What is the long legged doji pattern?

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is the long legged doji pattern? -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

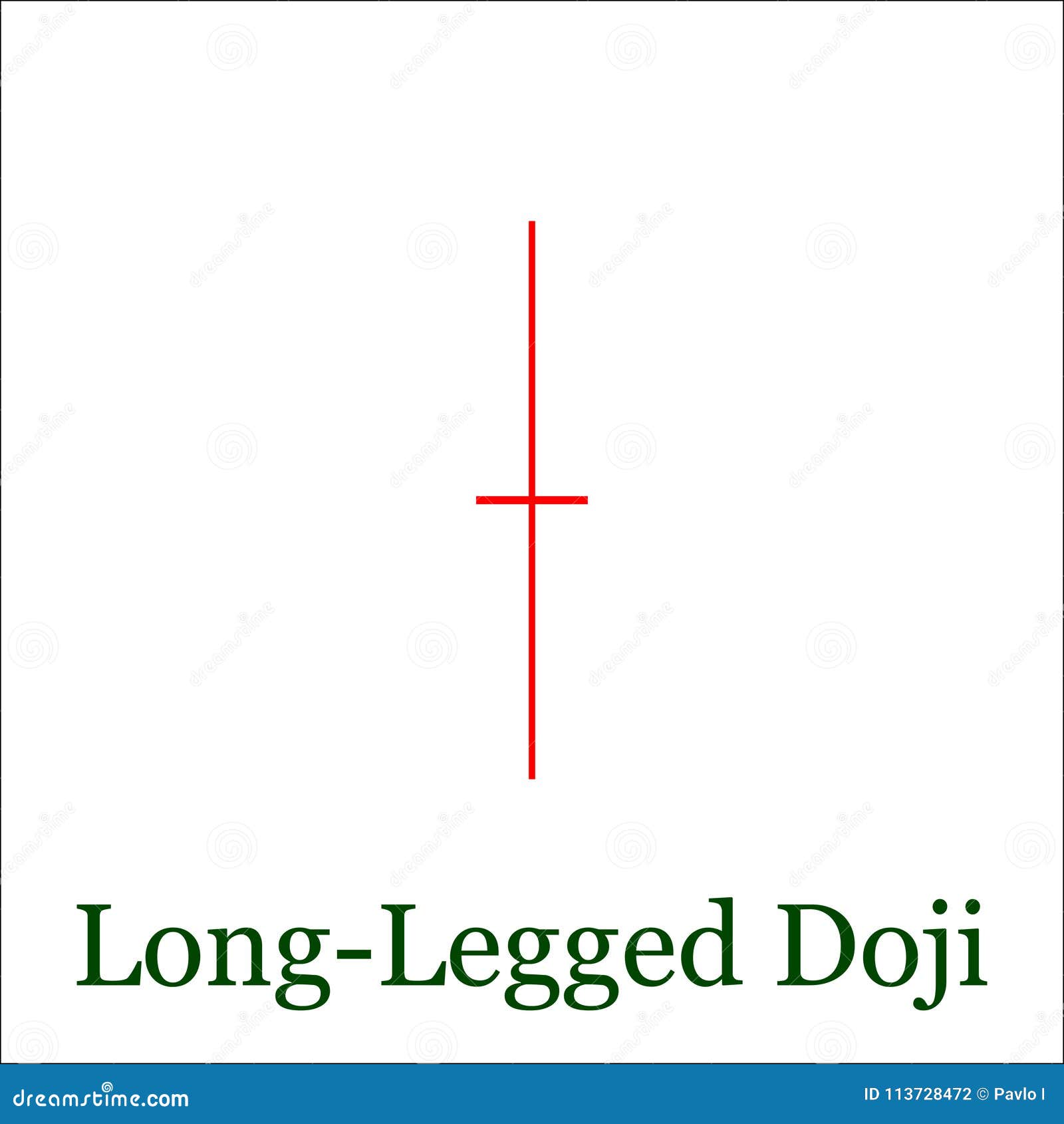

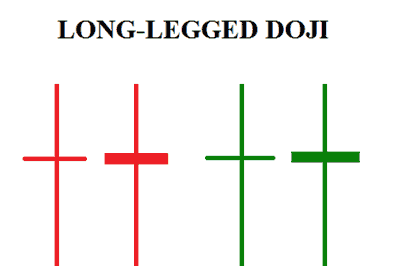

INTRODUCTION TO THE LONG LEGGED DOJI PATTERN : Long Legged Doji pattern technical analysis mein payi jane wali aham candlestick pattern hai. Is mein market ek price level par open hui aur close bhi usAssistant:ho gayi thi, lekin trade session ke dauran bahut zyada volatility aur price movement tha. Is pattern ko "long-legged" isliye kaha jata hai kyunki upper aur lower shadows (ya wicks) candlestick ke body ke mukabale kaafi lambi hoti hain. Isay market mein uncertainty ka sign samjha jata hai kyunki buyers aur sellers ek dusre se takra rahe hain, jiski wajah se koi clear trend nahi hota hai. Traders Long Legged Doji ko trend ki disha mein possible badlav ka sanket samajhte hain. CHARACTERISTICS OF A LONG LEGGED DOJI : Long Legged Doji pattern ko pehchanne ke liye, traders ek candlestick ki talash karte hain jisme opening aur closing prices virtually same hoti hain, jisse ek chota ya bilkul na-koi body banti hai. Is pattern ki mukhya pehchan lambi shadows hai jo body se upar aur neeche tak phailti hain. Upper shadow trading session ka high darshata hai, jabki lower shadow low darshata hai. Shadows ki lambai body se tulna mein Long Legged Doji ko dusre candlesticks se alag karti hai. Jitni lambi shadows hongi, utna hi pattern ahmiyat ki samjhi jati hai. INTERPRETATION OF THE LONG LEGGED DOJI PATTERN : Long Legged Doji pattern market mein uncertainty ka sign samjha jata hai. Iska matlab hai ki buyers aur sellers balanced hain aur koi bhi taraf control mein nahi hai. Iska natija hai ki yeh trend ka reversal ya consolidation phase ka sanket de sakta hai. Traders is pattern ko caution exercise karne aur further confirmation ke liye rukne ka signal samajhte hain. Is pattern ka khaas ahmiyat hota hai jab yeh support ya resistance levels par ya key Fibonacci retracement levels par banaye jata hai. Agar Long Legged Doji strong uptrend ke baad banati hai, toh yeh downside trend reversal ka sanket ho sakta hai, jabki agar yeh downtrend ke baad banati hai, toh yeh upside trend reversal ki possibility ho sakti hai. CONFIRMATION AND ENTRY STRATEGIES FOR THE LONG LEGGED DOJI PATTERN : Long Legged Doji pattern ke nature ke karan, traders trading decisions lene se pehle isay dusre technical indicators ya patterns se tasdeeq karte hain. Woh additional candlestick patterns jaise bearish ya bullish engulfing patterns ki madad se potential reversal ko tasdeeq kar sakte hain. Dusre indicators jaise moving averages, trendlines, ya oscillators jaise Relative Strength Index (RSI) ya Stochastic Oscillator, signal ko support karne ke liye istemal kiye ja sakte hain. Traders confirmation milte hi trade enter karne ka faisla lete hain aur long trade ke liye Long Legged Doji ke low se neeche stop-loss order lagate hain ya short trade ke liye high ke upar. LIMITATIONS AND RISKS OF THE LONG LEGGED DOJI PATTERN : Long Legged Doji pattern market sentiment aur potential reversals ke bare mein valuable insights provide kar sakta hai, lekin iski had aur risks ko dhyan mein rakhna zaruri hai. Pehle toh, jaise ki koi bhi technical indicator, yeh bhi foolproof nahi hota aur false signals de sakta hai. Isliye dusre indicators ki confirmation ka wait karna ahmiyat rakhta hai taaki trading ke success ke chances badhe. Dusre, Long Legged Doji low liquidity wale markets mein ya consolidation periods mein bhi ban sakti hai, jisse iski reliability kam ho sakti hai. Traders ko overall market conditions aur volume levels ko bhi samajhna chahiye, sirf is pattern par rely karne se pehle. Ant mein, risk ko manage karna hi zaruri hai, jiske liye appropriate stop-loss orders set karna aur har trade ke liye overall risk-reward ratio ko consider karna chahiye. Long Legged Doji pattern ek trader ke arsenal ha. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Stop Misfortune Kay Liye Exchange Ka Spread Daykhen Forex exchanging aik dangerous lekin worthwhile business hai jahan aap apnay paisay ko barhany aur nuksan se bachanay ka maqsad hasil kar saktay hain. Is principal exchanging procedures, market investigation, aur risk the board shaamil hoti hain. Stop misfortune bhi ek aham hissa hai jo brokers ko apnay nuksan se bachanay principal madadgar hota hai. Lekin, stop misfortune ka spread daykhnay ki ahamiyat ko kai brokers bhool jatay hain. Is article principal, ham aapko samjhayn gay ke stop misfortune kay liye exchange ka spread kyun daykhna zaroori hai. Spread Kya Hai? Sab se pehlay, aapko samajhna hoga ke spread kya hota hai. Forex market principal har money pair ka bid aur ask cost hota hai. Bid cost woh hota hai jis standard aap cash pair ko sell kar saktay hain, jabke ask cost woh hota hai jis standard aap money pair ko purchase kar saktay hain. Spread essentially offered cost aur ask cost ke darmiyan ka farq hai. Spread ka size money pair aur intermediary standard depend karta hai aur yeh brokers ko exchange karnay ke liye pay karna parta hai. Stop Misfortune Kya Hai? Stop misfortune ek risk the executives instrument hai jo merchants istemal kartay hain taa ke unka nuksan control primary reh sakay. Stop misfortune request, aap ki exchange ko consequently band kar deta hai punch market cost aap ke favor fundamental nahi hai. Is say aap apna nuksan limit kar saktay hain. Spread Ka Stop Misfortune Standard Asar Stop misfortune request lagatay waqt, aapko spread ko bhi madde nazar rakna chahiye. Agar aap stop misfortune request ke liye choti spread wali cash pair pick karte hain, to aapko kam spread standard exchange karne ki fursat milti hai. Is se aapka nuksan kam ho sakta hai. Lekin, agar aap ek cash pair pick karte hain jiska spread bara hota hai, to aapko stop misfortune request lagatay waqt zyada nuksan ho sakta hai. Kis Tarah Se Spread Ka Daykhna Zaroori Hai? Spread Size Daykhen: Aapko market fundamental mojood cash matches ki spread size ko look at karna chahiye. Choti spread wali money matches aapko stop misfortune request lagatay waqt faida pohnchati hain Unpredictability Ka Khayal Rakhen: Market ki instability bhi aik significant variable hai. Unstable business sectors principal spread aksar bara hota hai. Is liye, market ki halat ko bhi daykhna zaroori hai. -

#4 Collapse

LONG LEGGED DOJI:-Long-legged doji ek candlestick pattern hai jo forex aur doosre financial markets mein price charts par dikhta hai. Yeh ek tarah ka doji candlestick hota hai jismein real body (open aur close prices ke beech ka antar) bahut chhota hota hai aur upper aur lower wicks ya shadows lambe hote hain. Isko pehchanne aur samajhne ke liye niche diye gaye steps follow karein::max_bytes(150000):strip_icc()/DojiDefinition-efc3ba7213db4200a0a69f354369960b.png) LONG LEGGED DOJI K PATRS:-Dikhne mein: Open aur close prices ek dusre ke bahut kareeb hote hain, jiske karan real body chhoti hoti hai ya almost nahi hoti. Lambi upper aur lower wicks ya shadows hoti hain, iska matlab hai ki opening aur closing prices ke upar aur niche significant price movement hui thi. Matlab aur Tafsir: Long-legged doji pattern indecision ya market mein uncertainty ko darust karta hai.LONG LEGGED DOJI K STEPS:-Long-legged doji candlestick pattern ko samajhne ke liye, aap ye samajh sakte hain ke market mein traders mein confusion ya indecision hai. Jab ye pattern market chart par aata hai, to ye kuch important tafsirat ho sakti hain: Is pattern ka appearance dikha raha hai ke market mein buyers aur sellers ke darmiyan koi clear consensus nahi hai. Agar ye pattern uptrend ke baad aata hai, to ye bearish reversal signal ho sakta hai, matlab ke market ke bullish momentum mein kami aa sakti hai. Agar ye pattern downtrend ke baad aata hai, to ye bullish reversal signal ho sakta hai, matlab ke market ke bearish momentum mein kami aa sakti hai. Is pattern ke baad market mein volatility ya price movement barh sakti hai, isliye traders ko cautious rehna chahiye aur stop-loss orders ka istemal karna important ho sakta hai. Yaad rahe ke kisi bhi candlestick pattern ko trading decisions mein istemal karne se pehle, aapko market analysis aur risk management ke mool principles ko dhyan mein rakhna chahiye.

LONG LEGGED DOJI K PATRS:-Dikhne mein: Open aur close prices ek dusre ke bahut kareeb hote hain, jiske karan real body chhoti hoti hai ya almost nahi hoti. Lambi upper aur lower wicks ya shadows hoti hain, iska matlab hai ki opening aur closing prices ke upar aur niche significant price movement hui thi. Matlab aur Tafsir: Long-legged doji pattern indecision ya market mein uncertainty ko darust karta hai.LONG LEGGED DOJI K STEPS:-Long-legged doji candlestick pattern ko samajhne ke liye, aap ye samajh sakte hain ke market mein traders mein confusion ya indecision hai. Jab ye pattern market chart par aata hai, to ye kuch important tafsirat ho sakti hain: Is pattern ka appearance dikha raha hai ke market mein buyers aur sellers ke darmiyan koi clear consensus nahi hai. Agar ye pattern uptrend ke baad aata hai, to ye bearish reversal signal ho sakta hai, matlab ke market ke bullish momentum mein kami aa sakti hai. Agar ye pattern downtrend ke baad aata hai, to ye bullish reversal signal ho sakta hai, matlab ke market ke bearish momentum mein kami aa sakti hai. Is pattern ke baad market mein volatility ya price movement barh sakti hai, isliye traders ko cautious rehna chahiye aur stop-loss orders ka istemal karna important ho sakta hai. Yaad rahe ke kisi bhi candlestick pattern ko trading decisions mein istemal karne se pehle, aapko market analysis aur risk management ke mool principles ko dhyan mein rakhna chahiye. -

#5 Collapse

Describe Long Legged Doji Patterns ? Long Legged Doji pattern technical analysis mein payi jane wali aham candlestick pattern hai. Is mein market ek price level par open hui aur close bhi usAssistant:ho gayi thi, lekin trade session ke dauran bahut zyada volatility aur price movement tha. Is pattern ko "long-legged" isliye kaha jata hai kyunki upper aur lower shadows (ya wicks) candlestick ke body ke mukabale kaafi lambi hoti hain. Isay market mein uncertainty ka sign samjha jata hai kyunki buyers aur sellers ek dusre se takra rahe hain, jiski wajah se koi clear trend nahi hota hai. Traders Long Legged Doji ko trend ki disha mein possible badlav ka sanket samajhte hain. Causes of Long Legged Doji Patterns.... Long-legged doji candle Pattern samajhne ke liye, aap ye samajh sakte hain ke market mein brokers mein disarray ya hesitation hai. Punch ye design market graph standard aata hai, to ye kuch significant tafsirat ho sakti hain: Is design ka appearance dikha raha hai ke market mein purchasers aur venders ke darmiyan koi clear agreement nahi hai. Agar ye design upswing ke baad aata hai, to ye negative inversion signal ho sakta hai, matlab ke market ke bullish force mein kami aa sakti hai. Agar ye design downtrend ke baad aata hai, to ye bullish inversion signal ho sakta hai, matlab ke market ke negative force mein kami aa sakti hai. Is design ke baad market mein unpredictability ya cost development barh sakti hai, isliye merchants ko careful rehna chahiye aur stop-misfortune orders ka istemal karna significant ho sakta hai. Yaad rahe ke kisi bhi candle design ko exchanging choices mein istemal karne se pehle, aapko market investigation aur risk the executives ke mool standards ko dhyan mein rakhna chahiye.Long Legged Doji Pattern ko pehchanne ke liye, dealers ek candle ki talash karte hain jisme opening aur shutting costs practically same hoti hain, jisse ek chota ya bilkul na-koi body banti hai. Is design ki mukhya pehchan lambi shadows hai jo body se upar aur neeche tak phailti hain. Upper shadow exchanging meeting ka high darshata hai, jabki lower shadow low darshata hai. Shadows ki lambai body se tulna mein Long Legged Doji ko dusre candles se alag karti hai. Jitni lambi shadows hongi, utna hello there design ahmiyat ki samjhi jati hai. Hazards of Long Legged Doji Patterns.... Long Legged Doji Pattern market feeling aur potential inversions ke uncovered mein significant bits of knowledge give kar sakta hai, lekin iski had aur takes a chance with ko dhyan mein rakhna zaruri hai. Pehle toh, jaise ki koi bhi specialized marker, yeh bhi secure nahi hota aur bogus signs de sakta hai. Isliye dusre pointers ki affirmation ka stand by karna ahmiyat rakhta hai taaki exchanging ke achievement ke chances badhe. Dusre, Long Legged Doji low liquidity ridge markets mein ya solidification periods mein bhi boycott sakti hai, jisse iski dependability kam ho sakti hai. Brokers ko by and large economic situations aur volume levels ko bhi samajhna chahiye, sirf is design standard depend karne se pehle. Subterranean insect mein, risk ko oversee karna hey zaruri hai, jiske liye proper stop-misfortune orders set karna aur har exchange ke liye generally risk-reward proportion ko consider karna chahiye. Long Legged Doji Pattern ek broker ke armory ha. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Long Legged Doji" ek candlestick pattern hai jo technical analysis mein istemal hota hai. Yeh pattern market mein uncertainty ya indecision ko darust karta hai, aur traders ko price movement ke potential changes ke bare mein sochne ka mauqa deta hai. Long Legged Doji pattern doosre candlestick patterns se mukhtalif hota hai kyunki iski opening price aur closing price ek dusre ke bohot qareeb hoti hain, lekin iska range (yani high aur low) doosri candlesticks ke muqablay mein ziada hota hai. 1. **Opening Price**: Long Legged Doji candlestick ka opening price typically previous candlestick ke closing price ke qareeb hota hai. 2. **Closing Price**: Iski closing price bhi previous candlestick ke closing price ke qareeb hoti hai. 3. **High and Low**: Yeh doji candlestick ke high aur low prices doosri candlesticks ke muqablay mein ziada hoti hain. Iska matlab hai ke market mein trading session ke doran asset ki keemat bohot upar aur niche gayi, lekin session ke aakhir mein wapis kareeb wohi level par aayi. Long Legged Doji pattern ki ahmiyat yeh hai ke yeh indecision ya confusion ko darust karta hai. Iska matlab hai ke traders aur investors market mein kis tarah ka sentiment hai, woh samajh nahi paate aur ismein uncertainty hoti hai. Yeh pattern market ke potential reversals ko bhi darust karta hai, matlab ke market trend ke badalne ki sambhavna hoti hai. Is pattern ko trading decision ke liye istemal karne se pehle, traders ko doosre technical indicators aur patterns ko bhi madde nazar rakhna chahiye. Long Legged Doji pattern ke baad aksar price movement ka breakout hota hai, lekin yeh confirm karne ke liye traders doosri signals ka bhi intezar karte hain. In conclusion, Long Legged Doji ek aham candlestick pattern hai jo market mein uncertainty aur indecision ko represent karta hai. Is pattern ke signals ko samajhna traders ke liye ahem hota hai kyun ke yeh potential trend reversals ko peshgoi karta hai. Magar, is pattern ki confirmation aur doosre indicators ka istemal trading decisions ke liye zaroori hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Long Legged Doji Chart Pattern: Long Legged Doji design ki ahmiyat yeh hai ke yeh uncertainty ya disarray ko darust karta hai. Iska matlab hai ke brokers aur financial backers market mein kis tarah ka feeling hai, woh samajh nahi paate aur ismein vulnerability hoti hai. Yeh design market ke potential inversions ko bhi darust karta hai, matlab ke market pattern ke badalne ki sambhavna hoti hai.Is design ko exchanging choice ke liye istemal karne se pehle, brokers ko doosre specialized pointers aur designs ko bhi madde nazar rakhna chahiye. Long Legged Doji design ke baad aksar cost development ka breakout hota hai, lekin yeh affirm karne ke liye brokers doosri signals ka bhi intezar karte hain.Long Legged Doji ek aham candle design hai jo market mein vulnerability aur uncertainty ko address karta hai. Is design ke signals ko samajhna merchants ke liye ahem hota hai kyun ke yeh potential pattern inversions ko peshgoi karta hai. Magar, is design ki affirmation aur doosre markers ka istemal exchanging choices ke liye zaroori hai. Long Legged Doji" ek candle design hai jo specialized investigation mein istemal hota hai. Yeh design market mein vulnerability ya hesitation ko darust karta hai, aur dealers ko cost development ke potential changes ke exposed mein sochne ka mauqa deta hai.Long Legged Doji design doosre candle designs se mukhtalif hota hai kyunki iski opening cost aur shutting cost ek dusre ke bohot qareeb hoti hain, lekin iska range (yani high aur low) doosri candles ke muqablay mein ziada hota hai.Long Legged Doji candle ka opening cost regularly past candle ke shutting cost ke qareeb hota hai.ski shutting cost bhi past candle ke shutting cost ke qareeb hoti hai.Yeh doji candle ke high aur low costs doosri candles ke muqablay mein ziada hoti hain. Iska matlab hai ke market mein exchanging meeting ke doran resource ki keemat bohot upar aur specialty gayi, lekin meeting ke aakhir mein wapis kareeb wohi level standard aayi. Long legged Doji Chart Pattern Formation: Kisi bhi flame plan ko trading decisions mein istemal karne se pehle, aapko market examination aur risk the chiefs ke mool norms ko dhyan mein rakhna chahiye.Long Legged Doji Example ko pehchanne ke liye, vendors ek candle ki talash karte hain jisme opening aur closing costs basically same hoti hain, jisse ek chota ya bilkul na-koi body banti hai. Is plan ki mukhya pehchan lambi shadows hai jo body se upar aur neeche tak phailti hain. Upper shadow trading meeting ka high darshata hai, jabki lower shadow low darshata hai. Shadows ki lambai body se tulna mein Long Legged Doji ko dusre candles se alag karti hai. Jitni lambi shadows hongi, utna hi plan ahmiyat ki samjhi jati hai.

Long Legged Doji" ek candle design hai jo specialized investigation mein istemal hota hai. Yeh design market mein vulnerability ya hesitation ko darust karta hai, aur dealers ko cost development ke potential changes ke exposed mein sochne ka mauqa deta hai.Long Legged Doji design doosre candle designs se mukhtalif hota hai kyunki iski opening cost aur shutting cost ek dusre ke bohot qareeb hoti hain, lekin iska range (yani high aur low) doosri candles ke muqablay mein ziada hota hai.Long Legged Doji candle ka opening cost regularly past candle ke shutting cost ke qareeb hota hai.ski shutting cost bhi past candle ke shutting cost ke qareeb hoti hai.Yeh doji candle ke high aur low costs doosri candles ke muqablay mein ziada hoti hain. Iska matlab hai ke market mein exchanging meeting ke doran resource ki keemat bohot upar aur specialty gayi, lekin meeting ke aakhir mein wapis kareeb wohi level standard aayi. Long legged Doji Chart Pattern Formation: Kisi bhi flame plan ko trading decisions mein istemal karne se pehle, aapko market examination aur risk the chiefs ke mool norms ko dhyan mein rakhna chahiye.Long Legged Doji Example ko pehchanne ke liye, vendors ek candle ki talash karte hain jisme opening aur closing costs basically same hoti hain, jisse ek chota ya bilkul na-koi body banti hai. Is plan ki mukhya pehchan lambi shadows hai jo body se upar aur neeche tak phailti hain. Upper shadow trading meeting ka high darshata hai, jabki lower shadow low darshata hai. Shadows ki lambai body se tulna mein Long Legged Doji ko dusre candles se alag karti hai. Jitni lambi shadows hongi, utna hi plan ahmiyat ki samjhi jati hai.  Design or Plan ka appearance dikha raha hai ke market mein buyers aur sellers ke darmiyan koi clear understanding nahi hai.Agar ye plan rise ke baad aata hai, to ye negative reversal signal ho sakta hai, matlab ke market ke bullish power mein kami aa sakti hai.Agar ye plan downtrend ke baad aata hai, to ye bullish reversal signal ho sakta hai, matlab ke market ke negative power mein kami aa sakti hai.Is plan ke baad market mein unusualness ya cost advancement barh sakti hai, isliye traders ko cautious rehna chahiye aur stop-setback orders ka istemal karna critical ho sakta hai.doji flame Example samajhne ke liye, aap ye samajh sakte hain ke market mein intermediaries mein disorder ya wavering hai. Punch ye configuration market chart standard aata hai, to ye kuch critical tafsirat ho sakti hain Long legged Doji Chart Pattern Identification: Long Legged Doji design market feeling aur potential inversions ke exposed mein important bits of knowledge give kar sakta hai, lekin iski had aur takes a chance with ko dhyan mein rakhna zaruri hai. Pehle toh, jaise ki koi bhi specialized pointer, yeh bhi secure nahi hota aur misleading signs de sakta hai. Isliye dusre pointers ki affirmation ka stand by karna ahmiyat rakhta hai taaki exchanging ke achievement ke chances badhe. Dusre, Long Legged Doji low liquidity ridge markets mein ya union periods mein bhi boycott sakti hai, jisse iski unwavering quality kam ho sakti hai. Dealers ko generally speaking economic situations aur volume levels ko bhi samajhna chahiye, sirf is design standard depend karne se pehle. Insect mein, risk ko oversee karna hello there zaruri hai, jiske liye fitting stop-misfortune orders set karna aur har exchange ke liye generally risk-reward proportion ko consider karna chahiye. Long Legged Doji design ek broker ke arms stockpile ha.

Design or Plan ka appearance dikha raha hai ke market mein buyers aur sellers ke darmiyan koi clear understanding nahi hai.Agar ye plan rise ke baad aata hai, to ye negative reversal signal ho sakta hai, matlab ke market ke bullish power mein kami aa sakti hai.Agar ye plan downtrend ke baad aata hai, to ye bullish reversal signal ho sakta hai, matlab ke market ke negative power mein kami aa sakti hai.Is plan ke baad market mein unusualness ya cost advancement barh sakti hai, isliye traders ko cautious rehna chahiye aur stop-setback orders ka istemal karna critical ho sakta hai.doji flame Example samajhne ke liye, aap ye samajh sakte hain ke market mein intermediaries mein disorder ya wavering hai. Punch ye configuration market chart standard aata hai, to ye kuch critical tafsirat ho sakti hain Long legged Doji Chart Pattern Identification: Long Legged Doji design market feeling aur potential inversions ke exposed mein important bits of knowledge give kar sakta hai, lekin iski had aur takes a chance with ko dhyan mein rakhna zaruri hai. Pehle toh, jaise ki koi bhi specialized pointer, yeh bhi secure nahi hota aur misleading signs de sakta hai. Isliye dusre pointers ki affirmation ka stand by karna ahmiyat rakhta hai taaki exchanging ke achievement ke chances badhe. Dusre, Long Legged Doji low liquidity ridge markets mein ya union periods mein bhi boycott sakti hai, jisse iski unwavering quality kam ho sakti hai. Dealers ko generally speaking economic situations aur volume levels ko bhi samajhna chahiye, sirf is design standard depend karne se pehle. Insect mein, risk ko oversee karna hello there zaruri hai, jiske liye fitting stop-misfortune orders set karna aur har exchange ke liye generally risk-reward proportion ko consider karna chahiye. Long Legged Doji design ek broker ke arms stockpile ha.  Dealers exchanging choices lene se pehle isay dusre specialized markers ya designs se tasdeeq karte hain. Woh extra candle designs jaise negative ya bullish overwhelming examples ki madad se potential inversion ko tasdeeq kar sakte hain. Dusre pointers jaise moving midpoints, trendlines, ya oscillators jaise Relative Strength Record (RSI) ya Stochastic Oscillator, signal ko support karne ke liye istemal kiye ja sakte hain. Brokers affirmation milte hello exchange enter karne ka faisla lete hain aur long exchange ke liye Long Legged Doji ke low se neeche stop-misfortune request lagate hain Long Legged Doji design ko pehchanne ke liye, dealers ek candle ki talash karte hain jisme opening aur shutting costs practically same hoti hain, jisse ek chota ya bilkul na-koi body banti hai. Is design ki mukhya pehchan lambi shadows hai jo body se upar aur neeche tak phailti hain. Upper shadow exchanging meeting ka high darshata hai, jabki lower shadow low darshata hai. Shadows ki lambai body se tulna mein Long Legged Doji ko dusre candles se alag karti hai. Trading Of Long legged Doji Chart Pattern: Long Legged Doji design ka istemal exchanging technique mein kiya ja sakta hai. Agar Long Legged Doji design solid upturn ke baad dikhta hai, toh dealers short position lete hain aur stop misfortune request Doji candle ke significant level se thoda upar set karte hain. Agar Long Legged Doji design solid downtrend ke baad dikhta hai, toh merchants long position lete hain aur stop misfortune request Doji candle ke low level se thoda neeche set karte hain. Long Legged Doji design ka sahi translation, generally market setting aur pattern examination ke saath karna zaruri hai. Is design ko dusre specialized pointers aur cost designs ke saath affirm karna zaruri hai, taaki sahi exchanging choices liye ja sake

Dealers exchanging choices lene se pehle isay dusre specialized markers ya designs se tasdeeq karte hain. Woh extra candle designs jaise negative ya bullish overwhelming examples ki madad se potential inversion ko tasdeeq kar sakte hain. Dusre pointers jaise moving midpoints, trendlines, ya oscillators jaise Relative Strength Record (RSI) ya Stochastic Oscillator, signal ko support karne ke liye istemal kiye ja sakte hain. Brokers affirmation milte hello exchange enter karne ka faisla lete hain aur long exchange ke liye Long Legged Doji ke low se neeche stop-misfortune request lagate hain Long Legged Doji design ko pehchanne ke liye, dealers ek candle ki talash karte hain jisme opening aur shutting costs practically same hoti hain, jisse ek chota ya bilkul na-koi body banti hai. Is design ki mukhya pehchan lambi shadows hai jo body se upar aur neeche tak phailti hain. Upper shadow exchanging meeting ka high darshata hai, jabki lower shadow low darshata hai. Shadows ki lambai body se tulna mein Long Legged Doji ko dusre candles se alag karti hai. Trading Of Long legged Doji Chart Pattern: Long Legged Doji design ka istemal exchanging technique mein kiya ja sakta hai. Agar Long Legged Doji design solid upturn ke baad dikhta hai, toh dealers short position lete hain aur stop misfortune request Doji candle ke significant level se thoda upar set karte hain. Agar Long Legged Doji design solid downtrend ke baad dikhta hai, toh merchants long position lete hain aur stop misfortune request Doji candle ke low level se thoda neeche set karte hain. Long Legged Doji design ka sahi translation, generally market setting aur pattern examination ke saath karna zaruri hai. Is design ko dusre specialized pointers aur cost designs ke saath affirm karna zaruri hai, taaki sahi exchanging choices liye ja sake  Doji design mein, ek Doji candle structure hoti hai, jisme open aur close cost levels practically same hote hain. Is design mein, Doji candle ke dono taraf long upper aur lower shadows (wicks) hote hain. Ye design cost range ke uncertainty aur balance ko show karta hai.Long Legged Doji design cost inversion ya pattern continuation ki sign deta hai, contingent upon the unique situation. Agar Long Legged Doji design solid upswing ya downtrend ke baad dikhta hai, toh inversion ki sign ho sakti hai. Agar ye design sideways market mein dikhta hai, toh pattern continuation ki sign ho sakti hai Long Legged Doji design ka affirmation, next cost activity ke saath hota hai. Agar value Doji candle ke high ya low level ko break karke close karta hai, toh design ka affirmation hota hai. Affirmation ke baad dealers ko purchase ya sell signal milta hai.

Doji design mein, ek Doji candle structure hoti hai, jisme open aur close cost levels practically same hote hain. Is design mein, Doji candle ke dono taraf long upper aur lower shadows (wicks) hote hain. Ye design cost range ke uncertainty aur balance ko show karta hai.Long Legged Doji design cost inversion ya pattern continuation ki sign deta hai, contingent upon the unique situation. Agar Long Legged Doji design solid upswing ya downtrend ke baad dikhta hai, toh inversion ki sign ho sakti hai. Agar ye design sideways market mein dikhta hai, toh pattern continuation ki sign ho sakti hai Long Legged Doji design ka affirmation, next cost activity ke saath hota hai. Agar value Doji candle ke high ya low level ko break karke close karta hai, toh design ka affirmation hota hai. Affirmation ke baad dealers ko purchase ya sell signal milta hai.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:15 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим