Inverse Head and Shoulder Candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

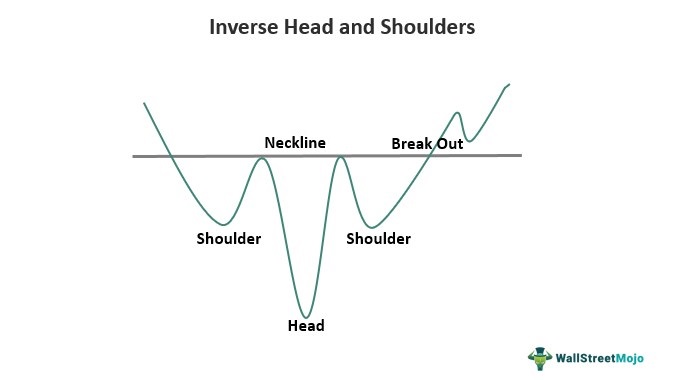

Inverse Head and Shoulder Candlestick Pattern Inverse Head and Shoulder Candlestick Pattern, ya inverse head and shoulder candlestick pattern, ek candlestick chart analysis technique hai jo traders aur investors ke liye ahem hai taake wo market trends aur reversals ko samajh saken. Ye pattern market mein hone wale potential bullish reversals ko dikhata hai. Is article mein, hum inverse head and shoulder candlestick pattern ko roman urdu mein detail se samjhenge.Inverse Head and Shoulder Candlestick Pattern ek useful technical analysis tool ho sakti hai traders aur investors ke liye. Is pattern ko samajh kar, market ke potential bullish reversals ko pehle se identify kar sakte hain aur traders ko alert karta hai. Lekin, trading decisions banate waqt hamesha caution aur risk management ka istemal karna zaroori hai. Inverse Head and Shoulder Pattern Ki Pechan Inverse head and shoulder candlestick pattern ek aisa pattern hai jo ke market mein hone wale potential bullish reversals ko indicate karta hai. Is pattern ki pehchan karne ke liye, teen consecutive candlesticks ki zaroorat hoti hai. Pehli candlestick bearish hoti hai aur market mein downtrend hota hai. Doosri candlestick bhi bearish hoti hai lekin iski range choti hoti hai aur iske baad ek third candlestick aati hai jo bullish hoti hai. Is third candlestick ki pehchan isse milti hai ke iski close price pehli bearish candlestick ki close price ke upper hoti hai. Inverse Head and Shoulder Pattern Ka Matlab Inverse head and shoulder pattern ka matlab hota hai ke market mein bearish trend weak ho raha hai aur bullish momentum build ho raha hai. Pehli aur doosri candlesticks mein bearish pressure hoti hai, lekin teesri candlestick jo ke bullish hoti hai, iska close price pehli bearish candlestick ki close price ke upper hoti hai. Iska asal matlab hota hai ke sellers ke paas initial strength thi, lekin phir buyers ne market ko control kiya aur bullish momentum create kiya. Is situation mein, traders ko alert karta hai ke market mein bullish reversal hone ke chances hain. Trading Strategies with Inverse Head and Shoulder Pattern Inverse head and shoulder pattern traders ke liye ek important tool ho sakti hai trading decisions banane mein. Jab ye pattern market mein aata hai, to traders isko dekhte hain aur samajhte hain ke market mein bullish reversal hone ke chances hain. Agar ye pattern ek downtrend ke baad aata hai, to iska matlab ho sakta hai ke bearish trend weak ho raha hai aur bullish reversal hone ke chances hain. Is tarah se, traders short positions ko close kar sakte hain ya long positions le sakte hain. Lekin, yaad rahe ke inverse head and shoulder pattern ek single indicator nahi hai, aur trading decisions banate waqt dusre technical indicators aur analysis tools ka bhi istemal karna zaroori hai. Market mein risk hota hai, aur isliye risk management ka bhi khayal rakha jana chahiye.Inverse head and shoulder pattern ko dusre indicators ke saath combine karke hi trading decisions lena behtar hota hai. -

#3 Collapse

Inverse Head and Shoulders Candlestick Pattern Introduction. Inverse Head and Shoulders (IHS) Candlestick Pattern ek technical analysis tool hai jo traders aur investors istemal karte hain taake market ke trends aur reversals ko samajh saken. Is pattern mein, candlestick charts ka istemal hota hai jisse ke market sentiment aur price movement ko samjha ja sake.Inverse Head and Shoulders Pattern ek bullish reversal pattern hota hai, jise traders market ke downtrend se uptrend mein jane ka sign samajhte hain. Is pattern mein 3 main components hote hain: Components of Head and Shoulders Candlestick Pattern. Left Shoulder. Yeh pehla phase hota hai jab market mein price downtrend mein hoti hai aur ek "shoulder" ban jata hai jo left side pe hota hai. Is phase mein price ek local low banati hai. Head. Head, left shoulder ke baad ata hai aur yeh ek aur local low hota hai lekin is bar left shoulder se kam low level pe. Is phase mein market ka sentiment negative hota hai. Right Shoulder.Right shoulder left shoulder ke baad ata hai aur yeh ek local low hota hai, lekin is bar head se kam low level pe. Is phase mein market mein price mein mazeed girawat hoti hai. Identification. Inverse Head and Shoulders Pattern ko pehchanne ke liye kuch important points hain.- Left Shoulder aur Right Shoulder ke beech mein Head hota hai, jo low levels pe hota hai.

- Left Shoulder aur Right Shoulder ke beech mein ek "neckline" hoti hai, jo ek horizontal line hoti hai jo shoulders ke bottoms se guzarti hai.

- Pattern complete hone par, traders expect karte hain ke price neckline ko break kare aur uptrend shuru kare.

- Mentions 0

-

سا0 like

-

#4 Collapse

Inverse Head and Shoulders Candlestick Pattern, ek bullish trend reversal pattern hai jo price chart par ek specific formation ko represent karta hai. Is pattern mein price chart par ek "head" aur do "shoulders" dikhte hain, jahan price pehle downward move karta hai, phir ek bottom banata hai, phir sey neeche jaata hai, phir dubara bottom banata hai, aur phir sey upward move karta hai. Chaliye is pattern ki wazahat karte hain: Inverse Head and Shoulder Candlestick Pattern 1. Formation: Inverse Head and Shoulders Candlestick Pattern formation mein price chart par ek "head" aur do "shoulders" dikhte hain. Head, price chart par ek bottom ko represent karta hai, jabki shoulders, price chart par do smaller bottoms ko represent karte hain. Head aur shoulders ke beech price chart par neckline hoti hai, jo resistance level ki tarah kaam karti hai. 2. Neckline: Neckline, Inverse Head and Shoulders Pattern ki important component hai. Ye resistance level ki tarah kaam karta hai. Jab price neckline ko break karke upar jaata hai, toh ye pattern confirm ho jata hai aur bullish trend reversal ki indication deta hai. 3. Volume: Volume analysis bhi Inverse Head and Shoulders Pattern mein important hota hai. Normally, jab price pattern ke formation ke time par neckline ko break karta hai, toh volume increase hota hai. Ye volume increase, bullish trend reversal ki confirmation deta hai. 4. Targets: Inverse Head and Shoulders Pattern mein traders price targets determine kar sakte hain. Is pattern mein price usually neckline ke break ke baad, pattern ke height ko approximate target maana jata hai. Traders is target ke basis par apne buy positions ko set kar sakte hain. Inverse Head and Shoulders Candlestick Pattern ka istemal karke traders buy entry point aur stop loss levels determine kar sakte hain. Jab price neckline ko break karta hai, traders buy kar sakte hain aur stop loss levels ko pattern ke neckline ke just below set kar sakte hain.Lekin jaise ki har technical analysis tool ya pattern ki tarah, Inverse Head and Shoulders Pattern ka bhi apne limitations hai. False signals, market volatility, aur other factors ko bhi consider karna zaruri hai. Traders ko hamesha apne own research aur risk management ke saath trading decisions lena chahiye. -

#5 Collapse

Inverse Head and Shoulder Pattren kiya hota hy? Dear my friends Inverse Head and Shoulder Pattern aik aisa candlestick patterns hy jo ki hamesha tab bante Hain Jab market down position mein hoti hai yah Jab market ka trend sell mein hota Hai Jab Bhi markets bilkul down Jaati Hai To Jo bilkul last candle Hoti Hai uske 7 Jo candles ki movement banti hai aur jo candles Banti Hain unko Ham inverse Head and Shoulder pattern kehte Hain Jab market mein Ek downtrend ho Aur FIR Uske bad bilkul end per candle ke sath ek candle buy main bany fir market downtrend mein chali Jaaye to vahan per Head and Shoulder pattern banta hai To Humein Head and Shoulder pattern ko follow karne ke liye zaruri hai ki Hamesha candlestick ki movement Ko achi se judge Kiya Karein Jitna achy sy hum apni judgement achi rakhen utna hi Humein sikhane ka mauka milega aur ham inverse Head and Shoulder pattern se ziada ziada faida uthate Huwe apni trade ko perform Karenge To Humein ziada se ziada faida mil sakta hai. Inverse Head and Shoulder Pattren kab banta hy: Dear forex traders Head and Shoulder pattern tab Banta Hai Jab market down trend ky andar move kar rhi hoti hai aur phir niche aik point se reject hokar thora sa uppar Chali Jaati hai aur fir market thori uppar jaa kar phir reject hoti hai aur Pichle support se aur ziada down chali jaati hai aur phir vahan se reject ho ker market FIR uppar ki taraf move karti hai aur uske baad again market thora sa down aati hai aur phir market yahan se up jana start ker deti hai to is surat mein hamare pass aik shape banati hai Jise hum Head and Shoulder pattern Kehte hain agar hum market ke sath touch rahenge to hum isase faida utha sakte hain Head and Shoulder pattern Kisi bhi time frame ke andar ban raha ho to market is ko zarur follow karti Hai Humein aisa chance miss nahin karna chahiye aur Is mauke per Humein is market mein trade zarur leni chahiye but Humein jazbati ho kar trade nahin karni chahiye money management ko follow karte hue sabar ke sath is market Mein ache entry point ke uppar he trade leni chahiye Jab market second shoulder Bana kar neckline ko cross karein to us time humein buy ki entry Le leni chahiye is se humein bohot faida hota hai . -

#6 Collapse

Inverse Head and Shoulder Candlestick Pattern "Inverse Head and Shoulder" candlestick pattern ko samajhna bohot aham hai, kyunki ye ek powerful trend reversal indicator hota hai. Is pattern ko samajhne ke liye, aapko candlestick charts ko dekh kar market ke behavior ko interpret karna hoga. Inverse Head and Shoulder pattern three main parts se milta hai: Left Shoulder Head Right Shoulder Yeh pattern usually downtrend ke baad aata hai aur bullish reversal signal provide karta hai. Is pattern ko samjhte waqt, aap ye dhundhna hoga: Left Shoulder: Pehli step me, aapko dekhna hai ke market ek downtrend se bahar nikal kar ek level par stabilize hota hai, jo ek "Left Shoulder" banata hai. Is shoulder ka size aur shape variable ho sakta hai. Head: Dusri step me, market ek aur bearish move ke baad ek lower low tak jata hai, jise "Head" kehte hain. Is low ko pehle left shoulder ke low se compare karna hoga. Head usually left shoulder se niche hota hai. Right Shoulder: Tisri step me, market phir se ek uptrend shuru karta hai, aur ek level par stabilize hota hai, jo left shoulder ke level se comparable hota hai. Is point par "Right Shoulder" banta hai.Inverse Head and Shoulder pattern tab confirm hota hai jab right shoulder ka formation ho jata hai aur uske baad market uptrend me chala jata hai. Is pattern ke confirmation ke liye, aapko volume bhi dekhna hoga. Generally, right shoulder ka formation low volume ke sath hota hai, aur jab price right shoulder ke upar move karta hai, to volume increase hota hai.Agar aapko ye pattern samajh me aata hai, to aap market me potential trend reversal ko identify kar sakte hain. Lekin, hamesha yaad rahe ke candlestick patterns ke sath aur bhi technical analysis tools ka istemal karna behtar hota hai trading decisions ke liye.

Inverse Head and Shoulder pattern three main parts se milta hai: Left Shoulder Head Right Shoulder Yeh pattern usually downtrend ke baad aata hai aur bullish reversal signal provide karta hai. Is pattern ko samjhte waqt, aap ye dhundhna hoga: Left Shoulder: Pehli step me, aapko dekhna hai ke market ek downtrend se bahar nikal kar ek level par stabilize hota hai, jo ek "Left Shoulder" banata hai. Is shoulder ka size aur shape variable ho sakta hai. Head: Dusri step me, market ek aur bearish move ke baad ek lower low tak jata hai, jise "Head" kehte hain. Is low ko pehle left shoulder ke low se compare karna hoga. Head usually left shoulder se niche hota hai. Right Shoulder: Tisri step me, market phir se ek uptrend shuru karta hai, aur ek level par stabilize hota hai, jo left shoulder ke level se comparable hota hai. Is point par "Right Shoulder" banta hai.Inverse Head and Shoulder pattern tab confirm hota hai jab right shoulder ka formation ho jata hai aur uske baad market uptrend me chala jata hai. Is pattern ke confirmation ke liye, aapko volume bhi dekhna hoga. Generally, right shoulder ka formation low volume ke sath hota hai, aur jab price right shoulder ke upar move karta hai, to volume increase hota hai.Agar aapko ye pattern samajh me aata hai, to aap market me potential trend reversal ko identify kar sakte hain. Lekin, hamesha yaad rahe ke candlestick patterns ke sath aur bhi technical analysis tools ka istemal karna behtar hota hai trading decisions ke liye.

-

#7 Collapse

Inverse Head and Shoulder pattern:

Inverse Head and Shoulder pattern ek bullish reversal pattern hai jo price chart par form hota hai. Is pattern mein three main components hote hain: ek head, do shoulders aur neckline.

1. Head:

Head component pattern ka central part hota hai. Ye generally price chart par ek downtrend ke baad form hota hai. Head component ke price level lower hota hai compared to the shoulders.

2. Shoulders:

Shoulders component pattern ke sides mein form hote hain. Ye head component ke dono taraf hote hain aur generally same price level par form hote hain. Left shoulder pattern ke baad head form hota hai, phir right shoulder pattern form hota hai.

3. Neckline:

Neckline component pattern ke base level ko represent karta hai. Ye ek horizontal line hoti hai jo left shoulder aur right shoulder ke bottoms ko connect karti hai. Jab price chart par inverse head and shoulder pattern form hota hai, to ye bullish reversal signal deta hai. Jab price neckline ko break karta hai, traders isko buy signal samajhte hain aur price ke further upside movement ki expectation hoti hai.

Trade with Head and shoulder pattern:

Inverse Head and Shoulder pattern ke saath trading karne ke liye aap ye steps follow kar sakte hain:

1. Identify the pattern:

Price chart par inverse Head and Shoulder pattern ko identify karein. Iske liye trend lines aur price levels ka use karein.

2. Confirm the pattern:

Pattern ko confirm karne ke liye aur strong entry point ke liye confirmatory indicators ka istemal karein, jaise ki volume, moving averages, ya oscillators.

3. Entry point:

Jab price neckline ko break karta hai, buy entry point consider karein. Entry point ko confirm karne ke liye aap additional indicators aur price action analysis ka bhi istemal kar sakte hain.

4. Stop loss:

Apni trade ko protect karne ke liye stop loss level set karein. Stop loss level ko pattern ke structure aur market volatility ke hisab se decide karein.

5. Target levels:

Target levels ko set karein jahaan aapko profit book karna hai. Target levels ko previous swings, resistance levels, ya Fibonacci retracement levels se identify kar sakte hain.

6. Monitor the trade:

Trade ko monitor karte rahein aur price action aur market conditions ko observe karein. Agar trade in your favor ja rahi hai, to profit levels ko adjust karein ya trailing stop loss ka istemal karein. Ye steps inverse Head and Shoulder pattern ke saath trading karne ke basic guidelines hai. Lekin hamesha apni research aur analysis karein aur apne trading plan ke hisab se trade karein. -

#8 Collapse

Inverse Head and Shoulder Candlestick Pattern Abi hum esko discuss krtay hain Inverse Head and Shoulder Candlestick Pattern, ya inverse head and shoulder candlestick pattern, ye ebst pattern hai ek candlestick chart analysis technique hai jo traders aur investors ke liye ahem hai ies pe analysis hotay hain taake wo market trends aur reversals ko samajh saken. chart mei candles dekh kr ye pattern market mein hone wale potential bullish reversals ko dikhata hai. Is puri hi post ka andar mein, hum inverse head and shoulder candlestick pattern ko roman urdu mein detail se samjhenge. theek faida deti hai ye Inverse Head and Shoulder Candlestick Pattern ek useful technical analysis tool ho sakti hai eska use bohat eham hai traders aur investors ke liye. Is pattern ko samajh kar, market ke potential bullish reversals ko shanakat pehle se theek se kar sakte hain aur traders ko alert karta hai. hum jantay hain k shayd trading decisions banate waqt hamesha caution aur risk management ka istemal karna zaroori hai. Inverse Head and Shoulder Pattern Ka asal meaning: Hum complete samjhtay hain Inverse head and shoulder pattern ka matlab hota hai ke market mein bearish walay momentum weak ho raha hai aur bullish momentum build ho raha hai. Pehli aur doosri candlesticks mein hum dekhta hain k ye bearish pressure hoti hai, lekin teesri candlestick jo ke bullish hoti hai, iska close price pehli bearish candlestick mukamal hi ye close price ke upper hoti hai. Iska asal matlab hota hai ke sellers ke paas initial strength thi, ye hum dekhtay hain k lekin phir buyers ne market ko control kiya aur bullish momentum create kiya. Humey iss halat mein, traders ko alert karta hai ke market mein bullish reversal hone ke chances hain. Eska asal matlab yahi hai eska use bohat zyada hai. Trading Strategy: Sab se pehle, traders ko pattern ko recognize karna hota hai, matlab left shoulder, head, aur right shoulder ko pehchan lena hota hai.Jab pattern complete hota hai aur price neckline ko break karta hai, traders entry point mante hain aur long position lete hain.Risk management ke liye, traders stop loss aur target levels set karte hain. Stop loss neckline ke neeche aur target neckline ke upar set kiye jate hain. -

#9 Collapse

DEFINITION AND FORMATION OF INVERSE HEAD AND SHOULDERS PATTERN: Inverse Head and Shoulders pattern ek bullish reversal pattern hai jo ek downtrend ke baad vikasit hota hai. Yah teen mukhya hisson se miltahota hai: sirde se niche tak ek central trough (head) aur dono taraf ke peaks (shoulders) se kam hota hai, aur ek neckline jise shoulders ke highs ko jodta hai. Ye pattern "inverse" kehte hain kyunki ye traditional Head and Shoulders pattern ka ulta hota hai, jo ek bearish reversal pattern hai. Inverse Head and Shoulders pattern banawat aam taur par ek lambi downtrend ke saath shuru hoti hai, jahan sellers market mein dominate karte hain. Is downtrend mein price ek low point tak pahunchti hai aur head banati hai. Iske baad price me ek recovery hoti hai, jo left shoulder ke naam se jaani jaati hai, jab buyers control hasil karne shuru karte hain. Halaanki, price phir se gir ke ek lower low banata hai, jo head ke bottom hota hai. Ant mein, buyers control paa lete hain, jo right shoulder banate hai, jo aam taur par left shoulder se kam hota hai. NECKLINE CONFIRMATION IN INVERSE HEAD AND SHOULDERS PATTERN: Neckline Inverse Head and Shoulders pattern ka ek mahatvapurn hissa hai. Yah dono shoulders ke high points ko jodkar banta hai. Neckline pattern ban rahi hoti hai, tab ye ek resistance level ke roop mein kaam karta hai aur pattern confirm hone ke baad ek support level ban jata hai. Pattern ki confirmation us waqt hoti hai jab price neckline ke upar break karti hai. Is breakout ke sath aksar volume badh jata hai, jo majboot buying pressure ko darshata hai. Ek confirm breakout ke pehle trade ko consider karne se pahle, false breakouts bhi ho sakte hain, isliye confirm breakout ka intezar karna zaroori hai. PRICE TARGETS IN INVERSE HEAD AND SHOULDERS PATTERN: Price targets pattern ke size ke aadhar par calculate kiye ja sakte hain. Price target calculate karne ke liye, head se neckline tak ki distance ko measure karein aur phir usko breakout point me add karein. Isse pata chalta hai ki breakout ke baad price kitna upar jaa sakta hai Halaanki, dhyan rakhna zaroori hai ki price hamesha target tak na pahunche. Price ki movement ko monitor karna aur raaste me profit lena, especially agar momentum kamzor hone ki ya resistance levels ke aage signs ho, ye zaroori hai. VOLUME ANALYSIS IN INVERSE HEAD AND SHOULDERS PATTERN: Volume analysis Inverse Head and Shoulders pattern ko trade karne me consider karne ki ek mahatvapurn baat hai. Pattern banane ke dauran volume left shoulder aur head ke dauran aam taur par badta hai, jo badhti hui buying interest ko darshata hai. Jab pattern progress karta hai, volume right shoulder ke dauran aksar kam hota hai, jisse buyers ki taraf se conviction ki kami ho sakti hai. Neckline ke upar breakout ke dauran ideally volume badhna chahiye, jo breakout ki strength ko confirm karta hai. Breakout ke dauran volume ki kami false breakout ko indicate kar sakti hai, isliye caution ke saath approach kiya jaana chahiye. POTENTIAL PITFALLS AND CONSIDERATIONS IN INVERSE HEAD AND SHOULDERS PATTERN: Inverse Head and Shoulders pattern ek powerful bullish reversal pattern ho sakta hai, lekin isme kuch potential pitfalls bhi hote hain. Sabhi patterns as expected work out nahi ho sakte. False breakouts ya breakout ke baad weak follow-through ho sakte hain, jisse potential losses ho sakte hain. Dusri baat, overall market trend aur pattern ban rahi context ko consider karna zaroori hai. Ek strong downtrend mein, Inverse Head and Shoulders pattern itna reliable nahi ho sakta aur ye bas temporary pause in the trend ho sakta hai. Iske alawa, pattern ki analysis ko dusre technical indicators aur chart patterns ke saath combine karna recommended hai. Isse trade ke success ke probability ko badhaya ja sakta hai aur false signals ke risk ko kam kar sakte hain. -

#10 Collapse

Introduction of Inverse Head and Shoulder pattern Dear Jase hm ne deeply study aur analyze kya he Head aur shoulder pattern mo ab is he tarh aik aur pattern ko deeply analyze kare gye ke inverse head and shoulder pattern kya he candlestick pattern, ek candlestick chart analysis technique hai jo traders aur investors ke liye ahem hai taake wo market trends aur iska close price pehli ai, toh volume increase hota hai. Ye volume increase, bullish trend reversal ki confirmation entry point mante hain aur long position lete hain.Risk management ke liye, traders stop loss aur bearish positions ko close kar sakte hain ya long positions le sakte hain. Lekin, yaad rahe kulder pattern ko dusre indicators ke saath combine karke hi trading candlestick ki close price ke upper hoti hai. Iska asal matlab hota hai ke sellers ke paas initial strength thi, lekin phir buyers ne market ko control kiya aur bullish momentum create kiya. Is situation mein, traders ko alert karta hai reversals ko samajh saken. Ye pattern market mein hone wale potential bullish reversals ko dikhata he Working and its role in Forex market Is ke hm working ke baat kare tu ap ne pehle he parha he ke ye aik inverse kesm ka pattern he agr ap Head and shoulder ke bare jamte hain wo ooper ja rha he ya neeche aa rha he tu ye pattern us ke inverse kaam kare gabreak karta hai, traders Normally, jab price pattern ke formation ke time par neckline ko break karta hr target levels set vahan per Head and Shoulder pattern banta hai To Humein Head and e inverse head and shoulder pattern ek single indicator nahi hai, aur trading decisions banate waqt dusre technical indicators aur analysis tools ka bhi istemal karna zaroori hai. Market mein risk hota hai, aur isliye risk management ka bhi khayal rakha jana chahiye.Inverse head and Shoulder pattern ko follow karne ke liye zaruri hai ki Hamesha candlestick ki movement Ko achi se judge Kiya Karein Jitna achy sy hum apni judgement achi rakhen utna hi Humein sikhane ka mauka milega aur ham inverse Head and Shoulder ko show karte hain. Stop loss neckline ke neeche aur target neckline ke upar set kiye jate hain.Pattern ke breakout ke bad, traders confirmatory signals ko bhi dekhte hain jaise ke volume increasee aur bullish bearish pattern ke bary me maloomat hona zaroori hain -

#11 Collapse

"Inverse Head and Shoulders Candlestick Pattern" ek ahem reversal pattern hai jo technical analysis mein istemal hota hai aur market mein bearish trend se bullish trend ki taraf hone wale possible reversal ko peshgoi karta hai. Is pattern ko "Inverse Head and Shoulders" ya "Head and Shoulders Bottom" bhi kaha jata hai. Is pattern mein typically teen candlesticks ya price points hote hain, jo neeche diye gaye hain: 1. **Left Shoulder:** Pehla candlestick bearish (giravat wala) hota hai aur existing downtrend ke hisaab se banta hai. Isme price girne ke baad recover kar leti hai, lekin yeh recover pehle ke highs se kam hota hai. 2. **Head:** Dusra candlestick jo hota hai, usse "Head" kehte hain. Yeh candlestick left shoulder ke neeche gir kar aata hai aur uski keemat left shoulder ke level tak gir sakti hai ya usse neeche bhi ja sakti hai. Iske baad price tezi se ooper jaati hai aur ek higher high banti hai. 3. **Right Shoulder:** Tisra aur aakhri candlestick "Right Shoulder" hota hai. Yeh bhi bearish candle hota hai, jisme price phir se gir kar left shoulder ke level tak pohunch sakti hai ya usse kam. Iske baad price dubara se ooper jaati hai, lekin is baar "Head" ke high se neeche rehti hai. Is pattern ko samajhne ke liye traders typically "neckline" ke concept ka istemal karte hain. Neckline ek imaginary line hoti hai jo left shoulder aur right shoulder ke bottoms ko connect karti hai. Inverse Head and Shoulders pattern ka confirmation tab hota hai jab price neckline ko break kar ke ooper jaati hai, yaani ke right shoulder ke baad ka candlestick neckline ke upar close karta hai. Is pattern ke characteristics: 1. **Reversal Signal:** Inverse Head and Shoulders pattern ek bullish reversal signal deta hai, matlab ke bearish trend ko khatam hone ki possibility hoti hai. 2. **Volume:** Traders often look for increasing trading volumes jab price neckline ko break karti hai, kyun ke yeh ek strong reversal signal hota hai. 3. **Price Target:** Pattern ko confirm karne ke baad traders potential price target ka estimate banate hain, jiska tareeka neckline se head ka distance calculate kar ke kiya jata hai. Inverse Head and Shoulders Candlestick Pattern traders ke liye ek valuable tool hota hai kyunki isse potential trend reversal ko pehchanne mein madad milti hai. Lekin jaise har trading pattern, yeh bhi 100% kaamyaab nahi hota aur risk management strategies, jaise stop-loss orders, ka istemal zaroori hota hai trading decisions mein.

- Mentions 0

-

سا0 like

-

#12 Collapse

Inverse Head and Shoulder Candlestick Pattern aj ham baat kra ga Inverse Head and Shoulders Candlestick Pattern, ek bullish bhoot trend aur reversal pattern hai jo paisy chart par ek maksuus information ki nomindigi karta hai. Is pattern mein price chart par ek haed aur do shoulders dikhte hain jee ha asa hi hota ha jahan paisy pehle bhot nicah jata ha phir ek bottom banata hai,jee aur phir sey neeche jaata hai, aur ak daam phir dubara bottom banata hai, aur phir sey oper jata ha asa hi karta hai. Chaliye is pattern ki wazahat karte hain jasa ka inverse head and shoulder pattern ka tranlation mtlb ka iska mtlb .. Inverse Head and Shoulder Pattern translation ab aga gutugu badhata ha jasa ka baat krta ha Inverse head and shoulder pattern ka matlab hota hai ke market mein bearish trend weak ho raha hai jee asa hi aur bullish momentum build ho raha hai tab asa ka . Pehli aur doosri candlesticks mein bearish pressure hoti hai baki sab thk lekin teesri candlestick jo ke bullish hoti hai, iska paisy pehli bearish candlestick ka kreeb paiso ke upper hoti hai.jee ha bilkul Iska asal matlab hota hai ke sellers ke paas initial strength thi, lekin phir trader ne market ko ma hath btaya sikha aur bullish momentum create kiya. Is halat mein, traders ko hoshyaar karta hai ke market mein bullish reversal hone ke chances hain takka wo ho shyaar ho jaya -

#13 Collapse

Inverse Head and Shoulder Candlestick Pattern aj ham baat kra ga Inverse Head and Shoulders Candlestick Pattern, ek bullish bhoot trend aur reversal pattern hai jo paisy chart par ek maksuus information ki nomindigi karta hai. Is pattern mein price chart par ek haed aur do shoulders dikhte hain jee ha asa hi hota ha jahan paisy pehle bhot nicah jata ha phir ek bottom banata hai,jee aur phir sey neeche jaata hai, aur ak daam phir dubara bottom banata hai, aur phir sey oper jata ha asa hi karta hai. Chaliye is pattern ki wazahat karte hain jasa ka inverse head and shoulder pattern ka tranlation mtlb ka iska mtlb .. Inverse Head and Shoulder Pattern translation ab aga gutugu badhata ha jasa ka baat krta ha Inverse head and shoulder pattern ka matlab hota hai ke market mein bearish trend weak ho raha hai jee asa hi aur bullish momentum build ho raha hai tab asa ka . Pehli aur doosri candlesticks mein bearish pressure hoti hai baki sab thk lekin teesri candlestick jo ke bullish hoti hai, iska paisy pehli bearish candlestick ka kreeb paiso ke upper hoti hai.jee ha bilkul Iska asal matlab hota hai ke sellers ke paas initial strength thi, lekin phir trader ne market ko ma hath btaya sikha aur bullish momentum create kiya. Is halat mein, traders ko hoshyaar karta hai ke market mein bullish reversal hone ke chances hain takka wo ho shyaar ho jaya kbi bhi istemal karna zaroori hai.ab Market mein bhhot ahtyat karni padti ha phr ahtyat risk management ka khayal rakha zruri ha .Inverse head and shoulder pattern ko dusre patran sa mila kr hi karket ki trading decisions lena behtar hota hai -

#14 Collapse

Inverse Head and Shoulder Candlestick Pattern: Ek Candlestick Patter Ki Guftagu

Kya Hai Inverse Head and Shoulder Candlestick Pattern?

Inverse Head and Shoulder Candlestick Pattern ek aham technical analysis tool hai jo market mein trend reversal ko indicate karta hai. Ye pattern typically downtrend ke baad dekha jata hai aur bullish trend ke hone ki possibility ko signal karta hai.

Kaise Pehchanein Inverse Head and Shoulder Pattern?

Inverse Head and Shoulder Pattern mein teen main components hote hain: left shoulder, head, aur right shoulder. Left shoulder aur right shoulder, price ke temporary rebounds ko represent karte hain jabki head, market ke bottom ko indicate karta hai.

Kaise Kaam Karta Hai?

Jab market downtrend se recover karta hai, left shoulder form hota hai, phir price neeche jaata hai aur head form hota hai, aur phir price phir se upar jaata hai lekin left shoulder ke level tak nahi pahunchta. Fir se ek neeche ka dip aata hai, jo right shoulder ko form karta hai. Jab price right shoulder ke bottom se upar jaata hai, pattern complete ho jaata hai aur bullish reversal ka indication hota hai.

Trading Signals

Inverse Head and Shoulder Pattern ko samajh kar traders ko trading signals milte hain. Jab price right shoulder ke top se upar jaata hai, yeh ek buy signal hai. Stop-loss ko left shoulder ke bottom ke neeche rakha ja sakta hai aur target price head ke level tak set kiya ja sakta hai.

Conclusion

Inverse Head and Shoulder Candlestick Pattern ek powerful tool hai jo traders ko bullish trend reversal ke baare mein batata hai. Magar, is pattern ke istemal se pehle, traders ko market context aur confirmatory signals ka dhyan rakhna zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Master Candle Ki Pehchan

Master Candle Ki Pehchan

Master Candle ko pehchanne ke liye, traders ko marketplace ke charge motion ko closely monitor karna hota hai. Is pattern mein, ek bari candle ko chhote candles se surrounded dekha jata hai.

Three. Master Candle Ki Formation

Master Candle ki formation marketplace mein kisi sizable event ke baad hoti hai jaise koi fundamental information release ya trend rMaster candle ki pehchan karna asaan nahi hai. Iske liye buyers ko market ko carefully display karna parta hai. Master candle banne ke baad, buyers iski breakout route ko dekhte hain. Agar next few candles grasp candle ke high ya low ko break karte hain, toh yeh ek potential trend reversal ya continuation ki nishani ho sakti hai.Eversal. Iske formation mein, pehli bari candle ko dekha jata hai jo chhote candles se zyada bari hoti hai.

4. Master Candle Ka Istemal

Master Candle ka istemal buying and selling techniques mein shamil kiya jata hai. Traders is sample ko dekh kar access aur exiiye jab woh master candle ka istemal karte hain. Iske alawa, market mein hone wale modifications aur sudden occasions ka bhi dhyaan rakhna zaroori hai, taake trading selections sahi aur profitable ho sakein.T points perceive karte hain.

Five. Master Candle Aur Price Action

Master Candle fee motion evaluation ka aik hissa hai jisme buyers market ki movement ko samajhte hain. Yeh sample market mein volatility aur momentum ko darust karne mein madadgar sabit hota hai.aster Candle ka istemal buying and selling techniques mein shamil kiya jata hai. Traders is sample ko dekh kar access aur exiiye jab woh master candle ka istemal karte hain. Iske alawa, market mein hone wale modifications aur sudden occasions ka bhi dhyaan rakhna zaroori hai, taake trading selections sahi aur profitable ho sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:08 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим