Details of Three Inside Down Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Details of Three Inside Down Pattern

Asalamualaikum! Dear member main umeed karti hun ap sab kehriyat sy hon gay, or achi earning kar rahy hon gay.agr ap Market main kamyabi hasil karna chahty hain, to es k liye zarori hai ap candlestick chart pattern ko achi tara samjhy, ta ap apni Trading main best work kar sakhyn. jab ap Forex trading market main fundamental and Technical Analysis ko perfect banate hain, to ap ko bahut jyada advantages hasil ho sakte hain, en analasis ko increase karne ky liye ap ko different patterns ki study krna hoti hai. Is main aik bahut hi strong pattern, jis ko ap Three Inside Up Candlestick Pattern keh sakhty Hain, us sy related kuch important information ap sa share krna chahti Hun . THREE INSIDE UP CANDLESTICK PATTERN: Dear members Jaisy Ky is k name sy hi ap idea lga sakhty Hain Ky is Candlestick Pattern main 3 different types ki Candlestick include hoti hain. Jab ap Three Inside Up Candlestick Pattern ko completely understand kar rahy hoty Hain, to is mein ap ko following mentioned Candlestick ko find out karna hota hai.IDENTIFICATION OF THREE INSIDE UP CANDLESTICK PATTERN: Dear Kisi bhi pattern ki identification bahut zarori hoti hai. Jab market main aik strong downtrend hota hai, or support level par jab buyer's pressure sellers ko futher down movement nahin krny deta, to us time par jab last Candlestick ko 2 bullish candlestick es tarah cover krti Hain, Ky first bullish candlestick last bearish candlestick ko more then 50 percent cover kiye hoye hoti hai, or 2nd bullish candlestick us ko completely cover Kar Ky bearish candlestick Ky opening point sy upper hi closing krti hai, is Candlestick Pattern ko ap Three Inside Up Candlestick Pattern khety Hain. Es candlestick pattern ko ap easily recognise kr sakhty Hain. Is k bad market main aik acha buy trend confirm ho jata hai, sometime Market lowwest value ko retest Kar sakhti hai. HOW TO TRADE IN THREE INSIDE UP CANDLESTICK PATTERN: Dear member Forex trading market main agar ap Three Inside Up Candlestick Pattern ko properly understand kar laty Hain, to is mein ap ko bahut hi acchi trading entry mil sakhti hai, Jo ap ki trading ko profitable banane main ap ki helpful ho sakti hai. Is candlestick pattern ki confirmation par ap ko hamesha buying entry Lena hoti hai. CHART ANALYSIS: Dear jab ap market main proper analysis kar Trading karty hain to ap ko bhot zyada fayda hota hai or ap ko acha profit mil jata hai.es liye ap ko hmesha market main judgement karna chahye ta k ap ko maximum Advantage available hon jab ap market main candlestick pattern ko achi tara indentify karty hain to ap successful Trading kar k achi earning kar sakhty hain.

OTHER DETAILS: Dear member main ap sy is pattern ka chart share krny ja rahi hun, is sy ap ka concept achi tarah clear ho jye ga or ap achi working kar k successful Trading kar sakhty hain. candlestick pattern ko ap easily recognise kr sakhty Hain. Is k bad market main aik acha buy trend confirm ho jata hai, or ap perfect entry par trade laga acha profit bana sakhty hai es liye ap ko best entry ka wait karna chahy.

-

#3 Collapse

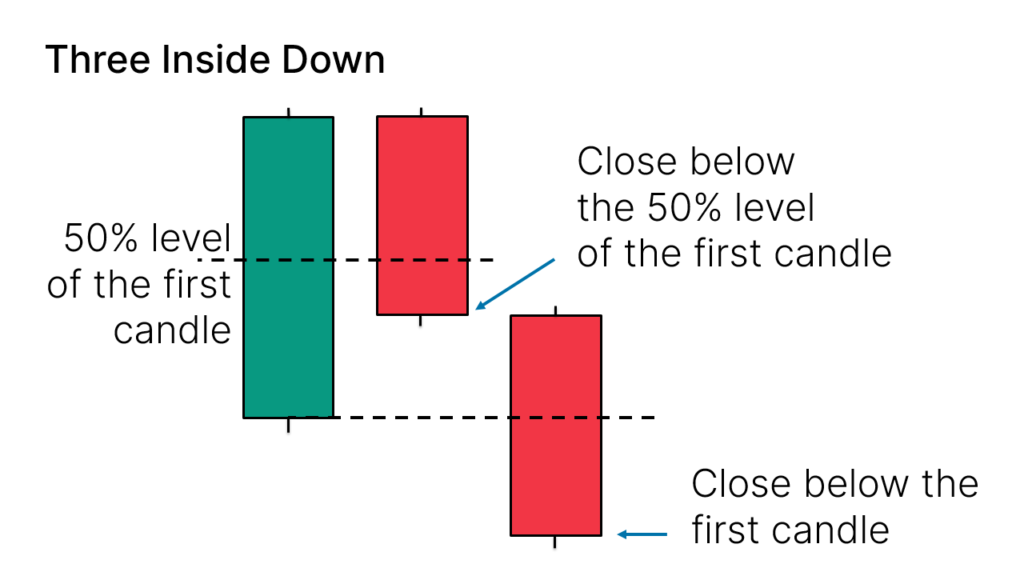

Three Inside Down Candlestick Pattern ka Introduction Three Inside Down Candlestick Pattern ek mahatvapurna technical analysis tool hai jo market mein hone wale trend reversals ko anticipate karne mein madadgar hota hai. Is pattern ko samajhna aur istemal karna traders ke liye ahem hai, lekin hamesha dhyan rahe ke market analysis ke doosre aspects aur indicators ko bhi consider karein. Trading market mein risk ke saath juda hota hai, isliye prudent trading strategies ka istemal karna zaroori hai. Traders ko market mein hone wale changes aur opportunities ko samajhne ke liye lagatar seekhna aur update rehna chahiye..Three Inside Down Candlestick Pattern ek ahem technical analysis tool hai jo stock market mein price movement aur trend ko samajhne mein madadgar hota hai. Ye pattern traders aur investors ke liye ahem hai kyunki iske zariye market mein hone wale possible changes ko anticipate kiya ja sakta hai. Is article mein hum Three Inside Down Candlestick Pattern ke baray mein tafseel se baat karenge aur iske maqsad aur istemal ko explore karenge. Three Inside Down Pattern Kya Hai Three Inside Down Candlestick Pattern ek bearish reversal pattern hai jo bullish trend ko reverse karne ki alamat hoti hai. Is pattern mein teen consecutive candlesticks shamil hoti hain. Pehli candlestick ek lambi bullish candle hoti hai, jo bullish trend ko represent karti hai. Dusri candlestick bhi bullish hoti hai, lekin uski body pehli candle ki body ke andar hoti hai, matlab ke dono candlesticks ek dosre ko cover karte hain. Teesri candlestick bearish hoti hai aur uski closing price pehli candlestick ki body ke andar hoti hai.Is pattern ko "Three Inside Down" kehte hain kyun ke teesri candlestick pehli do candlesticks ke andar chhupi hui hoti hai aur bearish trend ki shuruaat ko darust karte hue hai. Three Inside Down Pattern Ki Tafseelat Three Inside Down Candlestick Pattern ki pehchan karne ke liye traders ko market ki price chart ko carefully analyze karna hota hai. Is pattern ki tafseelat se traders ko ye idea milta hai ke pehle do candlesticks mein bullish trend thi lekin teesri candlestick ne bearish momentum ko shuru kar diya hai. Is pattern ki tafseelat se traders ko ye bhi samajhne mein madad milti hai ke bearish sentiment market mein barh gayi hai aur bullish trend weaken ho raha hai. Trading Mein Three Inside Down Pattern Ka Istemal Three Inside Down Candlestick Pattern ko samajh kar traders apni trading strategies banate hain. Is pattern ki tafseelat se traders ko ye idea milta hai ke bearish trend ki position strong ho rahi hai aur bullish trend ki shuruaat hone ki sambhavna hai. Lekin, yaad rahe ke is pattern ki confirmation ke liye doosre technical indicators aur analysis tools ka bhi istemal karna zaroori hai. Is pattern ko samajhne ke liye, traders ko doosre technical analysis tools jaise ke moving averages, RSI, aur volume analysis ka bhi sahara lena chahiye. Three Inside Down Pattern ki tafseelat ke sath-sath, market ke overall health aur sentiment ko bhi samajhna zaroori ha -

#4 Collapse

Three inside down pattern :

Three Inside Down pattern bearish continuation pattern hai. Is pattern mein ek bullish candle hai, uske baad ek small bearish candle hai jo pehle wale bullish candle ke andar fit hoti hai, aur phir ek aur bearish candle hai jo pehle bearish candle ke niche close hoti hai. Is pattern ko dekh kar traders expect karte hai ki downtrend continue hoga. Is pattern ko identify karne ke liye pehle bullish candle ke high aur low ko dekhe, phir second bearish candle ke high aur low ko dekhe, aur phir third bearish candle ke high aur low ko dekhe. Agar third candle pehle bearish candle ke niche close hoti hai, to ye Three Inside Down pattern hai.

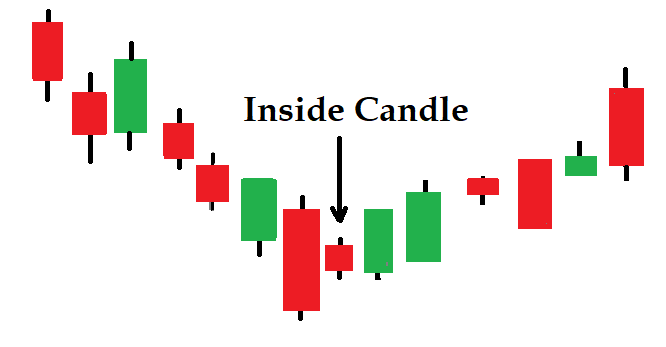

Identify three inside down pattern:

Three inside down pattern ko identify karne ke liye aapko candlestick chart pe dhyan dena hoga. Is pattern mein aapko teen consecutive candles dekhne honge. Pehla candle bullish hoga, dusra candle small bearish hoga jo pehle candle ke andar fit hota hai, aur teesra candle phir se bearish hoga jo pehle bearish candle ke niche close hota hai. Agar aapko yeh pattern milta hai, toh aap Three Inside Down pattern ko identify kar sakte hai.

Characteristics of trading with Three inside down pattern:

Three Inside Down pattern ka use karke trading karne ke liye kuch characteristics hai:

1. Entry point:

Jab third bearish candle pehle bearish candle ke niche close hoti hai, tab aap selling position mein enter kar sakte hai.

2. Stop-loss:

Stop-loss order ko pehle bullish candle ke high ke above set kar sakte hai, taki aapko loss control mein rahe.

3. Target:

Target price ko pehle bearish candle ke low ke around set kar sakte hai, jahaan tak aapko profit expect ho.

4. Risk management:

Hamesha apne trades mein risk management ka dhyan rakhe, jaise ki position size aur stop-loss levels set karke. Yeh characteristics aapko Three Inside Down pattern ke sath trading karne mein madad karenge. -

#5 Collapse

Three inside down pattern Is pattern mein ek bullish candle hai, uske baad ek small bearish candle hai jo pehle wale bullish candle ke andar fit hoti hai, aur phir ek aur bearish candle hai jo pehle bearish candle ke niche close hoti hai. Is pattern ko dekh kar traders expect karte hai ki downtrend continue hoga. Is pattern ko identify karne ke liye pehle bullish candle ke high aur low ko dekhe, phir second bearish candle ke high aur low ko dekhe, aur phir third bearish candle ke high aur low ko dekhe. Agar third candle pehle bearish candle ke niche close hoti hai, to ye Three Inside Down pattern hai. In detail three inside down candlestickThree Inside Down Candle Example ek negative inversion design hai jo bullish pattern ko switch karne ki alamat hoti hai. Is design mein youngster back to back candles shamil hoti hain. Pehli candle ek lambi bullish candle hoti hai, jo bullish pattern ko address karti hai. Dusri candle bhi bullish hoti hai, lekin uski body pehli light ki body ke andar hoti hai, matlab ke dono candles ek dosre ko cover karte hain. Teesri candle negative hoti hai aur uski shutting cost pehli candle ki body ke andar hoti hai.Is design ko "Three Inside Down" kehte hain kyun ke teesri candle pehli do candles ke andar chhupi hui hoti hai aur negative pattern ki shuruaat ko darust karte shade ha Feature how to trade on threeinside down candlestick Passage point: Poke third negative candle pehle negative light ke specialty close hoti hai, tab aap selling position mein enter kar sakte hai. Stop-misfortune: Stop-misfortune request ko pehle bullish candle ke high ke above set kar sakte hai, taki aapko misfortune control mein rahe. Target: Target cost ko pehle negative candle ke low ke around set kar sakte hai, jahaan tak aapko benefit anticipate ho. Risk the board: Hamesha apne exchanges mein risk the executives ka dhyan rakhe, jaise ki position size aur stop-misfortune levels set karke. Yeh qualities aapko Three Inside Down design ke sath exchanging karne mein madad karenge

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

What Is Three Inside Down Chart Pattern: Design mein ek bullish flame hai, uske baad ek little negative candle hai jo pehle rib bullish candle ke andar fit hoti hai, aur phir ek aur negative light hai jo pehle negative candle ke specialty close hoti hai. Is design ko dekh kar dealers expect karte hai ki downtrend proceed hoga. Is design ko recognize karne ke liye pehle bullish light ke high aur low ko dekhe, phir second negative candle ke high aur low ko dekhe, aur phir third negative flame ke high aur low ko dekhe. Agar third candle pehle negative flame ke specialty close hoti hai, to ye Three Inside Down design hai.Three Inside Down Candle Model ek negative reversal plan hai jo bullish example ko switch karne ki alamat hoti hai. Is plan mein young person consecutive candles shamil hoti hain. Pehli flame ek lambi bullish light hoti hai, jo bullish example ko address karti hai. Dusri flame bhi bullish hoti hai, lekin uski body pehli light ki body ke andar hoti hai, matlab ke dono candles ek dosre ko cover karte hain Three inside down design ko recognize karne ke liye aapko candle outline pe dhyan dena hoga. Is design mein aapko adolescent sequential candles dekhne honge. Pehla candle bullish hoga, dusra flame little negative hoga jo pehle light ke andar fit hota hai, aur teesra candle phir se negative hoga jo pehle negative candle ke specialty close hota hai. Agar aapko yeh design milta hai, toh aap Three Inside Down design ko recognize kar sakte hai.Three Inside Down design ka use karke exchanging karne ke liye kuch attributes hai third negative flame pehle negative candle ke specialty close hoti hai, tab aap selling position mein enter kar sakte hai.Stop-misfortune request ko pehle bullish candle ke high ke above set kar sakte hai, taki aapko misfortune control mein rahe.Target cost ko pehle negative candle ke low ke around set kar sakte hai, jahaan tak aapko benefit anticipate ho Three Inside Down Chart Pattern Formation: Three Inside Down design negative continuation design hai. Is design mein ek bullish candle hai, uske baad ek little negative light hai jo pehle grain bullish flame ke andar fit hoti hai, aur phir ek aur negative candle hai jo pehle negative candle ke specialty close hoti hai. Is design ko dekh kar dealers expect karte hai ki downtrend proceed hoga. Is design ko distinguish karne ke liye pehle bullish light ke high aur low ko dekhe, phir second negative flame ke high aur low ko dekhe, aur phir third negative candle ke high aur low ko dekhe. Agar third flame pehle negative candle ke specialty close hoti hai, to ye Three Inside Down design hai.andlestick Example ko samajh kar dealers apni exchanging methodologies banate hain. Is design ki tafseelat se brokers ko ye thought milta hai ke negative pattern ki position solid ho rahi hai aur bullish pattern ki shuruaat sharpen ki sambhavna hai. Lekin, yaad rahe ke is design ki affirmation ke liye doosre specialized markers aur investigation instruments ka bhi istemal karna zaroori hai. Is design ko samajhne ke liye, dealers ko doosre specialized investigation instruments jaise ke moving midpoints, RSI, aur volume examination ka bhi sahara lena chahiye.

Three inside down design ko recognize karne ke liye aapko candle outline pe dhyan dena hoga. Is design mein aapko adolescent sequential candles dekhne honge. Pehla candle bullish hoga, dusra flame little negative hoga jo pehle light ke andar fit hota hai, aur teesra candle phir se negative hoga jo pehle negative candle ke specialty close hota hai. Agar aapko yeh design milta hai, toh aap Three Inside Down design ko recognize kar sakte hai.Three Inside Down design ka use karke exchanging karne ke liye kuch attributes hai third negative flame pehle negative candle ke specialty close hoti hai, tab aap selling position mein enter kar sakte hai.Stop-misfortune request ko pehle bullish candle ke high ke above set kar sakte hai, taki aapko misfortune control mein rahe.Target cost ko pehle negative candle ke low ke around set kar sakte hai, jahaan tak aapko benefit anticipate ho Three Inside Down Chart Pattern Formation: Three Inside Down design negative continuation design hai. Is design mein ek bullish candle hai, uske baad ek little negative light hai jo pehle grain bullish flame ke andar fit hoti hai, aur phir ek aur negative candle hai jo pehle negative candle ke specialty close hoti hai. Is design ko dekh kar dealers expect karte hai ki downtrend proceed hoga. Is design ko distinguish karne ke liye pehle bullish light ke high aur low ko dekhe, phir second negative flame ke high aur low ko dekhe, aur phir third negative candle ke high aur low ko dekhe. Agar third flame pehle negative candle ke specialty close hoti hai, to ye Three Inside Down design hai.andlestick Example ko samajh kar dealers apni exchanging methodologies banate hain. Is design ki tafseelat se brokers ko ye thought milta hai ke negative pattern ki position solid ho rahi hai aur bullish pattern ki shuruaat sharpen ki sambhavna hai. Lekin, yaad rahe ke is design ki affirmation ke liye doosre specialized markers aur investigation instruments ka bhi istemal karna zaroori hai. Is design ko samajhne ke liye, dealers ko doosre specialized investigation instruments jaise ke moving midpoints, RSI, aur volume examination ka bhi sahara lena chahiye.  Candle Example ki pehchan karne ke liye merchants ko market ki cost outline ko cautiously investigate karna hota hai. Is design ki tafseelat se dealers ko ye thought milta hai ke pehle do candles mein bullish pattern thi lekin teesri candle ne negative energy ko shuru kar diya hai. Is design ki tafseelat se merchants ko ye bhi samajhne mein madad milti hai ke negative feeling market mein barh gayi hai aur bullish pattern debilitate ho raha hai. design mein youngster sequential candles shamil hoti hain. Pehli candle ek lambi bullish candle hoti hai, jo bullish pattern ko address karti hai. Dusri candle bhi bullish hoti hai, lekin uski body pehli light ki body ke andar hoti hai, matlab ke dono candles ek dosre ko cover karte hain. Teesri candle negative hoti hai aur uski shutting cost pehli candle ki body ke andar hoti hai.Is design ko "Three Inside Down" kehte hain kyun ke teesri candle pehli do candles ke andar chhupi hui hoti hai Types Of Three Inside Chart Pattern: Pattern or Outline Example aik specialized device hai jo market mein sharpen rib pattern inversions ko expect karne mein madadgar hota hai. Is design ko samajhna aur istemal karna brokers ke liye ahem hai, lekin hamesha dhyan rahe ke market investigation ke doosre viewpoints aur pointers ko bhi consider karein. Exchanging market mein risk ke saath juda hota hai, isliye reasonable exchanging procedures ka istemal karna zaroori hai. Dealers ko market mein sharpen rib changes aur open doors ko samajhne ke liye lagatar seekhna aur update rehna chahiye..Three Inside Down Candle Example ek ahem specialized investigation device hai jo securities exchange mein cost development aur pattern ko samajhne mein madadgar hota hai. Ye design brokers aur financial backers ke liye ahem hai kyunki iske zariye market mein sharpen rib potential changes ko expect kiya ja sakta hai.

Candle Example ki pehchan karne ke liye merchants ko market ki cost outline ko cautiously investigate karna hota hai. Is design ki tafseelat se dealers ko ye thought milta hai ke pehle do candles mein bullish pattern thi lekin teesri candle ne negative energy ko shuru kar diya hai. Is design ki tafseelat se merchants ko ye bhi samajhne mein madad milti hai ke negative feeling market mein barh gayi hai aur bullish pattern debilitate ho raha hai. design mein youngster sequential candles shamil hoti hain. Pehli candle ek lambi bullish candle hoti hai, jo bullish pattern ko address karti hai. Dusri candle bhi bullish hoti hai, lekin uski body pehli light ki body ke andar hoti hai, matlab ke dono candles ek dosre ko cover karte hain. Teesri candle negative hoti hai aur uski shutting cost pehli candle ki body ke andar hoti hai.Is design ko "Three Inside Down" kehte hain kyun ke teesri candle pehli do candles ke andar chhupi hui hoti hai Types Of Three Inside Chart Pattern: Pattern or Outline Example aik specialized device hai jo market mein sharpen rib pattern inversions ko expect karne mein madadgar hota hai. Is design ko samajhna aur istemal karna brokers ke liye ahem hai, lekin hamesha dhyan rahe ke market investigation ke doosre viewpoints aur pointers ko bhi consider karein. Exchanging market mein risk ke saath juda hota hai, isliye reasonable exchanging procedures ka istemal karna zaroori hai. Dealers ko market mein sharpen rib changes aur open doors ko samajhne ke liye lagatar seekhna aur update rehna chahiye..Three Inside Down Candle Example ek ahem specialized investigation device hai jo securities exchange mein cost development aur pattern ko samajhne mein madadgar hota hai. Ye design brokers aur financial backers ke liye ahem hai kyunki iske zariye market mein sharpen rib potential changes ko expect kiya ja sakta hai. Jab ap market main fundamental investigation kar karte hain to ap ko bhot zyada fayda hota hai or ap ko acha benefit mil jata hai.es liye ap ko hmesha market primary judgment karna chahye ta k ap ko most extreme Benefit accessible hon punch ap market principal candle design ko achi tara indentify karty hain to ap fruitful Exchanging kar k achi procuring kar sakhty hain.Forex exchanging market principal agar ap Three Inside Up Candle Example ko appropriately comprehend kar laty Hain, to is mein ap ko bahut hello acchi exchanging section mil sakhti hai, Jo ap ki exchanging ko beneficial banane principal ap ki supportive ho sakti hai. Is candle design ki affirmation standard ap ko hamesha purchasing passage lena hoti hai. Trading Of Three Inside Chart Pattern: Kisi bhi design ki distinguishing proof bahut zarori hoti hai.Jab market fundamental aik solid downtrend hota hai, or support level standard hit purchaser's tension venders ko futher down development nahi krny deta, to us time standard hit last Candle ko 2 bullish candle es tarah cover krti Hain, Ky first bullish candle last negative candle ko all the more then 50% cover kiye hoye hoti hai, or second bullish candle us ko totally cover Kar ke negative candle ki opening point sy upper greetings shutting krti hai, is candle example ko ap Three Inside up candle example khety Hain. Es candle design ko ap effectively perceive kr sakte hain. Is k awful market fundamental aik acha purchase pattern affirm ho jata hai, at some point Market lowwest esteem ko retest Kar sakhti hai.

Forex exchanging market primary central and Specialized Investigation ko wonderful banate hain, to ap ko bahut Zyada benefits hasil ho sakte hain, en analasis ko increment karne ky liye ap ko various examples ki study krna hoti hai. Is fundamental aik bahut howdy solid example, jis ko ap Three Inside Up Candle Example keh sakhty Hain, us sy related kuch significant data ahm hai .is Candle Example principal 3 unique sorts ki Candle incorporate hoti hain. Punch ap Three Inside Up Candle Example ko totally comprehend kar rahy hoty hain, to is mein ap ko following referenced Candle ko find out karna hota hai.

Forex exchanging market primary central and Specialized Investigation ko wonderful banate hain, to ap ko bahut Zyada benefits hasil ho sakte hain, en analasis ko increment karne ky liye ap ko various examples ki study krna hoti hai. Is fundamental aik bahut howdy solid example, jis ko ap Three Inside Up Candle Example keh sakhty Hain, us sy related kuch significant data ahm hai .is Candle Example principal 3 unique sorts ki Candle incorporate hoti hain. Punch ap Three Inside Up Candle Example ko totally comprehend kar rahy hoty hain, to is mein ap ko following referenced Candle ko find out karna hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:30 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим