Flag Chart Pattern In Forex Trading....

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

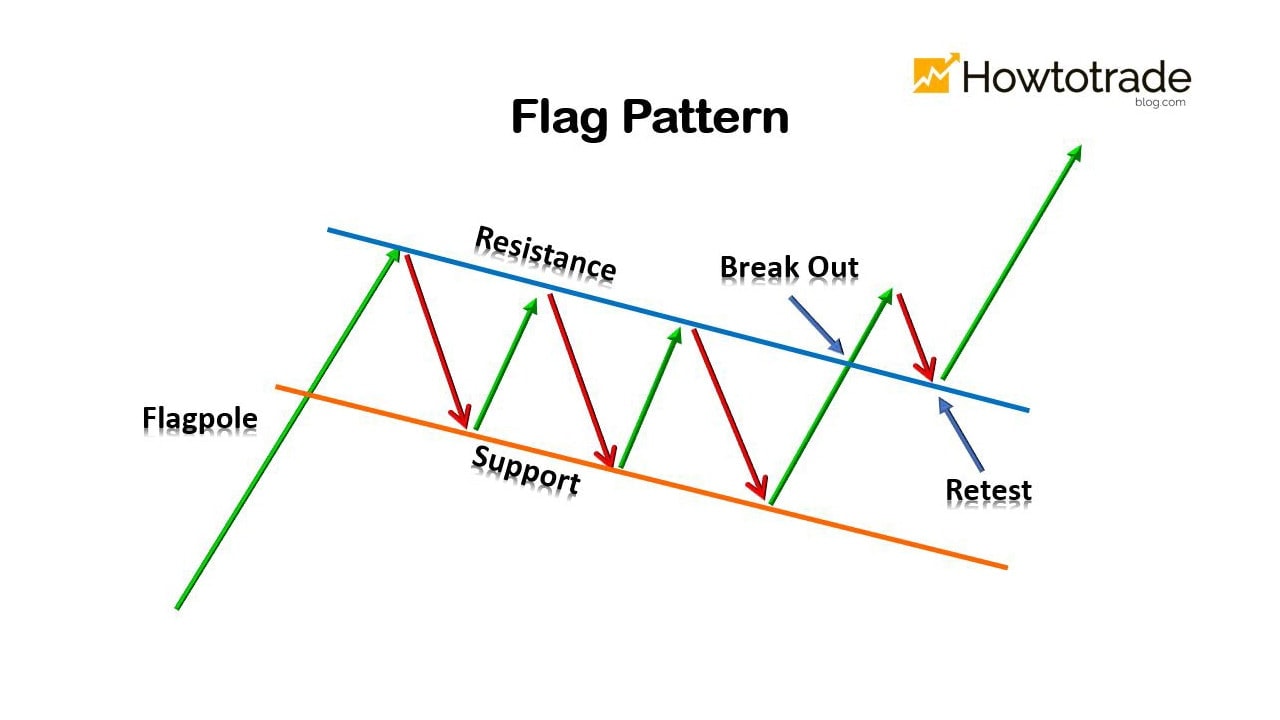

INTRODUCTION: Flag chart pattern ek technical analysis ka concept hai jo ke financial markets mein istemal hota hai. Yehh pattern ek trading chart par dekha jata hai aur traders isay price movement aur trend analysis ke li yeh istemal karte hain. Flag chart pattern ka naam is liyeh hai kyunki iska appearance flag ya jhanda ki tarah hota hai. Is pattern mein typically do main components hotay hain. FORMATION AND STRUCTURE OF FLAG CHART PATTERNS : 1. Flagpole (Jhanda Ki Dandi): Yeh wo initial price movement hota hai jo ek asset ya stock ki value mein sudden aur strong increase ya decrease dikhata hai. Is dandi ko flagpole kehte hain. 2. Flag (Jhanda): Flagpole ke baad, ek consolidation phase aati hai jahan price range mein kisi specific direction mein ziada change nahi hota. Yeh phase ek rectangle ya triangle ki shape mein ho sakti hai aur traders isay flag kehte hain. Flag chart pattern bullish (upward) aur bearish (downward) dono directions mein aati hai. Bullish Flag Chart Pattern: Agar flagpole ke baad flag ki direction up (ooper) hoti hai, to yeh bullish flag kehlata hai. Iska matlab hota hai ke market mein initial increase ke baad, ek temporary consolidation phase aati hai, lekin traders optimistic hote hain aur expect karte hain ke price phir se upar jaayehga. Bearish Flag Chart Pattern: Agar flagpole ke baad flag ki direction down (neeche) hoti hai, to yeh bearish flag kehlata hai. Iska matlab hota hai ke market mein initial decrease ke baad, ek temporary consolidation phase aati hai, lekin traders pessimistic hote hain aur expect karte hain ke price phir se neeche jaayehga. Trading in Flag Chart Pattern: Traders flag pattern ko dekhte hain taake woh future price movement ko predict kar saken. Is pattern ko samajhna aur sahi tarah se istemal karna, trading mein madadgar ho sakta hai. Lekin, yaad rahe ke kisi bhi pattern ki tarah, flag chart pattern bhi 100% confirmatory nahi hota aur risk management ke saath istemal karna zaroori hai. -

#3 Collapse

Forex mein Flag Chart Pattern Details. Forex market mein chart patterns ka istemal bohat aam hai. In patterns ki madad se traders market ki movement ko predict karte hain. Flag Chart Pattern bhi in patterns mein se ek hai. Is article mein hum Flag Chart Pattern ki tafseel karenge. Flag Chart Pattern ek continuation pattern hai. Yeh market mein trend ke dauran aik short term pause hota hai. Is pause ke doran price range ko ek rectangle ya flag ke andar limit kiya jata hai. Jab market wapas trend par chalta hai to price movement phir se shuru ho jata hai. Flag Chart Pattern Make. Flag Chart Pattern ko banane ke liye trend line ko draw karna zaroori hai. Trend line market mein trend ko represent karta hai. Agar market uptrend mein hai to trend line ko low se high ki taraf draw karna hota hai. Aur agar market downtrend mein hai to trend line ko high se low ki taraf draw karna hota hai. Jab trend line draw ho jaye to is ke baad flag ke andar price range ko limit kiya jata hai. Is price range ko rectangle ke andar draw karte hain. Flag Chart Pattern Identification. Flag Chart Pattern ki alamat kuch is tarah hoti hain: - Flag ke andar price range rectangle shape mein hota hai. - Flag ke andar price range trend line ke opposite direction mein hota hai. - Flag ko banane ke liye trend line ki zaroorat hoti hai. Flag Chart Pattern Trading Strategy. Flag Chart Pattern ki trading strategy kuch is tarah hoti hai: - Agar market uptrend mein hai aur flag pattern ban raha hai to buy position lena chahiye. - Agar market downtrend mein hai aur flag pattern ban raha hai to sell position lena chahiye. - Stop loss ko flag ke opposite side se set karna chahiye. - Take profit ko flag ke height se set karna chahiye. Flag Chart Pattern forex market mein bohat important hai. Is pattern ki madad se traders market ki movement ko predict karte hain aur trading strategies banate hain. Agar aap forex market mein trading karte hain to Flag Chart Pattern ko zaroor samajhna chahiye. -

#4 Collapse

Flag Chart Pattern in Forex Trading. Forex trading mein chart patterns ka istemal market trends aur price movements ko samajhne ke liye hota hai. Flag chart pattern ek aesa popular chart pattern hai jo traders ke liye ahem ho sakta hai flag chart pattern ek continuation pattern hota hai, jo market mein ek mukhtalif trend ke baad ati hai. Is pattern ko "flag" is liye kaha jata hai kyunki iski shape ek jhanda ya flag ki tarah hoti hai. Types of Flag Chart Pattern. Bullish Flag. Bullish flag pattern tab banta hai jab market mein pehle se upar ki trend hai aur phir ek choti si consolidation phase ati hai. Is phase mein prices sideways move karti hain aur ek flat rectangle ya pennant shape banti hai. Yeh continuation pattern hota hai, aur traders isko uptrend ke doran dekhte hain, jo indicate karta hai ke uptrend jaari hai. Bearish Flag. Bearish flag pattern tab banta hai jab market mein pehle se neeche ki trend hai aur phir ek choti si consolidation phase ati hai. Is phase mein prices sideways move karti hain aur ek flat rectangle ya pennant shape banti hai. Yeh bhi continuation pattern hota hai, aur traders isko downtrend ke doran dekhte hain, jo indicate karta hai ke downtrend jaari hai. Identification of Flag Pattern. Flag pattern ko tashkhees karne ke liye, aapko price chart par dhyan dena hoga. Bullish flag ko tashkhees karne ke liye, aap dekhein ke price mein pehle se upar ki trend hai, phir consolidation phase ati hai aur fir price breakout ke liye tayyar hoti hai. Isi tarah se bearish flag ko tashkhees karne ke liye, aap dekhein ke price mein pehle se neeche ki trend hai, phir consolidation phase ati hai aur fir price breakout ke liye tayyar hoti hai. Trading at Flag Pattern. Flag pattern ka istemal trading mein price ka future direction samajhne ke liye hota hai. Agar aap bullish flag dekhte hain, toh aap long position le sakte hain, yani ke price ke upar hone ki umeed. Aur agar aap bearish flag dekhte hain, toh aap short position le sakte hain Trading mein stop loss aur target levels set karna bhi ahem hota hai. Stop loss lagana important hota hai taake nuksan se bacha ja sake. Target levels set karke profit ko lock karne mein bhi madad milti hai.Flag chart pattern ek powerful tool ho sakta hai forex trading mein. Lekin, yaad rahe ke kisi bhi pattern ki tashkhees mein ghalatfehmi se bachna zaroori hai. Always apne trading strategy ko test karein aur risk management ka khayal rakhein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Flag Chart Pattern In Forex Trading.... Flag chart pattern forex trading mein ek pramukh technical analysis tool hai. Ye pattern ek trend continuation pattern hota hai aur traders ko market mein hone wale possible price movements ko samajhne mein madadgar hota hai. Flag pattern ka design kuch is tarah hota hai:Flag Pattern Ki Pechan: Flag pattern typically ek trend ke beech mein aata hai, jab market mein already ek strong trend ho raha hota hai, chahe wo uptrend (price badh raha hai) ho ya downtrend (price ghat raha hai) ho. Flag pattern ko do hisson mein divide kiya ja sakta hai: Pole :Flag pattern ke shuru mein ek lamba pole hota hai, jo trend ko represent karta hai.Agar trend uptrend hai, to pole bullish hota hai, aur agar trend downtrend hai, to pole bearish hota hai. Flag (Jhanda):Pole ke baad aata hai ek flag (jhanda) jo typically ek rectangular shape ka hota hai.Flag bearish pole ke baad aata hai agar trend downward hai, aur bullish pole ke baad aata hai agar trend upward hai.Flag ke andar price consolidation hoti hai, matlab ki price range mein choti movement hoti hai, jo ek indecision phase ko darust karti hai.Flag ke end mein ek breakout hota hai, jahan market wapas trend direction mein move karta hai.

Flag Pattern Ka Tafsili Bayan: Flag pattern trading mein istemal hota hai jab traders ko lagta hai ke market mein trend continue hone ke chances hain. Agar uptrend ke dauraan flag pattern banta hai, to traders long (khareedi jaa sakti hai) positions lete hain, aur agar downtrend ke dauraan flag pattern banta hai, to traders short (bikri jaa sakti hai) positions lete hain. Flag pattern ka ek important point hai ki breakout direction ko dekhna zaroori hai. Agar flag bullish hai aur breakout upside ki taraf hota hai, to ye bullish continuation ko darust karta hai. Agar flag bearish hai aur breakout downside ki taraf hota hai, to ye bearish continuation ko darust karta hai.Lekin yaad rahe ke trading market mein risk ke saath aata hai, aur isse judi gahri samajh aur experience hona chahiye. Agar aap trading mein naye hain, toh ek financial advisor ya expert se salah lena bhi mahatvapurn ho sakta hai.

Flag Pattern Ka Tafsili Bayan: Flag pattern trading mein istemal hota hai jab traders ko lagta hai ke market mein trend continue hone ke chances hain. Agar uptrend ke dauraan flag pattern banta hai, to traders long (khareedi jaa sakti hai) positions lete hain, aur agar downtrend ke dauraan flag pattern banta hai, to traders short (bikri jaa sakti hai) positions lete hain. Flag pattern ka ek important point hai ki breakout direction ko dekhna zaroori hai. Agar flag bullish hai aur breakout upside ki taraf hota hai, to ye bullish continuation ko darust karta hai. Agar flag bearish hai aur breakout downside ki taraf hota hai, to ye bearish continuation ko darust karta hai.Lekin yaad rahe ke trading market mein risk ke saath aata hai, aur isse judi gahri samajh aur experience hona chahiye. Agar aap trading mein naye hain, toh ek financial advisor ya expert se salah lena bhi mahatvapurn ho sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:24 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим