Engulfing candlestick patterns details bullish & bearish engulfing pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

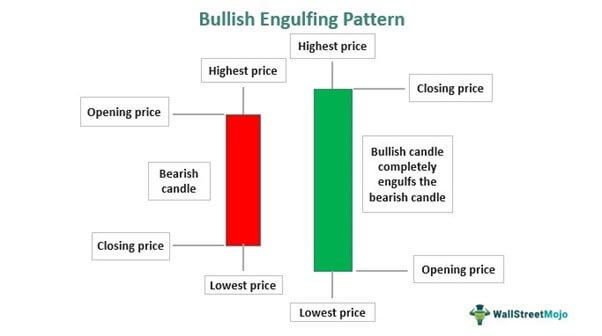

Engulfing candlestick patterns, bullish engulfing aur bearish engulfing, reversal patterns hote hain jo price action analysis mein use kiye jaate hain. In patterns mein ek large candlestick ek smaller candlestick ko engulf karta hai. Yahan fayde aur nuksan dono patterns ke baare mein details diye gaye hain: Bullish Engulfing Pattern:- Fayde: 1. Trend Reversal Signal: Bullish engulfing pattern bearish trend reversal ka strong signal provide karta hai. Is pattern ke formation ke baad, traders ko bullish trend ke reversal hone ki possibility ka indication milta hai. 2. Entry Point: Bullish engulfing pattern traders ko long positions enter karne ke liye ek entry point deta hai. Jab ye pattern form hoti hai, traders existing short positions ko exit kar sakte hain aur long positions enter kar sakte hain. 3. Confirmation: Bullish engulfing pattern ko dusre technical indicators aur analysis tools ke saath confirm karna aur combine karna important hai. Is pattern ke sath volume, support/resistance levels, aur oscillators jaise RSI ka istemal karke traders apne trading decisions ko further validate kar sakte hain. - Nuksan: 1. False Signals: Jaise ki har pattern, bullish engulfing pattern bhi false signals generate kar sakta hai. Market volatility aur price fluctuations ke wajah se, ye pattern kabhi kabhi inaccurate signals bhi de sakta hai. Isliye, isko confirm karne ke liye dusre technical indicators aur analysis tools ka istemal karna zaroori hai. 2. Lagging Indicator: Bullish engulfing pattern past price movements ke based par calculations karta hai, isliye ye ek lagging indicator hai. Isse pehle trend reversal hone ki confirmation nahi mil sakti. Isliye, isko dusre leading indicators aur price action patterns ke saath combine karna important hai. Bearish Engulfing Pattern: - Fayde: 1. Trend Reversal Signal: Bearish engulfing pattern bullish trend reversal ka strong signal provide karta hai. Is pattern ke formation ke baad, traders ko bearish trend ke reversal hone ki possibility ka indication milta hai. 2. Entry Point: Bearish engulfing pattern traders ko short positions enter karne ke liye ek entry point deta hai. Jab ye pattern form hoti hai, traders existing long positions ko exit kar sakte hain aur short positions enter kar sakte hain. 3. Confirmation: Bearish engulfing pattern ko dusre technical indicators aur analysis tools ke saath confirm karna aur combine karna important hai. Is pattern ke sath volume, support/resistance levels, aur oscillators jaise RSI ka istemal karke traders apne trading decisions ko further validate kar sakte hain. - Nuksan: 1. False Signals: Jaise ki har pattern, bearish engulfing pattern bhi false signals generate kar sakta hai. Market volatility aur price fluctuations ke wajah se, ye pattern kabhi kabhi inaccurate signals bhi de sakta hai. Isliye, isko confirm karne ke liye dusre technical indicators aur analysis tools ka istemal karna zaroori hai. 2. Lagging Indicator: Bearish engulfing pattern past price movements ke based par calculations karta hai, isliye ye ek lagging indicator hai. Isse pehle trend reversal hone ki confirmation nahi mil sakti. Isliye, isko dusre leading indicators aur price action patterns ke saath combine karna important hai.Har ek pattern apne fayde aur nuksan ke saath aata hai. Isliye, traders ko market conditions aur price action ko samajhne aur confirm karne ke liye dusre technical indicators aur analysis tools ka istemal karna zaroori hai. Dusra technical analysis aur risk management ka istemal karke traders apne trading decisions ko further validate kar sakte hain.

Bullish Engulfing Pattern:- Fayde: 1. Trend Reversal Signal: Bullish engulfing pattern bearish trend reversal ka strong signal provide karta hai. Is pattern ke formation ke baad, traders ko bullish trend ke reversal hone ki possibility ka indication milta hai. 2. Entry Point: Bullish engulfing pattern traders ko long positions enter karne ke liye ek entry point deta hai. Jab ye pattern form hoti hai, traders existing short positions ko exit kar sakte hain aur long positions enter kar sakte hain. 3. Confirmation: Bullish engulfing pattern ko dusre technical indicators aur analysis tools ke saath confirm karna aur combine karna important hai. Is pattern ke sath volume, support/resistance levels, aur oscillators jaise RSI ka istemal karke traders apne trading decisions ko further validate kar sakte hain. - Nuksan: 1. False Signals: Jaise ki har pattern, bullish engulfing pattern bhi false signals generate kar sakta hai. Market volatility aur price fluctuations ke wajah se, ye pattern kabhi kabhi inaccurate signals bhi de sakta hai. Isliye, isko confirm karne ke liye dusre technical indicators aur analysis tools ka istemal karna zaroori hai. 2. Lagging Indicator: Bullish engulfing pattern past price movements ke based par calculations karta hai, isliye ye ek lagging indicator hai. Isse pehle trend reversal hone ki confirmation nahi mil sakti. Isliye, isko dusre leading indicators aur price action patterns ke saath combine karna important hai. Bearish Engulfing Pattern: - Fayde: 1. Trend Reversal Signal: Bearish engulfing pattern bullish trend reversal ka strong signal provide karta hai. Is pattern ke formation ke baad, traders ko bearish trend ke reversal hone ki possibility ka indication milta hai. 2. Entry Point: Bearish engulfing pattern traders ko short positions enter karne ke liye ek entry point deta hai. Jab ye pattern form hoti hai, traders existing long positions ko exit kar sakte hain aur short positions enter kar sakte hain. 3. Confirmation: Bearish engulfing pattern ko dusre technical indicators aur analysis tools ke saath confirm karna aur combine karna important hai. Is pattern ke sath volume, support/resistance levels, aur oscillators jaise RSI ka istemal karke traders apne trading decisions ko further validate kar sakte hain. - Nuksan: 1. False Signals: Jaise ki har pattern, bearish engulfing pattern bhi false signals generate kar sakta hai. Market volatility aur price fluctuations ke wajah se, ye pattern kabhi kabhi inaccurate signals bhi de sakta hai. Isliye, isko confirm karne ke liye dusre technical indicators aur analysis tools ka istemal karna zaroori hai. 2. Lagging Indicator: Bearish engulfing pattern past price movements ke based par calculations karta hai, isliye ye ek lagging indicator hai. Isse pehle trend reversal hone ki confirmation nahi mil sakti. Isliye, isko dusre leading indicators aur price action patterns ke saath combine karna important hai.Har ek pattern apne fayde aur nuksan ke saath aata hai. Isliye, traders ko market conditions aur price action ko samajhne aur confirm karne ke liye dusre technical indicators aur analysis tools ka istemal karna zaroori hai. Dusra technical analysis aur risk management ka istemal karke traders apne trading decisions ko further validate kar sakte hain.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Engulfing Candlestick PatternEngulfing candlestick pattern forex aur stock market mein istemal hone wala aik ahem technical analysis tool hai. Yeh pattern traders aur investors ke liye market mein hone wale trend reversals ya trend changes ko pehchanne mein madadgar hota hai. Engulfing pattern ka naam uske appearance se aata hai jab aik candlestick doosri candlestick ko poori tarah se engulf (gher) leti hai. Is pattern ki pehchan ke liye traders ko market ke price charts aur candlesticks par focus rakhna hota hai. Bullish Engulfing Pattern First Candle (Bearish): Bullish engulfing pattern ki shuruaat ek bearish (girawat wali) candle se hoti hai. Is bearish candle mein market mein selling pressure hoti hai aur price down jata hai. Is candle ki high aur low levels important hoti hain. Second Candle (Bullish): Bullish engulfing pattern ki doosri candle ek bullish (barhawat wali) candle hoti hai, jo ke pehli candle ko poori tarah se engulf karti hai. Yani ke is candle ki high aur low levels pehli candle ke high aur low levels ko chhuti hain. Doosri candle bullish hoti hai aur ismein buying pressure dominate karti hai, jo ke price ko up lekar jati hai. Is candle ki closing price typically pehli candle ke closing price se oonchi hoti hai. Bearish Engulfing Pattern First Candle (Bullish): Bearish engulfing pattern ki shuruaat ek bullish (barhawat wali) candle se hoti hai. Is bullish candle mein market mein buying pressure hoti hai aur price up jata hai. Is candle ki high aur low levels important hoti hain. Second Candle (Bearish): Bearish engulfing pattern ki doosri candle ek bearish (girawat wali) candle hoti hai, jo ke pehli candle ko poori tarah se engulf karti hai. Yani ke is candle ki high aur low levels pehli candle ke high aur low levels ko chhuti hain. Doosri candle bearish hoti hai aur ismein selling pressure dominate karti hai, jo ke price ko down lekar jati hai. Is candle ki closing price typically pehli candle ke closing price se nichli hoti hai.ExplainationEngulfing candlestick pattern market mein hone wale trend reversals ko indicate karta hai. Is pattern ki explanation yeh hai ke pehli candle mein market mein ek trend hota hai, lekin doosri candle us trend ko reverse karta hai. Yeh reversal signal hota hai ke market sentiment change ho sakta hai. Bullish engulfing pattern bearish trend ke baad aata hai aur bearish engulfing pattern bullish trend ke baad aata hai.TradingEngulfing candlestick pattern ko trading ke liye istemal karne ke liye traders ko kuch important points par tawajjo deni chahiye:- Confirmation: Engulfing pattern ko confirm karne ke liye traders ko doosre technical indicators aur price patterns ka bhi istemal karna chahiye. Confirmatory signals ke bina trading nahi karni chahiye.

- Stop-Loss Aur Take-Profit Orders: Engulfing pattern ke sath traders stop-loss aur take-profit orders set kar sakte hain taki risk manage kiya ja sake aur munafa haasil kiya ja sake.

- Risk Management: Trading ke dauraan risk management ka dhyan rakhna zaroori hai. Position size ko manage karna aur risk tolerance ke hisab se trading karna chahiye.

- Market Analysis: Engulfing pattern ke sath-sath market analysis bhi karni chahiye. Market trend aur overall market conditions ko samajhna important hai.

- Educational Resources: Trading strategies aur candlestick patterns ko samjhne ke liye educational resources ka istemal karna chahiye. Books, online courses, aur expert opinions se traders apne knowledge ko enhance kar sakte hain.

-

#4 Collapse

√√√ ENGULFING CANDLESTICK PATTERNS IN FOREX TRADING √√√ Engulfing candlestick patterns forex trading mein ek important technical analysis tool hain, jo indicate karte hain ke market trend mein possible reversal hone wala hai. Ye patterns doosre candle ko "engulf" karte hain, matlab ke poori tarah se cover kar lete hain. √√√ TYPES OF ENGULFING PATTERNS IN FOREX TRADING √√√ 01. √√√ BULLISH ENGULFING PATTERN √√√ Jab ek chhota bearish candle ek bada bullish candle ko poori tarah engulf karta hai, to yeh bullish engulfing pattern hota hai. Yeh uptrend ke indication ke taur par dekha ja sakta hai. 02. √√√ BEARISH ENGULFING PATTERN √√√ Jab ek chhota bullish candle ek bada bearish candle ko poori tarah engulf karta hai, to yeh bearish engulfing pattern hota hai. Yeh downtrend ke possible indication ke taur par dekha ja sakta hai. √√√ RECOMMENDATIONS √√√ Engulfing patterns ko doosre technical indicators ke saath combine karke dekha jata hai for confirmation.In patterns ko different time frames par dekhna bhi important hai kyun ki woh short-term aur long-term trends ke liye useful ho sakte hain. √√√ ENGULFING CANDLESTICK PATTERNS USAGE IN FOREX TRADING √√√ Traders engulfing patterns ko dekhte hain taake woh spot karen ke market ka mood change hone wala hai.In patterns ko trend reversal ya trend continuation ka indication samajhne ke liye use kiya jata hai.Engulfing candlestick patterns traders ko market ke possible reversals ya trend changes ke liye alert karte hain, lekin hamesha confirmatory signals ke saath istemal karna zaroori hai.Yeh uptrend ke indication ke taur par dekha ja sakta hai.Traders engulfing patterns ko dekhte hain taake woh spot karen ke market ka mood change hone wala hai. -

#5 Collapse

Introduce of Engulfing Candlestick Pattern: Aoa Ummid karta hon Ap Sab Theek Hon gy AJ Engulfing CANDLESTICKS pattern forex aur stock market mein istemal hone wala aik ahem technical analysis tool hai. Yeh pattern traders aur investors ke liye market mein hone wale Trending reversals ya Trending changes ko pehchanne mein madadgar hota hai. Engulfing PATTERN ka naam uske appearance se aata hai jab aik candlestick doosri candlestick ko poori tarah se engulf (gher) leti hai. Is PATTERN ki pehchan ke liye traders ko market ke price charts aur candlesticks par Focus asaani Say kar Rahy hon gy The Explanation of Bullish Engulfing Pattern: Sir jab Bullishness Engulfing pattern ki shuruaat ek bearish (girawat wali) candle se hoti hai. Is bearish candle mein market mein selling pressure hoti hai aur price down jata hai. Is candle ki high aur low levels important hoti hain.aor Bullish engulfing PATTERN ki doosri candle ek bullish (barhawat wali) candle hoti hai, jo ke pehli candle ko poori tarah se engulf karti hai. Yani ke is candle ki high aur low levels pehli candle ke high aur low levels ko chhuti hain. Doosri candle bullish hoti hai aur ismein buying pressure dominate karti hai, jo ke price ko uptrends ki Truf Len gy Explainations: Dear jab bh Engulfings CANDLESTICKS pattern market mein hone wale trend reversals ko indicate karta hai. Is PATTERN ki explanation yeh hai ke pehli candle mein market mein ek trend hota hai, lekin doosri candle us trend ko reverse karta hai. Yeh reversal signal hota hai ke market sentiment change ho sakta hai. Bullish engulfing pattern bearish trend ke baad hi Trad Len gy Trading Stradgies: Sir Ess Engulfing Candlesticks pattern ko trading ke liye istemal karne ke liye traders ko kuch important points par Focus karein gy Confirmation of: Dear jab Engulfings Candlesticks pattern ko confirmations karne ke liye traders ko doosre technical indicators aur price patterns ka bhi istemal karna chahiye. Confirmatory signals ke bina trading Stradgies Say karein gy Stop-Loss Aur Take-Profit Orders ka Use: Dear jab Engulfings pattern ke sath traders stop-loss aur take-profit orders set kar sakte hain taki risk manage kiya ja sake aur munafa haasil kar Len gy Risk Management's: Friend's jab TRADING ke dauraan risk management ka dhyan rakhna zaroori hai. Position size ko manage karna aur risk tolerance ke hisab se trading bhoot important hy Marketing Analysis: Sir, Ess Engulfings PATTERN ke sath-sath market analysis bhi karni chahiye. Market Trending aur overall market conditions ko samajhna bhoot Zroori hy Educational Resources ka Use: Sir Ess Trading strategies aur CANDLESTICKS patterns ko samjhne ke liye educational resources ka istemal karna chahiye. Books, online courses, aur expert opinions se traders apne knowledge ko enhanced automatically ho gyEngulfing candlestick PATTERN ek powerful tool hai traders ke liye, lekin isse trading decisions lene se pehle thorough analysis ki zaroorat hoti hai. Risk management aur education bhi trading success asaani Say Len -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Engulfing candlestick patterns details bullish & bearish engulfing pattern Bullish engulfing candlestick pattern ek technical analysis tool hai jo ke stock market ya forex trading mein istemal hota hai. Is pattern ko "bullish engulfing" is liye kaha jata hai kyunki iska matlab hota hai ke market mein bullish ya uptrend hone ki sambhavna hai. Yeh pattern do candlesticks se banta hai. Peela Candlestick (1st Candlestick):- Pehla candlestick ek chota sa red (bearish) candle hota hai, jiska matlab hota hai ke market pehle down ja raha tha.

- Yeh candle ek downtrend ko darust karta hai.

- Dusra candlestick ek bada green (bullish) candle hota hai, jiska matlab hota hai ke market ab upar ja raha hai.

- Yeh candle pehle red candle ko poori tarah se engulf (daboch) leta hai.

- Iska matlab hota hai ke buyers ne control le liya hai aur market bullish trend mein ja sakta hai.

- Pehla candlestick ek chota sa green (bullish) candle hota hai, jiska matlab hota hai ke market pehle upar ja raha tha.

- Yeh candle ek uptrend ko darust karta hai.

- Dusra candlestick ek bada red (bearish) candle hota hai, jiska matlab hota hai ke market ab neeche ja raha hai.

- Yeh candle pehle green candle ko poori tarah se engulf (daboch) leta hai.

- Iska matlab hota hai ke sellers ne control le liya hai aur market bearish trend mein ja sakta hai.

-

#7 Collapse

Bullish overwhelming candle design ek specialized investigation instrument hai jo ke financial exchange ya forex exchanging mein istemal hota hai. Is design ko "bullish overwhelming" is liye kaha jata hai kyunki iska matlab hota hai ke market mein bullish ya upswing sharpen ki sambhavna hai. Yeh design do candles se banta hai. Peela Candle (first Candle): Pehla candle ek chota sa red (negative) flame hota hai, jiska matlab hota hai ke market pehle down ja raha tha. Yeh flame ek downtrend ko darust karta hai. Bada Candle (second Candle): Dusra candle ek bada green (bullish) light hota hai, jiska matlab hota hai ke market stomach muscle upar ja raha hai. Yeh flame pehle red candle ko poori tarah se immerse (daboch) leta hai. Iska matlab hota hai ke purchasers ne control le liya hai aur market bullish pattern mein ja sakta hai. Negative Immersing Example (Negative Halaat): Negative overwhelming example bhi market investigation mein istemal hota hai, lekin iska matlab hota hai ke market mein negative ya downtrend sharpen ki sambhavna hai. Peela Candle (first Candle): Pehla candle ek chota sa green (bullish) flame hota hai, jiska matlab hota hai ke market pehle upar ja raha tha. Yeh light ek upturn ko darust karta hai. Bada Candle (second Candle): Dusra candle ek bada red (negative) flame hota hai, jiska matlab hota hai ke market stomach muscle neeche ja raha hai. Yeh flame pehle green candle ko poori tarah se immerse (daboch) leta hai. Iska matlab hota hai ke venders ne control le liya hai aur market negative pattern mein ja sakta hai. In dono designs ka istemal dealers aur financial backers market ke future developments anticipate karne mein karte hain. Bullish overwhelming example bullish pattern ki shuruaat ko darust karta hai, jabki negative immersing design negative pattern ki shuruaat ko demonstrate karta hai. Lekin hamesha yaad rahe ke candle designs ko dusre specialized pointers ke sath istemal karna zaroori hota hai market examination mein.

-

#8 Collapse

Engulfing candlestick patterns details bullish & bearish engulfing pattern Bullish Engulfing candlestick pattern ek taqatwar uptrend ki shuruwat ko darust karnay ki aham alamat hai. Yeh pattern do candlesticks se ban jata hai.- Pehla Candlestick (First Candlestick):

- Pehla candlestick ek choti si bearish candle hoti hai, jise market ne neeche ki taraf giraata hai.

- Yeh bearish candle downtrend ya consolidation phase ko darust karti hai.

- Dusra Candlestick (Second Candlestick):

- Dusra candlestick ek lambi bullish candle hoti hai, jo pehli candlestick ko puri tarah se engulf karti hai.

- Yani, doosri candlestick pehli candlestick ki range ko ooper le jati hai.

- Is bullish candle ko "engulfing candle" kehte hain.

- Pehla Candlestick (First Candlestick):

- Pehla candlestick ek choti si bullish candle hoti hai, jise market ne ooper ki taraf bheja hai.

- Yeh bullish candle uptrend ya consolidation phase ko darust karti hai.

- Dusra Candlestick (Second Candlestick):

- Dusra candlestick ek lambi bearish candle hoti hai, jo pehli candlestick ko puri tarah se engulf karti hai.

- Yani, doosri candlestick pehli candlestick ki range ko neeche le jati hai.

- Is bearish candle ko "engulfing candle" kehte hain.

- Pehla Candlestick (First Candlestick):

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Engulfing Candlestick Patterns: A Comprehensive Guide

1. Engulfing Candlestick Patterns Kya Hain?

Engulfing candlestick patterns, technical analysis ke aik important tools hain jo investors aur traders ko market ki direction samajhne mein madad dete hain. Yeh patterns do candlesticks se mil kar bante hain, jahan pehle candlestick ka body doosre candlestick ke body ko completely engulf karta hai.

2. Bullish Engulfing Pattern

Bullish engulfing pattern tab banta hai jab ek choti bearish candlestick ke baad aik badi bullish candlestick aati hai. Yeh pattern indicate karta hai ke buyers ne market mein control hasil kar liya hai, jo price ki upward movement ka sabab banta hai.

3. Bearish Engulfing Pattern

Bearish engulfing pattern is ka bilkul ulta hota hai. Yeh tab hota hai jab ek choti bullish candlestick ke baad aik badi bearish candlestick banti hai. Is ka matlab yeh hai ke sellers ne market ko dominate kar liya hai, jo price ki downward movement ko darust karta hai.

4. Engulfing Patterns Ka Formation

Engulfing patterns ka formation mukhtalif market conditions ke darmiyan hota hai. Jab market bullish hoti hai aur phir bearish engulfing pattern banta hai, yeh reversal signal hota hai. Is ke bilkul ulta, jab market bearish hoti hai aur bullish engulfing pattern banta hai, yeh upward reversal ko indicate karta hai.

5. Candlestick Ki Importance

Candlestick charts trading ki duniya mein bohot ahmiyat rakhte hain. Yeh price action ka visual representation dete hain, jo traders ko market trends aur sentiments ko samajhne mein madad karta hai. Engulfing patterns in charts par aasani se nazar aate hain.

6. Bullish Engulfing Pattern Ki Pehchan

Bullish engulfing pattern ko pehchanne ke liye, pehle candlestick ka color bearish hona chahiye. Phir doosri candlestick ka color bullish hona chahiye, jo pehle candlestick ke body ko completely engulf kare. Is pattern ki tasveer bohot clear hoti hai aur price ke upward movement ka acha signal hota hai.

7. Bearish Engulfing Pattern Ki Pehchan

Bearish engulfing pattern ki pehchan karne ke liye, pehle candlestick ka color bullish hona chahiye. Phir doosri candlestick ka color bearish hona chahiye, jo pehle candlestick ke body ko completely engulf kare. Is pattern se traders ko pata chalta hai ke market mein selling pressure barh gaya hai.

8. Confirmation Ka Role

Engulfing patterns ke saath confirmation ka hona bohot zaroori hai. Aam tor par, yeh patterns tab zyada effective hote hain jab yeh kisi major support ya resistance level par bante hain. Is se traders ko confidence milta hai ke market ka direction asal mein badal raha hai.

9. Volume Ka Ahmiyat

Engulfing patterns ke saath volume bhi bohot ahmiyat rakhta hai. Jab volume bullish engulfing pattern ke dauran barhta hai, to yeh is baat ka indication hota hai ke buying interest mazid barh raha hai. Waisay hi, bearish engulfing pattern ke liye bhi yeh baat sahi hai.

10. Market Sentiment

Market sentiment bhi engulfing patterns ki validity ko samajhne mein madad karta hai. Jab market mein overall bullish sentiment ho aur phir bullish engulfing pattern bane, to yeh zyada reliable hota hai. Is ke ulta, bearish engulfing pattern tab zyada effective hota hai jab market mein bearish sentiment barh raha ho.

11. Risk Management

Engulfing patterns ka istemal karte waqt risk management bohot zaroori hai. Traders ko hamesha stop-loss orders set karne chahiye, taake agar market unki expectations ke against chale jaye to unka nuksan kam se kam ho.

12. Practical Examples

Aik practical example lete hain: agar aik trader bullish engulfing pattern dekhta hai ek major support level par, to wo apne entry point ke tor par doosri candlestick ke closing price ko le sakta hai. Is tarah wo ek strong upward move se faida utha sakta hai.

13. Engulfing Patterns Ki Limitations

Har pattern ki tarah, engulfing patterns bhi kuch limitations rakhte hain. Kabhi kabhi, yeh false signals de sakte hain, is liye traders ko hamesha dusre technical indicators ke saath inhe confirm karna chahiye.

14. Conclusion

Engulfing candlestick patterns trading ke liye ek valuable tool hain. In patterns ki madad se traders market ke reversal points ko samajh sakte hain aur behtar decisions le sakte hain. Lekin, inhe dusre indicators aur analysis ke saath milakar istemal karna chahiye taake trading ke results behtar ho sakein. Engulfing patterns ko sahi tarike se samajhne se aap apni trading strategy ko mazid behtar bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:41 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим