Symmetrical triangle candlestick pattern

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

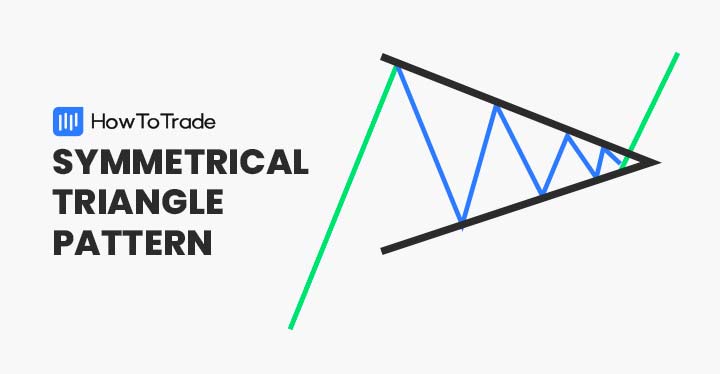

Symmetrical triangle candlestick sample Dekhye Friends Market market Mein bohat sary traders symmetrical Triangle Ko Jab use karty hain To Ham technical analysis ki assist tamam candlestick styles ko achi taraha se research kar sakty hain is sample mein fee ki excessive aur market ki low factor ko combine Kiya jata hai symmetrical triangle mein specific impulse wave aur collector waves ki length aur body humaisha identical hi hoti hai unki length aur frame kabhi bhi special nahi hoti ham symmetrical Triangle ki help se market breakout or breakdown condition ko bhi aasSymmetrical triangle candlestick pattern aik powerful device hai jo foreign exchange buyers ke liye market analysis mein istemal hota hai. Is sample ki pehchan aur sahi tarah se samajhna buyers ke liye zaroori hai taake woh breakout ki prediction kar sakein. Lekin, yeh bhi yaad rahe ke har aik technical evaluation tool ki tarah, is pattern ka bhi istemal samajhdari aur danger management ke sath karna zaroori hai. Trading mein safalta hasil karne ke liye, buyers ko constant gaining knowledge of aur exercise ki bhi zaroorat hoti haiani se samajh sakty hain Hamein symmetrical triangle ke sath sath distinct kind ke triangle ko bhi istiemal karna chahiye aur triangles ok bary mein humen achy se research ker k un ko use kerna chahiye aur jab bhi ye shape huon humen in ok bary mein identification ho jani chahiye.Symmetrical triangle candlestick pattern ​

Dekhye Friends Market market Mein bohat sary traders symmetrical Triangle Ko Jab use karty hain To Ham technical evaluation ki help tamam candlestick patterns ko achi taraha se analyze kar sakty hain is sample mein price ki excessive aur market ki low point ko combine Kiya jata hai symmetrical triangle mein exceptional impulse wave aur collector waves ki duration aur body humaisha equal hello hoti hai unki duration aur frame kabhi bhi specific nahi hoti ham symmetrical Triangle ki help se market breakout or breakdown situation ko bharoori hai taake woh breakout ki prediction kar sakein. Lekin, yeh bhi yaad rahe ke har aik technical evaluation device ki tarah, is sample ka bhi istemal samajhdari aur danger management ke sath karna zaroori hai. Trading mein safalta hasil karne ke liye, traders ko consistent learning aur practice ki bhi zaroorat hoti hai.I aaSymmetrical triangle candlestickupper aur lower lines donu symmetric yani equal hoti hain aur traingle ki form ascending ya descending hony ki bajaye symmetric dekhai deti hai dono strains similarly journey karti hui aik point par milti hain ye triangle shape ​karny ky liye marketplace k highs and Lows ko aik doosry ok sath horizontally mila deta pattern aik technical evaluation device hai jo foreign exchange buying and selling mein istemal hota hai. Is pattern ki pehchan aur samajhna traders ke liye zaroori hota hai taake woh behtar buying and selling selections le saken. Is sample ka naam "symmetrical" is wajah se hai kyunki iska shape aik symmetrical triangle jaisa hota hasani se samajh sakty hain Hamein symmetrical triangle ke sath sath specific type ke triangle ko bhi istiemal karna chahiye aur triangles okay bary mein humen achy se examine ker ok un ko use kerna chahiye aur jab bhi ye form huon humen in okay bary mein identity ho jani chahiye

-

#3 Collapse

Symmetrical triangle candlestick pattern forex trading mein ek continuation pattern hai. Is pattern mein price chart pe ek triangle shape form hota hai, jismein price higher lows aur lower highs banata hai. Ye pattern usually sideways (range-bound) market conditions mein form hota hai aur breakout ke baad existing trend ko continue karta hai. Symmetrical triangle candlestick pattern ki wazahat niche di gayi hai: 1. Trend Continuation Signal: Symmetrical triangle pattern existing trend ka continuation signal deta hai. Jab price higher lows aur lower highs banata hai, toh ye indicate karta hai ki market mein buying pressure aur selling pressure balance mein hai. Isse trend ka continuation hone ka potential highlight hota hai. 2. Breakout Confirmation: Symmetrical triangle pattern breakout confirmation ka intezar karta hai. Jab price triangle ke upper or lower boundary se bahar nikal jata hai, toh breakout confirm hota hai. Breakout direction ke according traders entry kar sakte hain aur trend ka continuation advantage utha sakte hain. 3. Volume Analysis: Symmetrical triangle pattern ke saath volume analysis ka istemal kiya jata hai. Breakout ke samay agar volume increase hota hai, toh ye indicate karta hai ki market mein strong buying or selling interest hai. Volume analysis breakout ke validity ko confirm karta hai. 4. Target Projection: Symmetrical triangle pattern traders ko target projection ka idea deta hai. Pattern ke breakout ke baad, traders often target the height of the triangle (distance between upper and lower boundary) and add it to the breakout level to project the potential move. Symmetrical triangle candlestick pattern forex trading mein ek useful tool hai, kyun ki ye trend continuation ka signal deta hai. Iske saath sahi confirmatory indicators, volume analysis, aur price action analysis ka istemal karna zaruri hai. Iske saath sahi risk management aur money management bhi important hai. Symmetrical triangle pattern ke saath practice aur experience se hi aapko iski wazahat ka pata chalega. -

#4 Collapse

Symmetrical Triangle Pattern :

Symmetrical triangle pattern ek technical analysis mein bearish ya bullish trend ke signals dene wala pattern hai. Is pattern mein price higher lows aur lower highs ke beech mein consolidate hota hai, jiski wajah se triangle shape banta hai. Traders is pattern ko breakout ke liye interpret karte hain, yaani jab price triangle ke upar ya neeche breakout karta hai, toh woh trend direction mein move kar sakta hai. Is pattern ko identify karne ke liye aapko trend lines draw karne hote hain, jo triangle ke boundaries ko define karte hain.

Characteristics of Symmetrical triangle pattern:

Symmetrical triangle pattern ke kuch characteristics hain:

1. Price consolidation:

Is pattern mein price higher lows aur lower highs ke beech mein consolidate hota hai.

2. Symmetrical shape:

Is pattern ka shape triangle jaisa hota hai, jismein trend lines draw karke price ke boundaries define kiye jaate hain.

3. Decreasing volatility:

Volatility is pattern ke andar generally decrease hoti hai, jisse price range bound rehta hai.

4. Breakout expectation:

Traders is pattern ko breakout ki expectation ke saath dekhte hain. Jab price triangle ke upar ya neeche breakout karta hai, trend direction mein move kar sakta hai.

5. Volume contraction:

Is pattern ke andar volume contraction bhi dekha jaata hai, jisse price movement ki intensity kam ho jaati hai. Yeh characteristics symmetrical triangle pattern ki basic properties hain, jo traders ko price movement aur trend direction ke liye signals provide karte hain.

Trade with Symmetrical Triangle Pattern:

Symmetrical triangle pattern ke sath trading karne ke liye aap ye steps follow kar sakte hain:

1. Pehele, symmetrical triangle pattern ko identify karein. Is pattern mein price higher lows aur lower highs ke beech mein consolidate hota hai.

2. Jab aap triangle pattern ko identify kar lein, breakout direction ka wait karein. Agar price triangle ke upar breakout karta hai, bullish trade consider karein. Agar price triangle ke neeche breakout karta hai, bearish trade consider karein.

3. Stop loss aur target levels set karein. Stop loss aapko protect karega agar price reversal ho jaaye aur target level aapko profit booking karne mein madad karega.

4. Confirmatory indicators ka bhi analysis karein, jaise ki volume, trend lines, aur other technical indicators.

5. Market conditions aur overall trend ko dhyan mein rakhein. Agar overall trend aapke trade ke favor mein hai, toh higher probability trade ho sakta hai.

6. Apne trade ko monitor karte rahein aur trade management ko follow karein. Agar price aapke favor mein move karti hai, stop loss level ko adjust kar sakte hain ya partial profit booking kar sakte hain. Yeh steps aapko symmetrical triangle pattern ke sath trading karne mein madad karenge. Hamesha apne risk tolerance aur trading plan ko dhyan mein rakhein. -

#5 Collapse

Symmetrical Triangle Candlestick Pattern introduction. Symmetrical Triangle Candlestick Pattern trading ka aik aham hissa hai jo chart analysis mein istemal hota hai. Yeh pattern traders ko market mein hone wale possible price movements ke baray mein ahem maloomat faraham karta hai Symmetrical Triangle Candlestick Pattern ek ahem technical analysis tool hai jo traders ko market mein hone wale price movements ko samajhne aur predict karne mein madadgar hota hai. Is pattern ko samajh kar tijarat karne se traders apne trading decisions ko behtar bana sakte hain. Lekin, is pattern ka istemal karne se pehle thorough research aur risk management ka khayal rakhna zaroori hai. Identification of Symmetrical Triangle & Shape of Symmetrical Triangle. Symmetrical Triangle ek technical analysis pattern hai jiska main maqsad market mein hone wale price movements ko predict karna hai. Is pattern mein aik aesa chart formation hota hai jismein price ki lines aik triangle ki tarah hoti hain. Yeh pattern market mein consolidation phase ko darust karti hai, jahan price range kam hoti hai aur traders uncertainty mein hotay hain.Is pattern ki banavat aam taur par aik bullish aur bearish trend ki milawat se hoti hai. Yeh pattern market mein hone wale breakout ko darust karti hai. Symmetrical Triangle mein price ki lines aik dusre ke qareeb hoti hain aur triangle ki upper aur lower sides par converging hoti hain. Trading at Symmetrical Triangle. Symmetrical Triangle Candlestick Pattern traders ke liye aik ahem tool hai. Is pattern ko samajh kar traders future price movements ke baray mein koshish karte hain. Is pattern ko tijarat mein istemal karne ke liye neechay diye gaye steps follow kiye ja sakte hain Symmetrical Triangle pattern ko dekhte hue trader entry point tay karta hai. Entry point usually pattern ke breakout point par hota hai. Agar triangle bullish hai, to entry point triangle ke upper side par hota hai, aur agar bearish hai to entry point triangle ke lower side par hota hai trading mein nuksan se bachne ke liye stop loss aur profit booking ke liye take profit level set kiye jate hain. Stop loss level ko entry point ke just opposite side par rakha jata hai taki nuksan minimize kiya ja sake.Position hold karne ka faisla trader ke liye ahem hota hai. Agar breakout direction ke mutabiq hota hai, to trader apne position ko hold karta hai. Lekin, agar breakout opposite direction mein hota hai, to trader position ko close kar leta hai. Symmetrical Triangle(Breakout). Symmetrical Triangle pattern ka asal maqsad price ka breakout darust karna hai. Breakout tab hota hai jab price triangle ke upper ya lower side se bahar nikalti hai. Is breakout ko dekhte hue traders apne positions ko enter ya exit karte hain.Symmetrical Triangle Candlestick Pattern ko samajhna aur istemal karna challenging ho sakta hai. Isme false breakouts ka khatra hota hai, jismein breakout hone ke baad bhi price phir se wapis triangle mein wapas aa jati hai. Isliye, stop loss aur take profit levels ko theek taur par set karna zaroori hai.Symmetrical Triangle Candlestick Pattern ka maqsad traders ko market mein hone wale possible price movements ke baray mein maloomat faraham karna hai. Is pattern ki madad se traders apne trading strategies ko behtar banate hain aur market mein hone wale opportunities ko pehchan kar faida uthate hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

Forex trading mein chart patterns ko samajhna ek bohat ahem hissa hai, aur unmein se ek mashhoor pattern Symmetrical Triangle Candlestick Pattern hai. Yeh pattern aksar continuation ka signal hota hai, yaani market apni pehle wali direction ko continue karne wali hoti hai. Symmetrical triangle pattern ko traders extensively use karte hain taake market ki future movement ko samajh sakein aur profitable trades kar sakein.

Symmetrical Triangle Pattern Ki Pehchan

Symmetrical triangle pattern do converging trend lines se banta hai jo ek triangle ki shakal ikhtiyar karte hain. Yeh pattern tab banta hai jab market consolidation phase mein hoti hai, yani price highs aur lows gradually narrow hote ja rahe hote hain. Yeh is baat ki nishani hoti hai ke market mein ek breakout hone wala hai.

Is pattern mein:

- Lower Trend Line: Yeh line price ke higher lows ko connect karti hai.

- Upper Trend Line: Yeh line price ke lower highs ko connect karti hai.

Jab dono lines converge karte hain, price ek tight range mein move karti hai, jo is baat ka ishara deti hai ke market ek strong move banane wali hai.

Symmetrical Triangle Ka Istemaal

Symmetrical triangle pattern ek neutral pattern hota hai, yani yeh is baat ko indicate nahi karta ke market upar jaye gi ya neeche. Lekin jab price triangle se breakout karti hai (upar ya neeche), tou yeh is baat ka indication hota hai ke market apni previous trend ko continue kare gi.- Bullish Breakout: Agar price upper trend line se break kare tou yeh bullish signal hota hai, aur traders buying position lete hain.

- Bearish Breakout: Agar price lower trend line se break kare tou yeh bearish signal hota hai, aur traders selling position lete hain.

Volume ka analysis bhi zaroori hota hai, kyun ke strong breakout ke sath aksar volume bhi increase hota hai, jo confirmation provide karta hai.

Conclusion

Symmetrical triangle candlestick pattern forex trading mein ek ahem continuation pattern hai jo market mein consolidation ke baad strong move ka signal deta hai. Traders is pattern ko breakout ke waqt use karte hain taake wo sahi direction mein trade kar sakein. Is pattern ka sahi istemal kar ke aap apni trading strategy ko behtareen bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:42 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим