 mein apne book "Japanese Candlestick Charting Techniques" mein define kiya tha. Ye pattern 18th century ke old-school Japanese candlestick charting methods par mabni hai.

Piercing line candlestick pattern ek aam maane jane wala candlestick pattern hai jo forex traders istemaal karte hain taaki woh market sentiment mein hone wale shifts ko pehchan sakein. Is pattern mein do candles shamil hote hain: ek lambi bearish candle, aur uske baad ek bullish candle jo pehle din ke low ke neeche open hota hai aur pehle bearish candle ke midpoint ke upar close hota hai.

Pattern ko "piercing" is liye kaha jata hai kyunki ye market mood mein ek shift ko darust karta hai, negative se bullish ki taraf. Isse often ek ishara samjha jata hai ki bearish trend ki momentum kam ho rahi hai aur ek naya bullish trend ubhar sakta hai. Pattern ke pehle candle mein selling pressure ka continuation dikhai deta hai, jabki doosra candle, jo bullish hota hai, pehle din ke close se neeche open hota hai lekin uske baad pehle bearish candle ke midpoint ke upar close ho jata hai. Ye ek potential shift ko darust karta hai, bearish trend se bullish trend ki taraf.

Explaination

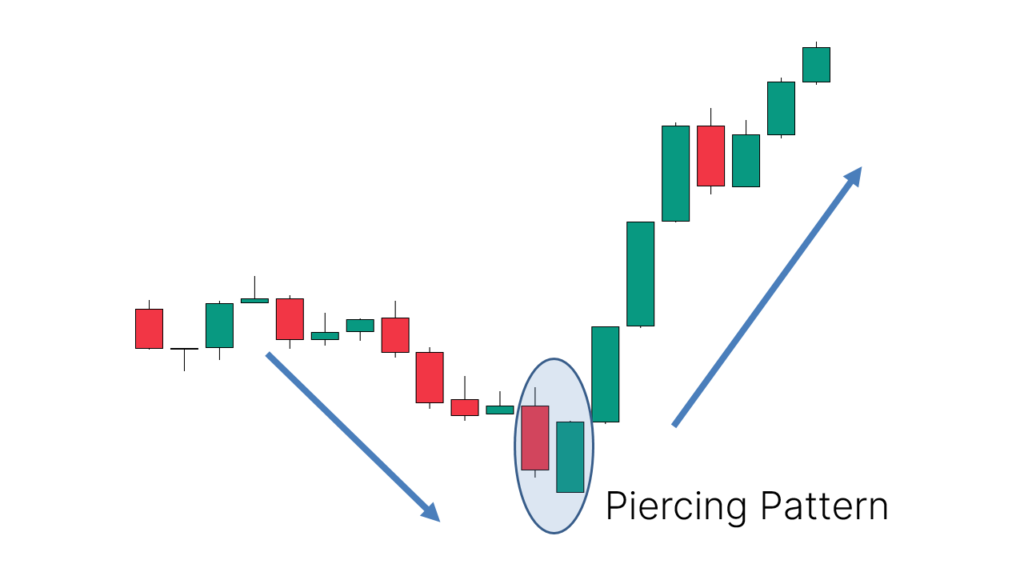

Piercing candlestick ek pattern hai jo forex ya stock markets mein possible price changes ko spot karne mein madad karta hai. Piercing candlestick do candles se bana hota hai, jisme pehla candle lamba red/bearish candle hota hai, uske baad aata hai ek lamba green/bullish candle jo pehle din ke low ke neeche open hota hai. Green candle phir pehle din ke red candle ke midpoint ke upar close hota hai, ise piercing kehte hain. Niche di gayi tasveer piercing candlestick pattern ko dikhati hai.

Ek girte hue asset ne pehle ek lambi bearish candle banai hoti hai, phir ek chhoti bullish candle aati hai jo 50% se zyada upar close hoti hai pehle wale bearish candlestick ke, ye ek piercing candlestick pattern banati hai. Aksar traders ek visual method ka istemaal karte hain taaki wo asset ko kharidne ya bechne ka faisla kar sakein. Niche di gayi tasveer ye pattern kaise banata hai, ko dikhati hai.

Piercing line candlestick pattern ye dikhata hai ki buyers ne selling ke baad control haasil kiya hai aur ise ek bullish signal maana jata hai. Traders is pattern ko doosre technical indicators ke saath istemaal karte hain trading decisions lene ke liye.

Piercing Line Pattern Ki Psychology

Piercing line pattern psychologically market ke mood mein ek badalav ko darust karta hai, jisme negative se bullish ki taraf ek shift hoti hai. Pehle din ke lambi red candle mein price ki badi giraawat aur negative feelings dikhai jaati hain. Lekin dusre din ka gap down optimistic traders ko market mein discounted rate par dakhil hone ka mauka deta hai. Positive sentiment badhta hai jab price dusre din badhti hai, aur pehle din ke actual body ke midpoint ke upar close hone ka matlab hai ki buyers ne market par control haasil kiya hai. Piercing line pattern ko traders frequently ek buy signal ke roop mein istemaal karte hain, jo keh sakta hai ki bearish trend khatam ho raha hai aur ek bullish trend shuru hone wala hai. Lekin kisi bhi trading decision se pehle, traders ko hamesha pattern ko doosre technical indicators aur fundamental research ke saath double-check karna chahiye.

[I Example: [/I] Chaliye ek example dekhte hain ki piercing line trading strategy kaise istemaal ki ja sakti hai. Traders pehle market mein ek downward trend dhoondhte hain. Jab ek downtrend establish ho jata hai, to wo dekhte hain ki ek choti bearish candlestick dikhai deti hai. Phir wo dekhte hain ki ek bullish candlestick aati hai jo pehle wale bearish candlestick ke low ke neeche open hoti hai lekin uske midpoint ke upar close hoti hai. Traders jo is pattern ko pehchaan lete hain, wo ek long position open karte hain bullish candlestick ke close par aur ek stop loss pehle wale bearish candlestick ke low ke neeche rakhte hain. Traders final mein profits ek predetermined level par le lete hain, jaise ki koi resistance level ya Fibonacci retracement level. Ye tactics traders ko help karte hain piercing candlestick pattern ka istemaal karke market bullish reversals se potentially profit kamane mein.

Technical Analysis Mein Piercing Line Patterns Ki Identification

Pehle toh confirm karna zaroori hai ki asset ki price decline ho rahi hai. Agar aisa nahi hai toh ye pattern nahi hai. Dusra, left side par ek bearish candle hoti hai jo aksar bada body wali hoti hai aur uske upper aur lower shadows kam hote hain. Iski lambai ek important consideration hai kyunki ye candle thodi lambi honi chahiye. Iske baad ek bullish candle aati hai jo pehle wale bearish candle ke closure ke kareeb 50% upar close hoti hai. Is candle mein thoda sa gap hota hai. Ye bullish candle aam taur par doosre candle ke neeche open hoti hai, jaise ki upar dikhaya gaya hai.

Price jo bearish candle ke upar close hoti hai, woh batata hai ki bearish trend kamzor ho raha hai. Ye pattern traders ko alert karta hai ki ek new bullish trend shuru hone wala hai. Lekin jab false breakout pattern hota hai, toh ye traders ko bhi alert karta hai ki negative continuation ho sakti hai.

Piercing Line pattern dikhata hai ki bulls control haasil kar rahe hain aur bears zameen kho rahe hain. Pehle candlestick ke low aur doosre candlestick ke open ke beech ka gap ek buying opportunity create karta hai traders ke liye jo samajhte hain ki trend reverse ho raha hai. Piercing Line pattern ko traders ek signal ke roop mein istemaal kar sakte hain long positions shuru karne ya short positions close karne ke liye. Stop-loss orders risk ko control karne ke liye lagaye jaate hain agar ye pattern expected reversal nahi dikhata.

Trader Ko Piercing Line Pattern Ka Kaise Reaction Hona Chahiye?

Jab ek Piercing Line pattern price chart par dikhai deta hai, traders ise ek buy signal ke roop mein interpret kar sakte hain. Ye pattern dikhata hai ki selling pressure kam ho gayi hai aur bulls control haasil kar rahe hain. Zaroori hai yaad rakhna ki koi bhi indicator ya pattern safalta ko guarantee nahi kar sakta, aur har trade kuch risk ke saath hoti hai. Traders Piercing Line candlestick pattern ke reaction par kuch kadam utha sakte hain. Pehle toh ye confirm karna zaroori hai ki pattern valid hai aur doosre candle ka close pehle candle ke midpoint ke upar hai. Fir market ke overall picture ko dekhein aur Piercing Line pattern dwara suggested bullish bias ko support karne wale aur signs ya patterns ko dhoondein. Traders risk ko control karne ke liye stop-loss orders lagayein aur trade ka risk-to-reward ratio analyze karein. Agar Piercing Line pattern verify hota hai aur market environment ise support karta hai, to trader long position open karne ka soch sakte hain. Price movement ko closely observe karna aur position ko close karna tay karna bhi bahut important hai agar market trader ke khilaaf ho jaata hai. Traders Piercing Line pattern ka istemaal karke risk ko manage karte hue potential profit kamane ki koshish kar sakte hain.

Piercing Line Candlestick Patterns ka Indicators K Sath Istemal

Piercing line candlestick pattern ke saath indicators ka istemaal karke traders apne trading decisions ko behtar bana sakte hain. Piercing line candlestick pattern ek downtrend ke baad aane wala bullish reversal pattern hai. Isme do candles hote hain, pehla ek lamba red candle aur doosra ek lamba green candle. Dono candles pehle din ke low ke neeche open hote hain aur pehle din ke candle ke midpoint ke upar close hote hain. Traders is pattern ko trade karte waqt Moving Average Convergence Divergence (MACD) ya Relative Strength Index (RSI) jaise indicators ka istemaal karte hain taaki reversal confirm ho sake. For example, agar RSI oversold hai aur piercing line pattern develop hone par badhne lagta hai, toh ye ek potential trend reversal ko indicate kar sakta hai. Agar MACD piercing line pattern develop hone par apne signal line ke upar cross karta hai, toh ye bhi ek possible trend reversal ko darust karta hai.

Jab Piercing Line pattern trade kiya jata hai, to traders typically confirmation ka wait karte hain trading decisions lene se pehle. Wo doosre bullish signals ko bhi dekhte hain, jaise ki ek bullish candlestick ya gap up, reversal ko strengthen karne ke liye. Market ke broader context ko bhi consider karna important hai, aur doosre technical indicators, jaise ki Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD), ka istemaal bhi pattern ko trade karne ke faislay ko support karne ke liye.- Piercing Line Pattern vs Stochastic Oscillator

Nahi, Stochastic Oscillator specifically Piercing Line Candlestick Patterns ke liye behtar indicator nahi hai, bhi kehne ki despite its usefulness in detecting overbought and oversold conditions. Ye is liye hai kyunki Stochastic Oscillator zyada tar momentum aur trend continuation ko spot karne mein accha hota hai, jabki Piercing Line pattern zyada trend reversal signal hai. - Piercing Line Pattern vs Relative Strength Index (RSI)

Nahi, RSI ko trading decisions ke liye sole basis ke taur par istemaal nahi karna chahiye, bhi kehne ki despite RSI can be used to confirm the strength of a Piercing Line pattern. Iske alawa, traders ko volume, trend lines, aur support aur resistance levels jaise doosre elements ko bhi madde nazar rakhna chahiye.

Piercing Line Pattern Advantages & Limitations

Piercing Line pattern ko pehchanne ke liye traders ko market mein ek saaf aur defineable downtrend dhoondhna chahiye. Pattern ke pehle candlestick, jo downtrend ke end par aata hai, woh ek bearish candlestick hona chahiye, jabki doosra candlestick ek bullish candle hona chahiye jo black candlestick ke neeche open hota hai aur black candlestick ke midpoint ke upar close hota hai. Jitna bada gap down black candle se white candle tak hoga, utni zyada powerful potential reversal hogi. White candle jo black candle par close hoti hai, utna zyada reversal probable hota hai.- Advantages

Piercing line candlestick patterns ke fayde unke simple hone se judte hain, niche teen advantages hain is pattern ke:- Traders ko piercing line pattern se ek clear signal milta hai, jo dikhata hai ki market attitude pessimistic se bullish ki taraf shift ho sakti hai. Ye sentiment ka badalav buyers ke liye ek mauka dikhata hai.

- Piercing line pattern probable price reversal ka indicator hai, kyunki isme dikhaya jata hai ki selling pressure kam ho gayi hai, jisse buyers market mein aakarshit ho sakte hain aur price ka direction reverse ho sakta hai.

- Traders is pattern ko frequently doosre technical indicators ke saath istemaal karte hain, jaise moving averages ya volume indicators, takatwar reversal ke chance ko confirm karne ke liye aur apne trades ki accuracy ko boost karne ke liye.

Piercing line pattern traders ke toolkit ka ek useful addition ho sakta hai aur agar ise cautious risk management aur market background ki in-depth study ke saath istemaal kiya jaye, toh ye trader ke overall trading strategy ka ek asset ban sakta hai. - Limitations

Piercing line candlestick patterns ka use hone ke bawajood unke kuch limitations hain. Yahaan teen main disadvantages hain:- Piercing line candlestick pattern sirf rare cases mein banta hai, iska matlab hai ki ye pattern anticipate karna mushkil ho jata hai.

- Piercing line candlestick pattern doji aur morning star ke comparison mein itna effective nahi hai. Iske false signals ka rate mentioned patterns se zyada hota hai.

- Sirf piercing line patterns par bharosa karke bina doosre technical analysis tools ya fundamental factors ko dhyan mein rakhe trading decisions lena galat ho sakta hai.

In limitations ka major hissa pattern ki rarity se juda hua hai. Iske liye sabse behtar hai ki aap ise actively dhoondhne ki jagah, jab aapko dikhe toh action lo.

Conclusion

Piercing Line pattern forex traders ke liye ek ahem tool hai jo unhe market mein potential bullish reversal signals ko pehchanne mein madad karta hai. Is pattern ke characteristics aur implications ko samajh kar, traders ise apne technical analysis mein shaamil karke well-informed trading decisions le sakte hain. Lekin ye bhi zaroori hai ki pattern ko doosre forms of analysis aur risk management strategies ke saath istemaal kiya jaye takay false signals aur market volatility ke potential ko kam kiya ja sake.

Piercing line candlestick pattern ko ek bullish reversal pattern maana jata hai. Ye pattern do din mein develop hota hai aur isme pehle din ek lamba red candle hota hai, jo uske baad ek lamba green candle ke saath aata hai. Green candle ka opening price pehle din ke closing price se neeche hota hai aur closing price pehle din ke candle ke midpoint se upar hota hai.

Haan, piercing line candlesticks ka istemaal karke trading profitable ho sakta hai. Is pattern ki success variables par depend karti hai, jaise market conditions, timeframe, aur doosre technical indicators. Piercing line candlestick pattern traders ko prudent risk management guidelines follow karne chahiye aur sure hona chahiye ki unke paas ek clear trading strategy hai. - Piercing Line Pattern vs Stochastic Oscillator

-

#4 Collapse

Piercing Line Candlestick Pattern

Piercing Line Candlestick Pattern ek bullish reversal pattern hai jo do candlesticks se mil kar banta hai. Ye pattern downtrend ke end ko indicate karta hai aur uptrend ki shuruaat ko suggest karta hai. Yeh pattern traders ke liye valuable hota hai kyunki isse market ke direction ka pata lagaya ja sakta hai. Chaliye, Piercing Line Candlestick Pattern k explanation ke baare mein baat karte hain:

Piercing Line Candlestick Pattern:

Piercing Line Candlestick Pattern do candlesticks se mil kar banta hai. Pehla candlestick ek bearish candle hota hai jo downtrend ko indicate karta hai. Dusra candlestick ek bullish candle hota hai jo pehle candle ki adhi body ko cover karta hai aur uptrend ki shuruaat ko signify karta hai. Yeh pattern tab hota hai jab pehla candlestick ke neeche ki taraf giraftar hota hai aur doosra candlestick pehle candlestick ke ooper close karta hai.

Identification Characteristics:- Downtrend: Piercing Line Candlestick Pattern usually downtrend ke end mein dekha jata hai.

- Bearish Candle: Pehla candlestick ek lambi bearish candle hoti hai jo selling pressure ko indicate karta hai.

- Bullish Candle: Dusra candlestick ek lambi bullish candle hoti hai jo pehle candlestick ke neeche open hoti hai aur pehle candlestick ki adhi body ko cover karti hai.

- Closing Price: Dusra candlestick pehle candlestick ke ooper close hoti hai ya uske qareeb close hoti hai.

Trading Strategy:

Piercing Line Candlestick Pattern ko trade karne ke liye, traders ko neeche diye gaye steps ko follow karna chahiye:- Confirmation: Piercing Line pattern ko confirm karne ke liye, traders ko doosre candlestick ka close pehle candlestick ke ooper dekhna chahiye.

- Entry Point: Agar Piercing Line pattern confirm ho jata hai, to traders long position enter kar sakte hain.

- Stop Loss: Stop loss order ko set karna important hota hai, taki traders risk ko minimize kar sakein.

- Target: Target ko set karna important hai. Traders ko price action aur market conditions ke hisab se target decide karna chahiye.

Explanation (Tafseel):

Piercing Line Candlestick Pattern, market ke direction ko samajhne ka ek important tool hai. Ye pattern downtrend ke baad bullish reversal ko signify karta hai. Jab market downtrend mein hota hai aur bearish candle form hoti hai, tab traders ko market ko closely monitor karna chahiye. Agar doosre din ek bullish candle form hoti hai jo pehle candle ki adhi body ko cover karta hai aur pehle candle ke ooper close hoti hai, to yeh Piercing Line pattern banata hai.

Yeh pattern indicate karta hai ke selling pressure kam ho rahi hai aur buying pressure increase ho rahi hai. Iska matlab hai ke market ka sentiment badal raha hai aur uptrend shuru hone ki sambhavna hai. Traders ko is pattern ko confirm karne ke liye doosre candlestick ka close closely monitor karna chahiye. Agar pattern confirm ho jata hai, to traders long position enter kar sakte hain.

Conclusion:

Piercing Line Candlestick Pattern ek powerful bullish reversal pattern hai jo traders ko market ke direction ka pata lagane mein madad karta hai. Is pattern ko samajhne aur trade karne ke liye, traders ko candlestick chart analysis aur market trends ka acchi tarah se gyaan hona chahiye. Saath hi, risk management strategies ka istemal karna bhi zaroori hai. Piercing Line pattern ke saath sahi tareeke se trade karne se, traders ko profitable trading opportunities mil sakti hain.

-

#5 Collapse

Trade piercing line candlestick Pattern

Piercing Line Candlestick Pattern forex trading mein ek bullish reversal pattern hai jo ke downtrend ke doran dekha jata hai aur bullish reversal ko indicate karta hai. Is pattern mein do candlesticks shamil hote hain: pehla ek long bearish candlestick jo ke downtrend ko darust karta hai, aur doosra ek bullish candlestick jo pehle candlestick ke neeche open hota hai lekin uske middle se guzar kar close hota hai. Neeche di gayi maloomat aapko Piercing Line Candlestick Pattern ke bare mein samajhne mein madad karegi:

Piercing Line Candlestick Pattern Kya Hai?

Formation:

Piercing Line Candlestick Pattern downtrend ke doran form hota hai jab market mein price down ja rahi hoti hai.

Pehla candlestick ek long bearish candle hoti hai jo ke selling pressure ko darust karti hai.

Doosra candlestick ek bullish candle hoti hai jo pehle candlestick ke neeche open hoti hai, lekin uske middle se guzar kar close hoti hai.

Bullish Reversal Signal:

Piercing Line Candlestick Pattern bullish reversal ko indicate karta hai.

Doosri candlestick pehli bearish candle ke neeche open hoti hai, indicating ki downtrend ke baad price gap down se open hoti hai.

Phir price downtrend ke doran recover karta hai aur doosri candlestick ka close pehli candlestick ke middle se upar hota hai.

Price Confirmation:

Agar doosri candlestick pehli bearish candlestick ke 50% se zyada upar close hoti hai, to ye pattern ko confirm karta hai.

Iska matlab hai ke bullish momentum strong hai aur potential trend reversal ho sakta hai.

Volume Analysis:

Pattern ko confirm karne ke liye traders volume analysis bhi karte hain.

Agar doosri candlestick ke baad high volume bhi hota hai, to ye pattern ko confirm karta hai.

Trading Strategy:

Piercing Line Candlestick Pattern ko dekh kar traders bullish reversal ke possibilities ko anticipate karte hain.

Agar is pattern ke baad bullish confirmation milta hai, to traders long positions enter karte hain aur stop-loss orders lagate hain.

Piercing Line Candlestick Pattern forex trading mein bullish reversal ko indicate karta hai aur traders ko market mein potential trend change ke bare mein alert rakhta hai. Is pattern ko samajh kar aur sahi tareeqe se trade karke traders apne trading strategies ko improve kar sakte hain aur market mein consistent profits earn kar sakte hain.

-

#6 Collapse

Trade piercing line candlestick Pattern

Piercing Line Candlestick Pattern forex trading mein ek bullish reversal pattern hai jo ke downtrend ke doran dekha jata hai aur bullish reversal ko indicate karta hai. Is pattern mein do candlesticks shamil hote hain: pehla ek long bearish candlestick jo ke downtrend ko darust karta hai, aur doosra ek bullish candlestick jo pehle candlestick ke neeche open hota hai lekin uske middle se guzar kar close hota hai. Neeche di gayi maloomat aapko Piercing Line Candlestick Pattern ke bare mein samajhne mein madad karegi:

Piercing Line Candlestick Pattern Kya Hai?

Formation:

Piercing Line Candlestick Pattern downtrend ke doran form hota hai jab market mein price down ja rahi hoti hai.

Pehla candlestick ek long bearish candle hoti hai jo ke selling pressure ko darust karti hai.

Doosra candlestick ek bullish candle hoti hai jo pehle candlestick ke neeche open hoti hai, lekin uske middle se guzar kar close hoti hai.

Bullish Reversal Signal:

Piercing Line Candlestick Pattern bullish reversal ko indicate karta hai.

Doosri candlestick pehli bearish candle ke neeche open hoti hai, indicating ki downtrend ke baad price gap down se open hoti hai.

Phir price downtrend ke doran recover karta hai aur doosri candlestick ka close pehli candlestick ke middle se upar hota hai.

Price Confirmation:

Agar doosri candlestick pehli bearish candlestick ke 50% se zyada upar close hoti hai, to ye pattern ko confirm karta hai.

Iska matlab hai ke bullish momentum strong hai aur potential trend reversal ho sakta hai.

Volume Analysis:

Pattern ko confirm karne ke liye traders volume analysis bhi karte hain.

Agar doosri candlestick ke baad high volume bhi hota hai, to ye pattern ko confirm karta hai.

Trading Strategy:

Piercing Line Candlestick Pattern ko dekh kar traders bullish reversal ke possibilities ko anticipate karte hain.

Agar is pattern ke baad bullish confirmation milta hai, to traders long positions enter karte hain aur stop-loss orders lagate hain.

Piercing Line Candlestick Pattern forex trading mein bullish reversal ko indicate karta hai aur traders ko market mein potential trend change ke bare mein alert rakhta hai. Is pattern ko samajh kar aur sahi tareeqe se trade karke traders apne trading strategies ko improve kar sakte hain aur market mein consistent profits earn kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

Piercing Line Candlestick Pattern

Piercing Line Candlestick Pattern ek bullish reversal pattern hai jo do candlesticks se mil kar banta hai. Ye pattern downtrend ke end ko indicate karta hai aur uptrend ki shuruaat ko suggest karta hai. Yeh pattern traders ke liye valuable hota hai kyunki isse market ke direction ka pata lagaya ja sakta hai. Chaliye, Piercing Line Candlestick Pattern k explanation ke baare mein baat karte hain:

Piercing Line Candlestick Pattern:

Piercing Line Candlestick Pattern do candlesticks se mil kar banta hai. Pehla candlestick ek bearish candle hota hai jo downtrend ko indicate karta hai. Dusra candlestick ek bullish candle hota hai jo pehle candle ki adhi body ko cover karta hai aur uptrend ki shuruaat ko signify karta hai. Yeh pattern tab hota hai jab pehla candlestick ke neeche ki taraf giraftar hota hai aur doosra candlestick pehle candlestick ke ooper close karta hai.

Identification Characteristics:- Downtrend: Piercing Line Candlestick Pattern usually downtrend ke end mein dekha jata hai.

- Bearish Candle: Pehla candlestick ek lambi bearish candle hoti hai jo selling pressure ko indicate karta hai.

- Bullish Candle: Dusra candlestick ek lambi bullish candle hoti hai jo pehle candlestick ke neeche open hoti hai aur pehle candlestick ki adhi body ko cover karti hai.

- Closing Price: Dusra candlestick pehle candlestick ke ooper close hoti hai ya uske qareeb close hoti hai.

Trading Strategy:

Piercing Line Candlestick Pattern ko trade karne ke liye, traders ko neeche diye gaye steps ko follow karna chahiye:- Confirmation: Piercing Line pattern ko confirm karne ke liye, traders ko doosre candlestick ka close pehle candlestick ke ooper dekhna chahiye.

- Entry Point: Agar Piercing Line pattern confirm ho jata hai, to traders long position enter kar sakte hain.

- Stop Loss: Stop loss order ko set karna important hota hai, taki traders risk ko minimize kar sakein.

- Target: Target ko set karna important hai. Traders ko price action aur market conditions ke hisab se target decide karna chahiye.

Explanation (Tafseel):

Piercing Line Candlestick Pattern, market ke direction ko samajhne ka ek important tool hai. Ye pattern downtrend ke baad bullish reversal ko signify karta hai. Jab market downtrend mein hota hai aur bearish candle form hoti hai, tab traders ko market ko closely monitor karna chahiye. Agar doosre din ek bullish candle form hoti hai jo pehle candle ki adhi body ko cover karta hai aur pehle candle ke ooper close hoti hai, to yeh Piercing Line pattern banata hai.

Yeh pattern indicate karta hai ke selling pressure kam ho rahi hai aur buying pressure increase ho rahi hai. Iska matlab hai ke market ka sentiment badal raha hai aur uptrend shuru hone ki sambhavna hai. Traders ko is pattern ko confirm karne ke liye doosre candlestick ka close closely monitor karna chahiye. Agar pattern confirm ho jata hai, to traders long position enter kar sakte hain.

Conclusion:

Piercing Line Candlestick Pattern ek powerful bullish reversal pattern hai jo traders ko market ke direction ka pata lagane mein madad karta hai. Is pattern ko samajhne aur trade karne ke liye, traders ko candlestick chart analysis aur market trends ka acchi tarah se gyaan hona chahiye. Saath hi, risk management strategies ka istemal karna bhi zaroori hai. Piercing Line pattern ke saath sahi tareeke se trade karne se, traders ko profitable trading opportunities mil sakti hain. -

#8 Collapse

Candlestick patterns forex trading mein ek ahem tool hain jo traders ko market sentiment aur possible price movements ke bare mein visual cues dete hain. In patterns mein se ek piercing line pattern hai, jo ek noteworthy bullish reversal signal hota hai, khas tor par jab downtrend chal raha ho. Is pattern ki formation, significance, aur isko trade karne ka tareeqa samajhna traders ko informed decisions lene mein madadgar ho sakta hai. Piercing line pattern ki tafseel mein jane se pehle, candlestick charts ki buniyadi samajh zaroori hai. 18th century Japan mein develop hue ye candlestick charts ab modern trading mein bohot zyada istemal hote hain. Har candlestick ek specific time period ko represent karta hai aur opening, closing, high, aur low prices ke bare mein information deta hai.

Candlestick patterns single ya multiple candlesticks par mushtamil hote hain. Ye patterns potential market reversals, continuations, ya indecision ko identify karne mein madad dete hain. Piercing line pattern multi-candlestick patterns ke zail mein aata hai aur ek potential bullish reversal signal deta hai.

Piercing Line Pattern ki Formation

Piercing line pattern do candlestick formation hai jo downtrend ke neeche aata hai. Is pattern mein do candlesticks shamil hain:- Pehli Candlestick Bearish Candle:

- Piercing line pattern ki pehli candle lambi bearish candlestick hoti hai, jo yeh zahir karti hai ke bears control mein hain.

- Ye candle downtrend ko continue karti hai, jo ke strong selling pressure ko reflect karta hai.

- Doosri Candlestick Bullish Candle:

- Doosri candle pehli candle ke low se neeche open hoti hai, aam tor par gap down ke sath.

- Ye candle phir pehli candle ke midpoint ke upar close karti hai, jo market sentiment mein bearish se bullish shift ko suggest karti hai.

Piercing Line Pattern ki Ahamiyat

Piercing line pattern ek bullish reversal signal mana jata hai:- Market Sentiment ka Shift:

- Ye pattern ek clear shift from bearish to bullish sentiment reflect karta hai. Pehli strong bearish candle ke baad ek strong bullish response ye dikhata hai ke buyers control le rahe hain.

- Psychological Impact:

- Doosri candle ka gap down open karna aur phir us gap ko fill karna aur pehli candle ke midpoint ke upar close karna market psychology mein significant change dikhata hai.

- Volume Considerations:

- Jab doosri candle ke formation ke doran trading volumes zyada hote hain, to pattern ki validation aur strong ho jati hai. Increased volume bulls ke strong commitment ko suggest karta hai.

Piercing line pattern ko effectively trade karne ke liye traders ko ye steps consider karne chahiye:- Pattern ko Confirm Karna:

- Ensure karen ke pattern sab criteria meet karta ho: pehli candle bearish ho, doosri candle pehli candle ke low se neeche open ho, aur pehli candle ke midpoint ke upar close ho.

- Context Matters:

- Piercing line pattern zyada reliable hota hai jab ye prolonged downtrend ya significant support level par appear hota hai. Broader market context aur additional technical indicators check karna pattern ki reliability ko enhance kar sakta hai.

- Entry Points:

- Traders aksar piercing line pattern confirm hone ke baad agle candle ke open par long position enter karte hain. Waisay, kuch traders better entry price achieve karne ke liye chhoti retracement ka wait karte hain.

- Stop-Loss Placement:

- Stop-loss order doosri candle ke low ke neeche place karna chahiye. Ye risk ko manage karta hai agar reversal fail ho jaye aur downtrend resume ho.

- Profit Targets:

- Profit targets set karna zaroori hai. Traders previous resistance levels, Fibonacci retracement levels, ya moving averages ko potential exit points ke tor par use kar sakte hain.

Sochiye ke EUR/USD pair ek steady downtrend mein hai. Aglay events ho sakte hain:- Din 1: Ek lambi bearish candlestick form hoti hai, downtrend ko continue karte hue.

- Din 2: Market gap down ke sath open hota hai, initial bearish sentiment create karta hai. Lekin, buyers aggressively step in karte hain, price ko upar push karte hue taake Day 1 ki bearish candle ke midpoint ke upar close ho.

Dusre Indicators Ke Sath Combine Karna

Additional confirmation ke liye, traders aksar piercing line pattern ko dusre technical indicators ke sath use karte hain:- Moving Averages:

- Moving averages ka bullish crossover jaise ke 50-day moving average ka 200-day moving average ke upar cross karna piercing line pattern ke paas additional confirmation provide kar sakta hai.

- Relative Strength Index (RSI):

- RSI below 30, jo ke ek oversold condition indicate karta hai, ko piercing line pattern ke sath combine karna bullish reversal ke case ko strengthen kar sakta hai.

- Support and Resistance Levels:

- Agar piercing line pattern significant support level ke paas form hota hai, to ye successful reversal ke likelihood ko enhance karta hai.

Iske potential ke bawajood, piercing line pattern ke kuch limitations hain:- False Signals:

- Har technical pattern ki tarah, piercing line bhi false signals produce kar sakta hai. Yeh zaroori hai ke additional indicators ya confirmation ka wait kiya jaye position lene se pehle.

- Market Conditions:

- Pattern trending markets mein zyada effective hota hai. Sideways ya choppy market mein, piercing line ki reliability kam ho jati hai.

- News aur Events:

- Sudden news ya economic events technical patterns ko override kar sakte hain. Traders ko broader market environment aur upcoming news releases se hamesha waqif rehna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Pehli Candlestick Bearish Candle:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

Trade Piercing Line Candlestick Pattern: Aik Tafseeli Jaiza

1. Muqadma

Trade Piercing Line Candlestick Pattern aik mashhoor candlestick pattern hai jo stock trading aur forex market mein kaafi istamal hota hai. Yeh pattern specially reversal signal dene ke liye jaana jata hai. Market mein aksar trend reverse hone wale hote hain lekin humein yeh samajhne mein mushkil hoti hai ke kab aur kaisay hoga. Piercing Line Pattern humein is confusion se bachata hai aur trend ke reversal ko identify karne mein madad karta hai. Is article mein hum is pattern ko detail mein discuss karenge aur samjhenge ke yeh kaise kaam karta hai aur isko trading mein kaise apply kiya jata hai.

2. Piercing Line Pattern Kya Hai?

Piercing Line Pattern do candlesticks par mushtamil hota hai. Pehli candlestick bearish hoti hai jo ke red ya black color mein hoti hai aur doosri candlestick bullish hoti hai jo ke green ya white color mein hoti hai. Pehli bearish candlestick is baat ka signal hoti hai ke market mein selling pressure hai aur price neeche ja rahi hai. Doosri bullish candlestick yeh signal deti hai ke buyers market mein enter ho rahe hain aur price ko upar le ja rahe hain. Is pattern ko hum tab identify karte hain jab bullish candlestick pehli bearish candlestick ke aadhe se zyada hisse ko cover kar leti hai.

3. Pattern Ki Pehchaan

Piercing Line Pattern ki pehchaan ke liye do shartein poori honi chahiye. Pehli shart yeh ke bearish candlestick ke baad bullish candlestick bani ho jo pehli candlestick ke midpoint se zyada ko cover kare. Doosri shart yeh ke bullish candlestick ki closing price pehli candlestick ke midpoint se upar ho. Yeh pattern aksar strong downtrend ke baad banta hai jo ke signal deta hai ke market reversal hone wala hai aur price upar jaane wali hai. Is pattern ko pehchaanne ke liye chart analysis kaafi zaroori hai taake hum sahih signal le sakain.

4. Pattern Ka Maqsad

Is pattern ka maqsad market ke trend reversal ko pehchanna hota hai. Aksar market downtrend mein hoti hai aur investors sochte hain ke price aur neeche jayegi. Piercing Line Pattern is baat ka indication hota hai ke selling pressure kam ho raha hai aur buying pressure barh raha hai. Iska matlab yeh hai ke market uptrend ki taraf jaa sakti hai. Yeh pattern investors ko market mein entry aur exit ke points ko pehchanne mein madad karta hai aur profitable trading decisions lene mein assist karta hai.

5. Candlestick Components

Candlestick patterns ka basic element candlesticks hain jo price action ko visually represent karti hain. Piercing Line Pattern do candlesticks par mushtamil hota hai: pehli bearish candlestick aur doosri bullish candlestick. Pehli candlestick ka body kaafi lamba hota hai jo market mein strong selling pressure ko indicate karta hai. Doosri candlestick ka body bhi lamba hota hai jo market mein buying pressure ko show karta hai. Is pattern mein shadows (wicks) bhi hoti hain jo high aur low prices ko represent karti hain.

6. Confirmation Kaisa Hota Hai?

Piercing Line Pattern tab confirm hota hai jab bullish candlestick pehli bearish candlestick ke midpoint ko cross kar jaye. Yani agar bearish candlestick ka low price 100 aur high price 80 hai, to midpoint 90 hoga. Agar bullish candlestick 90 ke upar close hoti hai to pattern confirm ho jata hai. Confirmation ke baad hum trading decision le sakte hain lekin hamesha volume aur other technical indicators ko dekhna zaroori hota hai taake signal ki reliability ko check kiya ja sake.

7. Entry Points

Piercing Line Pattern ke baad entry point bullish candlestick ki closing ke baad hota hai. Jab bullish candlestick close hoti hai aur pattern confirm ho jata hai, tab hum market mein buy position le sakte hain. Entry ke waqt humein market ka overall trend, support aur resistance levels ko dekhna chahiye. Yeh pattern aksar strong support level par banta hai jo market ke reversal ka strong signal hota hai. Entry lete waqt risk management ka khayal rakhna chahiye aur hamesha proper stop loss set karna chahiye.

8. Exit Points

Exit points mukhtalif ho sakte hain depending on market conditions aur trader ke risk appetite par. Aam tor par hum resistance levels ko target set karte hain jahan hum expect karte hain ke price ruk sakti hai ya reverse ho sakti hai. Is pattern ke baad price aksar pehle resistance level tak pohanchti hai. Traders apne risk aur reward ratio ko dekhte hue exit points decide kar sakte hain. Some traders trailing stop loss bhi use karte hain taake profit lock ho sake jab tak trend continue rahe.

9. Stop Loss Placement

Stop loss placement trading mein bohat important hai taake potential losses ko minimize kiya ja sake. Piercing Line Pattern mein stop loss aksar bearish candlestick ke low ke neeche set kiya jata hai. Agar price bearish candlestick ke low se neeche jati hai to iska matlab pattern fail ho gaya hai aur market downtrend mein wapas ja sakti hai. Proper stop loss set karne se hum apne capital ko protect kar sakte hain aur losses ko control mein rakh sakte hain. Risk management trading ka ek aham hissa hai aur hamesha iska khayal rakhna chahiye.

10. Market Context Ki Ahmiyat

Market context ko samajhna bohat zaroori hai kyun ke koi bhi pattern context ke baghair reliable nahi hota. Piercing Line Pattern ko identify karne ke liye market ka overall trend, support aur resistance levels aur other technical indicators ko dekhna zaroori hai. Agar market strong downtrend mein hai aur support level ke kareeb Piercing Line banta hai to yeh strong reversal signal hota hai. Lekin agar market range-bound hai ya volatile hai to pattern ki reliability kam ho sakti hai. Context ko samajhne ke liye technical analysis tools ka istemal kiya jata hai.

11. Time Frames Ka Kirdar

Time frames ka kirdar bhi bohat important hai. Piercing Line Pattern har time frame mein banta hai lekin higher time frames par yeh ziada reliable hota hai. Higher time frames jaise ke daily, weekly aur monthly charts par patterns ka significance ziada hota hai kyun ke yeh long-term trends ko represent karte hain. Lower time frames jaise ke 5-minute, 15-minute aur hourly charts par patterns ziada frequently bante hain lekin inki reliability kam hoti hai. Higher time frames par patterns ko dekh kar hum market ke major trends ko better samajh sakte hain.

12. Volume Analysis

Volume analysis bhi Piercing Line Pattern ko samajhne mein madad karta hai. Jab bullish candlestick banti hai to volume ka increase hona pattern ko mazboot banata hai. Higher volume yeh indicate karta hai ke buyers strong hain aur market mein price ko upar le jaane ki ability rakhte hain. Agar volume low hai to pattern weak ho sakta hai aur market reversal ka signal reliable nahi hota. Volume ko samajhne ke liye volume indicators jaise ke On-Balance Volume (OBV) aur Volume Oscillator ka use kiya jata hai.

13. Pattern Ki Limitation

Har pattern ki tarah, Piercing Line bhi hamesha successful nahi hoti. Iski kuch limitations hain jo traders ko samajhni chahiye. Yeh pattern false signals bhi de sakta hai specially jab market volatile ho. Isliye hamesha is pattern ko other technical indicators ke sath combine karna chahiye taake signal ki reliability ko confirm kiya ja sake. Iske ilawa, yeh pattern short-term price movements ko represent karta hai aur long-term trends ko nahi dikhata. Is pattern ko use karte waqt hamesha risk management aur proper stop loss ka khayal rakhna chahiye.

14. Trading Strategies

Piercing Line Pattern ko use karte hue mukhtalif trading strategies apnaai ja sakti hain. Ek common strategy yeh hai ke pattern ko moving averages ke sath combine kiya jaye. Agar Piercing Line Pattern moving average ke upar banta hai to yeh strong bullish signal hota hai. Iske ilawa, oscillators jaise ke Relative Strength Index (RSI) aur Stochastic Oscillator ko use karke overbought aur oversold conditions ko dekh kar pattern ki reliability ko check kiya jata hai. Ek aur strategy yeh hai ke pattern ko Fibonacci retracement levels ke sath combine kiya jaye taake potential reversal points ko identify kiya ja sake.

15. Concluding Thoughts

Piercing Line Candlestick Pattern aik valuable tool hai jo traders ko market ke reversals identify karne mein madad karta hai. Yeh pattern specially downtrend ke baad bullish reversal ka signal deta hai. Is pattern ko identify karne ke liye candlestick analysis, volume analysis aur market context ko samajhna zaroori hai. Lekin hamesha yaad rahe ke koi bhi pattern hamesha reliable nahi hota isliye proper risk management aur stop loss ka khayal rakhna chahiye. Trading mein har decision calculated aur well-informed hona chahiye taake long-term success hasil ki ja sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:29 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим