What is the Shark Candlestick Pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Shark Candlestick Pattern

Shark Candlestick Pattern, ek technical analysis tool hai jo financial markets mein price movements ko analyze karne mein istemal hota hai. Yeh ek specific candlestick pattern hai jo traders ko market trends aur reversals ke possibilities ke bare mein bata sakta hai. Shark pattern ka naam isiliye hai kyunki jab yeh form hota hai, toh market mein ek tarah ka "sharkish" movement hone ki possibility hoti hai. Shark Candlestick Pattern ka formation ek sequence par mabni hota hai. Is pattern mein kuch key levels aur ratios ka bhi dhyan rakhna hota hai. Jab yeh pattern form hota hai, toh traders iske through potential turning points ko identify karke apne trading decisions ko shape kar sakte hain. Shark pattern mein, price movement ke kuch specific retracement aur extension levels par focus hota hai, jo ke Fibonacci ratios se aate hain. Traders ko in levels ko observe karna hota hai taki woh shark pattern ka confirmation kar sakein. Shark pattern ka starting point hota hai ek impulse leg ya trend move ka, jise AB leg kehte hain. Iske baad BC leg hota hai jo retracement ko represent karta hai, aur iske baad CD leg hoti hai jo extension ko show karti hai. Jab yeh legs specific Fibonacci levels par aati hain, toh shark pattern form hota hai. Shark pattern ka ek key element hota hai 88.6% retracement level. Jab CD leg AB leg ke 88.6% ke aas-paas hoti hai, toh woh shark pattern ke liye important hota hai. Iske alawa, pattern ka completion point ya D point bhi specific Fibonacci extension levels par hota hai. Jab shark pattern form hota hai, toh traders ko yeh samajhna hota hai ke market mein reversal hone ke chances hai. Yani ke, agar market uptrend mein tha toh ab woh possibly downtrend mein ja sakta hai, aur vice versa. Traders shark pattern ko identify karne ke baad apne trading strategy ko adjust karte hain. Woh is pattern ke completion point par entry points set karte hain aur stop-loss levels ko define karte hain taki unka risk controlled rahe. Yeh important hai ke shark pattern ke istemal ko lekar traders cautious rahein aur confirmatory signals ko bhi dhyan mein rakhein. Har ek pattern ya indicator ki tarah, shark pattern bhi 100% guarantee nahi deta aur market dynamics ke changing nature ko consider karna important hai. In conclusion, Shark Candlestick Pattern ek advanced level ka technical analysis tool hai jo traders ko market mein hone wale potential reversals ko detect karne mein madad karta hai. Is pattern ka istemal karne ke liye traders ko Fibonacci retracement aur extension levels ko dhyan mein rakhna hota hai taki woh pattern ko sahi tarah se identify kar sakein aur apne trading decisions ko refine kar sakein.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Shark candlestick pattern ek technical analysis ka auzar hai jo forex trading mein istemaal hota hai taake kisi mumkin trend reversal ko darust kare. Ye ek kisam ka candlestick pattern hai jo teen candles se mil kar banta hai, har ek mein khaas sifoat hoti hai jo kisi mumkin keemat ke ulte hone ki nishani hoti hai.

Shark Candlestick Pattern Ki Banawat

Shark candlestick pattern teen candles se banta hai jo ek khaas shakl bana deti hain. Pehli candle ek lambi si siyah candle hoti hai jo keemat ke ooper kholi jati hai aur keemat ke neeche band hoti hai. Ye candle mazboot bechnay ki dabao ko darust karti hai aur ek mumkin neeche ki taraf ki taraf le jane ki ishara karti hai.

Dusri candle ek chhoti si safed ya hara candle hoti hai jo keemat ke neeche kholi jati hai aur darmiyan ke qareeb band hoti hai. Ye candle ek chand lamha ke kharidari dabao ki dastak hoti hai lekin iska koi maayne nahi hota.

Teesi candle is pattern mein sab se ahem hoti hai. Ye ek lambi si safed ya hara candle hoti hai jo keemat ke darmiyan kholi jati hai aur keemat ke ooper band hoti hai. Ye candle mazboot kharidari dabao ko darust karti hai aur ek mumkin ooper ki taraf jane ki ishara karti hai.

Shark Candlestick Pattern Ki Taweel

Shark candlestick pattern trend reversal ko darust karne ki ishara karta hai kyun ke is mein market ke jazbaat mein bechne se kharidari ki taraf ka shift hota hai. Pehli siyah candle mazboot bechnay ki dabao ko darust karti hai, jo ke dusri safed ya haray candle mein chand lamhon ki kharidari dabao ki dastak ke baad hoti hai. Lekin teesi lambi safed ya haray candle ye dikhata hai ke khareedne walay ne market par control dobara hasil kar liya hai, jo ke ek mumkin trend reversal ko darust karti hai.

Trading Strategies

Shark candlestick pattern ko forex traders is liye istemaal karte hain ke isse wo potential trend reversals ko pehchan sakte hain aur market ke jazbaat aur kharidari/bechnay ki dabao par mabni faislay kar sakte hain. Is pattern par amal karne wale kuch trading strategies yeh hain:

Khareedari Ki Alamat: Agar aap apne forex chart par shark candlestick pattern dekhte hain, to ye aapke liye khareedari ka moqa ho sakta hai. Teesi lambi safed ya haray candle ka intezar karen, jab tak ke iski band ke qareeb kholi jati hai, kyun ke ye mazboot kharidari dabao ko darust karti hai aur ek mumkin ooper ki taraf jane ki ishara karti hai. Apna stop-loss order pehli siyah candle ke neeche aur take-profit order teesi lambi safed ya haray candle ke ooper ke liye set karen.

Farokht Ki Alamat: Agar aap apne forex chart par shark candlestick pattern dekhte hain lekin aap pehle hi khareedari mein hain, to ye aapke liye farokht ka moqa ho sakta hai. Teesi lambi safed ya haray candle ka intezar karen, jab tak ke iski band ke qareeb kholi jati hai, kyun ke ye mazboot kharidari dabao ko darust karti hai lekin ek mumkin trend reversal ko bhi darust karti hai. Apna stop-loss order teesi lambi safed ya haray candle ke neeche aur take-profit order aapke dakhil hone ki keemat ke neeche set karen.

Intezar Aur Dekhna Ki Alamat: Agar aap apne forex chart par shark candlestick pattern dekhte hain lekin aap yeh nahi samajh pa rahe hain ke khareedna chahiye ya farokht, to ye aapke liye intezar aur dekhne ka moqa ho sakta hai. Fauran amal se bachne ke liye mazeed tasdeeq ke liye intezaar karen, jaise ke doosre candlestick pattern ya technical indicator ki ishara. Ye aapko akele ek pattern par buni hui faislon par jald baazi se amal karne se bacha sakta hai.

Shark Candlestick Pattern Ko Forex Trading Mein Istemaal Karne Ke Fayde Aur Nuksanat

Shark candlestick pattern forex traders ke liye faida mand ho sakta hai kyun ke isse unhe potential trend reversals pehchanne mein madad milti hai aur wo market ke jazbaat aur kharidari/bechnay ki dabao par mabni faislay karne mein salahiyat hasil karte hain. Lekin is pattern ke istemaal mein kuch nuksanat bhi hain:

Fayde:- Traders ko potential trend reversals pehchanne mein madad karta hai.

- Market ke jazbaat aur kharidari/bechnay ki dabao par insight deta hai.

- Isse trading strategy ka hissa banakar inform kiye bina faislay karne mein madad milti hai.

- Ek pattern par buni hui faislon par jald baazi se amal karne se bachane ke liye traders ko mazeed tasdeeq ke liye intezaar karnay ka tawon dena mein madad karta hai.

Nuksanat:- Shark candlestick pattern puri tarah se kaamil nahi hota aur is par bharosa karke trading faislay nahi lena chahiye.

- Is pattern ki banawat market ki hawale se tabdeel ho sakti hai aur hamesha trend reversal mein nahi result deti.

- Traders ko is pattern ke dwara paida hone wale signals ko tasdeeq karne ke liye dusre technical analysis tools aur fundamental analysis factors ka istemaal karna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Mentions 0

-

سا1 like

-

#4 Collapse

What is the Shark Candlestick Pattern kai hai

Shark Candlestick Pattern

1. Shark Candlestick Pattern Kya Hai:- Shark Candlestick Pattern ek technical analysis pattern hai jo market trends ko identify karne mein madad karta hai. Yeh pattern ek reversal pattern hai, yaani ke ye indicate karta hai ke market ka trend change hone wala hai.

2. Shark Candlestick Pattern Ki Tafseelat:- Formation:

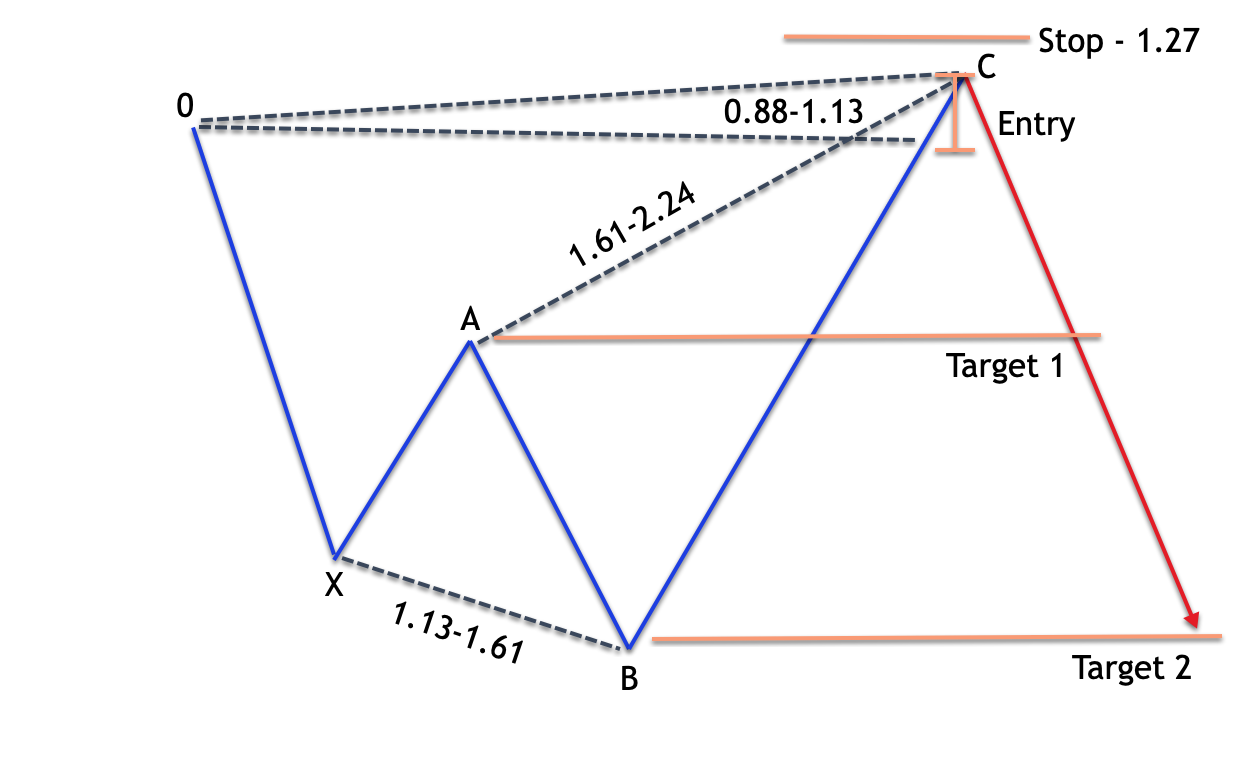

- Shark pattern ek complex pattern hai jismein kuch specific candlesticks aur Fibonacci retracement levels ka istemal hota hai.

- Is pattern mein kuch key points shamil hote hain, jese ke X, A, B, C, aur D points, jo Fibonacci ratios aur extension levels se related hote hain.

- Signal:

- Shark pattern complete hone par, traders ko ek potential reversal ka signal milta hai. Is pattern ka istemal market mein upcoming downtrend ya uptrend ka pata lagane ke liye hota hai.

- Fibonacci Retracement:

- Shark pattern mein Fibonacci retracement levels ka important role hota hai, jese ke 0.382, 0.618, 1.13, 1.618, aur 2.24. Ye levels market price ke movements ko analyze karne mein istemal hote hain.

- D Targets:

- Shark pattern ke D points, Fibonacci extension levels par base hote hain. In levels se traders price targets tay karte hain.

3. Shark Pattern Ke Components:- X Point (Start): Market ki initial move ko represent karta hai.

- A Point (Retracement): X se A tak ka retracement level hota hai.

- B Point (Extension): A se B tak ka extension level hota hai.

- C Point (Retracement): B se C tak ka retracement level hota hai.

- D Point (Extension): C se D tak ka extension level hota hai, jo Fibonacci ratios ke sath related hota hai.

4. Trading Strategy:- Entry Point: Shark pattern complete hone par entry point tay kiya jata hai.

- Stop-Loss: Stop-loss level tay karna important hai taki nuqsaan se bacha ja sake.

- Take-Profit: Fibonacci extension levels par based on D point, traders take-profit targets tay karte hain.

5. Trading Caution:- Shark pattern ko interpret karne mein experience aur technical analysis ka strong foundation hona zaroori hai. False signals se bachne ke liye doosre technical indicators ka bhi istemal kiya jata hai.

Conclusion (Mukhtasar): Shark Candlestick Pattern ek advanced technical analysis tool hai jo market trends ko anticipate karne mein madad karta hai. Is pattern ko correctly interpret karne ke liye traders ko Fibonacci retracement aur extension levels ko samajhna zaroori hai. Iske sahi istemal ke liye practice aur experience ki zarurat hoti hai.

-

#5 Collapse

What is the shark candlestick pattern

Shark candlestick pattern, ek relatively naya candlestick pattern hai jo technical analysis mein istemal hota hai, lekin iski widespread acceptance nahi hai aur ispar debate hoti hai. Yeh pattern harmonic trading principles par adharit hai, jo market trends aur price movements ko predict karne ke liye istemal hoti hain.

Shark pattern kuch key features par mabni hota hai:- Initial Price Thrust: Pehli stage mein, ek sharp price movement hota hai, jise "Initial Price Thrust" kehte hain. Ye move normally ek downtrend ke against hota hai, lekin iske specific ratios hote hain jo Fibonacci retracement levels se liye jaate hain.

- First Correction: Initial price thrust ke baad, ek correction wave aati hai jise "First Correction" kehte hain. Isme price me ek retracement hota hai, lekin wo Fibonacci levels par specific proportions mein hota hai.

- Second Price Thrust: Dusre stage mein, phir se ek sharp price movement hota hai, lekin iska magnitude pehle ke movement se chhota hota hai. Is movement ko "Second Price Thrust" kehte hain.

- Final Correction: Second price thrust ke baad, ek aur correction wave aati hai jise "Final Correction" kehte hain. Is wave mein bhi price me retracement hota hai, lekin Fibonacci levels ke specific proportions mein.

Shark pattern ka completion point wo level hota hai jahaan Final Correction end hoti hai, aur ek naya trend shuru hota hai.

Harmonic trading patterns, jaise ki shark pattern, traders ke beech mein popular hai, lekin inki effectiveness par opinion alag hoti hai. Kuch log in patterns ko powerful tools mante hain, jabki doosre is par skeptical hote hain. In patterns ka istemal karne se pehle, traders ko doosre technical indicators aur market conditions ka bhi dhyan rakhna chahiye. Iske alawa, risk management ka bhi khaas khayal rakhna zaroori hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Shark Candlestick Pattern :

Shark candlestick pattern ek bearish reversal pattern hai. Ismein price initially upar jata hai, phir neeche aata hai aur trend continue hota hai. Shark candlestick pattern ko dekhne ke liye, hum price action aur candlestick chart ka istemal karte hain. Ye pattern bearish reversal pattern hai, jisme price initially upar jata hai, phir neeche aata hai aur trend continue hota hai. Is pattern mein, ek upar wali long red candlestick hoti hai, jise hum body kehte hain, aur uske baad kuch chote red candles hote hain, jise hum teeth kehte hain. Ye pattern trend ki continuation ke baad dikhta hai aur bearish momentum indicate karta hai. Is pattern ko samajhne ke liye, aapko candlestick chart analysis aur price action ke basic concepts par focus karna chahiye.

Trade with Shark Pattern :

Shark candlestick pattern ke sath trade karne ke liye, aapko kuch steps follow karne honge:

1. Pattern ki identification:

Sabse pehle, aapko shark pattern ko identify karna hoga. Iske liye aap candlestick chart par price action aur pattern recognition ka istemal kar sakte hain.

2. Entry point:

Jab aap shark pattern ko identify kar lete hain, toh aapko entry point decide karna hoga. Entry point usually shark pattern ke completion point ke paas hota hai, jahan price neeche jaane ke baad reversal ka indication deta hai.

3. Stop loss:

Har trade mein stop loss ka hona bahut zaroori hai. Stop loss aapko protect karta hai agar trade against direction move karta hai. Aapko apne risk tolerance ke hisab se stop loss level decide karna hoga.

4. Target price:

Target price ko decide karna bhi important hai. Aapko dekhna hoga ki pattern ke according price kitna neeche jaa sakta hai. Isse aap apne profit target ko set kar sakte hain.

5. Risk management:

Trading mein risk management bahut zaroori hai. Aapko apne trade size ko control karna chahiye aur apne risk tolerance ke hisab se trade karna chahiye.

Yeh steps aapko shark pattern ke sath trade karne mein madad karenge. Lekin trading mein hamesha apne research aur analysis par focus karna zaroori hai.

Characteristics of Shark Pattern :

Shark candlestick pattern ke kuch characteristics hain:

1. Bearish reversal pattern:

Shark pattern ek bearish reversal pattern hai, jiske baad price neeche jaane ka indication deta hai.

2. Initial uptrend:

Is pattern mein price initially upar jata hai, jo ek bullish phase ko indicate karta hai.

3. Long red candle:

Shark pattern mein ek long red candle hoti hai, jise hum body kehte hain. Ye candle uptrend ke baad dikhti hai.

4. Teeth candles:

Shark pattern ke baad kuch chote red candles hote hain, jise hum teeth kehte hain. Ye candles body ke niche dikhte hain.

5. Continuation of trend:

Shark pattern trend ki continuation ke baad dikhta hai aur bearish momentum indicate karta hai.

Yeh characteristics shark candlestick pattern ke important features hai. Inko samajhne se aap is pattern ko better identify kar sakte hain. -

#7 Collapse

Shark Candlestick Pattern:

Shark Candlestick Pattern ek technical analysis tool hai jo financial markets mein istemal hota hai, khaas karke stock market mein. Yeh pattern traders ko market trends aur potential reversals ka pata lagane mein madad karta hai. Iske naam se hi pata chalta hai ki yeh pattern market mein ek "shark" jaise behavior ko represent karta hai, jisme price action ka ek specific arrangement hota hai.

Shark Candlestick Pattern ka sabse important feature hota hai ki isme five distinctive candles shamil hote hain, jo ek particular sequence mein aate hain. Yeh pattern trend reversal ko indicate karta hai, matlab jab market ek direction se dusre direction mein badalne wala hota hai.

Pehla candle is pattern mein "upward thrust" yaani tezi se upar ki taraf move karta hai. Dusra candle bhi upar ki taraf move karta hai, lekin isme thoda consolidation hota hai. Teesra candle downward move karta hai, lekin iski range pehle do candles ki range ke andar rehti hai. Yeh teesra candle shark pattern ka shuruwat hota hai.

Chauta candle neeche ki taraf move karta hai aur pehle teen candles ki range ko cross karta hai. Is point pe traders ko alert hona chahiye kyunki yeh shark pattern ka confirmation hota hai. Aakhir mein, paanchva candle ek strong downward move karta hai, confirming the trend reversal.

Shark Candlestick Pattern ka istemal karne ke liye traders ko market trend aur price action ko dhyan se observe karna padta hai. Is pattern ki identification mein accuracy aur experience ki zarurat hoti hai. Jab yeh pattern identify ho jata hai, toh traders iske signals ko analyze karke apne trading decisions ko shape dete hain.

Yeh pattern market volatility aur uncertainty ko highlight karta hai, jiski wajah se traders ko cautious rehna chahiye. Iske alawa, market conditions, economic indicators, aur global events ka bhi impact shark pattern par hota hai

Iske benefits ke alawa, Shark Candlestick Pattern ke risks ko bhi samajhna zaroori hai. False signals ya incorrect identification hone ki sambhavna hoti hai, isliye traders ko is pattern ke saath aur bhi technical analysis tools ka istemal karna chahiye.

To conclude, Shark Candlestick Pattern ek powerful tool hai jo traders ko market dynamics samajhne mein aur potential trend reversals ko predict karne mein madad karta hai. Lekin, iska istemal karna expertise aur market understanding ki zarurat hai, aur traders ko market risks ko bhi dhyan mein rakhna chahiye.

-

#8 Collapse

What is correlation in forex Analysis

Forex Analysis Mein Correlation:

1. Tafseelat:- Correlation ek statistical concept hai jo batata hai ke do variables (ya financial instruments) ke beech mein kaisa relationship hai, aur agar ek variable change hota hai toh doosre par kya asar hota hai.

2. Forex Trading Mein Correlation:- Forex market mein, correlation traders ke liye ek important concept hai. Yeh batata hai ke do currency pairs ke beech mein kaisa relationship hai.

- Positive correlation ka matlab hai ke dono currency pairs ek saath move karte hain, jabki negative correlation mein ek currency pair ki value badhti hai toh doosre ki ghat ti hai, aur vice versa.

3. Types of Correlation:- Positive Correlation:

- Positive correlation mein, ek currency pair ki value badhti hai toh doosre currency pair ki value bhi badhti hai. Example: EUR/USD aur GBP/USD.

- Negative Correlation:

- Negative correlation mein, ek currency pair ki value badhti hai toh doosre ki ghat ti hai. Example: USD/JPY aur EUR/USD.

4. Kyun Important Hai:- Correlation analysis traders ko help karta hai portfolio ko diversify karne mein. Agar kuch currency pairs positive correlation mein hain, toh ek currency pair par hone wale impact ko doosre pair mein compensate kiya ja sakta hai.

- Risk management mein bhi correlation ka istemal hota hai. Agar kuch currency pairs strongly correlated hain, toh trader ek hi direction mein heavy exposure se bach sakta hai.

5. Kaise Calculate Karein:- Correlation coefficient (-1 se +1 tak ka ek number) se measure kiya jata hai.

- +1 ka matlab hai perfect positive correlation, -1 ka matlab hai perfect negative correlation, aur 0 ka matlab hai koi correlation nahi.

6. Challenges:- Market conditions badalne ke sath correlation bhi change hota hai, isliye regularly update karna important hai.

- Sudden events ya market shocks bhi correlation ko temporarily affect kar sakte hain.

7. Example:- Agar USD/JPY aur EUR/USD mein negative correlation hai aur USD/JPY badhta hai, toh EUR/USD ghat sakta hai. Yeh traders ko help karta hai anticipate karne mein ki kaise market react karega.

8. Conclusion:- Correlation analysis ek important tool hai forex trading mein, lekin iska istemal prudent taur par karna chahiye. Dusre analysis tools aur market conditions ke saath milake traders ko sahi trading decisions lene mein madad karta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Shark Candlestick Pattern Candlestick patterns, jo ke technical analysis mein istemal hotay hain, tijarati charts par moujood data ko analyze karne ke liye istemal hotay hain. In patterns ki madad se traders market trends aur price movements ko samajhne mein madad milti hai. Shark candlestick pattern ek aham aur mufeed pattern hai jo ke traders ke liye mukhtalif market scenarios mein nishandahi karne mein madadgar hai.

Shark Candlestick Pattern ki Pehchan

Shark candlestick pattern ek reversal pattern hai jo ke price trend ke badalne ki nishandahi karta hai. Is pattern mein teen mukhtalif candlesticks ka istemal hota hai jo ke price trend ki mukhtalif stages ko darust karte hain.

Pehla Candlestick

Pehla candlestick ek lambi bearish candle hoti hai jo ke uptrend mein bani hoti hai. Is candle ki lambai aur chaudi hoti hai jo ke market mein behtar selling pressure ko darust karti hai. Isi tarah, yeh candle uptrend ki thakan ya mukhtalif technical levels ki takleef ko darust karta hai.

Doosra Candlestick

Doosri candlestick ek lambi bullish candle hoti hai jo ke pehli candle ke neechay tak giray hoti hai. Is candle ki wajah se price kaafi had tak wapas chali jati hai, lekin yeh puri tarah se pehli candle ko cover nahi karti. Yeh candle bearish pressure ko kam karti hai aur price ko wapas upar le jaati hai.

Teesra Candlestick

Teesri candlestick ek lambi bearish candle hoti hai jo ke doosri candle ko exceed karti hai aur pehli candle ki taraf se shuru hoti hai. Yeh candle price ko neeche le jaati hai aur bearish trend ko darust karti hai. Isi tarah, yeh price mein girawat ki takmeel ko darust karti hai aur uptrend ka mukammal khatma hota hai.

Candlestick Pattern ki Ahmiyat

Shark candlestick pattern ki ahmiyat traders ke liye is liye hai ke iski madad se wo market ke trend reversals ko pehchaan sakte hain. Jab market ek direction mein lambay arsay se chal rahi hoti hai aur phir uska trend badal jata hai, to traders ko is badalne ka pata lagana zaroori hota hai taake wo apne trading strategies ko mutabiq adjust kar sakein.

Trend Reversals ki Pehchaan

Shark candlestick pattern traders ko trend reversals ki early signs provide karti hai. Jub pehli bearish candle ke baad doosri bullish candle aur phir teesri bearish candle aati hai, to yeh indicate karta hai ke trend reversal hone ki sambhavna hai.

Entry aur Exit Points

Is pattern ki madad se traders ko entry aur exit points ka pata chalta hai. Agar uptrend mein shark candlestick pattern dikh raha hai to traders selling positions par enter kar sakte hain. Aur agar downtrend mein yeh pattern nazar aata hai to traders buying positions par enter kar sakte hain.

Stop Loss aur Risk Management

Shark candlestick pattern traders ko stop loss levels ka tay karna asaan banati hai. Jab trend reversal ka indication milta hai, to traders apni positions ko protect karne ke liye stop loss levels set kar sakte hain.

Confirmation ke Liye aur Technical Indicators

Traders ko shark candlestick pattern ke saath aur bhi technical indicators jaise ke moving averages, RSI, aur MACD ka istemal karke confirmations leni chahiye. Is tarah, wo apne trading decisions ko aur bhi mazboot bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:23 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим