How to trade Pennant Chart pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dosto!- umeed ha ap sb khairiat se hn gy or apka trading week acha jaa raha ho ga.

- aj ki post main hum continuation patterns main se pennant chart patterns ko study karen gy or dekhen gy ye kia hota ha or esko kesy trade kia hata ha.

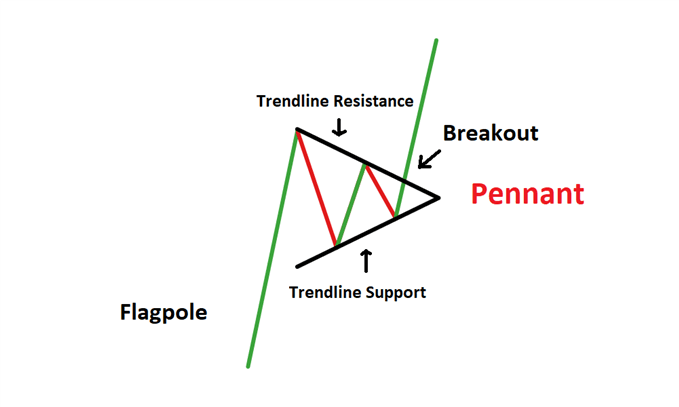

- dear members pennant pattern aik continuation pattern ha mtlb k ye jis trend main bnta ha us trend k continue hony ki nishani hota ha.agr bullish main bny to es k breakout k bad market bullish hoti ha.

- or agr bearish main bny to es k breakout k bad market bearish hoti ha. Es pattern ki 2 types hoti hain

- Bullish pennant pattern.

- Bearish Pennant Pattern.

- dear members ye pattern bullish trend main bnta ha jb market kafi opr ja chuki ho to market thori retracement leti ha or estrha ka pattern bnta ha.

- es main market higher lows or lower highs bnati ha.

- Highs ko highs se Milan to aik trend line bnti ha kr lows ko lows se mila k dosri trend line bnti ha estrha market 2 trend lines k darmyan move karti ha.

- Dear members bullish pennant ko trade karny k lye hamen chahye k pattern k complete hony or es k breakout ka wait karen jb breakout ho jy to uski confirmation ka wait karen jb confirmation ho jy to hum es main buy ki entry le skty hain or hmara stoploss bullish penneta ki hoper trend line ya us se nechy ho ga jb k profit tarhet pennant ki height k equal ho ga

- Dear members es pattern main trade karny k lye hmn breakout ka wait karna chahye or eski confirmation k bad sell ki trade leni chahye or es main hmara stop loss pennant ki lower trend line ya us se opr ho ga jb k profit targe pannent ki height k equal ho ga.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Pennant Chart Pattern

Technical analysis ke nazar se, pennant pattern ek trend continuity pattern samjha jata hai kyun ke isay ye ummeed hoti hai ke breakout trend ke rukh mein hoga. Ye ek chote time-frame patterns mein se aik hai kyun ke ye teen hafton ya usse kam waqt mein complete hota hai. Matlab, breakout (ya pattern failure) teen hafton ke andar hona chahiye. Pennant ke sath kamyaabi ka rasta upar ke trend ki quality par hai jo isay precede karti hai. Aapko isay banne se pehle sharp aur steep run dekhna chahiye kyun ke pennant banne se pehle hone wale aggressive trading ke zimmedar rukh breakout ke baad jari rahega.

Pennant chart pattern ek trading shuda pattern hai jo trend continuity category mein aata hai. Ye aik doraan mein chand chart formations se chota hota hai aur aksar ziada aggressive trading environments mein dekha jata hai. Aam taur par, pennant trend ke development ke darmiyan ke lagbhag darmiyan mein ban jata hai. Pennant ka breakout trend ke rukh mein dakhil hone ka ishara deta hai.

Explaination

Pennant chart pattern ek trend continuity pattern hai jo dono bullish aur bearish markets mein hota hai. Ye aik sharp advance of trend ke baad banta hai, ya to upar ya neeche, jab price aik choti samanli triangle ki shakal mein tight range mein trade karne lagti hai. Aksar, ye price move ke doraan banata hai jo trend ke doosre hisse ki shuruaat ko pehchanata hai.

Ye ek kaafi common pattern hai aur ye aam taur par tamam time frames mein ba aksar hota hai, lekin short-term timeframes mein ziada dekha jata hai. Pennants flag patterns ke lihaz se milti hain kyun ke dono mein ek sharp rally hota hai jo consolidation phase ko banata hai. Do trend lines pennant ke boundary ko pehchanti hain, jin mein upper trend line upar ki taraf mukhalif hoti hai aur lower trend line neeche ki taraf mukhalif hoti hai taake ye apex ke point par cross ho aur horizontally point karein.

Flagpole Ki Formation

Aik sahi pennant ke liye, isay ek tez aur seedhi rally (bull market) ya price mein tezi se girawat (bear market) se pehle precede karna zaroori hai. Pennant ke banne se pehle isay precede karne wale aggressive buying (bullish pennant) ya selling (bearish pennant) ke signs dekhne chahiye aur relative volume strong hona chahiye.

Pennant Breakout

Pennant chart pattern aksar formation ke pehle trend ke rukh mein ek breakout hota hai. Pechle trend ki aggressive hone ka maiz trend ke baad hone wale moves ko pehchanne ke liye ahem ishara hai.

Aik accurate pennant aam taur par kuch hafton tak consolidate hota hai aur zyada se zyada teen hafton tak. Agar isay zyada waqt tak ho jata hai to isay aik bada pattern, jaise ke aik samanli triangle, mein tabdeel hone ke zyada chances hain, ya phir fail ho sakta hai. Fail is waqt hota hai jab price expected rukh se opposite direction mein move karta hai. Pennant banate waqt volume kam hona chahiye. Lekin breakout ke waqt volume spike karna chahiye jo enthusiastic buyers ya sellers ko reflect karega aur sustained move ke liye chance banata hai. Ye extended breakout period traders ke liye is pattern ka istemal karne mein pasandeeda bana deta hai.

Dosre Chart Pattern se Comparison- Pennant Pattern vs. Wedge Pattern

Pennant pattern ko trend continuity pattern ke tor par istemal kiya jata hai jabke wedge pattern trend continuity aur reversal pattern dono ke tor par istemal kiya ja sakta hai. Isi ke alawa, wedge ke liye flagpole ki koi shart nahi hoti, bas pehle trend ki wujoodat kaafi hai. - Pennant Pattern vs. Symmetrical Triangle Pattern

Pennant aur symmetrical triangle patterns dono trend continuity patterns hote hain aur ishare ke liye dono ek samanli triangle ki shakal lete hain. Ye ek farq hai ke pennant triangle ki size symmetrical triangle se choti hoti hai. Isi ke sath, pennant ko sharp steep trend ko consolidating ke liye zaroorat hoti hai jabke symmetrical triangle bas kisi tarah ke trend mein hone ki zaroorat rakhti hai. - Pennant Pattern vs. Flag Pattern

Pennants aur flags ko dono trend continuity patterns aur consolidation phase shamil hoti hai. Iska primary farq flagpole ke baad hone wale consolidation ki shakal mein hota hai jaisa ke nicha diya gaya hai.

Trading

Pennant ko trend ke rukh mein breakout hone par trade kya jata hai. Lekin aap trend ko ride karne ke liye kuch entry strategies istemal kar sakte hain. Pattern ke liye aik measuring objective tayyar kiya jata hai jo pennant ke banne se pehle flagpole ke start se shuru hota hai (bull market) ya pole ke bottom se (bear market). Ye tayyar hota hai jab sharp move resistance ya support level ko todati hai. Distance ko ya to pennant ke top ya bottom tak napte hain trend direction ke mutabiq.

Reliability

John Murphy, jinhon ne classic technical analysis book "Technical Analysis of the Financial Markets" likhi hai, likhte hain ke pennant pattern technical analysis mein trend continuity patterns mein se aik hai jo bharosemand tareeqe se kaam karta hai. Lekin Thomas N. Bulkowski ki kitab "Encyclopedia of Chart Patterns" mein ki gayi aik study ne isay kuch doosre patterns ke barabar ya isse kam bharosemand paya. Yaad rahe ke Bulkowski ne pennant ke liye sirf short-term price swings par tests kiye hain, breakout se lekar eventual high ya low tak, jabke doosre pattern tests mein isay shamil nahi kiya gaya. Is se ye samjha jata hai ke result behtar ho sakte hain agar bade moves ko mad-e-nazar rakha jaye. Aksar, traders apne decision-making process ko madadgar banane aur kamyaabi ke chances ko barhane ke liye pennants ko doosre forms of technical analysis ke sath istemal karte hain.

- Bullish Pennant Chart Pattern

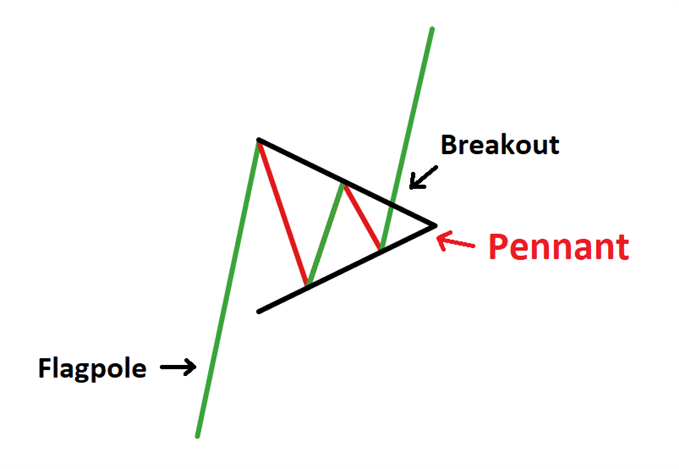

Aik bullish pennant ek uptrend mein hoti hai aur isay flagpole ke tor par ek tez aur seedhi rally se shuru hota hai. Iske baad aik short consolidation period hota hai jo ek pennant ya choti samanli triangle ki shakal mein hota hai. Bullish pennant price ke upar aur barhne ke liye rally karne se pehle banti hai. - Bullish Pennant Chart Pattern

A bearish pennant ek downtrend mein hoti hai aur isay flagpole ke tor par ek tez aur seedhi girawat se shuru hoti hai. Iske baad aik short consolidation period hota hai jo ek pennant ko banane ke liye hota hai. Bearish pennant price ko kam karne aur neeche jane se pehle banti hai. Jab price lower boundary line ke neeche ja kar break karta hai, to ye ek bearish short-sell signal create karta hai.

In dono mein farq hone ke bawajood, trading mein dono bullish aur bearish pennant patterns par wahi approach istemal kiya ja sakta hai. Farq sirf itna hai ke bullish pennant ke liye aap long bias ke sath trade karte hain aur bearish pennant ke liye short trade mein shamil hote hain.

- Pennant Pattern vs. Wedge Pattern

-

#4 Collapse

Pennant chart pattern ek popular technical analysis tool hai jo traders ko price movements ke trends ko identify karne mein madad karta hai. Yeh pattern market volatility ke dauran hone wale temporary pauses aur consolidations ko darust karta hai, jo ek strong move ke pesh-e-nazar hone se pehle hota hai. Yeh guide aapko pennant chart pattern ko samajhne aur istemal karne mein madad karega.

Key Points:- Understanding the Pennant Pattern:

- Pennant pattern ek flag pattern ki tarah hota hai jismein ek choti si flag ke tarah ek trendline formation hoti hai, jo market ki direction ko indicate karti hai. Yeh usually short-term trends ke doran dekha jata hai.

- Yeh pattern typically ek sharp price move ke baad aata hai, jise 'flagpole' kehte hain, phir ek consolidation phase hoti hai jise 'pennant' kehte hain. Yeh pennant flagpole ke saath ek triangular shape banata hai.

- Identification of Pennant Pattern:

- Pennant pattern ko identify karne ke liye, pehle ek sharp price move ko dekha jata hai jo flagpole ke roop mein hota hai.

- Phir, price consolidation phase mein jaakar ek triangular pennant pattern banata hai. Yeh typically kam volume ke saath hota hai.

- Is consolidation phase mein price trendline ko follow karta hai aur volume decrease hota hai.

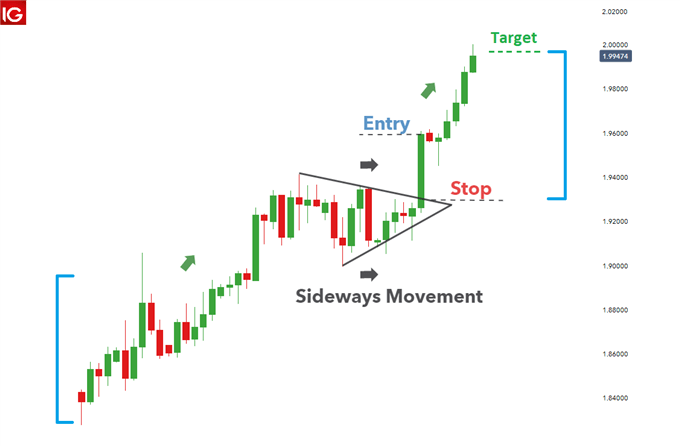

- Entry Points and Stop Loss:

- Pennant pattern ke entry point usually pennant ke breakout ke baad hota hai. Breakout ke baad, price ko confirm karte waqt ek trade enter kiya jata hai.

- Stop loss ek crucial component hai. Typically, traders stop loss ko pennant ke opposite side se kuch points dur rakhte hain, taki false breakout ki conditions mein losses minimize ho sakein.

- Target Setting:

- Target setting ko samajhna bhi zaroori hai. Iske liye, traders flagpole ki length ko measure karke pennant breakout ke point se add karte hain. Yeh ek estimate provide karta hai ke price kis direction mein move kar sakta hai.

- Volume Analysis:

- Volume analysis pennant pattern ke liye bhi important hai. Typically, volume flagpole ke dauran high hota hai, phir pennant ke andar decrease hota hai. Breakout ke samay volume ki sudden increase dekhi ja sakti hai, jo ek strong confirmation hai.

Trading Strategy using Pennant Pattern:

Pennant pattern ka istemal karne ke liye traders kuch steps follow karte hain:- Pattern Identification: Sabse pehle traders ko pennant pattern ko identify karna hota hai. Yeh sharp price move ke baad aata hai aur ek consolidation phase mein shape leta hai.

- Entry Point Determination: Entry point ko determine karne ke liye traders breakout ka wait karte hain. Breakout ke baad, unhe ek trade enter karne ki anumati milti hai.

- Stop Loss Placement: Stop loss ko pennant ke opposite side se set kiya jata hai, taki false breakouts ki surat mein losses minimize ho sakein.

- Target Setting: Target setting ko flagpole ki length ko measure karke aur breakout ke point se add karke kiya jata hai.

- Volume Confirmation: Volume analysis ka istemal karke traders ko confirmation milti hai ke breakout genuine hai ya nahi.

Conclusion:

Pennant chart pattern ek powerful tool hai jo traders ko market trends ko identify karne mein madad karta hai. Iske istemal se, traders breakout aur price movement ke predictions kar sakte hain. Lekin, yeh pattern bhi false signals de sakta hai, isliye proper risk management aur confirmation ke saath istemal karna zaroori hai. Training aur experience ke saath, traders pennant pattern ko effectively istemal kar sakte hain aur trading strategies ko improve kar sakte hain.

- Understanding the Pennant Pattern:

-

#5 Collapse

Sar 1: Pennant Chart Pattern Ki Pehchan Pennant chart pattern ek technical analysis tool hai jo forex trading mein istemal hota hai.

Sar 2: Pennant Kya Hai? Pennant ek continuation pattern hai jo market ke darmiyan mein hota hai aur trend ke agay barhne ka ishara deta hai.

Sar 3: Pennant Pattern Ki Tashkeel Pennant pattern mein market mein achanak se tezi ya mandi ki wajah se price range mein izafa hota hai, phir ek short term consolidation hoti hai jo jhandela ya flag ki shakal mein hoti hai.

Sar 4: Pennant Pattern Ki Tafseel Pennant pattern mein price range mein izafa ke baad ek symmetrical triangle ya flag formation hoti hai jise pennant kehte hain.

Sar 5: Pennant Pattern Ki Tajarbaat Pennant pattern ki tajarbaat se maloom hota hai ke is pattern ko istemal kar ke trading mein munafa hasil kiya ja sakta hai.

Sar 6: Pennant Pattern Ki Timing Pennant pattern ki timing ka sahi hona zaroori hai takay sahi waqt par trading ki ja sake.

Sar 7: Pennant Pattern Ki Entry Point Pennant pattern mein entry point ko tay karne ke liye price breakout ka intezar kiya jata hai.

Sar 8: Pennant Pattern Mein Stop Loss Aur Take Profit Pennant pattern mein stop loss aur take profit ki jagah ko tay karna ahem hai taki nuqsan se bacha ja sake aur munafa hasil kiya ja sake.

Sar 9: Pennant Pattern Ki Risk Management Pennant pattern ki trading mein risk management ka khayal rakhna zaroori hai taki nuqsan se bacha ja sake.

Sar 10: Pennant Pattern Ki Monitoring Pennant pattern ki monitoring trading ke doran zaroori hai takay trading strategy ko adjust kiya ja sake.

Sar 11: Pennant Pattern Ki Confirmation Pennant pattern ki confirmation ke liye volume aur price breakout ka intezar kiya jata hai.

Sar 12: Pennant Pattern Ki Practice Pennant pattern ko samajhne aur istemal karne ke liye practice aur experience zaroori hai.

Sar 13: Jamaal Khelaf Numaishi Bhi Jama Karein Pennant chart pattern ki trading mein har waqt jamaal khelaf numaishi bhi jama karna zaroori hai takay agar trade ulta ho to nuqsan se bacha ja sake.

Sar 13: Hamesha Naye Waqt Ka Intezar Karein Pennant pattern ki trading mein hamesha naye waqt ka intezar karein aur market ki halat ka tajziya karte rahein taake sahi waqt par trading ki ja sake.

Sar 13: Sabar Aur Discipline Pennant pattern ki trading mein sabar aur discipline ka khayal rakhna zaroori hai taake ghalat faislon se bacha ja sake aur munafa hasil kiya ja sake.

Sar 13: Seekhne Ka Tareeqa Pennant pattern ki trading ko seekhne ka tareeqa hamesha istiqamat aur mehnat se guzarna chahiye taake behtar trader ban sakein.

Sar 13: Shukriya Pennant chart pattern ki trading ke tareeqay ko samajhne aur istemal karne ke liye shukriya. Umeed hai ke yeh guide aapke liye mufeed sabit hogi aur aapko forex trading mein madad faraham karegi. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pennant Chart Pattern kya hai?

Pennant Chart Pattern ek technical analysis pattern hai jo ek trend ki temporary rukavat ko darshata hai. Is pattern me, price action ek symmetrical triangle ya flag ki tarah dikhai deta hai. Pennant pattern bullish ya bearish donon ho sakte hain.

Bullish Pennant Chart Pattern

Bullish pennant pattern ek uptrend ke dauran banta hai. Is pattern me, price action ek upar ki taraf jaane wali trendline aur ek horizontal trendline ke bich consolidate hota hai. Consolidation ke bad, price action upar ki taraf breakout karta hai aur uptrend jari rahata hai.

Bearish Pennant Chart Pattern

Bearish pennant pattern ek downtrend ke dauran banta hai. Is pattern me, price action ek niche ki taraf jaane wali trendline aur ek horizontal trendline ke bich consolidate hota hai. Consolidation ke bad, price action niche ki taraf breakout karta hai aur downtrend jari rahata hai.

Pennant Chart Pattern kaise trade karen?

Pennant chart pattern ko trade karne ke liye, aapko nimnalikhit kadmon ka palan karna hoga:

- Pennant pattern ki pahchan karen. Pahla kadam ek bullish ya bearish pennant pattern ki pahchan karna hai. Iske liye, aapko trendlines ko draw karna hoga. Bullish pennant ke liye, upar ki taraf jaane wali trendline aur ek horizontal trendline draw karen. Bearish pennant ke liye, niche ki taraf jaane wali trendline aur ek horizontal trendline draw karen.

- Breakout ka intezar karen. Ek bar jab aap pennant pattern ki pahchan kar lete hain, to aapko breakout ka intezar karna hoga. Bullish pennant ke liye, upar ki taraf breakout ka intezar karen. Bearish pennant ke liye, niche ki taraf breakout ka intezar karen.

- Trade mein enter karen. Breakout ke bad, aap trade mein enter kar sakte hain. Bullish pennant ke liye, upar ki taraf breakout ke bad buy order rakhen. Bearish pennant ke liye, niche ki taraf breakout ke bad sell order rakhen.

- Stop loss rakhen. Trade mein enter karne ke bad, aapko ek stop loss rakhna chahie. Bullish pennant ke liye, stop loss ko horizontal trendline ke niche rakhen. Bearish pennant ke liye, stop loss ko horizontal trendline ke upar rakhen.

- Profit target rakhen. Trade mein enter karne ke bad, aapko ek profit target bhi rakhna chahie. Bullish pennant ke liye, profit target ko uptrend ki resistance level per rakhen. Bearish pennant ke liye, profit target ko downtrend ki support level per rakhen.

Pennant Chart Pattern ki kuchh limitations:- Pennant chart pattern 100% accurate nahin hain.

- Pennant chart pattern ki timing predict karna mushkil hai.

- Pennant chart pattern ko trade karne ke liye risk management ka istemal karna important hai.

- Mentions 0

-

سا0 like

-

#7 Collapse

Trading mein kamyabi hasil karne ke liye, chart patterns ka istemal aik ahem tareeqa hai. In patterns mein se ek hai "Pennant", jo ke aksar traders ke darmiyan pasandeeda hai. Yeh article aapko sikhaega ke Pennant chart pattern ko kaise trade kiya ja sakta hai.

1. Chart Pattern Ki Understanding:

Pennant chart pattern ko samajhna zaroori hai. Yeh pattern aik continuation pattern hai jo market mein trend ke darmiyan paya jata hai.

Pennant chart pattern ki understanding ke liye, traders ko pehle market ki overall direction ko samajhna zaroori hai. Pennant typically ek short-term pattern hota hai jo ke uptrend ya downtrend ke darmiyan paya jata hai. Yeh pattern flag pattern ki tarah hota hai lekin chhota hota hai aur typically kuch weeks ya months ke liye form hota hai.

Pennant pattern mein, price action ek khas shape banata hai jo ek triangle ki tarah hota hai. Yeh triangle market mein aik chhote se area mein form hota hai aur price ke saath chhoti si range mein move karta hai.

2. Pennant Ki Formation:

Pennant formation ko pehchanna zaroori hai. Yeh typically ek short-term pattern hota hai jo flag pattern ki tarah hota hai lekin chhota hota hai.

Pennant formation ki pehchan karne ke liye, traders ko price action ko closely monitor karna hota hai. Pennant formation usually kuch weeks ya months ke liye form hota hai, aur ismein price ek triangle ki tarah move karta hai. Yeh triangle market mein aik chhote se area mein form hota hai aur price ke saath chhoti si range mein move karta hai.

Pennant formation ke doran, volume bhi ek ahem factor hota hai. Usually, pennant formation ke doran volume kam hojata hai, lekin breakout ke waqt volume ka izafa hota hai jo ke breakout ko confirm karta hai.

3. Price Action Ki Tafseelat:

Price action ko dekhte hue, pennant ki tafseelat ko samajhna zaroori hai. Price action ki madad se pennant ka breakout predict kiya ja sakta hai.

Price action analysis ke doran, traders ko pennant ke andar aur uske aas paas ke price movement ko closely observe karna hota hai. Ismein, traders ko price ke spikes aur consolidations ko dekhna hota hai jo pennant formation ki indication dete hain.

Pennant ke breakout ka intezar karte waqt, traders ko price movement ko closely monitor karna hota hai. Breakout ke waqt, price usually triangle ke ek taraf move karta hai, aur volume ka izafa hota hai jo ke breakout ko confirm karta hai.

4. Volume Ki Tafseelat:

Volume ki tafseelat bhi ahem hai. Breakout ke waqt, volume ka izafa hota hai jo ke breakout ko confirm karta hai.

Volume pennant pattern ko trade karte waqt ek ahem factor hai. Breakout ke waqt, volume ka izafa hota hai jo ke breakout ko confirm karta hai. Agar breakout ke waqt volume ka izafa na ho, toh breakout ka mukammal yaqeeni hone mein thoda waqt lag sakta hai.

Volume analysis ke doran, traders ko breakout ke waqt volume ke sudden increase ko dekhna hota hai. Isse, traders ko confirmati...Isse, traders ko confirmation milta hai ke breakout sahi aur strong hai.

5. Entry Point Ki Tafseelat

Entry point ko tay karna zaroori hai. Breakout ke baad entry point ka intezar karna zaroori hai.

Entry point ko tay karte waqt, traders ko breakout ke baad entry karne ke liye wait karna chahiye. Breakout ke baad price usually ek direction mein move karta hai, jise traders apne entry point ke liye utilize kar sakte hain.

Traders ko entry point tay karte waqt, price movement ko closely monitor karna chahiye aur agar confirmation mile ke breakout sahi hai, tab entry leni chahiye. Agar volume ke sath breakout hota hai, toh entry point ko aur bhi strong consider kiya ja sakta hai.

6. Stop Loss Aur Target Ki Tafseelat:

Stop loss aur target ko tay karna ahem hai. Risk management ke liye stop loss ko hamesha define karna zaroori hai.

Stop loss aur target ko tay karte waqt, traders ko apni risk tolerance ke hisab se decide karna chahiye. Stop loss ko define karte waqt, traders ko pennant pattern ke breakout point se thoda sa niche rakha ja sakta hai taake agar breakout galat direction mein hota hai, toh loss minimize ho sake.

Target tay karte waqt, traders ko previous swing high ya low ko target ke roop mein consider kar sakte hain. Isse, traders apne profit ko maximize kar sakte hain.

7. Trading Plan Banayein:

Pennant chart pattern ko trade karne se pehle aik mukammal trading plan banayein. Ismein entry points, stop loss, aur targets shaamil hote hain.

Har trading activity ke liye, traders ko ek mukammal trading plan banana zaroori hai. Trading plan ke andar, entry points, stop loss, target, aur risk management strategies shaamil hote hain.

Trading plan banate waqt, traders ko apni risk tolerance aur trading goals ko dhyan mein rakhna chahiye. Isse, traders apne trades ko organized tareeke se execute kar sakte hain.

8. Technical Indicators Ka Istemal:

Technical indicators ka istemal bhi kiya ja sakta hai. Misal ke taur par, RSI, MACD, aur moving averages ko istemal kar ke trading signals ko confirm kiya ja sakta hai.

Technical indicators ko istemal karke, traders apne trading signals ko confirm kar sakte hain. Misal ke taur par, RSI aur MACD jaise oscillators ko istemal karke, traders overbought aur oversold conditions ko identify kar sakte hain.

Moving averages ko istemal karke bhi, traders price ke trends aur reversals ko identify kar sakte hain. Isse, traders apne trading decisions ko aur bhi strong bana sakte hain.

9. Breakout Ka Intezar Karein:

Breakout ka intezar karna zaroori hai. Pennant pattern mein breakout ke baad hi trade kiya jana chahiye.

Breakout ka intezar karte waqt, traders ko patience ka istemal karna chahiye. Agar breakout sahi direction mein hota hai aur volume ke sath hota hai, toh traders ko entry point ke liye ready rehna chahiye.

Breakout ka intezar karte waqt, traders ko false breakouts se bachne ke liye cautious rehna chahiye. Isliye, breakout ko confirm karne ke liye price action aur volume ko closely monitor karna zaroori hai.

10. Risk Aur Reward Ka Talaash Karein:

Har trade mein risk aur reward ka talaash karein. Achhi risk reward ratio maintain karna trading ke liye zaroori hai.

Har trade ke liye, traders ko risk aur reward ka talaash karna chahiye. Achhi risk reward ratio maintain karke, traders apne trading ki profitability ko improve kar sakte hain.

Risk reward ratio tay karte waqt, traders ko apni entry point, stop loss, aur target ke darmiyan ka farq dhyan mein rakhna chahiye. Isse, traders apne trades ko strategically plan kar sakte hain.

11. Market Ki Tafseelat:

Market ki tafseelat ko mad e nazar rakhein. Market conditions ko samajh kar hi trading ki jaye.

Market ki tafseelat ko samajhne ke liye, traders ko current market conditions ko closely monitor karna chahiye. Ismein, economic indicators, news events, aur geopolitical factors ka bhi impact hota hai.

Market ki tafseelat ke doran, traders ko market sentiment aur trend ko analyze karna chahiye. Isse, traders apne trading decisions ko market ke according adjust kar sakte hain.

12. Emotions Ko Control Karein:

Emotions ko control karna trading mein zaroori hai. Greed aur fear se bachkar trading decisions ko rational taur par lena chahiye.

Emotions ko control karte waqt, traders ko apne trading plan aur strategy par focus karna chahiye. Greed aur fear se bachkar, traders apne trading decisions ko logical aur rational taur par lena chahiye.

Emotions ko control karne ke liye, traders ko apne trades ko objectively analyze karna chahiye. Isse, traders apne emotions ko apne trading ke decisions par zyada control kar sakte hain.

13. Practice Aur Learning:

Practice aur learning ko jari rakhein. Trading mein maharat hasil karne ke liye regular practice aur learning zaroori hai.

Trading mein maharat hasil karne ke liye, regular practice aur learning zaroori hai. Ismein, traders ko apne trading strategies ko refine karna chahiye aur naye trading techniques ko seekhna chahiye.

Practice ke doran, traders ko apne trades ko track karna chahiye aur apne performance ko evaluate karna chahiye. Isse, traders apne weaknesses aur strengths ko identify karke apni trading ko improve kar sakte hain.

Learning ke doran, traders ko market trends aur new trading tools ke bare mein updated rehna chahiye. Isse, traders apne trading skills ko enhance kar sakte hain aur apne trading performance ko improve kar sakte hain.

Pennant chart pattern ko trade karna mushkil ho sakta hai lekin agar sahi tareeqe se istemal kiya jaye to yeh ek mufeed tareeqa ho sakta hai trading mein kamyabi hasil karne ka. Is liye, har trader ko pennant pattern ko samajhna aur istemal karna chahiye. -

#8 Collapse

How to trade Pennant Chart pattern

Introduction:

Pennant chart pattern trading is a popular strategy among traders who analyze technical patterns to forecast price movements in financial markets. Pennant patterns are formed when there is a significant price movement followed by a period of consolidation, resembling a small symmetrical triangle. In this blog, we will delve into the intricacies of trading the Pennant chart pattern and explore strategies to capitalize on its potential.

Samajhne ke Aadhar:

Pennant chart pattern ka trading karna maharat aur tajurba maangta hai. Is pattern ko samajhne ke liye zaroori hai ke trader ko candlestick charts aur technical analysis ke basic concepts ka ilm ho.

Identifying the Pennant Pattern:

Pennant pattern ko pehchaanne ke liye, trader ko kuch key characteristics par tawajju deni chahiye:- Price Movement: Aik tezi se price move ke baad, market mein consolidation ka dor dekhne ko milta hai.

- Symmetrical Triangle: Consolidation phase mein price ke chand candlesticks ek symmetrical triangle banate hain.

- Decreasing Volume: Volume normally decrease hota hai during the consolidation phase.

Pennant pattern ka trading karne ke liye, kuch strategies hain jo traders istemal karte hain:

1. Breakout Strategy:- Entry Point: Breakout ke samay entry lena.

- Stop Loss: Previous swing low ya high ke neeche ya oopar stop loss lagana.

- Target: Price ke breakout direction mein target set karna.

- Entry Point: Pullback ke doran entry lena.

- Stop Loss: Pullback ke opposite direction mein previous swing low ya high ke neeche ya oopar stop loss lagana.

- Target: Price ke breakout direction mein target set karna.

Trading mein risk management ka bohot ahem kirdar hota hai. Pennant pattern trading mein risk management ka tariqa darust tareeqe se follow karna zaroori hai:- Position Sizing: Har trade mein sirf aik muqarrar hissa istemal karna.

- Stop Loss Placement: Har trade ke liye munasib stop loss set karna.

- Risk-Reward Ratio: Har trade ka risk-reward ratio theek tareeqe se calculate karna.

Pennant chart pattern trading ek mazedaar aur mufeed tajurba ho sakta hai agar sahi tareeqe se istemal kiya jaye. Samajh aur tajurba ke saath, traders Pennant patterns ki roshni mein behtar trading faislay kar sakte hain. Magar, hamesha yaad rahe ke har trade mein risk hota hai, is liye zaroori hai ke traders apne trades ko achhe se manage karen aur risk ko kam karen.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pennant Chart PatternPennant chart pattern ek technical analysis tool hai jo ke financial markets mein istemal hota hai price trends aur future movements ko predict karne ke liye. Ye pattern typically trend continuation ke baad hota hai, jab market mein price consolidation hoti hai. Pennant pattern ek triangular shape ko represent karta hai, jisme price ke ek small range mein fluctuation hoti hai.

Pennant pattern ki characteristics mein shamil hain:- Trend: Pennant pattern usually ek strong uptrend ya downtrend ke baad develop hota hai. Ye trend continuation pattern hota hai, jo ke indicate karta hai ke trend ka continuation hone wala hai.

- Shape: Pennant pattern ek flag jaisa shape hota hai, jisme ek pole ke baad price consolidation hoti hai aur phir ek triangle ban jata hai.

- Volume: Volume pennant pattern ke formation ke doran decrease hota hai. Ye indicate karta hai ke market participants ke interest mein kami aayi hai aur consolidation phase mein hain.

- Duration: Pennant pattern typically kuch weeks ya months ke doran form hota hai. Jaise hi pattern complete hota hai, traders expect karte hain ke previous trend continue hoga.

- Confirmation: Pennant pattern ko confirm karne ke liye traders usually breakout ka wait karte hain. Breakout jab price triangle ke andar se bahar nikal jata hai, bullish pennant ke case mein upar aur bearish pennant ke case mein neeche.

Confirmation ke liye traders typically volume aur price action ka istemal karte hain. Agar breakout ke samay volume increase hota hai, toh ye breakout ko strong aur reliable banata hai. Price action bhi important hai, kyun ke agar breakout ke samay price strong aur decisive movement show karta hai, toh ye confirmatory signal hai.

Pennant pattern ka istemal karne ka ek tareeqa hai:

- Identify: Sabse pehle, trend ko identify karein. Agar trend upward hai, toh bullish pennant pattern ki talaash karein, aur agar downward hai, toh bearish pennant pattern ki.

- Draw: Pattern ke boundaries ko draw karein, jaise ki ek trend line aur ek converging trend line.

- Confirmation: Breakout ka wait karein. Jab price triangle ke boundaries se bahar nikal jata hai, aur volume bhi increase hota hai, toh ye breakout confirmatory signal hai.

- Entry aur Exit: Breakout ke baad entry point decide karein, usually breakout ke just baad entry hota hai. Stop loss aur target levels bhi set karein.

Pennant pattern ek powerful tool hai jo traders ko trend continuation ke opportunities provide karta hai. Lekin, jaise har technical analysis tool, ye bhi false signals produce kar sakta hai, isliye proper risk management ke saath istemal karna important hai.

-

#10 Collapse

How to trade Pennant Chart pattern

Chart Pattern Ki Understanding:

Pennant chart pattern ko samajhna zaroori hai. Yeh pattern aik continuation pattern hai jo market mein trend ke darmiyan paya jata hai.

Pennant chart pattern ki understanding ke liye, traders ko pehle market ki overall direction ko samajhna zaroori hai. Pennant typically ek short-term pattern hota hai jo ke uptrend ya downtrend ke darmiyan paya jata hai. Yeh pattern flag pattern ki tarah hota hai lekin chhota hota hai aur typically kuch weeks ya months ke liye form hota hai.

Pennant pattern mein, price action ek khas shape banata hai jo ek triangle ki tarah hota hai. Yeh triangle market mein aik chhote se area mein form hota hai aur price ke saath chhoti si range mein move karta hai.

2. Pennant Ki Formation:

Pennant formation ko pehchanna zaroori hai. Yeh typically ek short-term pattern hota hai jo flag pattern ki tarah hota hai lekin chhota hota hai.

Pennant formation ki pehchan karne ke liye, traders ko price action ko closely monitor karna hota hai. Pennant formation usually kuch weeks ya months ke liye form hota hai, aur ismein price ek triangle ki tarah move karta hai. Yeh triangle market mein aik chhote se area mein form hota hai aur price ke saath chhoti si range mein move karta hai.

Pennant formation ke doran, volume bhi ek ahem factor hota hai. Usually, pennant formation ke doran volume kam hojata hai, lekin breakout ke waqt volume ka izafa hota hai jo ke breakout ko confirm karta hai.

3. Price Action Ki Tafseelat:

Price action ko dekhte hue, pennant ki tafseelat ko samajhna zaroori hai. Price action ki madad se pennant ka breakout predict kiya ja sakta hai.

Price action analysis ke doran, traders ko pennant ke andar aur uske aas paas ke price movement ko closely observe karna hota hai. Ismein, traders ko price ke spikes aur consolidations ko dekhna hota hai jo pennant formation ki indication dete hain.

Pennant ke breakout ka intezar karte waqt, traders ko price movement ko closely monitor karna hota hai. Breakout ke waqt, price usually triangle ke ek taraf move karta hai, aur volume ka izafa hota hai jo ke breakout ko confirm karta hai.

4. Volume Ki Tafseelat:

Volume ki tafseelat bhi ahem hai. Breakout ke waqt, volume ka izafa hota hai jo ke breakout ko confirm karta hai.

Volume pennant pattern ko trade karte waqt ek ahem factor hai. Breakout ke waqt, volume ka izafa hota hai jo ke breakout ko confirm karta hai. Agar breakout ke waqt volume ka izafa na ho, toh breakout ka mukammal yaqeeni hone mein thoda waqt lag sakta hai.

Volume analysis ke doran, traders ko breakout ke waqt volume ke sudden increase ko dekhna hota hai. Isse, traders ko confirmati...Isse, traders ko confirmation milta hai ke breakout sahi aur strong hai.

5. Entry Point Ki Tafseelat

Entry point ko tay karna zaroori hai. Breakout ke baad entry point ka intezar karna zaroori hai.

Entry point ko tay karte waqt, traders ko breakout ke baad entry karne ke liye wait karna chahiye. Breakout ke baad price usually ek direction mein move karta hai, jise traders apne entry point ke liye utilize kar sakte hain.

Traders ko entry point tay karte waqt, price movement ko closely monitor karna chahiye aur agar confirmation mile ke breakout sahi hai, tab entry leni chahiye. Agar volume ke sath breakout hota hai, toh entry point ko aur bhi strong consider kiya ja sakta hai.

6. Stop Loss Aur Target Ki Tafseelat:

Stop loss aur target ko tay karna ahem hai. Risk management ke liye stop loss ko hamesha define karna zaroori hai.

Stop loss aur target ko tay karte waqt, traders ko apni risk tolerance ke hisab se decide karna chahiye. Stop loss ko define karte waqt, traders ko pennant pattern ke breakout point se thoda sa niche rakha ja sakta hai taake agar breakout galat direction mein hota hai, toh loss minimize ho sake.

Target tay karte waqt, traders ko previous swing high ya low ko target ke roop mein consider kar sakte hain. Isse, traders apne profit ko maximize kar sakte hain.

7. Trading Plan Banayein:

Pennant chart pattern ko trade karne se pehle aik mukammal trading plan banayein. Ismein entry points, stop loss, aur targets shaamil hote hain.

Har trading activity ke liye, traders ko ek mukammal trading plan banana zaroori hai. Trading plan ke andar, entry points, stop loss, target, aur risk management strategies shaamil hote hain.

Trading plan banate waqt, traders ko apni risk tolerance aur trading goals ko dhyan mein rakhna chahiye. Isse, traders apne trades ko organized tareeke se execute kar sakte hain.

8. Technical Indicators Ka Istemal:

Technical indicators ka istemal bhi kiya ja sakta hai. Misal ke taur par, RSI, MACD, aur moving averages ko istemal kar ke trading signals ko confirm kiya ja sakta hai.

Technical indicators ko istemal karke, traders apne trading signals ko confirm kar sakte hain. Misal ke taur par, RSI aur MACD jaise oscillators ko istemal karke, traders overbought aur oversold conditions ko identify kar sakte hain.

Moving averages ko istemal karke bhi, traders price ke trends aur reversals ko identify kar sakte hain. Isse, traders apne trading decisions ko aur bhi strong bana sakte hain.

9. Breakout Ka Intezar Karein:

Breakout ka intezar karna zaroori hai. Pennant pattern mein breakout ke baad hi trade kiya jana chahiye.

Breakout ka intezar karte waqt, traders ko patience ka istemal karna chahiye. Agar breakout sahi direction mein hota hai aur volume ke sath hota hai, toh traders ko entry point ke liye ready rehna chahiye.

Breakout ka intezar karte waqt, traders ko false breakouts se bachne ke liye cautious rehna chahiye. Isliye, breakout ko confirm karne ke liye price action aur volume ko closely monitor karna zaroori hai.

-

#11 Collapse

PENNANT CHART PATTERN KI TRADING KA TARIQA- INTRODUCTION:

- Pennant chart pattern ek trading pattern hai jo price action ko represent karta hai.

- Ye pattern usually trend continuation ke indicators ke roop mein istemal hota hai.

- PENNANT CHART PATTERN KI PEHCHAN:

- Pennant pattern ek flag shape ka hota hai jismein price ek chhoti si range mein consolidate hoti hai.

- Is pattern mein price mein ek sharp move hota hai, phir ek chhoti si range mein consolidation hoti hai, jise flagpole kehte hain.

- PENNANT CHART PATTERN KI SHURUAT:

- Pennant pattern usually ek strong uptrend ya downtrend ke baad develop hota hai.

- Jab price mein ek sharp move hota hai, phir ek chhoti si range mein consolidation hoti hai, tab ye pattern ban sakta hai.

- PENNANT CHART PATTERN KI TRADING STRATEGY:

- Entry Point: Entry point usually breakout ke baad hota hai. Agar price flag ke upper trendline ko break kar ke upar jaati hai, toh long position lena consider kiya ja sakta hai. Agar price flag ke lower trendline ko break kar ke neeche jaati hai, toh short position lena consider kiya ja sakta hai.

- Stop Loss: Stop loss usually flag ke opposite side ke breakout ke just opposite side par rakha jaata hai, taki agar trade opposite direction mein chala gaya, toh nuksan kam ho sake.

- Target: Target usually flagpole ke height se measure kiya jaata hai aur flag breakout ke direction mein lagaya jaata hai.

- TRADING EXAMPLE:

- Maan lo ke ek stock XYZ mein pennant pattern form hua hai aur price upper trendline ko break kar ke upar jaati hai. Yeh ek long entry point ho sakta hai.

- Entry point par stop loss neeche set kiya jaata hai, aur target flagpole ke height se measure kar ke lagaya jaata hai.

- PENNANT CHART PATTERN KI ADVANTAGES:

- Ye pattern trend continuation ke liye powerful indicator hai.

- Entry aur exit points ko define karne mein madad karta hai.

- Risk aur reward ko manage karne mein madad karta hai.

- PENNANT CHART PATTERN KI LIMITATIONS:

- False breakouts ho sakte hain, jismein price breakout ke baad bhi reversal ho jaata hai.

- Sometimes price flag ke upper ya lower trendline se pehle hi breakout kar jaata hai, jise early entry kehte hain.

- TIPS FOR TRADING PENNANT CHART PATTERN:

- Always confirm breakout ke baad hi trade karein.

- Risk management ko prioritize karein aur stop loss ka istemal karein.

- Multiple indicators ka istemal karein jaise ki volume aur momentum indicators.

- CONCLUSION:

- Pennant chart pattern ek powerful tool hai trading mein, jo trend continuation ko identify karne mein madad karta hai.

- Is pattern ko samajhne aur istemal karne ke liye practice aur patience ki zaroorat hoti hai.

- Proper risk management aur entry/exit points ka dhyan rakh kar trading karne se successful results mil sakte hain.

- FURTHER STUDY:

- Pennant pattern ke alawa bhi chart patterns hote hain jaise ki head and shoulders, double top, double bottom, etc. In patterns ko bhi samajh kar trading strategy ko enhance kiya ja sakta hai.

- INTRODUCTION:

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pennant Chart PatternPennant chart pattern ek technical analysis concept hai jo ki stock market mein use hota hai. Ye pattern typically trend reversal ya continuation ke liye dekha jata hai, lekin ye traders aur investors ke dwara price movements ko analyze karne ke liye istemal kiya jata hai.

Identification

Pennant pattern ek flag pattern ka variation hota hai. Ye ek consolidation phase ko represent karta hai, jab price ek trend mein move karne ke baad temporarily stabilize ho jata hai. Pennant pattern ke formation mein, price ek chhoti si rectangular shape ke andar consolidate hota hai, jo ek pennant ki tarah dikhta hai. Ye rectangle typically ek short-term duration ke andar form hota hai.

Pennant pattern ko typically is tarah se describe kiya jata hai:- Flagpole: Pehle, ek sharp price move hota hai, jo flagpole ke roop mein dikhta hai. Is phase mein, price ek particular direction mein rapid movement karta hai.

- Consolidation (Pennant): Fir, ek rectangular shape mein price consolidate hota hai, jo flagpole ke upper ya lower end par hota hai. Ye consolidation phase usually short-term hota hai aur volume typically kam hota hai.

- Breakout: Consolidation phase ke baad, price ek naye direction mein breakout karta hai. Breakout direction generally flagpole ke opposite hota hai. Is breakout ke baad, traders typically expect ki price usi direction mein continue karega.

Treading Strategy

Pennant pattern ki trading strategy typically breakout ke around develop hoti hai. Jab price pennant ke andar consolidate hota hai, traders price ke breakout ka wait karte hain. Agar breakout upward hota hai, traders long positions lete hain, jabki agar breakout downward hota hai, traders short positions lete hain.Ye pattern traders ke liye ek indication provide karta hai ki market mein kis direction mein movement expected hai, lekin jaise hi koi trading strategy hoti hai, isme bhi risk management ka dhyan rakhna jaruri hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

**How to Trade Pennant Chart Pattern**

Pennant chart pattern ek common continuation pattern hai jo forex trading mein bohot important hota hai. Yeh pattern market ke short-term consolidation aur subsequent breakout ko indicate karta hai. Pennant pattern ko sahi tareeke se identify karke aur trade karke, traders significant profits kama sakte hain. Aayiye dekhtay hain ke Pennant chart pattern ko kaise trade kiya jaye.

**1. Pennant Pattern Ki Pehchaan:**

Pennant pattern ko identify karne ke liye, market mein ek strong price movement (flagpole) ke baad short-term consolidation phase dekhna hota hai. Pennant pattern do converging trendlines se banta hai jo ek small symmetrical triangle jaisa lagta hai. Yeh pattern flagpole ke beech mein appear hota hai aur consolidation ke baad continuation signal deta hai.

**2. Bullish Pennant vs. Bearish Pennant:**

Pennant pattern do types ka hota hai: bullish pennant aur bearish pennant. Bullish pennant tab banta hai jab ek strong upward movement ke baad market consolidate karti hai aur phir breakout hota hai. Bearish pennant tab banta hai jab ek strong downward movement ke baad market consolidate karti hai aur phir breakdown hota hai.

**3. Pennant Pattern Ki Confirmation:**

Pennant pattern ko trade karne se pehle, uski confirmation lena zaroori hai. Confirmation tab milti hai jab price pennant ke upper trendline (bullish pennant) ya lower trendline (bearish pennant) se breakout karti hai. Volume analysis bhi important hai; breakout ke waqt volume increase hona chahiye, jo breakout ki strength ko confirm karta hai.

**4. Entry Point:**

Pennant pattern ko trade karte waqt entry point ka selection bohot important hota hai. Bullish pennant ke case mein, upper trendline ke breakout ke baad buy position initiate karni chahiye. Bearish pennant ke case mein, lower trendline ke breakdown ke baad sell position initiate karni chahiye. Breakout ya breakdown ke waqt volume ka analysis karna bhi zaroori hai.

**5. Stop-Loss Levels:**

Risk management ke liye stop-loss levels ko define karna zaroori hai. Bullish pennant mein, stop-loss ko lower trendline ke niche place karna chahiye. Bearish pennant mein, stop-loss ko upper trendline ke upar place karna chahiye. Yeh stop-loss levels potential losses ko minimize karne mein madadgar hote hain agar market unexpected direction mein move kare.

**6. Take-Profit Levels:**

Take-profit levels ko define karna bhi zaroori hai. Pennant pattern ke target calculation ke liye flagpole ki height ko measure karna hota hai. Bullish pennant mein, breakout point se flagpole ki height ko add karke target define kar sakte hain. Bearish pennant mein, breakdown point se flagpole ki height ko subtract karke target define kar sakte hain.

**7. Practice and Patience:**

Pennant pattern ko trade karte waqt practice aur patience bohot zaroori hai. Pehle demo account par practice karein taake apko pattern ki identification aur trading strategy ka experience ho sake. Market mein har waqt perfect patterns nahi milte, isliye patience aur disciplined approach rakhein.

**Conclusion:**

Pennant chart pattern ek effective continuation pattern hai jo forex trading mein significant profits kama sakta hai. Sahi tareeke se pattern ki identification, confirmation, aur trading strategy ko implement karke, traders market ke potential breakout aur breakdown points ka fayda utha sakte hain. Risk management aur disciplined approach ko follow karte hue, Pennant pattern ko successfully trade kiya ja sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:07 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим