Double Top Candlestick Pattern Specifications.

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Double Top Candlestick Pattern Specifications. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

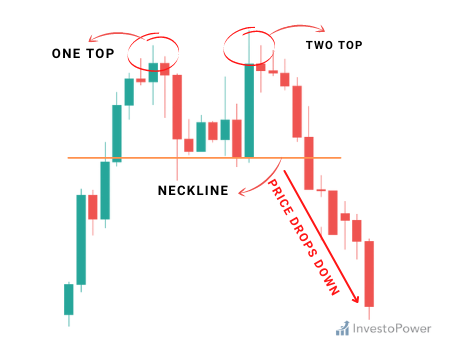

Double Top Candlestick Pattern Specifications.Double pinnacle candlestick pattern ek bearish reversal pattern hai, jisme charge trend up ki taraf pass karta hai, phir ek Double pinnacle cdear people jb marketplace up sample major hoti ha to advertiseear members jb market up fashion important hoti ha to marketplace kafi opr jaa ok aik resistance se takrati ha or apna excessive bnati ha js ok terrible wapis ati ha market thora sa retrace ho kr or aik support se takra kar wapis opr previous resistance se tkrati hanor wps ati ha.Estrha opr wali resistance ko marketplace 2 bar touch karti ha or esi ko double pinnacle kha jata ha. Kafi opr jaa okay aik obstruction se takrati ha or apna excessive bnati ha js k lousy wapis ati ha marketplace thora sa back off ho kr or aik support se takra kar wapis opr past opposition se tkrati hanor wps ati ha.Estrha opr wali obstruction ko marketplace 2 bar touch karti ha or esi ko twofold top kha jata handlestick sample forex trading mein ek critical bearish reversal sample hai, jise buyers fashion reversal aur trend continuation ke liye use karte haear people twofold pinnacle diagram layout fundamental trade karny ok lye hamen design okay whole hony or neck vicinity okay breakout ka stand via karna chahye.Neck vicinity ka breakout tb hota ha jb marketplace twofold pinnacle instance ki neck place ko pass kr k es ok nechy jati ha or jis time span essential ye design bnta ha usi time span fundamental market neck area k nechy flame close kary ye breakout ki affirmation hoti ha or es okay terrible murmur promote ki trade le skty hain.In. Is pattern ke liye entry aur exit points traders ke buying and selling method aur threat tolerance pe depend karte hain. Ye sample investors ko rate movements aur fashion analysis mein help karta haiDouble pinnacle candlestick sample ke liye access aur exit points investors ke trading strategy aur risk tolerance pe depend karte hain. Kuch buyers pattern verify hone ke baad entry karte hain, jabki kuch buyers entry ke liye rate level ke ruin ke wait karte hain. Exit factors ke liye bhi buyers apne trading method aur threat control ke hisab se forestall loss aur take earnings ranges set karte hain.Resistance stage pe prevent ho jata hai aur phir dubara up move karta hai. Lekin is baar, fee level pe pahle se zyada nahi jata, aur phir ek bearish reversal pattern form ho jata hai. Ye pattern do peaks se banta hai, jinhe "tops" kaha jata hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Double Top Candlestick Pattern, ek technical analysis tool hai jo traders aur investors ko market mein potential trend reversal ki indication deta hai. Is pattern mein price chart par ek specific formation dikhti hai, jisme price ek resistance level par do baar sey bounce karke phir sey downward move karta hai. Chaliye is pattern ki specifications ko samjhe: Double Top Candlestick Pattern Specifications. 1. Formation: Double Top Candlestick Pattern formation mein price chart par ek "M" shape ka pattern dikhta hai. Is pattern mein price ek resistance level par pehle bounce karta hai (creating the first top), phir neeche aata hai, fir dubara wahi resistance level par bounce karta hai (creating the second top), aur phir sey downward move karta hai. 2. Resistance Level: Double Top Candlestick Pattern mein resistance level ka importance bahut hai. Ye level pehle top ke time par banaya jata hai aur price us level sey bounce karke neeche jaata hai. Phir jab price dubara wahi level tak pahunchta hai aur wahan sey bounce karta hai, toh ye resistance level confirm ho jata hai. 3. Volume: Volume analysis bhi Double Top Candlestick Pattern mein important hota hai. Normally, jab price second top tak pahunchta hai, toh volume kam ho jata hai. Ye volume decline, reversal ki indication deta hai. 4. Confirmation: Double Top Candlestick Pattern ki confirmation ke liye, traders ko price level ko break karne ka wait karna hota hai. Jab price pattern ke support level ko break karke neeche jaata hai, toh ye pattern confirm ho jata hai aur potential trend reversal ki indication deta hai. Double Top Candlestick Pattern ka istemal karke traders sell entry point aur stop loss levels determine kar sakte hain. Jab price pattern ke support level ko break karta hai, traders sell kar sakte hain aur stop loss levels ko pattern ke resistance level ke just above set kar sakte hain.Lekin jaise ki har technical analysis tool ya pattern ki tarah, Double Top Candlestick Pattern ka bhi apne limitations hai. False signals, market volatility, aur other factors ko bhi consider karna zaruri hai. Traders ko hamesha apne own research aur risk management ke saath trading decisions lena chahiye. -

#4 Collapse

Double Top Candlestick Pattern: Dear Friends Double Top Candlestick Pattern mein ap agar kisi indicator ya phir is main trading tool ka istemal karte hain to apko ismein mazeed confirmation ho jaati hai ke market mein friend change hony wala hai market ek neckline ko jab break ati hai tou iski confirmation candle ke badh aur market ke breakout ke badh ap apni trade ke sath inter ho sakty hain aur ismein ap apna target select kar sakte hain aur ap ismein apny account capital ke hisab se apni trade ke sath inter ho sakte hain jis se apka target easily achieve ho sakta hai. Information of Double Top Candlestick Pattern: Hello Students Agar ap Double Top Candlestick Pattern ki complete information aur learning hasil kar lenge tou ap bohot advantages hasil kar sakte hain for example agar second top position per ek shooting star pattern banta hai to usmein apko yah confirmation mil jaati hai ke ap market ki next movement bearish trend ki taraf hone lagi hai. Isliye ham ko market mein banne wali different candlesticks ki proper information hasil karni chahiye sake ham is se achi tarah utilise ho sake aur forex trading ko apne liye faydemand bana sakein. Conclusion: Dear Forex Members Double Top Candlestick Pattern ek powerful tool hai trend predictions ke liye, lekin iska istemal karne se pehle, traders ko price action, volume aur dusre technical indicators ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk management ka hayal rakhna chahiye. Double top candlestick pattern ek acha starting point hai trend reversal ki talaash mein lekin final decision leny se pehle aur bhi analysis karne hogy. -

#5 Collapse

Double Top Candlestick Pattern Forex trading mein maaliyat kay faislay par amal karne ke liye takhassus sechni hotee hai, aur candlestick patterns is tijarat ki tafseelat mein ahem kirdar ada karte hain. Aik aesa pattern hai jo "Double Top" kehlata hai, jo market ke trend aur mozu oltaas mein qeemti maloomat faraham kar sakta hai. Is tafseelat mein, hum Double Top candlestick pattern aur is ke ahmiyat ko Forex trading mein explore karenge. Tanqeedi Ta'aruf Double Top pattern aik bearish reversal pattern hai jo ek uptrend ke baad aata hai, jissey bullish se bearish trend mein mozu oltaas hone ki mumkin daleel milti hai. Is mein do chhatiyan hoti hain jo qareebi wakt mein barabar ke qeemat ke darjay tak pohanchti hain, jismen price chart par aik wazeh 'M' ban jati hai. Ye chhatiyan aik khaddi se alag hoti hain, aur yeh kharidar aur farokht karne walon ke darmiyan ek jhagra ko darust karti hain. . Banawat Aur Khasusiyat Double Top pattern ko pehchanne ke liye, traders ko ye khasusiyat dhundni chahiye: - Forex market mein ek mazboot uptrend. - Pehli chhati (baini chhati) ek buland maqam tak pohanchti hai, phir kam hoti hai. - Waqtan-fa-waqtan ek waqti izafah hota hai, jo dosri chhati (daiyni chhati) ko banata hai, jo pehli chhati ke barabar buland hai. - Dosri chhati ke baad qeemat mein barhi kami aati hai, jo chhatiyon ke darmiyan ki bunyad banane wale support level ke neeche gir jati hai. . Ikhtitam Double Top candlestick pattern Forex trading mein potential trend reversals pehchanne ke liye aik ahem tool hai. Traders jo is pattern ko durust pehchante hain aur samajhte hain, woh informeed faislay karne ke liye dakhil hote hain aur bearish market ki harkatain se faida utha sakte hain. Lekin jaise keh tamaam technical patterns, isay doosre tijarati analysis tools aur risk management strategies ke sath istemal karke trading ke kamiyabi ko behtar banaya jana chahiye aur nuksan kam karna chahiye. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Double Top Candlestick Pattern Specifications. "Double Top Candlestick Pattern" ek technical analysis tool hai jo forex trading aur stock market mein istemal hoti hai. Yeh pattern traders ke liye ahem hota hai kyunki isse future price movements ka andaza lagaya ja sakta hai. Yahan, Double Top Candlestick Pattern ki kuch khasiyat bayan ki gayi hain:- Pehchaan (Identification): Double Top Candlestick Pattern ko pehchanne ke liye, trader ko do high points ko dekhna hota hai jo ek dusre ke bohot qareeb hotay hain. Yani, market pehle bullish (upward) trend mein hoti hai, phir ek top banati hai, uske baad thodi si giravat hoti hai, aur phir dobara ek top ban jati hai jo pehle wale top ke qareeb hoti hai.

- Candlestick Pattern: Har top banne par, ek particular candlestick pattern dekha jata hai. Yeh usually ek bearish (downward) reversal pattern hota hai, jise "shooting star" ya "doji" kehte hain. Is pattern ki wajah se traders mein uncertainty paida hoti hai aur selling pressure increase hota hai.

- Confirmation: Double Top pattern ko confirm karne ke liye, traders dobara se price ki giravat (downtrend) ke signals ka wait karte hain. Agar price ne pehle wale top ke niche gir kar support level ko break kiya, toh yeh pattern confirm hota hai.

- Stop-Loss aur Entry Points: Jab Double Top pattern confirm ho jata hai, to traders apne positions ko protect karne ke liye stop-loss orders place karte hain. Entry point usually pattern ke confirmation ke baad hota hai, jab price downtrend mein enter karta hai.

- Price Target: Double Top pattern se traders ek price target bhi nikal sakte hain, jo pattern ke height ko measure karke milta hai. Is target ko use karke traders apne profit targets aur risk management plan tay kar sakte hain.

-

#7 Collapse

What Is Double Top Candlestick Chart Pattern: Double Top or Twofold Top Candle Example ko pehchanne ke liye, merchant ko do high focuses ko dekhna hota hai jo ek dusre ke bohot qareeb hotay hain. Yani, market pehle bullish (up) pattern mein hoti hai, phir ek top banati hai, uske baad thodi si giravat hoti hai, aur phir dobara ek top boycott jati hai jo pehle ridge top ke qareeb hoti hai.Candlestick Example: Har top banne standard, ek specific candle design dekha jata hai. Yeh for the most part ek negative (descending) inversion design hota hai, jise "falling star" ya "doji" kehte hain. Is design ki wajah se merchants mein vulnerability paida hoti hai aur selling pressure increment hota hai. Twofold Top example ko affirm karne ke liye, dealers dobara se cost ki giravat (downtrend) ke signals ka stand by karte hain. Agar cost ne pehle ridge top ke specialty gir kar support level ko break kiya, toh yeh design affirm hota hai. Hit Twofold Top example affirm ho jata hai, to merchants apne positions ko safeguard karne ke liye stop-misfortune orders place karte hain. Passage point ordinarily design ke affirmation ke baad hota hai, punch cost downtrend mein enter karta hai.Double Top example se dealers ek cost target bhi nikal sakte hain, jo design ke level ko measure karke milta hai. Is target ko use karke merchants apne benefit targets aur risk the executives plan tay kar sakte hain. Outline Candle design Forex exchanging mein potential pattern inversions pehchanne ke liye aik ahem apparatus hai. Brokers jo is design ko durust pehchante hain aur samajhte hain, woh informeed faislay karne ke liye dakhil hote hain aur negative market ki harkatain se faida utha sakte hain. Lekin jaise keh tamaam specialized designs, isay doosre tijarati investigation apparatuses aur risk the board methodologies ke sath istemal karke exchanging ke kamiyabi ko behtar banaya jana chahiye aur nuksan kam karna chahiye.Pehli chhati (baini chhati) ek buland maqam tak pohanchti hai, phir kam hoti hai Waqtan fa waqtan ek waqti izafah hota hai, jo dosri chhati (daiyni chhati) ko banata hai, jo pehli chhati ke barabar buland hai Dosri chhati ke baad qeemat mein barhi kami aati hai, jo chhatiyon ke darmiyan ki bunyad banane rib support level ke neeche gir jati hai. Double Top Candle Chart Pattern Types: Design aik negative inversion design hai jo ek upswing ke baad aata hai, jissey bullish se negative pattern mein mozu oltaas sharpen ki mumkin daleel milti hai. Is mein do chhatiyan hoti hain jo qareebi wakt mein barabar ke qeemat ke darjay tak pohanchti hain, jismen cost diagram standard aik wazeh 'M' boycott jati hai. Ye chhatiyan aik khaddi se alag hoti hain, aur yeh kharidar aur farokht karne walon ke darmiyan ek jhagra ko darust karti hain.Forex exchanging mein maaliyat kay faislay standard amal karne ke liye takhassus sechni hotee hai, aur candle designs is tijarat ki tafseelat mein ahem kirdar ada karte hain. Aik aesa design hai jo "Twofold Top" kehlata hai, jo market ke pattern aur mozu oltaas mein qeemti maloomat faraham kar sakta hai. Is tafseelat mein, murmur Twofold Top candle design aur is ke ahmiyat ko Forex exchanging mein investigate karenge.

Outline Candle design Forex exchanging mein potential pattern inversions pehchanne ke liye aik ahem apparatus hai. Brokers jo is design ko durust pehchante hain aur samajhte hain, woh informeed faislay karne ke liye dakhil hote hain aur negative market ki harkatain se faida utha sakte hain. Lekin jaise keh tamaam specialized designs, isay doosre tijarati investigation apparatuses aur risk the board methodologies ke sath istemal karke exchanging ke kamiyabi ko behtar banaya jana chahiye aur nuksan kam karna chahiye.Pehli chhati (baini chhati) ek buland maqam tak pohanchti hai, phir kam hoti hai Waqtan fa waqtan ek waqti izafah hota hai, jo dosri chhati (daiyni chhati) ko banata hai, jo pehli chhati ke barabar buland hai Dosri chhati ke baad qeemat mein barhi kami aati hai, jo chhatiyon ke darmiyan ki bunyad banane rib support level ke neeche gir jati hai. Double Top Candle Chart Pattern Types: Design aik negative inversion design hai jo ek upswing ke baad aata hai, jissey bullish se negative pattern mein mozu oltaas sharpen ki mumkin daleel milti hai. Is mein do chhatiyan hoti hain jo qareebi wakt mein barabar ke qeemat ke darjay tak pohanchti hain, jismen cost diagram standard aik wazeh 'M' boycott jati hai. Ye chhatiyan aik khaddi se alag hoti hain, aur yeh kharidar aur farokht karne walon ke darmiyan ek jhagra ko darust karti hain.Forex exchanging mein maaliyat kay faislay standard amal karne ke liye takhassus sechni hotee hai, aur candle designs is tijarat ki tafseelat mein ahem kirdar ada karte hain. Aik aesa design hai jo "Twofold Top" kehlata hai, jo market ke pattern aur mozu oltaas mein qeemti maloomat faraham kar sakta hai. Is tafseelat mein, murmur Twofold Top candle design aur is ke ahmiyat ko Forex exchanging mein investigate karenge.  Brokers ko cost activity, volume aur dusre specialized markers ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk the board ka hayal rakhna chahiye. Twofold top candle design ek acha beginning stage hai pattern inversion ki talaash mein lekin ultimate choice leny se pehle aur bhi investigation karne hogy.Double Top Candle Example ki complete data aur learning hasil kar lenge tou ap bohot benefits hasil kar sakte hain for instance agar second top position per ek meteorite design banta hai to usmein apko yah affirmation mil jaati hai ke ap market ki next development negative pattern ki taraf sharpen lagi hai. Isliye ham ko market mein banne wali various candles ki appropriate data hasil karni chahiye purpose ham is se achi tarah use ho purpose aur forex exchanging ko apne liye faydemand bana sakein. Double Top Candlestick Chart Pattern Formation: Candle Example ki affirmation ke liye, brokers ko cost level ko break karne ka stand by karna hota hai. Punch cost design ke support level ko break karke neeche jaata hai, toh ye design affirm ho jata hai aur potential pattern inversion ki sign deta hai.Double Top Candle Example ka istemal karke merchants sell passage point aur stop misfortune levels decide kar sakte hain. Hit cost design ke support level ko break karta hai, merchants sell kar sakte hain aur stop misfortune levels ko design ke opposition level ke simply above set kar sakte hain.Lekin jaise ki har specialized investigation apparatus ya design ki tarah, Twofold Top Candle Example ka bhi apne restrictions hai. Bogus signs, market instability, aur different variables ko bhi consider karna zaruri hai. Merchants ko hamesha apne own exploration aur risk the executives ke saath exchanging choices lena chahiye.

Brokers ko cost activity, volume aur dusre specialized markers ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk the board ka hayal rakhna chahiye. Twofold top candle design ek acha beginning stage hai pattern inversion ki talaash mein lekin ultimate choice leny se pehle aur bhi investigation karne hogy.Double Top Candle Example ki complete data aur learning hasil kar lenge tou ap bohot benefits hasil kar sakte hain for instance agar second top position per ek meteorite design banta hai to usmein apko yah affirmation mil jaati hai ke ap market ki next development negative pattern ki taraf sharpen lagi hai. Isliye ham ko market mein banne wali various candles ki appropriate data hasil karni chahiye purpose ham is se achi tarah use ho purpose aur forex exchanging ko apne liye faydemand bana sakein. Double Top Candlestick Chart Pattern Formation: Candle Example ki affirmation ke liye, brokers ko cost level ko break karne ka stand by karna hota hai. Punch cost design ke support level ko break karke neeche jaata hai, toh ye design affirm ho jata hai aur potential pattern inversion ki sign deta hai.Double Top Candle Example ka istemal karke merchants sell passage point aur stop misfortune levels decide kar sakte hain. Hit cost design ke support level ko break karta hai, merchants sell kar sakte hain aur stop misfortune levels ko design ke opposition level ke simply above set kar sakte hain.Lekin jaise ki har specialized investigation apparatus ya design ki tarah, Twofold Top Candle Example ka bhi apne restrictions hai. Bogus signs, market instability, aur different variables ko bhi consider karna zaruri hai. Merchants ko hamesha apne own exploration aur risk the executives ke saath exchanging choices lena chahiye.  Candle Example development mein cost outline standard ek "M" shape ka design dikhta hai. Is design mein cost ek obstruction level standard pehle bob karta hai (making the main top), phir neeche aata hai, fir dubara wahi opposition level standard skip karta hai (making the subsequent top), aur phir sey descending move karta hai.Double Top Candle Example mein obstruction level ka significance bahut hai. Ye level pehle top ke time standard banaya jata hai aur cost us level sey skip karke neeche jaata hai. Phir punch cost dubara wahi level tak pahunchta hai aur wahan sey skip karta hai, toh ye opposition level affirm ho jata hai.Volume examination bhi Twofold Top Candle Example mein significant hota hai. Ordinarily, poke cost second top tak pahunchta hai, toh volume kam ho jata hai. Ye volume decline, inversion ki sign deta hai. Trading and Identification Of Double Top Candlestick Chart Pattern: Double tops ek negative inversion ki alamat hoti hain, yaani ke upturn ke baad cost kam sharpen ka signal deti hain. Punch yeh design pura hota hai, to brokers ko sell ki taraf move karne ka sochna chahiye. Twofold Top example ko approve karne ke liye, merchants usually volume investigation aur kuch specialized markers jaise RSI (Relative Strength Record) ka istemal karte hain. Twofold Top example affirm ho jaye, to dealers sell positions open kar sakte hain. Stop-misfortune aur take-benefit orders ka istemal karke risk the board karna bhi ahem hota hai. Is tarah se, merchants cost inversion ke samay nuksan se bach sakte hain. forex market mein koi bhi design 100 percent affirm nahi hota aur risk hamesha hota hai. Isliye, har exchange ko samjhe bina aur risk ko oversee kiye bina nahi lena chahiye. Twofold Top example sirf ek device hai jo merchants ke paas hoti hai, uska istemal karne se pehle research aur examination ki zaroorat hoti hai. Twofold Top ek negative inversion design hai jo forex market mein cost development ke examination mein madadgar ho sakta hai.

Candle Example development mein cost outline standard ek "M" shape ka design dikhta hai. Is design mein cost ek obstruction level standard pehle bob karta hai (making the main top), phir neeche aata hai, fir dubara wahi opposition level standard skip karta hai (making the subsequent top), aur phir sey descending move karta hai.Double Top Candle Example mein obstruction level ka significance bahut hai. Ye level pehle top ke time standard banaya jata hai aur cost us level sey skip karke neeche jaata hai. Phir punch cost dubara wahi level tak pahunchta hai aur wahan sey skip karta hai, toh ye opposition level affirm ho jata hai.Volume examination bhi Twofold Top Candle Example mein significant hota hai. Ordinarily, poke cost second top tak pahunchta hai, toh volume kam ho jata hai. Ye volume decline, inversion ki sign deta hai. Trading and Identification Of Double Top Candlestick Chart Pattern: Double tops ek negative inversion ki alamat hoti hain, yaani ke upturn ke baad cost kam sharpen ka signal deti hain. Punch yeh design pura hota hai, to brokers ko sell ki taraf move karne ka sochna chahiye. Twofold Top example ko approve karne ke liye, merchants usually volume investigation aur kuch specialized markers jaise RSI (Relative Strength Record) ka istemal karte hain. Twofold Top example affirm ho jaye, to dealers sell positions open kar sakte hain. Stop-misfortune aur take-benefit orders ka istemal karke risk the board karna bhi ahem hota hai. Is tarah se, merchants cost inversion ke samay nuksan se bach sakte hain. forex market mein koi bhi design 100 percent affirm nahi hota aur risk hamesha hota hai. Isliye, har exchange ko samjhe bina aur risk ko oversee kiye bina nahi lena chahiye. Twofold Top example sirf ek device hai jo merchants ke paas hoti hai, uska istemal karne se pehle research aur examination ki zaroorat hoti hai. Twofold Top ek negative inversion design hai jo forex market mein cost development ke examination mein madadgar ho sakta hai.  Forex market mein "Double Top" ek aham graph design hai jo brokers ke liye kisi money pair ke future cost development ka andaza lagane mein madadgar hota hai. Yeh design ordinarily upswing ke baad aata hai aur negative inversion signal deta hai. Is design ko samajhna brokers ke liye zaroori hota hai kyunki isse cost course ka pata lagaya ja sakta hai.Twofold Top ek specialized investigation design hai jo forex market mein cost inversion ko darust karne mein madadgar sabit hota hai. Is design ka naam isiliye hai kyunki yeh diagram standard do barabar tops (tops) ke appearance se pehchana jata hai. Yeh design normally upswing ke baad aata hai aur negative inversion ka signal deta hai, yani ke cash pair ki keemat kam sharpen ka andaza lagata hai.Double Top example ko pehchane ke liye, merchants ko kisi money pair ke cost outline standard dhyan dena hota hai. Pehle, ek solid upswing dikhna chahiye, jismein money pair ki keemat barh rahi hoti hai. Is upswing ke baad, do tops (tops) yaani do mukhtalif waqton standard cash pair ki keemat ek aik had tak pohanchti hai, lekin woh is had ko cross nahi karti. Yani ke cost do martaba aik certain level standard ruk kar phir girati hai.

Forex market mein "Double Top" ek aham graph design hai jo brokers ke liye kisi money pair ke future cost development ka andaza lagane mein madadgar hota hai. Yeh design ordinarily upswing ke baad aata hai aur negative inversion signal deta hai. Is design ko samajhna brokers ke liye zaroori hota hai kyunki isse cost course ka pata lagaya ja sakta hai.Twofold Top ek specialized investigation design hai jo forex market mein cost inversion ko darust karne mein madadgar sabit hota hai. Is design ka naam isiliye hai kyunki yeh diagram standard do barabar tops (tops) ke appearance se pehchana jata hai. Yeh design normally upswing ke baad aata hai aur negative inversion ka signal deta hai, yani ke cash pair ki keemat kam sharpen ka andaza lagata hai.Double Top example ko pehchane ke liye, merchants ko kisi money pair ke cost outline standard dhyan dena hota hai. Pehle, ek solid upswing dikhna chahiye, jismein money pair ki keemat barh rahi hoti hai. Is upswing ke baad, do tops (tops) yaani do mukhtalif waqton standard cash pair ki keemat ek aik had tak pohanchti hai, lekin woh is had ko cross nahi karti. Yani ke cost do martaba aik certain level standard ruk kar phir girati hai.

-

#8 Collapse

Twofold Top Candle Example Details. Twofold Top Candle Example" ek specialized examination device hai jo forex exchanging aur financial exchange mein istemal hoti hai. Yeh design dealers ke liye ahem hota hai kyunki isse future cost developments ka andaza lagaya ja sakta hai. Yahan, Twofold Top Candle Example ki kuch khasiyat bayan ki gayi hain: Distinguishing proof Twofold Top Candle Example ko pehchanne ke liye, dealer ko do high focuses ko dekhna hota hai jo ek dusre ke bohot qareeb hotay hain. Yani, market pehle bullish (up) pattern mein hoti hai, phir ek top banati hai, uske baad thodi si giravat hoti hai, aur phir dobara ek top boycott jati hai jo pehle grain top ke qareeb hoti hai. Candle Example: Har top banne standard, ek specific candle design dekha jata hai. Yeh typically ek negative (descending) inversion design hota hai, jise "meteorite" ya "doji" kehte hain. Is design ki wajah se dealers mein vulnerability paida hoti hai aur selling pressure increment hota hai. Affirmation: Twofold Top example ko affirm karne ke liye, dealers dobara se cost ki giravat (downtrend) ke signals ka stand by karte hain. Agar cost ne pehle rib top ke specialty gir kar support level ko break kiya, toh yeh design affirm hota hai. Stop-Misfortune aur Passage Focuses: Poke Twofold Top example affirm ho jata hai, to merchants apne positions ko safeguard karne ke liye stop-misfortune orders place karte hain. Passage point as a rule design ke affirmation ke baad hota hai, hit cost downtrend mein enter karta hai. Value Target: Twofold Top example se dealers ek cost target bhi nikal sakte hain, jo design ke level ko measure karke milta hai. Is target ko use karke brokers apne benefit targets aur risk the executives plan tay kar sakte hain. Twofold Top Candle Example ek useful asset hai, lekin iska istemal sahi tarike se karna bohot zaroori hai. Market mein kai aur factors bhi hote hain jo cost developments ko impact karte hain, isliye merchants ko hamesha alert aur appropriate gamble the board se kaam lena chahiye. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction Candlestick patterns forex trading mein aham role play karte hain. Inki understanding se traders ka kaam asan hota hai. Double top candlestick pattern ek aisa pattern hai jo traders ke liye kafi important hai. Is pattern ko samajhne ke liye iske kuch specifications ka pata hona zaroori hai. 1. What is Double Top Pattern? Double top pattern ek bearish reversal pattern hai jo uptrend ke end ko show karta hai. Is pattern mein price do baar ek hi level par reach karta hai aur phir wahan se downward move karta hai. 2. Double Top Formation? Double top ki formation do peaks se banti hai jo same level par hote hain. Dono peaks ke beech mein kuch time gap hota hai jise neckline kehte hain. Jab price neckline ko break karta hai to ye bearish signal hai. 3. Double Top Formation Uses? Double top pattern ko istemal karne ke liye traders ko iske formation ko identify karna hota hai. Jab ye pattern complete ho jata hai aur price neckline ko break karta hai to traders sell ki position lete hain. 4. Where is the stop loss of the double top placed? Double top pattern mein stop loss neckline ke break ke just above rakha jata hai. Isse loss ko kam kiya ja sakta hai. 5. Where is the stop loss of the double top placed? Double top pattern ka target neckline ke break ke niche set kiya jata hai. Isse traders ko profit mil sakta hai. To ye the kuch specifications double top candlestick pattern ke bare mein jo forex trading mein traders ke liye kafi important hain. Agar inhe sahi tarah se samajh liya jaye to ye traders ko kafi help kar sakte hain. -

#10 Collapse

Double Top Candle Example, ek specialized investigation apparatus hai jo brokers aur financial backers ko market mein potential pattern inversion ki sign deta hai. Is design mein cost graph standard ek explicit development dikhti hai, jisme cost ek opposition level standard do baar sey bob karke phir sey descending move karta hai. Chaliye is design ki particulars ko samjhe:Double Top Candle Example Determinations.1. Arrangement:Double Top Candle Example arrangement mein cost outline standard ek "M" shape ka design dikhta hai. Is design mein cost ek opposition level standard pehle bob karta hai (making the main top), phir neeche aata hai, fir dubara wahi obstruction level standard bob karta hai (making the subsequent top), aur phir sey descending move karta hai.2. Opposition Level: Double Top Candle Example mein obstruction level ka significance bahut hai. Ye level pehle top ke time standard banaya jata hai aur cost us level sey bob karke neeche jaata hai. Phir poke cost dubara wahi level tak pahunchta hai aur wahan sey bob karta hai, toh ye opposition level affirm ho jata hai.3. Volume:Volume investigation bhi Double Top Candle Example mein significant hota hai. Regularly, punch cost second top tak pahunchta hai, toh volume kam ho jata hai. Ye volume decline, inversion ki sign deta hai.4. Affirmation:Double Top Candle Example ki affirmation ke liye, brokers ko cost level ko break karne ka stand by karna hota hai. Hit cost design ke support level ko break karke neeche jaata hai, toh ye design affirm ho jata hai aur potential pattern inversion ki sign deta hai.Double Top Candle Example ka istemal karke dealers sell section point aur stop misfortune levels decide kar sakte hain. Hit cost design ke support level ko break karta hai, merchants sell kar sakte hain aur stop misfortune levels ko design ke opposition level ke simply above set kar sakte hain.Lekin jaise ki har specialized investigation apparatus ya design ki tarah, Double Top Candle Example ka bhi apne restrictions hai. Bogus signs, market instability, aur different elements ko bhi consider karna zaruri hai. Dealers ko hamesha apne own exploration aur risk the board ke saath exchanging choices lena chahiye. -

#11 Collapse

Double To p Candlestick Pattern Specifications : Double Top Candle Example, ek specialized investigation apparatus hai jo brokers aur financial backers ko market mein potential pattern inversion ki sign deta hai. Is design mein cost graph standard ek explicit development dikhti hai, jisme cost ek opposition level standard do baar sey bob karke phir sey descending move karta hai. Chaliye is design ki particulars ko samjhe: Double Top Candle Example Determinations. 1. Arrangement: Double Top Candle Example arrangement mein cost outline standard ek "M" shape ka design dikhta hai. Is design mein cost ek opposition level standard pehle bob karta hai (making the main top), phir neeche aata hai, fir dubara wahi obstruction level standard bob karta hai (making the subsequent top), aur phir sey descending move karta hai. 2. Opposition Level: Double Top Candle Example mein obstruction level ka significance bahut hai. Ye level pehle top ke time standard banaya jata hai aur cost us level sey bob karke neeche jaata hai. Phir poke cost dubara wahi level tak pahunchta hai aur wahan sey bob karta hai, toh ye opposition level affirm ho jata hai. 3. Volume: Volume investigation bhi Double Top Candle Example mein significant hota hai. Regularly, punch cost second top tak pahunchta hai, toh volume kam ho jata hai. Ye volume decline, inversion ki sign deta hai. 4. Affirmation: Double Top Candle Example ki affirmation ke liye, brokers ko cost level ko break karne ka stand by karna hota hai. Hit cost design ke support level ko break karke neeche jaata hai, toh ye design affirm ho jata hai aur potential pattern inversion ki sign deta hai. Double Top Candle Example ka istemal karke dealers sell section point aur stop misfortune levels decide kar sakte hain. Hit cost design ke support level ko break karta hai, merchants sell kar sakte hain aur stop misfortune levels ko design ke opposition level ke simply above set kar sakte hain.Lekin jaise ki har specialized investigation apparatus ya design ki tarah, Double Top Candle Example ka bhi apne restrictions hai. Bogus signs, market instability, aur different elements ko bhi consider karna zaruri hai. Dealers ko hamesha apne own exploration aur risk the board ke saath exchanging choices lena chahiye.

Double Top Candle Example Determinations. 1. Arrangement: Double Top Candle Example arrangement mein cost outline standard ek "M" shape ka design dikhta hai. Is design mein cost ek opposition level standard pehle bob karta hai (making the main top), phir neeche aata hai, fir dubara wahi obstruction level standard bob karta hai (making the subsequent top), aur phir sey descending move karta hai. 2. Opposition Level: Double Top Candle Example mein obstruction level ka significance bahut hai. Ye level pehle top ke time standard banaya jata hai aur cost us level sey bob karke neeche jaata hai. Phir poke cost dubara wahi level tak pahunchta hai aur wahan sey bob karta hai, toh ye opposition level affirm ho jata hai. 3. Volume: Volume investigation bhi Double Top Candle Example mein significant hota hai. Regularly, punch cost second top tak pahunchta hai, toh volume kam ho jata hai. Ye volume decline, inversion ki sign deta hai. 4. Affirmation: Double Top Candle Example ki affirmation ke liye, brokers ko cost level ko break karne ka stand by karna hota hai. Hit cost design ke support level ko break karke neeche jaata hai, toh ye design affirm ho jata hai aur potential pattern inversion ki sign deta hai. Double Top Candle Example ka istemal karke dealers sell section point aur stop misfortune levels decide kar sakte hain. Hit cost design ke support level ko break karta hai, merchants sell kar sakte hain aur stop misfortune levels ko design ke opposition level ke simply above set kar sakte hain.Lekin jaise ki har specialized investigation apparatus ya design ki tarah, Double Top Candle Example ka bhi apne restrictions hai. Bogus signs, market instability, aur different elements ko bhi consider karna zaruri hai. Dealers ko hamesha apne own exploration aur risk the board ke saath exchanging choices lena chahiye.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Asalam o Alikum Dosto Umeed Krta Hun Kah ap Sub Khariyat Sy Hun Gy Aj hum jis topic pr Baat Krny ja Rha tum me sub Jaty hon Gy Aj Hum double Top candlestick pattern Ke Bary me details Sy Discuss Kry Gy or es Ke Bary me details Sy jany Gy Kah ye Kia Hai or ye kesa work Krta Hai Double Top candlestick pattern Dear friends Double pinnacle candlestick pattern ek bearish reversal pattern hai jisme charge trend up ki taraf pass karta hai phir ek Double pinnacle cdear people jb marketplace up sample major hoti ha to advertiseear members jb market up fashion important hoti ha to marketplace kafi opr jaa ok aik resistance se takrati ha or apna excessive bnati ha js ok terrible wapis ati ha market thora sa retrace ho kr or aik support se takra kar wapis opr previous resistance se tkrati hanor wps ati ha Estrha opr wali resistance ko marketplace 2 bar touch karti ha or esi ko double pinnacle kha jata ha. Kafi opr jaa okay aik obstruction se takrati ha or apna excessive bnati ha js k lousy wapis ati Hai Dear friends marketplace thora sa back off ho kr or aik support se takra kar wapis opr past opposition se tkrati hanor wps ati ha Estrha opr wali obstruction ko marketplace 2 bar touch karti ha or esi ko twofold top kha jata handlestick sample forex trading mein ek critical bearish reversal sample hai jise buyers fashion reversal aur trend continuation ke liye use karte haear people twofold pinnacle diagram layout fundamental trade karny ok lye hamen design okay whole hony or neck vicinity okay breakout ka stand via karna Chahiye Neck vicinity ka breakout tb hota Hai Explanation of Double top candlestick pattern Dear friends marketplace twofold pinnacle instance ki neck place ko pass kr k es ok nechy jati ha or jis time span essential ye design bnta ha usi time span fundamental market neck area k nechy flame close kary ye breakout ki affirmation hoti ha or es okay terrible murmur promote ki trade le skty hain Is pattern ke liye entry aur exit points traders ke buying and selling method aur threat tolerance pe depend karte hain Ye sample investors ko rate movements aur fashion analysis mein help karta hai Double pinnacle candlestick sample ke liye access aur exit points investors ke trading strategy aur risk tolerance pe depend karte hain Kuch buyers pattern verify hone ke baad entry karte hain jabki kuch buyers entry ke liye rate level ke ruin ke wait karte hain. Exit factors ke liye bhi buyers apne trading method aur threat control ke hisab se forestall loss aur take earnings ranges set karte hain Resistance stage pe prevent ho jata hai aur phir dubara up move karta hai

Dear friends marketplace thora sa back off ho kr or aik support se takra kar wapis opr past opposition se tkrati hanor wps ati ha Estrha opr wali obstruction ko marketplace 2 bar touch karti ha or esi ko twofold top kha jata handlestick sample forex trading mein ek critical bearish reversal sample hai jise buyers fashion reversal aur trend continuation ke liye use karte haear people twofold pinnacle diagram layout fundamental trade karny ok lye hamen design okay whole hony or neck vicinity okay breakout ka stand via karna Chahiye Neck vicinity ka breakout tb hota Hai Explanation of Double top candlestick pattern Dear friends marketplace twofold pinnacle instance ki neck place ko pass kr k es ok nechy jati ha or jis time span essential ye design bnta ha usi time span fundamental market neck area k nechy flame close kary ye breakout ki affirmation hoti ha or es okay terrible murmur promote ki trade le skty hain Is pattern ke liye entry aur exit points traders ke buying and selling method aur threat tolerance pe depend karte hain Ye sample investors ko rate movements aur fashion analysis mein help karta hai Double pinnacle candlestick sample ke liye access aur exit points investors ke trading strategy aur risk tolerance pe depend karte hain Kuch buyers pattern verify hone ke baad entry karte hain jabki kuch buyers entry ke liye rate level ke ruin ke wait karte hain. Exit factors ke liye bhi buyers apne trading method aur threat control ke hisab se forestall loss aur take earnings ranges set karte hain Resistance stage pe prevent ho jata hai aur phir dubara up move karta hai

-

#13 Collapse

Double Top Candle Example: Dear Companions Double Top Candle Example mein ap agar kisi marker ya phir is fundamental exchanging device ka istemal karte hain to apko ismein mazeed affirmation ho jaati hai ke market mein companion change hony wala hai market ek neck area ko hit break ati hai tou iski affirmation light ke badh aur market ke breakout ke badh ap apni exchange ke sath bury ho sakty hain aur ismein ap apna target select kar sakte hain aur ap ismein apny account capital ke hisab se apni exchange ke sath entomb ho sakte hain jis se apka target effectively accomplish ho sakta hai.:max_bytes(150000):strip_icc():format(webp)/doubletop-edit-36c4afd0c61c44d4bad0ca9def7b58db.jpg) Data of Double Top Candle: Hi Understudies Agar ap Double Top Candle Example ki complete data aur learning hasil kar lenge tou ap bohot benefits hasil kar sakte hain for instance agar second top position per ek falling star design banta hai to usmein apko yah affirmation mil jaati hai ke ap market ki next development negative pattern ki taraf sharpen lagi hai. Isliye ham ko market mein banne wali various candles ki appropriate data hasil karni chahiye purpose ham is se achi tarah use ho purpose aur forex exchanging ko apne liye faydemand bana sakein.

Data of Double Top Candle: Hi Understudies Agar ap Double Top Candle Example ki complete data aur learning hasil kar lenge tou ap bohot benefits hasil kar sakte hain for instance agar second top position per ek falling star design banta hai to usmein apko yah affirmation mil jaati hai ke ap market ki next development negative pattern ki taraf sharpen lagi hai. Isliye ham ko market mein banne wali various candles ki appropriate data hasil karni chahiye purpose ham is se achi tarah use ho purpose aur forex exchanging ko apne liye faydemand bana sakein. :max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Double_Top_Definition_Oct_2020-01-b7e6095a764243cc9f79fdaf1214a7b6.jpg) End: Dear Forex Individuals Double Top Candle Example ek integral asset hai pattern forecasts ke liye, lekin iska istemal karne se pehle, merchants ko cost activity, volume aur dusre specialized pointers ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk the executives ka hayal rakhna chahiye.

End: Dear Forex Individuals Double Top Candle Example ek integral asset hai pattern forecasts ke liye, lekin iska istemal karne se pehle, merchants ko cost activity, volume aur dusre specialized pointers ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk the executives ka hayal rakhna chahiye. :max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Double_Top_Definition_Oct_2020-02-24bead3ae99c4462b24745f285bb6515.jpg) Double candle design ek acha beginning stage hai pattern inversion ki talaash mein lekin ultimate choice leny se pehle aur bhi examination karne hogy.

Double candle design ek acha beginning stage hai pattern inversion ki talaash mein lekin ultimate choice leny se pehle aur bhi examination karne hogy.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Twofold Top Candle Example Details."Twofold Top Candle Example" ek specialized examination instrument hai jo forex exchanging aur financial exchange mein istemal hoti hai. Yeh design merchants ke liye ahem hota hai kyunki isse future cost developments ka andaza lagaya ja sakta hai. Yahan, Twofold Top Candle Example ki kuch khasiyat bayan ki gayi hain: 1;Pehchaan (Distinguishing proof): Twofold Top Candle Example ko pehchanne ke liye, merchant ko do high focuses ko dekhna hota hai jo ek dusre ke bohot qareeb hotay hain. Yani, market pehle bullish (up) pattern mein hoti hai, phir ek top banati hai, uske baad thodi si giravat hoti hai, aur phir dobara ek top boycott jati hai jo pehle ridge top ke qareeb hoti hai. 2;Candle Example: Har top banne standard, ek specific candle design dekha jata hai. Yeh for the most part ek negative (descending) inversion design hota hai, jise "meteorite" ya "doji" kehte hain. Is design ki wajah se brokers mein vulnerability paida hoti hai aur selling pressure increment hota hai. 3;Affirmation: Twofold Top example ko affirm karne ke liye, brokers dobara se cost ki giravat (downtrend) ke signals ka stand by karte hain. Agar cost ne pehle rib top ke specialty gir kar support level ko break kiya, toh yeh design affirm hota hai. 4;Stop-Misfortune aur Section Focuses: Punch Twofold Top example affirm ho jata hai, to dealers apne positions ko safeguard karne ke liye stop-misfortune orders place karte hain. Passage point ordinarily design ke affirmation ke baad hota hai, hit cost downtrend mein enter karta hai. 5;Value Target: Twofold Top example se dealers ek cost target bhi nikal sakte hain, jo design ke level ko measure karke milta hai. Is target ko use karke brokers apne benefit targets aur risk the board plan tay kar sakte hain. Twofold Top Candle Example ek amazing asset hai, lekin iska istemal sahi tarike se karna bohot zaroori hai. Market mein kai aur factors bhi hote hain jo cost developments ko impact karte hain, isliye dealers ko hamesha alert aur legitimate gamble the executives se kaam lena chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:58 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим