Hockey stick candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

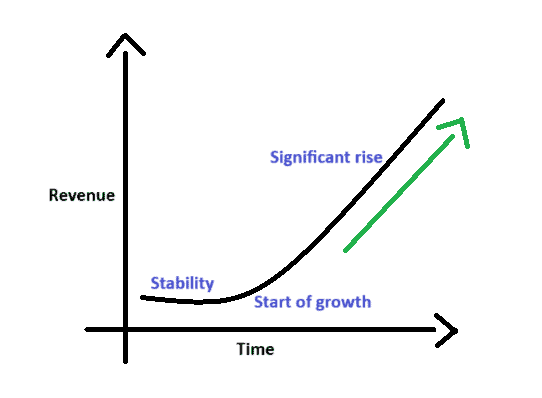

What is Hockey stick Definition hockey stick aik chart patteren hai jo nisbatan istehkaam ki muddat ke baad taizi se izafah dekhata hai. traders aksar is patteren ko talaash karte hain jab matrix ka andaza lagatay hain jaisay ke company ke sales ke hajam ya revenue mein izafah jis ke nateejay mein hasas ki qeematon mein isi terhan izafah ho sakta hai. hockey stick patteren ki shanakht kaisay karen. hockey stick ke patteren ki shanakht teen allag allag hisson se ki ja sakti hai : blade, inflection aur handle. aayiyae un mein se har aik ko baari baari dekhte hain. How to identify the Hockey stick hockey stick chart par blade aksar aik chapti lakeer hoti hai, jis mein numoo sust hoti hai, shayad jamood ka shikaar bhi. Inflection blade se aik munhani khutoot hai, jo taraqqi mein ibtidayi phatt ki numaindagi karta hai. handle inflection ke baad aata hai, aur yeh oopar ki raftaar ke sath musalsal aur phelti hui taraqqi ko zahir karta hai. hockey stick patteren hockey stick chart patteren ka taajiron ke liye kya matlab hai? What Does A Hockey stick Chart pattern Mean to Trader taajiron ke liye, farokht ke hajam ya aamdani mein izafay ke chart par hockey stick ka namona is baat ki nishandahi kar sakta hai ke company ki masnoaat ya khidmaat mein ziyada dilchaspi hai. farokht ka barhta sun-hwa hajam company ke hasas ki qeemat mein anay walay izafay ke mumkina isharay ke tor par kaam kere ga, kyunkay ziyada se ziyada sarfeen apni masnoaat mein dilchaspi letay hain. is ki wajah yeh hai ke ziyada sarfeen maang mein izafah karen ge, jis ke nateejay mein, company ke phelnay ke sath hi aamdani mein izafah hoga. jaisay jaisay company phelti hai aur is ki aamdani mein izafah hota rehta hai, tawaqqa ki jati hai ke company ke hasas ki qeemat bhi barhay gi – jo taajiron ke liye aik mauqa paish kere gi . Hockey stick. Chart pattern summed up hockey stick chart patteren aik makhsoos metric mein taizi se izafay ka ishara hai. farokht ke barhatay hue hajam ko zahir karne wala hockey stick chart patteren jis ke nateejay mein aamdani bherne ke sath hi company ke hasas ki qeemat mein bhi isi terhan ka izafah ho sakta hai. tajir hasas ki barhti hui qeematon par qiyaas aaraiyan karne ke liye aik lambi position len ge. hockey stick patteren ki tijarat karne ke liye, aaj hi aik account kholeen. -

#3 Collapse

Hockey stick candlestick pattern ko Explain karein: Assalam o alaikum!Dear forex members Hocky stick candlestick pattern aik aisa pattern hy jo har pair mein nhi banta q k kisi bhi currency ya commodity pairs ki market main itni fast change ya taizi nai ati keh is mein bohot thore waqat mein had sy ziada increase ho jaye yani is pattern mein jab aik aisa bahao ata hay ky isky last periods ki nisbat bohot limited waqat mein bohot ziada aur clear high increase ho jaye to isko hockey stick chart sy tashbeeh di jati hay. Aur ye amooman tab hi ho sakta hy ky jab kisi company ky stock ki prices high ho jaye ya is business ki last 20 years ky muqably mein sirf aik ya do saal main itna expansion aur increase ho jaye ky iska chart pattern just like aik hockey stick candlestick pattern ban jaye. Hockey stick candlestick pattern kab banta hy: Dear forex trading partners hockey stick candlestick pattern us waqat banta hai jab market me aam tor per khamoshi hoti hai aur achanak market mein disturbance ho jati hai. Hokey stick candlestick pattern ko world level mein us waqat show kiya jata hai jab financial satah pe ilmi maamlat ko dekha jata hai aur ghurbat ki satah ko maddey nazar rakha jata hai. Financial market me jab bhi market aik smooth tareeqay se sideways movement chal rahi ho to jab bhi koi new news market me jati hai jis se achanak market mein teezi ho jati hai to is se jo chart pattern banta hai wo hockey stick jesa hota hai, is wajah se is chart pattern ko hockey stick candlestick pattern kaha jata hai.

- Mentions 0

-

سا0 like

-

#4 Collapse

Hockey stick candlestick pattern introduction Aslaam o alaikum forex team members ummeed ha sb kheriyat sa ho gy aaj hum baat krein gy Hockey stick candlestick pattern k topic pr. Hockey stick candlestick pattern stock market trading mein ek prakar ka candlestick pattern hai. Isme do candlesticks hoti hain, ek bullish (upward) candlestick aur ek bearish (downward) candlestick. Bullish (Upward) Candlestick: Pehla candlestick ek bullish candle hota hai, jismein opening price se closing price jyada hota hai. Yani ki, is candle mein buyers ne control kiya hota hai aur stock price upar gaya hota hai. Bearish (Downward) Candlestick: Dusra candlestick ek bearish candle hota hai, jismein opening price se closing price kam hota hai. Yani ki, is candle mein sellers ne control kiya hota hai aur stock price nichay gaya hota hai. Yeh pattern usually ek uptrend ke baad aata hai, indicating a potential reversal in the trend. Iska matlab hota hai ki stock price ke uptrend ke baad downward movement ki sambhavna hoti hai. Hockey stick candlestick pattern formation Hockey stick candlestick pattern ek stock market technical analysis ka hissa hai, jise candlestick charts ki madad se monitor kiya jata hai. Hockey stick pattern ka matlab hota hai ki ek candlestick chart par ek lambi bullish (upward) candlestick followed by ek short bearish (downward) candlestick aata hai. Yeh pattern usually uptrend ke dauran dekha jata hai aur traders ko potential trend reversal ki indication deta hai. Hockey stick pattern ko identify karne ke liye, aapko candlestick charts par dhyan dena hoga. Yahan kuch steps hain jo is pattern ko detect karne me madadgar ho sakte hain: Pehle, ek lambi bullish candlestick ko dhundein, jo market me uptrend ko represent karta hai. Uske baad, dekhein ki us bullish candlestick ke turant baad ek short bearish candlestick aata hai. Is bearish candlestick ka open price bullish candlestick ke close price ke near hota hai. Hockey stick pattern tab samjha jata hai jab is bearish candlestick ke low price se neeche koi aur candlestick nahi hoti. How to trade Hockey stick candlestick pattern Hockey stick candlestick pattern, jo ke "hammer" pattern bhi kehlate hain, forex market mein aik aham signal ho sakti hai. Yeh typically bullish reversal pattern hota hai, jiska matlab hota hai ke market down trend se up trend mein ja sakta hai. Is pattern ko trade karne ke liye aap ye steps follow kar sakte hain: Identify the Pattern: Sab se pehle to aapko hockey stick candlestick pattern ko identify karna hoga. Is pattern ki pehchan k liye aapko ek candlestick chart par dekhna hoga jahan par ek lambi lower shadow (wicks) ke sath ek choti body hoti hai. Ye candle bullish (green) ya bearish (red) ho sakti hai, lekin bullish scenario mein iska zada effect hota hai. Confirm the Signal: Pattern ki pehchan ke bad, aapko dusri technical analysis tools aur indicators ka bhi sahara lena chahiye jaise ke RSI, MACD, ya moving averages. Ye tools aapko confirm karne mein madadgar ho sakte hain ke market trend real mein reversal kar raha hai. Set Stop Loss aur Take Profit: Trading ke liye stop loss aur take profit levels set karein, taake aap apne trade ko manage kar saken. Risk management bahut zaroori hai. Trade Entry: Jab aap confident ho ke hockey stick pattern valid hai aur market trend reversal hone ke chances hain, to aap apna trade enter kar sakte hain. Long position lena (buy) jyada common hota hai jab ye pattern dikhai deta hai. Monitor the Trade: Apne trade ko closely monitor karein aur market conditions ko dekhte rahein. Agar market aapke favor mein ja raha hai, to take profit kar lein, ya fir agar trade against aap hai to stop loss lagayein. Learn and Adapt: Hockey stick pattern ki sahi understanding aur trading strategy develop karne mein practice aur experience ki zaroorat hoti hai. Apne trades ki performance ko analyze karein aur apni strategy ko refine karte rahein. -

#5 Collapse

Hockey stick candlestick pattern Hockey Stick Candlestick Pattern ek technical analysis concept hai jo stock market, forex market, aur doosre financial markets mein payi jane wali price patterns mein se ek hai. Is pattern ka main maqsad bearish (giravat ki taraf) trend ke indication ko darust karna hai. Yeh pattern traders aur investors ko alert karta hai ke market mein downward pressure badh rahi hai. Hockey Stick Candlestick Pattern Ki Pechan: Is pattern ki pehchan karne ke liye kuch key characteristics hote hain:- Candlestick Pattern: Hockey Stick Candlestick Pattern ek single candlestick pattern hota hai, jo ki bearish trend ke doran paya jata hai.

- Long Upper Shadow: Is candlestick ka upper shadow (wick) lamba hota hai aur body ke upar extend hota hai. Upper shadow upper high (maximum price) ko represent karta hai.

- Choti Body: Candlestick ki body choti hoti hai aur usually lower side par hoti hai. Iska closing price opening price se neeche hota hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

Hockey stick candlestick pattern aik relatively new aur kam zikar hone wala pattern hai jo trading mein istimaal hota hai, lekin iska asar aur importance kabhi kabhi bohot zyada hoti hai. Yeh pattern apni shape ki wajah se "hockey stick" kehlaata hai, kyunki iska candlestick chart par nazar aane wala structure hockey stick jaisa hota hai. Is pattern ko pehchan-ne ka matlab yeh ho sakta hai ke market mein aik strong breakout ya reversal aane wala hai, aur agar trader is pattern ko sahi samajh jaye toh woh profitable trades kar sakta hai.

Hockey Stick Pattern ka Introduction

Hockey stick candlestick pattern aik aisa visual formation hai jo price chart par hockey stick jaisi shakal mein appear hota hai. Is pattern mein price pehle sideways ya flat hoti hai, yaani market bohot zyada move nahi karti, aur phir achanak se aik steep rise ya steep fall hota hai. Yeh rise ya fall aik strong breakout ki taraf indication hota hai.

Hockey stick pattern ka base aik consolidation phase hota hai jahan price bohot zyada move nahi karti. Is consolidation ke baad ek sudden price movement hoti hai jo market mein new trend ya breakout ko signal deti hai.

Is pattern ko zyada tar bullish aur bearish breakouts ke liye use kiya jata hai. Agar pattern hockey stick ke blade ki taraf upward move kare toh yeh bullish signal hota hai, aur agar blade downward ho toh yeh bearish signal ho sakta hai.

Hockey Stick Candlestick Pattern ki Structure

Hockey stick candlestick pattern ka structure aik typical candlestick chart par is tarah se hota hai:

1. Consolidation Phase (Handle)

Is pattern ka pehla hissa consolidation ya sideways movement hota hai. Is phase ko handle bhi kaha jata hai. Is waqt market mein koi major price movement nahi hoti. Market mein thoda bohot fluctuation hota hai lekin koi clear direction nahi hoti. Yeh phase market mein low volatility ko show karta hai, yaani log trades execute nahi kar rahe hote ya market kaafi stable hoti hai.

Is consolidation phase ka period different ho sakta hai. Kabhi kabhi yeh phase kuch dino tak bhi reh sakta hai aur kabhi kuch ghanton mein khatam ho jata hai. Is phase ko pehchan-na is liye zaroori hai kyunki yeh base provide karta hai market ke next strong move ke liye.

2. Sudden Breakout (Blade)

Handle ke baad, price mein ek sudden breakout hota hai jo is pattern ka blade kehlata hai. Yeh blade hockey stick ki shape banata hai aur yeh breakout kaafi sharp aur steep hota hai. Breakout ya toh bullish hota hai, jab price rapidly increase hoti hai, ya bearish hota hai jab price rapidly decrease hoti hai. Yeh price movement market ke previous low volatility period ke baad aata hai aur isme bohot zyada energy hoti hai, jo market participants ke sudden interest ko reflect karta hai.

Is breakout phase ko dekhte waqt traders ko zaroori hai ke woh volume par bhi nazar rakhain, kyunki volume ka increase breakout ki authenticity ko confirm karta hai. Agar breakout ke sath volume bhi increase ho rahi hai toh iska matlab yeh hai ke yeh breakout strong aur sustainable ho sakta hai.

Hockey Stick Pattern ka Interpretation aur Importance

Hockey stick candlestick pattern ko samajhna trading mein bohot zaroori ho sakta hai, kyunki yeh pattern market ke bohot important phases ko dikhata hai.

1. Bullish Hockey Stick Pattern

Bullish hockey stick pattern tab form hota hai jab consolidation phase ke baad price mein aik strong upward move hota hai. Yeh upward breakout market ke bullish sentiments ko show karta hai aur yeh signal deta hai ke price ab upar jaane wali hai. Is waqt trader ko yeh expect karna chahiye ke market mein upward trend continue hoga aur price higher highs banayegi.

Yeh bullish pattern aksar un situations mein dekha jata hai jab market mein koi positive news aati hai ya koi fundamental factor price ko push karta hai. Agar trader is pattern ko sahi waqt par identify kar le, toh woh ek achi buying opportunity ko capture kar sakta hai.

2. Bearish Hockey Stick Pattern

Bearish hockey stick pattern bilkul opposite hota hai bullish pattern ka. Isme consolidation phase ke baad ek strong downward breakout hota hai, jo yeh signal deta hai ke price ab neeche girne wali hai. Yeh pattern market ke bearish sentiments ko reflect karta hai aur is waqt traders ko selling opportunity ko dekhna chahiye.

Yeh bearish pattern kabhi kabhi tab form hota hai jab market mein koi negative news aati hai ya economic conditions deteriorate hoti hain, jo price ko neeche push kar deti hain. Yeh pattern price ke lower lows banane ka indication deta hai.

Hockey Stick Pattern ko Identify karne ka Tariqa

Hockey stick pattern ko identify karna itna mushkil nahi hota lekin iske liye aapko thoda patience aur focus chahiye hota hai. Yahan kuch important points hain jo aapko pattern ko pehchan-ne mein madad denge:

1. Price Consolidation ko Observe karna

Aapko pehle market mein aik consolidation phase ko dekhna hoga. Is phase mein price bohot limited range mein move karti hai aur zyada changes nahi hoti. Yeh market mein low volatility ko dikhata hai. Is phase ka period alag alag ho sakta hai lekin jab aap dekhte hain ke price ek tight range mein kaafi der se move kar rahi hai, toh yeh handle ka formation ho sakta hai.

2. Breakout ka Intizar karna

Breakout ka intizar karna bohot zaroori hota hai. Consolidation phase ke baad jab price ek taraf kaam karke sharply move karti hai, toh yeh pattern ka second part hota hai. Yeh breakout upward ya downward dono taraf ho sakta hai, lekin iska volume kaafi zyada hota hai jo price movement ko confirm karta hai.

3. Volume ko Monitor karna

Breakout ke waqt volume ko zaroor check karein. Agar volume high hai toh iska matlab yeh hai ke breakout kaafi strong hai aur market participants ka interest barh gaya hai. High volume ke sath breakout aksar sustainable hota hai.

Hockey Stick Pattern ke Pros aur Cons

Har candlestick pattern ki tarah, hockey stick candlestick pattern ke bhi kuch pros aur cons hain jo traders ko samajhne chahiye:

Pros- Clear Entry Signals: Is pattern ka aik clear advantage yeh hai ke yeh ek straightforward aur clear entry signal deta hai. Jab consolidation ke baad breakout hota hai, toh trader ko market mein entry ka pata chal jata hai.

- Strong Trend Indication: Yeh pattern aksar strong trends ko initiate karta hai. Agar aap isko sahi tarah se samajh lein, toh aap strong bullish ya bearish trends ko capture kar sakte hain.

- Simple to Identify: Is pattern ko chart par dekhna itna mushkil nahi hota. Sirf price ka behavior aur volume dekh kar aap easily isko pehchan sakte hain.

- False Breakouts: Kabhi kabhi consolidation ke baad false breakout bhi ho sakta hai. Iska matlab yeh hota hai ke price initially move karti hai lekin phir wapas apni previous range mein chali jati hai. Is liye volume ka check karna bohot zaroori hota hai.

- Short-Term Pattern: Yeh pattern short-term trading ke liye zyada useful hota hai. Long-term investors ke liye yeh itna faidamand nahi hota kyunki yeh short-term price movements ko highlight karta hai.

Hockey Stick Pattern ko Trading Strategy mein Shaamil karna

Hockey stick candlestick pattern ko apni trading strategy mein shaamil karne ke liye kuch important points ko dekhna zaroori hai:

1. Technical Indicators ke sath Combine karna

Is pattern ko sirf dekh kar trade karna thoda risky ho sakta hai. Aapko hamesha is pattern ko doosre technical indicators ke sath combine karna chahiye, jaise ke moving averages, relative strength index (RSI), aur stochastic oscillator. Yeh indicators aapko additional confirmation denge ke breakout legit hai.

2. Risk Management

Har trading pattern ke sath risk management bohot zaroori hoti hai. Hockey stick pattern mein jab aap breakout par entry lete hain toh aapko apne stop-loss ko usi consolidation range ke neeche set karna chahiye. Yeh aapko potential loss se bacha sakta hai agar breakout reverse ho jaye.

3. Trend Confirmation ka Intizar karna

Breakout ke baad kabhi kabhi price retrace karti hai ya consolidation range mein wapas chali jati hai. Aapko hamesha trend continuation ka confirmation lena chahiye. Agar breakout ke baad price continuous upward ya downward move kar rahi hai aur volume increase ho raha hai, toh yeh trend continuation ka signal hai.

Hockey stick candlestick pattern aik unique aur kaafi effective pattern hai jo traders ko market ke sudden moves ko samajhne mein madad deta hai. Yeh pattern consolidation ke baad ek strong breakout signal karta hai jo traders ke liye profitable trade ban sakta hai. Agar aap is pattern ko technical indicators aur proper risk management ke sath combine karein, toh aap apni trading strategy mein significant improvement dekh sakte hain.Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:47 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим