What is position trading strategy??

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is position trading strategy?? -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Position Trading Strategy Forex trading mein kai tarah ki trading strategies istemal hoti hain, jinme se ek strategy position trading hai. Position trading ek long-term trading approach hai jahan par traders positions ko weeks, months, ya saal tak hold karte hain. Is strategy mein traders market ki lambi muddat ke trends ko capture karne ki koshish karte hain. Is article mein hum position trading strategy ke bare mein mazeed tafseelat deinge. Position trading strategy ka maqsad hota hai lambi muddat mein asset (jese ke currency pairs) ke trends ko samajhna aur un trends mein trading karna. Yeh strategy traders ko market volatility se bachne mein madadgar hoti hai, kyunki ismein short-term fluctuations se nijaat milti hai. Trading Limit: Position trading mein tijarat ko lambe muddat tak hold kiya jata hai, jese ke kuch hafton, maheenon ya saalon tak. Ismein traders ko chahiye ke unka view market trend ke long-term hone par based ho, taki woh kisi bhi short-term fluctuations se affected na hon. Fundamental Aur Technical Analysis Position traders market trends ko samjhne ke liye fundamental aur technical analysis ka istemal karte hain. Fundamental analysis mein traders economic indicators, central bank policies, aur geopolitical events ko tajziya karte hain. Technical analysis mein woh price charts, trend lines, aur technical indicators ka istemal karte hain. Risk Management Position trading mein risk management bahut ahem hoti hai. Traders ko apni positions ko monitor karte rehna chahiye aur stop-loss orders ka istemal karke nuksan se bachna chahiye. Is strategy mein position size ko bhi barabar se manage karna zaroori hota hai. Position Trading Ke Faide Position trading ke kuch faide is tarah hain: 1. Lambi Muddat Ke Trends Ko Capture Karne Ka Mauqa 2. Market Volatility Se Bachao 3. Kam Trading Activity Se Kam Commissions Aur Spreads Position Trading Ke Nuksan Position trading ke kuch nuksan is tarah hain: 1. Lambi Muddat Ke Liye Investment Ki Zaroorat 2. Potential Nuksan Ki Sambhavna 3. Monitoring Aur Risk Management Ki Zaroorat In conclusion, position trading strategy ek long-term approach hai jisme traders lambi muddat ke trends ko capture karne ki koshish karte hain. Ismein fundamental aur technical analysis ka istemal hota hai aur risk management bhi ahem hoti hai. Yeh strategy traders ke liye faida mand ho sakti hai agar unka market analysis durust ho, lekin ismein lambi muddat ke liye investment ki zaroorat hoti hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Understanding Position Trading

Position trading ek lambay arsey tak ek position ko rakhna hai jo aksar forex market mein istemal ki jati hai. Ye aam tor par mahino se le kar hafton tak chalta hai, barray market trends ka faida uthane ke liye. Ye strategy day trading aur swing trading ke sath milati julti hai, jo chotay arsey ke trades ko shamil karti hain.

Key Principles of Position Trading- Long-Term Perspective: Position traders lambi fehristi nazar ikhtiyaar karte hain, jadoo-o-jaahat mein ghaasht karne wale asoolon par tawajjo di jati hai, tajziati asool, siyasi mozuat, markazi bank policies, aur dosri lambi fehristi market drivers par. Ye traders chhoti arsey ke market noise se kam waaqif hote hain aur daaimi trends ko pehchanne par tawajjo di jati hai.

- Fundamental Analysis: Buniyadi tahlil position trading mein ahem kirdar ada karta hai. Traders maasharti indicators, monitory policies, interest rates, siyasi mozuat, aur dosri macroeconomic factors ko tajziya karte hain taake currency movements ka andaaza lagaya ja sake aur trading opportunities ko pehchana ja sake.

- Risk Management: Karname ko khatam karne ke liye moassar risk management ki zaroorat hoti hai. Traders aksar stop-loss orders aur position sizing techniques ka istemal karte hain taake downside risk ko had mei rakha ja sake jabke lambi arsey ke returns ko maximize kiya ja sake.

- Patience and Discipline: Position trading sabr aur discipline ki zaroorat hoti hai. Traders ko waqti tabdeeliyon ka sahara lena nahi chahiye aur apne tajziati deedar ke saath mazid had tak pabandi se apne strategic iraadon par qayam rakhna chahiye.

- Reduced Transaction Costs: Position traders day traders ke muqable mein kam trades execute karte hain, jo kam transaction costs aur slippage ka nateeja dete hain. Ye aam tor par purani se zyada munafa barha sakte hain.

- Less Time-Intensive: Position trading day trading ke muqable mein kam waqt mashgooliyat hoti hai, jo masroof schedules ya trading ke liye aik zyada dilchaspi rakhne wale traders ke liye munasib hai. Ye zyada raahat aur azaadi deti hai bina markets ko nazar andaaz kiye.

- Capturing Major Trends: Barray trends par tawajjo dena traders ko ahem price movements ko pakaarna aur bohat zyada munafa haasil karne ka daira munhasar karta hai. Ye strategy "trend tumhara dost hai" ki misaal ke saath milti julti hai, jo current market trends ke taraf trading ki ahmiyat ko dikhata hai.

- Reduced Emotional Stress: Position trading waqti tabdeeliyon se mutasir hoti traders ki emotional stress ko kam kar sakti hai. Lambi fehristi nazar aur chhoti arsey ke fluctuations se bachne ke zariye, traders kam psychological strain mehsoos karte hain aur trading ke liye zyada disciplined rehte hain.

- Market Volatility: Position traders ko market volatility ka samna karna padta hai, jo ahem price fluctuations ko sath la sakta hai. Naummeed siyasi waqeyat, maasharti data releases, ya markazi bank ke ilanat aik currency pair mein tezi se movement ko trigger kar sakte hain, traders ko zyada resilient banne aur apne strategic convictions ke sath qayam rehne ki zaroorat hoti hai.

- Overnight Risk: Positions ko raat bhar rakhna traders ko overnight risk ka samna karata hai, jismein ghaasht ke waqt kisi ghair mutawaqa khabar ya waqeyat ki wajah se gap openings ka khatra hota hai. Traders ko munasib risk management techniques ka istemal karke raat bhar exposure ko durust taur par manage karna chahiye jaise ke stop-loss orders aur position sizing.

- Drawdowns and Floating Losses: Position trading mei drawdowns aur floating losses ka samna hota hai, jab market fluctuations ke doran floating losses ka samna karna padta hai. Traders ko drawdowns ko bardasht karne aur apne trading strategy par yaqeen banaye rakhne ki tayyari rakhni chahiye, chhoti arsey ke setbacks ke liye roozmarra ke reaction se bach kar.

- Missed Short-Term Opportunities: Barray trends par tawajjo denay ke liye, position traders chhoti arsey ke trading opportunities ko miss kar sakte hain jo din ya swing movements se paida hoti hain. Magar, ye trade-off aksar baray trends ko capture karne aur chhoti arsey trading se jo shor ko bachane ki taraf jaata hai, ke liye qubool kiya jata hai.

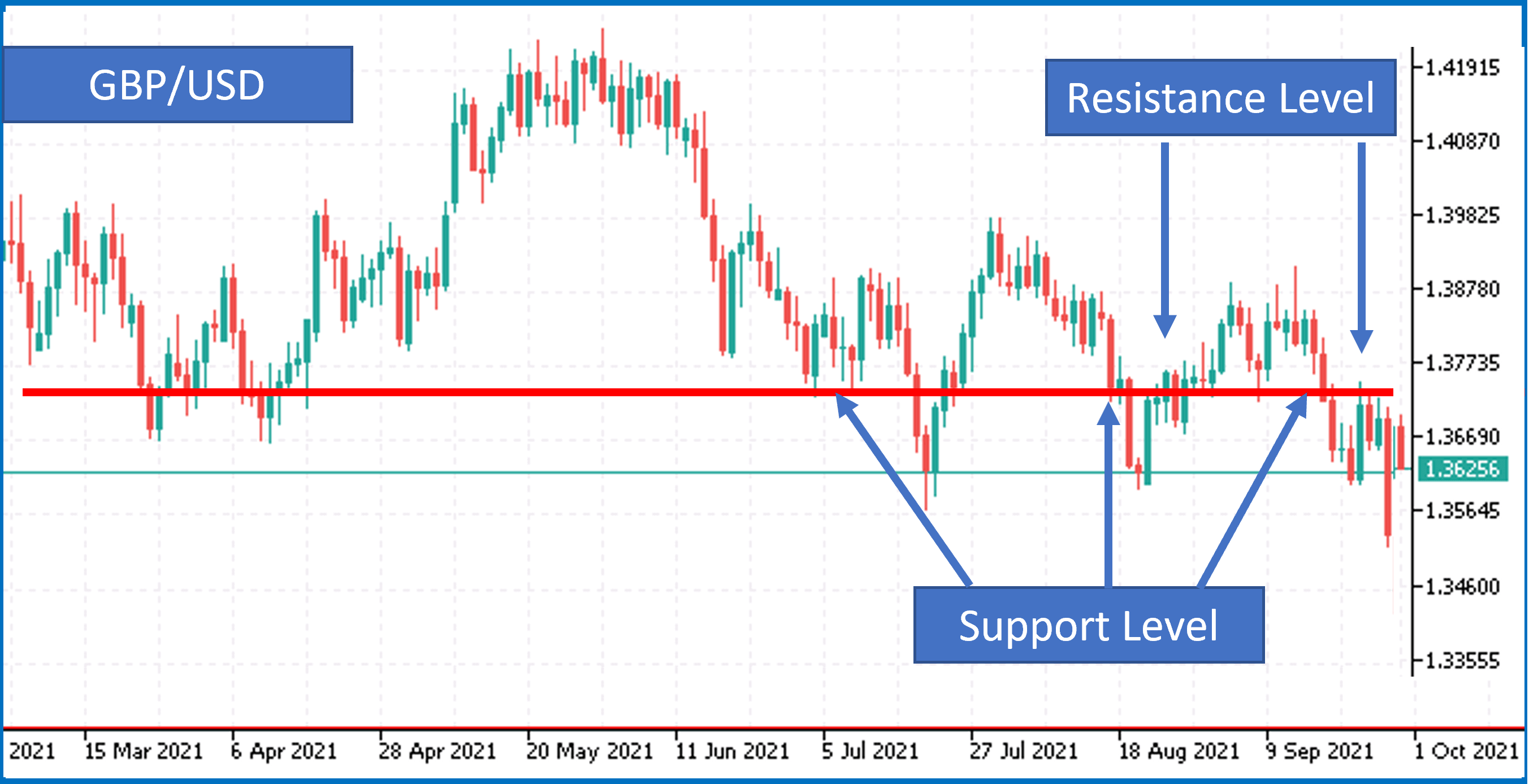

Implementing an Effective Position Trading Strategy- Market Analysis: Currency pairs ko strong long-term potential ke sath pehchanne ke liye tafseelat se fundamental analysis karein. Economic indicators, central bank policies, siyasi waqeyat, aur market sentiment ka tajziya karke ek strategic outlook ko banayein.

- Trade Entry: Apne lambi fehristi tajziyat ke mutabiq trade mein shamil hone ke liye moqa ka intezar karein. Technical indicators ya price action signals se apne trade thesis ko tasdeeq karne ke liye dhaakein talash karein.

- Risk Management: Capital ko mehfooz karne aur downside risk ko manage karne ke liye mazboot risk management techniques ka istemal karein. Technical ya fundamental factors par base ki gayi moassar stop-loss levels tay karein aur position sizing principles ko follow karke har trade par exposure ko had mei rakhein.

- Monitoring and Adjustment: Apne trades ka progress baar baar nigraani karte rahein aur zaroorat par stop-loss levels ya take-profit targets ko adjust karte rahein. Tehqeeq karain ke tajziyati conditions mein kaise tabdeel hone wale hain aur apni trading strategy ko mutabiq karne ke liye tayyar rahein.

- Psychological Discipline: Jazbati discipline ko maintain karein aur khauf ya lalach mein giraftaar hone se bachain. Apne tajziyaat aur trading plan par bharosa rakhein aur chhoti arsey market movements par rashk ya impulsively faislay na lein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

What is position trading strategy??

4.webp

Position trading ek lambi muddat (long-term) ki strategy hai jisme traders maqsad rakhte hain ke woh aik significant price trend ke doran faida utha sakein. Day trading ya swing trading ke mukhtalif hoti hai, position trading mein positions ko zyada arsa tak hold karna shamil hota hai, aksar hafton, maahon, ya sallon tak. Is strategy ka bunyadi tasawwur ye hai ke trends muddat bhar jaari rehti hain, jiski wajah se traders ko kisi asset ke overall directional movement se faida uthane ka imkan milta hai.

Yahan position trading ki kuch mukhtasir khasoosiyat aur asool hain:- Lambi Muddat Ki Soch: Position traders ek macroeconomic (makhraj) approach apnate hain, jisme unhain economic indicators, interest rates, aur fundamental analysis ka tajzia karna hota hai takay woh assets ko pehchaan sakein jo muddat bhar mein mazeed grow karenge.

- Trend Ki Tabeer Karna: Unka maqsad mukhtalif market trends ko pehchanna aur unmein shamil ho kar faida uthana hota hai. Traders aise assets ko dhoondhte hain jo strong aur lambi muddat tak jaari rehne wale uptrend mein hain.

- Fundamental Analysis: Position traders fundamental analysis ka istemal karte hain taake woh kisi company ya overall market ki financial health aur growth prospects ka andaza laga saken. Unka tajzia earnings reports, economic indicators, aur doosre factors ko shaamil karta hai.

- Kam Trading Frequency: Position trading mein kam trades hoti hain compared to day trading ya swing trading. Traders ko chhoti muddat ki price fluctuations se ghaafil rehna hota hai aur woh market ki taizi ko bardasht karne ki koshish karte hain.

- Risk Management: Lambi muddat ke bawajood, risk management ka kirdar ahem hota hai. Traders aksar stop-loss orders ka istemal karte hain takay nuksan ko had se zyada na hone diya ja sake aur unki capital ko mehfooz rakha ja sake.

- Sabr aur Discipline: Position trading mein kamiyabi ke liye sabr aur discipline ki zarurat hoti hai. Traders ko chhoti muddat ki market fluctuations par bharosa na karna aur apne lambi muddat ke investment thesis par qaim rehna parta hai.

- Diversification: Position traders apne portfolio ko aksar diversify karte hain takay unka risk alag-alag assets ya sectors mein taqseem ho. Is se kisi single investment ke ulte asarat ka asar kam hota hai.

- Monitoring aur Adjustments: Jabke position traders apne trades ko lambi muddat tak hold karte hain, woh apne investments ko regular tor par nigrani mein rakhte hain. Agar fundamentals mein ya trend mein koi tabdili hoti hai, to traders apni positions ko mutabiqat ke mutabiq adjust kar sakte hain.

Position trading woh logon ke liye munasib hai jo market ki taiz rawani ko bardasht kar sakte hain aur unke paas aik lambi muddat ki nazar hoti hai. Iske liye technical aur fundamental analysis ka achi khasi samajh zaroori hai, sath hi market fluctuations ke samne disciplined rehne ki bhi zarurat hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:53 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим