What is the Price Action Trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Price Action Trading Price Action Trading ek trading approach hai jo market ki movement ko analyze karne par focus karta hai, aur isme indicators ya oscillators ka kam istemal kam hota hai. Iski mool philosophy yeh hai ke price movement hi sab kuch bata sakta hai market ke bare mein, aur iske jariye traders market trends ko predict kar sakte hain. Price Action Trading ka mukhya dhyan candlestick patterns, price patterns, aur support/resistance zones par hota hai. Traders price charts par dhyan dete hain aur samajhte hain ke kis tarah ke price movements ho rahe hain. Is approach mein, traders price ke raw data par adharit decisions lete hain, aur unhe market ke current mood ka andaza hota hai. Candlestick patterns Price Action Trading ka ek ahem hissa hain. Inmein kuch common patterns hote hain jaise ki dojis, engulfing patterns, aur pin bars. Har ek pattern kuch khaas information provide karta hai jise traders apne decisions mein istemal kar sakte hain. For example, ek doji candlestick indicate kar sakta hai ke market indecision mein hai aur future movement uncertain hai. Price Patterns bhi ek important aspect hain Price Action Trading ka. Inmein kuch common patterns hote hain jaise ki head and shoulders, double tops, aur double bottoms. In patterns ki madad se traders future price movements ka anuman lagate hain. Support aur resistance zones bhi Price Action Trading mein crucial hote hain. Yeh levels hote hain jahan par market mein buying ya selling ka zor hota hai. Traders in levels ko identify karke, trend reversal ya trend continuation ke chances ko samajh sakte hain. Ek bada fayda Price Action Trading ka yeh hai ke isme traders ko apne decisions ke liye bahut saara information milta hai. Iske alawa, yeh approach subjective hota hai, matlab ke har trader apne tareeke se price action ko interpret karta hai. Har trader ki analysis alag hoti hai aur isme flexibility hoti hai. Price Action Trading ka ek important concept hai "Naked Trading." Isme traders ke paas koi bhi indicator ya tool nahi hota, sirf price charts ka istemal hota hai. Naked Trading mein traders direct price action ko padh kar trading decisions lete hain. Lekin, yaad rahe ke Price Action Trading bhi apne limitations ke saath aata hai. Market dynamics complex hote hain aur kai baar sirf price action par bharosa karke sahi decisions lena mushkil ho sakta hai. Isliye, har trader ko apne strategy ko develop karte waqt apne risk tolerance ke hisab se customize karna chahiye. In conclusion, Price Action Trading ek approach hai jisme traders price charts aur unke patterns ko study karke trading decisions lete hain. Yeh ek flexible aur subjective approach hai jo traders ko market ke asli mood ko samajhne mein madad karta hai -

#3 Collapse

Assalamu Alaikum Dosto!Price Action

Agar aap charts par indicators ke seekhne se pareshan hain, to price action ki knowledge aapko asaan aur zyada asar-dar tareeqe se market ko dekhne me madadgar sabit ho sakti hai. Haalaanki, forex trading mein traders aksar alag alag tools ka istemal karte hain, main aapko sabse classic tareeqa batane ja raha hoon. Yeh ek price action trading system hai. Forex mein price action trading ek aisi trading method hai jo sirf peechle price ke behaviour ko analyze karne par mabni hai. Iska matlab hai ki ek trader market ke halat ko ek khula chart dekh kar bina kisi aur indicator ya oscillators ka istemal kiye analyze karta hai. Yeh market ko evaluate karne ka sabse asli tareeqa hai, aur maine paya hai ki yeh trading karne ka sabse asar-dar tareeqa hai. Price Action trading hamein darja zel cheezein karne me madad karti hai:- Trend Pehchan

Price action trading strategy mein sabse ahem amal trendon ko pehchanne ka hota hai. Aapne shayad suna hoga ki "Trend aapka saathi hai." Aur yeh bilkul sahi hai. Trend sach mein aapka saathi hai. Aap hamesha koshish karenge ki jab mauka mile to prevailing trend ke mutabiq trading karen. - Consolidations Se Bachna

Price consolidation tab hoti hai jab price ek clear direction ke bina range me chala ja raha hai. Iska matlab hai ki forex pair ki price badh rahi ya ghat rahi nahi hai. Yeh zyadatar trading opportunities nahi deti hai. Aksar traders ke liye ek acha trading qaidah yeh ho sakta hai ki jab price consolidate ho rahi hai, to market se dur rahein, taki false signals se bacha ja sake. - Trend Reversals Dhoondhna

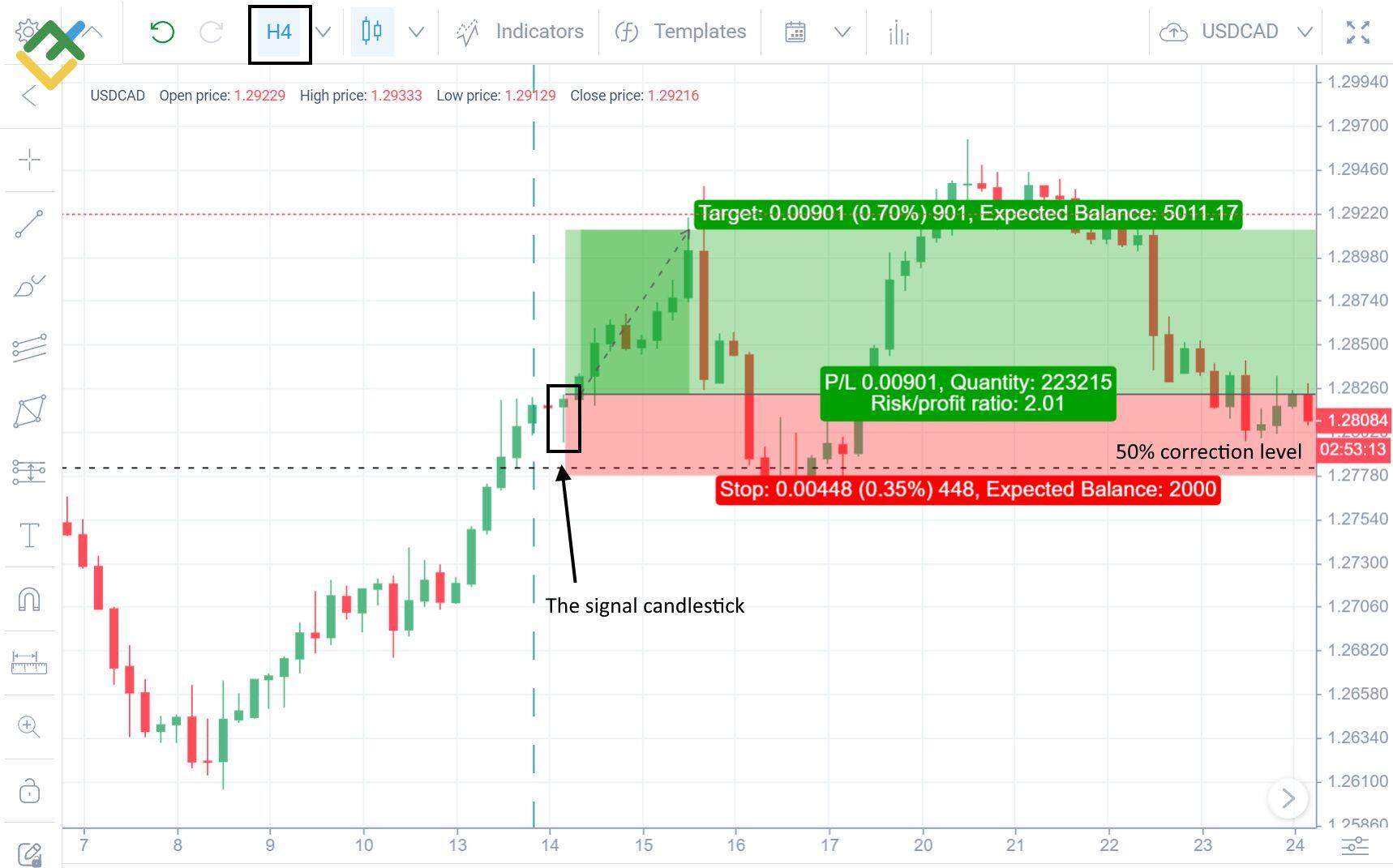

Kuch traders tab currency pairs par attack karte hain jab trend lines exhaust hone lage hain. Iska karan yeh hai ki trend reversals aapko trend ke shuruaat par market me hone ka mauka dete hain. Reversals dhoondhte waqt traders koshish karte hain ki crowd se pehle market me dakhil ho jayein, taki aise trades par potential reward to risk ratio ko badhaya ja sake. - Corrections Ki Tafseelat

Trend correction tab hoti hai jab price prevailing trend ke mukhalif direction me move kar rahi hai. Aam taur par correction ya retracement sloping trendline se bounce kar leti hai, jo trend ki dobara shuruaat ko confirm kar sakta hai. Corrections aksar regular trend movement se kam price movement ke saath move karti hain. Isi dauran, corrections aksar regular trend movement ke samaan samay me banti hain. Dusri baat, agar aap correction trading kar rahe hain, to aapki position ek regular trend movement ke samaan samay me complete hogi. Yeh market ke andar harmonic relationships par mabni hai. Kuch traders ka khayal hai ki correction trend movements se bachna chahiye kyun ki actual trend movement significantly behtar mauke deti hai. Lekin dusri taraf, aise traders hain jo counter trend trading pasand karte hain. Agar aap market timing ko control kar sakte hain, to aap payenge ki corrections trading bhi kaafi munafa de sakti hai. Lekin am taur par, main manta hoon ki aapko agar abhi tak anubhavi trader nahi hain, to corrections trading karne ki koshish nahi karni chahiye.

Important Tools for Price Action

Price action trading strategy ke framework mein aam taur par indicators ka istemal nahi hota, price action traders alag alag chart patterns par bharosa karte hain. Main aapko market me payi jane wali kuch sabse mashhoor chart patterns se parichay kar raha hoon. Lekin various chart patterns par pahunne se pehle, chaliye thoda sa Support aur Resistance levels ka concept parichay kar lein.- Support aur Resistance

Support aur resistance on-chart levels hote hain, jahan se price ka reaction ummid ki jati hai. Yeh aksar psychological levels hote hain jahan investors ki rai milne ke zyada chances hote hain. Yeh levels chart par aasani se dekhe ja sakte hain. Jab aap dekhte hain ki price kai bar ek certain level se guzarne ki koshish kar rahi hai lekin wahan khareedne ya bechne ki dabav se milti hai, to aapke paas ek psychological level hota hai. Agar price is level ki taraf bullish direction me badh rahi hai, to yeh ek resistance hota hai. Aur dusri taraf, agar price bearish direction me is level ki taraf badh rahi hai, to yeh ek support hota hai. Yaad rakhein ki har support ko tod kar phir se resistance bana diya ja sakta hai. Waise hi resistance ke liye bhi yeh baat lagu hoti hai. Ise traders support aur resistance levels ko price action trading me dakhil hone aur bahar nikalne ke liye entry aur exit points set karne ke liye istemal karte hain. - Trendlines

Trend lines ek horizontal support ya resistance lines ke tarah kaam karte hain. Farq yeh hai ki ek trend line inclined hoti hai. Ek trend ko confirm karne ke liye hamein kam se kam do tops ya bottoms ko ek line se jodna hoga. Is line ki jariye trend ka potential hota hai. Har agli price movement is established trendline se bounce karne ka zyada chance rakhti hai. Traders trendlines ko istemal kar sakte hain jab price usse bounce karta hai ya jab price trendline ke nazdik pahunchta hai, to existing position se bahar nikalne ke liye istemal kar sakte hain. - Channels

Price channels bhi trend line ki tarah kaam karte hain. Farq yeh hai ki channels ek aur level ke saath hoti hain, jo trend ke saath ek corridor banata hai. Jab hum chart par ek channel confirm karte hain, to hume ummid hoti hai ki price upper aur lower level of the channel se bounce karegi jaise ping pong ball. Yeh price action trader ko saaf dikha deta hai ki price kab direction badlegi aur kitne der tak us direction me jayegi. Iske alawa, adhik anubhavi traders actual trend movement ke alawa trend corrections bhi trade karne ke liye channels ka istemal kar sakte hain.

Candlestick Patterns

Candle patterns ka istemal price action traders ke liye ek bahut aam technique hai. Candlestick patterns charts par mukhtalif candle formations hote hain, jo alag-alag price potential ke isharon ko bata sakte hain. Chaliye kuch aam candle patterns par ek nazar dalte hain.- Doji

Doji candle chart par pehchanne me kaafi asan hai. Doji tab hoti hai jab price ek certain level par candle open karta hai aur phir usi level par candle close karta hai. Is tarah, Doji ek wick ke saath ek dash ki tarah dikhta hai. Doji candle market me uncertainty ko darust karata hai, aur kayi baar yeh trend ke baad exhaust hone ke baad exhaustion point ka ishara deta hai. - Hammer aur Hanging Man

Yeh do candles bilkul same dikhte hain. Inme ek lambi bearish wick aur ek head hota hai. Lekin in dono candles mein farq yeh hai ki Hammer ek bearish trend ke ant me hota hai aur potential reversal ka ishara karta hai, jabki Hanging Man aksar bullish trend ke ant me paya jata hai, jise ane wale reversal ka ishara hota hai. - Inverted Hammer aur Shooting Star

Inverted Hammer aur Shooting Star bhi bilkul same dikhte hain. Aur yeh dono Hammer aur Hanging Man ke bilkul ulte-mirrored image hote hain. Inme ek lower body aur ek lambi bullish candle wick hoti hai. Inverted Hammer ka istemal Hammer ki tarah hota hai. Jab aap ise bearish trend ke ant me paate hain, to aap ummid karte hain ki price badhegi. Ussi tarah, agar aap ek bullish trend ke ant me Shooting Star dekhte hain, to aapko price mein ghatne ki ummid hai.

Chart Patterns

Chart patterns mukhtalif formations aur figures hote hain jo chart par dikhne wale hote hain aur potential trend continuations aur reversals ke isharon ko dete hain. Chart patterns ki ek visheshta yeh hai ki pattern ko analyze karke hum trade ke liye potential targets set kar sakte hain. Kayi bar, chart patterns forex pair ko formation ke size ke barabar ek amount se move karne ki potential rakhte hain. Ise aksar ek measured move ke roop me refer kiya jata hai. Chart patterns ke success rates 60% - 65% ke upar bhi ho sakti hain, depending on the chart pattern and how it is traded. Ab main kuch sabse reliable chart patterns par baat karne wala hoon:- Double Top aur Double Bottom

Double top aur double bottom reversal chart patterns hote hain, jahan trend ke ant me price do tops (ya bottoms) lagbhag ek hi level par banata hai. In dono tops ke beech ka bottom signal level hota hai. Jab price signal level ko todta hai, hum formation ko confirm samajhte hain aur uske mutabiq ek position kholte hain. Phir hum market ko follow karte hain jab tak hum formation ke size ke barabar ek target tak pahunchte hain. Double bottom formation bhi waisa hi dikhta hai, lekin ulta. Yeh bearish trend ke ant me dikh sakta hai aur price movement ko double top ki tarah reverse kar sakta hai. Isi tarah, yeh double top formation ki tarah hi trade kiya jana chahiye, lekin opposite direction me. - Head and Shoulders aur Inverted Head and Shoulders

Head and shoulders ek reversal chart pattern hai, aur trade karne ke liye sabse bharosemand chart patterns me se ek hai. Head and shoulders formation tab hoti hai jab price teen spikes create karta hai, is order me - ek lower, ek higher aur ek aur lower, lagbhag pehle wale ke level par. Traders is formation ko head and shoulders kehte hain kyunki, aapne sahi samjha, yeh sach mein ek head aur shoulders ki tarah dikhta hai. Head and shoulders aksar bullish trend ke ant me dikhate hain. Ussi tarah, inverted head and shoulders aksar bearish trend ke ant me paye jate hain. Dono formations bilkul same dikhte hain, lekin ulte-mirrored image ki tarah. Jab aapko ek head and shoulders formation milta hai, to aapko ek signal line, jo ki neck line kehte hain, set karni chahiye. Neck line straight line hoti hai, jo dono bottoms ko jodti hai aur head ke beech create hoti hai. Jab price neck line ko todta hai, aap ek position kholte hain aur formation ke size ke barabar ek price movement ko target karte hain. Inverted head and shoulder formation bhi waisa hi kaam karta hai, lekin bearish trend ke ant me dikh sakta hai, jise bullish direction me reverse karta hai. - Rising Wedge aur Falling Wedge

Rising wedge tab hoti hai jab price higher tops aur even higher bottoms ke saath close hoti hai. Aur falling wedge tab hoti hai jab price lower bottoms aur even lower tops ke saath close hoti hai. Rising wedge falling wedge ki tarah hi potential rakhti hai, lekin opposite direction me. In dono formations ek dusre ke mirror image hote hain. Rising aur falling wedge overall trend ke sambandh me dikhne ke baad trend reversals ya trend confirmations ho sakte hain. Agar aapko bullish trend ke baad rising wedge milta hai, to yeh aksar price ko reverse hone ki ummid deta hai. Ussi tarah, agar aapko bearish trend ke dauran falling wedge dikhta hai, to yeh trend ko reverse hone ki ummid hoti hai. Agar yeh aapko confusing lag raha hai, to bas yaad rakhein ki rising wedge aksar ane wale bearish movement ki taraf ishara karta hai, jabki falling wedge mein aksar price badhne ki ummid hoti hai. Yehi strategy rising wedges ke liye lagu hoti hai. Agar rising wedge ek price increase ke baad ban jati hai, to yeh reversal pattern hoti hai aur humein price drop ki ummid hoti hai. Ussi waqat, agar falling wedge bullish trend ke baad dikh rahi hai, to yeh formation trend confirmation character rakhti hai.

- Trend Pehchan

-

#4 Collapse

Price ActionPrice action trading ek popular trading strategy hai jo traders dwara market ke price movements ko analyze karne ke liye istemal ki jati hai. Ismein traders sirf price charts aur historical price movements ka use karte hain, aur kisi bhi technical indicator ya external data ka use nahi karte hain.

Yahan kuch key points hain price action trading ke bare mein:

- Price Charts: Price action traders price charts ka use karte hain, jaise ki candlestick charts, bar charts, ya line charts. In charts par, har candle ya bar ek specific time period ke price movement ko represent karta hai.

- Patterns aur Trends: Price action traders price charts par patterns aur trends ko identify karte hain, jaise ki support aur resistance levels, chart patterns (jaise ki head and shoulders, double tops, double bottoms), aur trend lines. In patterns aur trends ke through, traders market ke future movements ka prediction karne ki koshish karte hain.

- Candlestick Analysis: Candlestick patterns ka use bhi price action trading mein common hai. Traders candlestick formations ko analyze karte hain taki wo market sentiment aur price direction ka insight gain kar sakein. Kuch popular candlestick patterns include doji, hammer, engulfing patterns, aur pin bars.

- No External Indicators: Price action traders kisi bhi external indicator ka use nahi karte hain. Instead, unka focus hota hai sirf price movements aur price action patterns par. Isse traders directly market ki behavior aur sentiment ko analyze kar sakte hain.

- Simple aur Clear Strategy: Price action trading ka approach simple aur clear hota hai. Traders ko complex indicators ya formulas ki zarurat nahi hoti, instead unka focus hota hai price action ke signals aur patterns par.

- Risk Management: Risk management price action trading mein bahut important hota hai. Traders stop-loss orders aur position sizing ka use karte hain taki losses ko minimize kiya ja sake aur capital preservation ko prioritize kiya ja sake.

Conclusion

Overall, price action trading ek versatile aur effective trading strategy hai jo traders ko market ke movements ko analyze karne aur trading decisions lene mein help karta hai. Ismein traders market ke dynamics aur price patterns ko samajhne par zyada dhyan dete hain, rather than relying on external indicators.

-

#5 Collapse

Price Action Trading ek tareeqa hai jis mein traders sirf market ki current price movement aur uske patterns ko dekhte hain. Is tareeqe mein kisi bhi technical indicator ka istemaal nahi hota, balki sirf purani price data aur chart patterns par zor diya jata hai. Ye ek popular aur effective trading methodology hai jo aam tor par forex, stocks, commodities, aur cryptocurrencies mein istemaal kiya jata hai.

1. Price Action Trading Kya Hai?

Price Action Trading ka matlab hota hai ke traders sirf price movement ki bunyadi aur asalat ko samajhte hain, bina kisi aur indicator ke istemaal kiye. Is tareeqe mein traders market ke samajhne ki koshish karte hain, jisse unhe future price ki direction ka andaza lagaya ja sake.

2. Price Action Trading Ka Itihas

Price Action Trading ka concept purane waqt se maujood hai, lekin iski popularity recent years mein barhti rahi hai. Iska asal concept Charles Dow ke principles par mabni hai, jo unho ne stock market analysis ke liye diye the.

3. Price Action Trading Ke Fawaid

Price Action Trading ka sab se bara faida yeh hai ke isme kisi bhi complicated indicator ki zarurat nahi hoti. Traders sirf price charts par amal karke trading decisions lete hain, jo unhein market ki asal halat ko samajhne mein madad karta hai.

4. Price Action Trading Ka Istemaal Kahan Hota Hai

Price Action Trading aam tor par forex, stocks, commodities, aur cryptocurrencies mein istemaal hota hai. Is tareeqe ka istemaal har woh market mein kiya ja sakta hai jahan price movement ho.

5. Price Action Trading Ke Basic Concepts

Price Action Trading ke basic concepts mein price bars, candlestick patterns, aur chart patterns shaamil hain. Traders in concepts ko samajh kar market ki movements ko analyze karte hain.

6. Price Bars

Price bars market ki movement ko darust karne ka aik tareeqa hain. In mein high, low, open, aur close prices shamil hote hain, jo traders ko market ki direction aur volatility ka andaza dete hain.

7. Candlestick Patterns

Candlestick patterns bhi price action traders ke liye ahem hote hain. Ye patterns bullish, bearish, aur reversal signals provide karte hain, jin par traders apne trading decisions base karte hain.

8. Chart Patterns

Chart patterns market ki trend aur reversals ko identify karne ke liye istemal kiye jate hain. In mein head and shoulders, triangles, aur flags shaamil hote hain, jo traders ko future price direction ka andaza lagane mein madad karte hain.

9. Price Action Trading Strategies

Price Action Trading ke kai strategies hain, jaise ki trend following, range trading, aur breakout trading. Har strategy apne tareeqe aur rules par kaam karti hai, lekin un sab ka maqsad market ki movements ko samajhna aur profit kamana hota hai.

10. Price Action Trading Ke Tools

Price Action Trading ke liye kuch tools bhi available hain, jaise ki Fibonacci retracements aur trendlines. Ye tools traders ko price action analysis mein madad karte hain aur unhein trading setups dhoondhne mein help karte hain.

11. Price Action Trading Aur Risk Management

Price Action Trading mein risk management ka ahem kirdar hota hai. Traders apne trades ko manage karte hue apni positions ko protect karte hain aur apne losses ko minimize karne ki koshish karte hain.

12. Price Action Trading Mein Success Ke Factors

Price Action Trading mein success ke liye patience, discipline, aur consistent analysis zaruri hote hain. Traders ko market ko samajhne aur apne trading plan ko follow karne par zor dena chahiye.

13. Price Action Trading Ka Mustaqbil

Price Action Trading ka mustaqbil bright hai, kyun ke is tareeqe ka istemaal aam tor par traders ke darmiyan popular hota ja raha hai. Is tareeqe ki simplicity aur effectiveness ki wajah se, iska istemaal mukhtalif markets mein barhta ja raha hai. -

#6 Collapse

Price action trading ek trading methodology hai jo traders ko market ke price movements ke base par trading karne ka tareeqa sikhaata hai, bina kisi indicators ya oscillators ke istemal kiye. Is approach mein traders price charts ko observe karte hain aur unke patterns, trends, aur price behavior ko analyze karte hain taake trading decisions liya ja sake.

Yahan kuch key points hain jo price action trading ke baare mein hain:

Price Charts

Price action trading mein traders price charts ka istemal karte hain, jaise ke candlestick charts ya bar charts. Unhone chart par price movements ko visualize karte hue trendlines, support aur resistance levels, aur price patterns jaise ke double tops, head and shoulders, aur triangles ko identify karte hain.

No Indicators

Price action traders indicators ya oscillators ka istemal nahi karte. Unka focus seedha price movement aur uski interpretation par hota hai. Is tarah se, price action traders market ki asli harkat ko samajhne ki koshish karte hain.

Candlestick Patterns

candlestick patterns kaafi ahem hota hai price action trading mein. Traders candlestick patterns jaise ke doji, engulfing, aur pin bars ko recognize karte hain, jo unhe potential reversals ya continuation ke signals provide karte hain.

Support aur Resistance

Price action traders support aur resistance levels ko bhi importance dete hain. Woh market mein kisi bhi level par price ke rejections aur breakouts ko observe karte hain taake market ke potential turning points ko identify kar sakein.

Trend Analysis

Trend analysis bhi price action trading ka ek important hissa hai. Traders trendlines aur price swings ko analyze karte hain taake current trend ka pata lag sake aur us direction mein trading decisions le sakein.

Risk Management

Risk management price action trading ka ek crucial aspect hai. Traders apne trades ke liye tight stop-loss orders aur proper position sizing ka istemal karte hain taake apne losses ko minimize kar sakein.

Overall, price action trading ek flexible aur effective trading methodology hai jo traders ko market ke asli dynamics ko samajhne mein madad karta hai. Is tarah se, traders apne trading strategies ko refine karke consistent aur profitable trading kar sakte hain.

-

#7 Collapse

What is the Price Action Trading

Price Action Trading: Keemat Amal Karne Ki Tehqiqat

Price Action Trading ek trading strategy hai jo sirf security ke recent price movements pe focus karta hai, bina kisi external indicator ke. Ye approach traders ko market ke dynamics ko samajhne mein madad karta hai, basing decisions on pure price movements and patterns rather than relying on lagging indicators. Yeh trading method bahut versatile hai aur har market condition mein kaam karta hai. Chaliye isko detail mein samajhte hain:

1. Introducing Price Action Trading (Price Action Trading Ka Tareef)

Price Action Trading ka maqsad market ke historical price movements aur patterns ko samajh kar trading decisions lena hai, jaise ke kisi security ka price chart par candlestick patterns, price ranges, aur support/resistance zones dekhna.

2. Price Action Analysis Techniques (Keemat Amal Tehqiqat Ke Tareeqay)

a. Candlestick Patterns (Shama Patterns): Candlestick patterns, jaise ke Doji, Hammer, aur Shooting Star, market sentiment ko reflect karte hain aur potential price reversals ya continuations ko indicate karte hain.

b. Support and Resistance (Madad aur Mukhalfat): Support aur resistance levels, jahan price historically bounce hoti hai, traders ko potential entry aur exit points provide karte hain.

c. Price Patterns (Keemat Patterns): Price patterns, jaise ke Head and Shoulders aur Double Tops/Bottoms, long-term trend changes ko anticipate karne mein madad karte hain.

3. Trading Strategies (Trading Strategies)

Price Action Trading ke kai saare strategies hain, jinmein se kuch pramukh hain:

a. Trend Following (Raasta Chalna): Is strategy mein traders current trend ke sath trade karte hain, jaise ke higher highs aur higher lows ke patterns par.

b. Range Trading (Hudood Trading): Yahan traders price ke specific range mein trade karte hain, support aur resistance levels ke beech.

c. Breakout Trading (Tutne Wale Keemat Mein Trading): Breakout trading mein traders price ke significant levels ke tutne par enter karte hain, jisse trend ka continuation ya reversal dekha ja sakta hai.

4. Advantages of Price Action Trading (Price Action Trading Ke Fawaid)

a. Simple aur Clear Signals (Sada aur Wazeh Signals): Price Action Trading traders ko clear entry aur exit points provide karta hai, bina kisi complicated indicator ke.

b. Adaptable to Different Markets (Mukhtalif Markets Ke Liye Laazmi): Ye approach har market condition mein kaam karta hai, whether it's trending, ranging, ya volatile.

5. Conclusion (Nateeja)

Price Action Trading ek powerful aur effective trading approach hai jo traders ko market ke asal dynamics samajhne mein madad karta hai. Lekin, ismein bhi practice aur experience ki zarurat hoti hai, taake traders sahi aur samajhdar decisions le sakein.

-

#8 Collapse

**Price Action Trading Kya Hai?**

Price action trading ek trading approach hai jo market ke price movements aur patterns ko analyze karke trading decisions lene par focus karta hai. Is technique mein technical indicators ki bajaye price movements ko hi primary source of information mana jata hai. Price action trading ka maqsad market ke behavior ko samajhna aur uske basis par profitable trades execute karna hota hai. Aayiye dekhtay hain ke price action trading kya hai aur isse kaise effectively use kiya ja sakta hai.

**Price Action Trading Ki Pehchaan:**

1. **Price Movements Aur Patterns:**

- Price action trading mein traders market ke price movements, trends, aur patterns ko analyze karte hain. Yeh movements charts par candlestick patterns, support and resistance levels, aur trendlines ke through visualized hote hain. Price action traders market ke past price movements ko dekh kar future price directions aur potential reversals ka prediction karte hain.

2. **No Indicators Approach:**

- Price action trading indicators aur lagging tools ki bajaye price movements par focus karta hai. Traders chart patterns, price levels, aur market structure ko directly analyze karte hain bina kisi additional indicators ke. Yeh approach traders ko market ki true behavior aur dynamics ko samajhne mein madad karta hai.

**Price Action Trading Ka Use:**

1. **Support Aur Resistance Levels:**

- Support aur resistance levels price action trading mein important roles play karte hain. Support level woh price point hota hai jahan se price ne multiple times bounce kiya hota hai, aur resistance level woh price point hota hai jahan se price ne multiple times reverse kiya hota hai. Yeh levels future price movements aur potential reversals ko predict karne mein madadgar hote hain.

2. **Candlestick Patterns:**

- Candlestick patterns price action trading mein commonly used patterns hain. In patterns ka analysis price trends aur market sentiment ko samajhne mein help karta hai. Kuch popular candlestick patterns hain: Doji, Hammer, Engulfing Pattern, aur Shooting Star. In patterns se traders market ke reversal points aur trend continuation signals ko identify karte hain.

3. **Trendlines Aur Channels:**

- Trendlines aur channels price action trading mein trends ko visualize karne ke liye use kiye jate hain. Trendlines price ke highs aur lows ko connect karti hain aur market ke current trend ko depict karti hain. Channels price ke high aur low points ke beech ka range define karti hain aur potential breakout aur breakdown points ko identify karne mein madad karti hain.

4. **Price Patterns:**

- Price patterns jaise Head and Shoulders, Double Top, aur Double Bottom price action trading mein significant hote hain. Yeh patterns price trends ke reversals aur continuation signals ko indicate karte hain. Traders in patterns ka use karke potential trading opportunities ko spot karte hain.

**Advantages Aur Disadvantages:**

1. **Advantages:**

- Simplicity: Price action trading indicators ki dependency ko kam karta hai aur charts par price movements par focus karta hai.

- Flexibility: Yeh approach kisi bhi market condition aur time frame par apply kiya ja sakta hai.

- Clear Signals: Price action trading direct price movements ko analyze karta hai, jo trading signals ko clearer aur more reliable banata hai.

2. **Disadvantages:**

- Subjectivity: Price action trading subjective hota hai aur traders ke interpretations alag ho sakte hain.

- Requires Experience: Effective price action trading ke liye experience aur practice zaroori hoti hai.

**Conclusion:**

Price action trading ek effective approach hai jo market ke price movements aur patterns ko analyze karke trading decisions lene par focus karta hai. Support aur resistance levels, candlestick patterns, trendlines, aur price patterns is technique ke key components hain. Is approach se traders market ke true behavior aur trends ko samajh kar profitable trades execute kar sakte hain. Lekin, is technique ko effectively use karne ke liye practice aur experience zaroori hoti hai. Price action trading ka use karke aap apne trading strategies ko enhance kar sakte hain aur market ke dynamic nature ko better understand kar sakte hain.

-

#9 Collapse

Price Action Trading Kya Hai?

Price Action Trading forex market main aik aisi trading strategy hai jisme trader sirf price movements ko dekh kar apne trading decisions leta hai. Is approach mein koi bhi complicated indicators ya fundamental analysis ka istemal nahi hota, balki sirf charts aur price patterns ka analysis kiya jata hai.

Price Action Trading Ki Basic Samajh

Price Action Trading main trader charts par bani candles ko dekh kar market ke movements ko analyze karta hai. Har candle ek specific time period ke dauran price ke movements ko represent karti hai. Trader in candles ke patterns ko dekh kar predict karta hai ke market aage kis direction mein move karegi. Yeh strategy market ki raw price ko dekh kar kaam karti hai bina kisi external indicators ke.

Candlestick Patterns

Candlestick patterns Price Action Trading ka buniyadi hissa hain. Yeh patterns market ke sentiment ko reflect karte hain. Kuch famous candlestick patterns jo traders use karte hain unmein Doji, Hammer, Engulfing Pattern, aur Shooting Star shamil hain. Har pattern ka apna specific meaning hota hai aur yeh market ke trend reversal ya continuation ka indication dete hain.

Support Aur Resistance Levels

Support aur resistance levels bhi Price Action Trading main bohat important hain. Support level wo price point hota hai jahan se market downtrend ke baad wapas uptrend main jati hai, aur resistance level wo price point hota hai jahan se market uptrend ke baad wapas downtrend main jati hai. In levels ko identify karke trader market ke entry aur exit points decide kar sakta hai.

Trend Analysis

Price Action Trading main trend analysis bhi bohat important hai. Market do tarah ke trends follow karti hai: uptrend aur downtrend. Uptrend main market consistently higher highs aur higher lows banati hai, jabke downtrend main lower highs aur lower lows bante hain. Trend lines ka istemal karke trader trend ko identify kar sakta hai aur uske mutabiq trading decisions le sakta hai.

Price Action Strategies

Price Action Trading ki kai strategies hain jo traders use karte hain. Inmein se kuch common strategies yeh hain:

Pin Bar Strategy

Pin bar strategy main trader ek specific candlestick pattern ko dekh kar trade karta hai jisme ek long tail hoti hai jo price rejection ko indicate karti hai. Yeh pattern trend reversal ka strong indication hota hai.

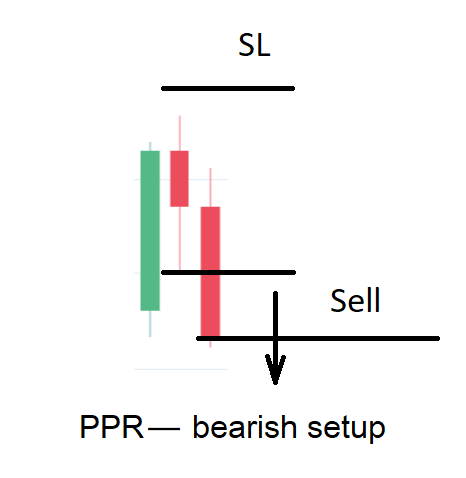

Inside Bar Strategy

Inside bar strategy main trader ek aise pattern ko dekh kar trade karta hai jahan ek choti candle ek badi candle ke andar ban rahi hoti hai. Yeh pattern market consolidation ko indicate karta hai aur breakout ke baad strong trend continuation ya reversal ka signal deta hai.

Breakout Strategy

Breakout strategy main trader support aur resistance levels ke breakout ka intezar karta hai. Jab market in levels ko break karti hai, to strong trend continuation ke chances hote hain aur trader us direction main trade leta hai.

Risk Management

Risk management Price Action Trading ka important hissa hai. Trader ko hamesha apne risk ko manage karna chahiye aur apni capital ka chota hissa hi trade main lagana chahiye. Stop-loss orders ka istemal karna zaroori hai taake unexpected market movements ke case main losses ko limit kiya ja sake.

Advantages of Price Action Trading

Price Action Trading ke kuch advantages hain jo isse popular banate hain

Simplicity

Is strategy main koi bhi complicated indicators ka istemal nahi hota, sirf price charts aur patterns ka analysis kiya jata hai.

Real-Time Analysis

Price Action Trading real-time data par based hoti hai, jo ke market ke current sentiment ko accurately reflect karti hai.

Flexibility

Yeh strategy kisi bhi time frame par use ki ja sakti hai, chahay aap short-term trader hon ya long-term investor.

Disadvantages of Price Action Trading

Price Action Trading ke kuch disadvantages bhi hain jo traders ko pata hone chahiye

Subjectivity

Price patterns ko interpret karna subjective hota hai aur har trader ke analysis alag ho sakti hai.

Market Noise

Short-term charts par market noise ziada hoti hai jo ke false signals generate kar sakti hai.

Note

Price Action Trading forex market main ek powerful strategy hai jo sirf price movements ko dekh kar trading decisions lene par focus karti hai. Is strategy ka buniyadi element candlestick patterns, support aur resistance levels, aur trend analysis hain. Proper risk management aur disciplined approach ke saath, Price Action Trading se consistent profits hasil kiya ja sakta hai. Lekin, trader ko hamesha market ke unpredictable nature ko madde nazar rakhte hue trade karna chahiye aur continuously seekhte rehna chahiye.

-

#10 Collapse

Price Action Trading

Definition

Price Action Trading ek trading strategy hai jo solely price movements aur patterns pe focus karti hai. Is strategy mein traders charts, price trends, aur key support/resistance levels ko analyze karte hain bina kisi technical indicator ya fundamental analysis ke. Price Action Trading traders ko market psychology aur supply-demand dynamics ko better understand karne mein madad deti hai.

Key Concepts of Price Action Trading- Candlestick Patterns: Candlestick charts aur unke patterns ko study karna Price Action Trading ka fundamental part hai. Different candlestick patterns market sentiments aur potential reversals ko indicate karte hain.

- Support and Resistance Levels: Key price levels jahan demand aur supply balance hoti hai. Support levels wo price points hote hain jahan buying interest strong hoti hai, aur resistance levels wo points hote hain jahan selling interest strong hoti hai.

- Trendlines: Trendlines price trends ko identify karne mein madad deti hain. Uptrend mein higher highs aur higher lows aur downtrend mein lower highs aur lower lows ko plot karke trendlines draw ki jaati hain.

- Chart Patterns: Different chart patterns jaise ke head and shoulders, double tops/bottoms, triangles, aur flags ko identify karke price action analyze kiya jata hai.

- Doji: Small body with long upper and lower shadows, indicating indecision.

- Hammer: Small body with long lower shadow, indicating potential bullish reversal.

- Shooting Star: Small body with long upper shadow, indicating potential bearish reversal.

- Engulfing: Larger body engulfing the previous candle, indicating strong reversal.

- Head and Shoulders: Reversal pattern indicating potential trend reversal.

- Double Top/Bottom: Reversal pattern indicating potential double test of resistance/support.

- Triangles: Continuation pattern indicating potential breakout after consolidation.

- Flags and Pennants: Continuation patterns indicating potential continuation of the existing trend.

- Identify Market Structure: Market structure ko samajhna aur trends, support/resistance levels, aur key price levels ko identify karna.

- Analyze Candlestick Patterns: Different candlestick patterns ko analyze karke market sentiment aur potential reversals ko identify karna.

- Draw Trendlines: Trendlines draw karke current price trend aur potential breakout/breakdown levels ko identify karna.

- Identify Chart Patterns: Different chart patterns jaise ke head and shoulders, double tops/bottoms, triangles, aur flags ko identify karna.

- Monitor Key Price Levels: Key support aur resistance levels ko monitor karna aur potential breakouts/breakdowns pe trade setups ko plan karna.

- Set Entry and Exit Points: Entry aur exit points ko based on identified patterns aur key levels define karna. Proper risk management aur stop loss levels ko set karna.

- Simplicity: Price Action Trading ko samajhna aur implement karna relatively simple hai compared to indicator-based

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

**Price Action Trading kya hai:**

1. **Definition:**

- Price Action Trading ek trading strategy hai jismein traders price ke historical aur current movements ko analyse karke trading decisions lete hain. Ismein technical indicators ki bajaye, solely price data aur candlestick patterns ko use kiya jata hai.

2. **Core Concept:**

- Is strategy ka basic principle ye hai ke price movements khud market ke underlying dynamics ko reflect karte hain. Traders price charts aur patterns ko study karke future price direction predict karte hain.

3. **Key Patterns:**

- **Support and Resistance:** Support level wo point hota hai jahan price girti hai aur resistance level wo point hota hai jahan price uthi hai. Ye levels future price movements ko predict karne mein madadgar hote hain.

- **Pin Bar:** Ek candlestick pattern jo ek long wick aur choti body se bana hota hai, jo price reversal ya rejection signal de sakta hai.

- **Inside Bar:** Ye pattern tab banta hai jab ek candlestick purani candlestick ke andar completely fit hoti hai, jo consolidation ya potential breakout ko darshata hai.

4. **Advantages:**

- **Simplicity:** Indicators ki zaroorat nahi hoti, isliye analysis straightforward aur clear hota hai.

- **Flexibility:** Is method ko kisi bhi financial market mein use kiya ja sakta hai, jaise Forex, stocks, commodities, etc.

- **Real-Time Decisions:** Traders real-time price movements ko dekh kar immediate decisions le sakte hain.

5. **Disadvantages:**

- **Subjectivity:** Price patterns aur movements ka interpretation subjective hota hai, aur different traders ek hi pattern ko alag tarike se samajh sakte hain.

- **No Indicators:** Indicators ki kami ki wajah se, trends aur market conditions ka detailed analysis mushkil ho sakta hai.

6. **Risk Management:**

- Risk management is strategy mein bhi important hai. Traders ko stop-loss orders aur position sizing ka use karna chahiye taake potential losses ko control kiya ja sake.

7. **Skill Development:**

- Price Action Trading ko effectively use karne ke liye experience aur skill ki zaroorat hoti hai. Traders ko price patterns aur market dynamics ko samajhne mein practice lagti hai.

8. **Combination with Other Methods:**

- Kuch traders Price Action ko other technical tools aur methods ke sath combine karte hain, jisse trading decisions ki accuracy aur reliability badh jati hai.

In summary, Price Action Trading ek simple aur direct approach hai jo market ke price movements aur patterns par focus karti hai, lekin is method ko effectively use karne ke liye practice aur experience ki zaroorat hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:08 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим