Support And Resistance Level.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

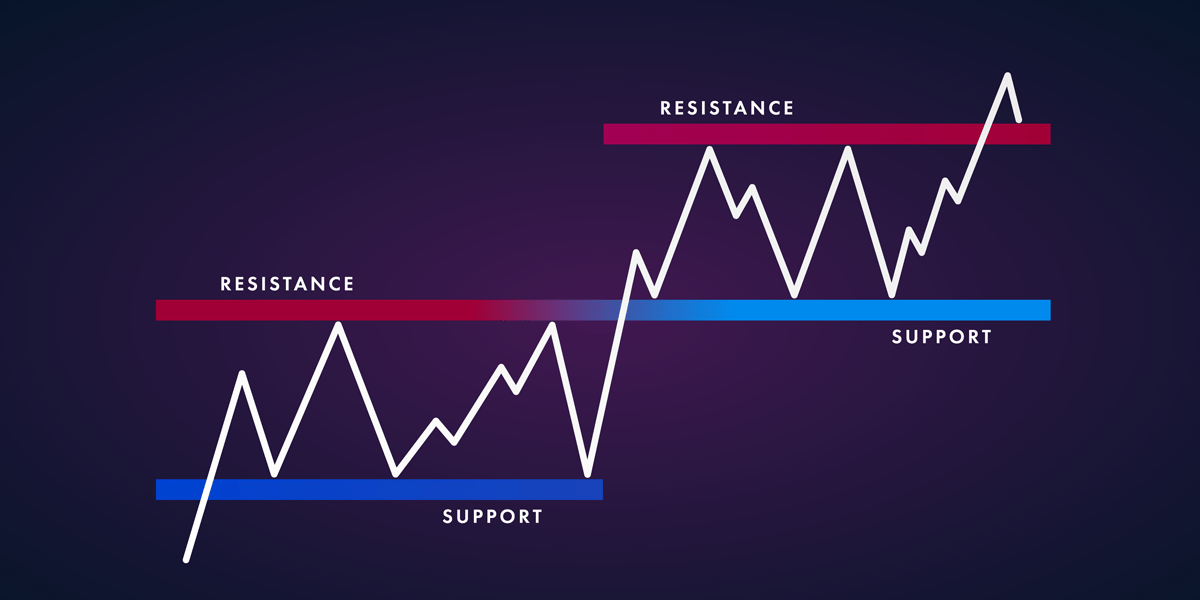

Support Aur Resistance Level Kya Hain: Support aur resistance trading ke mukhtalif pehlu hain jo traders ke liye ahem hotay hain. In dono concepts ko samajhna trading mein kamyabi ke liye zaroori hai. Support: Support ek price level hota hai jahan se stock ya asset ka price neechay gir kar rukta hai ya trend reversal hota hai. Ye level usually historical price data aur technical analysis se determine kiya jata hai. Support level par price agar giray toh yeh ek buying opportunity ban sakta hai. Resistance: Resistance ek price level hota hai jahan se stock ya asset ka price upar ja kar rukta hai ya trend reversal hota hai. Resistance level bhi historical data aur technical analysis se calculate kiya jata hai. Resistance level par price agar rukay toh yeh ek selling opportunity ho sakti hai. Trading Main Support Aur Resistance Ka Istemal: Support aur resistance levels ko identify karke traders market mein sahi waqt par entry aur exit points tay kar sakte hain. Agar kisi stock ka price support level tak gir gaya toh trader ko buy karne ka mauka mil sakta hai. Wahi agar resistance level tak price pohanchti hai toh bechne ka mauka ho sakta hai. Stop-Loss Aur Target Setting: Support aur resistance levels ka istemal stop-loss aur target setting mein bhi hota hai. Stop-loss ko support level ke neeche rakha jata hai taki nuksan se bacha ja sake. Target price ko resistance level ke paas rakha jata hai taki profit booking kiya ja sake. Risk Management: Support aur resistance levels ka istemal risk management mein bhi hota hai. Agar trader support aur resistance levels ko samajh leta hai toh woh apne trades ko samjh kar risk ko kam kar sakta hai. Conclusion: Support aur resistance trading ke aham hisse hain jo traders ko market mein sahi disha mein guide karte hain. In levels ko samajh kar trading decisions lene mein madad milti hai aur risk management bhi behtar hoti hai. Isliye traders ko in concepts ko samajhna zaroori hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Support aur resistance trading ki dunia mein do bohot ahem aur basic concepts hain. Yeh terms use hoti hain jab hum kisi stock, commodity, ya currency ke price movement ko samajhne ki koshish karte hain.

Support Level

Support level woh price point hota hai jahan ek asset ki demand barh jaati hai, aur yeh price girne se rokta hai. Yeh wo level hota hai jahan traders sochte hain ke asset undervalued hai, aur is wajah se zyada se zyada log is price par khareedari karte hain. Support level aksar is wajah se strong banta hai kyun ke yahan par buying interest zyada hota hai.

Agar asset ka price support level par aa kar ruk jaaye aur wahan se wapas upar chala jaaye, to yeh indicate karta hai ke support strong hai. Lekin agar price is level ko tod kar neeche chala jaaye, to yeh indicate karta hai ke market mein bearish sentiment hai aur yeh level ab resistance ban sakta hai.

Support levels identify karne ke liye traders different methods use karte hain, jaise:- Price Charts: Historical price data dekh kar support levels identify kiye jaa sakte hain. Aap dekh sakte hain ke pehle kis level par price gir kar ruk gaya tha.

- Moving Averages: Yeh ek popular tool hai jo past prices ka average leta hai aur support aur resistance levels ko identify karne mein madad deta hai.

- Fibonacci Retracement Levels: Yeh ek mathematical tool hai jo historical price movements ko analyze karte hue potential support aur resistance levels identify karta hai.

Resistance level woh price point hota hai jahan ek asset ki supply barh jaati hai, aur yeh price ko zyada barhne se rokta hai. Yeh wo level hota hai jahan traders sochte hain ke asset overvalued hai, aur is wajah se zyada se zyada log is price par bechna shuru kar dete hain. Resistance level bhi aksar is wajah se strong banta hai kyun ke yahan par selling pressure zyada hota hai.

Agar asset ka price resistance level par aa kar ruk jaaye aur wahan se wapas neeche chala jaaye, to yeh indicate karta hai ke resistance strong hai. Lekin agar price is level ko tod kar upar chala jaaye, to yeh indicate karta hai ke market mein bullish sentiment hai aur yeh level ab support ban sakta hai.

Resistance levels identify karne ke liye bhi traders different methods use karte hain, jaise:- Price Charts: Historical price data dekh kar resistance levels identify kiye jaa sakte hain. Aap dekh sakte hain ke pehle kis level par price barh kar ruk gaya tha.

- Moving Averages: Yeh bhi ek useful tool hai jo resistance levels ko identify karne mein madad karta hai.

- Fibonacci Retracement Levels: Yeh tool resistance levels identify karne mein bhi madadgar hai.

Support aur resistance levels ko samajhna bohot zaroori hai kyun ke yeh levels trading decisions ko influence karte hain. Jab traders yeh levels identify kar lete hain, to yeh unhe batata hai ke kab entry aur exit points consider karne hain. Iske ilawa, support aur resistance levels trading strategies ko define karne mein bhi madadgar hote hain, jaise ke:- Breakouts: Jab price support ya resistance level ko todta hai, to yeh indicate karta hai ke market trend mein change aane wala hai. Breakout trading strategy yeh hoti hai ke jab price resistance ko tod kar upar chala jaaye, to buy kar liya jaye, aur jab price support ko tod kar neeche chala jaaye, to sell kar diya jaye.

- Range Trading: Jab price ek specific range mein move kar raha ho aur support aur resistance levels ke beech mein trade kar raha ho, to range trading strategy yeh hoti hai ke support level ke qareeb buy kiya jaye aur resistance level ke qareeb sell kiya jaye.

Support aur resistance levels ko identify karne ke liye bohot se technical indicators aur tools use hote hain, jaise:- Trendlines: Yeh simple lines hoti hain jo price movements ko connect karti hain aur trends ko identify karne mein madad deti hain.

- Moving Averages: Yeh indicators historical price data ka average le kar support aur resistance levels ko define karte hain.

- Bollinger Bands: Yeh tool volatility ko measure karta hai aur price movements ke potential support aur resistance levels ko identify karta hai.

- Relative Strength Index (RSI): Yeh momentum oscillator hai jo overbought aur oversold conditions ko identify karta hai aur support aur resistance levels ko samajhne mein madadgar hota hai.

- MACD (Moving Average Convergence Divergence): Yeh trend-following momentum indicator hai jo support aur resistance levels ko identify karne mein madad deta hai.

Support aur resistance levels sirf technical analysis par hi depend nahi karte, balki psychological factors bhi bohot important role play karte hain. Traders aur investors ki collective behavior aur unki market ki expectations bhi yeh levels define karne mein madad deti hain. Jab ek bohot bara number of traders ek specific price level par buying ya selling karne ka decision lete hain, to yeh levels aur bhi zyada significant ban jaate hain.

Real-World Examples

Support aur resistance levels ko samajhne ke liye kuch real-world examples bhi dekhte hain:- Stock Market: Agar ek stock $50 par trade kar raha hai aur baar baar $45 par support mil raha hai, to yeh level significant support ban jaata hai. Agar yeh stock $55 ko baar baar tod nahi paa raha, to yeh level significant resistance ban jaata hai.

- Forex Market: Agar EUR/USD pair 1.1000 par trade kar raha hai aur 1.0900 par support mil raha hai, to yeh level support ban jaata hai. Agar yeh pair 1.1100 ko tod nahi paa raha, to yeh level resistance ban jaata hai.

Support aur resistance levels trading ki dunia mein bohot ahem role play karte hain. Yeh levels traders ko market ke trends aur price movements ko samajhne mein madad dete hain. Inko identify karne ke liye different tools aur indicators use hote hain, aur inka samajh traders ko apni trading strategies ko behtar banane mein madad karta hai. Psychological factors bhi in levels ko define karne mein significant role play karte hain, kyun ke market participants ki collective behavior inko influence karti hai.

In concepts ko achi tarah samajhne aur inko apni trading mein apply karne se aap apni trading performance ko improve kar sakte hain aur market ke risk ko effectively manage kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- 1.0855 EURUSD

- Mentions 0

-

سا0 like

-

#4 Collapse

**Support Aur Resistance Level**

Trading ki duniya mein, "Support" aur "Resistance" do aise concepts hain jo kisi bhi trader ke liye bohot ahmiyat rakhte hain. Yeh levels market ki price movements ko samajhne aur anticipate karne mein madadgar hote hain. Agar aap trading mein naya qadam rakh rahe hain, toh yeh samajhna zaroori hai ke support aur resistance levels kaise kaam karte hain aur inka sahi istemal karke trading strategies kaise banayi ja sakti hain.

### Support Level

Support level woh price point hai jahan par demand itni strong hoti hai ke price us level se neeche nahi girti. Iska matlab yeh hota hai ke buyers is price par zyada interested hote hain aur woh market mein buy karna shuru kar dete hain. Jab market price support level tak girti hai, toh zyadatar traders isse buying opportunity ke tor par dekhte hain.

Support level ko chart par dekhne ke liye, aap historical price data ka sahara le sakte hain. Woh levels jahan price ne baar baar bounce back kiya ho, unhe support points kaha ja sakta hai. For example, agar ek currency pair repeatedly 1.2000 par support dikhata hai, toh yeh ek significant support level hai.

### Resistance Level

Resistance level us price point ko kehte hain jahan supply itni strong hoti hai ke price us level ko paar nahi kar sakti. Iska matlab hai ke sellers is point par zyada active ho jate hain aur price ko neeche dhakel dete hain. Resistance level par zyadatar traders sell karne ki sochte hain, kyunki unhe lagta hai ke price is level par ruk jayegi ya wapas neeche jayegi.

Resistance level ko identify karne ke liye bhi historical price data ka istemal kiya jata hai. Jo levels baar baar price ko neeche dhakel rahe hon, woh resistance points ho sakte hain. Agar koi currency pair repeatedly 1.2500 par resistance face kar raha hai, toh yeh ek strong resistance level hai.

### Kaise Kaam Karte Hain

Support aur resistance levels ki pehchan karna itna asaan nahi hai, lekin practice ke saath inhe samajhna mumkin hai. In levels ko samajhne ke liye technical analysis tools jaise moving averages, trend lines, aur candlestick patterns ka istemal kiya ja sakta hai.

Jab ek support level toot jata hai, toh yeh aksar ek naye resistance level ki shakal ikhtiyar kar leta hai, aur vice versa. Is wajah se, price action par nazar rakhna aur levels ki confirmation lena bohot zaroori hota hai.

### Inka Sahi Istemaal

Support aur resistance levels ko samajhne ke baad, aap inhe apni trading strategies mein incorporate kar sakte hain. Support level par buy karna aur resistance level par sell karna ek aam strategy hai. Iske alawa, aap in levels par stop-loss aur take-profit levels bhi set kar sakte hain taake aapka risk management mazboot rahe.

Yeh levels har time frame par kaam karte hain, lekin short-term trading mein inka impact zyada nazar aata hai. Support aur resistance levels ko samajhkar, aap market movements ko better anticipate kar sakte hain aur trading decisions ko aur behtar bana sakte hain.

Akhir mein, yad rahe ke market unpredictable hoti hai aur koi bhi strategy hamesha successful nahi hoti. Lekin support aur resistance levels ko samajhkar aap market ke behavior ko behtar samajh sakte hain aur trading mein informed decisions le sakte hain. -

#5 Collapse

Support Aur Resistance Level: Ek Mukhtasir Jaiza

Muqaddama

Support aur resistance levels technical analysis ke bunyadi concepts hain jo Forex trading mein bohot ahmiyat rakhte hain. Ye levels market ke price movement ko predict karne mein madadgar hote hain aur traders ko effective trading decisions lene mein madad dete hain. Is article mein hum support aur resistance levels ko briefly explain karenge aur inke istimaal ka tareeqa samjhenge.

Support Level Kya Hai?

Support level wo price point hai jahan demand price ko neeche girne se rokta hai. Is point par buyers active ho jate hain aur price ko support dete hain. Ye level ek "floor" ki tarah kaam karta hai jo price ko neeche girne se bachata hai.

Resistance Level Kya Hai?

Resistance level wo price point hai jahan supply price ko upar jane se rokta hai. Is point par sellers active ho jate hain aur price ko resist karte hain. Ye level ek "ceiling" ki tarah kaam karta hai jo price ko upar jane se rokta hai.

Support Aur Resistance Levels Ka Istemaal- Trend Identification: Support aur resistance levels trend ko identify karne mein madadgar hote hain. Agar price support level ke paas repeatedly bounce kar raha hai, toh ye uptrend ka indication ho sakta hai. Aur agar price resistance level ke paas repeatedly reject ho raha hai, toh ye downtrend ka indication ho sakta hai.

- Entry Aur Exit Points: Support aur resistance levels trading ke entry aur exit points ko identify karne mein madadgar hote hain. Agar price support level ke paas hai aur bounce karne ke signs de raha hai, toh ye buy signal ho sakta hai. Aur agar price resistance level ke paas hai aur reverse hone ke signs de raha hai, toh ye sell signal ho sakta hai.

- Stop Loss Aur Take Profit: Support aur resistance levels stop loss aur take profit levels set karne mein bhi madadgar hote hain. Agar aap buy trade enter karte hain, toh aap apna stop loss support level ke neeche aur take profit resistance level ke paas set kar sakte hain. Isi tarah, agar aap sell trade enter karte hain, toh aap apna stop loss resistance level ke upar aur take profit support level ke paas set kar sakte hain.

Support Aur Resistance Levels Ko Identify Karna- Historical Data: Support aur resistance levels ko identify karne ke liye historical price data ka analysis zaroori hota hai. Wo points jahan pehle price ne reversal ya consolidation dikhayi ho, unko note karna hota hai.

- Trendlines Aur Moving Averages: Trendlines aur moving averages bhi support aur resistance levels ko identify karne mein madadgar hote hain. Trendlines price ki directional movement ko indicate karti hain aur moving averages dynamic support aur resistance levels ko highlight karti hain.

- Psychological Levels: Psychological levels jaise ke round numbers (e.g., 1.3000, 1.5000) bhi support aur resistance levels ke taur par kaam karte hain. Ye levels traders aur investors ke liye significant hote hain aur price action ko influence kar sakte hain.

Conclusion

Support aur resistance levels Forex trading mein bohot ahmiyat rakhte hain. Ye levels market ke price movement ko predict karne mein madadgar hote hain aur traders ko effective trading decisions lene mein madad dete hain. In levels ko sahi tarah se identify kar ke aur apni trading strategy mein shaamil kar ke aap apni trading performance ko enhance kar sakte hain aur profitable trading decisions le sakte hain. Har trader ke liye zaroori hai ke wo support aur resistance levels ko achi tarah samjhe aur unka sahi istemaal kare.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Support Aur Resistance Levels: Ek Tafseel

Support aur resistance levels trading ke fundamental concepts hain jo market analysis mein badi ahmiyat rakhte hain. Yeh levels traders ko market ki movement aur potential reversal points ka andaza lagane mein madad karte hain. Is post mein hum support aur resistance levels ki definition, characteristics, aur inka istemal trading strategies mein ghor karenge.

#### 1. **Support Level Kya Hai?**

Support level wo price point hai jahan ek asset ki demand itni zyada hoti hai ke price us level se neeche nahi girta. Iska matlab hai ke jab price is level par aata hai, toh buyers isse kharidne ke liye tayar hote hain, jo price ko support dete hain. Support level aksar historical price action ya psychological levels par banta hai, jaise round numbers (e.g., 1.2000).

#### 2. **Resistance Level Kya Hai?**

Resistance level wo price point hai jahan sellers itni taqat rakhte hain ke price us level se upar nahi ja sakta. Jab price is level par pahuncha, toh sellers khud ko bechne lagte hain, jo price ko resistance dete hain. Jaise support, resistance level bhi historical price action ya psychological barriers par banta hai.

#### 3. **Support Aur Resistance Ki Characteristics**

- **Flip Levels**: Jab price support level ko todta hai, toh yeh resistance ban jata hai, aur jab price resistance level ko todta hai, toh yeh support ban jata hai. Is phenomenon ko "flip level" kaha jata hai.

- **Multiple Touches**: Jab price ek hi level par bar-bar aata hai, toh yeh level zyada strong samjha jata hai. Zyada touches yeh darshate hain ke market participants is level par zyada interested hain.

- **Volume Confirmation**: High trading volume jab price support ya resistance level ko touch karta hai, toh yeh level ki strength ko confirm karta hai.

#### 4. **Support Aur Resistance Ka Istemal**

- **Entry Aur Exit Points**: Traders support aur resistance levels ka istemal entry aur exit points tay karne ke liye karte hain. Agar price support level par bounce hota hai, toh buy position lena behtar hota hai, aur agar price resistance level par girta hai, toh sell position lena munasib hai.

- **Stop-Loss Orders**: Support aur resistance levels ko stop-loss orders tay karne mein bhi istemal kiya ja sakta hai. Traders support ke neeche ya resistance ke upar stop-loss rakhenge taake potential losses ko control kiya ja sake.

#### 5. **Market Context**

Support aur resistance levels ko samajhne ke liye market context ka ghor se mutalia zaruri hai. Fundamental news, economic indicators, aur geopolitical events bhi in levels par asar daal sakte hain. Isliye, trading karte waqt in factors ko madde nazar rakhna chahiye.

#### Conclusion

Support aur resistance levels forex trading ka ek ahem hissa hain. Yeh levels traders ko market ki direction aur potential reversal points ka andaza lagane mein madad karte hain. Agar aap in levels ko sahi tarike se samajhte hain aur unka istemal apni trading strategies mein karte hain, toh aap apne trading decisions ko behtar bana sakte hain. In levels ka ghor se mutalia karke aap forex market mein zyada successful ho sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:14 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим