What's the Bearish kicking pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

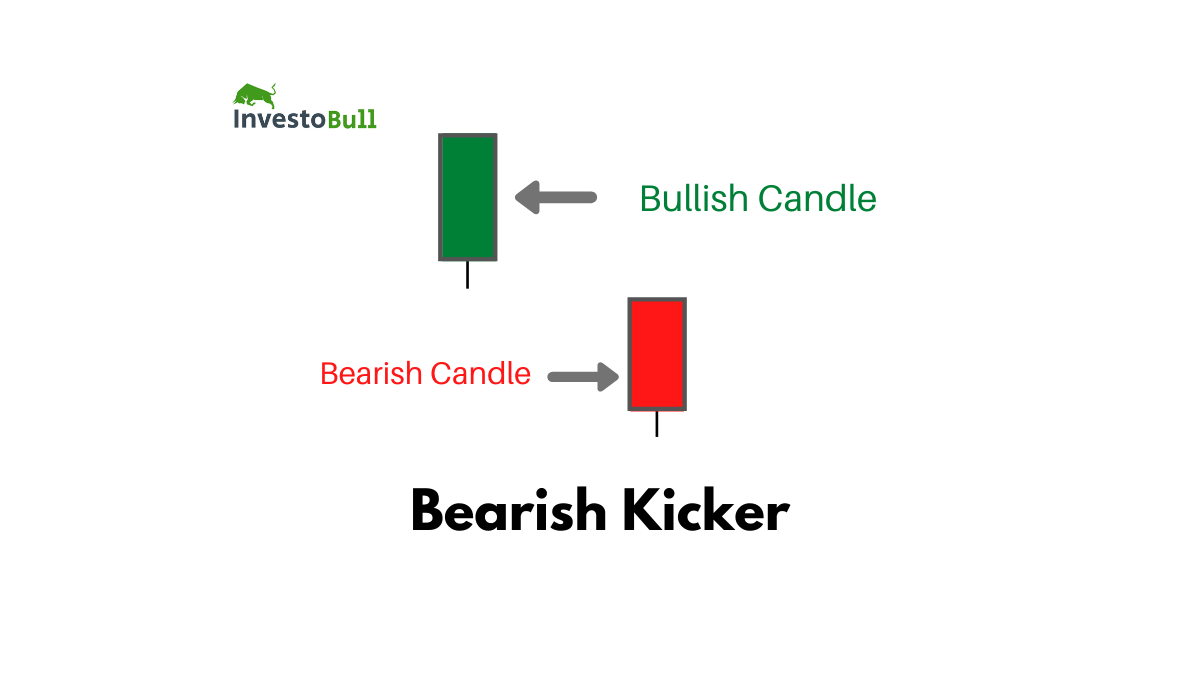

Bearish kicking pattern Bearish kicking pattern forex trading mein ek important candlestick pattern hai jo market analysis mein istemal hota hai. Yeh pattern market mein bearish reversal ko indicate karta hai aur traders ko potential downtrend ke liye alert karta hai. Bearish kicking pattern ka naam isliye hai kyunki iski appearance ek strong reversal signal provide karta hai, jisme previous bullish trend ko kick karta hai aur bearish momentum shuru hota hai. Is pattern ko samajhne ke liye, pehle candlesticks ki basic understanding honi chahiye. Candlesticks charts market movements ko visualize karne ka ek tareeqa hai, jisme har candlestick ek specific time frame ko represent karta hai. Bearish kicking pattern mein, do candlesticks shamil hote hain. Pehla candlestick bullish trend ko represent karta hai aur doosra candlestick ise follow karta hai. Yeh do candlesticks opposite directions mein move karte hain. Pehla candlestick ek strong bullish candle hota hai, jo upward trend ko indicate karta hai. Iske baad aata hai doosra candlestick, jo bearish hota hai aur pehle candlestick ke upper range mein open hota hai. Iska matlab hai ke market mein sudden shift aaya hai, aur bulls ke dominance ko bears ne kick kiya hai. Bearish kicking pattern ka key element hai doosre candlestick ka gap up opening. Yeh gap up opening, previous bullish trend ko abruptly terminate karke downtrend ko signal karta hai. Traders ko is gap up opening par focus karna chahiye, kyunki yeh ek potential reversal point ho sakta hai. Is pattern ko samajhne ke liye, traders ko candlestick patterns ka comprehensive study karna zaroori hai. Bearish kicking pattern ko identify karna, market trends ke reversal points ko predict karne mein madadgar hota hai. Traders ko dhyan rakhna chahiye ke ek single pattern par rely karna sufficient nahi hota. Technical analysis mein diversification aur confirmation ke liye multiple indicators ka use karna important hai. Bearish kicking pattern ke istemal mein, risk management bhi crucial hota hai. Stop-loss orders ka istemal karke traders apne positions ko protect kar sakte hain, agar market unexpected moves mein jaata hai. To sum up, bearish kicking pattern ek powerful reversal signal hai jo traders ko market trends ke changes ke liye alert karta hai. Is pattern ki sahi samajh aur istemal se, traders apne trading strategies ko refine kar sakte hain aur market movements ko better predict kar sakte hain. -

#3 Collapse

Assalamu Alaikum Dosto!Bearish Kicking Pattern

Bearish Kicking pattern ko financial markets ya forex trading me kicking down pattern bhi kaha jata hai. Bearish Kicking pattern me do(two) marubozu candles hoti hen jo k bihut bari lines ki hoti hai. Bearish Kicking pattern me marubozu candles ki formation is tarah se hoti hai k is me aik candle white (green ya bullish) marubozu hogi jab k second number pe ani wali candle bearish ya black marubozu candle hoti hai. Bearish Kicking pattern me pehle white marubozu candle se dosri bearish (black) se kafi fasle pe nechay side pe banti hai, jis k darmeyan gap lazmi hota hai. Bearish Kicking pattern me trend ki direction ki position aur is trend ki downward side pe continuation k bare me information deti hai. Bearish kicking candlestick pattern ki main key points darjazel hai;- Bearish Kicking Candlestick Pattern aik do days candles par mushtamil candlestick pattern hai.

- Ye pattern price chart par hamesha top position ya high price area hi mein moasar rehta hai.

- Pattern mein pehli candle lazmi tawar par greaan ya bullish honi chaheye, jo prices k maojoda trend ya high price zone ki akasi karti hai.

- Pattern ki dosri candle ko k prices k reversal ka sabab bhi banti hai, aik black/red ya bearish candle honi chaheye. Ye candle prices ko mazeed bullish trend main jane se hold karti hai.

- Pattern ki dosri candle ki position bohut zarori hai, jo k pehli candle k lower par banti gai.

- Pattern ki dono candles ziada tar bagher shadow k bante hen, lekin small shadows mein bhi ye pattern kar-amad hota hai. Patterns ki dono candles ya kam az kam dosri candle ka real body mein hona zarori hota hai.

Candles Formation

Bearish kicking candlestick pattern me do candles shamil hoti hai, jo k bearish trend reversal ka ka kaam karti hai, lekin ye pattern aam tawar par dosre pattern se mukhtalif iss waja se hai, q k iss pattern me aik to dono candles strong real body me hote hen aur dosra pattern k dono candle k darmeyan aik bara wazih gap hota hai. Pattern me shamil candles ki formation darjazel tarah se hota hai:- First Candle:

Bearish kicking candlestick pattern chonkeh uptrend me banta hai, iss waja se pattern ki pehli candle aik bullish candle hoti hai. Ye candle aik to prices ko upward side par move karnw ki koshash karti hai, to dosra ye aik strong bullish candle hoti hai, jiss k upper par ya lower side par koi shadow ya wick nahi banta hai. Aam tawar par ye candle aik marubozu candle hoti hai.

Pattern ki ye candle aik strong real body mein hoti hai, lekin ye zarori nahi hia. Q k koi bhi candle jo prices k top par bullish pattern k last par ban sakti hai. Pattern k ye candle bullish trend ki akasi karti hai, jiss mein prices k upper side par taqat ka andaza lagaya jata hai. Pehli candle agar indicator par bhi strongness zahir karti hai, ye indicator ki ye position overbought zone hota hai to ye hamesha trend reversal ki position hogi. - Second Candle:

Bearish kicking candlestick pattern ki dosri candle bhi same pehli candle ki tarah aik marubozu candle hoti hai, lekin ye candle pehli candle k bar-aks aik bearish candle hoti hai. Dosri candle aik to aik strong bearish candle banti hai, jiss k upper aur lower side par koi shadow nahi hota hai, jab k dosra ye candle pehli candle se lower side par aik wazih gap me banti hai.

Pattern ki doari candle khas ahmeyat ka hamil hoti hai, q k ye candle prices k reversal ka zarya banti hai. Pattern ki doari candle ka lazmi strong hona chaheye, q k ye prices ko nechay side par teezi dekhati hai. Pattern ki ye candle ziada tar aik marubozu candle hoti hai, jiss k upper aur lower dono sides par shadow nahi bata hai, lekin ye zarori nahi hai, bagher marubozu candle bhi yahan ban sakti hai.

Explaination

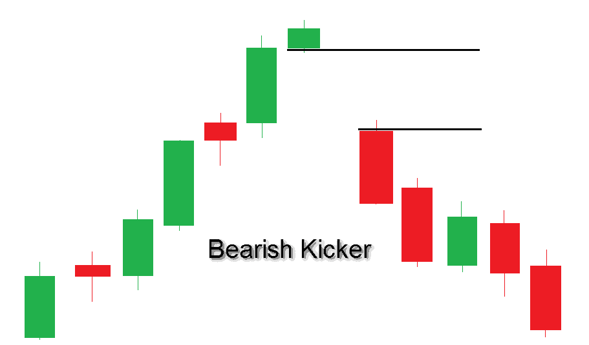

Bearish kicking candlestick pattern aam tawar long timeframes me yss waqat banta hai, jab financial markets me bohut zyada changes waqea hota hai. Pattern do candles bullish aur bearish candle se mel kar banta hai, jiss me dono candles strong real body me hoti hai. Iss k elawa dono candles k upper aur lower side par koi shadow ya wick nahi banta hai. Pattern me shamil pehli candle market me bullish trend ki akasi karti hai, jiss me ye candle ya to bullish trend k baad banti hai aur ya aur high price zone me waqea hoti hai. Pattern ki dosri candle aik bearish candle hoti hai, jo aik to market me bullish trend ka khatma karti hai, aur uss k sath sath ye candle bearish trend ka signal bhi deti hai. Ye candle aik strong real body me bagher shadow k banti hai. Patterns ki kamyabhi k leye kuch zarori points ko lazmi made nazar rakhen :- Market ki Current Position: Bearish kicking candlestick pattern k banne se pehle market ki current trend ka lazmi bullish hona chaheye. Lekin agara trend slow movement mein hai to prices ka lazmi higher area zone mein hona chaheye. Ya kam az kam chaar se lekar panch candlesticks ka bullish ka hone chaheye.

- Pattern ki Shap: Bearish kicking candlestick pattern ki shap do candles par mushtamil hona chaheye, jiss mein pehli candle aik strong real body wali bullish candle aur dosri candle aik strong real body wali bearish candle honi chaheye.

- Volume & Supply/Demand: Bearish Kicking candlestick pattern k dowran volum high hona chaheye aur market mein demand ki nisbat supply ka ratio bhi ziada hona chaheye. Ziada supply market mein current trend k upper side par kazmzoori zahir karti hai.

- News Impacts: Bearish kicking candlestick pattern aksar market mein news k time par bhi banta hai, jab bhi news event k dowran kisi assets ki value gir jati hai to achanak uss ki prices par bara asar par jata hai.

- Pattern k Baad: Bearish kicking candlestick pattern k baad achanak market mein entry nahi karni chaheye, bulkeh aik confirmation candle ka intezar karna chaheye, jo real body mein bearish honi chaheye aur sath hi sath ye candle dosri bearish candle k lower side par banni chaheye.

Trading

Bearish kicking candlestick pattern traders k leye entry ka aik behtareen signal ka zarya hai, agar pattern prices chart me bullish trend ya high price zone banta hai. Ye pattern market me high supply zone ki akasi karti hai, jiss me traders buy ki bajaye selling ko ziada tarjeeh dete hen. Pattern me trade entry karne se pehle trend confirmation ka hona zarori hai, jiss k leye pattern k baad aik bearish confirmation candle ka banna entry point ki position hoti hai. Pattern ki trwnd confirmation indicator se bhi ki ja sakti hai. Indicators par pattern k dowran value ka overbought zone me hona chaheye. Trend confirmation k leye strong indicators ka istemal kia karen, jo market me ziada reliable signals faraham karte hon. Trading Bearish Kicking pattern par amal karne ke liye, traders ko ye steps follow karne chahiye:- Identify the Pattern:

Pehle toh zaroori hai ke aap sahi tarah se Bearish Kicking pattern ko pehchanen. Is pattern mein pehla candlestick uptrend ko represent karega, jabke dusra candlestick pehle ke close se neeche gap down ke sath open hokar bearish movement dikhayega. - Confirmation:

Bearish Kicking pattern ko confirm karne ke liye, traders ko doosri technical analysis tools aur indicators ka istemal karna chahiye. Jaise ke trend lines, support aur resistance levels, ya phir oscillators jaise RSI (Relative Strength Index) ya Stochastic. - Short Position Entry:

Jab aapko lagta hai ke Bearish Kicking pattern confirm ho gaya hai aur market mein bearish movement ane wala hai, toh aap short position le sakte hain. Iske liye, aap apne trading platform par sell order place kar sakte hain. - Stop Loss aur Take Profit Levels:

Har trading strategy mein risk management bahut zaroori hai. Isliye, aapko apne trade ke liye stop loss aur take profit levels set karna chahiye. Stop loss, aapko protect karega agar trade against direction jaaye, aur take profit level aapko ye batayega ke kab aap apne profits secure kar len. - Market Monitoring:

Trade enter karne ke baad, market ko closely monitor karna important hai. Isme aapko market conditions aur price movements ka dhyan rakhna hoga. Agar aap dekhte hain ke market conditions aapke analysis ke khilaf ja rahi hain, toh aap apne positions ko adjust kar sakte hain.

-

#4 Collapse

BEARISH KICKING CANDLESTICK PATTERN

Bearish Kicking candlestick pattern kya hy?

As salam o alaikum dosto, Bearish Kicking Candlestick Pattern ik situation ko theek karta hy jab market main bearish trend shuru hota hy or previous bullish trend ko reverse karta hy. Is pattern main do consecutive candlestick hoty hain jin main sy pehli candle bullish hoti hy, or dusri candle bearish hoti hy, jo ky pehli candlestick ky close sy niche shuru hoti hy.Bearish Kicking Candlestick Pattern ik powerful bearish reversal pattern hy jo traders ko market trends ko identify karny main madad karta hy. Traders ko is pattern ka sahi istemal karny ky liye, market ki mukhtalif factors or confirmatory signals ko bhi mad e nazar rakhty huwy apny trading decisions ko samajhny ki zarurat hoti hy.

Types of Bearish and bullish kicking candlestick pattern:- Pehla Candlestick (Bullish):

- Dear friends, Pehla candlestick ik bullish candlestick hoti hy jo ky uptrend ko show karti hy.

- Dear, Is candlestick ki opening price low hoti hy or closing price high hoti hy, jo ky uptrend ko indicate karta hy.

- Dusra Candlestick (Bearish):

- Dear buddies, Dusra candlestick ik bearish candlestick hoti hy jo ky pehl candlestick ky opposite direction main hoti hy.

- Hello dosto, Iski opening price high hoti hy or closing price low hoti hy, jo ky bearish pressure ko theek karti hy.

- Do Candlesticks Ky Darmiyan Gap:

- Bearish Kicking pattern main do candlesticks ke darmiyan ik noticeable gap hota hy. Ye gap bullish trend ky abrupt end ko darust karta hy.

Bearish Kicking candlestick pattern in details:

Mere pyare aziz dosto, Bearish Kicking Pattern ka main maqsad uptrend ky bad any waly bearish reversal ko darust karna hy. Is pattern ki pehli candle bullish hoti hy, jo ky uptrend ko darust karti hy. Lekin dusri candlestick ny gap down ky sath open ho kar downtrend ko start kr diya hy .Is pattern main gape down ik ahem factor hy. Gap down ka matlab hota hy ky dusre din ki opening price pehly din ki closing price sy km hoti hy. Ye gape down bearish sentiment ko indicate karta hy or traders ko ye dikhata hy ky market ka mood change ho sakta hy. Bearish Kicking Pattern ki khas baat ye hy ky doosri candlestick ki body pehly candlestick ki body ky andar hoti hy. Iska matlab hy ky sellers ne control ko puri tarah sy apny hath main ly liya hy or ab market ko downtrend main ly ja rahy hain.

- Pehla Candlestick (Bullish):

-

#5 Collapse

Bearish Kicking Candlestick PatternBearish Kicking Candlestick Pattern ek bearish reversal pattern hai jo technical analysis mein istemal hota hai. Yeh pattern do candles se bana hota hai aur jab market mein uptrend hota hai to iska appearance aam hota hai. Yeh pattern traders ko indicate karta hai ke uptrend khatam ho sakta hai aur market mein downward movement ka trend shuru ho sakta hai. Yeh pattern candlestick charts par dekha ja sakta hai aur traders isay identify karke trading decisions lete hain.

Identification Characteristics:- First Candle (Bullish): Pehla candle uptrend ke doran form hota hai. Is candle ka open price first candle ke bottom par hota hai aur close price uske top par hota hai. Is candle ka range generally large hota hai.

- Second Candle (Bearish): Dusra candle pehle candle ke upar gap down ke saath open hota hai. Yeh candle pehle candle ke close price ke neeche close hota hai. Is candle ka range bhi generally large hota hai.

- Gap Down: Dusra candle pehle candle ke close price se neeche open hota hai. Yeh gap down bearish sentiment ko indicate karta hai.

- No Overlap: Dusra candle ka open price pehle candle ke range ke neeche hota hai aur dono candles ka range overlap nahi hota.

Confirmation:- Volume: Bearish Kicking pattern ke confirmation ke liye volume ka bhi dhyan diya jata hai. Agar second candle ke sath high volume ho to yeh pattern aur bhi strong hota hai.

- Price Action: Is pattern ke confirmation ke liye traders price action ko bhi dekhte hain. Agar third candle bearish move mein continue hota hai to yeh pattern aur bhi reliable hota hai.

- Support and Resistance: Agar bearish kicking pattern support ya resistance level ke near form hota hai to iska confirmation aur bhi strong hota hai.

Trading Strategy:

- Entry: Traders entry point ko confirm karne ke liye third candle ka wait karte hain. Agar third candle bearish move mein continue hoti hai aur volume bhi high hai to traders short position lete hain.

- Stop Loss: Stop loss ko set karne ke liye traders pehle candle ke high price ke just above ya resistance level ke just above rakhte hain.

- Target: Target ko set karne ke liye traders support level ya Fibonacci retracement level ka istemal karte hain.

- Risk Management: Risk management ke liye traders apne trade size ko apne risk tolerance ke according adjust karte hain.

Istemal Explanation:

Jab market mein uptrend hota hai aur bearish kicking pattern form hota hai, to yeh traders ko indicate karta hai ke uptrend khatam ho sakta hai aur downward movement ka trend shuru ho sakta hai. Traders is pattern ko identify karke short positions lete hain aur stop loss aur target levels ko set karke apni trades ko manage karte hain. Yeh pattern market sentiment ko reflect karta hai aur traders ko market direction ke baare mein alert rakhta hai.

Conclusion:

In conclusion, Bearish Kicking Candlestick Pattern ek powerful bearish reversal pattern hai jo traders ko market mein hone wale possible trend reversal ke baare mein alert karta hai. Is pattern ko samajhna aur istemal karna traders ke liye crucial hai taake woh sahi trading decisions le sakein.

-

#6 Collapse

Bearish Kicking Pattern:

Bearish Kicking Pattern ek candlestick pattern hai jo ke bearish reversal ko darust karti hai. Yeh pattern generally uptrend ke doran dikhai deta hai aur downside price movement ka signal deta hai.

Yeh pattern do candles se bana hota hai:

1. Pehla Candle:

Pehla candle ek bullish candle hota hai jo ke uptrend ke doran form hota hai.

2. Dusra Candle:

Dusra candle ek doosri direction mein open hota hai aur bearish candle hota hai. Iska open price pehle candle ke close price se behtar hota hai.

Bearish Kicking Pattern ka matlab hota hai ke buyers ka control ghaib ho gaya hai aur sellers ka dominance shuru ho gaya hai, is liye traders is pattern ko bearish reversal signal ke tor par consider karte hain.

Yeh pattern ko confirm karne ke liye traders ko doosri technical indicators aur patterns ka bhi istemal karna chahiye jaise ke volume analysis, support aur resistance levels, aur doosre reversal patterns. Trading decisions lene se pehle, traders ko market conditions aur overall trend ka bhi ghor karna zaroori hai. -

#7 Collapse

What is bearish kicking candlestick pattern in forex trading.

As salam o alaikum dosto, Bearish Kicking Candlestick Pattern ik situation ko theek karta hy jab market main bearish trend shuru hota hy or previous bullish trend ko reverse karta hy. Is pattern main do consecutive candlestick hoty hain jin main sy pehli candle bullish hoti hy, or dusri candle bearish hoti hy, jo ky pehli candlestick ky close sy niche shuru hoti hy.Bearish Kicking Candlestick Pattern ik powerful bearish reversal pattern hy jo traders ko market trends ko identify karny main madad karta hy. Traders ko is pattern ka sahi istemal karny ky liye, market ki mukhtalif factors or confirmatory signals ko bhi mad e nazar rakhty huwy apny trading decisions ko samajhny ki zarurat hoti hy.

.

Types of bearish kicking candlestick pattern.- Pehla Candlestick (Bullish):

- Dear friends, Pehla candlestick ik bullish candlestick hoti hy jo ky uptrend ko show karti hy.

- Dear, Is candlestick ki opening price low hoti hy or closing price high hoti hy, jo ky uptrend ko indicate karta hy.

- Dusra Candlestick (Bearish):

- Dear buddies, Dusra candlestick ik bearish candlestick hoti hy jo ky pehl candlestick ky opposite direction main hoti hy.

- Hello dosto, Iski opening price high hoti hy or closing price low hoti hy, jo ky bearish pressure ko theek karti hy.

- Do Candlesticks Ky Darmiyan Gap:

- Bearish Kicking pattern main do candlesticks ke darmiyan ik noticeable gap hota hy. Ye gap bullish trend ky abrupt end ko darust karta hy.

Explanation of bearish kicking candlestick pattern.

Mere pyare aziz dosto, Bearish Kicking Pattern ka main maqsad uptrend ky bad any waly bearish reversal ko darust karna hy. Is pattern ki pehli candle bullish hoti hy, jo ky uptrend ko darust karti hy. Lekin dusri candlestick ny gap down ky sath open ho kar downtrend ko start kr diya hy .Is pattern main gape down ik ahem factor hy. Gap down ka matlab hota hy ky dusre din ki opening price pehly din ki closing price sy km hoti hy. Ye gape down bearish sentiment ko indicate karta hy or traders ko ye dikhata hy ky market ka mood change ho sakta hy. Bearish Kicking Pattern ki khas baat ye hy ky doosri candlestick ki body pehly candlestick ki body ky andar hoti hy. Iska matlab hy ky sellers ne control ko puri tarah sy apny hath main ly liya hy or ab market ko downtrend main ly ja rahy hain.

- Pehla Candlestick (Bullish):

-

#8 Collapse

What is bearish kicking candlestick pattern in forex trading

Bearish Kicking Pattern forex trading mein ek bearish reversal pattern hai jo candlestick charts par dikhai deta hai. Is pattern mein do consecutive candles ka use hota hai jo bearish reversal signal ko indicate karte hain.

Bearish Kicking Pattern ka formation neeche diye gaye hote hain:

Pehli Candle (Bearish):

Pehli candle ek long bullish candle hoti hai jo uptrend ko reflect karti hai.

Is candle ka open price low se neeche hota hai aur close price high par hota hai, jisse bullish sentiment ko highlight kiya jata hai.

Dusri Candle (Bearish):

Dusri candle ek long bearish candle hoti hai jo pehli candle ke upar gap down ke sath open hoti hai.

Is candle ka open price pehli candle ke close price ke neeche hota hai aur close price bhi neeche hota hai, jisse bearish sentiment ko indicate kiya jata hai.

Dusri candle ka body pehli candle ke body se bahut alag hota hai, jisse clear distinction aur strong bearish reversal signal milta hai.

Bearish Kicking Pattern ko identify karne ke liye traders ko in key points par dhyan dena hota hai:

Gap Down Open: Dusri candle ka open price pehli candle ke close price ke neeche hota hai aur dono candles ke beech mein gap hota hai.

Strong Bearish Candle: Dusri candle ka body pehli candle ke body se significantly alag hota hai aur bearish sentiment ko reflect karta hai.

Volume Confirmation: Pattern ko confirm karne ke liye traders volume analysis ka istemal karte hain. Agar dusri candle ke sath increased selling volume hai, toh bearish reversal ka confirmation milta hai.

Bearish Kicking Pattern bearish reversal ko indicate karta hai aur traders ko potential downtrend ya price decline ke signals provide karta hai. Lekin, jaise har trading pattern ki tarah, false signals bhi ho sakte hain, isliye confirmatory signals aur thorough analysis ka istemal kiya jana chahiye pattern ko validate karne ke liye.

-

#9 Collapse

BEARISH KICKING CANDLESTICK PATTERN

Bearish Kicking candlestick pattern kya hy?

Dosto, Bearish Kicking Candlestick Pattern ik situation ko theek karta hy jab market main bearish trend shuru hota hy or previous bullish trend ko reverse karta hy. Is pattern main do consecutive candlestick hoty hain jin main sy pehli candle bullish hoti hy, or dusri candle bearish hoti hy, jo ky pehli candlestick ky close sy niche shuru hoti hy.Bearish Kicking Candlestick Pattern ik powerful bearish reversal pattern hy jo traders ko market trends ko identify karny main madad karta hy. Traders ko is pattern ka sahi istemal karny ky liye, market ki mukhtalif factors or confirmatory signals ko bhi mad e nazar rakhty huwy apny trading decisions ko samajhny ki zarurat hoti hy.

Types of Bearish and bullish kicking candlestick pattern:- Pehla Candlestick (Bullish):

- Dear friends, Pehla candlestick ik bullish candlestick hoti hy jo ky uptrend ko show karti hy.

- Dear, Is candlestick ki opening price low hoti hy or closing price high hoti hy, jo ky uptrend ko indicate karta hy.

- Dusra Candlestick (Bearish):

- Dear buddies, Dusra candlestick ik bearish candlestick hoti hy jo ky pehl candlestick ky opposite direction main hoti hy.

- Hello dosto, Iski opening price high hoti hy or closing price low hoti hy, jo ky bearish pressure ko theek karti hy.

- Do Candlesticks Ky Darmiyan Gap:

- Bearish Kicking pattern main do candlesticks ke darmiyan ik noticeable gap hota hy. Ye gap bullish trend ky abrupt end ko darust karta hy.

Bearish Kicking candlestick pattern in details:

Mere pyare aziz dosto, Bearish Kicking Pattern ka main maqsad uptrend ky bad any waly bearish reversal ko darust karna hy. Is pattern ki pehli candle bullish hoti hy, jo ky uptrend ko darust karti hy. Lekin dusri candlestick ny gap down ky sath open ho kar downtrend ko start kr diya hy .Is pattern main gape down ik ahem factor hy. Gap down ka matlab hota hy ky dusre din ki opening price pehly din ki closing price sy km hoti hy. Ye gape down bearish sentiment ko indicate karta hy or traders ko ye dikhata hy ky market ka mood change ho sakta hy. Bearish Kicking Pattern ki khas baat ye hy ky doosri candlestick ki body pehly candlestick ki body ky andar hoti hy. Iska matlab hy ky sellers ne control ko puri tarah sy apny hath main ly liya hy or ab market ko downtrend main ly ja rahy hain.

- Pehla Candlestick (Bullish):

-

#10 Collapse

BEARISH KICKING CANDLESTICK PATTERN.

As salam o alaikum dosto, Bearish Kicking Candlestick Pattern ik situation ko theek karta hy jab market main bearish trend shuru hota hy or previous bullish trend ko reverse karta hy. Is pattern main do consecutive candlestick hoty hain jin main sy pehli candle bullish hoti hy, or dusri candle bearish hoti hy, jo ky pehli candlestick ky close sy niche shuru hoti hy.Bearish Kicking Candlestick Pattern ik powerful bearish reversal pattern hy jo traders ko market trends ko identify karny main madad karta hy. Traders ko is pattern ka sahi istemal karny ky liye, market ki mukhtalif factors or confirmatory signals ko bhi mad e nazar rakhty huwy apny trading decisions ko samajhny ki zarurat hoti hy.

Types of Bearish and bullish kicking candlestick pattern:- Pehla Candlestick (Bullish):

- Dear friends, Pehla candlestick ik bullish candlestick hoti hy jo ky uptrend ko show karti hy.

- Dear, Is candlestick ki opening price low hoti hy or closing price high hoti hy, jo ky uptrend ko indicate karta hy.

- Dusra Candlestick (Bearish):

- Dear buddies, Dusra candlestick ik bearish candlestick hoti hy jo ky pehl candlestick ky opposite direction main hoti hy.

- Hello dosto, Iski opening price high hoti hy or closing price low hoti hy, jo ky bearish pressure ko theek karti hy.

- Do Candlesticks Ky Darmiyan Gap:

- Bearish Kicking pattern main do candlesticks ke darmiyan ik noticeable gap hota hy. Ye gap bullish trend ky abrupt end ko darust karta hy.

Bearish Kicking candlestick pattern in details:

Mere pyare aziz dosto, Bearish Kicking Pattern ka main maqsad uptrend ky bad any waly bearish reversal ko darust karna hy. Is pattern ki pehli candle bullish hoti hy, jo ky uptrend ko darust karti hy. Lekin dusri candlestick ny gap down ky sath open ho kar downtrend ko start kr diya hy .Is pattern main gape down ik ahem factor hy. Gap down ka matlab hota hy ky dusre din ki opening price pehly din ki closing price sy km hoti hy. Ye gape down bearish sentiment ko indicate karta hy or traders ko ye dikhata hy ky market ka mood change ho sakta hy. Bearish Kicking Pattern ki khas baat ye hy ky doosri candlestick ki body pehly candlestick ki body ky andar hoti hy. Iska matlab hy ky sellers ne control ko puri tarah sy apny hath main ly liya hy or ab market ko downtrend main ly ja rahy hain. - Pehla Candlestick (Bullish):

-

#11 Collapse

Doston ap ko maloom hona chahiye jjab market main bearish trend shuru hota hy or previous bullish momentum ko reverse karta hy. Is pattern main do consecutive candlestick hoty hain dekha jata hai jin main sy pehli candle bullish hoti hy, or dusri candle bearish hoti hy, Jab ye k esjo ky pehli candlestick ky close sy niche shuru hoti hai. Yahan pe hamesha Bearish Kicking Candlestick Pattern ik powerful bearish reversal pattern hota hai istemal karny kay liye, market ki yahan pe factors or confirmatory signals ko bhi tafseel se dekha jata hai dakhty huwy apny trading decisions ko samajhny ki behad zarurat hoti hy.

Bearish Kicking candlestick pattern in details:

Humare aziz friends, hum jantay hain k Bearish Kicking Pattern ka main maqsad uptrend ky bad any waly bearish reversal ko darust karna hy. Es formation ki pehli candle bullish hoti hy, jo ky uptrend ko darust karti hy. Hum jantay hain k dusri candlestick ny gap down ky sath open ho kar downtrend ko start kr diya hy. Hamesha es pattern main gape down ik ahem factor hy. Gap down ka matlab hota hay ky hamesha dusray din ki opening price pehly din ki closing price sy km hoti hy. Ye hamesha yahan gap down bearish sentiment ko indicate karta hay aur traders ko ye dikhata hy ky market ka mood change ho sakta hai.

Conclusion:

In conclusion, hum dekhtay hain k Bearish Kicking Candlestick Pattern ek powerful bearish reversal formation hota hota hai jo traders ko market mein hone wale possible trend reversal ke baray es mein alert karta hai. Hamesha ess pattern ko samajhna aur istemal karna traders ke liye bohat mushkil hai taakay woh sahi trading decisions le sakein.

- CL

- Mentions 0

-

سا0 like

-

#12 Collapse

1. Introduction:- Bearish Kicking pattern ek bearish reversal pattern hai jo candlestick charts mein dekha jata hai.

- Ye pattern bullish trend ke baad aata hai aur bearish reversal ka indication deta hai.

2. Working:- Bearish Kicking pattern do candles se bana hota hai - ek bullish candle aur ek bearish candle.

- Pehli candle bullish trend mein hoti hai aur doosri candle ise follow karti hai lekin neeche girti hai.

3. Characteristics:- Pehli candle, jo bullish hoti hai, strong uptrend ko reflect karti hai aur higher close ke saath open hoti hai.

- Doosri candle, jo bearish hoti hai, pehli candle ki body ke andar open hoti hai aur neeche ja kar pehli candle ki body ko completely cover karti hai.

4. Trading Signals:- Bearish Kicking pattern bearish reversal ka signal deta hai. Is pattern ko dekhte hue traders apne long positions ko close kar sakte hain ya short positions le sakte hain.

- Is pattern ke appearance ke baad, bearish momentum ka strong possibility hota hai, isliye traders is pattern ko confirm karke trading decisions lete hain.

5. Confirmation:- Bearish Kicking pattern ko confirm karne ke liye, traders dusre technical indicators aur chart patterns ka istemal karte hain.

- Volume analysis aur trend line breaks bhi is pattern ko confirm karne mein madadgar ho sakte hain.

6. Limitations:- Jaise har technical pattern ki tarah, Bearish Kicking bhi kabhi kabhi false signals generate kar sakta hai.

- Isliye, traders ko is pattern ke appearance ke baad confirmatory signals ka intezar karna chahiye aur risk management ka dhyan rakhna zaroori hai.

7. Conclusion:

Bearish Kicking pattern ek powerful bearish reversal signal hai jo traders ko market mein bearish reversals ka advance indication deta hai. Is pattern ko samajh kar aur confirm karke, traders apne trading strategies ko improve kar sakte hain aur profit opportunities ko identify kar sakte hain. Lekin, is pattern ko istemal karte waqt, sahi risk management aur confirmatory signals ka dhyan rakhna zaroori hai taake traders false signals se bach sakein.

-

#13 Collapse

Bearish Kicking Pattern:

1. Pattern Ki Tashreeh:

Bearish Kicking Pattern:

Bearish Kicking Pattern ek bearish reversal candlestick pattern hai jo downtrend ke baad market mein bullish movement ko indicate karta hai.

2. Pehchan:

Bearish Kicking Pattern Ki Pehchan:

Is pattern mein pehla candle bullish hota hai aur doosra candle bearish hota hai, jiska opening price pehle candle ke upper side ya close ke barabar hota hai.

3. Formation:

Bearish Kicking Pattern Ka Formation:

Bearish Kicking Pattern ka formation hota hai jab market mein sudden reversal hota hai. Pehla candle bullish trend ko represent karta hai, lekin doosra candle gap down opening ke saath shuru hota hai aur downward movement dikhata hai.

4. Indication:

Bearish Kicking Pattern Ki Tawajjuh:

Yeh pattern bullish trend ke baad bearish reversal ko indicate karta hai. Is pattern ka formation bearish sentiment aur selling pressure ko highlight karta hai.

5. Confirmation:

Bearish Kicking Pattern Ka Tasdeeq:

Is pattern ko confirm karne ke liye, traders doosre technical indicators jaise ki volume, trend lines, aur price action ka istemal karte hain. Agar doosre indicators bhi bearish signals ko show kar rahe hain, toh bearish kicking pattern ko confirm samjha jata hai.

6. Trading Strategies:

Bearish Kicking Pattern Ke Trading Strategies:

Bearish Kicking Pattern ke istemal se traders bearish reversal ka faida uthate hain. Agar is pattern ke baad confirmation milta hai, toh traders short positions enter kar sakte hain ya existing long positions ko close kar sakte hain.

7. Stop-Loss Aur Target:

Bearish Kicking Pattern Ke Stop-Loss Aur Target:

Is pattern ke istemal mein, stop-loss order usually pattern ke high ya upper wick ke upar lagaya jata hai, jabki target price support level ya neeche ki taraf set kiya jata hai.

8. Risks:

Bearish Kicking Pattern Ke Risks:

Jaise ki har trading pattern mein, bearish kicking pattern ka istemal bhi risks ke saath aata hai, isliye traders ko proper risk management ka dhyan rakhna zaroori hai.

9. Practice Aur Experience:

Bearish Kicking Pattern Ko Samajhne Ka Tadad:

Bearish Kicking Pattern ko samajhne aur istemal karne ke liye practice aur experience ka hona zaroori hai. Regularly charts analyze karke aur real-time trading mein istemal karke is pattern ko samajhna possible hai.

-

#14 Collapse

What's the Bearish kicking pattern

Bearish Kicking pattern ek bearish reversal candlestick pattern hai jo market ke sentiment ka drastic change darshaata hai. Ye pattern typically uptrend ke doran develop hota hai aur bearish reversal ko suggest karta hai. Chaliye is pattern ke kuch details samajhte hain:- Formation:

- Bearish Kicking pattern do candlesticks se milta hai.

- Pehla candlestick ek uptrend ke doran banata hai aur bullish candlestick hota hai.

- Dusra candlestick bhi uptrend ke doran hota hai, lekin yeh bearish candlestick hota hai aur pehle candlestick ke close ke neeche open hota hai.

- Interpretation:

- Bearish Kicking pattern ek sharp trend reversal ko indicate karta hai. Pehla bullish candlestick uptrend ka sign hai, lekin doosra bearish candlestick market sentiment ka sudden change darshaata hai aur bearish reversal ko darshaata hai.

- Yeh pattern sellers ke sudden aur aggressive entry ko darshaata hai, jo buyers ko overcome kar leta hai aur downtrend ki shuruaat hoti hai.

- Key Characteristics:

- Pehla candlestick ek uptrend ke doran hota hai aur bada body ke saath hota hai.

- Dusra candlestick bhi uptrend ke doran hota hai lekin pehle candlestick ke close ke neeche open hota hai aur bada body ke saath hota hai.

- Dusra candlestick ka open pehle candlestick ke close ke neeche hota hai, indicating a bearish gap down opening.

- Confirmation and Trading Strategies:

- Bearish Kicking pattern ke confirmation ke liye, traders doosre candlestick ke close ke neeche ek sell trade kar sakte hain.

- Stop-loss orders ko pattern ke high ke above place kiya jata hai taki losses limit mein rahein.

- Profit targets ko support levels ya technical analysis ke tools ke adhaar par set kiya jata hai.

- Limitations:

- Jaise kisi bhi technical indicator ya pattern mein, false signals ho sakte hain, isliye confirmation ke liye aur indicators ka istemal kiya jana chahiye.

- Market context aur doosre factors ko bhi madde nazar rakhte hue trading decisions liye jaana chahiye.

Bearish Kicking pattern ek powerful indicator hai bearish reversal ko recognize karne ke liye. Is pattern ke samajhne aur istemal se traders market mein hone wale potential reversals ko identify kar sakte hain aur profit kamane ke liye trades execute kar sakte hain.

- Formation:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Bearish Kicking Pattern: Ek Tafseeli Jaiza

Mudakhlat:

Bearish Kicking Pattern ek candlestick chart pattern hai jo market mein price reversal ko darust karta hai. Ye pattern bullish trend ke baad aata hai aur bearish trend ka signal deta hai.

Tasvir-e-Aamal:

1. Pattern Ki Pechan:

Bearish Kicking Pattern mein do candles shamil hote hain. Pehla candle bullish hota hai aur doosra candle is se bilkul alag hota hai. Doosra candle gap down open karta hai aur bearish trend ko shuru karta hai.

2. Components of Bearish Kicking Pattern:

Pehla candle uptrend mein hota hai aur generally bada size ka hota hai. Doosra candle gap down open karta hai, matlab ke uska open price pehle candle ke close price se niche hota hai. Yeh bearish candle hota hai aur generally bada size ka hota hai.

3. Market Sentiment Change:

Bearish Kicking Pattern dekh kar traders ko market sentiment ka change ka pata chalta hai. Is pattern ka istemal karke traders apni positions ko adjust karte hain aur bearish trend mein entry lete hain.

Tafsili Tafseel:

Bearish Kicking Pattern ek powerful bearish reversal signal hai jo market mein trend change ko indicate karta hai. Is pattern ka istemal sahi tajziya aur risk management ke saath kiya jata hai taake traders ko sahi entry aur exit points mil sakein.

Istifadah:

1. Reversal Signals:

Bearish Kicking Pattern ka istemal karke traders market mein bearish reversal signals ko identify kar sakte hain aur sahi samay par apni positions ko adjust kar sakte hain.

2. Technical Analysis:

Is pattern ka istemal karke traders apni technical analysis ko improve kar sakte hain aur market trends ko behtar taur par samajh sakte hain.

3. Risk Management:

Bearish Kicking Pattern trading mein risk management ka ahem hissa hai. Traders ko apni positions ke liye stop loss aur take profit levels set karne chahiye taake loss ko minimize kiya ja sake.

Ikhtitami Alfaaz:

Bearish Kicking Pattern ek ahem bearish reversal signal hai jo market mein trend change ko indicate karta hai. Traders ko is pattern ka istemal karke sahi entry aur exit points tay karne chahiye taake unhein profitable trading opportunities mil sakein.

Shukriya.

- CL

- Mentions 0

-

سا1 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим