What's the Dark Cloud Cover pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What's the Dark Cloud Cover pattern -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Dark Cloud Cover Dark Cloud Cover pattern ek candlestick chart pattern hai jo market analysis mein istemal hota hai, khaas karke trend reversal ko pehchanne ke liye. Is pattern mein do consecutive candles shamil hote hain – pehla candle bullish hota hai, jo ke ek uptrend ko represent karta hai, aur dusra candle bearish hota hai, jo pehle candle ki kuch had tak cover karta hai. Dark Cloud Cover ka naam isiliye hai kyunki yeh market ke ujale trend ko andhere se cover kar deta hai. Yeh ek bearish reversal pattern hai aur traders ko indicate karta hai ke uptrend kamzor ho sakta hai aur ab bearish trend ka dominance aa sakta hai. Is pattern ki samajh ke liye, pehle candle ko samajhna zaroori hai. Pehla candle uptrend ko darust karta hai, indicating buyers ki strength ko. Lekin dusra candle jo ata hai, woh pehle candle ke upar open hota hai aur phir neeche aata hai, ek significant portion ko cover karte hue. Ismein hawaayein badal jaati hain aur sellers ka zor badhne lagta hai. Dark Cloud Cover ka interpretation market sentiment ko reflect karta hai. Jab yeh pattern dikhta hai, traders ko samajhna chahiye ke buyers ne control kho diya hai aur ab sellers dominate kar rahe hain. Lekin, hamesha yaad rakha jaye ke ek pattern pe pura bharosa karne se pehle, confirmatory signals aur dusre technical indicators ka bhi istemal karna zaroori hai. Trading mein Dark Cloud Cover ka istemal risk management ke saath hota hai. Agar yeh pattern sahi tarah se identify hota hai, toh traders apne positions ko adjust karke ya band karke potential losses se bach sakte hain. Iske alawa, yeh pattern swing trading aur position trading mein bhi istemal hota hai, jahan trend reversal ko pehchanna crucial hota hai. Dark Cloud Cover pattern ek powerful tool hai, lekin hamesha dhyan mein rakha jaye ke market mein kai factors influence karte hain aur ek pattern pe pura bharosa karne se pehle thorough analysis karna important hai. Traders ko chahiye ke hamesha updated rahen aur market conditions ke mutabiq apne trading strategies ko adjust karte rahen. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Dark Cloud Cover Pattern

Dark cloud cover pattern aik Japanese candlestick pattern hai jo forex traders istemal karte hain taak bearish reversals market mein pehchan saken. Ye pattern kaafi aasan hai pehchanna aur samajhna. Jab traders ise dekhte hain, to wo is pattern ko ek signal ke taur par istemal karte hain taak short positions mein dakhil ho saken ya shayad long positions se nikal saken. Lekin is pattern ko akela dekhna behtar nahi hota. Is se pehle doosre technical signals, jaise oscillators par divergence, ya pattern ko resistance area mein ban rahe dekha jaye to tab action lene se pehle confirmation lena behtar hai. Jab kaafi saboot mojud hota hai, to is pattern se bearish trade karna aasaan ho jata hai.

Pattern Identification

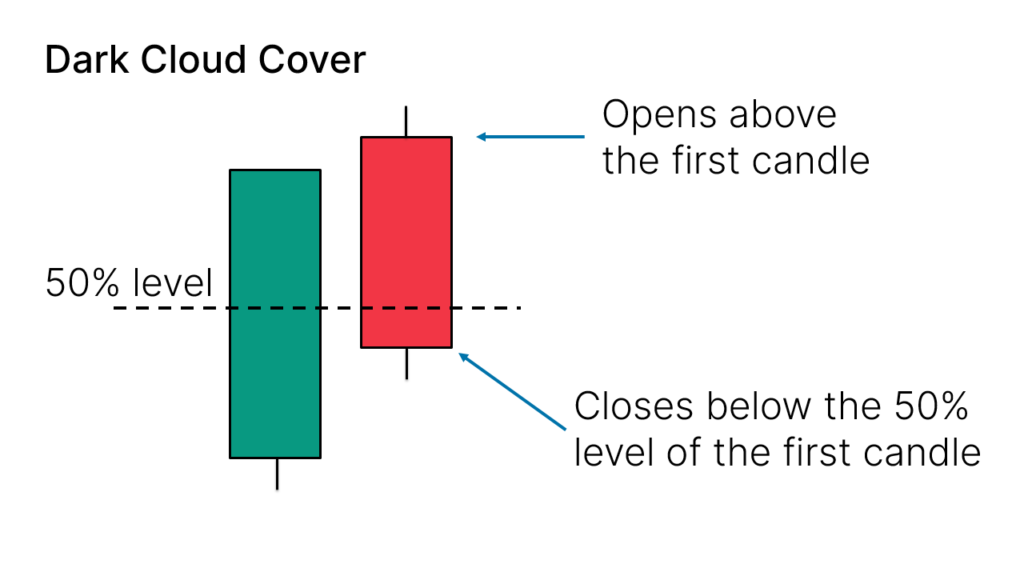

Dark Cloud Cover ek bearish two-candlestick pattern hai jisme pehli candle ek badi bullish range hoti hai. Uske baad ek bearish dusri candle aati hai jo apni opening par upar ki taraf gap karti hai, lekin pehli candle ki price range ke lower half mein band hoti hai.

Technical traders Dark Cloud Cover pattern ka istemal ek potential correction ki shuruaat ki taraf ishara dene ke liye karte hain. Agar ise sahi se pehchana jaye to crypto traders long trades se bahar nikalne ya short positions mein dakhil hone ke liye is signal ka istemal kar sakte hain.

Dark Cloud Cover pattern do opposite candlesticks ki tarah dikhta hai, ek bada green bullish candle pehle aata hai phir ek bada red candle aata hai. Green candle dwara ki gayi zyada price action ko poori tarah se kam kar diya jata hai.

Is price action se yeh pata chalta hai ki pehle to buyers control me hain, lekin phir sellers interfere karte hain aur ki gayi progress ko kafi had tak wapas le lete hain.

In do candlesticks ka net asar hota hai ki kafi buying power istemal hoti hai, lekin sirf price ko thoda upar le jane ke liye. Buyers momentum khote ja rahe hain, aur market aur consolidation ya phir outright reversal ke khatre mein hota hai.

Dark Cloud Cover candlestick pattern sabhi markets mein paya ja sakta hai, lekin ye crypto charts par reversals pe pehchanne mein khasi madadgar hota hai. Iske alawa, is candlestick formation ko sabhi chart time frames par dekha ja sakta hai.

Pattern Formation

Do-candle Dark Cloud Cover pattern ka structure kaafi simple hai.- Average bullish green candle se bada hona chahiye.

- Dusri candle ke open par upar ki taraf gap hona chahiye.

- Dusri candle ek large bearish red candle hona chahiye jo pehli candle ki kam se kam 50% price range ko wapas le.

Pehli candle ek bullish green candle hoti hai jiski price range chart par average candle se zyada hoti hai. Iska setup is pattern ke liye ahem hai, kyun ki ye market mein zyada buying interest ko darust karti hai.

Dusri candle apni opening par upar ki taraf gap karti hai, phir kam karke pehli candle ke body (previous candle) ke lower half mein band hoti hai. Is price action se ye sanket milta hai ki ek exhaustive bullish move hai, kyun ki price jaldi wapas le jati hai.

Adhik aggressive traders agli candle ke open par short trade kholne ka vichar kar sakte hain. Traders jo market mein existing long position khole hain, unke liye ye bearish Dark Cloud Cover pattern long trade ko poori ya partly band karne ki sambhavna ko darust karta hai.

Dark Cloud Cover pattern ko forex charts par dhundte waqt dhyan dene ki jarurat hai ki candlestick charts mein gaps ek rare ghatna hain. Iska karan hai crypto ke liye 24-hour trading uplabdh hai. Sanket darust karne ke liye aapko dekhna hai ki ek large-bodied red candle hai jo ek large-bodied green candle ki 50% se zyada ko wapas le.

Pattern Criteria

Dark Cloud Cover pattern ke teen ahem elements ke alawa, dusre criteria bhi signal ko majbooti dete hain.

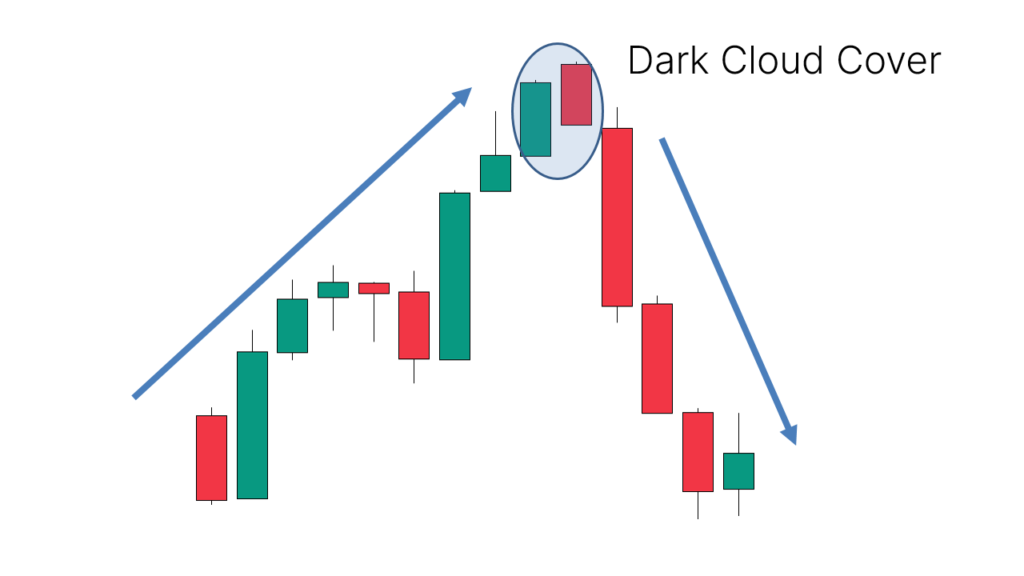

Pehle to candlestick pattern bearish hota hai, isliye ye uptrend ke ant mein behtar kaam karta hai. Agar market ne niche ki taraf move kiya hai, to ye pattern ek acchi risk-to-reward ratio opportunity nahi deta.

Dusri baat, aap oscillators aur doosre technical indicators mein overbought values dikh sakte hain, kyun ki trend ne tezi se upar ki taraf plant kiya gaya hai. Jab ye oscillators niche ki taraf murne lagte hain, to price action se alag hoti hain, jiske parinamswarup oscillator par lower high hota hai lekin price par higher high hota hai.

Is stage par uptrend abhi bhi shakti se jari hai lekin kafi kamjor ho gayi hai. Iska karan wave relationship ho sakta hai ya fir resistance level upar ho sakta hai. Chahe kuch bhi ho, market ek aakhri bar rally karne ki koshish karti hai, lekin us rally ko majboot resistance milta hai — aur ek bada red candle Dark Cloud Cover pattern ko carve karta hai.

Upar diya gaya Dark Cloud Cover pattern dikhata hai ki market uptrend se downtrend mein badal raha hai. Support ke tootne se trend badal gaya hai, jisse ek gehri correction ke liye darwaza khul jata hai.

Forex traders pattern ko doosre technical signals ke sath istemal karke naye short positions mein dakhil hone ya long positions ko band karne ke liye istemal karte hain.

Price Action/Context

Dark Cloud Cover pattern akela ek do-candle pattern hai. Lekin ise sahi se crypto chart par pehchanne ke liye doosre maanadhaar ka dhyan dena jaruri hai.

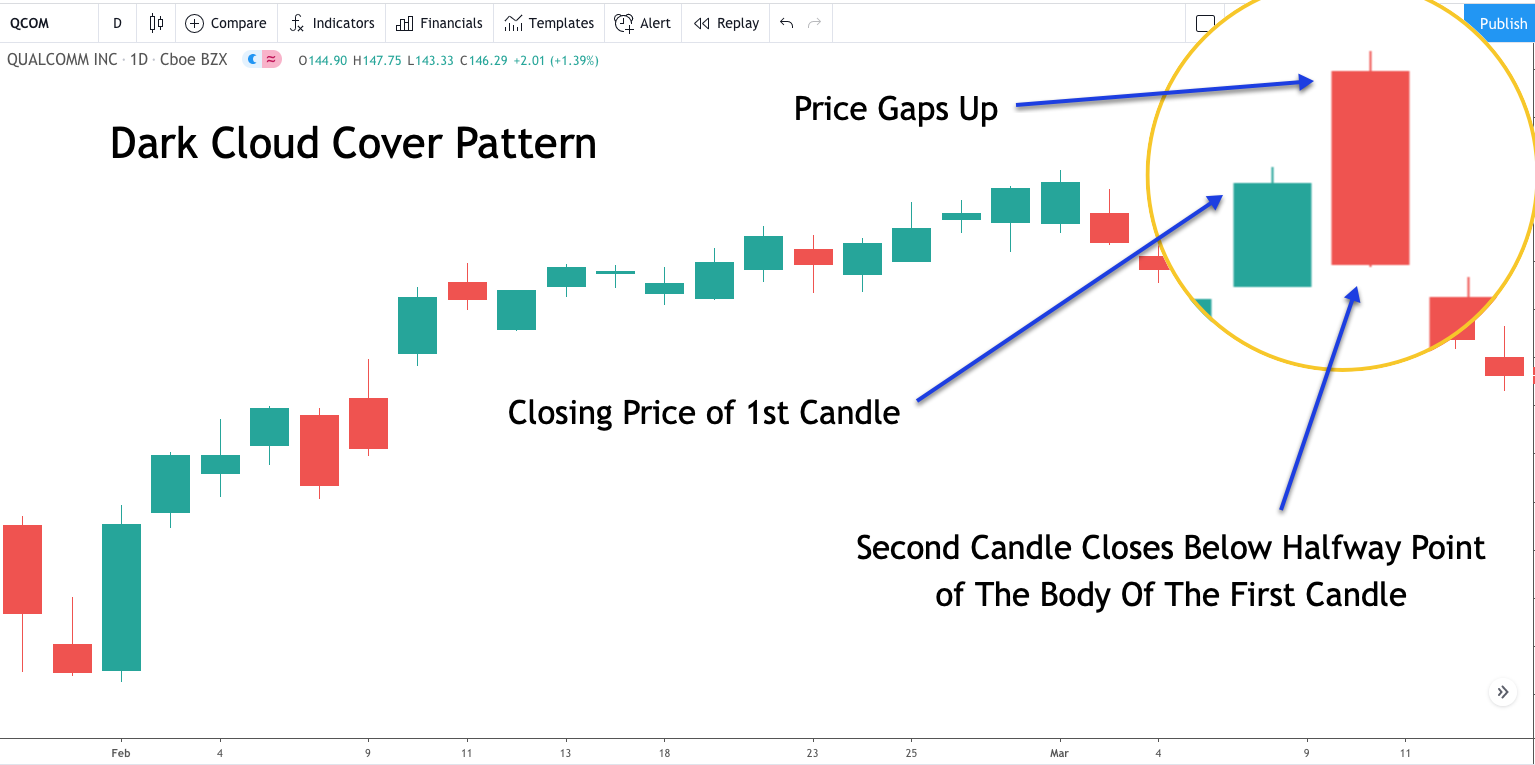

Is uptrend ke dauran, Relative Strength Index (RSI) oscillator hamesha overbought territory mein rehta tha. Lekin jab assets price all-time highs tak badhti rahi aur RSI lower highs dikhane lag gaya, to Dark Cloud Cover candlestick pattern dikhayi dene lagta hai. Pehla green candle naye all-time highs tak ja pahunchta hai. Phir pattern ka doosra candle, red candle, pehli green candle ke range ke lower half mein band hota hai.

Isse ye darust hota hai ki uptrend apni momentum kho raha hai, aur ek downtrend ki taraf ishara ho raha hai. Lekin market all-time highs par hai, isliye ye mushkil hai ki bearish reversal pattern dikhaye ya trend reversal ho raha hai.

Ek trader ko trend ki taraf badalne ki ek aur indication pane ke liye uptrend ko encompass karne wali ek trend line add karni chahiye. Jahaan trend line toot jati hai, wahaan trader ko confirmation mil jata hai ki ek correction shuru ho raha hai. Aap horizontal support levels par bhi dekhsakte hain aur wait kar sakte hain ki price action use tode. Phir aap short position shuru kar sakte hain ya long positions ko band karne ka mauka istemal kar sakte hain.

Trading

Jab aapne ek Dark Cloud Cover pattern pehchan liya hai, to usse trade karna kaafi aasan hai. Yeh kai tariko par trade karne ki anumati deta hai, kuch conservative traders ke liye aur kuch aggressive traders ke liye.

Zyada conservative approach aapko short me dakhil hone se pehle aur adhik trend confirmations dekhne ki anumati deta hai. Zyada aggressive approach aapko jaldi short trade me dalta hai lekin false signal par amal karne aur trade se bahar nikal dene ki zyada sambhavna hoti hai.

Is pattern ke prakat hone se pehle ek pehle uptrend dekhna zaroori hai. Uske baad ek average bullish candle dekhna zaroori hai jo pehli candle banane ke liye higher ja rahi hai. Pattern ke dusre candle ki price range ki kam se kam 50% ko wapas kar dena chahiye.

Stop loss abhi haal hil ke recent swing high ke upar lagaya jata hai, jo pattern ka high hone ke sambhavna hai. Traders kam se kam apne stop loss ke distance ka do guna target dekhna chahenge. Isse trader ko ek 1:2 risk-to-reward ratio milta hai.

Kabhi-kabhi turn lower ke liye sanket itne majboot nahi hote aur trader setup mein conservative hona chahte hain. Conservative traders support trend line ko tootne ka confirmation dene ke liye dekh sakte hain. Trade setup aggressive approach ki tarah hota hai, jahan stop loss bhi wahi jagah par lagaya jata hai, lekin entry price kam hoti hai kyun ki hum aur confirmation levels ka intezar kar rahe hain. Iska matlab hai ki humara target price bhi 1:2 risk-to-reward ratio maintain karne ke liye kam ho jayega.

Dark Cloud Cover vs. Bearish Engulfing: lekin

Ek naye trader ke liye, Dark Cloud Cover Bearish Engulfing candlestick pattern se milta julta lag sakta hai. Yakeen karne ke liye, dono mein kuch similarities hain, lekin kuch antar hain.

Samantarata hai ki dono candlestick patterns ek uptrend ke baad bane hain. Lekin in dono mein do bade antar hain. Pehla, Dark Cloud Cover mein candle price ranges average se badi honi chahiye. Bearish Engulfing pattern mein pehli candle ki koi size specifications nahi hoti.

Iske alawa, Dark Cloud Cover pattern ke doosre candle ko sirf pehle candle ki 50% ko cover karna chahiye. Bearish Engulfing mein doosra candle pehle candle ki poori body ko cover karna chahiye. Isliye, Bearish Engulfing pattern pehle candle ki poori body ko cover karna chahiye, jo choti ho sakti hai, lekin Dark Cloud Cover ke candles average se bade hote hain.

Reliability

Akela, Dark Cloud Cover pattern sirf consolidation ya ek lower turn ki sambhavna dikhata hai. Isliye trader ko doosre technical analysis tools se confirmation signals dhoondhne ki jarurat hoti hai.

Udaharan ke liye, sabhi Dark Cloud Cover patterns resistance ke pas nahi banenge. Lekin agar woh wahaan bante hain, to ye ek majboot signal pradan karte hain. Resistance ke saare prakar, chahe wo trend line resistance ho, horizontal resistance ho, ya Fibonacci retracement level ho, apply hote hain.

Is pattern ka prakat hone ka tend hamesha uptrend ke baad hota hai. Isliye indicators aur oscillators overbought dikhate hain. Agar aapke indicators sell signal dene lagte hain tab jab pattern dikhata hai, to ye confirmation signals ka combination signal ko majboot karta hai.

Phir se, dark cloud cover pattern forex charts ke sabhi time frames par dikh sakta hai. Lambi time frame charts chhote minute charts ke mukable adhik bharosa dete hain kyun ki risk-to-reward ratios aksar behtar hote hain.

Conclusion

Dark Cloud Cover ek Japanese candlestick pattern hai jo sabhi forex price charts ke sabhi time frames par pehchana ja sakta hai. Is pattern ko sahi se pehchane par aap asani se apne entry aur exit signals set up kar sakte hain. Lekin akela is pattern se false signals bhi aaye sakte hain. Isliye behtar hai ki aap is signals ko technical indicators se confirm karen aur moolbhoot analysis se trend ko aur bhi confirm karen. Chahe aap ek naye trader ho ya purane trader, hamesha samajhdar tarah se trade karen aur maforexrket mein daakhil hone se pehle market sentiment ka moolyaankan karen. Khaaskar extreme price fluctuations crypto market mein ho sakte hain. -

#4 Collapse

What's the Dark Cloud Cover pattern

Dark Cloud Cover pattern forex trading mein aik ahem technical analysis tool hai jo traders ke liye useful hai. Ye pattern typically bearish reversals ko identify karne mein madad deta hai aur uptrend ke end par appear hota hai.

Dark Cloud Cover pattern mein typically do consecutive candles dekhi jati hain. Pehli candle bullish hoti hai aur doosri candle bearish hoti hai. Doosri candle ki opening price pehli candle ki upper half mein hoti hai aur closing price pehli candle ki body ke andar hoti hai.

Dark Cloud Cover pattern ka main concept ye hai ke jab do consecutive candles ek saath appear hoti hain aur doosri candle pehli candle ki upper half mein open hoti hai aur pehli candle ki body ke andar close hoti hai, to ye bearish reversal signal provide karta hai. Iska matlab hai ke market mein bearish momentum shuru ho sakta hai aur uptrend khatam ho sakta hai.

Dark Cloud Cover pattern ko recognize karne ke liye traders ko kuch key points par dhyan dena hota hai:

- Two Consecutive Candles: Dark Cloud Cover pattern mein do consecutive candles dekhne par ye pattern confirm hota hai. Pehli candle bullish aur doosri candle bearish honi chahiye.

- Doosri Candle Ki Opening: Doosri candle ki opening price pehli candle ki upper half mein honi chahiye. Iska matlab hai ke doosri candle ne pehli candle ki upper half tak ki price range mein open ki hai.

- Doosri Candle Ki Closing: Doosri candle ki closing price pehli candle ki body ke andar honi chahiye. Iska matlab hai ke doosri candle ne pehli candle ki body ke andar close ki hai.

Dark Cloud Cover pattern ka istemal karke traders trend reversals ko anticipate kar sakte hain aur apne trading decisions ko improve kar sakte hain. Agar ye pattern sahi tareeke se interpret kiya jaye aur saath hi dusre technical indicators ke sath confirm kiya jaye, to isse successful trading opportunities mil sakti hain.

Lekin, dark cloud cover pattern ka istemal karte waqt bhi kuch limitations hain. Is pattern ko sahi tareeke se identify karna challenging ho sakta hai, aur false signals ka risk bhi hota hai. Isliye, traders ko dark cloud cover pattern ko confirm karne ke liye dusre technical tools aur price action ka bhi istemal karna chahiye.

Overall, Dark Cloud Cover pattern ek powerful tool hai jo traders ko bearish reversals ko identify karne mein madad deta hai. Is pattern ko samajh kar aur sahi tareeke se istemal karke, traders apne trading decisions ko improve kar sakte hain aur potentially profitable trades kar sakte hain.

-

#5 Collapse

What's the Dark Cloud Cover pattern

Dark Cloud Cover pattern ek candlestick pattern hai jo aksar ek uptrend ke doran nazar aata hai aur ek mojooda uptrend ko signal karta hai ke yeh mukhtalif reasons ki wajah se khatam ho sakta hai. Is pattern ko "Gehra Badal Dhankna" kehte hain. Yeh pattern do candlesticks se banta hai aur nichay diye gaye khasiyat se milta hai:- Appearance:

- Pehla candlestick ek uptrend ke doran nazar aata hai aur yeh aik bara white/green candle hota hai.

- Doosra candlestick pehle wale candle ki upper side par shuru hota hai aur pehle candle ki upper side par khatam hota hai.

- Color:

- Pehla candlestick white/green hota hai, jo uptrend ko darust karta hai.

- Doosra candlestick typically black/red hota hai, jo pehle candlestick ki upper side par shuru hota hai.

- Candlestick Length:

- Pehla candlestick ka lamba jism hota hai, jo zyada khareedari ko darust karta hai.

- Doosra candlestick ka lamba jism hota hai, jo pehle candlestick ki upper side par shuru hota hai aur downtrend ki shuruat ko darust karta hai.

- Upper Shadow:

- Pehle candlestick ka upper shadow chhota hota hai ya woh bilkul nahi hota, jo zyada khareedari ki taraf ishara karta hai.

- Doosre candlestick ka upper shadow lamba hota hai, jo bechne ki dabao ko darust karta hai.

- Confirmation:

- Dark Cloud Cover pattern ke pehle candlestick ke uptrend ki taasir ko darust karte hue, doosri candlestick ke aane se pehli ki bullish momentum ko rokne ka ishara hota hai.

Dark Cloud Cover pattern ki essence yeh hai ke uptrend mein pehle ki jaise khareedari ki dabao nahi hoti aur bechne ki dabao aa jati hai, jo mukhtalif reasons ki wajah se ho sakti hai. Is pattern ki tafseelat ko samajh kar, traders market ke potential reversals ko pehchante hain aur trading decisions banate hain.

- Appearance:

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark Cloud Cover pattern ek technical analysis ka tareeqa hai jo share market mein istemal hota hai. Is pattern ko samajh kar traders market trends ko samajhne mein madad lete hain aur trading decisions ko improve karte hain.

1. Dark Cloud Cover Pattern ki Pehchan:

Dark Cloud Cover pattern, do candlesticks se milta hai - ek bullish candlestick aur ek bearish candlestick. Ye pattern reversal ko darust karti hai aur bearish trend ka agaaz bhi ho sakta hai.

Dark Cloud Cover pattern ki pehchan karne ke liye, pehli candlestick bullish hoti hai, yaani ke uptrend mein hoti hai. Dusri candlestick bearish hoti hai, yaani ke downtrend mein hoti hai.

2. Bullish Candlestick:

Pehli candlestick bullish hoti hai, yaani ke uptrend mein hoti hai. Ye candlestick usually strong buying activity ko darust karta hai aur market mein positive sentiment ko indicate karta hai.

Bullish candlestick ki kuch important characteristics hain jaise ke lambi body, choti ya na-koi shadow, aur closing price open price se zyada hona.

3. Bearish Candlestick:

Dusri candlestick bearish hoti hai, yaani ke downtrend mein hoti hai. Ye candlestick usually selling pressure ko darust karta hai aur market mein negative sentiment ko indicate karta hai.

Bearish candlestick ki kuch important characteristics hain jaise ke lambi body, choti ya na-koi shadow, aur closing price open price se kam hona.

4. Kaise Kaam Karta Hai?

Dark Cloud Cover pattern mein bullish trend ke baad ek bearish candlestick aati hai jo pehli candlestick ko cover karti hai. Is tarah ka pattern reversal ko indicate karta hai aur bearish trend ka agaaz ho sakta hai.

Dark Cloud Cover pattern kaam karte waqt, bullish candlestick ke upar ek gap hona zaroori hai, aur dusri candlestick ke close neeche pehli candlestick ke body ke andar hona chahiye.

5. Iska Arth:

Dark Cloud Cover pattern ka arth hota hai ke market mein bullish trend ke baad ab bearish trend aa sakta hai. Is pattern ko samajh kar traders apni positions ko adjust karte hain aur trading strategies ko update karte hain.

Dark Cloud Cover pattern ke appearance ke baad, market mein selling pressure increase hota hai aur prices mein decline dekhne ko milta hai.

6. Kahan Milta Hai?

Dark Cloud Cover pattern kisi bhi time frame par dekha ja sakta hai, lekin zyadatar daily charts par istemal hota hai. Is pattern ko long-term trends ko identify karne ke liye bhi use kiya ja sakta hai.

Traders aur investors market ke different time frames par is pattern ko search karte hain taake unhe market ka overall direction aur potential reversals ka pata chal sake.

7. Kaise Identify Karein?

Dark Cloud Cover pattern ko identify karne ke liye, pehli candlestick ki high aur dusri candlestick ki low ko compare karna hota hai. Agar dusri candlestick pehli candlestick ke upar se start karke uski body ko cover karta hai, to ye Dark Cloud Cover pattern banata hai.

Traders is pattern ko confirm karne ke liye dusri candlestick ke close ke neeche ek stop loss lagate hain.

8. Trading Strategies:

Dark Cloud Cover pattern ko samajhne ke baad, traders trading strategies ko adjust karte hain taake wo market ke potential reversals ko catch kar sakein. Kuch common strategies include:- Short positions lena: Jab Dark Cloud Cover pattern appear hota hai, traders short positions lete hain ya existing long positions ko exit karte hain.

- Stop loss lagana: Traders stop loss orders lagate hain taake wo apne losses ko control kar sakein agar market against direction move karta hai.

- Trend analysis: Dark Cloud Cover pattern ko trend analysis ke saath combine karke traders future market direction ka idea bana sakte hain.

9. Risk Management:

Dark Cloud Cover pattern ko samajh kar traders apni positions ko manage karte hain aur risk ko kam karte hain. Risk management key component hai har trading strategy mein, aur is pattern ko use karte waqt bhi traders apne risk ko monitor karte hain.

Traders apne risk ko minimize karne ke liye stop loss orders ka istemal karte hain aur proper position sizing ka dhyan rakhte hain.

10. Mistakes to Avoid:

Is pattern ko samajhne ke liye proper training aur practice zaroori hai. Bina proper knowledge ke trading karne se nuqsaan ho sakta hai. Kuch common mistakes include:- Overtrading: Har pattern ko dekh kar trade karna, jaise ke Dark Cloud Cover pattern sirf ek hi indicator hai aur sirf us par depend karke trading karna riski ho sakta hai.

- Ignoring other factors: Sirf Dark Cloud Cover pattern par focus karna aur market ke other factors ko ignore karna bhi aik common mistake hai. Market sentiment, news, aur other technical indicators ko bhi consider karna important hai.

- Emotional trading: Jab market against move hota hai, traders ka emotions unke decisions ko influence kar sakte hain. Isliye, emotional trading se bachna zaroori hai.

11. Examples:

Dark Cloud Cover pattern ke examples dekh kar traders isay samajh sakte hain aur apne trading strategies ko improve kar sakte hain. Historical data aur real-time charts ko analyze karke traders is pattern ko identify kar sakte hain.

Examples dekhne se traders ko pattern ka appearance aur uske implications ka better understanding hota hai, aur wo apne trading decisions ko improve kar sakte hain.

12. Conclusion:

Dark Cloud Cover pattern ek powerful tool hai jo traders ko market trends ko samajhne aur trading decisions ko improve karne mein madad karta hai. Is pattern ko samajh kar, traders apne trading strategies ko refine kar sakte hain aur market mein successful trading kar sakte hain.

Dark Cloud Cover pattern ko istemal karke, traders market ke potential reversals ko recognize kar sakte hain aur profit generate kar sakte hain. Lekin, is pattern ko samajhne ke liye proper training aur practice zaroori hai.

13. Aakhri Alfaaz:

Is pattern ko samajhna aur istemal karna traders ke liye zaroori hai agar woh successful trading karna chahte hain. Dark Cloud Cover pattern ke saath proper risk management aur thorough analysis se traders apne trading skills ko enhance kar sakte hain aur consistent profits earn kar sakte hain. -

#7 Collapse

DARK CLOUD CANDLESTICL PATTERN

EXPLANATION OF DARK CLOUD CANDLESTICK PATTERN:

Forex trading main chart patterns ka eham kirdar hota hy, or Dark Cloud Cover Candlestick Pattern ik eham tijarati pattern hy jo ky bearish trend ki tashkhees main istemal hota hy. Is article main hum Dark Cloud Cover Candlestick Pattern ky mukhtalif pehluon par ghor karenge or samjhenge ky ye kis tarah sy forex trading main istemal hota hy.Dark Cloud Cover Candlestick Pattern ik bearish reversal pattern hy jo ky do candlesticks sy banta hy. Dark Cloud Cover pattern ko interpret karny ky liye, traders ko dosri candlestick ki clossing price or pehli candlestick ky upper body ky beech ka gap dikhna hota hy. Agar ye gap significant hy or dusri candlestick ka clossy pehli candlestick ky upper half main hy, to ye ik strong bearish signal hy.Dark Cloud Cover pattern ka interpretation ye hota hy ky uptrend ky bad ik reversal hony ki sambhavna hy or market main bearish momentum shuru ho sakta hy. Traders is signal par trading decisions lete hain jaisy ky short positions enter karna ya existing long positions ko exit karna.Is pattern main pehla candlestick bullish trend main hota hy or dosra candlestick is trend ko reversy karta hy. Dark Cloud Cover Candlestick Pattern ko dikhny ky liye do cheezein eham hoti hain:- Pehla Candlestick (Bullish): Pehla candlestick bullish trend main hota hy, yani ky us ki opening price niche hoti hy or clossing price upar hoti hy.

- Dosra Candlestick (Bearish): Dosra candlestick bullish candlestick ky upar open hota hy, lekin phir price nyeche girti hy or pehli candlestick ko kuch had tak overlap karti hy. Is tarah ka pattern "dark cloud" ki shakal ko yad dilata hy, jisy iska nam Dark Cloud Cover Candlestick Pattern rakha gaya hy.

- Entry Point:

- Dark Cloud Cover pattern bearish reversal ko darust karta hy, isliye ye traders ko entry point provide karta hy jahan sy wo short positions le sakty hain.

- Stop Loss:

- Stop loss orders lagana Dark Cloud Cover pattern ky istemal main zarori hy taky nuksan sy bacha ja saky. Agar price pattern ko confirm karta hy or reversal ho jata hy, toh stop loss position ko protect karny main madad karta hy.

- Wait for Confirmation:

- Dark Cloud Cover pattern ko confirm karny ky liye traders ko wait karna chahiye. Iska matlab hy ky ik single candlestick pattern par trade karny sy pehly, traders ko confirmatory signals ka intezar karna chahiye jaisy ky next candle ka opening price ya phir volume ky change.

- Risk Management:

- Har trade main risk management ka dhyan rakhna zarori hy. Traders ko apni position ka size theik tor par decide karna chahiye or risk ko manage karna chahiye taki nuksan sy bacha ja saky.

منسلک شدہ فائلیں -

#8 Collapse

DARK CLOUD CANDLESTICL PATTERN

EXPLANATION OF DARK CLOUD CANDLESTICK PATTERN:

Forex trading main chart patterns ka eham kirdar hota hy, or Dark Cloud Cover Candlestick Pattern ik eham tijarati pattern hy jo ky bearish trend ki tashkhees main istemal hota hy. Is article main hum Dark Cloud Cover Candlestick Pattern ky mukhtalif pehluon par ghor karenge or samjhenge ky ye kis tarah sy forex trading main istemal hota hy.Dark Cloud Cover Candlestick Pattern ik bearish reversal pattern hy jo ky do candlesticks sy banta hy. Dark Cloud Cover pattern ko interpret karny ky liye, traders ko dosri candlestick ki clossing price or pehli candlestick ky upper body ky beech ka gap dikhna hota hy. Agar ye gap significant hy or dusri candlestick ka clossy pehli candlestick ky upper half main hy, to ye ik strong bearish signal hy.Dark Cloud Cover pattern ka interpretation ye hota hy ky uptrend ky bad ik reversal hony ki sambhavna hy or market main bearish momentum shuru ho sakta hy. Traders is signal par trading decisions lete hain jaisy ky short positions enter karna ya existing long positions ko exit karna.Is pattern main pehla candlestick bullish trend main hota hy or dosra candlestick is trend ko reversy karta hy. Dark Cloud Cover Candlestick Pattern ko dikhny ky liye do cheezein eham hoti hain:- Pehla Candlestick (Bullish): Pehla candlestick bullish trend main hota hy, yani ky us ki opening price niche hoti hy or clossing price upar hoti hy.

- Dosra Candlestick (Bearish): Dosra candlestick bullish candlestick ky upar open hota hy, lekin phir price nyeche girti hy or pehli candlestick ko kuch had tak overlap karti hy. Is tarah ka pattern "dark cloud" ki shakal ko yad dilata hy, jisy iska nam Dark Cloud Cover Candlestick Pattern rakha gaya hy.

- Entry Point:

- Dark Cloud Cover pattern bearish reversal ko darust karta hy, isliye ye traders ko entry point provide karta hy jahan sy wo short positions le sakty hain.

- Stop Loss:

- Stop loss orders lagana Dark Cloud Cover pattern ky istemal main zarori hy taky nuksan sy bacha ja saky. Agar price pattern ko confirm karta hy or reversal ho jata hy, toh stop loss position ko protect karny main madad karta hy.

- Wait for Confirmation:

- Dark Cloud Cover pattern ko confirm karny ky liye traders ko wait karna chahiye. Iska matlab hy ky ik single candlestick pattern par trade karny sy pehly, traders ko confirmatory signals ka intezar karna chahiye jaisy ky next candle ka opening price ya phir volume ky change.

- Risk Management:

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark Cloud Cover Pattern: Forex Trading Mein Ek Rehnuma Pattern

Dark Cloud Cover ek popular candlestick pattern hai jo bearish reversal signal provide karta hai. Yeh pattern typically uptrend ke baad appear hota hai aur future price decline ka indication deta hai.

Dark Cloud Cover Pattern Ka Tareeqa:

1. Pehla Candlestick:

Dark Cloud Cover pattern ka pehla candlestick ek uptrend ke doran appear hota hai aur positive sentiment indicate karta hai. Yeh candlestick typically long aur bullish hota hai.

2. Doosra Candlestick:

Doosra candlestick pehle candlestick ke upar open hota hai, lekin phir downtrend mein close hota hai. Iska color typically red (bearish) hota hai aur pehle candlestick ke kuch hisse ko cover karta hai.

Dark Cloud Cover Pattern Ki Tafsilaat:

- Bearish Reversal Signal:

Dark Cloud Cover pattern bearish reversal signal provide karta hai, matlab ke uptrend ke baad price decline ki sambhavna hai.

- Confirmation Ki Zaroorat:

Is pattern ki sahi identification ke liye traders ko confirmation ki zaroorat hoti hai. Yeh confirm karne ke liye next candlestick ki price action ka wait karte hain. Agar next candlestick bearish hai aur pehle candlestick ke neeche close hota hai, toh yeh pattern confirm hota hai.

- Stop Loss Aur Risk Management:

Dark Cloud Cover pattern ke istemal mein traders ko apne positions ke liye stop loss aur risk management ka bhi khayal rakhna chahiye.

Dark Cloud Cover Pattern Ka Istemal:

- Dark Cloud Cover pattern ko confirm hone par traders sell positions lete hain ya existing long positions ko close karte hain.

- Stop loss orders ko set karne ka tareeqa istemal kiya jata hai taki agar price opposite direction mein move kare, toh nuksan se bacha ja sake.

Ikhtitami Alfaz:

Dark Cloud Cover pattern ek prabhavshali bearish reversal signal hai jo traders ko price decline ka indication deta hai. Is pattern ko sahi tareeqay se identify karke, traders apne trading strategies ko improve kar sakte hain aur potential profits ko maximize kar sakte hain.

-

#10 Collapse

Kya Hai Dark Cloud Cover Pattern?- Introduction to Dark Cloud Cover Pattern:

- Dark Cloud Cover Pattern ek candlestick charting pattern hai jo downtrend ke baad aata hai aur bearish reversal ki possibility ko darust karta hai.

- Dark Cloud Cover Pattern Ki Pehchan:

- Ye pattern do candlesticks se bana hota hai.

- Pehla candlestick uptrend ke doran banata hai.

- Dusra candlestick, pehle candlestick ki upar wale hisse ko dhak deta hai aur bearish signal deta hai.

- Pehle Candlestick Ka Character:

- Pehla candlestick strong uptrend ke doran aata hai.

- Iska range lamba hota hai.

- Iski closing price near high hoti hai, indicating bullish momentum.

- Dusra Candlestick Ka Character:

- Dusra candlestick, pehle candlestick ki upar wale hisse ko cover karta hai.

- Iski opening price pehle candlestick ki upar wale hisse ke near hoti hai.

- Iski closing price pehle candlestick ki body ke neeche hoti hai.

- Iska range pehle candlestick ke range se zyada hota hai.

- Dark Cloud Cover Pattern Ka Interpretation:

- Ye pattern bullish trend ke reversal ka signal deta hai.

- Dusra candlestick pehle candlestick ke bullish momentum ko khatam karta hai.

- Is pattern ko confirm karne ke liye, teesra din ki price action ka bhi dhyan diya jata hai.

- Dark Cloud Cover Pattern Ka Trading Strategy:

- Jab Dark Cloud Cover Pattern form ho, traders sell ki position enter karte hain.

- Stop loss ko pehle candlestick ke high ke thodi si upar rakhna hota hai.

- Target price ko support level ya previous low ke near set kiya jata hai.

- Dark Cloud Cover Pattern Ka Risk Management:

- Har trading strategy mein risk management ka mahatva hota hai.

- Stop loss ka use losses ko minimize karne mein madad karta hai.

- Position size ko manage karke risk ko control kiya jata hai.

- Dark Cloud Cover Pattern Ka Example:

- Maan lo, ek stock ka price $50 se $70 tak chala gaya.

- Phir ek din, ek candlestick pattern form hua jisme pehla candlestick uptrend ki taraf indicate karta hai.

- Dusra candlestick, pehle candlestick ki upar wale hisse ko cover karta hai aur price $65 pe close hoti hai.

- Is pattern ko Dark Cloud Cover kehte hain aur ye bearish reversal ka signal hai.

- Dark Cloud Cover Pattern Ka Importance:

- Ye pattern traders ko trend reversal ka indication deta hai.

- Iske istemal se traders ko entry aur exit points ka idea milta hai.

- Is pattern ko samajhne se traders apni trading strategies ko improve kar sakte hain.

- Conclusion:

- Dark Cloud Cover Pattern ek powerful bearish reversal pattern hai.

- Is pattern ko samajh kar, traders apne trading decisions ko improve kar sakte hain.

- Hamesha risk management ka dhyan rakhte hue, traders ko Dark Cloud Cover Pattern ka istemal karna chahiye.

- Introduction to Dark Cloud Cover Pattern:

-

#11 Collapse

Dark Cloud Cover pattern ek bearish reversal pattern hai jo uptrend ke baad dekha jata hai. Is pattern mein do consecutive candlesticks hote hain: pehla candlestick bullish (upward) hota hai aur doosra candlestick bearish (downward) hota hai. Neeche Dark Cloud Cover pattern ki tafseel di gayi hai

Dark Cloud Cover Pattern Ki Pehchan

1. Uptrend ke Baad Dekha Jata Hai

Dark Cloud Cover pattern typically uptrend ke baad dekha jata hai. Yeh pattern uptrend ke exhaustion aur reversal ko darust karta hai.

2. Pehla Bullish Candlestick

Pattern ki shuruaat ek lambi bullish (upward) candlestick se hoti hai, jo uptrend ko darust karta hai. Is candlestick ki body lambi hoti hai aur wicks chhoti hoti hain.

3. Doosra Bearish Candlestick

Pehle bullish candlestick ke baad, doosra candlestick dekhi jati hai jo bearish (downward) hoti hai. Is candlestick ki body pehli candlestick ki body ke oopar open hoti hai aur pehli candlestick ke upper wick tak close hoti hai.

4. Close Price ke Upper Half Mein

Doosri candlestick ka close price pehli candlestick ke body ke upper half mein hota hai. Yeh indicate karta hai ki bears ne control ko haasil kiya hai aur uptrend ke potential reversal ko darust karta hai.

5. Volume ka Increase

Dark Cloud Cover pattern ke formation ke dauran volume ka increase dekha jata hai, indicating ki market mein interest badh raha hai aur reversal ki possibility hai.

Tabeer aur Trading Strategy

Dark Cloud Cover pattern ek bearish reversal signal hai jo uptrend ke baad dekha jata hai. Is pattern ko dekhte hi traders ko selling pressure aur potential downtrend ki tayyari karni chahiye. Agar is pattern ke baad ek aur strong bearish candle ya fir downside price action ka confirmation milta hai, to traders short positions le sakte hain.

Dark Cloud Cover pattern ko samajhne ke liye, traders ko market context aur confirmatory signals ka bhi dhyan rakhna zaroori hai. Iske alawa, sahi risk management ka istemal karna bhi ahem hai trading decisions ke liye. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is dark cloud cover candlestick pattern in forex trading.

Forex trading main chart patterns ka eham kirdar hota hy, or Dark Cloud Cover Candlestick Pattern ik eham tijarati pattern hy jo ky bearish trend ki tashkhees main istemal hota hy. Is article main hum Dark Cloud Cover Candlestick Pattern ky mukhtalif pehluon par ghor karenge or samjhenge ky ye kis tarah sy forex trading main istemal hota hy.Dark Cloud Cover Candlestick Pattern ik bearish reversal pattern hy jo ky do candlesticks sy banta hy. Dark Cloud Cover pattern ko interpret karny ky liye, traders ko dosri candlestick ki clossing price or pehli candlestick ky upper body ky beech ka gap dikhna hota hy. Agar ye gap significant hy or dusri candlestick ka clossy pehli candlestick ky upper half main hy, to ye ik strong bearish signal hy.Dark Cloud Cover pattern ka interpretation ye hota hy ky uptrend ky bad ik reversal hony ki sambhavna hy or market main bearish momentum shuru ho sakta hy. Traders is signal par trading decisions lete hain jaisy ky short positions enter karna ya existing long positions ko exit karna.Is pattern main pehla candlestick bullish trend main hota hy or dosra candlestick is trend ko reversy karta hy. Dark Cloud Cover Candlestick Pattern ko dikhny ky liye do cheezein eham hoti hain:

- Pehla Candlestick (Bullish): Pehla candlestick bullish trend main hota hy, yani ky us ki opening price niche hoti hy or clossing price upar hoti hy.

- Dosra Candlestick (Bearish): Dosra candlestick bullish candlestick ky upar open hota hy, lekin phir price nyeche girti hy or pehli candlestick ko kuch had tak overlap karti hy. Is tarah ka pattern "dark cloud" ki shakal ko yad dilata hy, jisy iska nam Dark Cloud Cover Candlestick Pattern rakha gaya hy.

- Entry Point:

- Dark Cloud Cover pattern bearish reversal ko darust karta hy, isliye ye traders ko entry point provide karta hy jahan sy wo short positions le sakty hain.

- Stop Loss:

- Stop loss orders lagana Dark Cloud Cover pattern ky istemal main zarori hy taky nuksan sy bacha ja saky. Agar price pattern ko confirm karta hy or reversal ho jata hy, toh stop loss position ko protect karny main madad karta hy.

- Wait for Confirmation:

- Dark Cloud Cover pattern ko confirm karny ky liye traders ko wait karna chahiye. Iska matlab hy ky ik single candlestick pattern par trade karny sy pehly, traders ko confirmatory signals ka intezar karna chahiye jaisy ky next candle ka opening price ya phir volume ky change.

- Risk Management:

- Har trade main risk management ka dhyan rakhna zarori hy. Traders ko apni position ka size theik tor par decide karna chahiye or risk ko manage karna chahiye taki nuksan sy bacha ja saky.

-

#13 Collapse

Dark cloud cover candlestick pattern in forex trading.

Forex trading main chart patterns ka eham kirdar hota hy, or Dark Cloud Cover Candlestick Pattern ik eham tijarati pattern hy jo ky bearish trend ki tashkhees main istemal hota hy. Is article main hum Dark Cloud Cover Candlestick Pattern ky mukhtalif pehluon par ghor karenge or samjhenge ky ye kis tarah sy forex trading main istemal hota hy.Dark Cloud Cover Candlestick Pattern ik bearish reversal pattern hy jo ky do candlesticks sy banta hy. Dark Cloud Cover pattern ko interpret karny ky liye, traders ko dosri candlestick ki clossing price or pehli candlestick ky upper body ky beech ka gap dikhna hota hy. Agar ye gap significant hy or dusri candlestick ka clossy pehli candlestick ky upper half main hy, to ye ik strong bearish signal hy.Dark Cloud Cover pattern ka interpretation ye hota hy ky uptrend ky bad ik reversal hony ki sambhavna hy or market main bearish momentum shuru ho sakta hy. Traders is signal par trading decisions lete hain jaisy ky short positions enter karna ya existing long positions ko exit karna.Is pattern main pehla candlestick bullish trend main hota hy or dosra candlestick is trend ko reversy karta hy. Dark Cloud Cover Candlestick Pattern ko dikhny ky liye do cheezein eham hoti hain:- Pehla Candlestick (Bullish): Pehla candlestick bullish trend main hota hy, yani ky us ki opening price niche hoti hy or clossing price upar hoti hy.

- Dosra Candlestick (Bearish): Dosra candlestick bullish candlestick ky upar open hota hy, lekin phir price nyeche girti hy or pehli candlestick ko kuch had tak overlap karti hy. Is tarah ka pattern "dark cloud" ki shakal ko yad dilata hy, jisy iska nam Dark Cloud Cover Candlestick Pattern rakha gaya hy.

- Entry Point:

- Dark Cloud Cover pattern bearish reversal ko darust karta hy, isliye ye traders ko entry point provide karta hy jahan sy wo short positions le sakty hain.

- Stop Loss:

- Stop loss orders lagana Dark Cloud Cover pattern ky istemal main zarori hy taky nuksan sy bacha ja saky. Agar price pattern ko confirm karta hy or reversal ho jata hy, toh stop loss position ko protect karny main madad karta hy.

- Wait for Confirmation:

- Dark Cloud Cover pattern ko confirm karny ky liye traders ko wait karna chahiye. Iska matlab hy ky ik single candlestick pattern par trade karny sy pehly, traders ko confirmatory signals ka intezar karna chahiye jaisy ky next candle ka opening price ya phir volume ky change.

- Risk Management:

- Har trade main risk management ka dhyan rakhna zarori hy. Traders ko apni position ka size theik tor par decide karna chahiye or risk ko manage karna chahiye taki nuksan sy bacha ja saky.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Dark Cloud Cover Pattern: Ek Makhfi Badal Dhanak

Forex aur stock markets mein trading karte waqt, technical analysis ek aham hissa hai jise traders istemal karte hain taake market trends aur potential reversals ko samajh sakein. Dark Cloud Cover ek aise candlestick pattern hai jo bearish reversal ko indicate karta hai. Ye pattern do candlesticks se bana hota hai aur typically uptrend ke end par dekha jata hai.

Dark Cloud Cover Pattern Ka Tareeqa Amal: Dark Cloud Cover pattern ek bearish reversal pattern hai jo do candlesticks se banta hai:- Pehla Candlestick (Bullish): Pehla candlestick ek uptrend ke doran ban jata hai aur positive sentiment ko represent karta hai. Ye candlestick typically lamba hota hai aur strong buying activity ko darust karta hai.

- Doosra Candlestick (Bearish): Doosra candlestick pehle candlestick ki taraf se agay nikalta hai aur uske oopar kuch hissa cover karta hai. Ye candlestick typically red (downward) hota hai aur price ke neeche close hota hai, indicating selling pressure.

Dark Cloud Cover Pattern Ka Tafsili Bayan: Dark Cloud Cover pattern ko identify karne ke liye traders ko do candlesticks ko closely observe karna hota hai. Jab pehla candlestick bullish trend ke doran ban jata hai aur doosri candlestick iske upar se nikalti hai aur pehle candlestick ke kuch hissa ko cover karti hai, to ye pattern confirm hota hai.

Is pattern mein doosri candlestick pehle candlestick ke upar se nikalti hai aur iske neeche close hoti hai, indicating ke bullish momentum khatam ho raha hai aur bearish reversal hone ki possibility hai. Dark Cloud Cover pattern ko confirm karne ke liye traders ko volume aur market ke overall conditions ko bhi consider karna chahiye.

Dark Cloud Cover Pattern Ka Istemal: Dark Cloud Cover pattern ko istemal karke traders bearish reversal ki potential entry points ko identify karte hain. Agar ye pattern ek strong uptrend ke baad appear hota hai aur volume bhi high hai, to iska bearish reversal ka signal aur bhi powerful hota hai.

Traders Dark Cloud Cover pattern ke istemal ke saath stop-loss orders aur risk management strategies ka bhi istemal karte hain taake potential losses ko control kiya ja sake. Ye pattern sirf ek indicator hai aur dusri technical analysis tools ke saath mila kar istemal kiya jana chahiye trading decisions lene ke liye.

Dark Cloud Cover pattern ko samajh kar aur sahi tareeqe se istemal karke, traders market ke movements ko sahi taur par analyze kar sakte hain aur profit ko maximize kar sakte hain. Magar, har trading strategy ki tarah, Dark Cloud Cover pattern ka bhi istemal karte waqt risk management ka khaas khayal rakhna zaroori hai.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:03 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим