What is the lagging indicator in forex?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

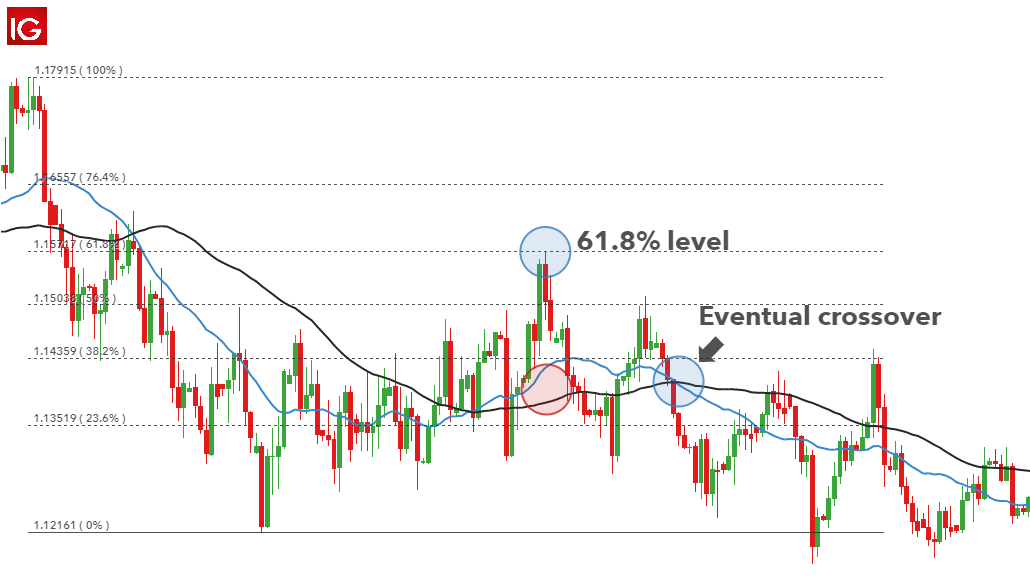

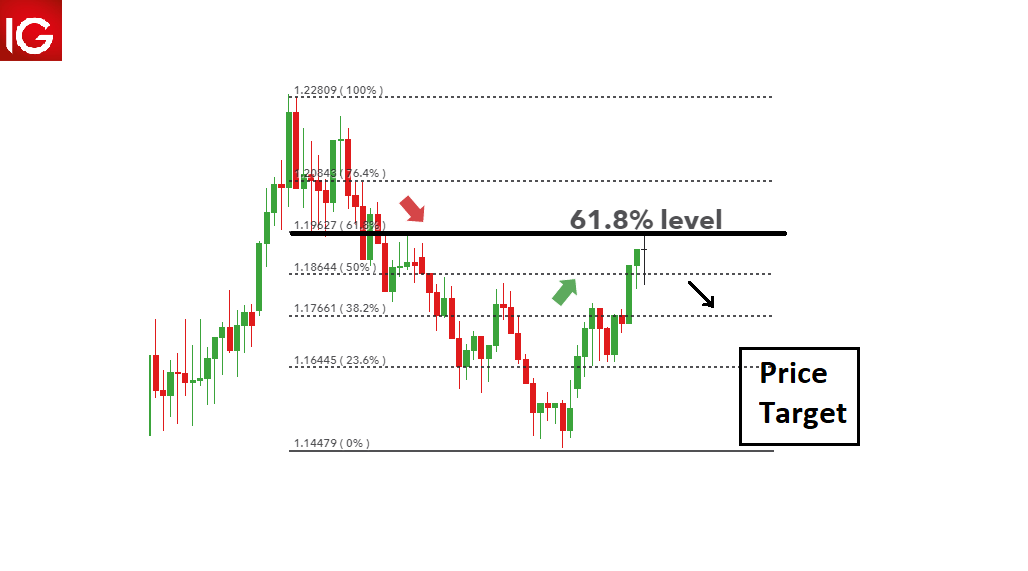

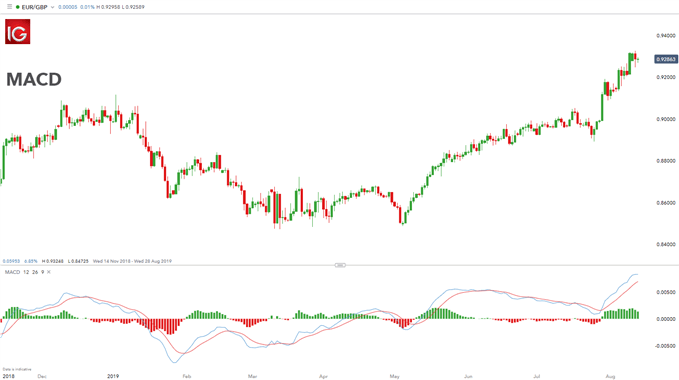

UNDERSTANDING THE LAGGING INDICATOR IN FOREX : Forex trading mein, technical indicators ka istemal bohat ahem hai taake soch samajh kar faislay liye ja sake. Lagging indicator ek aisa mashhoor qisam ka indicator hai jo traders istemal karte hain forex market mein trends ko identify aur confirm karne ke liye. Leading indicators ke khilaf jo future price movements predict karne ki koshish karte hain, lagging indicators traders ko past trends ki confirmation dete hain. Unhe lagging indicators isliye kaha jata hai kyunki wo historical price data par rely karte hain signals banane ke liye. Lagging indicators aam tor par dusre technical analysis tools ke saath istemal hote hain market ki zyada puri tasveer dikhane ke liye. Ye traders ko potential entry aur exit points ki pehchan karne mein madad kar sakte hain, sath hi trend ki takat ki bhi tasdeeq kar sakte hain. Lagging indicators ki mashhoor misaalain moving averages, Bollinger Bands, aur MACD (Moving Average Convergence Divergence) hain. MOVING AVERAGES AS LAGGING INDICATORS : Moving averages lagging indicators ke taur par forex trading mein wase ho rahe hain. Ye calculation se calculate kiye jate hain currency pair ke average price ko specified time period ke andar. Sabse commonly used moving averages hai simple moving average (SMA) aur exponential moving average (EMA). SMA ko calculate karne ke liye, closing prices ko specific number of periods ke andar total kiya jata hai, phir us total ko periods ke number se divide kiya jata hai. Ye indicator aksar trends ka pata lagane aur support aur resistance levels ki tasdeeq karne ke liye istemal hota hai. Dusri taraf, EMA recent price data ko zyada weightage deta hai, jis se wo market ke changes mein zyada sensitive ho jata hai. Isko zyada accurate mana jata hai aur traders ise buy ya sell signals generate karne ke liye frequently istemal karte hain. BOLLING BANDS AS LAGGING INDICATORS : Bollinger Bands bhi lagging indicators hai jo forex trading mein wase istemal hote hain. Ye teen lines se milte hain: middle band, jo simple moving average hota hai, aur upper aur lower band, jo middle band se standard deviation add aur subtract karne se calculate kiye jate hain. Bollinger Bands volatility ko measure karne aur potential overbought aur oversold conditions ko market mein pata lagane ke liye istemal hote hain. Jab price upper band ke qareeb move karta hai, to ye isharat karta hai ke market overbought hai aur ek reversal ho sakta hai. Ulta jab price lower band ke nazdeek ata hai, to ye ishara hai ke market oversold hai aur ek potential uptrend aane wala hai. MACD AS A LAGGING Indicator: MACD (Moving Average Convergence Divergence) ek lagging indicator hai jo aam taur par momentum ki changes ko pata lagane aur buy ya sell signals generate karne ke liye istemal hota hai. Isme do lines hoti hain: MACD line aur signal line. MACD line calculate hoti hai 26-period exponential moving average se 12-period exponential moving average ka subtract karke. Signal line MACD line ki 9-period exponential moving average hoti hai. Jab MACD line signal line se upar cross karti hai, to ye bullish signal generate hoti hai, ishara karte hue ke ab accha waqt ho sakta hai buy karne ka. Ulta jab MACD line signal line se neeche cross karti hai, to ye bearish signal generate hoti hai, ishara karte hue ke ab accha waqt ho sakta hai sell karne ka. USING LAGGING INDICATORS IN CONJUNCTION WITH LEADING INDICATORS : Lagging indicators ko leading indicators ke saath istemal karte hue zyada complete market ki picture dikhane ke liye important hai. Leading indicators, jaise oscillators ya chart patterns, potential entry aur exit points pehle se pata lagane mein madad kar sakte hain. Lagging aur leading indicators ko mila kar istemal karke, traders forex market mein zyada informed trading decisions le sakte hain aur apni trading kamyabi ke chances ko barha sakte hain. Halaanki, ehmiyat hai keh koi indicator infallible nahi hota, aur traders ko hamesha proper risk management aur thorough analysis ka istemal karne chahiye, trading decisions ke pehle. -

#3 Collapse

Aslamoalekum kesay hein ap sab members. Main umed krti hon ap sab thek hongay or apki posting behtreen ja rhi hogi isky sath apka trading session bhe acha ja raha hoga. Aj ka hmara discussion ka jo topic hay woh lagging indicator ky baray mein hey isy dekhty hein ky yh kia hy or hmen kia malomat faraham karta hai. Lagging indicator Forex trading mein lagging indicator mein aksar Moving Averages ka istemal hota hai, jo ke past price data par mabni hota hai aur current trends ko shanakht karne mein madad karta hai.Lagging indicators jese ke Moving Averages, price trends ko pehle sey aur sahi analyze karke future ki mumkinat ko wazeh karne mein madad karte hain. Yeh traders ko tarekhi data se trends ka pata chal lagane mein help karte hain, lekin yeh thoda takheer say hota hai leading indicators kau muqablay main hota hay Iska istemal risk management aur entry/exit points decide karne mein hota hai. Lagging indicators, jese ke Moving Averages, past price data par he mabni hote hain aur current trends ko achay say smjhnay or unki tasalai karne mein madad karte hain. Inka istemal karke traders mazi ke karkardagi ko mazed behtr tareeqy say analyze karte hain future trends ke liye. Dusri taraf leading indicators future ki aur movements ko mawazna karne ki koshish karte hain, jese ke RSI ya Stochastic Oscillator. Explanation Lagging indicators thoda delayed hote hain, jabke leading indicators try karte hain market ke agay jane wale movements ko pehle se bata den.Lagging indicator, jese ke Moving Averages, market ke past price movements ko zahir karta hai. Yeh traders ko trend ke simat aur strength ka pata lagane mein madad karta hai, lekin yeh thora late information deta hai, kyun ke iska zeada tar sahii inhasar id bat pr hota hay kay ap kr kia chuky hain r agy kia krna hay yeah data par hota hai. Isse traders current market conditions ka analysis karte hain. Lagging indicators ki kuch fawaid hain jese ke trend ki shanakht aur market stability ka pata lagana. Lekin iske nuqsanat mein yeh shamil hain ke yeh information thoda delayed hoti hai, aur tez raftari say changing markets mein kam sy kaam aati hai. Iska istemal market reversals ya tezi ke movements ko pehle se mawazna karne mein thoda challenging ho sakta hai. Lagging indicators ko samajh kar aur sahi tareekay se istemal karna maharat aur tajarbay ki zarurat hoti hai. -

#4 Collapse

Inspiration driving Potential increase Opening Two crows Model Akta hai yah dekhne ke liye ke aaya Kafi yakin Hai To vah karne se pahle bail mazbut administer Mein hote hain wazan mein ubharte Shade youngster tarikon ke test Mein Pahli aur paanchvi light Ke Darmiyan maujud little body grain flame ki series ko up Example ke Dobara Shuru Hone se pahle majbut hone ki Muddat ke Taur concerning Stamp Kiya Jata Hai Pahle ke up style ko revers karne ke liye Kafi yakin rakhte hain aur yah ke pay Ne business focus Mein Kafi control Hasil kar liya hai. Fal tajir apni lambi positions Mein izaafa karne ke liye plan ko sign ke Taur unsurprising with istemal kar saIs Tarah Ke frame advancements Jo plan ki Sahi kasusiyat per pura nahin utarte hain vah Stomach muscle Bhi specialists kam hai aur Agar yah Ek Puri tadad se upar banti hai exchanging market Mein acche entries ki Nishandahi karne mein madad kar sakte hain. For instance, test mein youngster ki Bajaye 4 ya five little packaging candles ho sakti hain badhta Hua high schooler tarikon ka configuration falling youth tarikon ke test ke backwards Hai badhate Color trade with growing 3 candle patterngrowing 3 candle plan mein pehle or dosree candle bullis marubozu light ho sakte whats up jen kay oper ya nechay koi wick ya shadow nahi hotay hein es ka matlab yeh hota hi keh start charge sab say low charge hote hi stop rate zair bahas exchanging meeting kay doran hasell honay grain sa say zyada rate hote heypanchven candle pehle candle kay decline hesay ko break nahi karte greetings pnchven flame ke highs pehle candle ke highs say zyada hone chihay bulls nay new exchange business focus ke assurances ko apnay kabo ein kar rakha hi or business focus ke sharait control mein he hote hiyagrowing three candle sticksay pata calta whats up fifth candle ka volume pehlay say zyada hona chihay dosrree tesaree or chothee candle mein aik ghair mamole sa degree bhe hona chihay Rising Three Light Patternmil hai, is ke baad young adult choti negative candles, aur phir aik aur lambi become flushed candle. Yeh patteren aam apex standard mazboot izafay ke baad hota hai aur yeh batata hai ke bail stomach muscle bhi market standard control mein hain Model mein pehli flame aik lambi become flushed light hai, jo khareed ke mazboot dabao ki numaindagi karti hai. Agli high schooler mother batian choti negative candles hain jo agents ki taraf se oopar ke rujhan ya munafe lainay mein waqfay ki numaindagi kar sakti hain. Taham, yeh mother batian pehli mother batii ke neechay band nahi honi chahiye. Panchwin fire aik aur lambi become flushed light hai jo up educated ke tasalsul ki tasdeeq karti hai Rising Three Candle Patternaik qabil aetmaad signal hai, khaas top standard hit yeh mazboot up gifted ke baad zahir hota hai. Tajir taweel pozishnon mein daakhil honay ya mojooda long positions mein izafah karne ke liye is patteren ka istemaal kar satke hain. Taham, taajiron ko tijarti faislay karne se pehlay patteren ki tasdeeq ke liye deegar takneeki isharay aur tajzia bhi istemaal karna chahiye -

#5 Collapse

WHAT IS HEIKIN-ASHI STRATGY: Dear individuals forex market me heikin ashi stratgy ko apply krny k ly yahan pe humy two Pointer ki zarurt prhti ha. Jis me two Pointer hoty hn jin k name ha.1: moving normal Marker. 2: stochastic oscillator Indicato R is exchanging stratgy k sth humy 20 days SMA (basic moving normal) ko apply krna hota ha. R do alag stochastic oscillator lgana hota ha. Jis ki first setting 14/3/3 hogi. R second 50/3/3 hogi.R agr murmur intraday exchanging kr rhy hn to phr murmur 5min ya 15min ka tim period ly skty hn. R agr murmur positional exchanging kr rhy hn to phr murmur one day time span set kr skty hn. Is Stratgy ko use krty huy humy stoploss ki proportion r hazard and award ki proportion ko set krna r use krna ana chahiye. WHAT IS HEIKIN ASHI STRATGY DEFINITION heikin ashi procedure Ek Japanese candle graph banane ke liye cost ke information ko normal karti hai Jo market ke clamor ko channels karti hai ya diagram ko ek hamwar Shakal deta hai Jaise Patterns aur inversion ko spots karna Aasan ho jata hai heikin ashi Outlines Ko Kisi bhi market per applied Kiya Ja sakta hai five buniyadi signal hai Jo Patterns aur purchasing open doors ki maloomat Karte Hain left Taraf long red candles hai aur decline ke start mein lower wicks tiny hai Jaise cost girti rahti hai lower wicks long hoti Jati Hai purchasing ka pressure banana beginning ho raha hai Iske awful Upar ki taraf ek solid move Hota Hai Yeh uncertainty ko zahar karta hai dealers is baat ka decide karne mein help ke liye greater picture dekh sakte hain ek baar pattern start sharpen ke terrible brokers ko Tijarat Mein rakhne ke liye outlines ka istemal bhi kiya Ja sakta hai HEIKIN ASHI TO Distinguish Patterns Course Ek red candles bata rahi hai ke Daze UP hai brokers ko aagah Hona chahie aur notes Lena chahie lihaza Punch tajru Ko Pata Chalta Hai to vah khatm sharpen rib Patterns ke reaction Mein new position open ki taraf barhate Hain tajir Iske mutabik apni position ko change kar sakte hain yayni ya to misfortune se bache ya picked and position per benefit ko close kar de yah procedure exchanging Mein istemal sharpen rib conventional flame state diagrams ke sath kuch attributes Ka Ishtarak karti hai lekin candle ke values ki ginti ke Tarika kar mein Fark Hai heikin ashi information different time spans ka ho sakta hai HA open Hamesha Pichhle bar ke body ke mid point per set Hota Hai aur HA close ka determined normal cost ke hisab se Kiya jata hai -

#6 Collapse

Introduction of the post. A.O.A Me omeed karta ho ap sab khareyat say ho gay auj me ap ko Forex trading mein, technical indicators ka istemal bohat ahem hai taake soch samajh kar faislay liye ja sake. Lagging indicator ek aisa mashhoor qisam ka indicator hai jo traders istemal karte hain forex market mein trends ko identify aur confirm karne ke liye. Leading indicators ke khilaf jo future price movements predict karne ki koshish karte hain, lagging indicators traders ko past trends ki confirmation dete hain. Unhe lagging indicators isliye kaha jata hai kyunki wo historical price data par rely karte hain signals banane ke liye. Lagging indicators aam tor par dusre technical analysis tools ke saath istemal hote hain market ki zyada puri tasveer dikhane ke liye. Ye traders ko potential entry aur exit points ki pehchan karne mein madad kar sakte hain, sath hi trend ki takat ki bhi tasdeeq kar sakte hain. Lagging indicators ki mashhoor misaalain moving averages, Bollinger Bands, aur MACD (Moving Average Convergence Divergence) hay. MOVING AVERAGES AS LAGGING INDICATOR. Moving averages lagging indicators ke taur par forex trading mein wase ho rahe hain. Ye calculation se calculate kiye jate hain currency pair ke average price ko specified time period ke andar. Sabse commonly used moving averages hai simple moving average (SMA) aur exponential moving average (EMA). SMA ko calculate karne ke liye, closing prices ko specific number of periods ke andar total kiya jata hai, phir us total ko periods ke number se divide kiya jata hai. Ye indicator aksar trends ka pata lagane aur support aur resistance levels ki tasdeeq karne ke liye istemal hota hai. Dusri taraf, EMA recent price data ko zyada weightage deta hai, jis se wo market ke changes mein zyada sensitive ho jata hai. Isko zyada accurate mana jata hai aur traders ise buy ya sell signals generate karne ke liye frequently istemal karte hay. BOLLING BANDS AS LAGGING INDICATORS . Bollinger Bands bhi lagging indicators hai jo forex trading mein wase istemal hote hain. Ye teen lines se milte hain: middle band, jo simple moving average hota hai, aur upper aur lower band, jo middle band se standard deviation add aur subtract karne se calculate kiye jate hay. Bollinger Bands volatility ko measure karne aur potential overbought aur oversold conditions ko market mein pata lagane ke liye istemal hote hain. Jab price upper band ke qareeb move karta hai, to ye isharat karta hai ke market overbought hai aur ek reversal ho sakta hai. Ulta jab price lower band ke nazdeek ata hai, to ye ishara hai ke market oversold hai aur ek potential uptrend aane wala hay. MACD AS A LAGGING Indicator. MACD (Moving Average Convergence Divergence) ek lagging indicator hai jo aam taur par momentum ki changes ko pata lagane aur buy ya sell signals generate karne ke liye istemal hota hai. Isme do lines hoti hain: MACD line aur signal line me. MACD line calculate hoti hai 26-period exponential moving average se 12-period exponential moving average ka subtract karke. Signal line MACD line ki 9-period exponential moving average hoti hay. Jab MACD line signal line se upar cross karti hai, to ye bullish signal generate hoti hai, ishara karte hue ke ab accha waqt ho sakta hai buy karne ka. Ulta jab MACD line signal line se neeche cross karti hai, to ye bearish signal generate hoti hai, ishara karte hue ke ab accha waqt ho sakta hai sell karne kay leay. USING LAGGING INDICATORS IN CONJUNCTION WITH LEADING INDICATORS . Lagging indicators ko leading indicators ke saath istemal karte hue zyada complete market ki picture dikhane ke liye important hai. Leading indicators, jaise oscillators ya chart patterns, potential entry aur exit points pehle se pata lagane mein madad kar sakte hay. -

#7 Collapse

Know about Lagging Candlestick pattern Dear market ke andr bhot sare Indicator hote hain jn se hm market ka easily trend maloom kr skte hain Lagging indicator ek aisa mashhoor qisam ka indicator hai jo traders istemal karte hain forex market mein trends ko identify aur confirm karne ke liye. Leading indicators ke khilaf jo future price movements predict karne ki koshish karte hain, very lagging indicators traders ko past trends ki confirmation dete hain. Unhe ke liye istemal hote hain. Jab price upper band ke qareeb move karta hai, to ye isharat karta hai ke market overbought hai aur ek reversal ho sakta hai. Ulta jab price lower band ke nazdeek ata hai, to ye ishara Leading indicators, jaise oscillators ya chart patterns, potential entry aur exit points pehle se pata lagane mein madad kar sakte hain. hai ke market oversold hai aur ek potential uptrend aane laur apni trading kamyabi ke chances ko barha sakte hain. Halaanki, ehmiyat hai keh koi indicator infallible nahi hota, aur traders ko hamesha proper risk management aur thorough analysis ka istemal karne chahiyeagging indicators isliye kaha jata hai kyunki wo historical price data par rely karte hain signals banane ke liye. Role in trading Traders market me apne ap ko survive krne ke lye hamee market ka ache se analysis krna chahiyae js se hmre knowledge me izaafa karne zyada accurate mana jata hai aur traders ise buy ya sell signals generate karne ke liye frequently istemal karte ke liye plan ko sign ke Taur unsurprising with istemal kar saIs Tarah Ke frame advancements cost girti rahti hai lower wicks long hoti Jati Hai purchasing ka pressure banana indicators, jaise oscillators ya chart patterns, potential entry aur exit points pehle se pata lagane mein madad kar sakte hay is beginning ho raha hai Iske awful Upar ki taraf ek solid move Hota Hai Yeh uncertainty ko zahar karta hai dealers is baat ka decide karne mein help ke liye greater picture dekh sakte hain ek baar pattern start sharpen ke terrible brokers Jo plan ki Sahi kasusiyat per pura nahin utarte hain vah Stomach muscle Bhi specialists kam hai aur Agar yah Ek Puri tadad se upar banti hai exchanging market Mein acche entries he ap ke trade ko define krte hain -

#8 Collapse

FOREX ME LOGGING INDICATOR:-Forex trading mein, "lagging indicators" ya "lagging technical indicators" wo tools hote hain jo past price data ko analyze karte hain, aur traders ko market ke trend ya momentum ke baray mein information dete hain. Ye indicators market ke historical data ko istemal karte hain, isliye inhe "lagging" ya "trend-following" indicators bhi kaha jata hai. FOREX ME LOGGING INDICATOR KI BASE:-Moving Averages (MA): Moving averages price data ko smooth karke trend ko identify karne mein madadgar hote hain. Simple Moving Average (SMA) aur Exponential Moving Average (EMA) do aam taur par istemal hoti hain. Bollinger Bands: Ye indicator volatility aur price range ko measure karte hain. Isse traders price ke potential reversals aur market volatility ko samajh sakte hain. MACD (Moving Average Convergence Divergence): MACD price ke momentum aur trend changes ko detect karne mein madad karta hai. Isme do moving averages ka use hota hai. RSI (Relative Strength Index): RSI overbought aur oversold conditions ko darust karne mein help karta hai, jo market reversals ki indications dete hain. Stochastic Oscillator: Stochastic oscillator bhi overbought aur oversold conditions ko darust karne mein madad karta hai, jo market reversals ko suggest karte hain. In lagging indicators ka istemal traders price trends aur potential reversals ko identify karne mein karte hain, lekin ye indicators future price movements ko nahi predict karte. Isliye, inhe dusre leading indicators ke saath istemal karna aksar behtar hota hai, jo market ke potential changes ko pehle detect karne mein madad karte hain. Trading strategy banate waqt, traders ko lagging aur leading indicators dono ka samavesh karke puri tarah se market analysis karna chahiye.

FOREX ME LOGGING INDICATOR KI BASE:-Moving Averages (MA): Moving averages price data ko smooth karke trend ko identify karne mein madadgar hote hain. Simple Moving Average (SMA) aur Exponential Moving Average (EMA) do aam taur par istemal hoti hain. Bollinger Bands: Ye indicator volatility aur price range ko measure karte hain. Isse traders price ke potential reversals aur market volatility ko samajh sakte hain. MACD (Moving Average Convergence Divergence): MACD price ke momentum aur trend changes ko detect karne mein madad karta hai. Isme do moving averages ka use hota hai. RSI (Relative Strength Index): RSI overbought aur oversold conditions ko darust karne mein help karta hai, jo market reversals ki indications dete hain. Stochastic Oscillator: Stochastic oscillator bhi overbought aur oversold conditions ko darust karne mein madad karta hai, jo market reversals ko suggest karte hain. In lagging indicators ka istemal traders price trends aur potential reversals ko identify karne mein karte hain, lekin ye indicators future price movements ko nahi predict karte. Isliye, inhe dusre leading indicators ke saath istemal karna aksar behtar hota hai, jo market ke potential changes ko pehle detect karne mein madad karte hain. Trading strategy banate waqt, traders ko lagging aur leading indicators dono ka samavesh karke puri tarah se market analysis karna chahiye. -

#9 Collapse

What is the lagging indicator in forex? Figuring out THE Trailing result IN FOREX :Forex exchanging mein, specialized markers ka istemal bohat ahem hai taake soch samajh kar faislay liye ja purpose. Incidental result ek aisa mashhoor qisam ka marker hai jo merchants istemal karte hain forex market mein patterns ko recognize aur affirm karne ke liye. Proactive factors ke khilaf jo future cost developments anticipate karne ki koshish karte hain, incidental results brokers ko past patterns ki affirmation dete hain. Unhe reactive results isliye kaha jata hai kyunki wo authentic cost information standard depend karte hain signals banane ke liye.Trailing results aam peak standard dusre specialized investigation devices ke saath istemal hote hain market ki zyada puri tasveer dikhane ke liye. Ye merchants ko potential passage aur leave focuses ki pehchan karne mein madad kar sakte hain, sath hey pattern ki takat ki bhi tasdeeq kar sakte hain. Trailing results ki mashhoor misaalain moving midpoints, Bollinger Groups, aur MACD (Moving Normal Assembly Uniqueness) hain. MOVING Midpoints AS Reactive results :Moving midpoints incidental results ke taur standard forex exchanging mein wase ho rahe hain. Ye computation se work out kiye jate hain cash pair ke normal cost ko indicated time span ke andar. Sabse usually utilized moving midpoints hai straightforward moving normal (SMA) aur dramatic moving normal (EMA).SMA ko compute karne ke liye, shutting costs ko explicit number of periods ke andar absolute kiya jata hai, phir us all out ko periods ke number se partition kiya jata hai. Ye pointer aksar patterns ka pata lagane aur support aur opposition levels ki tasdeeq karne ke liye istemal hota hai.Dusri taraf, EMA late cost information ko zyada weightage deta hai, jis se wo market ke changes mein zyada delicate ho jata hai. Isko zyada exact mana jata hai aur dealers ise purchase ya sell signals create karne ke liye habitually istemal karte hain.BOLLING Groups AS Incidental results :Bollinger Groups bhi reactive results hai jo forex exchanging mein wase istemal hote hain. Ye high schooler lines se milte hain: center band, jo straightforward moving normal hota hai, aur upper aur lower band, jo center band se standard deviation add aur deduct karne se ascertain kiye jate hain.Bollinger Groups unpredictability ko measure karne aur potential overbought aur oversold conditions ko market mein pata lagane ke liye istemal hote hain. Hit cost upper band ke qareeb move karta hai, to ye isharat karta hai ke market overbought hai aur ek inversion ho sakta hai. Ulta punch cost lower band ke nazdeek ata hai, to ye ishara hai ke market oversold hai aur ek potential upswing aane wala hai.

MOVING Midpoints AS Reactive results :Moving midpoints incidental results ke taur standard forex exchanging mein wase ho rahe hain. Ye computation se work out kiye jate hain cash pair ke normal cost ko indicated time span ke andar. Sabse usually utilized moving midpoints hai straightforward moving normal (SMA) aur dramatic moving normal (EMA).SMA ko compute karne ke liye, shutting costs ko explicit number of periods ke andar absolute kiya jata hai, phir us all out ko periods ke number se partition kiya jata hai. Ye pointer aksar patterns ka pata lagane aur support aur opposition levels ki tasdeeq karne ke liye istemal hota hai.Dusri taraf, EMA late cost information ko zyada weightage deta hai, jis se wo market ke changes mein zyada delicate ho jata hai. Isko zyada exact mana jata hai aur dealers ise purchase ya sell signals create karne ke liye habitually istemal karte hain.BOLLING Groups AS Incidental results :Bollinger Groups bhi reactive results hai jo forex exchanging mein wase istemal hote hain. Ye high schooler lines se milte hain: center band, jo straightforward moving normal hota hai, aur upper aur lower band, jo center band se standard deviation add aur deduct karne se ascertain kiye jate hain.Bollinger Groups unpredictability ko measure karne aur potential overbought aur oversold conditions ko market mein pata lagane ke liye istemal hote hain. Hit cost upper band ke qareeb move karta hai, to ye isharat karta hai ke market overbought hai aur ek inversion ho sakta hai. Ulta punch cost lower band ke nazdeek ata hai, to ye ishara hai ke market oversold hai aur ek potential upswing aane wala hai. MACD AS An Incidental result:MACD (Moving Normal Union Uniqueness) ek reactive result hai jo aam taur standard energy ki changes ko pata lagane aur purchase ya sell signals produce karne ke liye istemal hota hai. Isme do lines hoti hain: MACD line aur signal line.MACD line ascertain hoti hai 26-period remarkable moving normal se 12-period outstanding moving normal ka take away karke. Signal line MACD line ki 9-period dramatic moving normal hoti hai.Poke MACD line signal line se upar cross karti hai, to ye bullish sign produce hoti hai, ishara karte tint ke stomach muscle accha waqt ho sakta hai purchase karne ka. Ulta poke MACD line signal line se neeche cross karti hai, to ye negative sign create hoti hai, ishara karte tint ke stomach muscle accha waqt ho sakta hai sell karne ka.

MACD AS An Incidental result:MACD (Moving Normal Union Uniqueness) ek reactive result hai jo aam taur standard energy ki changes ko pata lagane aur purchase ya sell signals produce karne ke liye istemal hota hai. Isme do lines hoti hain: MACD line aur signal line.MACD line ascertain hoti hai 26-period remarkable moving normal se 12-period outstanding moving normal ka take away karke. Signal line MACD line ki 9-period dramatic moving normal hoti hai.Poke MACD line signal line se upar cross karti hai, to ye bullish sign produce hoti hai, ishara karte tint ke stomach muscle accha waqt ho sakta hai purchase karne ka. Ulta poke MACD line signal line se neeche cross karti hai, to ye negative sign create hoti hai, ishara karte tint ke stomach muscle accha waqt ho sakta hai sell karne ka. Involving Reactive results Related to Proactive factors :Trailing results ko proactive factors ke saath istemal karte tint zyada complete market ki picture dikhane ke liye significant hai. Proactive factors, jaise oscillators ya outline designs, potential passage aur leave focuses pehle se pata lagane mein madad kar sakte hain.Slacking aur proactive factors ko mila kar istemal karke, brokers forex market mein zyada informed exchanging choices le sakte hain aur apni exchanging kamyabi ke chances ko barha sakte hain. Halaanki, ehmiyat hai keh koi marker reliable nahi hota, aur brokers ko hamesha legitimate gamble the board aur careful examination ka istemal karne chahiye, exchanging choices ke pehle.

Involving Reactive results Related to Proactive factors :Trailing results ko proactive factors ke saath istemal karte tint zyada complete market ki picture dikhane ke liye significant hai. Proactive factors, jaise oscillators ya outline designs, potential passage aur leave focuses pehle se pata lagane mein madad kar sakte hain.Slacking aur proactive factors ko mila kar istemal karke, brokers forex market mein zyada informed exchanging choices le sakte hain aur apni exchanging kamyabi ke chances ko barha sakte hain. Halaanki, ehmiyat hai keh koi marker reliable nahi hota, aur brokers ko hamesha legitimate gamble the board aur careful examination ka istemal karne chahiye, exchanging choices ke pehle.

- Mentions 0

-

سا0 like

-

#10 Collapse

Lagging indicator ko samjjhna: Forex trading mein, je haan technical indicators ka istemal bohat ahem hai taake soch samajh kar faislay liye ja sake. ap ki baat theek hai. Lagging indicator ek aisa mashhoor qisam ka indicator hai jo traders istemal karte hain sahe kaha forex market mein trends ko identify aur confirm karne ke liye. boht zarroori ha Leading indicators ke khilaf jo future price movements predict karne ki koshish karte hain, thek baat lagging indicators traders ko past trends ki confirmation dete hain. agay ye kaha jay Unhe lagging indicators isliye kaha jata hai kyunki wo historical price data wagaura wagaira par rely karte hain signals banane ke liye. Explanation: mai explain karta hun Lagging indicators thoda delayed hote hain, jabke leading indicators try karte hain je han market ke agay jane wale movements ko pehle se den.Lagging indicator, jese ke Moving Averages, market ke past qeemyton ko movements ko zahir karta hai. Yeh traders ko trend ke direction aur way ka pata lagane mein madad karta hai, lekin yeh thora late information deta hai, hum zaroor dekgtay hain kyun ke iska zeada tar sahii inhasar id bat pr hota hay kay ap kr kia chuky hain sahe kaha r agy kia krna hay yeah data par hota hai. Isse traders current market ki hallat ka analysis karte hain. Lagging indicators ki kuch bohat hi zyada faiday hain jese ke trend ki shanakht aur market stability ka pata lagana bihat he aham hai. Lekin iske nuqsanat mein yeh shamil hain ke yeh maloomat kafi zyada thoda delayed hoti hai, aur tez raftari say changing markets mein minimum aati hai. Iska istemal market reversals ya tezi ke movements ko pehle se samjhnay k lye mein thoda challenging ho sakta hai. Lagging indicators ko deakh kar aur sahi tareekay se istemal karna ustaadi aur tajarbay ki zarurat hoti hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

What is the lagging indicator in forex? Forex market mein lagging indicators, market analysis aur trading decisions mein istemal hone wale aise indicators hote hain jo past price data par based hote hain. In indicators ki madad se traders market ke historical performance aur trends ko samajhte hain. Lagging indicators ko "lagging" isliye kaha jata hai kyunki ye current market conditions ko accurately predict karne mein der lagate hain, aur wo information provide karte hain jo pehle ho chuka hota hai. Yahan par main aapko kuch important lagging indicators ke bare mein detail mein bataunga: Moving Averages: Moving averages, market ke average price ko ek specific time frame ke period ke hisab se calculate karte hain. Inmein simple moving averages (SMA) aur exponential moving averages (EMA) shamil hain. SMA purane prices ko barabar weigh karte hain, jabki EMA recent prices ko zyada weightage deti hai. Moving averages market trends ko identify karne aur confirm karne mein istemal hote hain. Bollinger Bands: Bollinger Bands bhi ek lagging indicator hote hain. Ye volatility ko measure karte hain aur price ke potential reversal points ko darust karne mein madadgar hote hain. Bollinger Bands price ke around ek envelope create karte hain jiska center line usually simple moving average hota hai. Relative Strength Index (RSI): RSI ek momentum indicator hai jo market ke overbought aur oversold conditions ko indicate karta hai. Ye trader ko ye batata hai ke kis extent par market mein price changes hone ki sambhavna hai. RSI 0 se 100 ke beech hota hai, aur overbought zone (70 se upar) aur oversold zone (30 se niche) ke levels par focus karta hai. Stochastic Oscillator: Stochastic Oscillator bhi market mein momentum aur potential reversal points ko identify karne ke liye istemal hota hai. Ye indicator 0 se 100 scale par hota hai aur overbought (80 se upar) aur oversold (20 se niche) levels par focus karta hai. MACD (Moving Average Convergence Divergence): MACD ek trend-following lagging indicator hai jo moving averages ka use karta hai. Is indicator ki madad se market ke short-term aur long-term trends ko identify kiya ja sakta hai. MACD line aur signal line ke crossover points bhi trading signals generate kar sakte hain.Lagging indicators ki madad se traders market ke historical data ko analyze karte hain, lekin in indicators ka istemal current market conditions ko predict karne mein kam hota hai. Inko doosre leading indicators ke sath milakar istemal karna behtar hota hai taki trading decisions ko aur bhi reliable banaya ja sake. Forex trading mein, aapko market ke tamam aspects ko samajhne aur analyze karne ke liye lagging aur leading indicators ka sahi tarah se istemal karna chahiye.

Moving Averages: Moving averages, market ke average price ko ek specific time frame ke period ke hisab se calculate karte hain. Inmein simple moving averages (SMA) aur exponential moving averages (EMA) shamil hain. SMA purane prices ko barabar weigh karte hain, jabki EMA recent prices ko zyada weightage deti hai. Moving averages market trends ko identify karne aur confirm karne mein istemal hote hain. Bollinger Bands: Bollinger Bands bhi ek lagging indicator hote hain. Ye volatility ko measure karte hain aur price ke potential reversal points ko darust karne mein madadgar hote hain. Bollinger Bands price ke around ek envelope create karte hain jiska center line usually simple moving average hota hai. Relative Strength Index (RSI): RSI ek momentum indicator hai jo market ke overbought aur oversold conditions ko indicate karta hai. Ye trader ko ye batata hai ke kis extent par market mein price changes hone ki sambhavna hai. RSI 0 se 100 ke beech hota hai, aur overbought zone (70 se upar) aur oversold zone (30 se niche) ke levels par focus karta hai. Stochastic Oscillator: Stochastic Oscillator bhi market mein momentum aur potential reversal points ko identify karne ke liye istemal hota hai. Ye indicator 0 se 100 scale par hota hai aur overbought (80 se upar) aur oversold (20 se niche) levels par focus karta hai. MACD (Moving Average Convergence Divergence): MACD ek trend-following lagging indicator hai jo moving averages ka use karta hai. Is indicator ki madad se market ke short-term aur long-term trends ko identify kiya ja sakta hai. MACD line aur signal line ke crossover points bhi trading signals generate kar sakte hain.Lagging indicators ki madad se traders market ke historical data ko analyze karte hain, lekin in indicators ka istemal current market conditions ko predict karne mein kam hota hai. Inko doosre leading indicators ke sath milakar istemal karna behtar hota hai taki trading decisions ko aur bhi reliable banaya ja sake. Forex trading mein, aapko market ke tamam aspects ko samajhne aur analyze karne ke liye lagging aur leading indicators ka sahi tarah se istemal karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:19 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим