Tweezer Bottom Candlestick Pattern.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

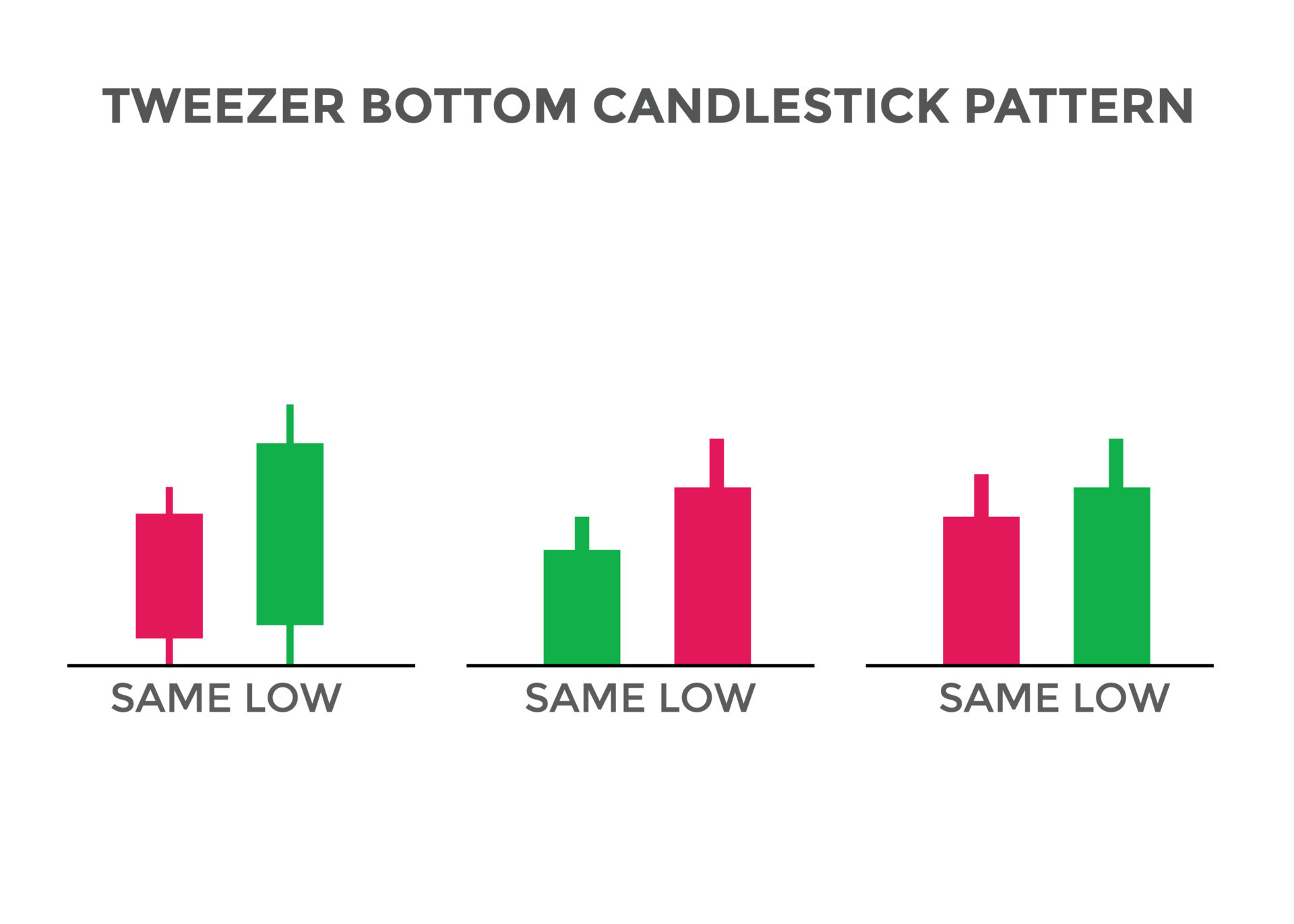

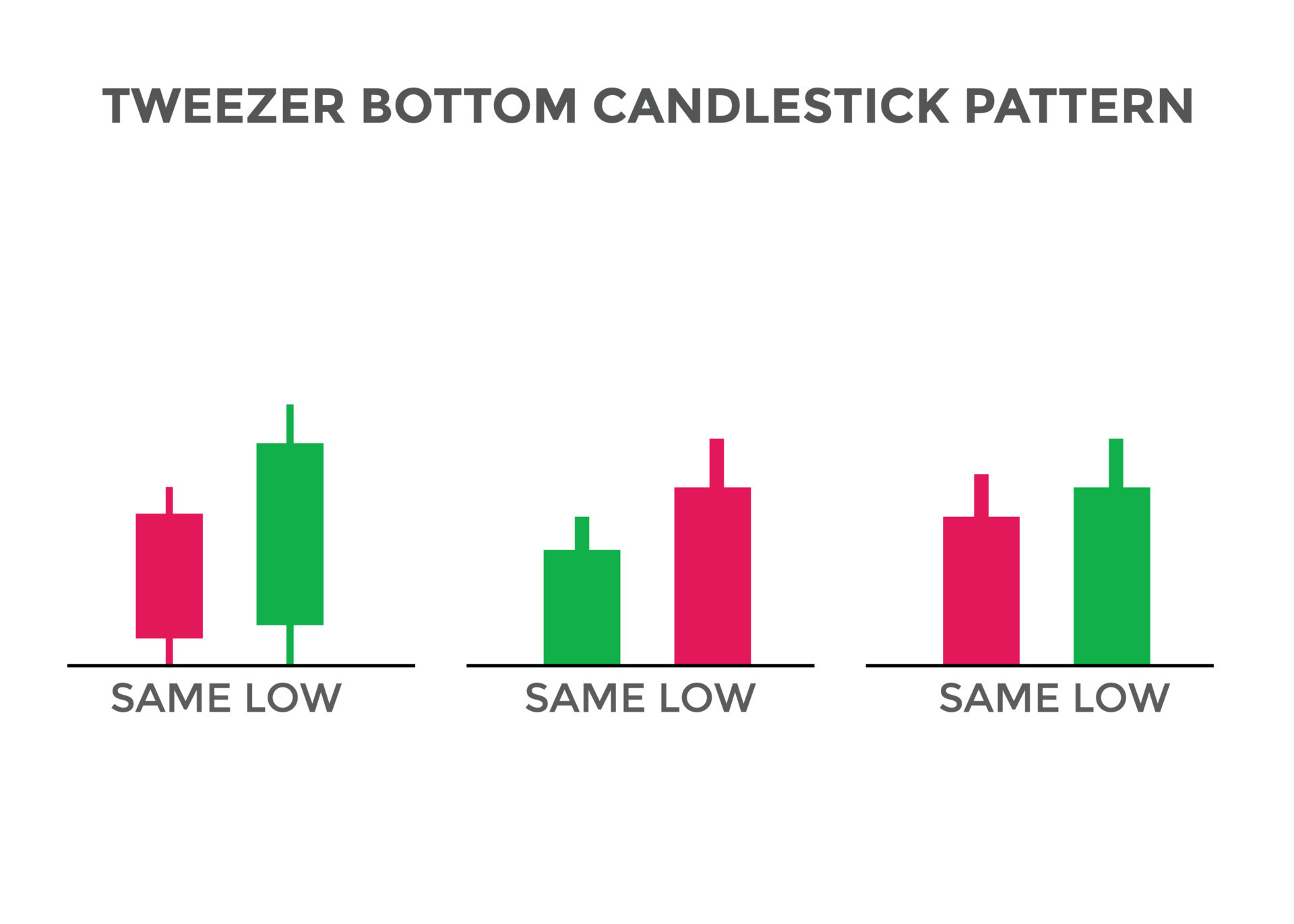

Tweezer Bottom Candlestick Pattern introduction. Tweezer Bottom Candlestick Pattern, ya 'Tweezer Bottom' ek technical analysis tool hai jo forex trading aur stocks mein istemal hota hai. Ye pattern market mein price reversal ko indicate karta hai, jahan se price ne gir kar badhna shuru karna hota hai. Is pattern ko samajhna traders ke liye ahem hota hai, kyunki is se unko market ke future trends ka andaza lagaya ja sakta hai. What is Tweezer Bottom cadlestick pattern. Tweezer Bottom ek candlestick pattern hota hai jahan par do alag-alag candlesticks ek saath aate hain. Ye pattern typically downtrend ke baad aata hai aur bullish reversal ko suggest karta hai. Components of Tweezer Bottom. First part: Ek bearish (girawat ki taraf) candle hoti hai jiski lambai normal hoti hai. Is candle ka closing price niche hota hai. Second part: Doosri candle ek bullish (badhne ki taraf) candle hoti hai, jiska opening price pehli candle ke closing price ke qareeb hota hai. Iska closing price pehli candle ke closing price ke upar hota hai. Trading Strategy. Tweezer Bottom pattern ka main maqsad hota hai market ke bottom ko identify karna. Pehli candle se market down ja rahi hoti hai lekin doosri candle ke aane se market ka trend change ho jata hai aur bullish trend shuru hota hai. Tweezer Bottom pattern ko samajh kar traders apni trading strategy tay kar sakte hain. Agar aap is pattern ko dekhte hain toh aap long position (khareedne ka position) le sakte hain, yaani ke bullish trend ke sath trade kar sakte hain. Stop-Loss , Target & Confirmation. Traders ko hamesha stop-loss aur target levels set karne ki salahiyat rakhni chahiye. Tweezer Bottom pattern ke use mein bhi stop-loss aur target levels decide karna zaroori hai taki risk management ho sake. Tweezer Bottom pattern ko confirm karne ke liye traders dusri technical indicators ka bhi sahara le sakte hain jaise ki RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence).Tweezer Bottom candlestick pattern ek powerful tool hai jo traders ko market ke trend reversals ko identify karne mein madadgar hota hai. Lekin, is pattern ko samajhne aur istemal karne se pehle acchi tarah se training aur practice ki zarurat hoti hai taki aap market mein successful trading kar saken. -

#3 Collapse

Tweezer Bottom Candlestick Pattern. "Tweezer Bottom" candlestick pattern forex aur stock trading mein ek aham reversal pattern hai jo traders aur investors ke liye significant information provide karta hai. Is pattern ko samajh kar aap market mein potential bullish reversal ko identify kar sakte hain. Tweezer Bottom pattern ki pehchan karna market analysis mein kafi madadgar hota hai. Is pattern ki pehchan ke liye aapko do consecutive candlesticks ki zaroorat hoti hai, aur inmein kuch specific conditions meet honi chahiye: Tweezer Bottom pattern ka formation: Pehla Candlestick: Tweezer Bottom pattern ke formation ki shuruaat pehle candlestick se hoti hai, jo ek downtrend ke baad aata hai. Is candlestick ki real body (opening aur closing price ke beech ka area) bearish (red ya black) hoti hai, aur iski closing price pehle candlestick ki closing price se lower hoti hai. Dusra Candlestick: Dusra candlestick bhi downtrend ke baad aata hai, lekin iski real body bullish (green ya white) hoti hai. Is candlestick ki opening price pehle candlestick ki closing price ke bohot kareeb hoti hai aur phir iska closing price pehle candlestick ki real body ke andar hoti hai.Tweezer Bottom pattern ek bullish reversal pattern hota hai, matlab ke is pattern ke formation ke baad market mein downtrend ki jagah bullish trend ki sambhavna hoti hai. Yeh pattern traders ko ye signal deta hai ke downtrend kamzor ho raha hai aur buyers ki strength barh rahi hai.Is pattern ko samajhne ke liye, traders ko market ke overall context aur doosre technical indicators ka bhi istemal karna hota hai. Tweezer Bottom pattern ke confirmation ke liye, traders often doosre indicators jaise ki volume analysis aur trend lines ka istemal karte hain.Lekin yaad rahe ke kisi bhi candlestick pattern ki tarah, Tweezer Bottom pattern bhi kabhi-kabhi false signals bhi de sakta hai, isliye risk management aur stop-loss orders ka istemal karna hamesha zaroori hota hai jab aap trading karte hain.

Tweezer Bottom pattern ka formation: Pehla Candlestick: Tweezer Bottom pattern ke formation ki shuruaat pehle candlestick se hoti hai, jo ek downtrend ke baad aata hai. Is candlestick ki real body (opening aur closing price ke beech ka area) bearish (red ya black) hoti hai, aur iski closing price pehle candlestick ki closing price se lower hoti hai. Dusra Candlestick: Dusra candlestick bhi downtrend ke baad aata hai, lekin iski real body bullish (green ya white) hoti hai. Is candlestick ki opening price pehle candlestick ki closing price ke bohot kareeb hoti hai aur phir iska closing price pehle candlestick ki real body ke andar hoti hai.Tweezer Bottom pattern ek bullish reversal pattern hota hai, matlab ke is pattern ke formation ke baad market mein downtrend ki jagah bullish trend ki sambhavna hoti hai. Yeh pattern traders ko ye signal deta hai ke downtrend kamzor ho raha hai aur buyers ki strength barh rahi hai.Is pattern ko samajhne ke liye, traders ko market ke overall context aur doosre technical indicators ka bhi istemal karna hota hai. Tweezer Bottom pattern ke confirmation ke liye, traders often doosre indicators jaise ki volume analysis aur trend lines ka istemal karte hain.Lekin yaad rahe ke kisi bhi candlestick pattern ki tarah, Tweezer Bottom pattern bhi kabhi-kabhi false signals bhi de sakta hai, isliye risk management aur stop-loss orders ka istemal karna hamesha zaroori hota hai jab aap trading karte hain.

-

#4 Collapse

Tweezer Bottom Candlestick Pattern Forex trading, with its myriad of candlestick patterns, offers traders valuable insights into market sentiment. One such pattern is the "Tweezer Bottom," which can provide traders with potential reversal signals. In Roman Urdu, let's explore this candlestick pattern and its significance in Forex trading. Tweezer Bottom Kya Hai? Tweezer Bottom ek candlestick pattern hai jo Forex trading mein aik aham kirdar ada karta hai. Is pattern mein do candles hoti hain jo market ki mukhtalif phases ko darust karti hain. Pehli candle bullish hoti hai, jabke doosri candle bearish hoti hai. Tweezer Bottom pattern tab banta hai jab do candlesticks, usually ek bullish aur ek bearish, market mein aik doosre ke qareeb close hoti hain. In candlesticks ke tops aur bottoms aik jaise hotay hain, jo market mein aik potential reversal signal deta hai. Ehmiyat Tweezer Bottom pattern, traders ko market mein potential trend reversal ka pata lagane mein madadgar hota hai. Jab ye pattern market mein aata hai, to ye traders ko ye ishara deta hai ke bearish trend khatam ho sakta hai aur bullish trend shuru ho sakta hai. Istemal Traders ko Tweezer Bottom pattern ko samajhna aur istemal karna aham hota hai. Agar ye pattern aap dekhte hain to iska matlab hai ke aapko cautious hona chahiye. Is signal ko confirm karne ke liye, traders doosri technical indicators aur price action analysis ka bhi sahara le sakte hain. Tweezer Bottom pattern dekh kar traders apni positions ko manage karte waqt stop-loss orders ka istemal karte hain. Agar pattern confirm hojata hai, to traders apni positions ko protect karne ke liye stop-loss orders set kar sakte hain. Conclusion Forex trading mein Tweezer Bottom candlestick pattern, traders ke liye aik ahem tool hai jo market trends aur reversals ko samajhne mein madadgar hota hai. Is pattern ko samajh kar aur sahi tarah se istemal karke traders apni trading strategies ko improve kar sakte hain aur market mein behtar faisle kar sakte hain. Is liye, har trader ko Tweezer Bottom pattern ki ahmiyat ko samajhna aur iska sahi istemal karna chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Tweeze Bottom Candndlestick Pattern : Forex exchanging, with its horde of candle designs, offers dealers important experiences into market feeling. One such example is the "Tweezer Base," which can give brokers potential inversion signals. In Roman Urdu, how about we investigate this candle design and its importance in Forex exchanging. Tweezer Base Kya Hai? Tweezer Base ek candle design hai jo Forex exchanging mein aik aham kirdar ada karta hai. Is design mein do candles hoti hain jo market ki mukhtalif stages ko darust karti hain. Pehli flame bullish hoti hai, jabke doosri light negative hoti hai.Tweezer Base example tab banta hai punch do candles, as a rule ek bullish aur ek negative, market mein aik doosre ke qareeb close hoti hain. In candles ke tops aur bottoms aik jaise hotay hain, jo market mein aik potential inversion signal deta hai. Ehmiyat: Tweezer Base example, merchants ko market mein potential pattern inversion ka pata lagane mein madadgar hota hai. Poke ye design market mein aata hai, to ye merchants ko ye ishara deta hai ke negative pattern khatam ho sakta hai aur bullish pattern shuru ho sakta hai. Istemal : Merchants ko Tweezer Base example ko samajhna aur istemal karna aham hota hai. Agar ye design aap dekhte hain to iska matlab hai ke aapko wary hona chahiye. Is signal ko affirm karne ke liye, merchants doosri specialized markers aur cost activity examination ka bhi sahara le sakte hain.Tweezer Base example dekh kar merchants apni positions ko oversee karte waqt stop-misfortune orders ka istemal karte hain. Agar design affirm hojata hai, to dealers apni positions ko safeguard karne ke liye stop-misfortune orders set kar sakte hain. End: Forex exchanging mein Tweezer Base candle design, merchants ke liye aik ahem apparatus hai jo market patterns aur inversions ko samajhne mein madadgar hota hai. Is design ko samajh kar aur sahi tarah se istemal karke merchants apni exchanging techniques ko improve kar sakte hain aur market mein behtar faisle kar sakte hain. Is liye, har merchant ko Tweezer Base example ki ahmiyat ko samajhna aur iska sahi istemal karna chahiye.

Tweezer Base Kya Hai? Tweezer Base ek candle design hai jo Forex exchanging mein aik aham kirdar ada karta hai. Is design mein do candles hoti hain jo market ki mukhtalif stages ko darust karti hain. Pehli flame bullish hoti hai, jabke doosri light negative hoti hai.Tweezer Base example tab banta hai punch do candles, as a rule ek bullish aur ek negative, market mein aik doosre ke qareeb close hoti hain. In candles ke tops aur bottoms aik jaise hotay hain, jo market mein aik potential inversion signal deta hai. Ehmiyat: Tweezer Base example, merchants ko market mein potential pattern inversion ka pata lagane mein madadgar hota hai. Poke ye design market mein aata hai, to ye merchants ko ye ishara deta hai ke negative pattern khatam ho sakta hai aur bullish pattern shuru ho sakta hai. Istemal : Merchants ko Tweezer Base example ko samajhna aur istemal karna aham hota hai. Agar ye design aap dekhte hain to iska matlab hai ke aapko wary hona chahiye. Is signal ko affirm karne ke liye, merchants doosri specialized markers aur cost activity examination ka bhi sahara le sakte hain.Tweezer Base example dekh kar merchants apni positions ko oversee karte waqt stop-misfortune orders ka istemal karte hain. Agar design affirm hojata hai, to dealers apni positions ko safeguard karne ke liye stop-misfortune orders set kar sakte hain. End: Forex exchanging mein Tweezer Base candle design, merchants ke liye aik ahem apparatus hai jo market patterns aur inversions ko samajhne mein madadgar hota hai. Is design ko samajh kar aur sahi tarah se istemal karke merchants apni exchanging techniques ko improve kar sakte hain aur market mein behtar faisle kar sakte hain. Is liye, har merchant ko Tweezer Base example ki ahmiyat ko samajhna aur iska sahi istemal karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:46 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим