CFD Trading

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

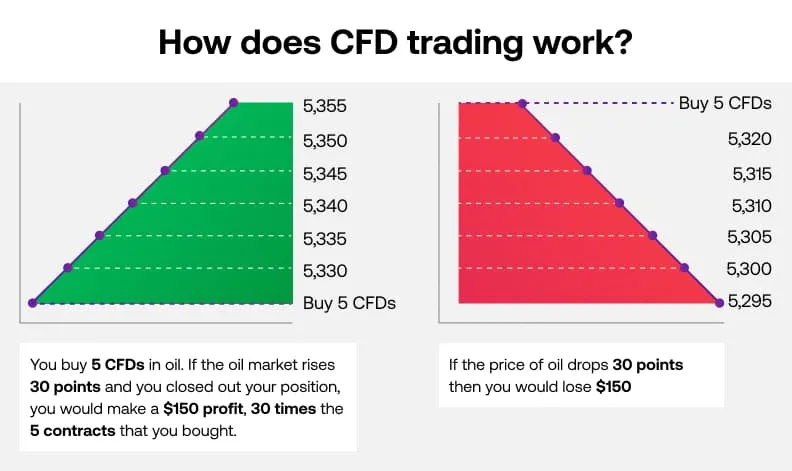

Financial ke bohot se aur tezi se tabdeel hone wale duniya mein,Forex (foreign exchange) trading investors ke liye sab se mashhoor aur munafa dene wala zaria hai. Forex trading ki duniya mein, aik taqatwar tool mojood hai jo ke Contract for Difference (CFD) trading ke naam se jani jati hai, jise traders mein flexibility aur mukhtalif trading mauqaat ki talash mein shauqeen logon mein barii shohrat hasil hui hai. CFD Trading Asal mein Contract for Difference (CFD) ek maali derivative hai jo traders ko yeh ijaazat deta hai ke woh mukhtalif maali asaasiyon ke (jis mein currencies bhi shamil hain) qeemat ke tezibi pe ghor-o-fikar kar sakein, lekin asal maalik na hone ke bawajood. Forex ke context mein, CFD trading investors ko mukhtalif currency pairs ke darmiyan tabdili daro mein se faida uthane ki ijaazat deta hai. How CFD Trading Works in Forex CFD trading mein, traders broker ke saath aik contract mein dakhil hojate hain jismein currency pair ki keemat ke farq ko trade ke dakhil aur nikalne ke points ke darmiyan tabdil karte hain. Yeh traditional Forex trading ke khilaf hai, kyun ke CFD trading mein asal currencies ki malikiyat nahi hoti. Balkay, traders asal mein woh direction par shart lagate hain jis mein currency pair ki keemat chalay gi. Advantages of CFD Trading in Forex

How CFD Trading Works in Forex CFD trading mein, traders broker ke saath aik contract mein dakhil hojate hain jismein currency pair ki keemat ke farq ko trade ke dakhil aur nikalne ke points ke darmiyan tabdil karte hain. Yeh traditional Forex trading ke khilaf hai, kyun ke CFD trading mein asal currencies ki malikiyat nahi hoti. Balkay, traders asal mein woh direction par shart lagate hain jis mein currency pair ki keemat chalay gi. Advantages of CFD Trading in Forex- Leverage: CFD trading ka aik bara khobsurat hissa yeh hai ke is mein margin par trade kiya ja sakta hai, jis se traders ko chand paise se bara positions control karne ki ijaazat milti hai. Yeh leverage dono maali faide aur nuqsaan ko ziada kar deta hai.

- Diverse Asset Selection: CFD trading currency pairs ki mukhtalif tadad mein daakhil hone ki ijaazat deta hai, jis se traders apni portfolios ko mukhtalif trading strategies se bharna aur takhleeq karne ki ijaazat milti hai.

- Short Selling: CFDs ke zariye traders ko izazat milti hai ke woh barhne (buy/long) aur girne (sell/short) wale markets se faida utha sakein. Traders ke liye yeh mumkin hai ke woh CFDs bech kar keemat girne ka faida uthayein bina ke asal assets ke malik ho.

- Hedging Opportunities: CFDs traders ko is ijaazat deti hain ke woh apni mojudah Forex positions ko hedge kar sakein, opposite CFD trades khole kar, jisse volatile markets mein risk management ka zariya bane.

Risks Associated with CFD Trading Jabke CFD trading faida dene wale mouqaat pesh karti hai, toh traders ke liye aham hai ke woh is ke sath judi hui khatron ko samajhte hain:

- Leverage Risks: Leverage ka istemal faide ko barhata hai lekin nuqsaan ke khatre ko bhi barhata hai. Agar market trader ke khilaf hojaye toh traders apni asal rakam se ziada nuqsaan utha sakte hain.

- Market Volatility: Forex markets ziada tezi se tabdeel hone wale hote hain, jo ke jald aur foran keemaat mein izafay ki taraf le ja sakti hai. Achanak hone wale market movements CFD traders ke liye bari nuqsaan mein tabdeel ho sakti hain.

- Counterparty Risks: CFD traders broker ki iqtisadi rishtedari se mutasir hote hain. Is khatraat ko kam karne ke liye zaroori hai ke aap ek maqbool aur nigran broker ko chunte hain.

CFD Trading Strategies Kamyabi se CFD trading in Forex mein kaam karne ke liye ek mansoobat aur market dynamics ki gehrai se samajh hona zaroori hai. Kuch mashhoor strategies mein shaamil hain:

CFD Trading Strategies Kamyabi se CFD trading in Forex mein kaam karne ke liye ek mansoobat aur market dynamics ki gehrai se samajh hona zaroori hai. Kuch mashhoor strategies mein shaamil hain:- Trend Following: Traders tareekhi keemat data ka analysis karte hain taake woh trends ko pehchan sakein aur prevailing trend ke rukh mein trades mein shamil ho sakein.

- Range Trading: Yeh strategy is pe mabni hai ke currency pair ki fluctuations ke darmiyan kiye gaye price ranges ko pehchanne mein madad karti hai. Traders nichli range mein khareedte hain aur upper range mein bechte hain, keemat ki tabdiliyon se faida uthane ke liye.

- Swing Trading: Swing traders un mukhtalif trends ke darmiyan hone wale chand dinon ya hafton ki keemat ki tabdiliyon ko pakadne ki koshish karte hain. Woh price swings ke buniyad par trades mein shamil ho kar, positions ko chand dinon ya hafton tak hold karte hain.

- Risk Management: Mukhlis risk management techniques ki istemal karke, jese ke stop-loss aur take-profit orders set kar ke, apni asal rakam ko bachane aur nuqsaan ko kam karne ke liye zaroori hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

CFD TRADING DEFINITION contrast for difference Ek Aisa arrangement hai Jo financial derivative trading mein Kiya Jata Hai Jahan open aur closing trade ki prices Ke Darmiyan settlement mein differences cash settle se Tay Hota Hai CFDs ke sath physical goods ya security ki koi delivery nahi hai contrast ke contrast Ek advance trading strategy haiy Jise analyst trader used karte hain aur United state mein iski allowed Nahin Hai cfds trader ko security aur derivative ki prices ki movement main trade karne ki allowed Dete Hain derivative or financial investment Jo Kisi underlying asset se Hasil ki Jaati Hai essentially investors ki taraf se CFDs ka used price ki bets ke liye Kiya jata hai Ke Aaya Kisi underlying asset security ki price rise ya fall:max_bytes(150000):strip_icc()/CFD-b99b747a807e4abda0918e74a355592d.jpg) TRANSACTING IN CFDS Difference ke contrast ko bahut se asset aur security including exchange traded FTFs ki trade ke liye use Kiya Ja sakta hai trader in protect ka use commodity ke future ke contrast Jaise crude oil or corn contrast Mein prices ke bare mein speculate karne ke liye bhi Karenge future ke contrast mayari contrast ya contrasts Hain jinmen Kisi particular asset ko future ki expiration khatm hone ki date ke sath preset price per buy ya Sell ki obligation hoti hai Agarcha CFDs investor ko future ki price ki movement ki trade karne ki allow Dete Hain lekin vah Khud future c contrast nahi hai CFDs ki expiration containing hone ki date Nahin Hoti Hai Jin Se Pahle Se preset prices hoti hain but buy and sell ki prices ke sath other security Ki Tarah trade hoti hai

TRANSACTING IN CFDS Difference ke contrast ko bahut se asset aur security including exchange traded FTFs ki trade ke liye use Kiya Ja sakta hai trader in protect ka use commodity ke future ke contrast Jaise crude oil or corn contrast Mein prices ke bare mein speculate karne ke liye bhi Karenge future ke contrast mayari contrast ya contrasts Hain jinmen Kisi particular asset ko future ki expiration khatm hone ki date ke sath preset price per buy ya Sell ki obligation hoti hai Agarcha CFDs investor ko future ki price ki movement ki trade karne ki allow Dete Hain lekin vah Khud future c contrast nahi hai CFDs ki expiration containing hone ki date Nahin Hoti Hai Jin Se Pahle Se preset prices hoti hain but buy and sell ki prices ke sath other security Ki Tarah trade hoti hai  ADVANTAGE OF A CFDS CFDs trader ko security Ke Malik hone ke Tamam benefits au risks provide karte hain without is ke actually iski owning ho ha na hi Aisa Koi physical delivery Ho CFDs ki trade margin per ki Jati Hai Jis Ka means Hai Ke broker investors ko fayda uthane ke liye ya position ke size ko badhane ke liye Money borrow Ki allow deta hai broker traders se is type ke transaction ki Allowed dine Se Pahle specific account balance ko barkrar rakhne ka mutalba Karenge

ADVANTAGE OF A CFDS CFDs trader ko security Ke Malik hone ke Tamam benefits au risks provide karte hain without is ke actually iski owning ho ha na hi Aisa Koi physical delivery Ho CFDs ki trade margin per ki Jati Hai Jis Ka means Hai Ke broker investors ko fayda uthane ke liye ya position ke size ko badhane ke liye Money borrow Ki allow deta hai broker traders se is type ke transaction ki Allowed dine Se Pahle specific account balance ko barkrar rakhne ka mutalba Karenge

-

#4 Collapse

Assalamu Alaikum Dosto!CFDs Trading

CFD ya Contract for Difference derivative products hain jo traders ko bagher asal items rakhne ki mukhtalif asasat ki price ki speculate karne ki permission deta hain. Ye 20th sadi ke aakhir mein internet revolution ke nateejay mein nikale gaye naye products hain, jinhon ne traders ko button ki chhuan se chhote arse tak ke trades karne ki suhulat di. Aaj kal ke mashhoor brokers inhe farahmi aur zyada leverage dene ki ijaazat dete hain, jise stocks, indices, currencies, aur commodities mein trade kiya ja sakta hai.

CFD Ki History

20th sadi ke aakhir mein, exchange trading ne tareekh ki aik se bare tabdeeliyon mein se aik ko guzara. Internet ne traders ko button ki chhuan se chhote arse tak ke trades karne ki ijaazat di. Intraday trading aik mukhtasar zamane mein sab se ahem trends mein se aik ban gayi - aur leading brokers jald hi samajh gaye ke yeh segment private traders ke darmiyan mein bohot zyada demand mein hoga.

Trading ke liye aik barra masla yeh raha ke exchanges ki sakht khasoosiyat thi. Currency, stocks, aur futures exchanges aapas mein alag alag thi. Is natijay mein, agar koi trader currency broker ke saath kaam karta, to usay futures ya stocks se munafa kamane ka mauqa nahi milta tha.

Yeh mumkin tha ke aap doosri company ke saath aik aur account kholen, lekin aisi faislaat mumkin nahi thi. Ek aur masla bhi zahir tha: chhote arse tak ke trades se paisa kamane ke liye zyada leverage ki zarurat thi, aur stock exchanges traditional tor par risky marginal trading se door rehte thay.

In masail ko hal karne ke liye, UBS Investment Bank ke employees ne aik naya exchange instrument socha, contract for difference (CFD). Isne ye ijaazat di ke asasat ko exchange par malik bina hi uske rate mein izafa ya kamai ki ja sake. Ab traders shares, oil, aur doosre commodities ke saath kaam kar sakte thay, aik hi broker ke saath. Iske ilawa, contract for difference ne zyada leverage ke saath trade karne ki bhi ijaazat di.

Waqt ke sath sath, CFD ko aaj kal tamaam mashhoor brokers dwara pesh kiya jane laga, jinme forex market mein kaam karne wale bhi shamil hain. Aaj, yeh tool short-term traders aur long-term investors dono ke liye kamyabi se istemal ho raha hai.

CFD Leverage ki Explained

CFD margin trading ki permission dete hain, yaani ke broker se paisa udhaar lena. Is case mein, hum leverage ke asar ki baat karte hain. Misal ke tor par, 1:50 leverage ek ko $1,000 apne account mein hone par $50,000 ke liye aik position kholne ki ijaazat deta hai.

CFD mein leverage ki miqdaar asal malik par mabni hoti hai. Misal ke tor par, shares ke liye ye aksar 1:20 se zyada nahi hoti, jabke oil ke liye ye aksar 1:100 tak pohanch jata hai.

Forex ke currency pairs ke mawafiq, 1:20 leverage itna zyada nahi lagta. Lekin comparison se sikha jata hai: classic stock markets mein equity leverage aksar 1:2 se zyada nahi hota.

CFD Kaise Kaam Karte Hain

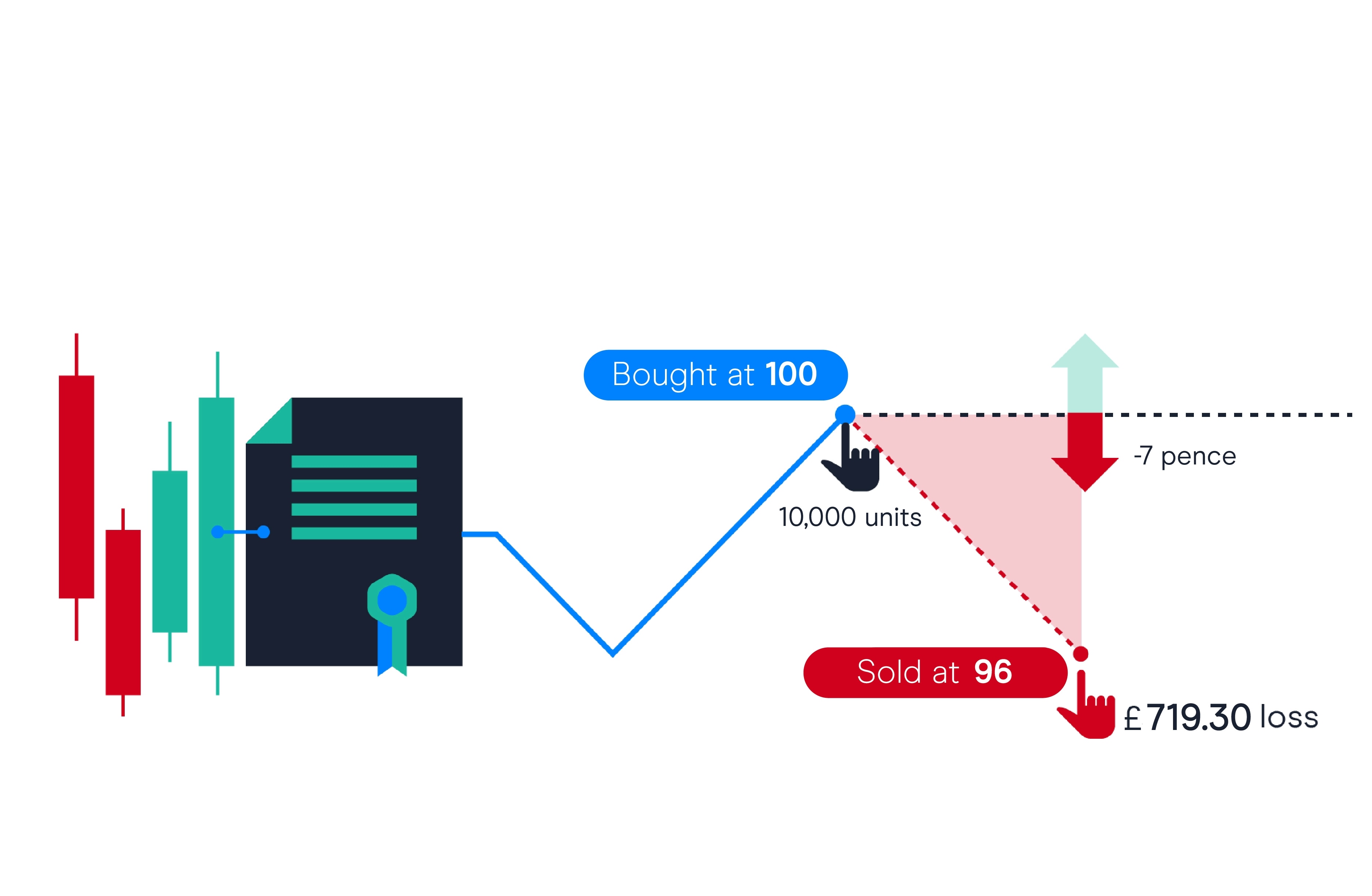

Agar Share ki Ask price $171.23 hai, aur ek trader ne 100 shares khareedi hain, to transaction ka kharch $171.23 plus commission aur fees hoga.

Is transaction ke liye kam se kam $1,263 ka free cash traditional broker ke paas margin account mein hona chahiye, jabke CFD brokers ne haal hi mein sirf 5% margin ya $126.30 ki zarurat rakhi.

Jab aap aik CFD position kholte hain, to aapko trade ke waqt spread ke barabar ka nuksan dikhai deta hai, is liye agar spread 5 cents ka hai, to stock ko breakeven level tak pohanchane ke liye stock ko 5 cents barhna hoga.

Agar aap seedha stock malik hote to aapko 5 cents ka munafa hota, lekin aapko commission dena hota aur hasil hone wale izafay zyada hote.

Agar traditional brokerage account mein stock ki offer price $25.76 tak pohanchti hai, to positions $50 ya $50/1263 = 3.95% ke munafa par band ho sakti hain.

Lekin jab price national exchange par is level tak pohanchta hai, to CFD par bid price sirf $25.74 ho sakti hai.

CFD ka munafa kam ho ga kyun ke trader ko trade bid price par exit karna hoga, aur iske ilawa, spread regular market se zyada hota hai. Is misal mein, aik CFD trader ko lagbhag $48 ka munafa hota hai ya $48/126.30 = 38% return on investment.

CFD par Trading Kyun Karein

Classical forex market sirf currencies ki trading ki ijaazat deta hai. CFD ka istemaal trading instruments ki list ko badi had tak barha deta hai. Aaj kal ke zyadatar brokers par yeh mumkin hai ke aap gold, stocks, aur stock indices par trade karen.

CFD ko asal malik ka seedha badalne ka naqal nahi samjha ja sakta. Haan, contract price asal instrument ki dynamics ko dohraati hai, lekin iski qeemat ab bhi musbat ya manfi ho sakti hai.

CFD ke liye commissions asal malik ke liye alag bhi ho sakti hain, jo ke lambi muddat ki trading mein khaas tor par ahem hai. Ab ham is tool ke asal faiday aur nuksanat par tawajjo denge.

CFD Trading Ke Pros and Cons

CFD trading ke apne faiday aur nuksanat hote hain. Yahan kuch faiday aur nuksanat diye gaye hain:- Pros

- Leverage: CFD trading leverage deta hai, jo ke yeh matlab hai ke aap asal mal ko seedha khareedne ke liye zaroorat hone wale paisay se kam mehnat mein trade kar sakte hain. Yeh aapke munafa ko barha sakti hai, lekin isse aapki risk bhi barh jati hai.

- Access to a wide range of markets: CFD trading aapko stocks, indices, currencies, aur commodities jaise mukhtalif markets mein trade karne ki ijaazat deta hai. Yeh aapko market movements se munafa kamane ke liye zyada mauqaat deta hai.

- Short-selling: CFD trading ke zariye aap girte prices se bhi munafa kamane ka mauqa deta hai. Iska matlab hai ke aap aise asset ko bech sakte hain jo aapke paas nahi hai, umeed hai ke aap use baad mein kam rate par khareedenge.

- No stamp duty: Kayi countries mein CFD trading ko stamp duty ke taht nahi rakha jata, jo ke isay ek cost-effective tareeqay se trade karne ka bana deta hai.

- Cons

- High risk: CFD trading zyada risk ke saath aati hai, kyun ke leverage aapke munafa aur nuksanat ko dono barha sakta hai. Iska matlab hai ke aap apne asal investment se zyada bhi kho sakte hain.

- Hidden costs: Kuch CFD brokers hidden fees charge kar sakte hain, jaise ke overnight financing fees aur spread mark-ups, jo ke waqt ke saath aapke munafa ko kam kar sakti hain.

- Complexity: CFD trading complex ho sakti hai, khaas karke beginners ke liye. Risks ko samajhna aur unko effectively manage karne ke liye kafi waqt aur mehnat ki zarurat hoti hai.

CFDs trading shuru karne se pehle in faiday aur nuksanat ko dhyan se sochna zaroori hai. Yeh bhi zaroori hai ke aap aik reputable CFD broker chunte hain aur aik sound trading strategy develop karen jo aapki risk tolerance aur financial goals ko madde nazar rakhe.

CFDs Trading Ke Risk

CFD trading (Contracts for Difference) zyada risk ke saath aata hai, aur trading shuru karne se pehle in risks ko samajhna bohot zaroori hai. Yahan kuch key risks hain jo CFDs trading se juri hain:- Leverage risk: CFDs leverage dete hain, jo ke yeh matlab hai ke aap apne account balance se zyada position khol sakte hain. Jabke leverage aapke potential profits ko barha sakta hai, wohi leverage aapke potential losses ko bhi barha sakta hai, is liye aapko apne risk ko carefuly manage karna chahiye.

- Market risk: CFDs ek asal mal ke price movements se judi hoti hain, aur yeh price kisi bhi factor, jaise ke economic data, news events, aur market sentiment ke asar mein ho sakti hai. Yeh factors price ko tezi se badal sakte hain, jo ke aapko significant losses mein mubtala kar sakti hai.

- Counterparty risk: Jab aap CFDs trade karte hain, to aap CFD provider ke saath aik contract mein dakhil ho rahe hote hain. Iska matlab hai ke aap counterparty risk ka shikar hote hain, jo ke yeh risk hai ke provider aapke liye apni zimmedariyon par khara na utre. Is risk ko kam karne ke liye ek reputable CFD provider ko chunna zaroori hai.

- Operational risk: CFD trading platforms technical issues ka samna kar sakte hain, jaise ke outages ya errors, jo aapko positions kholne ya band karne mein rok sakte hain. Yeh aapko unexpected losses ya missed opportunities mein daal sakte hain.

- Liquidity risk: Kuch CFD markets illiquid ho sakte hain, jiska matlab hai ke market mein kuch khareedne walay ya bechne walay kam hote hain. Yeh aapko maqamiyat ke dauran positions mein dakhil ya nikalne mein mushkilat daal sakta hai, khaas karke high volatility ke doran.

- Hidden costs: Kuch CFD brokers hidden fees charge kar sakte hain, jaise ke overnight financing fees aur spread mark-ups, jo waqt ke saath aapke munafa ko kam kar sakte hain.

CFDs trading mein in risks ko samajhna aur unko manage karna zaroori hai. Is mein stop-loss orders set karna, apne positions ko nazdeek se monitor karna, aur leverage ko responsibly istemal karna shamil hai. Aapko bhi ek aisa reputable CFD provider chunna chahiye jo ke kisi financial authority ki nigrani mein hai, aur jo transparent pricing aur achi customer support offer karta hai.

CFD Trading Ke Liye Accurate Broker Select Karen

CFD trading ke liye broker chunne waqt, ye parameters ahem hain:- Reliability aur reputation. CFD ke case mein clients ke liye rawaiyya khaas tor par strong hota hai: yeh instrument bohot mashhoor nahi hai, is liye agar liquidity mein kami ho to "chart ko draw karna" ya quote badalna bohot mumkin hai.

- Trading ke liye CFDs ki tadad. Hum aapko yeh mashwara denge ke aap broker ki website par mojood contracts ki poori list dekhen aur ye dekhen ke list mein woh sab kuch shamil hai jo aapko zaroorat hai.

- Contract specifications. List mein wo CFDs talash karen jo aap regularly kaam karna chahte hain. Ye dekhen ke spreads, commissions, aur swaps aapke trading style ke mutabiq hain. Agar high leverage ki zarurat hai, to har CFD category se maloomat len.

CFDs ke liye, InstaForex aik behtareen choice hogi. Isne tamam asset classes ke liye CFDs offer kiye hain - traditional forex trading se le kar cryptocurrency aur indices tak. Yeh company 5 saal se brokerage services provide kar rahi hai aur market professionals ke darmiyan achi reputation hasil ki hai.

CFDs aur Futures

CFDs aur Futures mukhtalif qisam ke investors ke liye istemal hote hain. In dono cheezon ke ilawa, ye do sab se mashhoor tareeqay hain jin se indices, currencies aur commodities jese bade markets mein trade kiya jata hai. Dono types ke financial instruments online trading platforms ke zariye aasaani se dastiyab hain, jiski wajah se ye bohat mashhoor aur dunia bhar mein istemal ho rahe hain.

CFDs

CFD ka matlab hota hai Contract For Difference. Jab aap CFD trade mein dakhil hote hain, to aap asal asset nahi khareedte, balki aap broker ke sath ek muqabla karte hain, aur us muqablay mein, aap future price ki taraf ek qeemat par lagwate hain.

Aap lambi bet laga sakte hain (ke price barhegi) ya Short (ke price giregi) aur agar aap sahi hain to broker aapko wo farq ada karega jo aapne contract mein dakhil hone par asset ki keemat ke darmiyan paya.

Agar aap galat hain aur price aapke soche hue opposite direction mein chali jati hai, to aapko apne account balance se broker ko farq ada karna hoga.

Futures

Futures contract ek aisa muqabla hai jise aap broker ke sath karte hain ke kisi asset ko set future price par khareedna ya bechna hoga. Futures contracts traders ko security, stock index, commodity, ya dosre financial instruments ki taraf long ya short bet lagane ki ijaazat dete hain.

Futures professional mahol mein aksar ek asset ki price movement ko hedge karne ke liye istemal hote hain taake nuksan ka khatma ho sake jo kuch muddat ke liye nuksan de tabdiliyon se aata hai.

Dono ye instruments derivatives hain, iska matlab hai ke aap asal (physical) asset jo aapne contracts ke liye dakhil kiya hai, usko nahi khareed rahe. Iska matlab hai ke aap kisi asset ke bohat se quantity ke price par bet laga sakte hain, jese ke 20,000 bushels gehoon ke maal ki keemat, bina physical commodity ko khareedne ya store karne ke zarurat ke.

Difference Between CFDs & Futures

Teen mukhtalif farqat hain futures aur CFDs ke darmiyan jo ye tay karte hain ke inka istemal kaun karta hai aur kis waqt kon sa instrument behtar hai.- Spreads:

Spread asset ki khareed aur farokht value ke darmiyan ka farq hai. Jab market volume zyada hoti hai to spreads kam ho jate hain, aur jab market mein volume kam hoti hai to spreads barh jate hain. CFDs mein trade karte waqt traders typically sirf ek spread pay karenge, jabke futures mein futures exchange ke taraf se ek spread aur broker ke taraf se ek commission pay karna padta hai. - Holding Period:

CFDs ko short term contracts banaya gaya hai, ye ek saal ke andar ke holding periods ke liye sab se cost-effective hote hain. Iski wajah ye hai ke in par overnight fees, ya 'financing costs' hoti hain, iska matlab hai ke jitna zyada time aap trade ko hold karenge, utni hi ziada cost aayegi. Futures par overnight fees nahi hoti kyun ke interest rates ke kisi asar ko futures prices mein directly built-in kiya jata hai jo contract expire hone par hota hai. Common hai ke futures traders apne positions ko kuch hafton tak hold karte hain lekin contracts expire hote hain aur unhe agle contract period mein roll karna padta hai. - Expiration:

CFDs expire nahi hote kyun ke trade bar-bar roll hota hai - isliye overnight fees. Jabke Futures ka ek expiry date hota hai jo futures exchange ne contract banate waqt set kiya hota hai.

Traders CFDs Kyun Istemal Karte Hain?

CFDs aam taur par retail investors ke zariye istemal hote hain. Ye roz marra ke log hain jo apne paise se financial markets mein invest karte hain. CFDs in chhote scale ke investing ke liye specifically muqarrar hai.

Iska pehla risk/reward dilemma CFDs ke volatility ka hai. Leverage ka istemal trading ke risk ko barha deta hai kyun ke potential jeet aur haar dono collateral ke muqablay mein bade size ke ho jate hain.

Volatility ke sath high leverage ka risk bilkul asal hai, log nuksan utha sakte hain agar unko sahi tarbiyat aur risk-awareness nahi hai. Lekin everyday logon ke liye ye mauqa hai ke woh professionals ke sath barabar ke profit aur loss hasil karenge.

CFDs trade karne ka ek aur faida ye hai ke ye flexible hote hain. Traditional stock market mein, aap ek stock khareedte hain, use thodi dair ke liye hold karte hain aur phir use bechte hain jab aapko lagta hai ke market aapke khilaf ja raha hai.

Kyunki aap asal asset ke malik nahi hote, aap sirf future price par speculation kar rahe hote hain. Isse ek CFD khareedne ya bechne mein utna hi aasan hota hai. Long ya short jaane ka mauqa traders ko mushkil halat mein faida uthane ka mauqa deta hai.

Traders Futures Kyun Istemal Karte Hain?

Futures contracts ko aam taur par commercial duniya mein bohat wide istemal hota hai, zyadatar iska istemal ek moqaayi qeemat ko hedge ya 'lock in' karne ke liye hota hai jo kisi contract mein muaahida ki gayi hoti hai. Futures, ek company ke liye ek muaahide ki faida ko kam karne wale price ke fluctuations ke khilaf ek asar daar hedge hote hain.

Ek misaal ke tor par, hum ek Canadian company ko lete hain jo products ko USA mein export karti hai. Unki inventory Canadian dollars mein moolya lagayi gayi hai, jabke U.S. mein beche jane wale tayyar products ko U.S. dollars mein ada kiya jata hai.

Kyunki kharche aik currency mein hain aur hasilat doosre mein, is company ko kisi bhi currency ki risk ka samna karna padta hai (aur is case mein, Canadian dollar ka U.S. dollar ke khilaf barhna).

Agar Canadian dollar inventory khareedne aur inventory ko bechne ke darmiyan me majboot hota hai, to socha gaya munafa kimat mein kam ho jayega.

Export company faisla karte hai ke wo December Canadian dollar futures khareedein, taake aane wale mahine ke liye tasdeeq shuda exchange rate par aane wale munafa ko hedge karein. Ye effectively exchange rate ko agle mahine ke liye "lock-in" kar dega.

Agar Canadian dollar hedge dakhil karne aur bechne ke waqt majboot hota hai, to futures transaction par munafa, Canadian dollar revenue mein kisi bhi kami ko kheench lega. Dusri taraf, agar Canadian dollar kamzor hota hai, to company ki revenue barhegi lekin ye barhawar futures transaction ke nuksan se maqsoos hoga.

Jab USD ko CAD (Canadian Dollars) mein convert karte hain, to wo December Canadian dollar futures contracts ko current market price par bech dega.

Conclusion

CFDs aapko sabse mashhoor exchange-traded assets tak pahunchate hain. Inhe aap stocks, indices, aur cryptocurrencies ke saath trade karne ki suhulat dete hain aik hi CFD broker ke services ka istemal kar ke.

CFD trading mein kamyabi ye hai ke trader ne kis had tak kisi khaas instrument ki khususiyyat ko mutala kiya hai. Behtareen nateejay woh log haasil karte hain jo aik asset class ya phir kisi khaas instrument par tawajjuh dete hain. Mazboot ilm aur qeemat-e-tareef ke andar, aap market ko peechay chhod sakte hain aur woh munafa hasil kar sakte hain jo aapko haq hai.

CFDs aur Futures ek hi asal se paida hote hain, ye dono aise tools hain jo mukhtalif trading styles ko zyada se zyada access dene mein madad karte hain, jo roz marra ke logon ko maali aur commodity markets mein shamil hone ki ijaazat dete hain. CFDs complex instruments hote hain aur har kisi ke liye munasib nahi hote kyun ke ye jaldi se nuksan pahuncha sakte hain jo aapki jama ki gayi raqm se zyada bhi hosakti hai. Aapko ye sochna chahiye ke aapko CFDs kaam kaise karte hain, taake aap inke kaam karne ke tareeqay ko puri tarah se samajh saken. Risk ke mutalik ilmiyat hasil karen, taake aap samajh saken ke isme kitna risk hai aur kya aap is risk ko utha sakte hain ya nahi. - Pros

-

#5 Collapse

CFD Trading: Ek Mukhtasir Jaiza

Muqaddama

CFD (Contract for Difference) trading ek popular financial instrument hai jo traders ko financial markets mein speculation karne ki facility deta hai baghair underlying asset ko own kiye. CFD trading flexibility aur leverage provide karta hai, lekin iske sath kuch risks bhi involved hote hain. Is article mein hum CFD trading ko briefly explain karenge aur iske faide aur nuqsanat ka jaiza lenge.

CFD Trading Kya Hai?

CFD ek derivative product hai jisme trader aur broker ek contract sign karte hain. Is contract ke mutabiq, trader aur broker price difference ko exchange karte hain jab position open hoti hai aur jab close hoti hai. CFD trading ka basic concept yeh hai ke aap price movements par speculate karte hain bina underlying asset ko own kiye.

CFD Trading Ka Tareeqa- Market Selection: Sabse pehla step market ko select karna hai jahan aap trade karna chahte hain. CFDs ko aap multiple markets mein trade kar sakte hain, jaise ke stocks, indices, commodities, forex, aur cryptocurrencies.

- Leverage: CFD trading mein leverage ka concept involve hota hai. Leverage ka matlab hai ke aap apne initial investment se zyada position control kar sakte hain. Yeh aapki potential profits ko increase kar sakta hai, magar saath hi risks ko bhi barhata hai.

- Long aur Short Positions: CFD trading mein aap dono, long (buy) aur short (sell) positions le sakte hain. Agar aapko lagta hai ke market price barhegi, to aap long position lete hain. Aur agar aapko lagta hai ke market price giregi, to aap short position lete hain.

- Margin Requirements: CFDs margin trading ke concept par based hain. Margin woh initial capital hota hai jo aapko position open karne ke liye chahiye hota hai. Margin requirements brokers ke hisaab se vary kar sakti hain.

CFD Trading Ke Faide- Leverage: CFD trading aapko leverage provide karta hai jo aapko apni purchasing power increase karne mein madad deta hai.

- Market Access: CFDs aapko multiple markets mein trading karne ki facility deti hain bina alag-alag accounts open kiye.

- Flexibility: CFD trading mein aap long aur short dono positions le sakte hain, jo aapko market ke har direction mein profit banane ka mauka deti hai.

CFD Trading Ke Nuqsanat- High Risk: Leverage ki wajah se CFD trading high risk hoti hai. Agar market aapke against move kare, to aapke losses significant ho sakte hain.

- Costs: CFDs ke sath kuch hidden costs bhi hoti hain, jaise ke spreads, commissions, aur overnight financing charges.

- Regulatory Risks: Har mulk mein CFD trading ko regulate nahi kiya jata. Is wajah se regulatory risks bhi involved hote hain.

Conclusion

CFD trading ek powerful financial instrument hai jo traders ko flexibility aur leverage provide karta hai. Lekin iske sath high risks bhi hoti hain. Isliye, CFD trading shuru karne se pehle zaroori hai ke aap iske concepts aur risks ko achi tarah samajh lein. Proper risk management aur trading strategy se aap apni profitability ko enhance kar sakte hain aur potential losses ko minimize kar sakte hain.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

CFD Trading: An Overview

CFD trading ya Contract for Difference trading ek popular tareeqa hai jis mein traders financial markets mein trade karte hain bina actual asset ko kharidne ya bechne ke. Is article mein hum CFD trading ke basic concepts, benefits, risks, aur kuch strategies par baat karenge.

1. CFD Trading Kya Hai?

CFD trading ek financial derivative hai jisme traders asset ke price movement par speculate karte hain, magar unhe actual asset ko buy ya sell karne ki zarurat nahi hoti. CFDs mein trader ek contract sign karta hai jisme asset ki price ke difference par trade hota hai. Jaise hi position close hoti hai, trader ko profit ya loss hota hai, jo asset ki price movement par depend karta hai.

2. CFD Trading Ke Mauzuat

CFD trading aam taur par stocks, commodities, currencies, indices, aur cryptocurrencies par kiya jata hai. Har ek asset ke liye alag trading conditions hoti hain jaise leverage, margin requirements, aur trading hours.

3. CFD Trading Ke Fayde- Leverage: CFDs allow karte hain ke small margin se large positions open kiye ja sake.

- Market Access: Traders ko access hota hai global financial markets without owning the underlying asset.

- Short Selling: CFDs allow karte hain ke traders asset ke price girne par profit kama sake.

4. CFD Trading Ki Khatre- Leverage Risks: Leverage use karne se high risk hota hai kyunki small price movement bade losses ya profits ke liye responsible ho sakti hai.

- Market Risks: Price volatility se traders ko losses ho sakte hain.

- Counterparty Risks: CFD providers bankrupt hone se traders ke liye risk ho sakta hai.

5. CFD Trading Ke Strategies- Trend Trading: Isme traders asset ke price trends ke according positions lete hain.

- Range Trading: Price range ke boundaries mein trading ki jaati hai, jahan price ka movement predictable hota hai.

- News Trading: Important economic aur political events ke baad price volatility se profit kamane ki koshish ki jati hai.

6. CFD Trading Ka Legal Aur Regulatory Environment

CFD trading ki legality aur regulation har country mein alag hoti hai. Traders ko apne local regulations aur tax implications ko samajhna zaroori hota hai trading shuru karne se pehle.

7. CFD Trading Ki Steps- Education: Trading ke concepts aur strategies ko samajhna zaroori hai.

- Broker Selection: Reliable aur regulated broker select karna zaroori hai.

- Risk Management: Position sizing, stop-loss orders, aur risk management techniques ko follow karna zaroori hai.

8. CFD Trading Mein Success Ke Factors- Discipline: Trading plan ko follow karna aur emotions ko control karna zaroori hai.

- Knowledge: Market trends, technical analysis, aur fundamental analysis ko samajhna zaroori hai.

- Patience: Price movements ko samajhne aur opportunities ka wait karna zaroori hai.

Conclusion

CFD trading ek powerful tool hai financial markets mein profit kamane ke liye, magar isme associated risks ko samajhna aur manage karna zaroori hai. Har trader ko apne risk tolerance aur financial goals ke according trading strategies choose karni chahiye. Iske saath hi, legal aur regulatory requirements ko bhi follow karna zaroori hai trading experience ko safe aur profitable banane ke liye.

-

#7 Collapse

CFD Trading Kya Hai?

CFD (Contract for Difference) trading ek financial derivative hai jo traders ko underlying assets ko physically own kiye baghair unke price movements par speculate karne ki ijazat deta hai. CFD trading mein, aap asset ki price changes ko trade karte hain aur sirf price difference par profit ya loss earn karte hain.

CFD Trading Kaise Kaam Karta Hai?

CFD trading mein, aap ek contract enter karte hain jo aapko aur broker ke darmiyan hota hai. Yeh contract underlying asset ke price difference ko represent karta hai jab aap contract open karte hain aur jab aap usay close karte hain. Agar price aapki favor mein move hoti hai, toh aap profit earn karte hain, aur agar price aapki against move hoti hai, toh aap loss face karte hain.

Key Features of CFD Trading

1. Leverage

CFD trading mein leverage use hota hai jo aapko apne capital se zyada exposure lene ki ijazat deta hai. Leverage ke through aap small margin ke sath large positions control kar sakte hain.

2. Short Selling

CFD trading aapko short selling ki bhi ijazat deta hai, yani aap un assets par bet kar sakte hain jinke prices girne wale hain. Iska matlab hai ke aap downtrend market mein bhi profit kama sakte hain.

3. Wide Range of Markets

CFDs ke through aap different markets mein trade kar sakte hain jaise ke stocks, commodities, forex, indices, aur cryptocurrencies. Yeh aapko diversification ka mauka dete hain.

4. No Ownership of Underlying Asset

CFD trading mein aap underlying asset ko physically own nahi karte. Aap sirf asset ki price movement par speculate karte hain.

Advantages of CFD Trading

1. High Leverage

CFD trading high leverage offer karta hai jo aapki potential returns ko enhance kar sakta hai. Lekin, leverage ke sath risk bhi increase hota hai, isliye risk management bohot zaroori hai.

2. Access to Global Markets

CFD trading aapko global markets mein trade karne ka mauka deta hai. Aap different countries ke stocks, indices, aur commodities ko trade kar sakte hain.

3. No Stamp Duty

UK aur bohot se dusre countries mein CFDs par stamp duty nahi lagti kyunke aap underlying asset ko own nahi karte.

4. Flexible Trading Hours

CFDs aapko 24-hour trading ka mauka dete hain, khas tor par forex aur commodities markets mein.

Disadvantages of CFD Trading

1. High Risk

Leverage ke wajah se CFD trading high risk activity hai. Market against move hone par aapko significant losses face karne par sakte hain.

2. Overnight Fees

Jab aap apne CFD positions ko overnight hold karte hain, toh aapko overnight fees ya swap charges pay karne par sakte hain.

3. Complexity

CFD trading complex ho sakti hai aur beginners ke liye mushkil ho sakti hai. Isme technical analysis aur market knowledge ki zaroorat hoti hai.

4. Market Volatility

CFDs highly volatile markets mein trade kiye jate hain jo unpredictable price movements ka shikar hote hain. Is wajah se aapko quick decision making aur proper risk management ki zaroorat hoti hai.

Example of CFD Trading

Sochiye ke aapko lagta hai ke Apple ke shares ki price barhne wali hai. Apple ka current share price $150 hai aur aap ek CFD contract buy karte hain 100 shares par, leverage 10:1 ke sath. Yeh matlab hai ke aap sirf $1,500 (10% of $15,000) invest kar rahe hain.

Agar Apple ka share price $160 ho jata hai, toh aapka profit hoga:

\[ (160 - 150) \times 100 = $1,000 \]

Lekin agar share price $140 ho jata hai, toh aapka loss hoga:

\[ (150 - 140) \times 100 = $1,000 \]

Conclusion

CFD trading ek powerful financial instrument hai jo aapko multiple markets mein trade karne ka mauka deta hai bina underlying assets ko physically own kiye. Leverage aur short selling ki facilities CFD trading ko attractive banati hain, lekin high risk aur complexity bhi saath le kar aati hain. CFD trading mein success hasil karne ke liye market knowledge, technical analysis, aur effective risk management bohot zaroori hain. Hamesha trading karte waqt apne risk appetite aur financial goals ko madde nazar rakhte hue informed decisions lein. -

#8 Collapse

**CFD Trading**

CFD trading yaani Contract for Difference trading ek aisa investment tool hai jo aapko financial markets mein speculation ka mauka deta hai bina asli asset ke malik banne ke. Ismein aapko sirf price ke movement par bet karna hota hai. Yani agar aapko lagta hai ke kisi asset ki qeemat barhegi, to aap buy karte hain, aur agar lagta hai ke qeemat ghatayegi, to aap sell karte hain.

CFD trading ke kuch major faiday aur nuqsanat hain jo yahan discuss karna zaroori hain.

### Faiday:

1. **Leverage:** CFD trading mein aapko leverage milta hai jo aapke initial investment se zyada trade karne ka mauka deta hai. Yani aap kam paison se zyada paison ka faida utha sakte hain.

2. **Diverse Markets:** CFD trading mein aapko mukhtalif markets mein trade karne ka mauka milta hai jaise ke stocks, commodities, forex, aur indices. Yeh diversity aapko zyada trading opportunities provide karti hai.

3. **Short Selling:** CFD trading mein aapko short selling ka option milta hai yani aap market girawat se bhi faida utha sakte hain. Aap sell pehle karte hain aur baad mein buy karte hain.

4. **No Stamp Duty:** UK mein CFD trading pe stamp duty nahi lagti, jo ke ek bara faida hai compared to traditional stock trading.

### Nuqsanat:

1. **Leverage Risk:** Leverage ka faida jahan hota hai, wahan nuksaan ka bhi khatra hota hai. Agar market aapke against jati hai to aapko bara nuksaan uthana par sakta hai.

2. **Overnight Fees:** CFD positions ko raat bhar rakhnay par aapko overnight fees deni parti hai jo ke aapke profits ko kam kar sakti hai.

3. **Market Volatility:** CFD trading mein market volatility ka buhat bara asar hota hai. Aapko price swings se buhat ehtiyaat se deal karna parta hai.

4. **Complexity:** CFD trading thodi complex hoti hai aur beginners ke liye mushkil sabit ho sakti hai. Ismein kamyab hone ke liye aapko markets ki understanding aur proper strategy ki zaroorat hoti hai.

### Kaise Shuru Karein:

1. **Research:** Sabse pehle, markets ki research karein jahan aap trade karna chahte hain. Mukhtalif assets aur unke movements ko samjhein.

2. **Choose a Broker:** Achi reputation wala broker select karein jo aapko reliable platform aur tools provide kare.

3. **Demo Account:** Trading start karne se pehle demo account pe practice karein taake aapko system aur strategies ka acha idea ho jaye.

4. **Risk Management:** Hamesha apni trades ke liye risk management strategies banayein aur unhe strictly follow karein.

Agar aap samajhdari se aur properly informed hoke CFD trading karein to aapko ismein achi kamyabi mil sakti hai. Lekin, hamesha yaad rakhein ke trading ke sath risks bhi involved hain, isliye aapko hamesha apni risk capacity ko madde nazar rakhte hue decisions lene chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

CFD Trading Kya Hai?Introductio CFD trading ka matlub hai "Contract for Difference" trading. Yeh aik aisa financial instrument hai jo investors ko yeh moqa deta hai ke woh bina actual asset ko own kiye uski price movements pe speculate kar sakte hain. Working of CFDs: CFDs ka basic principle yeh hai ke investor aur broker ke darmiyan aik contract hota hai. Investor predict karta hai ke asset ki price upar jayegi ya neeche. Agar investor ka prediction sahi hota hai, toh usay profit hota hai, warna loss. 1. Leverage: CFDs me leverage ka concept hota hai. Yeh aapko chhoti amount se bade position control karne ki ijazat deta hai. Misal ke tor pe, agar aapka leverage 1:10 hai aur aap $100 invest karte hain, toh aap $1000 worth ki position control kar rahe hain. 2. Margin: Leverage ke sath margin bh important hai. Margin wo amount hai jo aapko broker ke paas rakhnay parhti hai as a security. Agar market aapke against jati hai, toh broker aapki margin ko cover karne ke liye use kar sakta hai. 3. Long and Short Positions: CFDs me aap long ya short position le sakte hain. Long position ka matlab hai ke aapko lagta hai price barhegi, aur short position ka matlab hai ke aapko lagta hai price giregi. Advantages of CFD Trading: 1. Diversification: CFDs aapko multiple markets me trade karne ka moqa dete hain, jaise stocks, commodities, forex, etc. Isse aap apne portfolio ko diversify kar sakte hain. 2. No Ownership:Aapko actual asset own nahi karna padta, sirf uski price movement pe speculate karna hota hai. 3. Leverage: Leverage ke through aa chhoti capital se bade profits bana sakte hain, magar isme risk bhi zyada hota hai. Disadvantages of CFD Trading: 1. Hi Risk: Leverage ke wajah se losses bhi amplify ho jate hain. Aap jitni capital invest karte hainusse zyada loss bhi ho sakta hai. 2. Cost CFDs pe spreads au commissions hoti hain jo aapke profits ko kam kar sakti hain. Overnight funding costs bhi lagti hain agar aap apni position zyada dair tak hold karte hain. 3.Regulation:Har country me CFDs ke regulations mukhtalif hain. Kuch countries me yeh restricted hain. Conclusion: CFD trading ek powerful tool ho sakta hai agar aap isse theek se samajh kar use karein. Isme high potential profits hain magar uske sath high risk bhi attached hai. Isliye hamesha proper research aur risk management techniques ko apnana chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:06 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим