EMA Strategy in Forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

EMA Strategy in Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

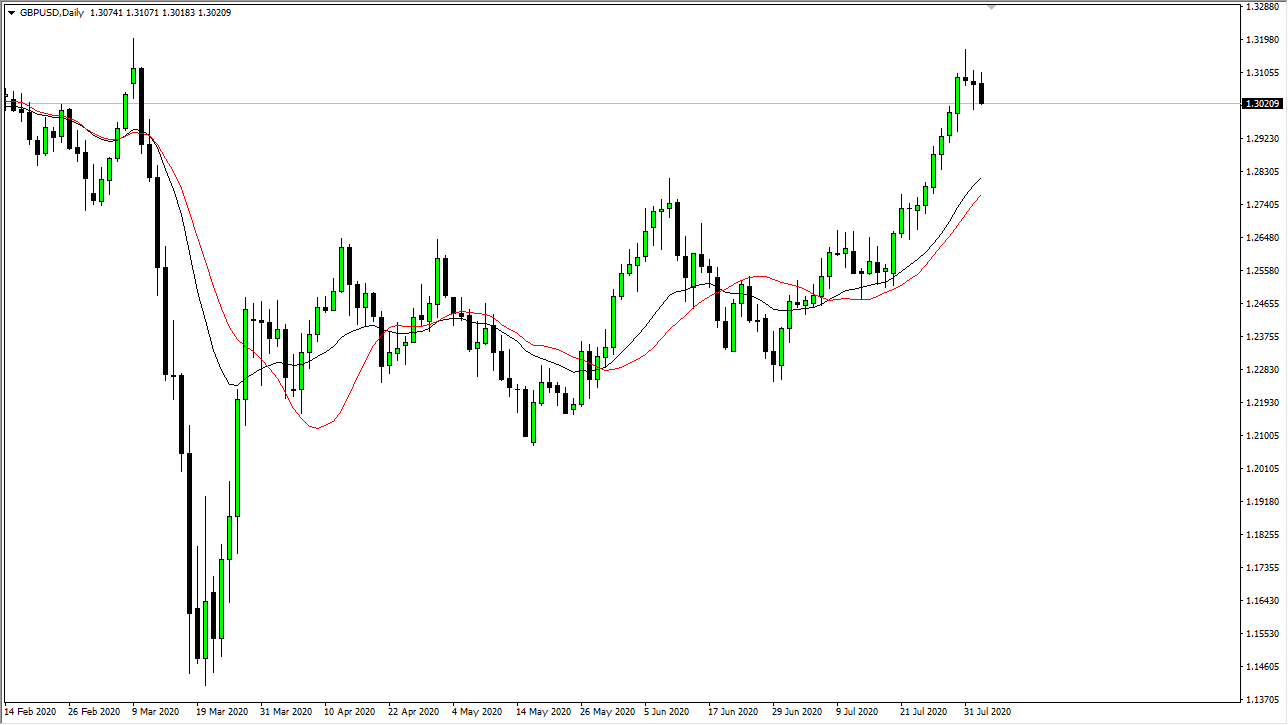

Exponential Moving Average (EMA) ek mashhoor trading strategy hai jo foreign exchange (forex) market mein istemal hoti hai. Ye ek technical analysis ka zariya hai jo traders ko trends aur market mein dakhil aur nikalne ke potenti​​al points pehchanne mein madad karti hai. EMA ek aisi moving average hai jo recent price data ko zyada weight deti hai, jiski wajah se wo recent price changes ke liye Simple Moving Average (SMA) ke mukabley zyada responsive hoti hai. Understanding Moving Averages Moving averages tabulated hoti hain jin mein kuch specific periods ke closing prices ka average nikala jata hai. For example, 10-day moving average calculate ki jaati hai jisme last 10 days ke closing prices ko add kiya jata hai aur phir ye sum ko 10 se divide kiya jata hai. Lekin EMA mein recent prices ko zyada weight diya jata hai, jiski wajah se ye price changes ke liye zyada responsive hoti hai.:max_bytes(150000):strip_icc()/EMA-5c535d5a46e0fb000181fa56.png) EMA Calculation EMA calculate karne ke liye ek multiplier ka istemal hota hai (aam tor par 2 / (N + 1), jahan N periods ka number hota hai) jo recent prices ko zyada weight deta hai. Isko calculate karne ka tareeqa ye hai. EMA=(Close−EMA previous)×multiplier+EMA previous

EMA Calculation EMA calculate karne ke liye ek multiplier ka istemal hota hai (aam tor par 2 / (N + 1), jahan N periods ka number hota hai) jo recent prices ko zyada weight deta hai. Isko calculate karne ka tareeqa ye hai. EMA=(Close−EMA previous)×multiplier+EMA previous - EMA current period ke Exponential Moving Average ko represent karta hai.

- Close current period ka closing price hai.

- EMA_previous previous period ka Exponential Moving Average hai.

- Multiplier weighting factor hai.

Advantages of EMA

Advantages of EMA- Responsiveness: EMA recent price changes ke liye zyada responsive hoti hai, jo isay current market conditions ke liye zyada responsive banati hai. Traders trends aur potential reversals ko spot kar sakte hain aur dusri moving averages ke mukabley jaldi.

- Reduced Lag: EMA price movement aur moving average line ke darmiyan lag ko kam kar deta hai. Ye traders ke liye ahem hai jo sahi waqt par positions mein dakhil ya nikalna chahte hain.

- Trend Identification: EMAs trends pehchanne ke liye behtareen tools hain. Jab price EMA ke upar hoti hai, to ye uptrend suggest karta hai, aur jab price EMA ke neeche hoti hai, to ye downtrend suggest karta hai.

- Trend Identification: Traders aksar do EMAs istemal karte hain jin ki periods alag hoti hain, jaise 50-day EMA aur 200-day EMA. Jab shorter EMA longer EMA ke upar se cross karta hai, to ye ek buy signal generate karta hai, jo ek potential uptrend ko indicate karta hai. Ulta, jab shorter EMA longer EMA ke neeche se cross karta hai, to ye ek sell signal generate karta hai, jo ek potential downtrend ko indicate karta hai.

- Support and Resistance Levels: EMAs dynamic support aur resistance levels ke taur par kaam kar sakti hain. Uptrend mein, price aksar rising EMA se bounce karti hai, jo traders ke liye potential entry points provide karta hai. Downtrend mein, falling EMA ek resistance level ke taur par kaam kar sakti hai.

- Crossovers: EMA crossovers traders ke liye significant signals hote hain. Jab price apne EMA ke upar cross karta hai, to ye ek buying opportunity ko indicate kar sakta hai, jabki EMA ke neeche cross hona ek selling opportunity ko indicate kar sakta hai.

- Divergence: Traders price aur EMA ke darmiyan divergence ke liye bhi dekhte hain. For example, agar price new highs banati hai lekin EMA nahi follow kar rahi, to ye ek kamzor trend aur ek potential reversal ko indicate kar sakta hai.

- Combining with Other Indicators: Traders often EMAs ko dusre technical indicators jaise Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD) ke saath combine karte hain taki unke trading signals ki accuracy barh sake.

Limitations of EMA

Limitations of EMA- Whipsaws: EMAs, jaise ke doosri moving averages, false signals generate kar sakti hain, khaas kar choppy ya ranging markets mein. Traders crossovers ke basis pe trades enter karte hain, lekin price jald hi reverse ho sakta hai.

- Not Suitable for All Market Conditions: EMAs sirf strong trends mein achi tarah kaam karti hain. Lekin sideways ya consolidating markets mein, sirf EMA signals pe bharosa karke nuksan ho sakta hai.

- Subjectivity: EMA periods ka chayan aur crossovers ki interpretation traders ke darmiyan vary ho sakta hai. Jo ek trader ke liye kaam karta hai, wo doosre trader ke liye kaam nahi kar sakta.

- Data Sensitivity: EMAs recent price data ke liye zyada sensitive hoti hain. Sudden price movements, khaas karke low-liquidity markets mein, false signals create kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:41 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим