What is the fibonacci retracement levels?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

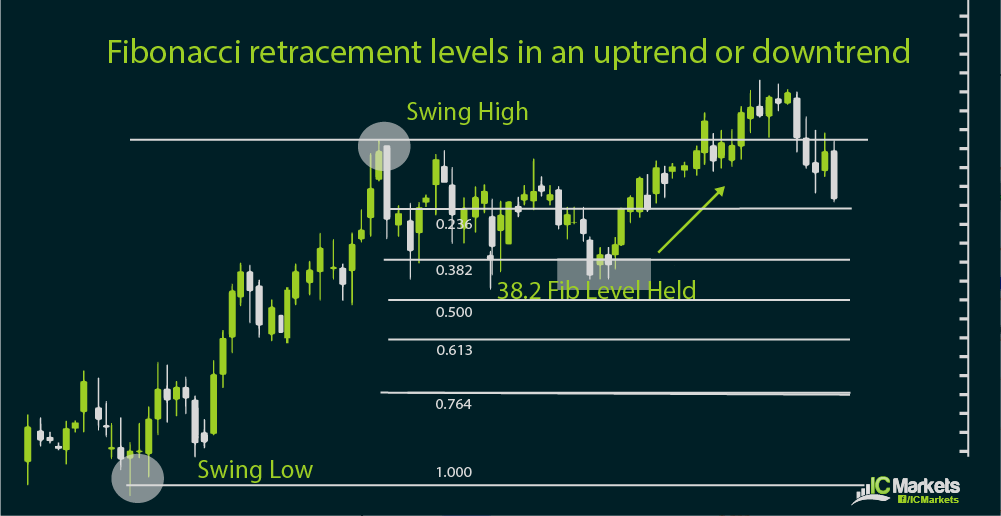

WHAT IS FIBONACCI RETRACEMENT LEVEL ? Fibonacci retracement levels Forex trading mein istemaal hone wala ek tool hai, jiski madad se possible support aur resistance levels ko pata kiya jata hai. Iski bunyad Fibonacci sequence par hoti hai, jo numbers ki series hoti hai jahan har number apne do pichle numbers ka jod hota hai. Forex trading ke context mein, Fibonacci retracement levels horizontal lines hote hain jo price chart par draw kiye jate hain aur possible support ya resistance levels ko indicate karte hain. Ye levels Fibonacci ratios se derive hote hain, jo Fibonacci sequence ke numbers ke beech ke mathematical relationships hote hain. Forex trading mein sabse commonly used Fibonacci retracement levels 38.2%, 50.0%, aur 61.8% hote hain. HOW TO CALCULATE FIBONACCI RETRACEMENT LEVELS : Fibonacci retracement levels calculate karne ke liye, aapko apne Forex price chart par significant price move ko identify karna hota hai. Ye move ya toh ek uptrend ho sakta hai ya ek downtrend ho sakta hai, kyunki Fibonacci retracement levels dono situations mein apply kiye ja sakte hain. Jab aap price move ko identify kar lete hain, toh aap us move ke high aur low points ko select karke Fibonacci retracement levels draw kar sakte hain. High point move ka peak hota hai, jabki low point move ka trough hota hai. Jab aap in points ko select kar lete hain, toh aap apne trading platform par Fibonacci retracement tool apply kar sakte hain, jisse ye tool automatically different Fibonacci retracement levels par horizontal lines draw karega. UNDERSTANDING FIBONACCI RATIOS : Jaisa ki pehle bhi mention kiya gaya hai, Fibonacci retracement levels Fibonacci ratios se derive hote hain. Forex trading mein sabse commonly used Fibonacci ratios 38.2%, 50.0%, aur 61.8% hote hain. Ye ratios Fibonacci sequence ke numbers ko uske peeche wale number se divide karke calculate kiye jate hain. For example, 55 ko 89 se divide karne se approximately 0.618 ka ratio milta hai, jo 61.8% Fibonacci retracement level hota hai. Isi tarah, 34 ko 89 se divide karne se approximately 0.382 ka ratio milta hai, jo 38.2% Fibonacci retracement level hota hai. Ye ratios fir Forex chart par price move par apply kiye jate hain, jiske dwara potential support aur resistance levels determine hote hain. USING FIBONACCI RETRACEMENT LEVELS IN FOREX TRADING : Fibonacci retracement levels Forex trading mein ek powerful tool maane jate hain, kyunki ye traders ko potential support aur resistance areas ko identify karne mein madad karte hain. Jab market uptrend mein hota hai, tab traders Fibonacci retracement levels par potential buying opportunities ko dekhte hain, jo support ka kaam karte hain. Virodh mein, jab market downtrend mein hota hai, tab traders Fibonacci retracement levels par potential selling opportunities ko dekhte hain, jo resistance ka kaam karte hain. Ye levels dusre technical indicators aur tools ke saath istemaal kiye ja sakte hain, jisse successful trades ki probability badhti hai. LIMITATIONS OF FIBONACCI RETRACEMENT LEVELS : Jabki Fibonacci retracement levels support aur resistance levels identify karne mein kaaragar ho sakte hain, lekin yeh foolproof nahi hote hain. Forex market mein price action various factors, including economic news, market sentiment, aur geopolitical events ke influence mein ho sakta hai. Isliye, Fibonacci retracement levels ke saath dusre technical indicators aur fundamental analysis ko bhi consider karna zaroori hai, jisse informed trading decisions liye ja sakte hain. Additionally, Fibonacci retracement levels subjective hote hain aur inka variation chosen price move aur chart ki timeframe par depend karta hai. Traders ko savdhani se kaam karne ki zaroorat hai aur apni trading strategies mein Fibonacci retracement levels par poora bharosa na rakhe. -

#3 Collapse

What is the fibonacci retracement levels? Fibonacci retracement levels ek technical analysis tool hain jo stock market, forex market, commodities market, aur doosre financial markets mein price movements ko analyze karne ke liye istemal hotay hain. Ye levels traders aur investors ko market ke potential support aur resistance areas ko identify karne mein madadgar hotay hain. Fibonacci Retracement Ka Taaruf: Fibonacci retracement levels Fibonacci sequence par based hain, jo ek mathematical sequence hai jismein har number apne do pichle numbers ka addition hota hai. Fibonacci sequence kuch is tarah se shuru hota hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, ... Fibonacci retracement levels mein kuch specific ratios istemal hoti hain, jo Fibonacci sequence ke numbers ke basis par calculate ki jati hain. Sab se common Fibonacci retracement levels include hain: 1. 0.236 (23.6%): Is level ko traders often istemal karte hain taake identify kar saken ke price kis extent tak retracement kar sakta hai before continuing in the original trend. 2. 0.382 (38.2%): Ye bhi ek ahem retracement level hai. Traders is level ko dekhte hain taake determine karein ke price kitni had tak wapas aasakta hai. 3. 0.500 (50%): Is level ko traders ke liye key retracement level consider kiya jata hai. Agar price 50% tak retracement karti hai, toh traders often is level par dhyan dete hain. 4. 0.618 (61.8%): Is level ko "golden ratio" ke naam se bhi jana jata hai. Is level par price ka retracement hota hai, toh isay strong retracement maana jata hai. 5. 0.786 (78.6%): Ye bhi ek important retracement level hai, jise traders closely monitor karte hain. Fibonacci Retracement Ka Istemal: Fibonacci retracement levels ka istemal price chart par vertical lines draw karke hota hai jo price ke key turning points (like tops aur bottoms) par lagate hain. In levels ko use karke traders aur investors price movements ko analyze karte hain. Agar price kisi trend mein hai aur phir retracement start hoti hai, to traders in levels ko dekhte hain taake woh samajh saken ke price kis Chaliye ek example dekhte hain: Imagine karein ke ek stock ka price uptrend mein hai aur phir ek downtrend shuru hota hai. Traders Fibonacci retracement levels ka istemal karte hain taake identify karein ke price kitni had tak retracement kar sakta hai. Agar price uptrend mein tha aur phir 0.618 (61.8%) Fibonacci retracement level tak wapas aata hai aur support paata hai, to traders ko lag sakta hai ke yeh level ek potential reversal point ho sakta hai aur bullish trend shuru ho sakta hai. Lekin yaad rahe ke Fibonacci retracement levels ke istemal mein bhi risk hota hai aur yeh ekmatra indicator nahi hai. Traders aur investors hamesha doosre technical indicators aur market analysis tools ke saath istemal karte hain, aur risk management ko bhi madde nazar rakhte hain, taake unki trading decisions mehfooz aur sahi ho. -

#4 Collapse

Aslamoalekum kesay hein ap sab members. Main umed krti hon ap sab thek hongay or apki posting behtreen ja rhi hogi isky sath apka trading session bhe acha ja raha hoga. Aj ka hmara discussion ka jo topic hay woh Fibonacci Retracements levels ky baray mein hey isy dekhty hein ky yh kia hy or hmen kia malomat faraham karta hai. fibonicci Retracements levels Forex trading mein Fibonacci retracement levels mainly support aur resistance ke tor par istemal hotay hain. Ye levels hain 23.6%, 38.2%, 50%, 61.8%, aur 78.6%. Inko istemal kar ke traders currency price ki mumkina reversal points ko shanakht karte huye har trah hain.Fibonacci retracement levels ka istemal karnay se traders ko idea milta hai ke market mein price ka kis tarah ka oper sy nchy ka harkat ho sakta hai. Ye levels support aur resistance ko daryaft karne mein madad karte hain, jiski wajah se traders apni trading strategies ko behtar kar saktay hain. Fibonacci retracement levels market trends ko samajhne aur future price movements ko shanakht karne mein aik tool ki tarah istemal hotay hain. Explanation Fibonacci retracement levels traders ko market mein hone wale har trah kay mumkina reversals aur trends ka pata lagane mein madad karte hain. Jab price ek trend mein hoti hai aur phir retraces karti hai, to Fibonacci levels traders ko ye batate hain ke sahi retracement kis level tak ja sakta hai. Traders in levels ko istemal kar ke potential entry points aur stop-loss levels ko smjhnay or shanakht kar saktay hain, jo unko risk management mein madadgar hotay hain. Is tarah, Fibonacci retracement levels trading say decisions mein har tarah say rehnumai dete hain.Fibonacci retracement levels istemal karne ke bawajood, kuch traders ko lagta hai ke ye kabhi kabhi ger mutawaqy ho saktay hain. Market volatility aur achanak anay wali news events ki wajah se, Fibonacci ky levels ka accuracy kam ho sakta hai. Aur agar traders sirf is tool par pura bharosa karte hain to woh overtrading mein mubtila ho saktay hain. Is liye, hamesha doosre technical analysis tools aur market indicators ko bhi madde nazar rakha jana chahiye, taake ek mukammal tasweer hasil ki ja sake. -

#5 Collapse

What is the fibonacci retracement levels?

Title: "Fibonacci Retracement Levels: Roman Urdu Mein"

Introduction: Fibonacci Retracement Levels ek popular technical analysis tool hai jo traders aur investors ke liye market trends aur price movements ko analyze karne mein madad karta hai. Ye levels Fibonacci sequence par based hote hain aur market mein support aur resistance levels ka pata lagane mein help karte hain. Is article mein hum Fibonacci Retracement Levels ke bare mein gehri understanding hasil karne ki koshish karenge.- Fibonacci Sequence ki Tareef: Fibonacci sequence ek mathematical sequence hai jisme har number apne pehle do numbers ka sum hota hai. Ye sequence 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, aur aage chalte rahta hai. Is sequence ko dekhte hue Fibonacci Retracement Levels tay kiye jate hain.

- Fibonacci Retracement Levels Ki Tashkeel: Fibonacci Retracement Levels market mein price movements ko analyze karne ke liye use hotay hain. Ye levels horizontal lines hote hain jo chart par draw kiye jate hain. In levels mein include hote hain 0.236, 0.382, 0.500, 0.618 aur 0.786. Ye levels Fibonacci sequence ke proportions ko represent karte hain.

- Fibonacci Retracement Levels Ka Istemal: Traders aur investors Fibonacci Retracement Levels ka istemal karte hain taake market mein potential support aur resistance levels ka pata lagaya ja sake. Jab market uptrend ya downtrend mein hota hai, to Fibonacci Retracement Levels ko use karke traders price retracements ko predict karte hain. Agar price ek specific level tak gir jata hai, to waha se reversal ka potential hota hai.

- Fibonacci Retracement Levels aur Trading Strategy: Traders Fibonacci Retracement Levels ko apni trading strategy mein shamil karte hain taake entry aur exit points ko determine kar sakein. Jab price ek Fibonacci level tak pohanchta hai, to traders apne positions ko adjust karte hain ya phir reversal ka wait karte hain.

Conclusion: Fibonacci Retracement Levels ek powerful tool hai jo market trends aur price movements ko analyze karne mein madad karta hai. Iske istemal se traders aur investors market ka better understanding gain karte hain aur sahi trading decisions lete hain. Magar yaad rakhein, Fibonacci Retracement Levels bhi kisi bhi situation mein 100% accurate nahi hote, isliye risk management aur technical analysis ke saath sahi tarah se istemal karna zaroori hai.

منسلک شدہ فائلیں -

#6 Collapse

**Fibonacci Retracement Levels: Kya Hain Aur Inka Use Kaise Karein?**

Fibonacci retracement levels technical analysis ka ek ahem tool hain jo market ke price movements aur trends ko analyze karne mein madad karte hain. Ye levels market ke pullbacks aur corrections ko identify karne ke liye use hote hain aur traders ko potential support aur resistance levels determine karne mein help karte hain. Aaiye, Fibonacci retracement levels ko detail mein samjhte hain aur inka effective use kaise kiya jata hai, ye dekhte hain.

**1. Fibonacci Retracement Levels Ki Definition:**

Fibonacci retracement levels Fibonacci sequence ke principles par based hote hain, jo ek mathematical sequence hai jisme har number pichle do numbers ka sum hota hai (0, 1, 1, 2, 3, 5, 8, 13, 21, etc.). In levels ko market analysis mein support aur resistance levels ko identify karne ke liye use kiya jata hai. Commonly used Fibonacci retracement levels hain 23.6%, 38.2%, 50%, 61.8%, aur 76.4%.

**2. Fibonacci Retracement Levels Ka Use:**

- **Support Aur Resistance Levels:** Fibonacci retracement levels ko market ke recent price swings ko analyze karke plot kiya jata hai. Jab market ek significant trend ke baad pullback ya correction karta hai, to Fibonacci levels identify kiye jate hain jahan price support ya resistance face kar sakti hai. Ye levels market ke reversal points ko predict karne mein madadgar hote hain.

- **Trend Analysis:** Trend analysis ke liye, Fibonacci retracement levels ko high aur low points ke beech draw kiya jata hai. Uptrend mein, retracement levels ko swing low se swing high tak plot kiya jata hai aur downtrend mein swing high se swing low tak. In levels ki madad se traders price corrections aur trend continuations ko analyze kar sakte hain.

**3. Plotting Aur Interpretation:**

- **Plotting:** Fibonacci retracement levels ko plot karne ke liye, aapko pehle market ke major swing high aur swing low points ko identify karna hota hai. Trading platforms pe Fibonacci retracement tool use karke, in points ko select karke retracement levels ko chart par plot kiya jata hai.

- **Interpretation:** Plot kiye gaye levels ko market ke price action ke sath compare karke interpret kiya jata hai. Agar price 38.2% retracement level pe support ya resistance face karti hai, to ye level market ke important reversal point ko indicate kar sakta hai. Multiple levels ke around price action ko monitor karke, traders potential market reversals aur continuations ko analyze kar sakte hain.

**4. Advantages Aur Disadvantages:**

- **Advantages:**

- **Potential Reversal Points:** Fibonacci retracement levels potential reversal points ko identify karne mein madad karte hain, jo trading decisions ko enhance karte hain.

- **Support Aur Resistance Identification:** Ye levels market ke support aur resistance zones ko clearly define karte hain, jo trading strategy development ke liye useful hote hain.

- **Disadvantages:**

- **Subjectivity:** Fibonacci retracement levels ka use subjective hota hai aur levels ki accuracy market conditions ke hisaab se vary kar sakti hai.

- **False Signals:** Kabhi-kabhi, price retracement levels ko touch karne ke bawajood trend reversal nahi hota, jo false signals ka sabab ban sakta hai.

**Conclusion:**

Fibonacci retracement levels technical analysis ka ek powerful tool hain jo market ke potential reversal points aur support/resistance levels ko identify karne mein madad karte hain. In levels ko market ke major swing points ke beech plot karke, traders price corrections aur trend continuations ko analyze kar sakte hain. Effective trading ke liye, Fibonacci retracement levels ko additional technical indicators aur market analysis ke sath combine karna zaroori hai. Is tarah se, traders market ke movements ko accurately predict kar sakte hain aur informed trading decisions le sakte hain.

-

#7 Collapse

What is the fibonacci retracement levels?

1. Fibonacci Retracement Levels Kya Hain?

Fibonacci retracement levels ek technical analysis ka tool hain jo traders ko support aur resistance levels identify karne mein madad karta hai. Yeh levels mathematically derived hote hain aur market psychology ko reflect karte hain. Jab bhi price ek trend follow karte hue retrace hota hai, yeh levels potential reversal points indicate karte hain.

Fibonacci retracement ka concept is baat par mabni hai ke market trends sirf ek straight line mein move nahi karte, balki unmein pullbacks aur retracements hote hain. In retracements ko identify karke traders ko apne positions ko adjust karne ka moka milta hai.

2. Fibonacci Series Aur Uska Forex Mein Istemaal

Fibonacci series ek mathematical sequence hai jo forex trading mein price movement aur reversal points ko samajhne ke liye use hoti hai. Is series mein har number apne pichle do numbers ka sum hota hai, jaise ke 0, 1, 1, 2, 3, 5, 8, 13, aur is tarah aage.

Forex trading mein Fibonacci sequence ke ratios ko use karke retracement levels calculate kiye jate hain. In ratios mein 23.6%, 38.2%, 50%, 61.8%, aur 100% shamil hain. Yeh ratios market ke psychological levels ko reflect karte hain jahan price move karke wapas apne trend ko follow kar sakta hai.

3. Retracement Levels Ka Taaruf

Fibonacci retracement levels mein commonly 23.6%, 38.2%, 50%, 61.8%, aur 100% levels shamil hote hain. Yeh levels market trends ke beech mein potential reversal points ko indicate karte hain. Jab bhi market kisi trend ko follow karta hai, to yeh retracement levels use karke predict kiya jata hai ke price wapas trend ki taraf move kar sakta hai ya nahi.

For example, agar ek uptrend hai aur price 61.8% retracement level tak wapas aata hai, to yeh ek potential buying opportunity ho sakti hai, kyunke yeh level ek strong support level ka kaam kar sakta hai.

4. Historical Background

Fibonacci sequence ko pehli martaba 13th century ke Italian mathematician Leonardo Fibonacci ne introduce kiya. Yeh sequence uske kitab "Liber Abaci" mein mention hui thi, jo 1202 mein publish hui thi. Fibonacci ne yeh sequence rabbits ke breeding ke problem ko solve karte hue discover ki thi, lekin aaj yeh sequence har field mein use hoti hai, including financial markets.

Financial markets mein Fibonacci sequence ka istimaal 1970s ke baad popular hua jab traders ne dekha ke yeh ratios market trends aur reversal points ko accurately predict kar sakte hain.

5. Calculating Fibonacci Levels

Fibonacci retracement levels ko calculate karne ke liye pehle high aur low points ko identify kiya jata hai. Agar market ek uptrend mein hai, to low point se high point tak ki distance ko calculate kiya jata hai. Fir in distances ko Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, aur 100%) ke saath multiply karke retracement levels nikalte hain.

For example, agar low point $100 aur high point $200 hai, to 50% retracement level $150 par hoga. Yeh levels traders ko potential support aur resistance levels identify karne mein madad karte hain.

6. Importance of 61.8% Level

61.8% retracement level ko golden ratio bhi kaha jata hai aur yeh bohot significant hota hai trading mein. Yeh ratio naturally occurring proportions ko reflect karta hai jo ke art, architecture, aur nature mein bhi paye jate hain.

Trading mein 61.8% level ko is liye significant mana jata hai kyunke yeh level market psychology ko strongly influence karta hai. Jab price is level par pohanchti hai, to bohot se traders isko ek strong support ya resistance level ke taur par dekhte hain aur apne trades ko adjust karte hain.

7. Applying Fibonacci Retracement

Fibonacci retracement levels ko apply karne ke liye charting software mein high aur low points select karke retracement tool use kiya jata hai. Yeh tool automatically retracement levels ko calculate karke chart par draw kar deta hai.

Jab traders in levels ko identify kar lete hain, to yeh unhe potential entry aur exit points ko identify karne mein madad karte hain. For example, agar price 38.2% retracement level par hai aur market ek strong uptrend mein hai, to yeh ek buying opportunity ho sakti hai.

8. Identifying Support Aur Resistance

Fibonacci retracement levels traders ko potential support aur resistance points dikhate hain jahan price reversal ho sakta hai. Support levels wo points hote hain jahan price girte hue ruk jati hai aur wapas upar move karti hai, jabke resistance levels wo points hote hain jahan price chadte hue ruk jati hai aur wapas neeche move karti hai.

In levels ko identify karke traders apne trading strategies ko adjust kar sakte hain aur better trading decisions le sakte hain. For example, agar price 61.8% retracement level par support dikhati hai, to yeh ek buying signal ho sakta hai.

9. Combining With Other Indicators

Fibonacci retracement levels ko doosre technical indicators ke saath combine karna analysis ko mazid mazboot banata hai. Indicators jaise ke moving averages, RSI, aur MACD ke saath milake yeh levels market trends aur reversal points ko aur bhi accurately predict kar sakte hain.

For example, agar Fibonacci retracement level par price aur RSI dono oversold condition dikhate hain, to yeh ek strong buying signal ho sakta hai. Is tarah, traders apne analysis ko mazid mazboot banake better trading decisions le sakte hain.

10. Swing Highs Aur Lows

Swing highs aur lows ko identify karna zaroori hota hai taake accurate retracement levels nikal sakein. Swing high wo point hota hai jahan price temporary peak par hoti hai aur wapas neeche move karti hai, jabke swing low wo point hota hai jahan price temporary bottom par hoti hai aur wapas upar move karti hai.

In points ko accurately identify karke Fibonacci retracement levels ko calculate karna possible hota hai. Isse traders ko better support aur resistance levels identify karne mein madad milti hai.

11. Price Action Analysis

Price action analysis ke saath milake Fibonacci retracement levels ko use karna trading decisions ko improve karta hai. Price action analysis mein price movements aur chart patterns ko study kiya jata hai taake market trends aur reversal points ko samjha ja sake.

For example, agar price ek strong uptrend mein hai aur 38.2% retracement level par ek bullish candlestick pattern form hota hai, to yeh ek strong buying signal ho sakta hai. Is tarah, traders apne trading strategies ko better analyze kar sakte hain.

12. Trends Aur Retracement

Yeh levels uptrend aur downtrend dono mein use hote hain taake potential reversal points ko samjha ja sake. Uptrend mein retracement levels support points identify karte hain jahan price wapas trend ko follow kar sakti hai, jabke downtrend mein yeh levels resistance points identify karte hain.

For example, agar market downtrend mein hai aur price 61.8% retracement level tak wapas aata hai, to yeh ek potential selling opportunity ho sakti hai, kyunke yeh level ek strong resistance level ka kaam kar sakta hai

.

13. Risk Management

Fibonacci retracement levels ko stop loss aur take profit levels set karne ke liye bhi use kiya jata hai. Stop loss level wo point hota hai jahan trader apni position close karke loss ko minimize karta hai, jabke take profit level wo point hota hai jahan trader apni position close karke profit ko realize karta hai.

For example, agar trader ek buying position open karta hai aur price 61.8% retracement level tak girti hai, to stop loss level ko 61.8% level ke neeche set karna ek wise decision ho sakta hai. Is tarah, risk ko effectively manage kiya ja sakta hai.

14. Combining With Moving Averages

Moving averages ke saath combine karke Fibonacci levels ko aur bhi effective banaya ja sakta hai. Moving averages price trends ko smooth karte hain aur support aur resistance levels ko accurately predict karte hain.

For example, agar 200-day moving average aur 61.8% retracement level dono ek hi point par hain, to yeh level ek bohot strong support level ban sakta hai. Is tarah, traders ko better entry aur exit points identify karne mein madad milti hai.

15. Entry Aur Exit Points

In levels ke through traders accurate entry aur exit points identify kar sakte hain. Entry points wo points hote hain jahan trader apni position open karta hai, jabke exit points wo points hote hain jahan trader apni position close karta hai.

For example, agar price 38.2% retracement level par support dikhati hai aur ek bullish candlestick pattern form hota hai, to yeh ek strong buying signal ho sakta hai. Is tarah, traders better entry points identify karke profitable trades execute kar sakte hain.

16. Time Frames Ka Asar

Different time frames par Fibonacci retracement levels ka analysis karna trading strategy ko aur effective banata hai. Long-term time frames jaise ke daily aur weekly charts pe in levels ka analysis karna broader market trends ko samajhne mein madad karta hai, jabke short-term time frames jaise ke hourly aur minute charts pe in levels ka analysis karna short-term trading decisions mein madad karta hai.

For example, agar weekly chart par price 50% retracement level tak wapas aati hai aur wahan se support dikhati hai, to yeh ek strong buying signal ho sakta hai. Is tarah, different time frames ka analysis karke traders apni trading strategies ko improve kar sakte hain.

17. Limitations of Fibonacci Retracement

Har technical indicator ki tarah, Fibonacci retracement levels bhi perfect nahi hain aur hamesha accurate predictions nahi dete. Yeh levels sirf potential support aur resistance points ko indicate karte hain, lekin market mein bohot si aur factors bhi hoti hain jo price movements ko influence karte hain.

For example, geopolitical events, economic data releases, aur market sentiment bhi price movements ko influence karte hain. Isliye, Fibonacci retracement levels ko doosre indicators ke saath combine karna zaroori hai taake better trading decisions liye ja sakein.

18. Learning and Practice

In levels ko effectively use karne ke liye learning aur practice bohot zaroori hai. Technical analysis ke concepts ko samajhna aur inka practical application karna ek successful trader banne ke liye zaroori hota hai.

Boht se online resources, books, aur courses available hain jo Fibonacci retracement levels aur technical analysis ke baare mein detailed information provide karte hain. Inko study karke aur demo trading platforms par practice karke traders apni skills ko improve kar sakte hain.

19. Conclusion

Fibonacci retracement levels forex trading mein ek powerful tool hain jo market movements ko samajhne aur profitable trading decisions lene mein madad karte hain. Yeh levels mathematically derived hote hain aur market psychology ko reflect karte hain.

Traders in levels ko use karke potential support aur resistance points ko identify kar sakte hain aur better entry aur exit points ko determine kar sakte hain. Lekin yeh levels sirf ek tool hain aur unhe doosre technical indicators aur market factors ke saath combine karke use karna zaroori hai taake better trading decisions liye ja sakein.

Fibonacci retracement levels ko effectively use karne ke liye learning aur practice bohot zaroori hai. Traders ko continuous learning aur market analysis ke through apni skills ko improve karna chahiye taake wo successful trading kar sakein. -

#8 Collapse

What is the fibonacci retracement levels?

Fibonacci Retracement Levels kya hain?

Forex trading mein, Fibonacci Retracement levels aik popular technical analysis tool hain jo traders ko potential support aur resistance levels identify karne mein madad karte hain. Yeh levels market ke previous price movements ko analyze karte hain aur future price movements ko predict karne mein madadgar hote hain. Fibonacci retracement levels ko use karke, traders apni trading strategies ko enhance kar sakte hain aur risk ko effectively manage kar sakte hain.

Fibonacci Sequence

Fibonacci sequence aik mathematical series hai jahan har number pichlay do numbers ka sum hota hai. Yeh sequence kuch is tarah hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, aur yeh silsila chalta rehta hai. Fibonacci sequence ko 13th century ke Italian mathematician Leonardo Fibonacci ne introduce kiya tha. Is sequence ko natural phenomena, architecture, aur art mein bhi observe kiya gaya hai. Financial markets mein, yeh sequence aur is se derived ratios kaafi useful hote hain, especially for predicting price movements.

Fibonacci Ratios

Is sequence se kuch important ratios derive hoti hain, jaise ke 23.6%, 38.2%, 50%, 61.8%, aur 100%. Yeh ratios financial markets mein important support aur resistance levels identify karne ke liye use hoti hain. For example, 61.8% ratio ko golden ratio bhi kaha jata hai aur yeh nature mein bhi kaafi commonly dekhi jati hai. Yeh ratios traders ko market movements ko samajhne aur unke trading decisions ko enhance karne mein madad karte hain.

Fibonacci Retracement ka Concept

Fibonacci retracement ka concept yeh hai ke market trend ke against retrace karti hai aur phir wapas apni original direction mein move karti hai. In retracement points ko identify karne ke liye Fibonacci levels use kiye jate hain. Jab market ek significant move karti hai, toh yeh levels predict karte hain ke market kahaan tak retrace kar sakti hai pehle ke phir se apni original trend ko continue kare. Yeh retracement levels market participants ke behavior aur sentiment ko reflect karte hain.

23.6% Level

Yeh level indicate karta hai ke market apni move ka 23.6% retrace kar sakti hai. Yeh weak retracement level mana jata hai. Agar market is level par pause karti hai aur phir se apni original trend mein move karti hai, toh yeh indicate karta hai ke market mein strong momentum hai. Is level par traders short-term trading opportunities dekh sakte hain, magar yeh level akser itna reliable nahi hota jitna ke dusre higher retracement levels.

38.2% Level

Yeh level aik stronger retracement point hai jo indicate karta hai ke market apni previous move ka 38.2% retrace kar sakti hai. Yeh level akser strong support ya resistance provide karta hai. Jab market is level par pohanchti hai, toh kaafi traders is point ko monitor karte hain for potential trading opportunities. Is level par agar market bounce karti hai, toh yeh indicate karta hai ke market trend shayad wapas se continue karegi.

50% Level

50% level aik psychological level hai jo indicate karta hai ke market apni previous move ka aadha retrace kar sakti hai. Yeh level officially Fibonacci sequence ka part nahi hai, magar phir bhi trading mein kaafi commonly use hota hai. Yeh level traders ko potential reversal points identify karne mein madad karta hai. Agar market is level tak pohanchti hai aur phir se apni original trend mein move karti hai, toh yeh strong confirmation hota hai ke market trend intact hai.

61.8% Level

Yeh level kaafi important mana jata hai kyunki yeh golden ratio bhi kehlata hai. Market is level par akser apni direction wapas le sakti hai. Is level par kaafi strong support ya resistance dekhi jati hai. Agar market is level tak retrace karti hai aur phir bounce karti hai, toh yeh indicate karta hai ke market mein significant buying ya selling interest hai. Yeh level traders ke liye kaafi important hota hai aur akser significant price action dekha jata hai.

100% Level

Yeh level indicate karta hai ke market ne apni previous move ka pura retracement kar liya hai aur phir se apni original direction mein move kar sakti hai. Is level par market akser apni previous high ya low ko test karti hai. Agar market is level ko breach karti hai, toh yeh akser indicate karta hai ke market ek naya trend initiate kar sakti hai. Traders is level ko closely monitor karte hain for potential breakout ya reversal signals.

Fibonacci Retracement ko Plot Karna

Fibonacci retracement levels plot karne ke liye, trader ko ek significant high aur low point select karna padta hai. Yeh points market trend ke according select kiye jate hain. Ek uptrend mein, low point se high point tak levels plot kiye jate hain, aur downtrend mein, high point se low point tak levels plot kiye jate hain. Yeh levels market ke potential retracement points ko highlight karte hain aur traders ko potential trading opportunities identify karne mein madad karte hain.

Uptrend Mein Levels Plot Karna

Uptrend mein, low point se high point tak retracement levels plot kiye jate hain taake potential support levels identify kiye ja sakein. Yeh levels indicate karte hain ke market kahaan tak retrace kar sakti hai pehle ke phir se apni upward trend ko continue kare. Uptrend mein, yeh levels support ke tor par act karte hain aur traders ko potential buying opportunities identify karne mein madad karte hain. Agar market retracement level par support paati hai aur phir se upar move karti hai, toh yeh bullish signal hota hai.

Downtrend Mein Levels Plot Karna

Downtrend mein, high point se low point tak retracement levels plot kiye jate hain taake potential resistance levels identify kiye ja sakein. Yeh levels indicate karte hain ke market kahaan tak retrace kar sakti hai pehle ke phir se apni downward trend ko continue kare. Downtrend mein, yeh levels resistance ke tor par act karte hain aur traders ko potential selling opportunities identify karne mein madad karte hain. Agar market retracement level par resistance paati hai aur phir se neeche move karti hai, toh yeh bearish signal hota hai.

Support aur Resistance Levels

Fibonacci retracement levels ko use karke, traders potential support aur resistance levels identify kar sakte hain. Yeh levels trading decisions mein kaafi madadgar hote hain. Jab market ek retracement level par pohanchti hai, toh yeh akser temporary pause ya reversal indicate karte hain. Yeh levels market participants ke behavior ko reflect karte hain aur trading strategies ko enhance karne mein madadgar hote hain. Strong support aur resistance levels traders ko better entry aur exit points identify karne mein madad karte hain.

Entry Points Identify Karna

Fibonacci retracement levels traders ko potential entry points identify karne mein madad karte hain. Jab market kisi retracement level par pohanchti hai, traders entry ki opportunity dekh sakte hain. Uptrend mein, retracement levels buying opportunities provide karte hain jab market support par paunchti hai. Downtrend mein, retracement levels selling opportunities provide karte hain jab market resistance par paunchti hai. Accurate entry points traders ko better risk-reward ratio achieve karne mein madadgar hote hain.

Stop Loss Levels

Traders apne stop loss orders bhi Fibonacci levels ke kareeb place karte hain taake apne risk ko manage kar sakein. Yeh levels potential reversal points indicate karte hain aur stop loss orders ko place karne mein madadgar hote hain. Uptrend mein, stop loss orders retracement levels ke neeche place kiye jate hain aur downtrend mein, retracement levels ke upar. Is tarah se, agar market against move karti hai, toh traders apne loss ko limit kar sakte hain aur capital ko protect kar sakte hain.

Profit Targets

Fibonacci extension levels use karke, traders apne profit targets bhi identify kar sakte hain. Yeh extension levels market ke potential future move ko predict karte hain. For example, agar market uptrend mein 100% retracement level ko breach karti hai, toh next potential target 161.8% extension level hota hai. Extension levels traders ko better exit points identify karne mein madad karte hain aur profit booking ke liye effective strategies develop karne mein madadgar hote hain.

Trend Confirmation

Fibonacci retracement levels use karke, traders apne trend analysis ko confirm kar sakte hain. Agar market retracement level se bounce karti hai, toh yeh trend continuation ka signal ho sakta hai. Uptrend mein, retracement levels par support milna bullish trend ka confirmation hota hai. Downtrend mein, retracement levels par resistance milna bearish trend ka confirmation hota hai. Yeh confirmation signals traders ko better trading decisions lene mein madadgar hote hain aur market trends ko accurately analyze karne mein help karte hain.

Combining with Other Tools

Fibonacci retracement levels ko dusre technical analysis tools ke sath combine karna trading strategies ko aur bhi strong bana sakta hai. For example, moving averages, trend lines, aur candlestick patterns ke sath combine karke, traders apne analysis ko enhance kar sakte hain. Yeh combination trading signals ko confirm karne mein madadgar hota hai aur better trading opportunities identify karne mein help karta hai. Combining tools se traders ko more reliable trading setups milte hain aur trading success ko enhance karne mein madad milti hai.

Practice aur Experience

Fibonacci retracement levels use karne mein practice aur experience kaafi zaroori hain. Market dynamics ko samajhna aur accurate levels plot karna waqt ke sath aata hai. Beginners ko initially demo accounts par practice karni chahiye taake woh Fibonacci levels ko effectively use karna seekh sakein. Jaise jaise experience barhta hai, traders market movements ko better analyze karne aur accurate trading decisions lene mein expert ho jate hain. Regular practice aur continuous learning se Fibonacci retracement levels ka use kaafi effective ban jata hai.

Conclusion

Fibonacci retracement levels forex trading mein aik powerful tool hain jo traders ko market moves ko samajhne aur accurate trading decisions lene mein madad karte hain. In levels ko sahi tarike se use karke, traders apni trading performance ko improve kar sakte hain. Yeh levels potential support aur resistance points ko highlight karte hain aur trading strategies ko enhance karne mein madadgar hote hain. Accurate entry aur exit points, risk management, aur profit targets identify karne ke liye Fibonacci retracement levels ka use trading success ke liye kaafi important hota hai. Regular practice aur dusre technical tools ke sath combination se traders ko better trading results milte hain aur market trends ko effectively analyze karne mein madad milti hai. -

#9 Collapse

Fibonacci Series Aur Uska Forex Mein Istemaal

Fibonacci series ek mathematical sequence hai jo forex trading mein price movement aur reversal points ko samajhne ke liye use hoti hai. Is series mein har number apne pichle do numbers ka sum hota hai, jaise ke 0, 1, 1, 2, 3, 5, 8, 13, aur is tarah aage.

Forex trading mein Fibonacci sequence ke ratios ko use karke retracement levels calculate kiye jate hain. In ratios mein 23.6%, 38.2%, 50%, 61.8%, aur 100% shamil hain. Yeh ratios market ke psychological levels ko reflect karte hain jahan price move karke wapas apne trend ko follow kar sakta hai.

Retracement Levels Ka Taaruf

Fibonacci retracement levels mein commonly 23.6%, 38.2%, 50%, 61.8%, aur 100% levels shamil hote hain. Yeh levels market trends ke beech mein potential reversal points ko indicate karte hain. Jab bhi market kisi trend ko follow karta hai, to yeh retracement levels use karke predict kiya jata hai ke price wapas trend ki taraf move kar sakta hai ya nahi.

For example, agar ek uptrend hai aur price 61.8% retracement level tak wapas aata hai, to yeh ek potential buying opportunity ho sakti hai, kyunke yeh level ek strong support level ka kaam kar sakta hai.

Historical Background

Fibonacci sequence ko pehli martaba 13th century ke Italian mathematician Leonardo Fibonacci ne introduce kiya. Yeh sequence uske kitab "Liber Abaci" mein mention hui thi, jo 1202 mein publish hui thi. Fibonacci ne yeh sequence rabbits ke breeding ke problem ko solve karte hue discover ki thi, lekin aaj yeh sequence har field mein use hoti hai, including financial markets.

Financial markets mein Fibonacci sequence ka istimaal 1970s ke baad popular hua jab traders ne dekha ke yeh ratios market trends aur reversal points ko accurately predict kar sakte hain.

Calculating Fibonacci Levels

Fibonacci retracement levels ko calculate karne ke liye pehle high aur low points ko identify kiya jata hai. Agar market ek uptrend mein hai, to low point se high point tak ki distance ko calculate kiya jata hai. Fir in distances ko Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, aur 100%) ke saath multiply karke retracement levels nikalte hain.

For example, agar low point $100 aur high point $200 hai, to 50% retracement level $150 par hoga. Yeh levels traders ko potential support aur resistance levels identify karne mein madad karte hain.

Importance of 61.8% Level

61.8% retracement level ko golden ratio bhi kaha jata hai aur yeh bohot significant hota hai trading mein. Yeh ratio naturally occurring proportions ko reflect karta hai jo ke art, architecture, aur nature mein bhi paye jate hain.

Trading mein 61.8% level ko is liye significant mana jata hai kyunke yeh level market psychology ko strongly influence karta hai. Jab price is level par pohanchti hai, to bohot se traders isko ek strong support ya resistance level ke taur par dekhte hain aur apne trades ko adjust karte hain.

Profit Targets

Fibonacci extension levels use karke, traders apne profit targets bhi identify kar sakte hain. Yeh extension levels market ke potential future move ko predict karte hain. For example, agar market uptrend mein 100% retracement level ko breach karti hai, toh next potential target 161.8% extension level hota hai. Extension levels traders ko better exit points identify karne mein madad karte hain aur profit booking ke liye effective strategies develop karne mein madadgar hote hain.

Trend Confirmation

Fibonacci retracement levels use karke, traders apne trend analysis ko confirm kar sakte hain. Agar market retracement level se bounce karti hai, toh yeh trend continuation ka signal ho sakta hai. Uptrend mein, retracement levels par support milna bullish trend ka confirmation hota hai. Downtrend mein, retracement levels par resistance milna bearish trend ka confirmation hota hai. Yeh confirmation signals traders ko better trading decisions lene mein madadgar hote hain aur market trends ko accurately analyze karne mein help karte hain.

Combining with Other Tools

Fibonacci retracement levels ko dusre technical analysis tools ke sath combine karna trading strategies ko aur bhi strong bana sakta hai. For example, moving averages, trend lines, aur candlestick patterns ke sath combine karke, traders apne analysis ko enhance kar sakte hain. Yeh combination trading signals ko confirm karne mein madadgar hota hai aur better trading opportunities identify karne mein help karta hai. Combining tools se traders ko more reliable trading setups milte hain aur trading success ko enhance karne mein madad milti hai.

Practice aur Experience

Fibonacci retracement levels use karne mein practice aur experience kaafi zaroori hain. Market dynamics ko samajhna aur accurate levels plot karna waqt ke sath aata hai. Beginners ko initially demo accounts par practice karni chahiye taake woh Fibonacci levels ko effectively use karna seekh sakein. Jaise jaise experience barhta hai, traders market movements ko better analyze karne aur accurate trading decisions lene mein expert ho jate hain. Regular practice aur continuous learning se Fibonacci retracement levels ka use kaafi effective ban jata hai. -

#10 Collapse

Fibonacci retracement levels trading ki duniya mein aik mashhoor technique hai jo traders ko market trends aur potential reversal points identify karne mein madad deti hai. Ye technique Italy ke mashhoor mathematician Leonardo Fibonacci ke mathematical principles par mabni hai, jo unho ne 13th century mein introduce kiye the. Fibonacci retracement levels ka use kar ke, traders market mein support aur resistance levels identify kar sakte hain, jo unhe trading decisions lenay mein madadgar sabit hote hain.

Fibonacci sequence aik mathematical sequence hai jo ke 0 aur 1 se shuru hoti hai, aur ismein har number us se pehle do numbers ka sum hota hai. Sequence kuch is tarah hoti hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, aur yeh silsila yeh taraqqi karta rehta hai. Fibonacci sequence mein kuch khas ratios bhi hoti hain jo ke trading mein bohot important hoti hain. In mein se kuch important ratios hain: 23.6%, 38.2%, 50%, 61.8%, aur 100%.

In ratios ko trading charts par apply karne se humein Fibonacci retracement levels milte hain. Yeh levels humein market mein potential support aur resistance points identify karne mein madad deti hain.

Fibonacci Retracement Levels ka Formula aur Calculation

Fibonacci retracement levels calculate karne ke liye, pehle humein market mein high aur low points identify karne padte hain. Yeh points usually recent trend ke extremes hote hain. Us ke baad humein yeh steps follow karne padte hain:- High aur Low Points Identify karna: Pehle market ka high aur low point note karein.

- Retracement Levels Calculate karna: High aur low points ke darmiyan distance calculate kar ke, is distance ko Fibonacci ratios se multiply karein.

- Retracement Lines Draw karna: Jo values aap ne calculate ki hain, unhein chart par draw karein.

- 23.6% retracement level: 50 * 0.236 = 11.8

- 38.2% retracement level: 50 * 0.382 = 19.1

- 50% retracement level: 50 * 0.5 = 25

- 61.8% retracement level: 50 * 0.618 = 30.9

- 23.6% level: 50 + 11.8 = 61.8

- 38.2% level: 50 + 19.1 = 69.1

- 50% level: 50 + 25 = 75

- 61.8% level: 50 + 30.9 = 80.9

Fibonacci Retracement Levels ka Practical Istemaal

Trading mein Fibonacci retracement levels ko kai tarikon se use kiya ja sakta hai:

Trend Reversal Identify karna

Fibonacci retracement levels trend reversal points ko identify karne mein madadgar hote hain. Agar market uptrend mein hai aur phir decline hone lagti hai, to yeh levels humein batate hain ke decline kahaan tak ja sakti hai aur wahan se market dobara upar ja sakti hai. Is tarah se, traders potential buying opportunities identify kar sakte hain.

Entry aur Exit Points

Fibonacci retracement levels entry aur exit points decide karne mein bhi madadgar hote hain. Agar aapko lagta hai ke market kisi certain retracement level par support le sakti hai, to aap wahan buy order place kar sakte hain. Waisa hi, agar aapko lagta hai ke market kisi resistance level par pahunch kar wapis niche aa sakti hai, to wahan aap sell order place kar sakte hain.

Stop-Loss aur Take-Profit Levels

Trading mein risk management bohot zaroori hota hai. Fibonacci retracement levels ko use kar ke aap apne stop-loss aur take-profit levels bhi decide kar sakte hain. Agar aap buy trade enter kar rahe hain, to aap apna stop-loss nearest retracement level ke niche aur take-profit agle level par set kar sakte hain.

Confirming Other Indicators

Fibonacci retracement levels ko doosre technical indicators ke sath combine karna trading strategies ko aur bhi mazboot bana sakta hai. Indicators jaise ke moving averages, RSI, aur MACD ko Fibonacci levels ke sath use kar ke aap trading decisions ko aur bhi validate kar sakte hain.

Example

Aik misaal se samajhte hain ke kaise Fibonacci retracement levels ko trading mein use kiya ja sakta hai:

Misaal ke taur par, suppose karein ke aap kisi stock ka chart dekh rahe hain aur aapne dekha ke stock ne recent low 100 par aur recent high 200 par banaya hai. Aapko lagta hai ke market uptrend mein hai aur yeh ab correction phase mein aa sakti hai.- Aap 100 se 200 tak ki range note karte hain.

- Ab aap yeh range ko Fibonacci ratios se multiply karte hain:

- 23.6% retracement level: (200-100) * 0.236 = 23.6 + 100 = 123.6

- 38.2% retracement level: (200-100) * 0.382 = 38.2 + 100 = 138.2

- 50% retracement level: (200-100) * 0.5 = 50 + 100 = 150

- 61.8% retracement level: (200-100) * 0.618 = 61.8 + 100 = 161.8

Fibonacci Retracement Levels ki Limitations

Fibonacci retracement levels trading mein bohot useful tool hain, magar inki kuch limitations bhi hain jo traders ko samajhni chahiyein:- Subjective Nature: High aur low points ka selection subjective hota hai aur yeh trader ke experience aur understanding par depend karta hai.

- Market Conditions: Fibonacci retracement levels hamesha accurate nahi hote. Market conditions, news events, aur doosre factors in levels ko influence kar sakte hain.

- Over-Reliance: Sirf Fibonacci retracement levels par rely karna risky ho sakta hai. Inhe doosre technical indicators ke sath combine kar ke use karna chahiye.

Fibonacci retracement levels ko samajh kar aur effectively use kar ke, aap apni trading strategies ko aur bhi mazboot aur profitable bana sakte hain. Trading mein hamesha risk management ka khayal rakhein aur over-reliance se bachne ki koshish karein. In sab baaton ko madde nazar rakhte hue, Fibonacci retracement levels aapko successful trading journey mein madadgar sabit ho sakte hain.Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#11 Collapse

Fibonacci Retracement Levels Kya Hain? Forex Trade Mein

1. Fibonacci Retracement Ka Taaruf

Fibonacci retracement levels trading aur technical analysis mein aik aham concept hain. Ye levels market ke price movements ke dauran potential reversal points ko identify karne ke liye use kiye jate hain. Iska mtlb yeh hai ke jab price kisi trend ke dauran move karti hai, toh yeh retracement levels possible points hain jahan price temporary reversal ya correction le sakti hai. Traders in levels ko monitor karke apne trading decisions ko guide karte hain, aur yeh levels unko entry aur exit points identify karne mein madad dete hain.

2. Fibonacci Series Ka Khulasa

Fibonacci series aik numerical sequence hai jo mathematician Leonardo Fibonacci ne introduce kiya tha. Is sequence mein har number pichle do numbers ka sum hota hai. Sequence ka shuruat 0 aur 1 se hota hai, aur uske baad aage ka sequence is tarah se hota hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, aur aise hi chalta rehta hai. Fibonacci sequence ke numbers financial markets mein price retracements ko analyze karne ke liye use kiye jate hain.

3. Forex Trading Mein Fibonacci Retracement Ka Istemaal

Forex trading mein, Fibonacci retracement levels ko market ki price movements ke dauran potential support aur resistance levels identify karne ke liye use kiya jata hai. Traders yeh levels isliye monitor karte hain kyunke yeh levels price movements ke natural patterns ko reflect karte hain. Fibonacci retracement levels ka use karke, traders future price movements ko predict kar sakte hain aur better trading decisions le sakte hain.

4. Major Fibonacci Retracement Levels

Fibonacci retracement levels market analysis mein kuch specific levels ko define karte hain jo traders ke liye important hote hain. In major levels mein shamil hain:- 23.6% Level: Yeh level choti price corrections ke liye use hota hai. Jab price kisi trend ke dauran ek choti si reversal le, toh yeh level us reversal ko indicate karta hai.

- 38.2% Level: Yeh medium-term price corrections ke liye use hota hai. Yeh level moderate support ya resistance points ko indicate karta hai.

- 50% Level: Yeh level ek psychological level hai jahan price ka zyada chance hota hai ke wapas reversal aaye. Yeh level technical analysis mein aik significant level ke roop mein dekha jata hai.

- 61.8% Level: Yeh level Fibonacci series ka "golden ratio" kehlata hai aur major support ya resistance points ko identify karne mein madad karta hai.

- 76.4% Level: Yeh level deep retracements ko indicate karta hai aur price ke substantial reversal points ko identify karne mein madad karta hai.

5. 23.6% Level

23.6% retracement level ko choti price corrections aur minor support aur resistance points identify karne ke liye use kiya jata hai. Jab price kisi strong trend ke dauran choti si correction le, toh 23.6% level us correction ka potential reversal point hota hai. Is level ko monitor karke traders yeh identify kar sakte hain ke price kis direction mein move kar sakti hai.

6. 38.2% Level

38.2% level ko medium-term retracement point ke roop mein dekha jata hai. Yeh level moderate support ya resistance points ko indicate karta hai aur price movements ke analysis mein aik ahem role play karta hai. Agar price kisi trend ke dauran 38.2% level tak retrace hoti hai, toh traders is level ko dekh kar decide kar sakte hain ke kya price wapas trend direction mein move karegi ya reverse hogi.

7. 50% Level

50% retracement level ko aik psychological level ke roop mein dekha jata hai. Yeh level trading decisions ke liye aik key point hota hai, kyunke yeh level market participants ke liye ek significant point hota hai. Agar price 50% level tak retrace hoti hai, toh yeh traders ko yeh indicate karta hai ke price wapas trend direction mein move karne ka chance hai.

8. 61.8% Level

61.8% retracement level ko "golden ratio" ke roop mein jaana jata hai. Yeh level major support ya resistance points ko identify karne mein madad karta hai aur price movements ke analysis mein aik significant level hota hai. Agar price kisi strong trend ke dauran 61.8% level tak retrace hoti hai, toh yeh level aik critical point hota hai jahan price reversal ya continuation ka decision liya ja sakta hai.

9. 76.4% Level

76.4% retracement level ko deep retracement points identify karne ke liye use kiya jata hai. Yeh level price movements ke analysis mein aik important level hota hai aur deep retracements ko identify karne mein madad karta hai. Agar price 76.4% level tak retrace hoti hai, toh yeh level traders ko yeh indicate karta hai ke price mein substantial reversal ka potential hai.

10. Fibonacci Levels Ka Calculation Kaise Karein?

Fibonacci retracement levels calculate karne ke liye, aapko recent high aur low price points ko use karna hota hai. Sabse pehle, aapko market ka recent high aur low points identify karna hota hai. Uske baad, aap in points ke beech ka difference calculate karte hain aur us difference ko Fibonacci levels ke respective percentages se multiply karte hain. In values ko subtract karke retracement levels ko plot kiya jata hai.

11. How To Draw Fibonacci Retracement Levels?

Fibonacci retracement levels draw karne ke liye, aapko charting software ya trading platform par Fibonacci retracement tool select karna hota hai. Chart par recent high aur low points ko select karne ke baad, tool automatically retracement levels ko plot kar deta hai. Traders in levels ko visualize karke potential support aur resistance points ko identify karte hain aur apne trading decisions ko guide karte hain.

12. Fibonacci Retracement Aur Trend Analysis

Fibonacci retracement levels ko trend analysis ke sath combine karna trading decisions ko improve kar sakta hai. Trend analysis mein aap market ke overall direction ko samajhne ki koshish karte hain aur Fibonacci levels ko us direction ke sath match karte hain. Agar trend analysis ke sath Fibonacci levels confirm karte hain, toh yeh stronger trading signals provide karte hain aur better decision-making ko facilitate karte hain.

13. Fibonacci Levels Aur Market Psychology

Fibonacci retracement levels market psychology ko reflect karte hain, kyunke traders aur investors in levels ko significant points ke roop mein dekhtay hain. Market participants often react to these levels, aur yeh levels market mein psychological barriers create karte hain. Jab price Fibonacci levels ke aas paas hoti hai, toh traders ka behavior aur trading decisions bhi in levels ke influence se shape hotay hain.

14. Fibonacci Levels Ka Reliability

Fibonacci retracement levels ki reliability market conditions aur price volatility par depend karti hai. Jab market stable aur trending hoti hai, toh Fibonacci levels zyada reliable ho sakte hain. Lekin, high volatility ya sideways market conditions ke dauran, yeh levels less reliable ho sakte hain aur false signals generate kar sakte hain.

15. Combining Fibonacci With Other Indicators

Fibonacci retracement levels ko dusre technical indicators ke sath combine karna trading decisions ko aur bhi accurate bana sakta hai. For example, moving averages, Relative Strength Index (RSI), aur MACD (Moving Average Convergence Divergence) ko Fibonacci levels ke sath combine karke, traders market ki overall strength aur trend direction ko better samajh sakte hain.

16. Fibonacci Levels Ka Limitations

Fibonacci retracement levels ke kuch limitations bhi hain. Kabhi kabhi yeh levels false signals generate kar sakte hain aur market ke actual movements ko accurately reflect nahi karte. Isliye, traders ko in levels ko sirf aik tool ke roop mein use karna chahiye aur dusre analysis methods aur indicators ko bhi consider karna chahiye.

17. Common Mistakes In Using Fibonacci Levels

Fibonacci levels use karte waqt kuch common mistakes se bachna chahiye. Aksar traders in levels ko over-rely karte hain aur market conditions ko accurately consider nahi karte. Incorrect placement of Fibonacci levels aur improper use of multiple time frames bhi common mistakes hain. Yeh mistakes trading decisions ko impact kar sakti hain aur losses ka risk badha sakti hain.

18. Real-Life Example

Ek real-life example se Fibonacci retracement levels ki effectiveness ko samjha ja sakta hai. Maan lijiye ke ek currency pair, jaise EUR/USD, strong uptrend ke dauran move kar rahi hai aur aap 50% aur 61.8% retracement levels ko monitor karte hain. Agar price 50% level ke aas paas ek significant reversal show karti hai, toh yeh level aapko potential buying opportunity indicate kar sakta hai.

19. Conclusion

Fibonacci retracement levels Forex trading mein aik valuable tool hain jo price movements ko samajhne aur trading decisions ko improve karne mein madadgar sabit hote hain. In levels ka use karke, traders market ki potential reversal points ko identify kar sakte hain aur apne trades ko effectively manage kar sakte hain. Lekin, in levels ko sirf aik tool ke roop mein use karna chahiye aur market conditions aur dusre indicators ko bhi consider karna chahiye.

Yeh detailed article aapko Fibonacci retracement levels ke baare mein comprehensive understanding provide karta hai aur aapki trading strategies ko enhance karne mein madadgar sabit ho sakta hai. -

#12 Collapse

**What is the Fibonacci Retracement Levels?**

Fibonacci retracement levels trading ke mehsoor tools hain jo traders ko markets ke technical analysis mein madad dete hain. Ye levels Italian mathematician Leonardo Fibonacci ki numbers se derived hain, jo natural phenomena aur proportions ko explain karte hain. Fibonacci sequence 0 se shuru hota hai aur har number pichle do numbers ka sum hota hai, jaise: 0, 1, 1, 2, 3, 5, 8, 13, aur aise hi aage.

Fibonacci retracement levels markets mein potential support aur resistance zones ko identify karne ke liye use kiye jaate hain. Ye levels typical ratios par based hote hain jo Fibonacci sequence ke numbers ke darmiyan calculate hote hain, jaise: 23.6%, 38.2%, 50%, 61.8%, aur 100%. Inhe charts par plot karke, traders market ki direction aur potential reversal points ko samajhne ki koshish karte hain.

**Fibonacci Retracement Levels Kaise Kaam Karte Hain?**

Fibonacci retracement levels ko use karne ke liye, pehle aapko price movement ka range select karna hota hai, jo ek high se low tak ya low se high tak hota hai. Phir aap in levels ko is range par plot karte hain. Ye levels aapko batate hain ke price kahaan kahaan se reverse ya bounce ho sakti hai.

### **Important Levels:**

1. **23.6% Level:** Ye level typically minor retracement ke liye dekha jata hai aur often market mein choti choti corrections ko represent karta hai.

2. **38.2% Level:** Ye ek strong retracement level hai jahan price significant support ya resistance face kar sakti hai.

3. **50% Level:** Although Fibonacci sequence mein nahi hai, magar ye level psychological hota hai aur market mein bht bara role play karta hai.

4. **61.8% Level:** Is level ko golden ratio bhi kaha jata hai aur ye market ke liye ek major retracement point hota hai.

5. **100% Level:** Iska matlab hota hai ke price apni poori range ko retrace kar chuki hai aur yahan se ya to breakout ho sakta hai ya fir reverse.

### **Fibonacci Retracement Levels ka Use**

Traders in levels ko trading strategies ke liye use karte hain, jaise ke:

- **Entry aur Exit Points:** In levels ke madad se traders apne entry aur exit points ko decide karte hain.

- **Stop Loss Placement:** Fibonacci levels ko stop loss set karne ke liye use kiya ja sakta hai, taake potential losses ko minimize kiya ja sake.

- **Target Levels:** Profit targets ko set karne mein bhi ye levels madadgar hote hain.

**Kya In Levels Ko Akela Use Karna Chahiye?**

Fibonacci retracement levels ko hamesha doosri technical analysis tools, jaise ke trend lines, moving averages, aur candlestick patterns ke saath mila ke use karna chahiye. Ye levels kisi bhi trading strategy ka hissa hone chahiye, lekin inhe akela rely nahi karna chahiye kyunke market ki dynamics complex hoti hain aur inhe alag se dekhna mushkil hota hai.

Akhir mein, Fibonacci retracement levels ek powerful tool hain jo traders ko market analysis mein help karte hain, lekin inka sahi istemal aur dusri tools ke saath integration zaroori hai taake trading decisions mehnat aur soch samajh kar liye ja sakein. -

#13 Collapse

Fibonacci Retracement Levels Kya Hain? Forex Trade Mein

1. Fibonacci Retracement Ka Taaruf

Fibonacci retracement levels trading aur technical analysis mein aik aham concept hain. Ye levels market ke price movements ke dauran potential reversal points ko identify karne ke liye use kiye jate hain. Iska mtlb yeh hai ke jab price kisi trend ke dauran move karti hai, toh yeh retracement levels possible points hain jahan price temporary reversal ya correction le sakti hai. Traders in levels ko monitor karke apne trading decisions ko guide karte hain, aur yeh levels unko entry aur exit points identify karne mein madad dete hain.

2. Fibonacci Series Ka Khulasa

Fibonacci series aik numerical sequence hai jo mathematician Leonardo Fibonacci ne introduce kiya tha. Is sequence mein har number pichle do numbers ka sum hota hai. Sequence ka shuruat 0 aur 1 se hota hai, aur uske baad aage ka sequence is tarah se hota hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, aur aise hi chalta rehta hai. Fibonacci sequence ke numbers financial markets mein price retracements ko analyze karne ke liye use kiye jate hain.

3. Forex Trading Mein Fibonacci Retracement Ka Istemaal

Forex trading mein, Fibonacci retracement levels ko market ki price movements ke dauran potential support aur resistance levels identify karne ke liye use kiya jata hai. Traders yeh levels isliye monitor karte hain kyunke yeh levels price movements ke natural patterns ko reflect karte hain. Fibonacci retracement levels ka use karke, traders future price movements ko predict kar sakte hain aur better trading decisions le sakte hain.

4. Major Fibonacci Retracement Levels

Fibonacci retracement levels market analysis mein kuch specific levels ko define karte hain jo traders ke liye important hote hain. In major levels mein shamil hain:- 23.6% Level: Yeh level choti price corrections ke liye use hota hai. Jab price kisi trend ke dauran ek choti si reversal le, toh yeh level us reversal ko indicate karta hai.

- 38.2% Level: Yeh medium-term price corrections ke liye use hota hai. Yeh level moderate support ya resistance points ko indicate karta hai.

- 50% Level: Yeh level ek psychological level hai jahan price ka zyada chance hota hai ke wapas reversal aaye. Yeh level technical analysis mein aik significant level ke roop mein dekha jata hai.

- 61.8% Level: Yeh level Fibonacci series ka "golden ratio" kehlata hai aur major support ya resistance points ko identify karne mein madad karta hai.

- 76.4% Level: Yeh level deep retracements ko indicate karta hai aur price ke substantial reversal points ko identify karne mein madad karta hai.

5. 23.6% Level

23.6% retracement level ko choti price corrections aur minor support aur resistance points identify karne ke liye use kiya jata hai. Jab price kisi strong trend ke dauran choti si correction le, toh 23.6% level us correction ka potential reversal point hota hai. Is level ko monitor karke traders yeh identify kar sakte hain ke price kis direction mein move kar sakti hai.

Fibonacci Retracement Levels ka Practical Istemaal

Trading mein Fibonacci retracement levels ko kai tarikon se use kiya ja sakta hai:

Trend Reversal Identify karna

Fibonacci retracement levels trend reversal points ko identify karne mein madadgar hote hain. Agar market uptrend mein hai aur phir decline hone lagti hai, to yeh levels humein batate hain ke decline kahaan tak ja sakti hai aur wahan se market dobara upar ja sakti hai. Is tarah se, traders potential buying opportunities identify kar sakte hain.

Entry aur Exit Points

Fibonacci retracement levels entry aur exit points decide karne mein bhi madadgar hote hain. Agar aapko lagta hai ke market kisi certain retracement level par support le sakti hai, to aap wahan buy order place kar sakte hain. Waisa hi, agar aapko lagta hai ke market kisi resistance level par pahunch kar wapis niche aa sakti hai, to wahan aap sell order place kar sakte hain.

Stop-Loss aur Take-Profit Levels

Trading mein risk management bohot zaroori hota hai. Fibonacci retracement levels ko use kar ke aap apne stop-loss aur take-profit levels bhi decide kar sakte hain. Agar aap buy trade enter kar rahe hain, to aap apna stop-loss nearest retracement level ke niche aur take-profit agle level par set kar sakte hain.

Confirming Other Indicators

Fibonacci retracement levels ko doosre technical indicators ke sath combine karna trading strategies ko aur bhi mazboot bana sakta hai. Indicators jaise ke moving averages, RSI, aur MACD ko Fibonacci levels ke sath use kar ke aap trading decisions ko aur bhi validate kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#14 Collapse

# What is the Fibonacci Retracement Levels?

Fibonacci retracement levels ek popular technical analysis tool hain, jo traders ko price corrections aur potential reversal points ko samajhne mein madad karte hain. Ye levels Fibonacci sequence par based hote hain, jo ek mathematical series hai. Is post mein hum Fibonacci retracement levels ki definition, calculation, aur trading strategies par nazar dalenge.

### Fibonacci Sequence Ki Samajh

Fibonacci sequence ek series hai jisme har number pehle do numbers ka sum hota hai. Ye series is tarah se shuru hoti hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, aur aise hi aage barhti hai. Is sequence se kuch key ratios derive hote hain, jaise 23.6%, 38.2%, 50%, 61.8%, aur 100%, jo trading mein istamal hote hain.

### Fibonacci Retracement Levels Ki Definition

Fibonacci retracement levels wo horizontal lines hain jo key Fibonacci ratios par draw ki jaati hain, jisse traders price movements ke potential support aur resistance levels ko identify kar sakte hain. Ye levels price ke pullbacks ya corrections ke dauran trading decisions lene mein madadgar hote hain.

### Calculation Ka Tareeqa

Fibonacci retracement levels ko calculate karne ke liye, aapko price chart par do extreme points, yani high aur low ko identify karna hota hai. Phir, aap in levels ko in ratios ke mutabiq calculate karte hain:

1. **Identify High and Low**: Price chart par recent high aur low points ko identify karein.

2. **Calculate Range**: High aur low ke beech ka difference nikaalein.

3. **Apply Fibonacci Ratios**: Is difference ko Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%) se multiply karke retracement levels ko nikaalain.

4. **Draw Levels**: In levels ko price chart par draw karein, jo aapko potential reversal points dikhayenge.

### Trading Strategies

1. **Support and Resistance**: Fibonacci levels ko support aur resistance points ke tor par dekha ja sakta hai. Agar price kisi level par bounce karti hai, to ye potential reversal signal ho sakta hai.

2. **Entry and Exit Points**: Traders in levels ka istemal entry aur exit points identify karne ke liye karte hain. Agar price retracement level par aati hai aur wahan se bounce hoti hai, to ye buy opportunity ho sakti hai.

3. **Combining with Other Indicators**: Fibonacci retracement levels ko dusre technical indicators, jaise moving averages ya RSI ke sath combine karke trading strategies ko enhance kiya ja sakta hai.

### Conclusion

Fibonacci retracement levels Forex trading mein ek valuable tool hain jo traders ko price corrections aur reversal points samajhne mein madad karte hain. Inka istemal sahi tarah se karke, aap apne trading decisions ko behtar bana sakte hain. Market analysis mein in levels ko shamil karna aapko informed decisions lene mein madad karega, jo aapki profitability ko barha sakta hai. Har trader ko in levels ko samajhna aur inka istemal karna seekhna chahiye, taake wo apne trading performance ko enhance kar saken.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

what Fibonacci retracement levels?

Fibonacci retracement levels forex, stocks, aur commodities trading mein aik bohat aham technical analysis tool hai. Yeh levels market ke price movements mein potential reversal points ko identify kerne mein madad detey hain. Fibonacci retracement ki madad se traders ko support aur resistance levels ka andaza hota hai, jis se woh sahi entry aur exit decisions le sakte hain.

• Fibonacci Sequence Aur Its Relevance

Fibonacci sequence aik mathematical series hai jismein numbers ka aisa silsila banta hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, ... Is sequence ke hisaab se, har number apnay pichlay do numbers ka jama hota hai. Traders believe kerte hain ke yeh natural ratios aur patterns nature mein paaye jate hain aur yeh financial markets mein bhi nazar aate hain. Fibonacci retracement levels in ratios ko use kerte hue, market ke price movements mein potential reversal areas ko identify kerte hain. Common Fibonacci ratios 23.6%, 38.2%, 50%, 61.8%, aur 78.6% shamil hotay hain. In ratios ko technical analysis mein support aur resistance ke important levels samjha jata hai.

• Definition of Fibonacci Retracement Levels

Fibonacci retracement levels woh horizontal lines hoti hain jo price chart par key support aur resistance zones ko represent karti hain. Yeh levels previous price move ke range ke andar calculate kiye jate hain aur unka objective yeh hota hai ke price retracement ke dauran, yaani ke reversal ya correction ke time, kin levels par support ya resistance mil sakta hai. Jab market ek strong trend ke baad temporarily reverse ya consolidate ker rahi hoti hai, to yeh Fibonacci levels potential turning points ke tor par kaam kerte hain.

• Calculation of Fibonacci Retracement Levels

Fibonacci retracement levels calculate kerne ke liye pehle aapko ek significant price move identify kerna hota hai, jese ke ek strong uptrend ya downtrend. Is move ke start point (low) aur end point (high) ko mark ker ke aap in levels ko plot kerte hain. Basic steps ye hain:

• Identify kerain ke price ne ek significant move complete ker liya hai.

• Apne chart par high aur low points mark kerain.

• In dono points ke darmiyan ke distance ka calculation kerain.

• Is distance ko Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, 78.6%) ke sath multiply ker ke horizontal lines draw kerain.

Is se aapko chart par potential retracement levels nazar aayenge, jinhein aap support ya resistance ke tor par use ker sakte hain.

• Interpretation of Fibonacci Retracement Levels

Fibonacci levels ko interpret kerna trading decisions ke liye bohot aham hai.

• Support Aur Resistance:

Jab price retrace ker rahi hoti hai, to yeh levels indicate kerte hain ke market kis had tak price reverse ker sakti hai. Agar price in levels par bounce ker jaye, to yeh support ka signal hota hai; aur agar price in levels ko break ker jaye, to yeh resistance ka signal ho sakta hai.

• Trend Reversal Indicators:

Agar market strong trend se reverse kerne lagti hai to Fibonacci levels potential reversal points ban jate hain. Misal ke taur par, agar price ek uptrend ke baad retrace ker ke 61.8% level par ruk jati hai, to yeh indicate ker sakta hai ke trend reversal hone wala hai.

• Entry Aur Exit Points:

Fibonacci retracement levels traders ko precise entry aur exit points provide kerte hain. Agar aap long position mein hain, to aap entry ko ek retracement level par consider ker sakte hain jab price support dikhaye. Wahi agar aap short position mein hain, to resistance levels aapke exit points ho sakte hain.

• Application in Forex Trading

Forex market mein Fibonacci retracement levels ko use kerna bohot common hai kyun ke forex market bohot volatile hota hai aur price corrections frequently hotay hain.

• Identifying Correction Levels:

Strong trends ke baad price corrections aam hotay hain. Fibonacci levels se aap andaza laga sakte hain ke price kin levels par retrace ker sakti hai.

• Combining with Other Indicators:

Fibonacci retracement levels ko doosray technical indicators jaise moving averages, RSI, aur MACD ke sath combine kerna chahiye. Agar multiple indicators ek hi retracement level ko confirm kerte hain, to entry aur exit decisions zyada reliable ho jate hain.

• Breakout Strategy:

Jab price in Fibonacci levels ko test ker ke break ker jati hai, to yeh breakout signal hota hai. Is scenario mein aap apni trade entry ko breakout point ke qareeb set ker sakte hain aur stop loss ko previous retracement level par lagakar risk manage ker sakte hain.

• Advantages of Using Fibonacci Retracement Levels

Fibonacci retracement levels ka use kerne ke kai faide hain:

• Clarity in Trend Reversals:

Yeh levels aapko clear indications dete hain ke market kab reverse ho sakti hai, jis se aap apni trading strategy ko adjust ker sakte hain.

• Objective Analysis:

Fibonacci ratios mathematically derived hotay hain, is liye yeh objective aur standardized levels provide kerte hain jo market ke subjective opinions se pare hote hain.

• Versatility:

Fibonacci retracement ko aap har market mein use ker sakte hain – forex, stocks, commodities, aur indices – jo isko bohot versatile banata hai.

• Risk Management:

Retracement levels aapko apne stop loss aur profit targets ko set kerne mein madad detey hain. Yeh levels market ke potential turning points ko highlight kerte hain, jis se aap risk ko effectively manage ker sakte hain.

• Integration with Other Tools:

Fibonacci retracement levels ko doosray indicators ke sath integrate kerna aapko detailed market analysis aur confirmation signals provide ker deta hai, jo entry aur exit decisions ko refine kerte hain.

• Limitations of Fibonacci Retracement Levels

Har technical indicator ke kuch limitations hotay hain, aur Fibonacci retracement bhi un se mehroom nahin hai:

• Subject to Interpretation:

Fibonacci levels ka selection aur drawing kabhi kabhi subjective ho sakta hai. Different traders alag alag high aur low points select kerte hain, jis se levels mein thora farq aa sakta hai.

• False Signals:

Market kabhi kabhi in levels ko test ker ke false breakouts ya pullbacks generate ker sakta hai. Is liye, additional confirmation tools ka istemal zaroori hai.

• Not Always Predictive:

Har market environment mein Fibonacci retracement effective nahin hota. Bahut volatile ya news-driven markets mein yeh levels accurate prediction nahin ker sakte.

• Lagging Nature:

Yeh indicator past price action par base hota hai, is liye real-time market conditions ke sath in ka thoda delay ho sakta hai.

• Practical Example in Forex Trading

Maan lijiye ke aap EUR/USD pair ka chart analyze ker rahe hain aur aap dekhte hain ke price ne recent high aur low form ker liya hai. Aap in points ko use ker ke Fibonacci retracement levels ko plot kerte hain – jese ke 23.6%, 38.2%, 50%, aur 61.8%. Agar price ek strong uptrend ke baad retrace ker ke 38.2% level par ruk jati hai aur phir wahan se bounce ker jati hai, to yeh support ka signal hai. Aap is point par long position enter ker sakte hain, stop loss ko 50% level ke neeche set ker sakte hain, aur profit target ko previous resistance level ke hisaab se define ker sakte hain. Is practical example se pata chalta hai ke Fibonacci retracement levels ko use ker ke aap market ke key turning points aur trend reversals ko identify ker sakte hain.

• Integrating Fibonacci Retracement with Other Indicators

Effective trading ke liye, Fibonacci retracement levels ko dusray technical indicators ke sath combine kerna bohot aham hai:

• Moving Averages:

Moving averages se overall trend ko confirm kerne mein madad milti hai. Agar moving average bullish trend dikhata hai aur Fibonacci retracement support level confirm ker deta hai, to yeh strong long entry signal hai.

• RSI (Relative Strength Index):

RSI se overbought ya oversold conditions ka andaza lagaya jata hai. Agar RSI oversold condition dikhata hai aur price Fibonacci support level par ruk jati hai, to yeh bullish reversal ka signal ho sakta hai.

• MACD (Moving Average Convergence Divergence):

MACD se momentum changes aur trend reversals ka signal milta hai. Agar MACD bullish crossover dikhata hai jab price retracement level ko test ker rahi ho, to yeh confirmation signal hai.

• Volume Analysis:

Breakout ya reversal ke dauran volume ka spike hona bhi confirmation provide ker deta hai ke market ke buyers ya sellers dominant hain.Fibonacci retracement levels forex trading mein ek bohot powerful technical analysis tool hai jo aapko market ke support aur resistance levels ko objectively identify kerne mein madad karta hai. Yeh levels, jo mathematically derived ratios par base hotay hain, aapko market ke potential reversal points aur retracement zones ka andaza detey hain. Agar aap is tool ko sahi tareeqe se use kerte hain, to aap apne entry aur exit points ko refine ker sakte hain, risk management ko improve ker sakte hain, aur overall trading decisions ko objective bana sakte hain. Lekin, Fibonacci retracement levels ko hamesha additional confirmation tools, jaise moving averages, RSI, MACD aur volume analysis ke sath integrate kerna chahiye, taake false signals se bach sakein.

Practical examples se yeh sabit hota hai ke jab price significant move complete ker ke retrace kerte hue in levels ko test ker rahi hoti hai, to woh market ke key turning points ko highlight ker deti hai. Consistent practice, proper backtesting aur disciplined approach se aap Fibonacci retracement levels ko apni trading strategy ka hissa bana ke sustainable aur profitable trading decisions le sakte hain. Ultimately, yeh tool aapki overall market analysis ko enhance kerne ke liye ek integral part ban jata hai, jis se aap apne trading journey ko zyada effective aur successful bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:54 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим