Forex Arbitrage Trading

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Arbitrage Trading -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Forex arbitrage trading ek trading strategy hai jisme traders profit kamane ke liye price discrepancies ka fayda uthate hain. Is strategy mein traders ek currency pair ko different financial markets mein simultaneously buy aur sell karte hain, taki unko price differences se fayda ho sake. Forex arbitrage trading ki wazahat niche di gayi hai: 1. Definition: Forex arbitrage trading mein traders price differences ka fayda uthate hain jo ek currency pair ke alag-alag markets mein exist karte hain. Price discrepancies tab paida hote hain jab market inefficiencies, liquidity imbalances, ya delayed information ki wajah se ek market mein price change hoti hai aur dusre market mein uska impact der se hota hai. 2. Types of Arbitrage: Forex arbitrage trading ke alag-alag types hote hain: a) Simple Arbitrage: Simple arbitrage mein traders ek currency pair ko different markets mein buy aur sell karte hain, taki unko price differences se fayda ho sake. Ye typically short-lived opportunities hote hain aur traders inhe quickly capture karke positions close kar dete hain. b) Triangular Arbitrage: Triangular arbitrage mein traders three currency pairs ka fayda uthate hain. Isme, traders different markets mein ek currency ko buy karte hain, dusre market mein use sell karte hain, aur phir third market mein resulting currency ko buy karke profit kamate hain. c) Statistical Arbitrage: Statistical arbitrage mein traders statistical models aur algorithms ka istemal karte hain, jinse price patterns, correlations, aur market inefficiencies ko identify karke profit kamate hain. 3. Risk and Challenges: Forex arbitrage trading mein risk aur challenges bhi hote hain: a) Execution Speed: Arbitrage opportunities short-lived hoti hain, isliye traders ko fast execution capability ki zaroorat hoti hai. Delayed execution ki wajah se opportunities miss ho sakti hain. b) Transaction Costs: Arbitrage trading mein transaction costs (jaise spreads, commissions, aur slippage) ka impact ho sakta hai. Ye costs profit margins ko affect kar sakte hain. c) Market Efficiency: Market efficiency ki wajah se arbitrage opportunities kam ho sakti hain. Efficient markets mein price discrepancies kam hote hain, isliye traders ko constantly market conditions monitor karna zaroori hota hai. 4. Technology and Tools: Forex arbitrage trading mein technology aur trading tools ka istemal kiya jata hai. High-speed trading platforms, algorithmic trading, aur automated systems traders ko arbitrage opportunities capture karne aur positions execute karne mein madad karte hain.Forex arbitrage trading ek advanced trading strategy hai aur ismein strong technical skills, market knowledge, aur fast execution capability ki zaroorat hoti hai. Traders ko market inefficiencies aur price discrepancies ko identify karne ke liye constant monitoring aur analysis karna padta hai. Risk management aur transaction costs ko bhi dhyan mein rakhna zaroori hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Arbitrage Trading Strategy

Forex trading yeh koshish hoti hai ke aap currency pair ki price direction ko anticipate kar ke profit hasil kar sakein. Magar agar aap bina price direction ko anticipate kiye bhi Forex market se profit kama sakte hain, toh kya hoga? Kuch 'market-neutral' Forex trading strategies hoti hain jo aapko yeh mauka deti hain aur Forex arbitrage trading ek aisa hi method hai.

Forex Arbitrage ek aisi trading form hai jahan traders price discrepancies ko exploit karke profit kamaane ki koshish karte hain. Arbitrageurs, jo ke arbitrage mein engage hote hain, aik market mein khareedte hain aur simultaneously doosri magar related market mein equivalent size ko bechte hain. Yeh wo tab karte hain jab unhe price divergences ka faida uthana hota hai.

Kuch waqt aisa hota hai financial markets mein jab effectively same cheez mukhtalif jagon par ya thodi mukhtalif forms mein trade hoti hai. Maslan, kuch bari companies aik se zyada stock exchanges par listed hoti hain. Theoretically, kyunke shares har stock exchange par ek hi company ke hote hain, unhe equally price hona chahiye.

Magar, asal mein, duniya ke tamaam hisson tak information ka pohanchna instant nahi hota aur markets bhi complete efficiency ke sath operate nahi karti.

Is liye, jab dono stock exchanges khuli hoti hain, yeh mumkin hota hai ke share price mein farq ho. Pehla shakhs jo price difference ko notice kare, woh cheaper price wale exchange se stock khareed sakta hai aur higher price wale exchange par bech sakta hai aur is tarah profit secure kar sakta hai.

Arbitrage illegal practice nahi hai. Yeh aik perfectly legitimate trading technique hai aur actually market efficiency ko improve karne mein madadgar ho sakti hai. Yeh is liye ke jab arbitrage opportunity ko identify aur exploit kiya jata hai, toh market automatically apne aap ko correct karna shuru kar deti hai.

Arbitrage Trading in Forex

Ab jab ke humne general terms mein yeh jawab diya ke 'arbitrage trading kya hai', chaliye specifically Forex mein arbitrage trading ko explain karte hain.

Asal mein, traders jo Forex arbitrage trading mein engage hoti hain, woh wohi kaam karte hain jo upar describe kiya gaya. Woh cheaper version of a currency ko khareed kar aur simultaneously more expensive version ko bech kar profit kamaane ki koshish karte hain.

Ek Forex arbitrage trading system mukhtalif tareeqon se operate kar sakta hai, magar basics hamesha same hoti hain. Forex arbitrageurs price anomalies ko exploit kar ke profit kamaane ki koshish karte hain. Ek approach yeh ho sakti hai ke spot rates aur currency futures ke darmiyan discrepancies ko dekha jaye. Futures contract aik agreement hota hai kisi instrument ko future mein aik fixed date par predetermined price par trade karne ka.

Forex broker arbitrage tab hota hai jab do mukhtalif brokers ek hi currency pair ke liye mukhtalif quotes offer karte hain. Magar retail FX market mein, brokers ke darmiyan prices usually uniform hoti hain, iska matlab yeh particular arbitrage strategy Forex mein zyada tar institutional market tak limited hoti hai.

Arbitrage Trading Strategies

Forex broker arbitrage spot market mein akeli opportunity nahi hai. Ek Forex arbitrage strategy mein teen mukhtalif currency pairs ko dekhna shamil hota hai.

Forex Triangular Arbitrage

Forex triangular arbitrage aik method hai jo offsetting trades ko use karta hai taake Forex market mein price discrepancies se profit hasil kiya ja sake. FX pairs ko arbitrage karne ke liye, humein pehle currency pairs ki basic understanding honi chahiye.

Jab aap ek currency pair trade karte hain, toh aap asal mein do positions le rahe hote hain: ek currency ko pair mein buy karte hain aur doosri ko sell karte hain.

Currency pairs ek currency ki value ko doosri currency ke relative express karte hain. Maslan, EUR/USD currency pair euros ki value ko US dollars mein express karta hai.

Forex triangular arbitrage system ke sath, hum do aur currency pairs ko use karke ek currency pair ke liye implied value identify karne ki koshish karte hain. Yeh sabse easily aik example se samjha ja sakta hai.

Maan lein ke EUR/USD currently 1.05302 par trade ho raha hai aur GBP/USD 1.25509 par trade ho raha hai. Yeh humein yeh batata hai ke 1 euro ki qeemat filhal 1.05302 US dollars hai aur 1 British pound ki qeemat filhal 1.25509 US dollars hai.

Ek potential Forex arbitrage opportunity identify karne ke liye, humein yeh information use karke EUR/GBP ki implied value calculate karni hogi, jo hum EUR/USD ko GBP/USD se divide karke kar sakte hain.

1.05302 / 1.25509 = 0.83900

Hum ek ko doosre se kyun divide karte hain? Currency pairs fractions ki tarah treat kiye ja sakte hain. Is liye, EUR/USD divided by GBP/USD = EUR/GBP. Yeh is liye ke jab aap GBP/USD se divide karte hain, fractions ki tarah, yeh inverse (USD/GBP) se multiply karne ke barabar hota hai.

Is liye: EUR/USD x USD/GBP = EUR/GBP x USD/USD = EUR/GBP

Agar EUR/GBP currency pair ka actual traded value upar calculate ki gai implied value se mukhtalif hai, toh ek arbitrage opportunity mojood hoti hai. Jaise ke is strategy ka naam suggest karta hai, triangular arbitrage Forex mein teen alag trades par mushtamil hoti hai.

Maan lein ke EUR/GBP actually implied value se zyada high trade ho raha hai, 0.83944 par.

Jab trading value implied value se zyada hoti hai, toh hum usay sell karna chahte hain. Humay do aur trades bhi karni hongi do related currency pairs mein, taake ek synthetic EUR/GBP opposing position create kar sakein. Yeh Forex triangle arbitrage humari risk ko offset karega aur profit ko lock in karega. Kyunke price discrepancy is example mein choti hai, humein substantial volume mein deal karna hoga taake yeh worthwhile ho.

Ek lot 100,000 units hota hai first-named currency ka, maan lein ke hum 10 lots of EUR/USD khareedte hain, toh 1,000,000 EUR. Yaad rahe, jab hum currency pairs trade karte hain, hum asal mein ek currency ko buy aur doosri ko sell kar rahe hote hain.- Trade 1:

Ek buy trade ke liye hum first named currency ko buy karte hain aur second ko sell karte hain. Toh is case mein, hum 1,000,000 EUR buy kar rahe hain. EUR/USD pair 1.05302 par trade ho raha hai, iska matlab agar hum 1,000,000 EUR buy kar rahe hain, toh hum simultaneously 1,000,000 x 1.05302 = 1,053,020 USD sell kar rahe hain. - Trade 2:

Pehle position ko lene ke sath sath, hum equivalent amount of EUR ko EUR/GBP mein sell karna chahte hain. Is liye, hum 10 lots of EUR/GBP sell karte hain. EUR/GBP currently 0.83944 par trade ho raha hai, iska matlab hum 1,000,000 x 0.83944 = 839,440 GBP buy kar rahe hain. - Trade 3:

Teesri aur aakhri position mein hum GBP/USD sell karte hain taake Forex triangle arbitrage complete ho sake. Yeh teesra trade humein kisi bhi teen currency pairs mein overall exposure se free kar deta hai.

GBP se apni exposure ko remove karne ke liye, hum utna hi amount sell karenge jitna humne EUR/GBP trade mein buy kiya tha. Is liye, hum 839,440 GBP sell karna chahte hain. Hum GBP/USD ko 1.25509 rate par deal kar rahe hain is liye hum 839,440 x 1.25509 = 1,053,573 USD buy kar rahe hain.

In steps ke implications ko consider karein, yeh madadgar hoga ke inhe wapas ja kar dekhein aur sochain ke har stage par aap physical currency transactions kar rahe hain. Is last step mein humne 1,053,573 USD hasil kiye hain jabke initially humne 1,053,020 USD ko EUR mein exchange kiya tha.

Teeno transactions ka profit, is tarah, hoga 1,053,573 - 1,053,020 = 553 USD.

Jaise ke aap dekh sakte hain, profit chota hai compared to humare large transaction sizes. Spreads aur doosre transaction costs ko bhi account nahi kiya gaya. Of course, retail FX broker ke sath, aap physically currencies ko exchange nahi kar rahe. Yeh steps aapko profit mein lock kar sakte hain, magar aapko phir bhi manually har position ko unwind karna hoga.

Forex Statistical Arbitrage

Jabke yeh pure arbitrage ka form nahi hai, Forex statistical arbitrage aik quantitative approach le kar price divergences ko dhondhta hai jo statistically future mein correct hone ke chances rakhte hain.

Yeh over-performing currency pairs ka basket aur under-performing currency pairs ka basket compile kar ke karta hai. Yeh basket is goal ke sath banaya jata hai ke over-performers ko short kiya jaye aur under-performers ko purchase kiya jaye.

Assumption yeh hoti hai ke aik basket ki relative value doosre se waqt ke sath mean par wapas aayegi. Is assumption ke sath, aapko tight historical correlation dono baskets ke darmiyan chahiye. Toh yeh ek aur factor hai jo arbitrator ko original selections ko compile karte waqt dhyan mein rakhna hota hai. Aapko market neutrality ko bhi ensure karna hota hai.

Riskless Profit

Arbitrage ko kabhi kabhi riskless kaha jata hai, magar yeh exactly sach nahi hai. Ek achi tarah se implemented Forex arbitrage strategy fairly low risk hoti hai, magar implementation half the battle hota hai. Execution risk aik significant problem hai. Aapko apni offsetting positions ko simultaneously, ya close to simultaneously execute karna hota hai. Yeh zyada mushkil hota hai kyunke arbitrage mein edge choti hoti hai, sirf kuch pips ka slippage aapka profit erase kar sakti hai.

Arbitrage Trading: Challenges

Challenges arise hote hain jab bohot sare log yeh strategy use kar rahe hote hain. Arbitrage fundamentally price differentials par rely karta hai, aur yeh differentials arbitrageurs ke actions se affect hote hain.

Arbitrage ke wajood se FX market par asar hota hai ke currency exchange rates apne aap ko correct karne lagti hain. Overpriced instruments ko sell kar ke unki price ko niche le aate hain. Underpriced ones ko purchase karke unki price ko upar push karte hain. Consequently, price differential dono ke darmiyan shrink ho jata hai.

Akhirkar yeh disappear ho jata hai ya itna chota ho jata hai ke arbitrage profitable nahi rehta. Either way, FX arbitrage opportunity kam ho jati hai. Forex market ke vast number of participants generally ek bara benefit hai, magar iska matlab yeh bhi hota hai ke pricing disparities rapidly discover aur exploit hoti hain.

Iska natija yeh hota hai ke arbitrage ke game mein sabse tezi se khelne wala jeet ta hai. Fastest price feeds essential hain agar aap profit kamaana chahte hain. Misaal ke taur par, humara Zero.MT5 account institutional-grade execution speed offer karta hai, jo ke is tarah ki trading ke liye essential hai, kyunke aap duniya ke sabse fast traders se compete kar rahe hote hain. Execution speed farq bana sakta hai, is liye sahi Forex arbitrage software ko choose karna bhi aapko competitive edge de sakta hai.

- Trade 1:

-

#4 Collapse

Forex arbitrage trading

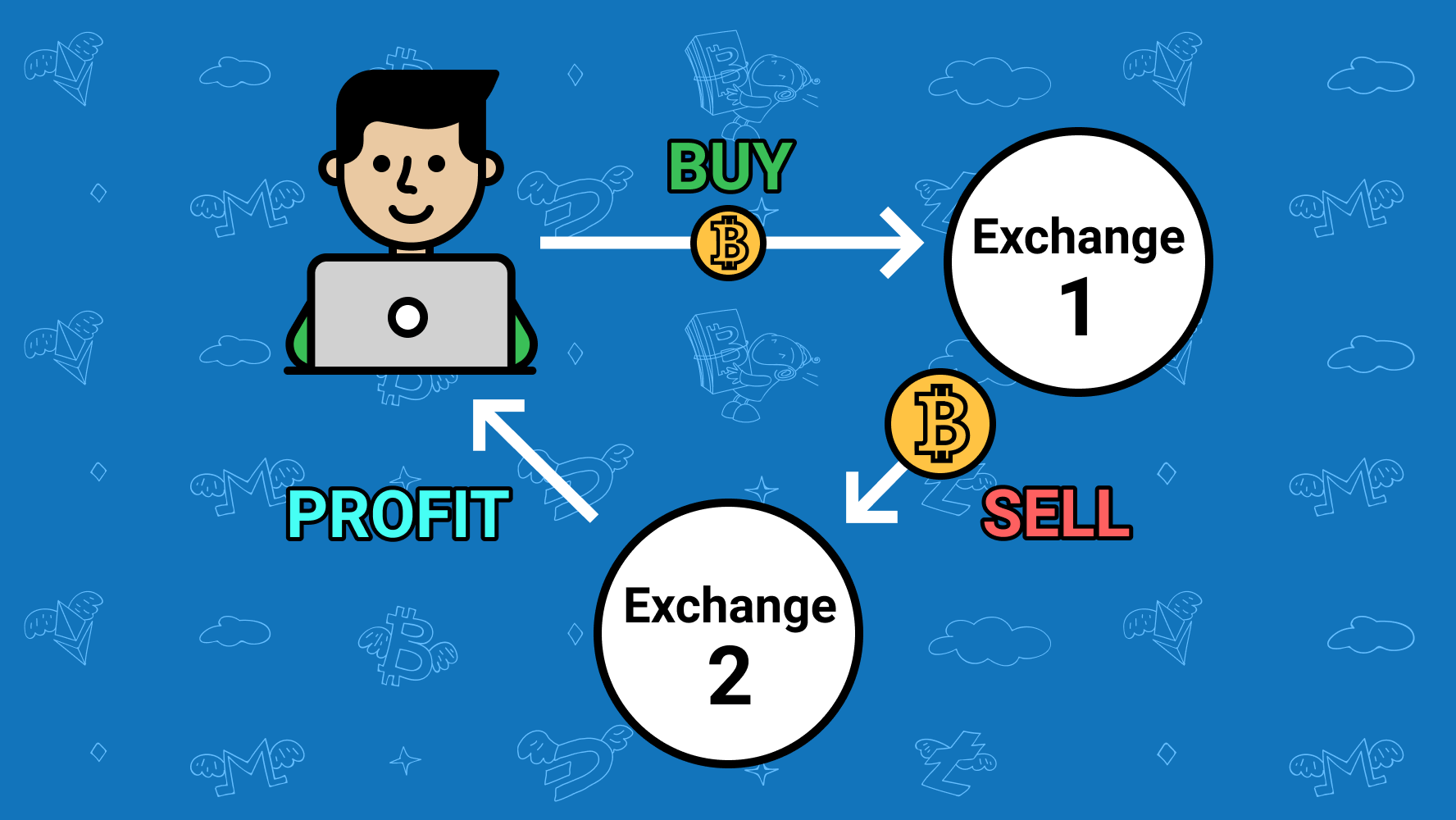

Forex arbitrage trading ek trading strategy hai jo forex market mein price differences ka faida uthane ke liye use hoti hai. Is strategy mein trader ek hi currency pair ko different markets ya brokers par alag-alag prices par simultaneously buy aur sell karta hai, taake risk-free profit generate kar sake. Forex arbitrage ka basic concept yeh hai ke kisi bhi instant par agar currency pair ki prices do jagah par different hain, to trader in differences ka faida utha sakta hai.

Types of Forex Arbitrage:- Spatial Arbitrage (Two-Point Arbitrage): Is type mein trader do different brokers ya markets ke beech price difference ka faida uthata hai. Example ke taur par, agar EUR/USD ka rate Broker A par 1.1050 hai aur Broker B par 1.1040 hai, to trader Broker B se buy karega aur Broker A par sell karega, instantly profit generate karte hue.

- Triangular Arbitrage: Is type mein teen different currency pairs ka use hota hai. Example ke taur par, EUR/USD, USD/GBP, aur EUR/GBP. Trader in tino pairs mein price differences ka faida utha kar profit generate karta hai. Agar direct EUR/GBP ke rate aur EUR/USD aur USD/GBP ke cross-rate mein difference ho, to trader in differences ko exploit kar sakta hai.

Suppose:- EUR/USD = 1.1050

- USD/GBP = 0.7650

- EUR/GBP = 0.8450

- Trader pehle EUR 10,000 ko USD 11,050 (EUR/USD = 1.1050) mein convert karta hai.

- Phir USD 11,050 ko GBP 8,453.25 (USD/GBP = 0.7650) mein convert karta hai.

- Aur phir GBP 8,453.25 ko EUR 10,006.71 (EUR/GBP = 0.8450) mein convert karta hai.

Akhir mein trader ne EUR 10,000 ko EUR 10,006.71 mein convert karke profit kamaya.

Benefits of Forex Arbitrage:- Risk-Free Profit: Agar properly execute kiya jaye, to arbitrage trading almost risk-free profit generate kar sakti hai.

- No Market Prediction Required: Trader ko market ka direction predict karne ki zarurat nahi hoti, sirf price differences ka faida uthana hota hai.

- Execution Speed: Forex arbitrage trading bohot fast execution demand karti hai. Price differences bohot kam time ke liye exist karte hain.

- Transaction Costs: Spreads, commissions, aur transaction costs profits ko affect kar sakte hain.

- Market Efficiency: Advanced trading algorithms aur high-frequency trading ke wajah se markets zyada efficient ho gaye hain, aur arbitrage opportunities bohot kam aur short-lived ho gaye hain.

- Capital Requirements: Arbitrage trading mein significant capital ki zarurat hoti hai taake chhote price differences se meaningful profit generate kiya ja sake.

Forex arbitrage trading ek sophisticated trading strategy hai jo price differences ko exploit karke risk-free profits generate karne par focus karti hai. Ye strategy rapid execution aur low transaction costs par depend karti hai. Trading environment aur tools ke advancements ke bawajood, arbitrage opportunities dhundna aur unka faida uthana challenging ho sakta hai.

-

#5 Collapse

Forex Arbitrage Trading:&:&:&:&

Forex arbitrage trading ka matlab hai ke currency pairs ke different markets mein price ka farq uthakar munafa kamana. Seedha sa matlab yeh hai ke aap ek market mein us currency ko sasti mein kharidte hain jahan uski keemat kam hai aur usi waqt dusri market mein bechte hain jahan uski keemat zyada hai.

Arbitrage opportunities tab banti hain jab forex market mein efficiencies na ho, jo ke brokeron ke darmiyan keemat mein farq, information ki deri ya marketon mein liquidity ke imkanat mein izafa ki wajah se hota hai.

Forex Arbitrage Trading Ke Features:&:&:&:&

Forex arbitrage trading ke kuch key features hain:- Price Discrepancies: Different markets mein currency pairs ki prices mein farq hota hai, jo ki arbitrage opportunities create karta hai.

- Quick Execution: Arbitrage trades ko jaldi execute karna zaroori hota hai taake price discrepancies ka faida uthaya ja sake, kyun ke yeh discrepancies aksar transient hoti hain.

- Sophisticated Technology: Arbitrage opportunities ko pehchanne aur trade karte waqt advanced technology aur algorithms ka istemal hota hai.

- High Capital Requirement: Arbitrage trading mein aksar ziada paisay lagte hain kyun ke chand mukhtalif markets mein trades ki jati hain.

- Regulatory Considerations: Regulatory bodies arbitrage trading ko closely monitor karte hain, aur kuch jurisdictions mein isko restrict ya regulate kiya ja sakta hai.

- Risk Management: Arbitrage trading mein execution risk, market risk, aur regulatory risk ka khaas khayal rakhna zaroori hai.

- Profit Potential: Sahi tareeqay se kiya gaya arbitrage trading munafa dila sakta hai, lekin ismein risk bhi hota hai, aur munafa potential arbitrage opportunities ke frequency aur size par depend karta hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

#### IntroductionForex arbitrage trading ek advanced trading strategy hai jo forex market mein price discrepancies ka faida uthane ke liye use hoti hai. Is strategy ka main focus different currency pairs ya different markets mein prices ke difference ko exploit karna hota hai taake risk-free profit kamaya ja sake. Forex arbitrage trading bohot complex ho sakti hai aur iske liye high-speed execution aur deep market knowledge ki zarurat hoti hai. Is guide mein hum forex arbitrage trading ko detail mein discuss karenge aur yeh samjhenge ke yeh strategy kaise kaam karti hai.#### Forex Arbitrage Trading Ke Fundamentals1. **Arbitrage Kya Hai?**- Arbitrage ek trading technique hai jisme ek asset ko ek market se kharid kar doosre market mein higher price par becha jata hai. Isse risk-free profit hasil hota hai.2. **Forex Arbitrage:**- Forex arbitrage mein different currency pairs ke beech price differences ka faida uthaya jata hai. Yeh discrepancies usually short-lived hoti hain aur high-speed trading systems ki zarurat hoti hai.3. **Types of Forex Arbitrage:**- Triangular Arbitrage- Statistical Arbitrage- Two-Currency Arbitrage#### Types of Forex Arbitrage Trading1. **Triangular Arbitrage:**- Is strategy mein teen different currency pairs use hote hain jahan ek currency ko buy aur sell karne ka process complete circle banata hai.- Example: EUR/USD, USD/GBP, GBP/EUR. Aap EUR/USD buy karte hain, USD/GBP sell karte hain, aur GBP/EUR buy karte hain taake profit kamaya ja sake.2. **Statistical Arbitrage:**- Is strategy mein historical price data aur statistical models ka use karke price discrepancies ko identify kiya jata hai.- Advanced algorithms aur quantitative analysis ka use hota hai.3. **Two-Currency Arbitrage:**- Is strategy mein sirf do currencies aur unke price differences ka faida uthaya jata hai.- Example: USD/JPY aur EUR/USD ka price difference agar favorable ho, to uska faida uthaya jata hai.#### Forex Arbitrage Trading Kaise Kaam Karti Hai?1. **Identifying Opportunities:**- Forex arbitrage trading mein sabse pehla step price discrepancies ko identify karna hota hai. Yeh discrepancies bohot short-lived hoti hain, isliye high-speed trading systems aur algorithms use hote hain.- Example: Agar EUR/USD ka price ek broker par 1.1200 aur doosre broker par 1.1202 hai, to arbitrage opportunity create hoti hai.2. **Executing Trades:**- Jab bhi koi arbitrage opportunity milti hai, trades ko simultaneously execute kiya jata hai taake risk-free profit kamaya ja sake.- Yeh trades bohot quickly execute hone chahiye kyunki price differences bohot jaldi vanish ho jate hain.3. **Monitoring and Adjusting:**- Arbitrage trading mein market ko continuously monitor aur adjust karna hota hai. Price discrepancies identify karne aur unhe exploit karne ke liye advanced tools aur software use hote hain.#### Tools Aur Resources1. **High-Speed Trading Platforms:**- Forex arbitrage trading ke liye high-speed trading platforms aur direct market access (DMA) ki zarurat hoti hai.- Example: MetaTrader 4, MetaTrader 5, cTrader.2. **Advanced Algorithms:**- Arbitrage opportunities ko identify aur exploit karne ke liye advanced algorithms aur trading bots ka use hota hai.- Example: Quantitative models, machine learning algorithms.3. **Real-Time Data Feeds:**- Accurate aur real-time data feeds ke bina arbitrage trading mushkil hai. Reliable data providers aur APIs ka use hota hai.#### Pros of Forex Arbitrage Trading1. **Risk-Free Profits:**- Properly executed arbitrage trades risk-free profits generate karte hain.- Example: Agar aap simultaneously buy aur sell karte hain, to market risk minimal hota hai.2. **Market Efficiency:**- Arbitrage trading market ko efficient banata hai kyunki yeh price discrepancies ko quickly eliminate karta hai.3. **Diverse Opportunities:**- Different types of arbitrage strategies ke through aap multiple opportunities explore kar sakte hain.#### Cons of Forex Arbitrage Trading1. **High Complexity:**- Arbitrage trading bohot complex hai aur advanced mathematical models aur algorithms ki zarurat hoti hai.- Example: Statistical arbitrage mein extensive quantitative analysis ka use hota hai.2. **Execution Risks:**- High-speed execution aur latency issues arbitrage opportunities ko miss karne ka risk badhate hain.3. **Limited Opportunities:**- Arbitrage opportunities short-lived aur rare hoti hain, isliye continuous monitoring aur quick action ki zarurat hoti hai.4. **Regulatory Challenges:**- Different markets aur countries mein regulatory constraints aur restrictions arbitrage trading ko complex bana sakte hain.#### ConclusionForex arbitrage trading ek advanced aur sophisticated strategy hai jo traders ko price discrepancies ka faida uthakar risk-free profits kamane ka mauka deti hai. Lekin, is strategy ko successfully implement karne ke liye high-speed trading systems, advanced algorithms, aur deep market knowledge ki zarurat hoti hai. Arbitrage trading ki complexity aur execution risks ko samajhna zaroori hai taake yeh strategy effectively use ki ja sake. Proper education, training, aur continuous market monitoring ke zariye aap forex arbitrage trading mein successful ho sakte hain. -

#7 Collapse

1. Introduction:

Forex arbitrage trading ek trading strategy hai jahan trader simultaneously different markets ya brokers se currencies ko buy aur sell karta hai taake risk-free profit kamaya ja sake. Yeh strategy price discrepancies ka faida uthati hai jo short timeframes ke liye exist karti hain. Forex arbitrage trading highly efficient aur fast execution ki demand karti hai.

2. Types of Forex Arbitrage:

a. Two-Point Arbitrage: Two-point arbitrage, ya simple arbitrage, mein trader do different brokers ya exchanges ke beech price discrepancies ka faida uthata hai. Yeh strategy currencies ko ek exchange se buy karke doosre exchange par higher price par sell karti hai.

b. Triangular Arbitrage: Triangular arbitrage mein teen different currencies involved hoti hain. Trader ek currency ko doosri ke sath, doosri ko teesri ke sath, aur teesri ko phir pehli ke sath exchange karta hai. Yeh process simultaneously hota hai aur price differences se profit generate karta hai.

c. Covered Interest Arbitrage: Covered interest arbitrage interest rate differentials aur forward contracts ka faida uthata hai. Trader high interest rate wali currency ko buy karta hai aur low interest rate wali currency ko sell karta hai, forward contract ke zariye future exchange rate ko lock karke risk-free profit earn karta hai.

3. Working Method of Forex Arbitrage:

a. Identifying Discrepancies: Forex arbitrage traders continuously market prices ko monitor karte hain taake price discrepancies identify ki ja sakein. Yeh discrepancies bohot short-lived hoti hain, isliye fast execution ki zaroorat hoti hai.

b. Simultaneous Transactions: Once a discrepancy is identified, trader simultaneously currencies ko buy aur sell karta hai taake price difference se profit kamaya ja sake. Yeh transactions bohot tezi se execute hoti hain taake market price changes ka asar minimize kiya ja sake.

c. Execution Platforms: High-frequency trading (HFT) platforms aur algorithms ka use forex arbitrage trading mein bohot common hai. Yeh platforms real-time price monitoring aur ultra-fast execution provide karte hain, jo arbitrage opportunities ko effectively capitalize karne mein madadgar hote hain.

4. Benefits of Forex Arbitrage:

a. Risk-Free Profit: Forex arbitrage theoretically risk-free profit generate karti hai kyunki yeh strategy price discrepancies ko exploit karti hai jo guaranteed profit provide karti hain.

b. Market Efficiency: Arbitrage trading market inefficiencies ko eliminate karti hai aur prices ko equilibrium par laati hai, jo overall market efficiency ko improve karta hai.

c. Short Timeframes: Yeh strategy bohot short timeframes mein profits generate karti hai, jo traders ko quick returns provide karti hai.

5. Challenges of Forex Arbitrage:

a. High Competition: Forex arbitrage mein high competition hoti hai kyunki large financial institutions aur HFT firms bhi yeh strategy use karti hain. Is wajah se profitable opportunities bohot rapidly disappear ho jati hain.

b. Execution Speed: Fast execution ke bina arbitrage trading profitable nahi hoti. Delays aur slippages trades ko unprofitable bana sakti hain.

c. Transaction Costs: High transaction costs profits ko significantly reduce kar sakti hain. Spreads, commissions, aur other fees arbitrage profits ko negatively impact karte hain.

6. Risk Management in Forex Arbitrage:

a. Efficient Platforms: High-frequency trading platforms aur advanced algorithms ka use karke execution speed ko optimize karein. Yeh platforms real-time data aur fast execution provide karte hain.

b. Monitoring and Analysis: Market prices ko continuously monitor karein aur detailed analysis ke zariye profitable arbitrage opportunities ko identify karein. Yeh process automated systems aur software ke zariye effective banaya ja sakta hai.

c. Cost Management: Transaction costs ko minimize karne ke liye competitive brokers aur exchanges ka election karein. Low spreads aur commissions profits ko maximize karte hain.

Conclusion:

Forex arbitrage trading ek sophisticated strategy hai jo price discrepancies ko exploit karke risk-free profits generate karti hai. Different types of arbitrage strategies jaise two-point, triangular, aur covered interest arbitrage traders ko various opportunities provide karte hain. Fast execution, efficient platforms, aur continuous market monitoring arbitrage trading mein success ke key elements hain. Challenges jaise high competition aur transaction costs ke bawajood, proper risk management aur efficient execution forex arbitrage trading ko profitable bana sakti hai.

-

#8 Collapse

Forex Arbitrage Trading: Ek Jameen Se Asman Tak Safar

1. Forex Arbitrage Trading Kya Hai?

Forex arbitrage trading aik sophisticated investment strategy hai jo forex market ki volatility aur inefficiencies ka faida uthati hai. Ismein trader ek currency ko ek market se khareed kar dusri market mein mehenga bech kar profit kamaata hai. Yeh strategy price differences ko exploit karti hai jo aksar different forex exchanges par exist karte hain. Forex arbitrage usually risk-free mana jata hai kyun ke yeh theoretical gains par depend karta hai jo price mismatches ki wajah se hotay hain. Aik effective arbitrage trade ke liye trader ko fast execution aur accurate data ki zaroorat hoti hai taake wo timely profits kama sake.

2. Arbitrage Trading Ki Buniyadi Samajh

Arbitrage trading ko samajhne ke liye yeh zaroori hai ke hum price discrepancies ko samjhein jo alag alag forex markets mein hoti hain. Misaal ke taur par, agar EUR/USD pair New York aur London markets mein slightly different rates par trade ho raha hai, to trader us price difference ka faida uthata hai. Aik successful arbitrage trade tabhi mumkin hai jab market mein sufficient liquidity ho aur execution speed fast ho. Forex arbitrage ke liye trading costs, transaction fees aur exchange rates ko bhi consider karna zaroori hai. Yeh sab factors arbitrage opportunities ko profitable banate hain ya nahi, is ka tayyun karte hain.

3. Kis Tarah Arbitrage Trading Ki Jaati Hai?

Forex arbitrage trading ko implement karne ke liye, traders advanced trading software aur algorithms ka use karte hain. Yeh software real-time market data ko analyze karke price discrepancies ko identify karte hain aur phir automatic trades execute karte hain. Manual arbitrage trading bhi ki ja sakti hai magar yeh method zyada reliable nahi hota kyun ke market prices rapidly change hoti hain. Is liye, traders zyada tar automated systems par depend karte hain jo millisecond ke andar trades execute kar sakti hain. Effective arbitrage trading ke liye, trader ko reliable data sources, fast internet connection aur efficient brokerage services ki zaroorat hoti hai.

4. Forex Market Ki Dynamics

Forex market duniya ki sab se bara financial market hai jahan har roz trillion dollars ki trading hoti hai. Yeh market decentralized hai aur is mein banks, financial institutions, corporations, governments aur individual traders participate karte hain. Forex market 24/5 open rehta hai aur time zones ke hisaab se global regions mein continuously trade hota rehta hai. Forex market mein liquidity aur volatility high hoti hai jo arbitrage opportunities ko janam deti hain. Price discrepancies ka faida uthana arbitrage traders ke liye faidemand hota hai, magar yeh sab kuch market dynamics ko samajhne par depend karta hai.

5. Triangular Arbitrage Kya Hai?

Triangular arbitrage aik complex type ki arbitrage strategy hai jismein teen different currency pairs ka use hota hai. Iska basic principle yeh hai ke agar EUR/USD, USD/JPY aur EUR/JPY pairs mein koi price discrepancy ho, to trader in pairs ke through sequential trades execute karke profit kama sakta hai. Misaal ke taur par, agar EUR/USD aur USD/JPY ke rates kuch is tarah ho ke inka multiplication EUR/JPY ke rate se different ho, to trader arbitrage opportunity exploit kar sakta hai. Yeh method zyada advanced aur complex hota hai magar experienced traders ke liye zyada profitable bhi hota hai.

6. Opportunities Ko Pehchaan-na

Forex markets mein prices continuously fluctuate karte hain, is wajah se arbitrage opportunities bar bar samne aati hain. Market inefficiencies, news events, economic data releases aur geopolitical events price discrepancies ko janam dete hain. Arbitrage traders in opportunities ko identify karne ke liye sophisticated tools aur real-time data analytics ka use karte hain. Yeh tools price feeds ko monitor karte hain aur jaise hi koi discrepancy detect hoti hai, trades execute kar dete hain. Lekin yeh zaroori hai ke traders ke paas aise tools aur technology ho jo efficient aur accurate ho taake opportunities ko timely exploit kiya ja sake.

7. Technology Ka Role

Technology forex arbitrage trading mein central role play karti hai. Automated trading systems, high-frequency trading (HFT) platforms aur advanced algorithms arbitrage trades ko execute karte hain. In systems ke bina, arbitrage trading ki speed aur accuracy achieve karna mushkil hota hai. Yeh systems multiple markets se real-time data ko analyze karte hain aur phir trades ko milliseconds ke andar execute karte hain. Algorithms ko is tarah design kiya jata hai ke wo minimal human intervention ke sath profitable trades identify kar sakein. Additionally, data security aur reliability bhi technology ke zariye ensure ki jati hai taake trading process seamless aur error-free ho.

8. Risk Factors

Forex arbitrage trading theoretically risk-free hota hai magar practically yeh kuch risks se mukt nahi hota. Execution risk sab se bara risk hai jismein trades ka timely execution na hona shamil hai jo price discrepancies ko eliminate kar sakta hai. Transaction costs aur fees bhi arbitrage profits ko minimize kar sakti hain. Regulatory risks bhi hotay hain, kyun ke har country ki financial regulations different hoti hain jo trading ko influence kar sakti hain. Market liquidity agar kam ho to arbitrage trades profitable nahi reh sakte. Yeh sab risks ko mitigate karne ke liye proper risk management aur planning zaroori hai.

9. Regulation Ki Ahmiyat

Different countries aur markets mein regulations vary karte hain jo arbitrage trading ko asaan ya mushkil bana sakti hain. Forex trading ko regulate karne wale authorities, jaise ke US mein CFTC (Commodity Futures Trading Commission) aur Europe mein ESMA (European Securities and Markets Authority), trading practices ko oversee karte hain. Yeh regulations traders ko transparency, security aur fairness provide karte hain. Lekin, regulations ke compliance aur changing policies ka traders par impact hota hai. Proper knowledge aur understanding of these regulations arbitrage trading ke success ke liye critical hai taake compliance issues aur legal penalties se bachaa ja sake.

10. Scalping vs Arbitrage

Scalping aur arbitrage trading do different strategies hain magar dono hi short-term trading ke zariye profits kamaane par focus karti hain. Scalping mein trader market ke short-term price movements ka faida uthata hai aur ek din mein multiple trades execute karta hai. Scalping zyada risk involve karta hai aur ismein trader ki market timing aur speed important hoti hai. Arbitrage trading mein, price differences ko exploit kar ke risk-free profits kamaaye jate hain. Arbitrage zyada sophisticated hai aur automated systems par depend karta hai. Dono strategies fast execution aur market understanding demand karti hain magar arbitrage relatively safer mana jata hai.

11. Professional Arbitrage Traders

Professional arbitrage traders aur hedge funds ke pass sophisticated tools aur resources hote hain jo unhe arbitrage opportunities ko efficiently exploit karne mein madad karte hain. Yeh traders high-frequency trading platforms, data analytics tools aur advanced algorithms ka use karte hain. Inke paas professional expertise aur market knowledge hoti hai jo unhe complex arbitrage strategies ko successfully implement karne mein madad karti hai. Professional traders risk management techniques aur financial models ko bhi use karte hain taake market risks ko minimize kar sakein aur consistent profits kama sakein.

12. Execution Speed Ki Ahmiyat

Forex arbitrage trading mein execution speed paramount importance rakhti hai. Price discrepancies extremely short-lived hoti hain aur unhe timely exploit karne ke liye fast execution zaroori hai. Automated trading systems aur high-frequency trading platforms fast execution ko ensure karte hain. Agar execution slow ho, to price discrepancies eliminate ho sakti hain aur arbitrage opportunities miss ho sakti hain. Is liye, traders fast internet connections, low-latency trading systems aur efficient brokers ka use karte hain jo unhe timely trades execute karne mein madad karte hain. Execution speed arbitrage trading ki profitability ko directly impact karti hai.

13. Broker Selection

Acha broker choose karna arbitrage trading ke success ke liye zaroori hai. Broker ke transaction costs, execution speed aur market access trading performance ko influence karte hain. Low transaction costs aur fast execution brokers arbitrage traders ke liye ideal hote hain. Brokers jo multiple forex markets aur instruments ko access provide karte hain wo arbitrage opportunities ko maximize karne mein madad karte hain. Additionally, brokers ka regulatory compliance aur financial stability bhi important factors hain. Reliable brokers trading process ko seamless aur secure banate hain jo arbitrage trading ki efficiency ko enhance karta hai.

14. Real-World Examples

Real-world examples mein EUR/USD, GBP/USD, aur USD/JPY pairs ke beech arbitrage trading common hai. Misaal ke taur par, agar EUR/USD New York market mein 1.1200 par trade ho raha hai aur London market mein 1.1205 par, to trader yeh price difference ka faida uthakar New York market se khareed kar London market mein bech sakta hai. Similarly, triangular arbitrage mein agar EUR/USD, USD/JPY aur EUR/JPY pairs mein koi price discrepancy ho, to sequential trades execute kar ke profit kama sakte hain. Yeh real-world examples arbitrage trading ki practical application aur profitability ko demonstrate karte hain.

15. Future of Forex Arbitrage

Jese jese technology aur market access improve ho raha hai, arbitrage trading ki opportunities bhi evolve ho rahi hain. Advanced trading algorithms, machine learning aur artificial intelligence arbitrage trading ko zyada efficient aur profitable bana rahe hain. Market access aur trading platforms ki development traders ko global forex markets mein arbitrage opportunities ko exploit karne mein madad kar rahi hain. Future mein, arbitrage trading ki growth aur development ke new avenues explore kiye jayenge jo traders ke liye new opportunities aur challenges laayenge. Forex arbitrage trading aik dynamic field hai jo continuous learning aur adaptation demand karti hai.

Forex arbitrage trading aik complex magar lucrative field hai jo proper knowledge, tools, aur strategy ke baghair impossible lagti hai. Lekin, jo traders ismein maharat hasil kar lete hain, unke liye ye khud ko financial independence ki taraf le jaane ka ek raasta ban sakta hai. Arbitrage trading se profits kamaane ke liye dedicated efforts, advanced technology aur market understanding zaroori hai. Yeh field traders ko constant evolution aur growth ka platform provide karti hai jahan opportunities aur challenges dono barabar hoti hain. Proper planning aur execution se forex arbitrage trading zyada rewarding aur fulfilling ho sakti hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Arbitrage Trading

Forex arbitrage trading aik technique hai jo traders ko low-risk profit kamane ka moka deti hai. Yeh strategy currencies ke price differences ka faida uthati hai jo different markets ya brokers mein maujood hoti hain. Forex arbitrage trading mein, trader aik currency ko aik market se sasta kharidta hai aur dosri market mein mehnga bechta hai, thus without any significant risk profits earn karta hai.

### Arbitrage Trading ke Types

Forex arbitrage trading ke kuch mukhtalif types hain:

1. **Spatial Arbitrage**: Is tarike mein trader aik currency ko aik market se kharid kar dosri market mein bechta hai jahan price zyada hoti hai. Misal ke tor par, agar EUR/USD New York market mein 1.1200 pe trade ho raha hai aur London market mein 1.1210 pe, toh trader New York se kharid kar London mein bech sakta hai aur 10 pips ka profit kama sakta hai.

2. **Triangular Arbitrage**: Is method mein trader three different currency pairs ke price differences ka faida uthata hai. Misal ke tor par, agar EUR/USD, USD/JPY aur EUR/JPY mein kuch price inconsistencies hain, toh trader in inconsistencies ko exploit karke profit kama sakta hai.

### Forex Arbitrage Trading ki Importance

Forex arbitrage trading kafi profitable ho sakti hai, magar yeh zaroori hai ke trader fast execution aur low transaction costs ke sath trade kare. Iske liye, high-speed internet connection aur reliable trading platform ki zarurat hoti hai. Advanced algorithms aur automated trading systems bhi is process ko smooth aur efficient banate hain.

### Forex Arbitrage Trading ke Advantages

1. **Low Risk**: Forex arbitrage trading ka sabse bada faida yeh hai ke yeh low-risk strategy hai kyunki price differences ko instant exploit kiya jata hai. Price movements ka asar kam hota hai aur thus risk bhi kam hota hai.

2. **Quick Profits**: Is strategy mein profits jaldi aur consistently mil sakte hain. Price differences ko exploit karte hue trader jaldi se jaldi profit earn kar sakta hai.

3. **Market Efficiency**: Forex arbitrage trading market efficiency ko improve karti hai kyunki yeh prices ko balance mein rakhne mein madad karti hai. Jab bhi price difference hota hai, arbitrage trading us difference ko jaldi se jaldi khatam karti hai.

### Forex Arbitrage Trading ki Challenges

1. **Execution Speed**: Arbitrage opportunities jaldi disappear ho jati hain, is liye fast execution bohot zaruri hai. Agar execution speed slow ho, toh profits miss ho sakte hain.

2. **Transaction Costs**: High transaction costs arbitrage profits ko significantly reduce kar sakti hain. Is liye low-cost brokers aur platforms ko prefer karna chahiye.

3. **Market Access**: Multiple markets aur brokers tak access hona zaruri hai taake arbitrage opportunities ko effectively exploit kiya ja sake.

### Forex Arbitrage Trading ke Liye Tips

1. **High-Speed Internet**: Forex arbitrage trading mein high-speed internet connection zaruri hai taake trades quickly execute kiye ja sakein.

2. **Reliable Broker**: A reliable aur low-cost broker ka hona zaruri hai jo fast execution aur low transaction costs provide kare.

3. **Automated Systems**: Advanced trading algorithms aur automated systems use karke arbitrage opportunities ko effectively exploit kiya ja sakta hai.

Forex arbitrage trading aik fascinating aur profitable strategy hai jo ke price differences ko exploit karke low-risk profits kamaane ka moka deti hai. Lekin ismein execution speed, low transaction costs aur reliable market access ka hona bohot zaruri hai taake successful trading ho sake. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

Forex Arbitrage Trading?

**Forex Arbitrage Trading**

**1. Forex Arbitrage Trading Kya Hai?**

Forex arbitrage trading ek tarika hai jisme traders profit kamane ki koshish karte hain, exploiting the price differences between similar financial instruments on different markets.

**2. Kaise Kaam Karta Hai?**

Arbitrage traders prices ko closely monitor karte hain aur jab wo kisi instrument mein price difference detect karte hain, to wo usse exploit karke profit kamane ki koshish karte hain. For example, agar ek currency pair ka price ek market mein zyada hai aur doosre market mein kam hai, to trader ek market se sasta kharid kar doosre market mein mahanga bech kar profit kamata hai.

**3. Types of Forex Arbitrage:**

- **Simple Arbitrage:** Isme traders ek hi samay par ek hi financial instrument ko ek market se sasta kharidte hain aur doosre market mein mahanga bechte hain.

- **Triangular Arbitrage:** Isme traders ek currency pair ko istemal karte huye, multiple currencies ke beech price differences exploit karte hain.

- **Statistical Arbitrage:** Isme traders historical data aur statistical models ka istemal karte hain, price anomalies ko identify karke profit kamane ke liye.

**4. Challenges and Risks:**

Forex arbitrage trading ke kuch challenges aur risks hote hain:

- **Execution Risk:** Prices mein difference hone par bhi execution delay ya issues ho sakte hain, jisse profit margin kam ho sakta hai.

- **Market Volatility:** Market volatility aur liquidity issues bhi arbitrage trading ko challenging bana sakte hain.

- **Regulatory Risks:** Kuch jurisdictions mein arbitrage trading par restrictions ya regulations ho sakte hain, jo traders ko constrain kar sakte hain.

**5. Conclusion:**

Forex arbitrage trading ek advanced trading strategy hai jo price differences ko exploit karke profit kamane ki koshish karta hai. Ye strategy high-speed trading aur advanced analytical skills ko require karta hai. However, traders ko market volatility aur regulatory risks ka bhi dhyan rakhna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:34 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим