what is the Triangle Trading

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

what is the Triangle Trading -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

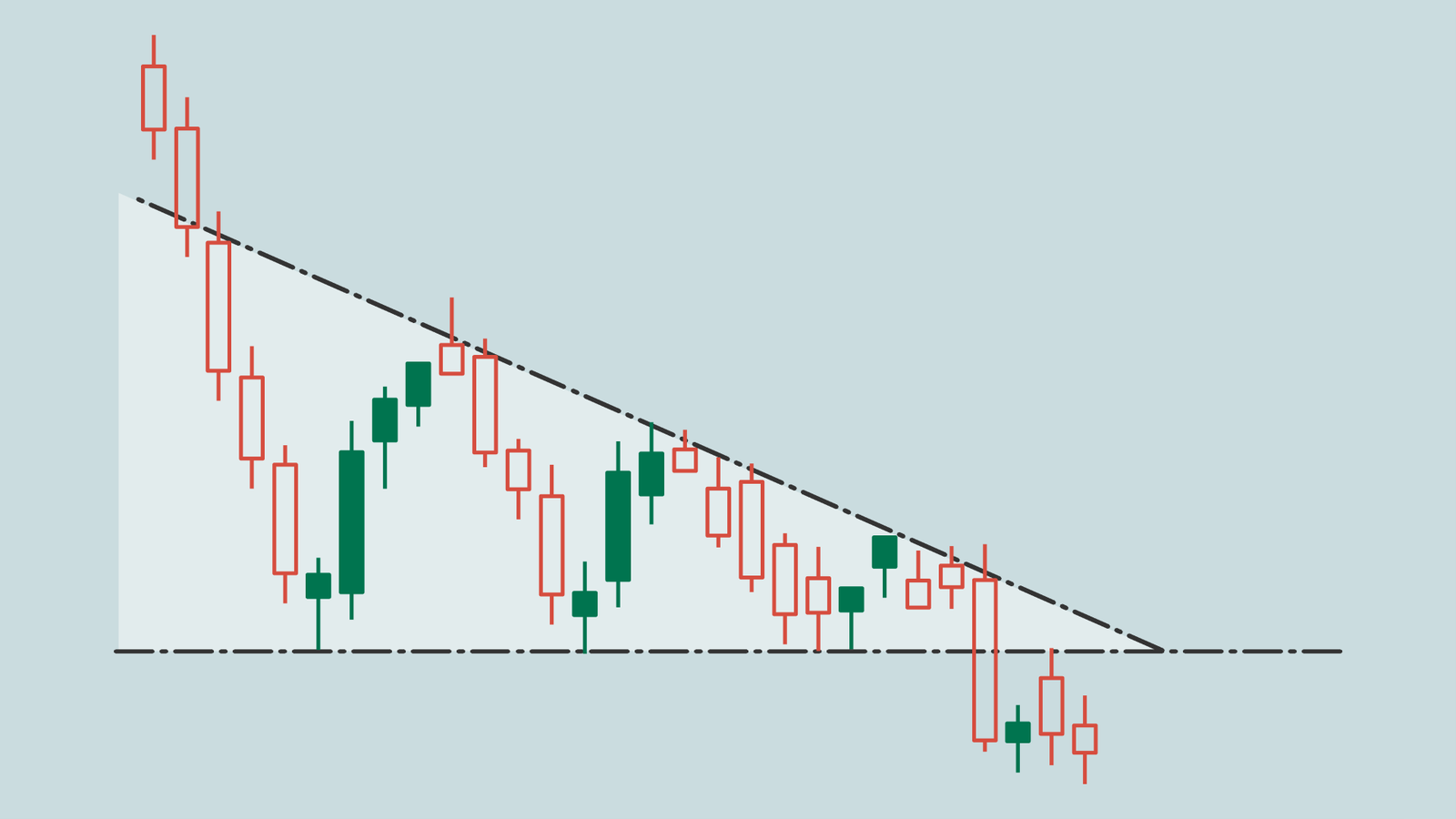

Triangle Trading Triangle Trading ek technical analysis concept hai jo financial markets mein istemal hota hai, khaas kar ke price movements aur trend patterns ko analyze karne mein. Triangle patterns chart par geometric shapes banate hain, aur inke appearance se traders ko future price movements ke possibilities ka andaza milta hai. Yeh patterns market mein hone wale potential reversals ya continuation ke signals ke liye istemal hote hain. Triangle patterns market mein do tarah ke hote hain: symmetrical triangles aur asymmetrical (or ascending/descending) triangles. Symmetrical triangles mein, price high lows aur low highs ke beech mein consolidate hota hai, jabki asymmetrical triangles mein price ek specific direction mein move karta hai aur doosre direction mein consolidate hota hai. Symmetrical Triangle mein, price apne peaks aur troughs ko ek line ke aspas arrange karta hai, jise traders trendlines ke zariye draw karte hain. Yeh triangles typically indecision ko reflect karte hain kyun ki buyers aur sellers mein equilibrium hota hai. Jab price triangle ke andar se bahar move karta hai, yeh trend reversal ya continuation signal ho sakta hai, depending on the direction of the breakout. Asymmetrical Triangle mein, price ki movement ascending (upward) ya descending (downward) hoti hai, lekin trendlines draw karne par yeh ek triangle shape banata hai. Jab price triangle ke andar se bahar move karta hai, yeh ek trend reversal ya continuation ka signal ho sakta hai, depending on the direction of the breakout. Triangle Trading ka istemal traders ko market ke future direction ke predictions mein madad karta hai. Jab triangle form hota hai, toh iska matlab hai ke market mein consolidation ho rahi hai aur ek breakout hone wala hai. Breakout ke direction ke basis par, traders apne positions ko adjust karte hain. Traders ko symmetrical triangles ke breakout se pehle yeh dekhna hota hai ke kis direction mein breakout hone wala hai. Agar breakout upward hota hai, toh yeh bullish signal hai aur traders long positions le sakte hain. Agar breakout downward hota hai, toh yeh bearish signal hai aur traders short positions le sakte hain. Asymmetrical triangles mein bhi breakout direction ka careful analysis kiya jata hai. Ascending triangle ke breakout upward bullish signal hota hai, jabki descending triangle ke breakout downward bearish signal hota hai. Triangle Trading mein volume bhi important role play karta hai. Breakout ke time par agar volume high hota hai, toh yeh confirmatory signal provide karta hai ke breakout strong hai aur market mein momentum hai. Lekin, yaad rahe ke triangle patterns bhi 100% guarantee nahi dete, aur market dynamics hamesha changing rehti hain. Traders ko confirmatory signals aur risk management ka bhi dhyan rakhna chahiye. In conclusion, Triangle Trading ek powerful tool hai jo traders ko market ke future movements ke baare mein information deta hai. Iske through, traders apne trading strategies ko refine kar sakte hain aur market ke potential reversals ya continuations ko anticipate kar sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Triangle Trading patterns Triangle Trading forex me ek common chart pattern hai. Is pattern me price higher lows aur lower highs ke beech me consolidate hota hai, jaise ki ek triangle ka shape banata hai. Jab price triangle ke breakout karta hai, yani ki triangle ke upper ya lower side se bahar nikalta hai, tab traders entry ya exit points identify kar sakte hai. Triangle patterns alag-alag types ke hote hai jaise ki ascending triangle, descending triangle, aur symmetrical triangle. Har type ke triangle ke breakout ke baad price me significant movement dekha ja sakta hai. Is tarah ke patterns ko identify karke traders price ka direction anticipate kar sakte hai. Ascending Triangle pattern Ascending Triangle pattern forex me ek bullish chart pattern hota hai. Is pattern me price higher lows banata hai, jabki upper side me ek horizontal resistance line hoti hai. Yeh pattern jab market me uptrend hota hai aur price higher lows banata hai, lekin resistance line ko break nahi karta hai. Jab price resistance line ko break karke upar jaata hai, tab traders entry points identify kar sakte hai. Ascending Triangle pattern breakout ke baad price me further upside movement dekha ja sakta hai. Is pattern ko identify karke traders price ka potential growth anticipate kar sakte hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

:-Forex me Triangle Trading Patterns-:

Forex mein "Triangle Trading Patterns" un chart patterns ko refer karta hai jo price action ko triangle shape mein represent karte hain. Inmein mukhtalif qisam ke triangles shamil hote hain aur inka istemal traders market trends aur potential breakouts ko samajhne mein karte hain.

:-Forex me Triangle Trading Patterns ki Eqsaam-:Symmetrical Triangle:- Isme price higher lows aur lower highs ke darmiyan consolidate hoti hai.

- Traders is pattern ko dekhte hain, kyun ki yeh ishara karta hai ke market mein uncertainty hai aur ek breakout hone wala hai.

- Symmetrical triangle ke breakout ke baad, price ek direction mein strong move karta hai.

Ascending Triangle:- Is pattern mein, price higher lows banata hai aur ek flat resistance level hota hai.

- Yeh ishara karta hai ke buyers strong hain aur market mein bullish sentiment hai.

- Jab price ascending triangle ke upper resistance level ko break karta hai, toh yeh bullish breakout ko suggest karta hai.

Descending Triangle:- Isme price lower highs banata hai aur ek flat support level hota hai.

- Yeh ishara karta hai ke sellers strong hain aur market mein bearish sentiment hai.

- Jab price descending triangle ke lower support level ko break karta hai, toh yeh bearish breakout ko suggest karta hai.

Breakout (Izafah):

Breakout woh waqt hota hai jab price ek triangle ke borders ko cross karti hai. Symmetrical triangle mein breakout ke baad, price mein tezi se izafah hota hai, jabki ascending triangle breakout bullish move ko aur descending triangle breakout bearish move ko represent karta hai.

Trading Strategy (Trading Tadbeer):

Traders in patterns ka istemal karke apne trading strategies tajwez karte hain. Breakout ke baad, unhe entry aur exit points tay karne mein madad milti hai. Stop-loss orders ka istemal karna important hai taki nuksan se bacha ja sake.

Risk Management (Khatra Nigrani):

Triangle trading patterns ke istemal mein risk management ka khaas khayal rakhna zaroori hai. Stop-loss orders aur position sizes ka theek se tay karna traders ko market ki volatility ke khilaaf mehfooz rakhta hai.

Continuation Patterns (Musalsal Patterns):

Triangle patterns market mein hone wale trends ko continue karne ka ishara bhi kar sakte hain. Yeh traders ko existing trend mein hone wale moves ko anticipate karne mein madad karte hain.

Multiple Time Frame Analysis (Mukhtalif Time Frames Ka Mutala'a):

Traders ko triangle patterns ko mukhtalif time frames par dekhte hue market ka comprehensive analysis karna chahiye. Yeh madad karta hai unko confirm karna ke breakout genuine hai aur false signals ko avoid karne mein madad milti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим