Piercing line candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Piercing Line Candlestick Pattern ka Introduction

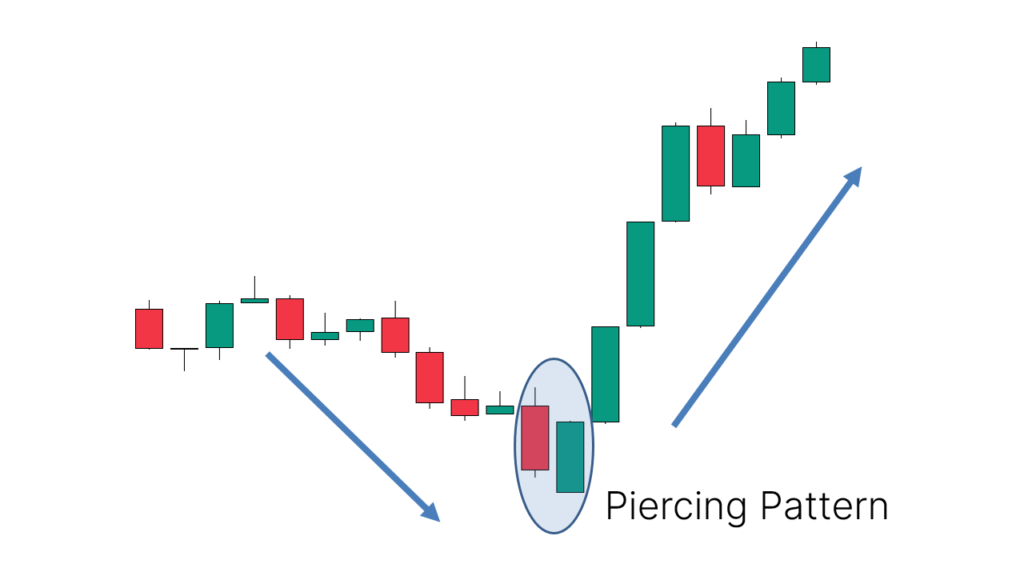

Piercing Line Candlestick Pattern ek ahem technical indicator hai jo stock market aur forex market mein traders aur investors ke liye ahem hota hai. Yeh pattern typically ek bearish trend ke baad aata hai aur bullish reversal ko darust karta hai. Is article mein, hum Piercing Line Candlestick Pattern ke bare mein Roman Urdu mein tafseel se baat karenge. Piercing Line Candlestick Pattern ki Formation

Piercing Line Pattern traders ke liye ek ahem tool hai jo market trends ko samajhne aur trading decisions ko improve karne mein madadgar hota hai. Is pattern mein typically do alag-alag candlesticks hoti hain. Pehli candle ek strong bearish candle hoti hai, jo market mein sellers ki taqat ko darust karti hai. Is candle ki body lambi hoti hai aur closing price opening price se ziada hoti hai. Yeh bearish trend ko represent karti hai. Doosri candle, jo ke bullish hoti hai, short-term uptrend ko darust karti hai. Is candle ki body pehli bearish candle ki body ke neeche hoti hai aur closing price opening price se ziada hoti hai. Lekin, is candle ki body pehli candle ki body ke andar hoti hai. Piercing Line Candlestick Pattern ki Pehchan

Piercing Line Candlestick Pattern traders ko bullish reversal signal deta hai jab doosri candle pehli bearish candle ki body ke neeche se upar nikalti hai aur market price mei ziada change hota hai. Isse yeh pata chalta hai ke bearish trend shayad khatam ho raha hai aur bullish trend ka aghaz ho sakta hai. Is pattern ko samajhna aur istemal karna traders ke liye zaroori hai taake woh market trends ko sahi tarah se interpret kar saken. Piercing Line Candlestick Pattern traders ko market mein hone wale bullish reversal ko pehchanne mein madadgar hota hai aur unko buy karne ka mauka deta hai. Piercing Line Candlestick Pattern kb banta hy

Piercing Line Candlestick Pattern ek powerful technical indicator hai jo market mein hone wale bullish reversal ko pehchanne mein madadgar hota hai. Traders ko is pattern ko samajhna aur istemal karna chahiye lekin hamesha yaad rahe ke market mein risk hota hai aur prudent trading practices ka bhi khayal rakha jana chahiye.Lekin yaad rahe ke kisi bhi technical indicator ki tarah, Piercing Line Candlestick Pattern bhi 100% confirm nahin hota aur market mein risk hamesha hota hai. Isliye, is pattern ko istemal karte waqt proper risk management ka bhi khayal rakhna zaroori hai. -

#3 Collapse

Piercing line candlestick pattern "Piercing Line Candlestick Pattern" ek ahem technical analysis tool hai jo stock market aur financial trading mein istemal hota hai. Is pattern ki madad se traders aur investors market ki future movement ko predict karne ki koshish karte hain. Chaliye, is pattern ke baray mein mazeed maloomat hasil karne ke liye Ruman Urdu mein baat karte hain. Piercing Line Candlestick Pattern: Piercing Line Candlestick Pattern ek reversal pattern hai jo bearish trend ko indicate karta hai aur ek possible bullish trend ka sign deta hai. Is pattern mein do candlesticks shamil hote hain:- Pehla Candlestick: Pehla candlestick red (bearish) hota hai aur downtrend ko darust karta hai. Is candlestick mein price kam hoti hai aur market sentiment negative hota hai.

- Dusra Candlestick: Dusra candlestick green (bullish) hota hai aur uptrend ko darust karta hai. Is candlestick mein price pehle candlestick ke neeche open hoti hai, lekin phir tezi se upar ki or move karti hai aur pehle candlestick ke beech mein close hoti hai.

-

#4 Collapse

piercing line candlestick pattern: Forex trading mein "Piercing Line Candlestick Pattern" ek important bullish reversal pattern hai jo market analysis mein istemal hota hai. Is pattern ka maqsad hota hai ke price ki downward trend ko reverse karne aur uptrend ka indication dena. Main aapko Roman Urdu mein iske tafseelat bataunga: Piercing Line Candlestick Pattern ka matlab hota hai ke jab ye pattern market chart par appear hota hai, to ye indicate karta hai ke downtrend ke baad uptrend ka possibility hai. Ismein kuch key points hote hain: Pehla Candlestick: Piercing Line pattern ki shuruaat ek bearish (downward) candlestick se hoti hai, jo ke downtrend ko represent karta hai. Is candlestick ki closing price neechay hoti hai. Dusra Candlestick: Dusra candlestick bullish (upward) hoti hai aur pehli candlestick ke neechay open hoti hai aur pehli candlestick ke kareebi middle point par close hoti hai. Dusra candlestick ki body pehli candlestick ki body ke andar enter karti hai. Tasdeeqi Signal: Piercing Line pattern ko confirm karne ke liye traders candlestick patterns ke saath-saath dusre technical indicators aur price levels ki tasdeeq karte hain. Confirmatory signals ka hona important hota hai. Uptrend Ki Expectation: Jab Piercing Line pattern market chart par dikhai deta hai, to traders uptrend ki expectation rakhte hain. Yani ke price ka dobara se barhna shuru hone ka potential hota hai. Piercing Line Candlestick Pattern bullish reversal signals mein se ek hai aur traders iska istemal karte hain market ke reversals ko identify karne ke liye. Lekin yaad rahe ke kisi bhi pattern ko samajhne aur istemal karne ke liye practice aur confirmatory signals ki bhi zarurat hoti hai. Trading mein safalta hasil karne ke liye, aapko risk management aur dusri analysis techniques ka bhi khayal rakhna hoga. Explaining piercing line: Forex trading mein "Piercing Line Candlestick Pattern" ek aham candlestick pattern hai jo market mein trend reversal ko indicate karne mein istemal hota hai. Ye pattern typically bearish (girawat ki taraf) trend ke baad aata hai aur bullish (barhati hui) trend ke aane ka signal deta hai. Main aapko Roman Urdu mein iske tafseelat bataunga: Piercing Line Candlestick Pattern ye do candlesticks se bana hota hai: Pehli Candlestick: Pehli candlestick ek downtrend mein ati hai aur typically red (bearish) hoti hai. Iska matlab hota hai ke price ghat rahi hai. Dusri Candlestick: Dusri candlestick pehli candlestick ki range ke neeche open hoti hai lekin phir usi range ke upar close hoti hai. Dusri candlestick green (bullish) hoti hai aur iska matlab hota hai ke price phir se barh rahi hai. Piercing Line Candlestick Pattern ka maqsad hota hai ke jab pehli candlestick ke baad dusri candlestick strong bullish close ke saath aati hai, to ye bearish trend ko weaken karke bullish trend ke aanay ka signal deta hai. Is pattern ko samajhne ke liye, traders typically dusri candlestick ki peechli candlestick ke closing price se zyada close hone par dhyan dete hain. Piercing Line Pattern ek reversal pattern hota hai, lekin iski tasdeeq ke liye dusri confirmatory signals ki bhi zarurat hoti hai. Traders is pattern ko trend reversal ke indication ke roop mein istemal karte hain, lekin yaad rahe ke kisi bhi trading decision se pehle thorough analysis aur risk management ka bhi khayal rakhna hoga. -

#5 Collapse

Piercing Line Candlestick Pattern: Dear Friends Piercing Line Candlestick Pattern os waqat creat hota hai jab market continue downward movement karty huey aik bearish candle complete hony ke badh next candle kuch gap ke sath down sy start ho kar bullish candle is tarha se creat ho ke last bearish candle ke more than fifty percent per close ho jay tou aysy main jo pattern creat hota hai usko piercing line candlestick pattern kehty hain aur jab yeh pattern complete hota hai tou uske badh market ki hundred percent movement ka uptrend start ho jata hai aur wahan per buy ki trade open kar ke ham bohot achi earning kar sakty hain. Support Level of Piercing Line Candlestick Pattern: Dear Sisters and Brothers Piercing Line Candlestick Pattern ek bohot hi important market pattern hota hai jo hamesha bearish trend per banta hai aur jab ap is ko observe karna chahte hain to apko yah pata hona chahiye ke hamesha yah pattern support level per banega. Understand of Piercing Line Candlestick Pattern: Dear Forex Members Apko agar Piercing Line Candlestick Pattern ko samajhna hai tou sabse pahle apko is pattern ki pahchan ka pata hona chahiye ke ab yah pattern market mein ban chuka hai to iski kuch science hote hain jiski vajah se ap isko recognise kar sakte hain ke ap market mein piercing line candlestick pattern ban raha hai. Jab market mein ek strong downtrend ke badh ek buy wali candle banti hai jo last bearish candle ka hisab se 50% barhi aur us ke hundred percent choti hoti hai to ismein apko idea laga lena chahiye ke yah pattern ban raha hai. Importance of Piercing Line Candlestick Pattern: Dear Trading Partners Forex trading main Piercing Line Candlestick Pattern bohot important hai is se confirm movement ka pata chalta hai is liye humy is pattern ko achi tahra seekena or samajna bohot zarori hai is liye humy candle chart main different patterns ko zehen main rakhena hon ga ke forex main hum log jitni mehnat kary gy to utny he kamyab hon gy forex trading main humy different patterns ko seekena ho ga or ache trading ke liye har pattern pe practice karna lazmi hai jab tak hum log proper pattern ko seek ni laty hain or is main take profit or stop loss ka istamal is tahra karna ho ga ke humy loss bilkal bi na ho or hum behtar earning kar sakein. -

#6 Collapse

Piercing Line candlestick pattern ek bullish reversal pattern hai jo traders aksar long trade mein dakhil ho jane ka ya ek potential reversal ko tasdeeq karna ke liye talash karte hain, jab yeh lamba downtrend ke baad nazar aata hai. Is mein do candles hote hain aur jab yeh bearish trend ke baad nazar aata hai, to yeh market ki feeling mein ek shift ki possibility ko dikhata hai, bearish se bullish ki taraf.

Understanding the Piercing Line Candlestick Pattern- Components of the Pattern

- Pehli Candle (Bearish): Pehli candle lambi bearish candle hoti hai jo market mein strong downtrend ko darust karti hai. Yeh session ke shuru mein high ke qareeb open hoti hai aur session ke akhri mein low ke qareeb close hoti hai, jo strong selling pressure ko dikhata hai.

- Doosri Candle (Bullish): Doosri candle pehli candle (bearish candle) ke low se nichle opening hoti hai lekin session ke doran yeh bohot zyada rally karti hai aur kam se kam pehli candle ke body ka adha hissa cover kar leti hai. Yeh rally hi pattern ko bullish reversal signal dene mein madad karti hai.

Piercing Line pattern ahmiyat rakhta hai kyun ke yeh market ki feeling mein ek change ko darust karta hai. Ek lambi downtrend ke baad, jahan sellers dominant hote hain, Piercing Line ka nazar aana yeh dikhata hai ke buyers market mein dakhil ho rahe hain aur prices ko upar le ja rahe hain. Yeh sentiment ka reversal ek bullish reversal ya ek potential uptrend ke shuru hone ko darust karta hai.

3. Identification and Confirmation

Piercing Line pattern ko darust taur par pehchanne aur tasdeeq karne ke liye traders ko ye cheezein dekhni chahiye:- Pehli candle ko strong bearish candle honi chahiye jo significant body ke saath aati hai aur ideal taur par upper shadow kam ho.

- Doosri candle pehli candle bearish candle ke low se nichle open honi chahiye, jisse ke initially downtrend ko jari rakha ja sake.

- Lekin doosri candle session ke doran bohot zyada rally karti hai aur kam se kam pehli candle ke body ka adha hissa cover karti hai, behtar yeh hota hai ke doosri candle pehli candle ke midpoint ke upar close ho.

- Volume bhi ek confirming factor ho sakta hai. Doosri candle ki bullish rally ke doran volume ka increase, pattern ki validity ko mazbooti deta hai.

Traders Piercing Line pattern ko dusri technical indicators ya patterns ke saath combine karke uski reliability ko increase kar sakte hain. Kuch common strategies include karti hain:- Confirmation with Support Levels: Traders Piercing Line pattern ko key support levels ke paas dekhte hain, jo bullish reversal signal ko aur bhi mazboot banata hai.

- Combining with Oscillators: Oscillators jaise ke Relative Strength Index (RSI) ya Stochastic Oscillator ka istemal oversold conditions ko tasdeeq karne mein madadgar ho sakta hai, Piercing Line ke bullish signal ko mazbooti dene ke liye.

- Wait for Confirmation Candle: Kuch traders tisri candle ka usually bullish candle intezar karte hain, jo ke reversal ko tasdeeq karne ke liye aham ho sakti hai. Yeh approach confirming factor ke taur par kaam karta hai.

Jaise ke kisi bhi trading strategy mein, risk management Piercing Line pattern ke sath trading karte waqt bhi zaroori hai. Traders ko Piercing Line pattern ke low ke neeche stop-loss order lagane ka intekhab karna chahiye, taake agar reversal jaise ki umeed thi wo na ho, to nuksan ko kam kiya ja sake. Iske alawa, risk-reward ratios ke base par position sizing ko bhi trading plan ka hissa banana chahiye.

6. Example of Trading Scenario- Confirmation with Support Levels: Ek stock ke price mein ek lambi downtrend ke baad, trader ko daily chart par Piercing Line pattern nazar aata hai.

- Combining with Oscillators: Pattern ki doosri candle low se nichle open hoti hai lekin session ke doran bohot zyada rally karti hai aur pehli candle ke body ka adha hissa cover kar leti hai. Volume bhi is bullish rally ke doran increase hoti hai, pattern ko confirm karte hue.

- Entry and Stop Loss: Trader doosri candle ke opening par long position enter karta hai, Piercing Line pattern ke baad ki next candle par, stop-loss order pattern ke low ke neeche lagata hai risk management ke liye.

- Target and Exit: Trader technical analysis ke base par ek profit target set karta hai, jaise ki koi resistance level ya Fibonacci retracement level, aur jab price us target tak pahuchta hai, to wo trade ko exit karta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#7 Collapse

Forex Trading Mein Piercing Line Candlestick Pattern Ki Ahmiyat- Forex trading mein candlestick patterns ka aham role.

Forex trading ek dynamic aur volatile market hai jahan traders ko market trends ko samajhne aur unke hisaab se trades execute karne ke liye mukhtalif tools aur techniques ka istemal karna parta hai. Candlestick patterns ismein ek zaroori hissa hain jo traders ko price action ka insight deta hai. In patterns mein se ek ahem pattern hai "Piercing Line Candlestick Pattern".

Candlestick patterns market psychology ko reflect karte hain. Har ek candlestick ek specific time period ko represent karta hai aur uske open, high, low, aur close prices market sentiment ko darust tarah se reflect karte hain. Is tarah se, candlestick patterns ke study se traders ko market ka trend aur momentum ka pata chalta hai, jisse wo better trading decisions le sakte hain.

- Piercing line candlestick pattern ka introduction.

Piercing line candlestick pattern ek bullish reversal pattern hai jo downtrend ko indicate karta hai. Yeh do candlesticks se bana hota hai, jismein pehli candlestick bearish hoti hai aur doosri bullish hoti hai aur pehli ki body ke andar doosri candlestick ki body aati hai.

Jab market bearish trend mein hota hai aur ek downward candlestick form hota hai, toh agli candlestick mein bullish movement ka sign hota hai. Agar doosri candlestick pehli ki body ke andar enter karta hai aur ek significant portion ko cover karta hai, toh ise piercing line pattern kaha jata hai.

- Piercing line pattern ki pehchan kaise karein?

Piercing line pattern ko pehchanne ke liye pehle candlestick ki body ko dekha jata hai, jo downtrend ko represent karti hai. Doosri candlestick ki body pehli ki body ke andar enter karti hai aur ideally pehli candlestick ki 50% se zyada area cover karti hai.

Is pattern mein pehli candlestick ki body red ya black hoti hai jo ki downtrend ko darust karta hai, jabki doosri candlestick ki body green ya white hoti hai jo ki bullish movement ko darust karta hai. Doosri candlestick ki low pehli ki low se neeche nahi honi chahiye.

- Bullish reversal indication: Piercing line pattern.

Piercing line pattern ek bullish reversal indication hai. Jab market downtrend mein hota hai aur piercing line pattern form hota hai, toh yeh ek potential trend reversal ka sign deta hai aur traders ko bullish movement ki expectation hoti hai.

Is pattern ka formation bullish momentum ki shuruat ko darust karta hai. Jab doosri candlestick pehli ki body ke andar enter karta hai aur ek significant portion ko cover karta hai, toh iska matlab hai ki bulls control ko regain kar rahe hain aur price mein reversal hone ki possibility hai.

- Piercing line pattern ki anatomy.

Piercing line pattern do candlesticks se bana hota hai. Pehla candlestick bearish hota hai, jiska close price pehle candlestick ke neeche hota hai. Doosri candlestick bullish hoti hai aur uska open price pehli candlestick ki body ke andar hota hai.

Is pattern mein doosri candlestick ki body pehli candlestick ki body ke andar enter karti hai aur ideally pehli candlestick ki 50% se zyada area ko cover karti hai. Doosri candlestick ki low pehli candlestick ki low se neeche nahi honi chahiye.

- Piercing line pattern ko confirm karne ke liye kya dekhein?

Piercing line pattern ko confirm karne ke liye traders ko volume aur doji ki presence ko bhi observe karna chahiye. Agar piercing line pattern ke sath high volume aur doji ki absence ho, toh yeh pattern aur bhi reliable hota hai.

High volume ke saath piercing line pattern ka formation bullish reversal ke liye strong confirmation provide karta hai. Doji ki presence bhi is pattern ki strength ko darust karti hai, kyun ki doji market ke indecision ko represent karta hai.

- Piercing line pattern ka istemal kis tarah se karein?

Piercing line pattern ka istemal karke traders uptrend ke shuru hone ki expectation rakhte hain. Jab yeh pattern confirm ho jata hai, toh traders long positions enter karte hain ya phir existing short positions ko close karke profits secure karte hain.

Is pattern ka istemal karte waqt, traders ko stop loss aur take profit levels ka bhi tay karna chahiye taake unhe risk management mein asani ho aur wo apne trades ko effectively manage kar sakein.

- Piercing line pattern ke faide aur nuqsan.

Piercing line pattern ka istemal karke traders ko early entry ka faida hota hai, jo unhe potential profits mein izafa karne mein madad karta hai. Magar is pattern ka istemal karne ke dauran false signals ka khatra bhi hota hai, jo traders ko nuqsaan mein daal sakta hai.

Is pattern ke saath trading karte waqt, traders ko market ki overall trend aur price action ko bhi mad e nazar rakhna chahiye taake unhe sahi aur reliable trading decisions lena asaan ho.

- Piercing line pattern ke sath risk management.

Piercing line pattern ka istemal karte waqt, traders ko hamesha apni risk management ko mad e nazar rakhna chahiye. Stop loss orders lagana aur position size control karna zaroori hai taake nuqsanat kam ho sakein agar trade opposite direction mein chala gaya.

Traders ko apne risk tolerance ke mutabiq apne trading positions ko manage karna chahiye aur aggressive trading se bachna chahiye, taake unka capital protection ho aur wo long term mein consistent profits generate kar sakein.

- Piercing line pattern ka istemal karne ka tareeqa.

Piercing line pattern ka istemal karne ke liye traders ko sabar aur discipline ke saath market ko monitor karna chahiye. Is pattern ki confirmation ke baad, entry aur exit points ko carefully plan karna zaroori hai.

Traders ko apne trading plan ke mutabiq apne positions ko manage karna chahiye aur emotional trading se bachna chahiye taake wo apne trading goals ko achieve kar sakein.

- Piercing line pattern aur doosre technical indicators.

Piercing line pattern ko confirm karne ke liye traders doosre technical indicators jaise ki moving averages, RSI, aur MACD ka istemal bhi kar sakte hain. In indicators ki madad se traders piercing line pattern ki reliability ko aur bhi barha sakte hain.

Technical indicators ke saath piercing line pattern ka combination traders ko market ka comprehensive analysis karne mein madad karta hai aur unhe better trading decisions lene mein help karta hai.

- Piercing line pattern ke saath trading strategies.

Piercing line pattern ke saath trading strategies ko develop karna traders ke liye zaroori hai. Traders apne risk tolerance aur trading style ke hisaab se alag alag strategies ka istemal karke piercing line pattern ka istemal kar sakte hain.

Traders ko apne trading strategies ko backtest karna chahiye aur unhe market conditions ke mutabiq adapt karna chahiye taake unka trading performance consistent ho aur wo long term mein success achieve kar sakein.

- Piercing line pattern ki limitations.

Piercing line pattern ki limitations mein false signals ka khatra shamil hai. Kabhi kabhi market mein volatility ya phir unexpected news ke chalte yeh pattern unreliable ho sakta hai, isliye traders ko cautious rehna chahiye.

Traders ko piercing line pattern ko identify karne aur uski limitations ko samajhne ke liye proper education aur experience hona chahiye taake wo sahi aur reliable trading decisions le sakein.

- Piercing line pattern ki mazeed samajh.

Piercing line pattern ki mazeed samajh ke liye traders ko practice aur experience ki zaroorat hoti hai. Historical data analysis aur real-time market observation ke zariye traders apne understanding ko improve kar sakte hain.

Traders ko apne trading skills ko regularly improve karna chahiye aur wo hamesha market ke latest developments aur trends ko track karte rahein taake unka trading performance consistent ho aur wo long term mein success achieve kar sakein.

- Piercing line pattern: Forex trading mein ek mukhtasir jayeza.

Piercing line pattern forex trading mein ek valuable tool hai jo traders ko market trends ka insight deta hai. Is pattern ki sahi samajh aur istemal se traders apne trading performance ko improve kar sakte hain aur consistent profits earn kar sakte hain.

Traders ko piercing line pattern ko sahi tarah se identify aur interpret karna seekhna chahiye taake unhe market ka comprehensive analysis karne mein asani ho aur wo profitable trading decisions le sakein.

- Forex trading mein candlestick patterns ka aham role.

-

#8 Collapse

Piercing Line Candlestick Pattern

Forex trading mein candlestick patterns ka istemal price movements ka analysis karne ke liye kiya jata hai. Piercing Line candlestick pattern bhi aik aham price pattern hai jo bullish reversal ke liye signal deta hai.

Piercing Line Candlestick Pattern Kya Hai?

Piercing Line candlestick pattern ek bullish reversal pattern hai jo normal downtrend ke end par dekha jata hai. Is pattern mein do consecutive candles hote hain jin mein pehli candle bearish hoti hai aur doosri candle bullish hoti hai. Doosri candle pehli candle ke neeche open hoti hai lekin during the day price upar chali jati hai aur candle ki body pehli candle ki body ke andar close hoti hai.

Piercing Line Candlestick Pattern ke Mukhtalif Parts

Piercing Line candlestick pattern mein do mukhtalif parts hote hain:

Pehli Candle (Bearish)

Pehli candle downtrend ko indicate karti hai aur bearish hoti hai.

Doosri Candle (Bullish)

Doosri candle bullish hoti hai aur pehli candle ki body ke andar close hoti hai.

Piercing Line Candlestick Pattern ka Tareeqa Kar

Piercing Line candlestick pattern ka tareeqa kar aam tor par ye hota hai:

Downtrend

Piercing Line pattern normal downtrend ke end par dekha jata hai.

Pehli Candle

Pehli candle bearish hoti hai aur normal downtrend ko indicate karti hai.

Doosri Candle

Doosri candle pehli candle ke neeche open hoti hai lekin day ke during price upar chali jati hai aur pehli candle ki body ke andar close hoti hai.

Confirmation

Piercing Line pattern ko confirm karne ke liye traders doosri candle ke close ke neeche buy ki entry lete hain.

Piercing Line Candlestick Pattern ka Istemal

Piercing Line candlestick pattern ka istemal karne ke liye traders ye steps follow karte hain:

Piercing Line Candlestick Pattern ki Pehchan

Traders ko pehle Piercing Line pattern ko sahi tareeke se pehchan'na hota hai.

Confirmation

Pattern ko confirm karne ke liye traders doosri candle ke close ke neeche buy ki entry lete hain.

Stop Loss

Stop loss lagana zaroori hota hai taake agar trade ulta ho jaye to nuksan kam ho sake.

Target

Target set karne ke liye traders previous resistance level ko dekhte hain.

Piercing Line Candlestick Pattern ki Ahmiyat

Piercing Line candlestick pattern ki ahmiyat ye hai ke ye bullish reversal ke liye acha signal deta hai. Is pattern ko sahi tareeke se samajh kar traders achay profit earn kar sakte hain.

Piercing Line Candlestick Pattern ke Nuqsanat

Piercing Line candlestick pattern ke kuch nuqsanat bhi hain jin mein shaamil hain:

False Signals

Kabhi-kabhi Piercing Line pattern false signals bhi de sakta hai jo traders ko nuksan pahuncha sakte hain.

Confirmation Ki Zaroorat

Is pattern ko samajhne aur istemal karne ke liye confirmation ki zaroorat hoti hai.

Piercing Line Candlestick Pattern ka Istemal Karte Waqt Sawalat

Piercing Line candlestick pattern ka istemal karte waqt traders ke zehan mein kuch sawalat zaroor rehte hain jaise:

Kya Downtrend Ke End Par Pattern Hai?

Piercing Line pattern sirf downtrend ke end par hi form hota hai ya phir kisi aur situation mein bhi?

Kya Pattern Ko Confirm Kiya Gaya Hai?

Pattern ko confirm karne ke liye doosri candle ke close ke neeche buy ki entry li gayi hai ya nahi?

Stop Loss Aur Target Kya Hai?

Stop loss aur target kis tareeke se set kiye gaye hain?

Piercing Line Candlestick Pattern ki Misalen

Piercing Line candlestick pattern ki samajhne ke liye kuch misalen darj hain:

Misal 1

Downtrend ke end par Piercing Line pattern form hota hai.

Misal 2

Do consecutive candles mein doosri candle pehli candle ki body ke andar close hoti hai.

Piercing Line Candlestick Pattern ka Istemal Karne ka Faida

Piercing Line candlestick pattern ka istemal karne ke kuch faiday hain:

Bullish Reversal

Ye pattern bullish reversal ke liye acha signal deta hai.

Profitable Trades

Is pattern ko sahi tareeke se samajh kar traders achay profit earn kar sakte hain.

Note

Piercing Line candlestick pattern ek useful bullish reversal pattern hai jo traders ko achay profit earn karne mein madadgar sabit ho sakta hai. Is pattern ko sahi tareeke se samajh kar aur sahi time par istemal karke traders apne trading performance ko behtar bana sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

### Piercing Line Candlestick Pattern

Forex trading mein candlestick patterns market ke future trends aur potential reversals ko samajhne ke liye ek essential tool hain. **Piercing Line Candlestick Pattern** ek aisa pattern hai jo bearish trend ke baad bullish reversal ka signal deta hai. Yeh pattern market ke trend direction ko determine karne aur trading decisions ko guide karne mein madadgar hota hai. Yahan Piercing Line Candlestick Pattern ki pehchan aur forex trading mein iska istemal detail mein bataya gaya hai:

**Piercing Line Pattern Kya Hai?**

Piercing Line Pattern ek bullish reversal pattern hai jo market ke downtrend ke baad develop hota hai. Is pattern mein do candles hoti hain: ek bearish candle aur ek bullish candle. Yeh pattern price action ke strong bearish momentum ke baad ek reversal signal ko represent karta hai. Piercing Line Pattern ki khasiyat yeh hai ke yeh bearish trend ke baad market ko upward direction mein shift karta hai.

**Pattern Ki Pehchan:**

1. **First Candle**: Pehli candle ek long bearish candle hoti hai jo market ke strong downtrend ko dikhati hai. Yeh candle price ke low levels aur selling pressure ko reflect karti hai.

2. **Second Candle**: Dusri candle ek long bullish candle hoti hai jo pehli candle ke close ke baad develop hoti hai. Yeh bullish candle pehli candle ke body ke midpoint ko cross karti hai, lekin closing price pehli candle ke close ke above hoti hai. Yeh candle market ke bullish momentum aur reversal signal ko dikhati hai.

**Forex Trading Mein Piercing Line Pattern Ka Istemaal:**

1. **Entry Point**: Piercing Line Pattern ka entry point tab hota hai jab dusri candle ke bullish breakout ko observe kiya jata hai. Jab price dusri candle ke high ko break karti hai aur bullish trend ko confirm karti hai, tab aap buy position open kar sakte hain. Yeh signal market ke bullish trend ki shuruaat ko indicate karta hai.

2. **Stop Loss**: Stop loss ko pehli candle ke low ke thoda niche set karna chahiye. Yeh aapki position ko unexpected market movements aur false breakouts se protect karta hai aur risk management ko ensure karta hai.

3. **Take Profit**: Take profit target ko recent resistance levels ya pattern ke potential price targets ke aas paas set karna chahiye. Yeh aapko profit-taking opportunities aur trade exit points ko determine karne mein madad karta hai.

**Risk Management Aur Confirmation:**

Piercing Line Pattern ko use karte waqt risk management ko zaroor consider karein. Market conditions aur price action ko closely monitor karna zaroori hai. Is pattern ko dusre technical indicators, jaise Moving Averages ya RSI, ke sath combine karke use karna, stronger trading signals aur confirmation provide kar sakta hai.

**Conclusion:**

Piercing Line Candlestick Pattern forex trading mein ek valuable tool hai jo bearish trend ke baad bullish reversal ko identify karne mein madad karta hai. Is pattern ko accurately pehchaan kar aur sahi trading strategy ke sath istemal karke, aap market ke potential bullish movements ko capitalize kar sakte hain aur apni trading decisions ko enhance kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:45 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим