Inverted hammer candlestick pattern kia hai?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

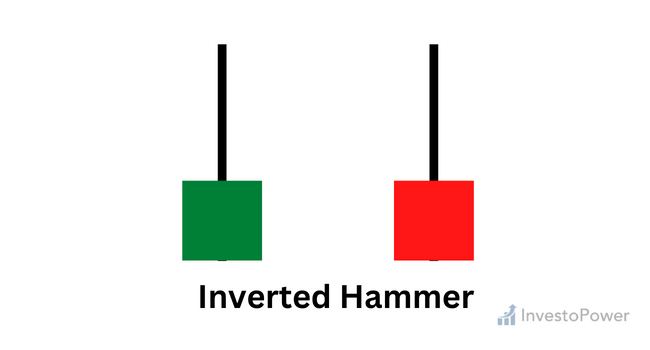

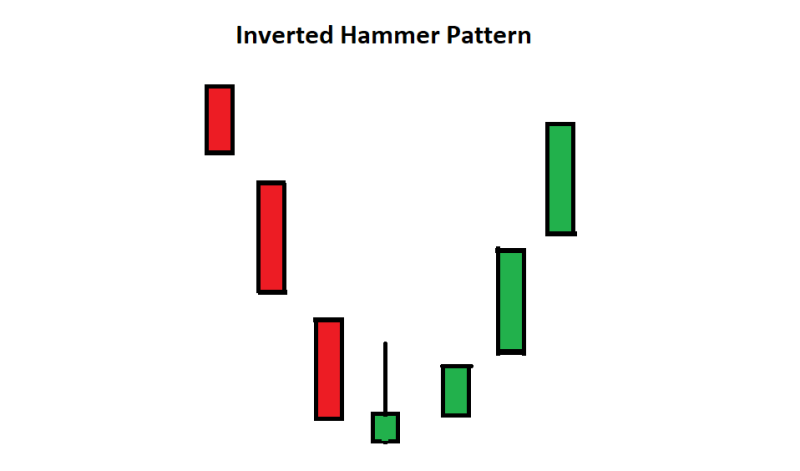

Introduction: Inverted Hammer Candlestick Pattern ya "Palto Hathi Mombatti" aik ahem technical analysis tool hai jo kisi bhi financial market mein trading aur investment ke liye istemal hota hai. Yeh pattern traders ko market ke future price movement ke baray mein ahem maloomat faraham karta hai. Is pattern ka main maqsad yeh hota hai ke woh point pehchan saken jahan market ke trend mein palat (reversal) hone ke imkanat hain.Inverted Hammer Candlestick Pattern:Inverted Hammer candlestick pattern ek specific market situation ko darust karti hai. Is pattern mein, aik single candlestick hoti hai jo neechay di gayi outline ko milti hai aur upper tail lambi hoti hai. Yeh upper tail market mein bulls aur bears ke darmiyan jang (struggle) ko darust karti hai. Explanation: Inverted Hammer pattern ki pehchan ke liye, yeh amal karna zaroori hai: Candlestick Ko Pehchanen: Inverted Hammer candlestick ko chart par pehchanen. Iski pehchan ke liye, aapko aik lambi upper tail aur choti body wali candle dikhayi degi jo ke neechay di gayi outline ko milti hai. Context Samajhna: Inverted Hammer candlestick pattern ko samajhnay ke liye, aapko current market context ko bhi dekhna hoga. Agar yeh pattern kisi strong support level ke qareeb ya downtrend ke baad aata hai, toh yeh bullish reversal ki alamat ho sakti hai. Confirmation Wait Karna: Inverted Hammer pattern ki tasdeeq ke liye, traders ko doosri indicators aur tools ka bhi sahara lena chahiye. Iska matlab hai ke aapko kisi doosre technical indicator ya trend line ke saath is pattern ki tasdeeq kar leni chahiye. Inverted Hammer Candlestick Pattern Ke Istemal Ka Tariqa Inverted Hammer candlestick pattern ke istemal se pehle, traders ko is pattern ki tasdeeq aur market ke context ko samajhna zaroori hai. Agar yeh pattern strong support level ya downtrend ke baad aata hai aur doosre indicators bhi bullish signals de rahe hain, toh traders long position le sakte hain. Nuksanat: Inverted Hammer pattern ka bhi apna nuksan hota hai. Kabhi-kabhi yeh pattern false signals bhi de sakta hai, isliye iske istemal mein careful rehna zaroori hai. Conclusion: Inverted Hammer candlestick pattern ek powerful technical analysis tool hai jo traders ko market ke trend reversals ka pata lagane mein madadgar ho sakta hai. Lekin, iska istemal samajhdari aur aur doosre technical tools ke saath karna zaroori hai taake false signals se bacha ja sake. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Inverted Hammer Candlestick Pattern Forex trading ek complexities se bharpoor maali asar hai, jahan traders mukhtalif technical analysis tools ka sahara letay hain taakay unhain maali faislay mein madad milay. Aik aisa tool hai jo aksar traders ke liye ahem hota hai, aur woh hai "Inverted Hammer" candlestick pattern. Is pattern ka mahaul aur iske asar ko samajhna traders ke liye zaroori hai. Inverted Hammer Candlestick Ko Samajhna Inverted Hammer ek aisa single candlestick pattern hai jo aam tor par downtrend ke akhir mein nazr aata hai. Is mein aik chhota sa body hota hai jo candlestick ke oopar qareeb hota hai, sath hi sath aik lambi upper shadow hoti hai aur neeche koi shadow ya bohot kam shadow hoti hai. Inverted Hammer ke nazr aane se yeh ishara hota hai ke buyers bearish pressure ke baad mein dobara control hasil kar rahe hain. Inverted Hammer Ki Tafsili Tafseel Jab aap ek downtrend mein Inverted Hammer candlestick pattern dekhte hain, to yeh aik ishara hai ke bears control khona shuru kar rahe hain, aur bullish reversal mumkin hai. Lekin traders ko ehtiyaat baratna chahiye aur trade mein shamil hone se pehle Inverted Hammer ke ilawa doosre technical indicators ya patterns se tasdeeq talash karni chahiye. Trading Strategies 1. * Confirmation: Inverted Hammer signal ki bharpoor tasdeeq ke liye, traders aksar intezar karte hain ke aglay session mein aik bullish candle ya aik ahem price ki tezi ho. 2. *Stop-Loss aur Take-Profit: Sahi risk management ahem hai. Traders ko Inverted Hammer ke low ke neeche stop-loss orders lagane aur profit lock karne ke liye take-profit levels ko ehtiyaat se set karna chahiye. 3. *Volume Analysis: Trading volume ko janchne se mazeed insight milti hai. Inverted Hammer ke sath barhne wala volume bullish case ko mazbooti deta hai. Conclusion Inverted Hammer candlestick pattern Forex traders ke liye aik ahem tool hai. Yeh downtrend mein mumkinah palat ke isharaat deta hai aur market sentiment mein taqat deti hai. Lekin, jaise kisi bhi technical indicator ko, isko doosre analysis methods ke saath istemal karke achi tarah se trading decisions banane ke liye istemal karna chahiye. Forex mein kamyabi hasil karne ke liye technical analysis, risk management, aur market dynamics ki gehri samajh ki aik combination ki zaroorat hoti hai. -

#4 Collapse

Inverted hammer candlestick pattern kia hai? Exclamation Inverted Hammer candlestick pattern ek aisa specific pattern nahi hai jo trading mein prasiddh ho. Aap shayad kisi galat ya a-vakyat (uncommon) term ka zikar kar rahe hain. Trading aur technical analysis mein istemal hone wale patterns aur candlestick formations prasiddh hain aur unka specific naam hota hai jo traders ke liye mahatvapurn hota hai.Lekin, main aapko Inverted Hammer candlestick pattern ke baare mein aur detail se batata hoon: Inverted Hammer Candlestick Pattern: Inverted Hammer candlestick pattern ek bearish reversal pattern hai jo traders dwara market analysis mein istemal hota hai. Ye pattern typically downtrend (price ghat raha hai) ke baad aata hai aur bearish trend ke reversal ko indicate karta hai.Inverted Hammer candlestick ki pehchan is prakar hoti hai:

Inverted hammer candlestick pattern kia hai? Exclamation Inverted Hammer candlestick pattern ek aisa specific pattern nahi hai jo trading mein prasiddh ho. Aap shayad kisi galat ya a-vakyat (uncommon) term ka zikar kar rahe hain. Trading aur technical analysis mein istemal hone wale patterns aur candlestick formations prasiddh hain aur unka specific naam hota hai jo traders ke liye mahatvapurn hota hai.Lekin, main aapko Inverted Hammer candlestick pattern ke baare mein aur detail se batata hoon: Inverted Hammer Candlestick Pattern: Inverted Hammer candlestick pattern ek bearish reversal pattern hai jo traders dwara market analysis mein istemal hota hai. Ye pattern typically downtrend (price ghat raha hai) ke baad aata hai aur bearish trend ke reversal ko indicate karta hai.Inverted Hammer candlestick ki pehchan is prakar hoti hai:  Shape: Inverted Hammer candle ek chhota candle hota hai jiska upper shadow (uncha chhaya) lamba hota hai jabki lower shadow (neecha chhaya) chhota hota hai. Candle ka body upper end par hota hai.

Shape: Inverted Hammer candle ek chhota candle hota hai jiska upper shadow (uncha chhaya) lamba hota hai jabki lower shadow (neecha chhaya) chhota hota hai. Candle ka body upper end par hota hai.  Context: Ye pattern downtrend ke baad aata hai aur bearish trend ke sign ke roop mein aata hai. Iska matlab hota hai ke pehle sellers ne control mei hokar price ko niche le gaye the, lekin phir buyers ne control mei le liya aur price mein aas-pass ki recovery shuru ho gayi.Inverted Hammer pattern traders ko ye indication deta hai ke market mein selling pressure kamzor ho raha hai aur potential reversal ho sakta hai. Lekin, is pattern ke istemal mein doosre technical indicators aur analysis tools ka bhi istemal kiya jata hai trading decisions ke liye.Trading market mein risk ke saath aata hai, aur ismein gahri samajh aur experience hona chahiye. Agar aap trading mein naye hain, toh ek financial advisor ya expert se salah lena bhi mahatvapurn ho sakta hai.

Context: Ye pattern downtrend ke baad aata hai aur bearish trend ke sign ke roop mein aata hai. Iska matlab hota hai ke pehle sellers ne control mei hokar price ko niche le gaye the, lekin phir buyers ne control mei le liya aur price mein aas-pass ki recovery shuru ho gayi.Inverted Hammer pattern traders ko ye indication deta hai ke market mein selling pressure kamzor ho raha hai aur potential reversal ho sakta hai. Lekin, is pattern ke istemal mein doosre technical indicators aur analysis tools ka bhi istemal kiya jata hai trading decisions ke liye.Trading market mein risk ke saath aata hai, aur ismein gahri samajh aur experience hona chahiye. Agar aap trading mein naye hain, toh ek financial advisor ya expert se salah lena bhi mahatvapurn ho sakta hai.

-

#5 Collapse

Inverted hammer candlestick pattern kia hai? "Exclamation Inverted Hammer" candlestick pattern ek technical analysis concept hai jo financial markets, jaise ke stock market aur forex market, mein price action analysis mein istemal hota hai. Ye pattern market ke potential reversals ko samjhne mein madadgar hota hai. Is pattern ka naam iske appearance se milta julta hai, kyun ke yeh ek inverted hammer candlestick pattern ke specific variation hai. Exclamation Inverted Hammer Candlestick Pattern Ki Tafseelat: Is pattern ki pehchan karne ke liye, aapko ye kuch key characteristics dekhni hoti hain: 1. Inverted Hammer: 2. Exclamation Inverted Hammer pattern ka pehla hissa ek inverted hammer candlestick hota hai. Inverted hammer candlestick ek aisi candlestick hoti hai jismein: o Opening price aur closing price ke darmiyan aik choti si body hoti hai. 3. o Upper shadow (wicks) lamba hota hai aur lower shadow lamba nahi hota, jo ke price ke upward reversal ko indicate karta hai. 4. 5. 6. Exclamation Mark: 7. Is pattern ka distinctive hissa ek exclamation mark (!) ki tarah dikhta hai, jo inverted hammer ke upper side par hota hai. 8. Yeh mark is pattern ko "exclamation" inverted hammer banata hai. Exclamation Inverted Hammer Pattern Ka Maqsad: Exclamation Inverted Hammer pattern market ke potential reversals ko darust karta hai, lekin iska interpretation thoda tricky ho sakta hai. Is pattern ka maqsad hota hai ke jab market ek downtrend mein hoti hai aur ek exclamation inverted hammer candle pattern banata hai, to isse ye samjha jata hai ke downward trend mein weakness aane ki sambhavna hai aur price mein upward reversal ki ummeed hai.Exclamation Inverted Hammer Pattern Ka Istemal Kaise Hota Hai: Traders exclamation inverted hammer pattern ko trading decisions ke liye istemal karte hain. Agar yeh pattern downtrend ke baad aata hai, to traders long position (khareedne ki position) le sakte hain ya existing short position ko cover (close) kar sakte hain, kyun ke iska appearance upward reversal ko indicate karta hai. Lekin, yaad rahe ke kisi bhi single candlestick pattern par pura bharosa na karein aur market context aur doosre technical indicators ko bhi madde nazar rakhein. Risk management hamesha ahem hota hai, aur trading decisions ko carefully plan aur execute karein.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Describe Inverted hammer candle stick patterns ? Inverted Hammar Candle Example ya "Palto Hathi Mombatti" aik ahem specialized investigation device hai jo kisi bhi monetary market mein exchanging aur speculation ke liye istemal hota hai. Yeh design merchants ko market ke future cost development ke baray mein ahem maloomat faraham karta hai. Is design ka primary maqsad yeh hota hai ke woh point pehchan saken jahan market ke pattern mein palat (inversion) sharpen ke imkanat hain. Inverted Hammer Candlesstick Example: Inverted Hammer candle design ek explicit market circumstance ko darust karti hai. Is design mein, aik single candle hoti hai jo neechay di gayi frame ko milti hai aur upper tail lambi hoti hai. Yeh upper tail market mein bulls aur bears ke darmiyan jang (battle) ko darust karti hai. Formation of Inverted Hammer Candle stick.... 1. * Affirmation: Rearranged Sledge signal ki bharpoor tasdeeq ke liye, brokers aksar intezar karte hain ke aglay meeting mein aik bullish light ya aik ahem cost ki tezi ho. 2. *Stop-Misfortune aur Take-Benefit: Sahi risk the board ahem hai. Dealers ko Transformed Mallet ke low ke neeche stop-misfortune orders lagane aur benefit lock karne ke liye take-benefit levels ko ehtiyaat se set karna chahiye. 3. *Volume Examination: Exchanging volume ko janchne se mazeed understanding milti hai. Rearranged Sledge ke sath barhne wala volume bullish case ko mazbooti deta hai. Conculsion.... Inverted Hammer candle design ek strong specialized examination instrument hai jo dealers ko market ke pattern inversions ka pata lagane mein madadgar ho sakta hai. Lekin, iska istemal samajhdari aur doosre specialized apparatuses ke saath karna zaroori hai taake bogus signs se bacha ja purpose. -

#7 Collapse

Introduction: Inverted Hammer Candlestick Pattern ya "Palto Hathi Mombatti" aik ahem technical evaluation tool hai jo kisi bhi financial market mein buying and selling aur investment ke liye istemal hota hai. Yeh sample traders ko marketplace ke future fee movement ke baray mein ahem maloomat faraham karta hai. Is pattern ka important maqsad yeh hota hai ke woh point pehchan saken jahan market ke fashion mein palat (reversal) hone ke imkanat hain.Inverted Hammer candlestick sample ke istemal se pehle, buyers ko is pattern ki tasdeeq aur market ke context ko samajhna zaroori hai. Agar yeh pattern strong help degree ya downtrend ke baad aata hai aur doosre signs bhi bullish alerts de rahe hain, toh traders lengthy position le sakte hain.Forex trading ek complexities se bharpoor maali asar hai, jahan buyers mukhtalif technical evaluation gear ka sahara letay hain taakay unhain maali faislay mein madad milay. Aik aisa tool hai jo aksar investors ke liye ahem hota hai, aur woh hai "Inverted Hammer" candlestick sample. Is sample ka mahaul aur iske asar ko samajhna investors ke liye zaroori hai. Inverted Candlestick Pattern: Inverted Hammer candlestick pattern ek particular market situation ko darust karti hai. Is pattern mein, aik unmarried candlestick hoti hai jo neechay di gayi define ko milti hai aur higher tail lambi hoti hai. Yeh top tail market mein bulls aur bears ke darmiyan jang ko darust karti hai. Inverted Hammer candlestick ko chart par pehchanen. Iski pehchan ke liye, aapko aik lambi upper tail aur choti body wali candle dikhayi degi jo ke neechay di gayi define ko milti hai.Inverted Hammer candlestick sample ko samajhnay ke liye, aapko current marketplace context ko bhi dekhna hoga. Agar yeh sample kisi strong aid level ke qareeb ya downtrend ke baad aata hai, toh yeh bullish reversal ki alamat ho sakti hai. Investors ko doosri indicators aur tools ka bhi sahara lena chahiye. Iska matlab hai ke aapko kisi doosre technical indicator ya trend line ke saath is pattern ki tasdeeq kar leni chahiye.Inverted Hammer; Inverted Hammer ek aisa single candlestick sample hai jo aam tor par downtrend ke akhir mein nazr aata hai. Is mein aik chhota sa body hota hai jo candlestick ke oopar qareeb hota hai, sath hi sath aik lambi higher shadow hoti hai aur neeche koi shadow ya bohot kam shadow hoti hai. Inverted Hammer ke nazr aane se yeh ishara hota hai ke shoppers bearish stress ke baad mein dobara control hasil kar rahe hain.Jab aap ek downtrend mein Inverted Hammer candlestick sample dekhte hain, to yeh aik ishara hai ke bears control khona shuru kar rahe hain, aur bullish reversal mumkin hai. Lekin investors ko ehtiyaat baratna chahiye aur exchange mein shamil hone se pehle Inverted Hammer ke ilawa doosre technical signs ya patterns se tasdeeq talash karni chahiye. Jaise kisi bhi technical indicator ko, isko doosre evaluation methods ke saath istemal karke achi tarah se buying and selling selections banane ke liye istemal karna chahiye. The Forex market mein kamyabi hasil karne ke liye technical evaluation, threat control, aur marketplace dynamics ki gehri samajh ki aik combination ki zaroorat hoti hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

What Is Inverted Hammer Candlestick Chart Pattern: Inverted Hammer ek aisa single candle test hai jo aam pinnacle standard downtrend ke akhir mein nazr aata hai. Is mein aik chhota sa body hota hai jo candle ke oopar qareeb hota hai, sath greetings sath aik lambi higher shadow hoti hai aur neeche koi shadow ya bohot kam shadow hoti hai. Altered Mallet ke nazr aane se yeh ishara hota hai ke customers negative pressure ke baad mein dobara control hasil kar rahe hain.Jab aap ek downtrend mein Upset Sledge candle test dekhte hain, to yeh aik ishara hai ke bears control khona shuru kar rahe hain, aur bullish inversion mumkin hai. Lekin financial backers ko ehtiyaat baratna chahiye aur trade mein shamil sharpen se pehle Transformed Sledge ke ilawa doosre specialized signs ya designs se tasdeeq talash karni chahiye. Jaise kisi bhi specialized marker ko, isko doosre assessment techniques ke saath istemal karke achi tarah se trading choices banane ke liye istemal karna chahiye. Candle design ek specific market circumstance ko darust karti hai. Is design mein, aik unmarried candle hoti hai jo neechay di gayi characterize ko milti hai aur higher tail lambi hoti hai. Yeh top tail market mein bulls aur bears ke darmiyan jang ko darust karti hai. Upset Sledge candle ko diagram standard pehchanen. Iski pehchan ke liye, aapko aik lambi upper tail aur choti body wali light dikhayi degi jo ke neechay di gayi characterize ko milti hai.Inverted Mallet candle test ko samajhnay ke liye, aapko current commercial center setting ko bhi dekhna hoga. Agar yeh test areas of strength for kisi level ke qareeb ya downtrend ke baad aata hai, toh yeh bullish inversion ki alamat ho sakti hai. Financial backers ko doosri pointers aur devices ka bhi sahara lena chahiye. Iska matlab hai ke aapko kisi doosre specialized pointer ya pattern line ke saath is design ki tasdeeq kar leni chahiye. Inverted Hammer Candles Formation: Design ka significant maqsad yeh hota hai ke woh point pehchan saken jahan market ke style mein palat (inversion) sharpen ke imkanat hain.Inverted Sledge candle test ke istemal se pehle, purchasers ko is design ki tasdeeq aur market ke setting ko samajhna zaroori hai. Agar yeh design solid assistance degree ya downtrend ke baad aata hai aur doosre signs bhi bullish cautions de rahe hain, toh brokers extended position le sakte hain.Forex exchanging ek intricacies se bharpoor maali asar hai, jahan purchasers mukhtalif specialized assessment gear ka sahara letay hain taakay unhain maali faislay mein madad milay. Aik aisa device hai jo aksar financial backers ke liye ahem hota hai, aur woh hai "Upset Mallet" candle test. Is test ka mahaul aur iske asar ko samajhna financial backers ke liye zaroori hai.

Candle design ek specific market circumstance ko darust karti hai. Is design mein, aik unmarried candle hoti hai jo neechay di gayi characterize ko milti hai aur higher tail lambi hoti hai. Yeh top tail market mein bulls aur bears ke darmiyan jang ko darust karti hai. Upset Sledge candle ko diagram standard pehchanen. Iski pehchan ke liye, aapko aik lambi upper tail aur choti body wali light dikhayi degi jo ke neechay di gayi characterize ko milti hai.Inverted Mallet candle test ko samajhnay ke liye, aapko current commercial center setting ko bhi dekhna hoga. Agar yeh test areas of strength for kisi level ke qareeb ya downtrend ke baad aata hai, toh yeh bullish inversion ki alamat ho sakti hai. Financial backers ko doosri pointers aur devices ka bhi sahara lena chahiye. Iska matlab hai ke aapko kisi doosre specialized pointer ya pattern line ke saath is design ki tasdeeq kar leni chahiye. Inverted Hammer Candles Formation: Design ka significant maqsad yeh hota hai ke woh point pehchan saken jahan market ke style mein palat (inversion) sharpen ke imkanat hain.Inverted Sledge candle test ke istemal se pehle, purchasers ko is design ki tasdeeq aur market ke setting ko samajhna zaroori hai. Agar yeh design solid assistance degree ya downtrend ke baad aata hai aur doosre signs bhi bullish cautions de rahe hain, toh brokers extended position le sakte hain.Forex exchanging ek intricacies se bharpoor maali asar hai, jahan purchasers mukhtalif specialized assessment gear ka sahara letay hain taakay unhain maali faislay mein madad milay. Aik aisa device hai jo aksar financial backers ke liye ahem hota hai, aur woh hai "Upset Mallet" candle test. Is test ka mahaul aur iske asar ko samajhna financial backers ke liye zaroori hai.  inverted or Reversed hammer design ko exchanging choices ke liye istemal karte hain. Agar yeh design downtrend ke baad aata hai,to merchants long position (khareedne ki position) le sakte hain ya existing short position ko cover (close) kar sakte hain, kyun ke iska appearance up inversion ko demonstrate karta hai.kisi bhi single candle design standard pura bharosa na karein aur Hazard the board hamesha ahem hota hai, aur exchanging choices ko cautiously plan aur execute karein.pattern ka pehla hissa ek altered hammer candle hota hai. Modified hammer candle ek aisi candle hoti hai jismein Opening cost aur shutting cost ke darmiyan aik choti si body hoti hai.shadow (wicks) lamba hota hai aur lower shadow lamba nahi hota, jo ke cost ke up inversion ko demonstrate karta hai Inverted Hammer Chart pattern Types: Diagram Example downtrend ke baad aata hai aur negative pattern ke sign ke roop mein aata hai. Iska matlab hota hai ke pehle merchants ne control mei hokar cost ko specialty le gaye the, lekin phir purchasers ne control mei le liya aur cost mein aas-pass ki recuperation shuru ho gayi.Inverted Mallet design brokers ko ye sign deta hai ke marketmein selling pressure kamzor ho raha hai aur potential inversion ho sakta hai. Lekin, is design ke istemal mein doosre specialized pointers aur investigation devices ka bhi istemalkiya jata hai exchanging choices ke liye.Trading market mein risk ke saath aata hai, aur ismein gahri samajh aur experience hona chahiye. Agar aap exchanging mein naye hain,toh ek monetary counsel ya master se salah lena bhi ho sakta hai.

inverted or Reversed hammer design ko exchanging choices ke liye istemal karte hain. Agar yeh design downtrend ke baad aata hai,to merchants long position (khareedne ki position) le sakte hain ya existing short position ko cover (close) kar sakte hain, kyun ke iska appearance up inversion ko demonstrate karta hai.kisi bhi single candle design standard pura bharosa na karein aur Hazard the board hamesha ahem hota hai, aur exchanging choices ko cautiously plan aur execute karein.pattern ka pehla hissa ek altered hammer candle hota hai. Modified hammer candle ek aisi candle hoti hai jismein Opening cost aur shutting cost ke darmiyan aik choti si body hoti hai.shadow (wicks) lamba hota hai aur lower shadow lamba nahi hota, jo ke cost ke up inversion ko demonstrate karta hai Inverted Hammer Chart pattern Types: Diagram Example downtrend ke baad aata hai aur negative pattern ke sign ke roop mein aata hai. Iska matlab hota hai ke pehle merchants ne control mei hokar cost ko specialty le gaye the, lekin phir purchasers ne control mei le liya aur cost mein aas-pass ki recuperation shuru ho gayi.Inverted Mallet design brokers ko ye sign deta hai ke marketmein selling pressure kamzor ho raha hai aur potential inversion ho sakta hai. Lekin, is design ke istemal mein doosre specialized pointers aur investigation devices ka bhi istemalkiya jata hai exchanging choices ke liye.Trading market mein risk ke saath aata hai, aur ismein gahri samajh aur experience hona chahiye. Agar aap exchanging mein naye hain,toh ek monetary counsel ya master se salah lena bhi ho sakta hai.  Inverted Hammer candlestick design Forex merchants ke liye aik ahem apparatus hai. Yeh downtrend mein mumkinah palat ke isharaat deta hai aur market opinion mein taqat deti hai. Lekin, jaise kisi bhi specialized pointer ko, isko doosre examination strategies ke saath istemal karke achi tarah se exchanging choices banane ke liye istemal karna chahiye. Forex mein kamyabi hasil karne ke liye specialized investigation, risk the board, aur market elements ki gehri samajh ki aik mix ki zaroorat hoti hai. Transformed Sledge candle design ek aisa explicit example nahi hai jo exchanging mein prasiddh ho. Aap shayad kisi galat ya a-vakyat (unprecedented) term ka zikarkar rahe hain. Exchanging aur specialized investigation mein istemal sharpen rib designs aur candle arrangements prasiddh hain aur unka explicit naam hota hai jo brokers ke liye hota hai.lekin, Sledge candle design ek negative inversion design hai jo merchants dwara market examination mein istemal hota hai. Ye design regularly downtrend (cost ghat raha hai) ke baad aata hai aur negative pattern ke inversion ko demonstrate karta hai.Inverted Mallet candle ki pehchan is prakar hoti hai Inverted Hammer Chart pattern Trading: Inverted Hammer ki bharpoor tasdeeq ke liye, dealers aksar intezar karte hain ke aglay meeting mein aik bullish flame ya aik ahem cost ki tezi ho.Stop-Misfortune aur Take-Benefit: Sahi risk the executives ahem hai. Brokers ko Reversed Mallet ke low ke neeche stop-misfortune orders lagane aur benefit lock karne ke liye take-benefit levels ko ehtiyaat se set karna chahiye.Trading volume ko janchne se mazeed knowledge milti hai. Altered Mallet ke sath barhne wala volume bullish case ko mazbooti deta hai.aap ek downtrend mein Transformed Sledge candle design dekhte hain, to yeh aik ishara hai ke bears control khona shuru kar rahe hain, aur bullish inversion mumkin hai. Lekin dealers ko ehtiyaat baratna chahiye aur exchange mein shamil sharpen se pehle Upset Mallet ke ilawa doosre specialized pointers ya designs se tasdeeq talash karni chahiye.

Inverted Hammer candlestick design Forex merchants ke liye aik ahem apparatus hai. Yeh downtrend mein mumkinah palat ke isharaat deta hai aur market opinion mein taqat deti hai. Lekin, jaise kisi bhi specialized pointer ko, isko doosre examination strategies ke saath istemal karke achi tarah se exchanging choices banane ke liye istemal karna chahiye. Forex mein kamyabi hasil karne ke liye specialized investigation, risk the board, aur market elements ki gehri samajh ki aik mix ki zaroorat hoti hai. Transformed Sledge candle design ek aisa explicit example nahi hai jo exchanging mein prasiddh ho. Aap shayad kisi galat ya a-vakyat (unprecedented) term ka zikarkar rahe hain. Exchanging aur specialized investigation mein istemal sharpen rib designs aur candle arrangements prasiddh hain aur unka explicit naam hota hai jo brokers ke liye hota hai.lekin, Sledge candle design ek negative inversion design hai jo merchants dwara market examination mein istemal hota hai. Ye design regularly downtrend (cost ghat raha hai) ke baad aata hai aur negative pattern ke inversion ko demonstrate karta hai.Inverted Mallet candle ki pehchan is prakar hoti hai Inverted Hammer Chart pattern Trading: Inverted Hammer ki bharpoor tasdeeq ke liye, dealers aksar intezar karte hain ke aglay meeting mein aik bullish flame ya aik ahem cost ki tezi ho.Stop-Misfortune aur Take-Benefit: Sahi risk the executives ahem hai. Brokers ko Reversed Mallet ke low ke neeche stop-misfortune orders lagane aur benefit lock karne ke liye take-benefit levels ko ehtiyaat se set karna chahiye.Trading volume ko janchne se mazeed knowledge milti hai. Altered Mallet ke sath barhne wala volume bullish case ko mazbooti deta hai.aap ek downtrend mein Transformed Sledge candle design dekhte hain, to yeh aik ishara hai ke bears control khona shuru kar rahe hain, aur bullish inversion mumkin hai. Lekin dealers ko ehtiyaat baratna chahiye aur exchange mein shamil sharpen se pehle Upset Mallet ke ilawa doosre specialized pointers ya designs se tasdeeq talash karni chahiye.  Inverted Hammer ek aisa single candle design hai jo aam pinnacle standard downtrend ke akhir mein nazr aata hai. Is mein aik chhota sa body hota hai jo candle ke oopar qareeb hota hai, sath greetings sath aik lambi upper shadow hoti hai aur neeche koi shadow ya bohot kam shadow hoti hai. Modified Sledge ke nazr aane se yeh ishara hota hai ke purchasers negative tension ke baad mein dobara control hasil kar rahe hain. candle design ko samajhnay ke liye, aapko current market setting ko bhi dekhna hoga. Agar yeh design serious areas of strength for kisi level ke qareeb ya downtrend ke baad aata hai, toh yeh bullish inversion ki alamat ho sakti hai. Transformed Mallet design ki tasdeeq ke liye, brokers ko doosri pointers aur instruments ka bhi sahara lena chahiye. Iska matlab hai ke aapko kisi doosre specialized pointer ya pattern line ke saath is design ki tasdeeq kar leni chahiye.

Inverted Hammer ek aisa single candle design hai jo aam pinnacle standard downtrend ke akhir mein nazr aata hai. Is mein aik chhota sa body hota hai jo candle ke oopar qareeb hota hai, sath greetings sath aik lambi upper shadow hoti hai aur neeche koi shadow ya bohot kam shadow hoti hai. Modified Sledge ke nazr aane se yeh ishara hota hai ke purchasers negative tension ke baad mein dobara control hasil kar rahe hain. candle design ko samajhnay ke liye, aapko current market setting ko bhi dekhna hoga. Agar yeh design serious areas of strength for kisi level ke qareeb ya downtrend ke baad aata hai, toh yeh bullish inversion ki alamat ho sakti hai. Transformed Mallet design ki tasdeeq ke liye, brokers ko doosri pointers aur instruments ka bhi sahara lena chahiye. Iska matlab hai ke aapko kisi doosre specialized pointer ya pattern line ke saath is design ki tasdeeq kar leni chahiye.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:44 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим