Double bottom pattern:

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

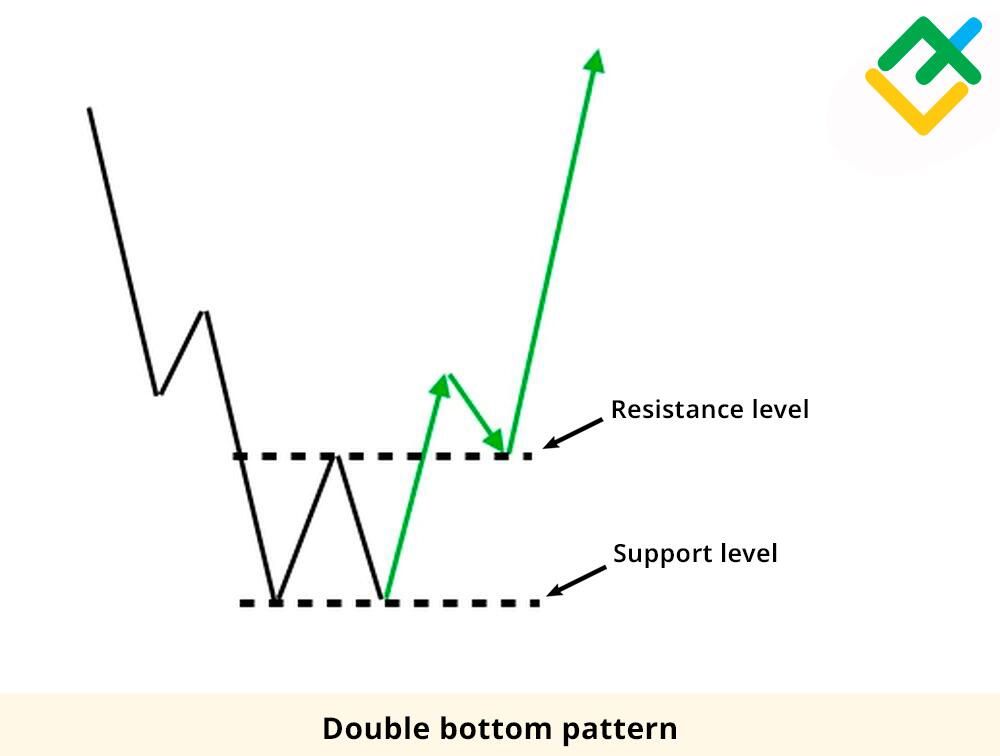

Double bottom pattern ek bullish reversal pattern hai, jo price chart par dikhai deta hai. Yeh pattern typically downtrend ke baad form hota hai aur indicate karta hai ki market trend reverse ho raha hai aur bullish trend shuru hone wala hai. Double bottom pattern ki wazahat karne ke liye, kuch important points niche diye gaye hain: 1. Formation: Double bottom pattern mein market pehle ek downtrend follow karta hai aur price bottom level tak pahunchta hai, jise neckline bhi kaha jata hai. Fir price rebound karta hai aur phir se bottom level tak pahunchta hai, lekin is baar previous bottom level se kam nahi jata hai. Iske baad price fir se rebound karta hai aur neckline ko break karke upar move karta hai. Isse double bottom pattern form hota hai. 2. Support Level: Double bottom pattern mein dono bottoms ek support level ke aspas form hote hain. Yeh support level previous downtrend ke bottom levels par paye jate hain aur traders ka buying interest dikhate hain. 3. Neckline Breakout: Double bottom pattern ka confirmation neckline breakout se hota hai. Jab price neckline ko break karke upar move karta hai aur neckline level se paar kar deta hai, tab yeh ek bullish signal ho jata hai. Traders is breakout ke baad long positions lete hain. 4. Volume Analysis: Double bottom pattern ke saath volume analysis bhi important hai. Agar volume neckline breakout ke samay high hai, toh yeh indicate karta hai ki buying interest strong hai aur market mein bullish momentum hai. Isse pattern ka validity aur strength badhta hai. 5. Target Price: Double bottom pattern ka target price calculate karne ke liye, neckline level se pattern ka height (distance between neckline and bottom level) calculate kiya jata hai. Is height ko neckline breakout level mein add karke target price milta hai. Traders is target price par apne long positions ko close kar sakte hain. Hamesha yaad rakhein ki double bottom pattern ek potential bullish reversal signal hai, lekin ek hi pattern par rely karna sahi nahi hota hai. Isliye, dusre technical analysis tools aur price action analysis ka bhi istemal karna zaroori hai. Pattern ko confirm karne ke liye, dusre indicators aur price patterns ke saath inka istemal kiya jana chahiye. Upar di gayi wazahat se aapko double bottom pattern ki samajh aayegi. Lekin trading mein inka istemal karne se pehle, practice aur risk management zaroori hai. Technical analysis ke saath fundamental analysis aur overall market sentiment ko bhi consider karna zaroori hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Double Bottom Chart Pattern

Forex trading mein, double bottom pattern aik ahem technical analysis hai. Ye bohot se currencies pairs k traders ke liye potential trading opportunities pehchanne mein eham role ada karta hai. Double bottom pattern ek bullish reversal pattern hai jo market trends aur possible buying opportunities ke liye qeemti insights faraham kar sakta hai. Is article mein, hum explore karenge ke double bottom pattern kya hai, isay kaise pehchane jata hai, aur traders ise apne crypto trading strategies mein kaise effectively istemal kar sakte hain.

Double top pattern se mukhtalif, double bottom pattern ek bullish reversal pattern hai jo ek downtrend ke baad banta hai. Isme do mukhtalif lows hote hain, jo ke aik peak ya short-term rally se alag hote hain. Ye pattern market sentiment mein bearish se bullish ki taraf tabdeel hone ko darust karta hai aur possible trend reversal ko indicate karta hai. Esentially, ye dikhata hai ke buyers market mein dakhil ho rahe hain aur sellers ko maat de rahe hain, jiski wajah se price mein potential upward movement ho sakti hai.

Double Bottom Pattern ki Identification

Double bottom pattern pehchanne ke liye traders ko price chart mein kuch khas sifat par nazar rakhni chahiye. Yahan double bottom pattern ko pehchane ke liye kuch ahem elements hain:- Downtrend: Pattern ek sustain downtrend ke baad banta hai, jo ke selling pressure ki ek dor ko darust karta hai.

- Do Lows: Price ko do mukhtalif lows banane chahiye jo ke height mein taqreeban barabar hon. Ye lows aik peak se alag hote hain, jo ke short-term price rally se banta hai.

- Neckline: Neckline ek horizontal line hai jo peak ke darmiyan kheechni jati hai aur do lows ko alag karta hai. Ye aik resistance level ka kaam karta hai jo pattern ko confirm karne ke liye tora jana chahiye.

Top Trading Strategies (Pattern Confirmation)

Double bottom pattern ko confirm karne ka tariqa ye hai ke jab price neckline ke upar se break kare, tab confirmation hoti hai. Ye breakout aksar tezi se trading volume ke sath hota hai, jo pattern ki validiy ko mazeed taqwiyat deta hai. Jab breakout hota hai, traders long position mein dakhil ho sakte hain, price mein mazeed tezi ka intezar karte hue.

Yahan kuch trading strategies hain jo traders double bottom pattern ke sath istemal karte hain:- Entry aur Stop-Loss: Traders aksar long position mein dakhil hote hain jab price neckline ke upar se break karta hai. Risk ko manage karne ke liye, ek stop-loss order second low ke thode se neeche rakh sakte hain, taki agar pattern materialize nahi hota to nuksan se bacha ja sake.

- Price Targets: Potential price targets determine karne ke liye, traders neckline aur pattern ke lows ke darmiyan ki doori ko measure kar sakte hain. Ye measurement breakout point se apply kiya ja sakta hai taake upward movement ke liye potential price target project ho sake. Fibonacci retracement levels aur pehle ke support/resistance areas ko bhi identify karne ke liye istemal kiya ja sakta hai.

- Volume Confirmation: Breakout ke doran strong volume pattern ko credibility deta hai. Traders aksar breakout ke doran trading volume mein izafay ko dekhte hain, jo ke increased buying pressure ko darust karta hai.

- Timeframe Considerations: Ye important hai ke pattern kis timeframe mein banta hai. Double bottoms jo daily ya weekly charts par banate hain, wo zyada weight rakhte hain aur mazeed significant price movements ke liye lead kar sakte hain.

Double Bottom Pattern Limitations

Double bottom pattern traders ke liye ek qeemti tool ho sakta hai, lekin iske limitations aur potential false signals ko consider karna bohot zaroori hai. Yahan kuch points hain jo dhyan mein rakhne chahiye:- False Breakouts: Kabhi-kabhi, price neckline ke thode se upar briefly break kar sakti hai aur phir tezi se reverse ho sakti hai, jiski wajah se ek false breakout ho jata hai. Traders ko ehtiyaat se kaam lena chahiye aur trade mein dakhil hone se pehle confirmation ka intezar karna chahiye.

- Volume Analysis: Breakout ke doran badh gaya volume generally ek positive sign hai, lekin volume ko carefully analyze karna bohot zaroori hai. Kabhi-kabhi unusually high volume selling pressure ya market manipulation ko bhi darust kar sakta hai, is liye additional caution ki zaroorat hai.

- Market Context: Broad market context aur doosre technical indicators ko analyze karna bohot zaroori hai jab double bottom pattern ko dekha jata hai. Overall market trend, support aur resistance levels, aur doosre chart patterns jaise factors additional insights provide kar sakte hain aur trade ke successful hone ke chances ko badha sakte hain.

Double Bottom Ke Sath Trading

Double bottom pattern ke sath trading karte waqt entry point determine karna, stop-loss order set karna, aur take-profit levels identify karna risk ko manage aur potential profits ko maximize karne ke liye bohot zaroori hai. Yahan kuch guidelines hain jo dhyan mein rakhni chahiye:

- Entry Point

Double bottom pattern ke liye entry point typically tab hota hai jab price neckline ke upar se break karta hai, pattern ko confirm karte hue. Ye breakout ek potential bullish reversal ko signal karta hai aur buying opportunity provide karta hai. Traders price convincingly neckline ke upar close hone ke baad long position mein dakhil ho sakte hain. - Stop Loss

Ek stop-loss order set karna potential losses ko limit karne ke liye crucial hai agar pattern materialize nahi hota ya market reverse ho jata hai. Aam approach ye hai ke stop-loss order second low ke thode se neeche place kiya jaye. Ye level invalidation point ka kaam karta hai, jisse ye darust hota hai ke bullish reversal jaise expected nahi ho raha. Stop loss ko second low ke thode se neeche rakhkar traders apne capital ko protect kar sakte hain aur agar price continue ho raha hai to losses ko minimize kar sakte hain. - Take Profits

Take-profit levels determine karne ka tariqa trader ke risk tolerance aur trading strategy par depend karta hai. Yahan kuch common methods hain:- Pattern ko measure karna: Ek approach ye hai ke pattern ke neckline aur lows ke darmiyan ki doori ko measure kiya jaye. Ye measurement breakout point se apply kiya jaye ga potential price target ke liye. For example, agar neckline aur lows ke darmiyan ki doori $100 hai, to traders $100 above the neckline par ek take-profit level set kar sakte hain.

- Fibonacci retracement levels: Fibonacci retracement levels bhi potential take-profit levels identify karne ke liye istemal kiye ja sakte hain. Traders aksar Fibonacci retracement levels ko plot karte hain previous downtrend ke high se double bottom pattern ke second low tak. Common retracement levels jaise ke 38.2%, 50%, aur 61.8% potential profit-taking areas ka kaam kar sakte hain.

- Previous resistance levels: Ek aur technique ye hai ke pehle ke resistance levels ya significant selling pressure ke areas ko identify kiya jaye, jahan price temporarily stall ya reverse ho sakta hai. Ye levels potential take-profit targets ka kaam karte hain, kyun ke wahan price ruk sakti hai ya palat sakti hai.

Ye yaad rakhne wala hai ke traders aksar in methods ka combination istemal karte hain taake woh incremental taur par profits secure kar sake aur changing market conditions ke mutabiq adapt ho sake.

Double Bottom Pattern Se Profitable Trade Karna

Double bottom pattern se profitable trade karne ke imkanat ko neeche diye gaye factors par asar hota hai:- Pattern Quality: Double bottom pattern ki quality bohot ahem hai. Achi tarah defined pattern jisme do mukhtalif lows, clear neckline, aur decisive breakout ho, wo zyada strong aur reliable consider hota hai. Patterns jo symmetry dikhate hain, lows ki similar depths, aur dono lows ke darmiyan sahi time duration rakhte hain, wo amm taur par zyada favorable consider kiye jate hain.

- Confirmation: Pattern ki confirmation bohot zaroori hai. Traders ko aik convincing breakout ka intezar karna chahiye jo neckline ke upar ho aur increased trading volume ke sath ho. Breakout ke doran zyada volume ka hone se increased buying pressure aur pattern ki credibility ko mazeed barhata hai.

- Market Conditions: Overall market conditions aur trend pattern ke successful hone mein ahem role ada karte hain. Double bottom pattern jo overall bullish market mein ya doosre bullish indicators ke sath ban raha hai, wo zyada profitable hone ke imkanat rakhta hai. Umum taur par, agar pattern ek strong bearish market mein ya high volatility ke doraan ban raha hai to iski success rate kam ho sakti hai.

- Risk Management: Sahi risk management techniques ka istemal, jaise ke appropriate stop-loss orders, position sizing, aur profit-taking strategies, double bottom pattern se profitable trade karne ke imkanat mein contribute karte hain. Effective risk management implement karna potential losses se bachane mein madad karta hai aur ye bhi ensure karta hai ke profits secure ho rahe hain.

Double bottom pattern ki success trader ke ability par depend karta hai ke woh market conditions ko analyze kaise karte hain, patterns ko kitna accurately identify karte hain, trades ko kaise effectively execute karte hain, aur risk ko kaise manage karte hain. Traders ko ye bhi dhyan mein rakhna chahiye ke additional technical analysis tools ka istemal karen, fundamental analysis ko incorporate karen, aur apni strategies ko barqarar rakhne ke liye continuously learn karen aur adapt karen.

Conclusion

Double bottom pattern ek popular chart formation hai jo crypto traders ko potential bullish reversal opportunities pehchane mein madad karta hai. Is pattern ke characteristics ko samajh kar aur sahi trading strategies istemal karke, traders apne decision-making process ko enhance kar sakte hain aur trend reversals se potential profit kama sakte hain. Lekin, ehtiyaat baratna, supporting technical indicators ko consider karna, aur sahi risk management techniques ko practice karna bohot zaroori hai. Jaise ke kisi bhi trading strategy mein, double bottom pattern ko apne crypto trading strategy mein successfully incorporate karne ke liye thorough analysis, continuous learning, aur experience key hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

What Double Bottom Candlestick Pattern

Forex trading mein, double bottom pattern aik ahem technical analysis hai. Ye bohot se currencies pairs k traders ke liye potential trading opportunities pehchanne mein eham role ada karta hai. Double bottom pattern ek bullish reversal pattern hai jo market trends aur possible buying opportunities ke liye qeemti insights faraham kar sakta hai. Is article mein, hum explore karenge ke double bottom pattern kya hai, isay kaise pehchane jata hai, aur traders ise apne crypto trading strategies mein kaise effectively istemal kar sakte hain.Double top pattern se mukhtalif, double bottom pattern ek bullish reversal pattern hai jo ek downtrend ke baad banta hai. Isme do mukhtalif lows hote hain, jo ke aik peak ya short-term rally se alag hote hain. Ye pattern market sentiment mein bearish se bullish ki taraf tabdeel hone ko darust karta hai aur possible trend reversal ko indicate karta hai. Esentially, ye dikhata hai ke buyers market mein dakhil ho rahe hain aur sellers ko maat de rahe hain, jiski wajah se price mein potential upward movement ho sakti hai.

Formation And Identification

Double bottom pattern pehchanne ke liye traders ko price chart mein kuch khas sifat par nazar rakhni chahiye. Yahan double bottom pattern ko pehchane ke liye kuch ahem elements hai. Pattern ek sustain downtrend ke baad banta hai, jo ke selling pressure ki ek dor ko darust karta hai.Do Lows: Price ko do mukhtalif lows banane chahiye jo ke height mein taqreeban barabar hon. Ye lows aik peak se alag hote hain, jo ke short-term price rally se banta hai. Neckline ek horizontal line hai jo peak ke darmiyan kheechni jati hai aur do lows ko alag karta hai. Ye aik resistance level ka kaam karta hai jo pattern ko confirm karne ke liye tora jana chahiye.

Treading strategies- Entry Point:Double bottom pattern ke liye entry point typically tab hota hai jab price neckline ke upar se break karta hai, pattern ko confirm karte hue. Ye breakout ek potential bullish reversal ko signal karta hai aur buying opportunity provide karta hai. Traders price convincingly neckline ke upar close hone ke baad long position mein dakhil ho sakte hain.

- Stop Loss

Ek stop-loss order set karna potential losses ko limit karne ke liye crucial hai agar pattern materialize nahi hota ya market reverse ho jata hai. Aam approach ye hai ke stop-loss order second low ke thode se neeche place kiya jaye. Ye level invalidation point ka kaam karta hai, jisse ye darust hota hai ke bullish reversal jaise expected nahi ho raha. Stop loss ko second low ke thode se neeche rakhkar traders apne capital ko protect kar sakte hain aur agar price continue ho raha hai to losses ko minimize kar sakte hain. - Take Profits

Take-profit levels determine karne ka tariqa trader ke risk tolerance aur trading strategy par depend karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:37 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим