ADX Indicator in Forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

ADX Indicator in ForexBelieve in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

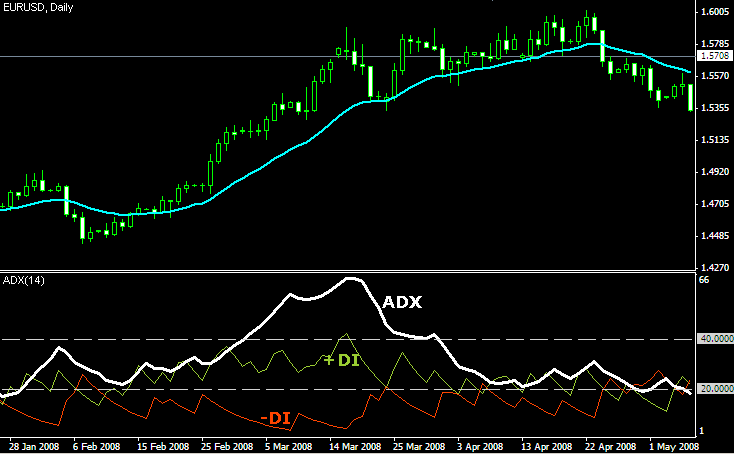

Forex trading ki dunia mein sahi tools aur strategies ka hona zaroori hai taake sahi faislay kiye ja sakein aur munafa ziada kiya ja sake. Aik aisi tool jo traders aksar istemal karte hain woh hai Average Directional Index (ADX). J. Welles Wilder ne isay develop kiya tha, ADX indicator aik popular technical analysis tool hai jo trend ki taqat aur direction ko measure karne ke liye istemal hota hai. Understanding the ADX Indicator ADX indicator trend-following indicators mein shaamil hota hai aur isay mojooday trend ki taqat ko identify karne ke liye istemal kiya jata hai. Ye trend ki direction ke baray mein maloomat nahi deta, balkay sirf trend ki taqat par tawajju deta hai. ADX ki values 0 se lekar 100 tak hoti hain, jahan ziada values aik zyada taqatwar trend ko aur kam values aik kam taqatwar trend ya range-bound market ko indicate karti hain.Calculation of ADX ADX Positive Directional Index (+DI) aur Negative Directional Index (-DI) naam ke doosray indicators se nikalta hai. Ye components specific period ke price movements par based hotay hain. ADX ki formula mein +DI aur -DI ke darmiyan farqat ki averages ko smooth kiya jata hai, aam taur par 14 periods ke liye, jisse trend ki taqat ko represent karne wali aik line banayi jati hai. Interpreting ADX Values

- ADX Below 20: Jab ADX ki value 20 ke neeche hoti hai, to ye weak trend ya range-bound market ko indicate karti hai. Traders isay aik ishara samajh kar trend-based trading strategies se bachne aur range-bound strategies ko consider karne ka soch sakte hain.

- ADX Between 20 and 40: 20 se lekar 40 ke darmiyan ki reading development mein mubtala trend ko dikhata hai jiska moderate strength hota hai. Traders mojooday trend ki taraf trades mein dakhil hone ka soch sakte hain, potential opportunities ki talash mein.

- ADX Above 40: ADX ki value 40 ke upar aane par aik strong trend ko indicate karti hai. Traders isay trend continuation strategies ke liye confirmation signal ke tor par istemal karte hain. Taqatwar trends traders ke liye munafa dene wale moqaat present kar sakte hain agar woh momentum ke sath trading karne ke liye tayyar hain.

Practical Applications of ADX in Forex Trading

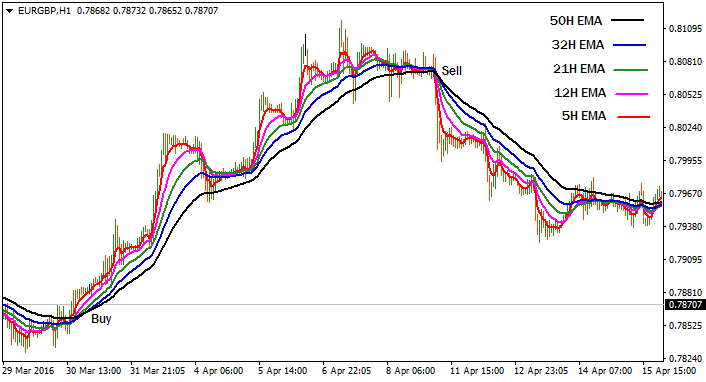

- Trend Confirmation: ADX indicator ka aik mukammal istemal trend ki mojoodgi ki tasdeek ke liye hota hai. Traders isay doosray technical indicators ya chart patterns ke sath combine kar ke potential trade setups ko confirm karne ke liye istemal kar sakte hain, jisse successful trades ki probability barh jati hai.

- Trend Reversal Identification: Walaugh ke ADX direct signals trend reversals ke liye nahi deta, lekin ADX ki value mein significant tabdeeli trend reversal ki indication de sakti hai. Maslan, agar ADX aik strong uptrend ko indicate kar rahi hai aur phir kam hone lagti hai, to ye trend ki kamzori aur possible market reversal ki taraf ishara kar sakti hai.

- Volatility Measurement: ADX market ki volatility ko measure karne ke liye istemal kiya ja sakta hai. Barhte huye ADX values taqatwar market volatility ko show karti hain, jabke girte huye values kam hone wali volatility ko indicate karti hain. Traders apni trading strategies ko current market conditions aur ADX ke zariye indicate ki jane wali volatility ke mutabiq adjust kar sakte hain.

- Filtering Trades: ADX trades ke liye aik filter ke tor par istemal ho sakta hai. Maslan, traders sirf tab trade mein shamil hone ka soch sakte hain jab ADX ki value aik certain threshold ke upar hoti hai, taake woh strong trend ki taraf trading kar rahe hon aur weak ya sideways market mein nahi.

- Setting Stop Loss and Take Profit Levels: Traders ADX ka istemal sahi stop loss aur take profit levels set karne ke liye bhi kar sakte hain. Aik strong trend mein (ADX 40 ke upar) traders ziada profit targets chun sakte hain, jisse unki trades ziada price movements ko capture kar sakein. Wahi, aik weak ya range-bound market mein (ADX 20 ke neeche) traders choti profit targets ko choose kar sakte hain, jisse choti aur predictable earnings hasil ho sakein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

About ADX indicator: Forex trading mein "ADX Indicator" ya "Average Directional Index Indicator" ek aham technical analysis tool hai jo market trends ko samajhne aur trading decisions banane mein madadgar hota hai. Isay Roman Urdu mein samjhaatay hain: ADX Indicator ka maqsad market ke trend ko measure karna hai, yaani ke ye samjhnay mein madad karta hai ke market mein trend hai (upward or downward movement) ya phir range-bound (sideways movement) hai. Is indicator mein teen components hotay hain: Positive Directional Index (+DI): Yeh index market ke upward trend ko represent karta hai. Agar +DI zyada hai, to ye show karta hai ke uptrend strong ho sakta hai. Negative Directional Index (-DI): Yeh index market ke downward trend ko represent karta hai. Agar -DI zyada hai, to ye show karta hai ke downtrend strong ho sakta hai. Average Directional Index (ADX): ADX, jese ke naam se zahir hai, average direction ko measure karta hai. Iski range 0 se 100 tak hoti hai. Agar ADX ki value choti hai (30 se kam), to ye indicate karta hai ke market mein trend kamzor hai ya sideways hai. Lekin agar ADX ki value barh jati hai (30 se zyada), to ye show karta hai ke market mein strong trend hai. Trading mein ADX Indicator ka istemal trend strength aur trend reversal ke liye hota hai. Traders ADX ko doosre indicators ke saath istemal karte hain taaki woh market ka direction samajh saken aur entry aur exit points tay kar saken. Yad rahe ke ADX Indicator ek tool hai aur usay sahi tafseelat ke saath istemal karna maharat aur practice ki zaroorat hoti hai. Trading mein risk management aur aur technical analysis ke principles bhi ahem hotay hain. Trade using ADX indicator: Forex trading mein "ADX Indicator" ya "Average Directional Index Indicator" ek aham technical analysis tool hai jo market trend ki strength ko measure karne mein madadgar hota hai. Isko samajhne ke liye, main aapko Roman Urdu mein iske mukhtasar tafseelat bataunga: ADX Indicator primarily ye cheezein measure karta hai: Market Trend Ki Strength: ADX indicator market mein chal rahe trend ki strength ko measure karta hai, yaani ke ye batata hai ke market mein uptrend (price barh rahi hai) ya downtrend (price ghat rahi hai) kitni taqat hai. Trend Ka Hone Ka Pata: ADX 0 se 100 scale par hota hai. Generally, jab ADX 25 ya usse zyada hota hai, to ye indicate karta hai ke market mein aik strong trend present hai. Jab ADX kam hota hai, to ye market mein weak ya sideways (jahan price kisi khas direction mein nahi jaa rahi) trend ko darust karta hai. Directional Movement: ADX indicator ke saath do aur lines hoti hain: +DI (Positive Directional Indicator) aur -DI (Negative Directional Indicator). +DI positive trend ko, aur -DI negative trend ko represent karte hain. In dono lines ka comparison ADX ke saath dekha jata hai takay trend ki direction aur strength maloom ho. Trading Signals: Traders ADX ko trend reversal ya trend continuation ke signals ke liye istemal karte hain. For example, jab ADX 25 se kam ho aur +DI -DI se close hota hai, to ye trend weakening ya reversal ka signal ho sakta hai. ADY Indicator traders ke liye useful hai kyun ke isse market trend ki strength aur direction ka pata chalta hai. Lekin yaad rahe ke ADX ek indicator hai aur dusri analysis techniques ke saath istemal hota hai, taaki sahi trading decisions li ja saken. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

ADX (Average Directional Index) Forex mein ek prashansaaniya upkaran hai jo vyaparik vyaktiyon ko trend ka moolyaankan karne mein madad karta hai. Ye technical analysis ka ek mahatvapurn hissa hai aur traders dwara upayog kiya jata hai trend strength ya trend weakness ko samajhne ke liye. ADX indicator ka upayog primarily do cheezon ke liye kiya jata hai: Trend Strength ki Pahchan::max_bytes(150000):strip_icc():format(webp)/dotdash_Final_ADX_The_Trend_Strength_Indicator_Sep_2020-01-e6f5e79d222343cc83b23d75312f09ce.jpg) ADX trend ki shakti ko darust rup se pradarshit karta hai. Ye 0 se 100 ke beech ek range mein hota hai. ADX ki value badhne ke sath, trend ki shakti bhi badhti hai. ADX ki value 25 se kam hone par, market mein sideways ya range-bound trading ki sthiti hoti hai, jabki ADX ki value 25 se adhik hone par, ek mazboot trend ki sthiti hoti hai. Trend Direction ki Pahchan: ADX indicator, trend ki disha ko bhi dikhata hai. Iske saath hi, ADX ke saath lagaye gaye directional indicators (jaise ki +DI aur -DI) traders ko ye batate hain ki kis disha mein trend badh raha hai - upar ya niche. +DI (Positive Directional Indicator) uptrend ko darust karta hai, jabki -DI (Negative Directional Indicator) downtrend ko darust karta hai. ADX indicator ki jyada value, ek mazboot trend ko darust karti hai, jabki kam value, market ki achanak parivartan ki sthiti ko darust karti hai. Is indicator ka upayog traders trend ke peechhe lagne ke liye, trend ki shakti ko pahchante samay aur samay par trading decisions lene ke liye karte hain. Lekin yaad rahe ki ADX indicator keval ek tool hai, aur iska upayog dusre technical indicators ke saath kiya jana chahiye, taki trading decisions ko sahi roop se grahan kiya ja sake. Trading mein risk management ka bhi mahatvapurn bhaag hai, aur ADX indicator ismein madad kar sakta hai, lekin yeh ek complete trading strategy nahin hai.

ADX trend ki shakti ko darust rup se pradarshit karta hai. Ye 0 se 100 ke beech ek range mein hota hai. ADX ki value badhne ke sath, trend ki shakti bhi badhti hai. ADX ki value 25 se kam hone par, market mein sideways ya range-bound trading ki sthiti hoti hai, jabki ADX ki value 25 se adhik hone par, ek mazboot trend ki sthiti hoti hai. Trend Direction ki Pahchan: ADX indicator, trend ki disha ko bhi dikhata hai. Iske saath hi, ADX ke saath lagaye gaye directional indicators (jaise ki +DI aur -DI) traders ko ye batate hain ki kis disha mein trend badh raha hai - upar ya niche. +DI (Positive Directional Indicator) uptrend ko darust karta hai, jabki -DI (Negative Directional Indicator) downtrend ko darust karta hai. ADX indicator ki jyada value, ek mazboot trend ko darust karti hai, jabki kam value, market ki achanak parivartan ki sthiti ko darust karti hai. Is indicator ka upayog traders trend ke peechhe lagne ke liye, trend ki shakti ko pahchante samay aur samay par trading decisions lene ke liye karte hain. Lekin yaad rahe ki ADX indicator keval ek tool hai, aur iska upayog dusre technical indicators ke saath kiya jana chahiye, taki trading decisions ko sahi roop se grahan kiya ja sake. Trading mein risk management ka bhi mahatvapurn bhaag hai, aur ADX indicator ismein madad kar sakta hai, lekin yeh ek complete trading strategy nahin hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:21 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим