rounding bottom candlestick pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

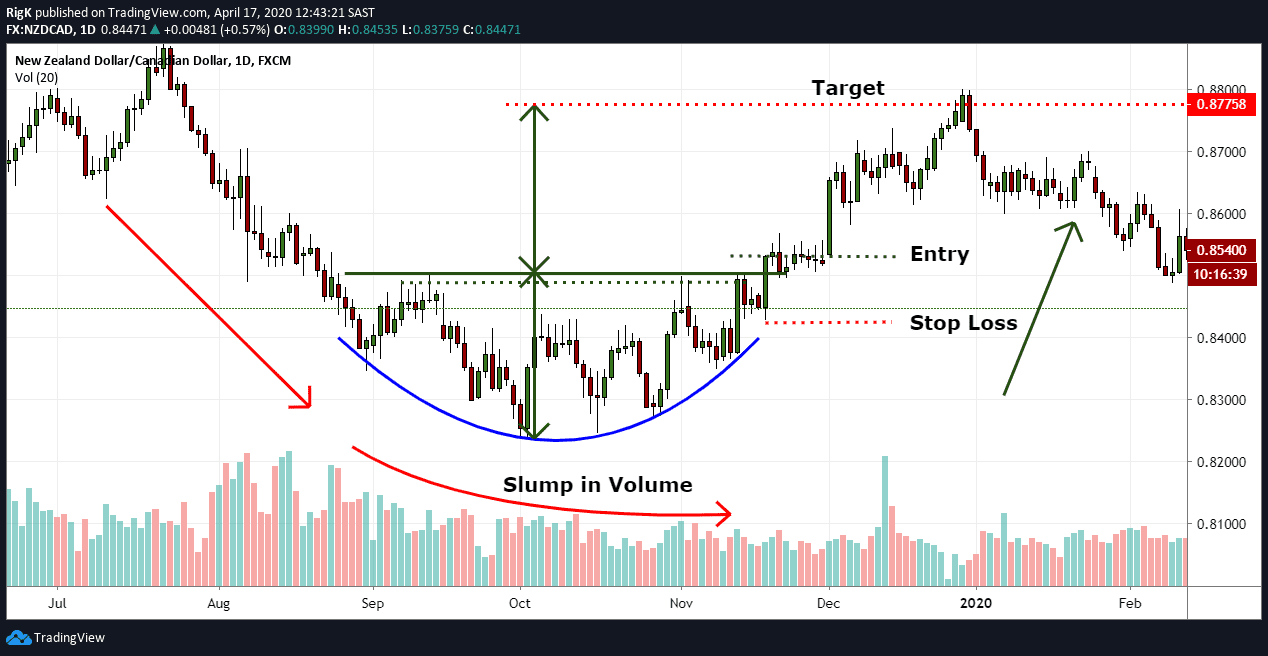

Rounding bottom candlestick pattern ek bullish reversal pattern hai, jisme price action ek rounded shape banata hai, jahan price initially downtrend mein hoti hai aur phir gradually recover karke uptrend mein chali jati hai. Is pattern ki wazahat, fayde aur nuksan is prakar hai: Wazahat: 1. Bullish Reversal: Rounding bottom pattern ek bullish reversal pattern hai, jiske signals ki madad se traders ko trend reversal ke potential ka pata chalta hai. Yeh pattern indicate karta hai ki bearish trend khatam ho raha hai aur bullish trend shuru hone wala hai. 2. Entry Points: Rounding bottom pattern traders ko entry points provide karta hai. Jab price bottoming phase se recover karke uptrend mein chali jati hai, tab traders entry positions le sakte hain. 3. Price Targets: Rounding bottom pattern traders ko potential price targets bhi provide karta hai. Is pattern ke hisab se, price ka recover hone ke baad target price ko calculate kiya ja sakta hai, jisse traders apni profit targets set kar sakte hain. Fayde: 1. Trend Reversal Confirmation: Rounding bottom pattern traders ko trend reversal ki confirmation deta hai. Is pattern ki wazahat se traders ko bearish trend se bullish trend mein hone wali shift ke bare mein pata chalta hai, jisse unhe profitable trading opportunities mil sakti hain. 2. Entry and Exit Points: Rounding bottom pattern traders ko entry aur exit points provide karta hai. Traders is pattern ki madad se price recover ke baad entry positions le sakte hain aur price targets achieve karne ke baad exit positions bhi le sakte hain. Nuksan: 1. False Signals: Jaise ki har technical analysis pattern ki tarah, rounding bottom pattern bhi false signals generate kar sakta hai. Yeh pattern kabhi-kabhi trend reversal ke bajaye temporary price recovery ko indicate kar sakta hai, jisse traders ko loss ho sakta hai. 2. Delayed Confirmation: Rounding bottom pattern ki confirmation mein samay lag sakta hai. Price ka recovery process gradual hota hai, jisse traders ko confirmation milne mein time lag sakta hai. Isse traders ko missed opportunities ka samna karna pad sakta hai. 3. Volatile Markets: Rounding bottom pattern volatile markets mein kam effective ho sakta hai. Agar market mein jyada volatility hai, toh price fluctuations ki wajah se pattern ki accuracy kam ho sakti hai. Yeh fayde aur nuksan general hain aur har trader ke trading strategy aur risk appetite par depend karte hain. Traders ko round bottom pattern ke sahi tarike se samajhne, confirmations ke liye dusre technical indicators ka istemal karne aur proper risk management ke sath trading decisions lena chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

Rounding bottom candlestick pattern ek technical analysis pattern hai jo ki stock market me use hota hai. Ye pattern usually ek downtrend ke baad aata hai aur ye price reversal ko indicate karta hai. Is pattern ko recognize karne ke liye, aapko price charts par candlesticks ki madhyam se price movements ko dekhna hoga. Rounding bottom pattern ka primary characteristic ye hota hai ki price initially downtrend me hoti hai, lekin phir gradually upward move karti hai aur ek rounded shape create karti hai. Is pattern ko complete hone me kuch samay lagta hai, kyun ki price ko gradual recovery karna hota hai. Is pattern ko identify karne ke liye aapko kuch key points dekhne honge: Initial Downtrend: Pehle, aapko ek clear downtrend dekhna hoga, jismein stock ki price continuously ghat rahi hai. Gradual Recovery: Downtrend ke baad, price me gradual recovery honi chahiye, jisse ek rounded bottom shape banti hai. Volume: Volume bhi dekha jata hai, kyun ki is pattern ke saath usually volume increase hota hai jab price recover kar rahi hoti hai. Confirmation: Is pattern ko confirm karne ke liye, traders usually wait karte hain ki price ek specific resistance level ko break kare, jisse ki uptrend start ho sake. Rounding bottom pattern, price reversal ko indicate karta hai aur traders is pattern ko dekh kar future price movement ke decisions le sakte hain. Lekin, yaad rahe ki kisi bhi technical analysis pattern ki tarah, ye bhi 100% reliable nahi hota aur false signals bhi ho sakte hain. Isliye, is pattern ko samajhne aur us par rely karne se pehle, aur bhi factors aur analysis ka istemal karna important hota hai. Trading me risk management bhi bahut mahatvapurn hota hai.

Initial Downtrend: Pehle, aapko ek clear downtrend dekhna hoga, jismein stock ki price continuously ghat rahi hai. Gradual Recovery: Downtrend ke baad, price me gradual recovery honi chahiye, jisse ek rounded bottom shape banti hai. Volume: Volume bhi dekha jata hai, kyun ki is pattern ke saath usually volume increase hota hai jab price recover kar rahi hoti hai. Confirmation: Is pattern ko confirm karne ke liye, traders usually wait karte hain ki price ek specific resistance level ko break kare, jisse ki uptrend start ho sake. Rounding bottom pattern, price reversal ko indicate karta hai aur traders is pattern ko dekh kar future price movement ke decisions le sakte hain. Lekin, yaad rahe ki kisi bhi technical analysis pattern ki tarah, ye bhi 100% reliable nahi hota aur false signals bhi ho sakte hain. Isliye, is pattern ko samajhne aur us par rely karne se pehle, aur bhi factors aur analysis ka istemal karna important hota hai. Trading me risk management bhi bahut mahatvapurn hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:15 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим