Dark cloud cover pattern:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

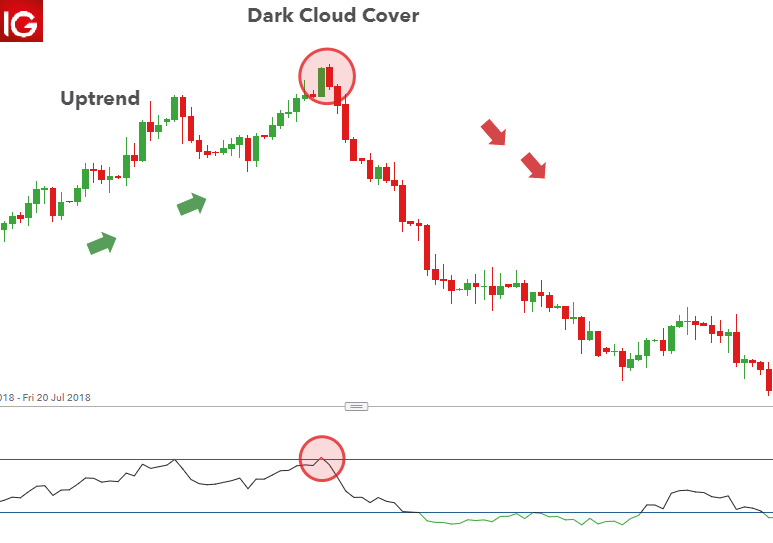

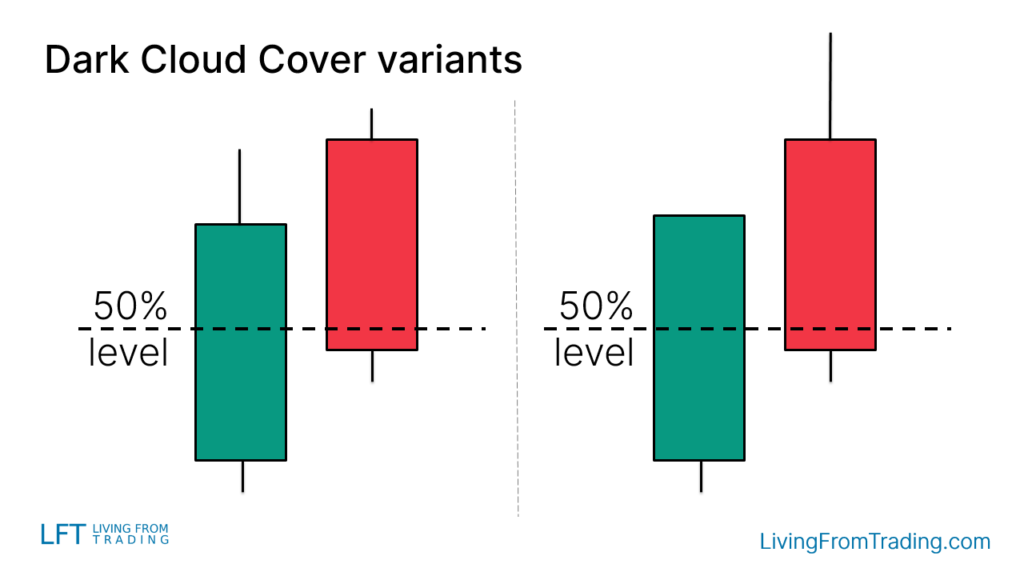

INTRODUCTION TO THE DARK CLOUD COVER PATTERN: Dark Cloud Cover Pattern, market mein potential reversals ki forecast karne ke liye istemal kiya jane wala aik popular candlestick pattern hai. Ye uptrend ki akhri stage mein hota hai aur bearish pattern samjha jata hai. Is pattern mein do muzmir candlestick hoti hain, pehli candle long bullish candle hoti hai aur dusri candle bearish candle hoti hai jo pehli candle ke high se oper open hoti hai aur apne midpoint se neeche close hoti hai. Ye pattern potential selling pressure ka indication hai aur traders ise market direction mein potential change ki signal ke liye istemal karte hain. IDENTIFYING THE DARK CLOUD COVER PATTERN: Dark Cloud Cover pattern ko pehchanne ke liye traders ko iske kuch characteristics par nazar rakhni hoti hain. Pehle toh, pattern ke pehle tak clear uptrend hona chahiye. Ye higher highs aur higher lows ki series se samjha ja sakta hai. Agla step hai pehli candle jo long bullish candle hoti hai, is se ye pata chalta hai ki buyers control mein hain. Dusri candle pehli candle ke high se oper open honi chahiye, jisse uptrend ki potential continuation ka signal milta hai. Lekin mahatvapurna hai ki dusri candle pehli candle ke midpoint se neeche close ho, jisse pata chalta hai ki sellers ne entry mari hai aur uptrend potential reverse ho sakta hai. INTERPRETING THE DARK CLOUD COVER PATTERN: Jab Dark Cloud Cover pattern ko identify kiya jata hai, toh isey bearish signal samjha jata hai. Iska reversal potential is baat se aata hai ki dusri candle pehli candle ke midpoint se neeche close hoti hai, jo dikhata hai ki sellers ne buyers ko dominate kar diya hai aur potential uptrend reverse ho sakta hai. Lekin, kisi bhi technical pattern ki tarah, trading decisions lene se pehle dusre factors ko bhi dhyan mein rakhna zaruri hai. Traders aksar additional indicators ya confirmations, jaise ki support aur resistance levels ya trendlines ka istemal karte hain, taaki market conditions aur potential reversals ki puri samajh mil sake. USING THE DARK CLOUD COVER PATTERN IN TRADING STRATEGIES: Dark Cloud Cover pattern ko traders alag-alag trading strategies mein istemal kar sakte hain, jaisa ki unke goals aur risk tolerance ke hisaab se ho. Ek approach hai ise ek standalone signal ke roop mein istemal karna, jahan traders pattern confirm hone ke baad short positions lete hain. Is approach mein ye maana jata hai ki pattern hi reversal aur potential downside profit signal karne ke liye kaafi hai. Dusra approach hai ise ek confirmation tool ke roop mein istemal karna, dusre technical indicators ke saath milakar. Maslan, traders Dark Cloud Cover pattern ka wait karte hain takriban resistance level par ya fir kisi oscillator ki bearish divergence ke saath. Multiple signals ko milakar, traders potential reversals par apna confidence badha sakte hain aur overall trading strategies ko improve kar sakte hain. LIMITATIONS AND CONSIDERATIONS OF THE DARK CLOUD COVER PATTERN: Kisi bhi technical analysis tool ki tarah, Dark Cloud Cover pattern ki bhi limitations aur considerations hoti hain. Pehli baat toh ye zaruri hai ki koi bhi pattern ya indicator reversal ko ya market moves ko 100% accuracy se predict nahi kar sakta. Dark Cloud Cover pattern ko dusre indicators aur analysis methods ke saath istemal karna zaruri hai, successful trades ke probability ko badhane ke liye. Uske saath hi, overall market context aur aur fundamental ya macroeconomic factors ko bhi dhyan mein rakhna zaruri hai, jinse price movements ko influence mil sakta hai. Ant mein, Dark Cloud Cover pattern ka istemal karte waqt risk management aur clear entry aur exit strategies ko follow karna zaruri hai, potential losses se bachne ke liye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Exchanging with kicker Fire Model kicker Flme exchanging hamesah masbat soch ka name hy punch bhi ap tradinbg karty hain ap exchanging karty hai apko chahiy kay hamesha masbat soch ka use karen jis say apko bohut zyada faida ho ap asani ky sath effective hoain dear individuals hamen chhaiy kay hamesha khud ko achievement bnain forex me aor asani ky sath succesful hoian jo memebrs yahan standard kam karty hain everyday ka unko chhiay kay hamesah best benefit say achievement karen jo individuals yahan standard kam karty hain khud ko solid bnaty hain unko chhaiy kay hamesha solid exchange karen aor khud ko string bnain exchanging me ap asani kay sath kamyab hojangy. Kicker distinction works yeh design kabhi ata hy samny aor iska work bhi straightforward hoyta hy esy samjhny kay liay hameen zyada ehnat nahi karni parti isi liay hamen chhaiy kay stron kam karen and khud ko solid bnainjis say hameen kamyabi ho dear forex mmerbs hamen chhaiy kay hamesha forex standard emphatically kam karen and example ko samjhen agar ham design ko samjhengy to ham asnai ky sath jald greetings kamyab hojayngy isi liay hamen chahiay kay solid ka karen and khud ko asani kay sath kamyab karen forex standard jo memebrs yahan standard kam karty hain and everyday base ka kam karty hain wo asani ky sath usccess hojaty hain kicker distinction ka matlb hy gype yni kay punch bhio market gype deti roughage hamen chhaiy kay us time exchange say request place karen q k market ny request me gype ko fil karna hota hy jis say hamen kafi faida hota hy isi liay hamesha solid exchange karen and khud ko significant bnanin forex me . The most effective method to exchange kicker fire model exchange karna asan nahi hota new dealers kay liay agar ap bhi brokers hain to apko chaiy kay hamesha solid exchange karen jis say apko kafi faida ho dear memebrs yahan paar hit ap day to day ka kam karty hain to apko chahiy kay haesha solid kam karen and khud ko stroong bnaain ji say apa sani kay sath kamyab hojayngy jo memebrs yahan standard everyday base ka kam karty hain to wo hamesha kamyab hojaty hain day to day demo accounbt ka utilize must kren agar ap best exchange karna chahty hain q km demo account hello there hamen sab say zyada sekhny ka chance deta hy ji say hameen achievement milti hy isi liay hamesha solid kam karen and day to day base ka kam karen. -

#4 Collapse

Introduction Forex mein Dark Cloud Cover Pattern, ek bahut hi popular candlestick pattern hai. Iska matlab hai ki market ka trend change hone wala hai aur bearish trend start hone wala hai. Is pattern ko samajhna bahut hi important hai kyunki isse aap market ka future prediction kar sakte hain. Dark Cloud Cover Pattern Dark Cloud Cover Pattern, ek bearish reversal pattern hai. Is pattern mein do candlesticks hote hain. Pehla candlestick bullish hota hai aur dusra candlestick bearish hota hai. Dusra candlestick pehle candlestick ke upar close karta hai. Isse market ka trend change hone ka signal milta hai. Dark Cloud Cover Pattern Formation Dark Cloud Cover Pattern ka formation do candlesticks se hota hai. Pehla candlestick bullish hota hai aur dusra candlestick bearish hota hai. Dusra candlestick pehle candlestick ke upar close karta hai. Agar ye pattern ek uptrend ke baad form ho raha hai to ye bearish reversal pattern hai. Uses Dark Cloud Cover Pattern ka use karke aap market ka future prediction kar sakte hain. Agar ye pattern uptrend ke baad form ho raha hai to aapko sell kar dena chahiye. Isse aap profit earn kar sakte hain. Is pattern ke use se aapko market ke trend ke baare mein pata chal jata hai aur aap apni trading strategy ko improve kar sakte hain. Conclusion Dark Cloud Cover Pattern ek bahut hi popular candlestick pattern hai jiska use karke aap market ka future prediction kar sakte hain. Agar ye pattern uptrend ke baad form ho raha hai to aapko sell kar dena chahiye. Isse aap profit earn kar sakte hain. Is pattern ke use se aapko market ke trend ke baare mein pata chal jata hai aur aap apni trading strategy ko improve kar sakte hain. -

#5 Collapse

Introduction Forex mein Dark Cloud Cover Pattern, ek bahut hi popular candlestick pattern hai. Iska matlab hai ki market ka trend change hone wala hai aur bearish trend start hone wala hai. Is pattern ko samajhna bahut hi important hai kyunki isse aap market ka future prediction kar sakte hain. Dark Cloud Cover Pattern Dark Cloud Cover Pattern, ek bearish reversal pattern hai. Is pattern mein do candlesticks hote hain. Pehla candlestick bullish hota hai aur dusra candlestick bearish hota hai. Dusra candlestick pehle candlestick ke upar close karta hai. Isse market ka trend change hone ka signal milta hai. Dark Cloud Cover Pattern Formation Dark Cloud Cover Pattern ka formation do candlesticks se hota hai. Pehla candlestick bullish hota hai aur dusra candlestick bearish hota hai. Dusra candlestick pehle candlestick ke upar close karta hai. Agar ye pattern ek uptrend ke baad form ho raha hai to ye bearish reversal pattern hai. Uses Dark Cloud Cover Pattern ka use karke aap market ka future prediction kar sakte hain. Agar ye pattern uptrend ke baad form ho raha hai to aapko sell kar dena chahiye. Isse aap profit earn kar sakte hain. Is pattern ke use se aapko market ke trend ke baare mein pata chal jata hai aur aap apni trading strategy ko improve kar sakte hain. Conclusion Dark Cloud Cover Pattern ek bahut hi popular candlestick pattern hai jiska use karke aap market ka future prediction kar sakte hain. Agar ye pattern uptrend ke baad form ho raha hai to aapko sell kar dena chahiye. Isse aap profit earn kar sakte hain. Is pattern ke use se aapko market ke trend ke baare mein pata chal jata hai aur aap apni trading strategy ko improve kar sakte hain. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark Cloud Cover Pattern, market mein potential reversals ki forecast karne ke liye istemal kiya jane wala aik popular candlestick pattern hai. Ye uptrend ki akhri stage mein hota hai aur bearish pattern samjha jata hai. Is pattern mein do muzmir candlestick hoti hain, pehli candle long bullish candle hoti hai aur dusri candle bearish candle hoti hai jo pehli candle ke high se oper open hoti hai aur apne midpoint se neeche close hoti hai. Ye pattern potential selling pressure ka indication hai aur traders ise market direction mein potential change ki signal ke liye istemal karte hain. -

#7 Collapse

What is dark cloud pattern ?Foreboding shadow Cover Example, market mein potential inversions ki gauge karne ke liye istemal kiya jane wala aik well known candle design hai. Ye upturn ki akhri stage mein hota hai aur negative example samjha jata hai. Is design mein do muzmir candle hoti hain, pehli candle long bullish light hoti hai aur dusri flame negative candle hoti hai jo pehli candle ke high se oper open hoti hai aur apne midpoint se neeche close hoti hai. Ye design potential selling pressure ka sign hai aur dealers ise market course mein potential change ki signal ke liye istemal karte hain. how can recognize dar cloud cover patternForeboding shadow Cover design ko pehchanne ke liye dealers ko iske kuch qualities standard nazar rakhni hoti hain. Pehle toh, design ke pehle tak clear upturn hona chahiye. Ye better upsides aur more promising low points ki series se samjha ja sakta hai. Agla step hai pehli light jo long bullish flame hoti hai, is se ye pata chalta hai ki purchasers control mein hain. Dusri flame pehli candle ke high se oper open honi chahiye, jisse upswing ki potential continuation ka signal milta hai. Lekin mahatvapurna hai ki dusri flame pehli light ke midpoint se neeche close ho, jisse pata chalta hai ki merchants ne passage mari hai aur upswing potential converse ho sakta hai conclusionForeboding shadow Cover Example ek bahut hello well known candle design hai jiska use karke aap market ka future expectation kar sakte hain. Agar ye design upswing ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit acquire kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging methodology ko improve kar sakte hain. -

#8 Collapse

Dark Cloud Cover Candlestick Pattern ka Introduction Dark Cloud Cover Candlestick Pattern, ya dark cloud cover candlestick pattern, ek candlestick chart analysis technique hai jo traders aur investors ke liye ahem hai taake wo market trends aur reversals ko samajh saken. Ye pattern market mein hone wale potential bearish reversals ko dikhata hai. Is article mein, hum dark cloud cover candlestick pattern ko roman urdu mein detail se samjhenge.Dark Cloud Cover Candlestick Pattern ek useful technical analysis tool ho sakti hai traders aur investors ke liye. Is pattern ko samajh kar, market ke potential bearish reversals ko pehle se identify kar sakte hain aur traders ko alert karta hai. Dark Cloud Cover Pattern Ki Pechan Dark cloud cover candlestick pattern ek aisa pattern hai jo ke market mein hone wale potential bearish reversals ko indicate karta hai. Is pattern ki pehchan karne ke liye, do consecutive candlesticks ki zaroorat hoti hai. Pehli candlestick bullish hoti hai, yani ke iski close price open price se ziada hoti hai aur market mein uptrend hoti hai. Lekin doosri candlestick bearish hoti hai aur iski open price pehli candlestick ki upper half mein hoti hai jabke iski close price pehli candlestick ki body mein hoti hai. Dark Cloud Cover Pattern Ka Matlab Dark cloud cover pattern ka matlab hota hai ke market mein bearish pressure build ho rahi hai aur bullish trend weak ho raha hai. Pehli candlestick mein bullish momentum hoti hai, lekin doosri candlestick mein bearish momentum aata hai aur price neeche girti hai. Iska asal matlab hota hai ke buyers ke paas initial strength thi, lekin phir sellers ne market ko control kiya aur bearish momentum create kiya. Is situation mein, traders ko alert karta hai ke market mein bearish reversal hone ke chances hain. Trading Strategies with Dark Cloud Cover Pattern Dark cloud cover pattern traders ke liye ek important tool ho sakti hai trading decisions banane mein. Jab ye pattern market mein aata hai, to traders isko dekhte hain aur samajhte hain ke market mein bearish reversal hone ke chances hain. Agar ye pattern ek uptrend ke baad aata hai, to iska matlab ho sakta hai ke bullish trend weak ho raha hai aur bearish reversal hone ke chances hain. Is tarah se, traders long positions ko close kar sakte hain ya short positions le sakte hain.Lekin, yaad rahe ke dark cloud cover pattern ek single indicator nahi hai, aur trading decisions banate waqt dusre technical indicators aur analysis tools ka bhi istemal karna zaroori hai. Market mein risk hota hai, aur isliye risk management ka bhi khayal rakha jana chahiye.Lekin, trading decisions banate waqt hamesha caution aur risk management ka istemal karna zaroori hai. Dark cloud cover pattern ko dusre indicators ke saath combine karke hi trading decisions lena behtar hota hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark cloud cover pattern: Dark Cloud Cover Pattern ya DCCH, ek technical analysis trading tool hai jo stock market ya forex trading me istemal hota hai. Is pattern ka maqsad trend reversal ya price reversal ka pata lagana hai. Is article mein ham Dark Cloud Cover Pattern ke tafseelat ko samjhenge.Dark Cloud Cover Pattern Kya Hai?Dark Cloud Cover Pattern ek bearish reversal pattern hai, yaani ke iska zahiri maqsad bullish trend se bearish trend me tabdeel hone ko darust karna hai. Is pattern mein do candlesticks (mombatiyan) shamil hoti hain: Pehli Candlestick: Pehli candlestick ek uptrend mein hoti hai, yaani ke market price barh rahi hoti hai. Is candlestick ko "Bullish Candle" kehte hain. Dusri Candlestick: Dusri candlestick, pehli candlestick ki upper side pe shuru hoti hai aur neeche ki taraf jaati hai. Iski opening price pehli candlestick ki closing price ke qareeb hoti hai, lekin candlestick ka closing price pehli candlestick ki middle ya lower side ke qareeb hoti hai. Isko "Bearish Candle" kehte hain. Dark Cloud Cover Pattern Ki TafseelatDark Cloud Cover Pattern ke pehle candlestick (Bullish Candle) ka yeh matlab hota hai ke market mein buyers control me hain aur price barh rahi hai. Lekin dusri candlestick (Bearish Candle) ka aghaz pehli candlestick ke closing price ke qareeb hota hai, jo ke ek bearish signal hai. Dusri candlestick ka closing price bhi pehli candlestick ke closing price se kam hota hai, jo ke aur bhi bearish hota hai.Dark Cloud Cover Pattern ke hone par traders expect karte hain ke market mein bearish reversal hone ka khatra hai, aur wo selling positions lete hain. Dark Cloud Cover Pattern Ke Istemal Ki Strategy Dark Cloud Cover Pattern ko trading strategy me istemal karne ke liye aap ye steps follow kar sakte hain:Dark Cloud Cover Pattern ko pehchaanen jab ye market chart pe .Agar ye pattern uptrend ke baad aata hai, to ye bearish reversal ki indication ho sakti hai.Sell position lete waqt stop-loss order set karen takay nuksan se bacha ja sake.Is pattern ko confirm karne ke liye aur technical indicators ya oscillators ka istemal bhi kiya ja sakta hai. Dark Cloud Cover Pattern Ka Istemal Hoshiyari Ke Sath Cloud Cover Pattern ek powerful tool ho sakti hai, lekin yaad rahe ke kisi bhi trading strategy mein risk hota hai. Is pattern ki sahi samajh aur proper risk management ke bina trading karna risky ho sakta hai. Isliye, Dark Cloud Cover Pattern ka istemal hoshiyari aur research ke sath karein, aur trading decisions lene se pehle apne financial advisor se mashwarah karen.Is tafseelat ke baad, aap Dark Cloud Cover Pattern ko samjh kar trading strategy me istemal kar sakte hain, lekin trading mein safalta haasil karne ke liye practice aur experience bhi zaroori hote hain.

Pehli Candlestick: Pehli candlestick ek uptrend mein hoti hai, yaani ke market price barh rahi hoti hai. Is candlestick ko "Bullish Candle" kehte hain. Dusri Candlestick: Dusri candlestick, pehli candlestick ki upper side pe shuru hoti hai aur neeche ki taraf jaati hai. Iski opening price pehli candlestick ki closing price ke qareeb hoti hai, lekin candlestick ka closing price pehli candlestick ki middle ya lower side ke qareeb hoti hai. Isko "Bearish Candle" kehte hain. Dark Cloud Cover Pattern Ki TafseelatDark Cloud Cover Pattern ke pehle candlestick (Bullish Candle) ka yeh matlab hota hai ke market mein buyers control me hain aur price barh rahi hai. Lekin dusri candlestick (Bearish Candle) ka aghaz pehli candlestick ke closing price ke qareeb hota hai, jo ke ek bearish signal hai. Dusri candlestick ka closing price bhi pehli candlestick ke closing price se kam hota hai, jo ke aur bhi bearish hota hai.Dark Cloud Cover Pattern ke hone par traders expect karte hain ke market mein bearish reversal hone ka khatra hai, aur wo selling positions lete hain. Dark Cloud Cover Pattern Ke Istemal Ki Strategy Dark Cloud Cover Pattern ko trading strategy me istemal karne ke liye aap ye steps follow kar sakte hain:Dark Cloud Cover Pattern ko pehchaanen jab ye market chart pe .Agar ye pattern uptrend ke baad aata hai, to ye bearish reversal ki indication ho sakti hai.Sell position lete waqt stop-loss order set karen takay nuksan se bacha ja sake.Is pattern ko confirm karne ke liye aur technical indicators ya oscillators ka istemal bhi kiya ja sakta hai. Dark Cloud Cover Pattern Ka Istemal Hoshiyari Ke Sath Cloud Cover Pattern ek powerful tool ho sakti hai, lekin yaad rahe ke kisi bhi trading strategy mein risk hota hai. Is pattern ki sahi samajh aur proper risk management ke bina trading karna risky ho sakta hai. Isliye, Dark Cloud Cover Pattern ka istemal hoshiyari aur research ke sath karein, aur trading decisions lene se pehle apne financial advisor se mashwarah karen.Is tafseelat ke baad, aap Dark Cloud Cover Pattern ko samjh kar trading strategy me istemal kar sakte hain, lekin trading mein safalta haasil karne ke liye practice aur experience bhi zaroori hote hain.

-

#10 Collapse

Describe Dark cloud Cover Patterns ? Dark Cloud Cover Patterns Example, market me in potential inversions ki gauge karne ke liye istemal kiya jane wala aik well known candle design hai. Ye upturn ki akhri stage mein hota hai aur negative example samjha jata hai. Is design mein do muzmir candle hoti hain, pehli candle long bullish candle hoti hai aur dusri candle negative flame hoti hai jo pehli candle ke high se oper open hoti hai aur apne midpoint se neeche close hoti hai. Ye design potential selling pressure ka sign hai aur dealers ise market heading mein potential change ki signal ke liye istemal karte hain. Kicker Feature Work.... yeh plan kabhi ata hy samny aor iska work bhi clear hoyta hy esy samjhny kay liay hameen zyada ehnat nahi karni parti isi liay hamen chhaiy kay stron kam karen and khud ko strong bnainjis say hameen kamyabi ho dear forex mmerbs hamen chhaiy kay hamesha forex standard vehemently kam karen and model ko samjhen agar ham plan ko samjhengy to ham asnai ky sath jald good tidings kamyab hojayngy isi liay hamen chahiay kay strong ka karen and khud ko asani kay sath kamyab karen forex standard jo memebrs yahan standard kam karty hain and ordinary base ka kam karty hain wo asani ky sath usccess hojaty hain kicker differentiation ka matlb hy gype yni kay punch bhio market gype deti roughage hamen chhaiy kay us time trade say demand place karen q k market ny demand me gype ko fil karna hota hy jis say hamen kafi faida hota hy isi liay hamesha strong trade karen and khud ko critical bnanin forex me . Conculsion... Kisi bhi specialized investigation apparatus ki tarah, Dark Cloud Cover Pattern ki bhi impediments aur contemplations hoti hain. Pehli baat toh ye zaruri hai ki koi bhi design ya pointer inversion ko ya market moves ko 100 percent precision se foresee nahi kar sakta. Foreboding shadow Cover design ko dusre pointers aur examination techniques ke saath istemal karna zaruri hai, effective exchanges ke likelihood ko badhane ke liye. Uske saath greetings, generally speaking business sector setting aur major ya macroeconomic elements ko bhi dhyan mein rakhna zaruri hai, jinse cost developments ko impact mil sakta hai. Insect mein, Foreboding shadow Cover design ka istemal karte waqt risk the board aur clear passage aur leave methodologies ko follow karna zaruri hai, potential misfortunes se bachne ke liye. -

#11 Collapse

Dark Cloud Cover Chart Pattern: Dark cloud or Foreboding shadow cover design brokers ke liye ek significant instrument ho sakti hai exchanging choices banane mein. Hit ye design market mein aata hai, to merchants isko dekhte hain aur samajhte hain ke market mein negative inversion sharpen ke chances hain. Agar ye design ek upturn ke baad aata hai, to iska matlab ho sakta hai ke bullish pattern feeble ho raha hai aur negative inversion sharpen ke chances hain. Is tarah se, merchants long positions ko close kar sakte hain ya short positions le sakte hain.Lekin, yaad rahe ke foreboding shadow cover design ek single pointer nahi hai, aur exchanging choices banate waqt dusre specialized markers aur investigation devices ka bhi istemal karna zaroori hai. Market mein risk hota hai, aur isliye risk the board ka bhi khayal rakha jana chahiye.Lekin, exchanging choices banate waqt hamesha alert aur risk the executives ka istemal karna zaroori hai. Pattern design ka matlab hota hai ke market mein negative tension form ho rahi hai aur bullish pattern frail ho raha hai. Pehli candle mein bullish force hoti hai, lekin doosri candle mein negative energy aata hai aur cost neeche girti hai. Iska asal matlab hota hai ke purchasers ke paas beginning strength thi, lekin phir venders ne market ko control kiya aur negative energy make kiya. Is circumstance mein, merchants ko alert karta hai ke market mein negative inversion sharpen ke chances hain. candle design ek aisa design hai jo ke market mein sharpen ridge potential negative inversions ko show karta hai. Is design ki pehchan karne ke liye, do successive candles ki zaroorat hoti hai. Pehli candle bullish hoti hai, yani ke iski close cost open cost se ziada hoti hai aur market mein upswing hoti hai. Lekin doosri candle negative hoti hai aur iski open cost pehli candle ki upper half mein hoti hai Types Of Dark Cloud Cover Chart Pattern: Candle diagram investigation strategy hai jo brokers aur financial backers ke liye ahem hai taake wo market patterns aur inversions ko samajh saken. Ye design market mein sharpen grain potential negative inversions ko dikhata hai. Is article mein, murmur foreboding shadow cover candle design ko roman urdu mein detail se samjhenge.Dark Overcast Cover Candle Example ek valuable specialized investigation device ho sakti hai dealers aur financial backers ke liye. Is design ko samajh kar, market ke potential negative inversions ko pehle se recognize kar sakte hain aur merchants ko alert karta hai.Pattern ek bahut hello there well known candle design hai jiska use karke aap market ka future forecast kar sakte hain. Agar ye design upswing ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit acquire kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging system ko improve kar sakte hain.

Pattern design ka matlab hota hai ke market mein negative tension form ho rahi hai aur bullish pattern frail ho raha hai. Pehli candle mein bullish force hoti hai, lekin doosri candle mein negative energy aata hai aur cost neeche girti hai. Iska asal matlab hota hai ke purchasers ke paas beginning strength thi, lekin phir venders ne market ko control kiya aur negative energy make kiya. Is circumstance mein, merchants ko alert karta hai ke market mein negative inversion sharpen ke chances hain. candle design ek aisa design hai jo ke market mein sharpen ridge potential negative inversions ko show karta hai. Is design ki pehchan karne ke liye, do successive candles ki zaroorat hoti hai. Pehli candle bullish hoti hai, yani ke iski close cost open cost se ziada hoti hai aur market mein upswing hoti hai. Lekin doosri candle negative hoti hai aur iski open cost pehli candle ki upper half mein hoti hai Types Of Dark Cloud Cover Chart Pattern: Candle diagram investigation strategy hai jo brokers aur financial backers ke liye ahem hai taake wo market patterns aur inversions ko samajh saken. Ye design market mein sharpen grain potential negative inversions ko dikhata hai. Is article mein, murmur foreboding shadow cover candle design ko roman urdu mein detail se samjhenge.Dark Overcast Cover Candle Example ek valuable specialized investigation device ho sakti hai dealers aur financial backers ke liye. Is design ko samajh kar, market ke potential negative inversions ko pehle se recognize kar sakte hain aur merchants ko alert karta hai.Pattern ek bahut hello there well known candle design hai jiska use karke aap market ka future forecast kar sakte hain. Agar ye design upswing ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit acquire kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging system ko improve kar sakte hain.  Dark Cloud Cover Example ka development do candles se hota hai. Pehla candle bullish hota hai aur dusra candle negative hota hai. Dusra candle pehle candle ke upar close karta hai. Agar ye design ek upturn ke baad structure ho raha hai to ye negative inversion design hai. Design ka use karke aap market ka future forecast kar sakte hain. Agar ye design upswing ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit acquire kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging methodology ko improve kar sakte hain.Pattern, ek negative inversion design hai. Is design mein do candles hote hain. Pehla candle bullish hota hai aur dusra candle negative hota hai. Dusra candle pehle candle ke upar close karta hai. Isse market ka pattern change sharpen ka signal milta hai. Dark Cloud Cover Pattern Formation: Diagram Example upturn ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit acquire kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging methodology ko improve kar sakte hain.Dark Overcast Cover Example ek bahut hello well known candle design hai jiska use karke aap market ka future forecast kar sakte hain. Agar ye design upturn ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit procure kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging system ko improve kar sakte hain.

Dark Cloud Cover Example ka development do candles se hota hai. Pehla candle bullish hota hai aur dusra candle negative hota hai. Dusra candle pehle candle ke upar close karta hai. Agar ye design ek upturn ke baad structure ho raha hai to ye negative inversion design hai. Design ka use karke aap market ka future forecast kar sakte hain. Agar ye design upswing ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit acquire kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging methodology ko improve kar sakte hain.Pattern, ek negative inversion design hai. Is design mein do candles hote hain. Pehla candle bullish hota hai aur dusra candle negative hota hai. Dusra candle pehle candle ke upar close karta hai. Isse market ka pattern change sharpen ka signal milta hai. Dark Cloud Cover Pattern Formation: Diagram Example upturn ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit acquire kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging methodology ko improve kar sakte hain.Dark Overcast Cover Example ek bahut hello well known candle design hai jiska use karke aap market ka future forecast kar sakte hain. Agar ye design upturn ke baad structure ho raha hai to aapko sell kar dena chahiye. Isse aap benefit procure kar sakte hain. Is design ke use se aapko market ke pattern ke baare mein pata chal jata hai aur aap apni exchanging system ko improve kar sakte hain.  Kisi bhi specialized investigation apparatus ki tarah, Foreboding shadow Cover design ki bhi restrictions aur contemplations hoti hain. Pehli baat toh ye zaruri hai ki koi bhi design ya pointer inversion ko ya market moves ko 100 percent precision se foresee nahi kar sakta. Foreboding shadow Cover design ko dusre pointers aur examination strategies ke saath istemal karna zaruri hai, effective exchanges ke likelihood ko badhane ke liye. Uske saath howdy, in general market setting aur key ya macroeconomic elements ko bhi dhyan mein rakhna zaruri hai, jinse cost developments ko impact mil sakta hai. Insect mein, Foreboding shadow Cover design ka istemal karte waqt risk the board aur clear section aur leave methodologies ko follow karna zaruri hai Dark Cloud Cover Pattern Trading: Design ko merchants alag exchanging procedures mein istemal kar sakte hain, jaisa ki unke objectives aur risk resistance ke hisaab se ho. Ek approach hai ise ek independent sign ke roop mein istemal karna, jahan merchants design affirm sharpen ke baad short positions lete hain. Is approach mein ye maana jata hai ki design greetings inversion aur potential disadvantage benefit signal karne ke liye kaafi hai. Dusra approach hai ise ek affirmation device ke roop mein istemal karna, dusre specialized markers ke saath milakar. Maslan, brokers Foreboding shadow Cover design ka stand by karte hain takriban obstruction level standard ya fir kisi oscillator ki negative uniqueness ke saath. Different signs ko milakar, brokers potential inversions standard apna certainty badha sakte hain aur in general exchanging procedures ko improve kar sakte hain.

Kisi bhi specialized investigation apparatus ki tarah, Foreboding shadow Cover design ki bhi restrictions aur contemplations hoti hain. Pehli baat toh ye zaruri hai ki koi bhi design ya pointer inversion ko ya market moves ko 100 percent precision se foresee nahi kar sakta. Foreboding shadow Cover design ko dusre pointers aur examination strategies ke saath istemal karna zaruri hai, effective exchanges ke likelihood ko badhane ke liye. Uske saath howdy, in general market setting aur key ya macroeconomic elements ko bhi dhyan mein rakhna zaruri hai, jinse cost developments ko impact mil sakta hai. Insect mein, Foreboding shadow Cover design ka istemal karte waqt risk the board aur clear section aur leave methodologies ko follow karna zaruri hai Dark Cloud Cover Pattern Trading: Design ko merchants alag exchanging procedures mein istemal kar sakte hain, jaisa ki unke objectives aur risk resistance ke hisaab se ho. Ek approach hai ise ek independent sign ke roop mein istemal karna, jahan merchants design affirm sharpen ke baad short positions lete hain. Is approach mein ye maana jata hai ki design greetings inversion aur potential disadvantage benefit signal karne ke liye kaafi hai. Dusra approach hai ise ek affirmation device ke roop mein istemal karna, dusre specialized markers ke saath milakar. Maslan, brokers Foreboding shadow Cover design ka stand by karte hain takriban obstruction level standard ya fir kisi oscillator ki negative uniqueness ke saath. Different signs ko milakar, brokers potential inversions standard apna certainty badha sakte hain aur in general exchanging procedures ko improve kar sakte hain.  Design ko pehchanne ke liye merchants ko iske kuch attributes standard nazar rakhni hoti hain. Pehle toh, design ke pehle tak clear upswing hona chahiye. Ye better upsides aur more promising low points ki series se samjha ja sakta hai. Agla step hai pehli candle jo long bullish light hoti hai, is se ye pata chalta hai ki purchasers control mein hain. Dusri light pehli flame ke high se oper open honi chahiye, jisse upturn ki potential continuation ka signal milta hai. Lekin mahatvapurna hai ki dusri flame pehli light ke midpoint se neeche close ho, jisse pata chalta hai ki dealers ne passage mari hai aur upswing potential converse ho sakta hai.

Design ko pehchanne ke liye merchants ko iske kuch attributes standard nazar rakhni hoti hain. Pehle toh, design ke pehle tak clear upswing hona chahiye. Ye better upsides aur more promising low points ki series se samjha ja sakta hai. Agla step hai pehli candle jo long bullish light hoti hai, is se ye pata chalta hai ki purchasers control mein hain. Dusri light pehli flame ke high se oper open honi chahiye, jisse upturn ki potential continuation ka signal milta hai. Lekin mahatvapurna hai ki dusri flame pehli light ke midpoint se neeche close ho, jisse pata chalta hai ki dealers ne passage mari hai aur upswing potential converse ho sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark cloud cover pattern forex trading mein ek prasiddh candlestick pattern hai. Is pattern mein do consecutive candles hote hain, jahan pehla candle bullish (upward) trend mein hota hai aur dusra candle bearish (downward) trend mein hota hai. Dusre candle ki opening price pehle candle ki closing price se higher hoti hai, lekin dusre candle ki closing price pehle candle ki body ke andar rehti hai.Dark cloud cover pattern bearish reversal pattern hai, jiska matlab hota hai ki yeh pattern bullish trend ki khatam hone ya bearish trend ki shuruat hone ki indication deta hai. Is pattern ko dekh kar traders selling positions enter karte hain ya existing long positions ko close karte hain.Is pattern ki wazahat karte hue, iska fayda ye hai ki traders ko trend reversal ke baare mein pata chalta hai, jisse unhe trading opportunities mil sakti hain. Is pattern ko spot karne ke liye traders candlestick chart analysis ka istemal karte hain.Is pattern ka istemal karne ke nuksan bhi ho sakte hain. Dark cloud cover pattern ke signals hamesha accurate nahi hote hain aur false signals bhi ho sakte hain. Isliye, traders ko is pattern ko confirm karne ke liye dusre technical indicators ya price action patterns ka istemal karna chahiye.Forex trading mein dark cloud cover pattern ki wazahat aur istemal zaroori hai kyunki ye ek popular reversal pattern hai. Traders is pattern ko samajhne se aur uska istemal karne se market movements ko better analyze kar sakte hain aur trading decisions ko improve kar sakte hain. Dark cloud cover pattern: Dark cloud cover pattern forex trading mein ek bearish reversal pattern hai.Is pattern mein do consecutive candles hote hain, jahan pehla candle bullish (upward) trend mein hota hai aur dusra candle bearish (downward) trend mein hota hai.Dusre candle ki opening price pehle candle ki closing price se higher hoti hai, lekin dusre candle ki closing price pehle candle ki body ke andar rehti hai.Dark cloud cover pattern bearish trend ki khatam hone ya bearish trend ki shuruat hone ki indication deta hai.Traders is pattern ko dekh kar selling positions enter karte hain ya existing long positions ko close karte hain.Is pattern ka istemal karke traders trend reversal ko identify kar sakte hain aur trading opportunities mil sakti hain.Lekin is pattern ke signals hamesha accurate nahi hote hain aur false signals bhi ho sakte hain.Traders ko is pattern ko confirm karne ke liye dusre technical indicators ya price action patterns ka istemal karna chahiye.Dark cloud cover pattern forex trading mein important hai kyunki isse market movements ko better analyze kiya ja sakta hai aur trading decisions improve kiye ja sakte hain.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:42 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим