What's the Bollinger Band Indicator

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Bollinger Band Indicator

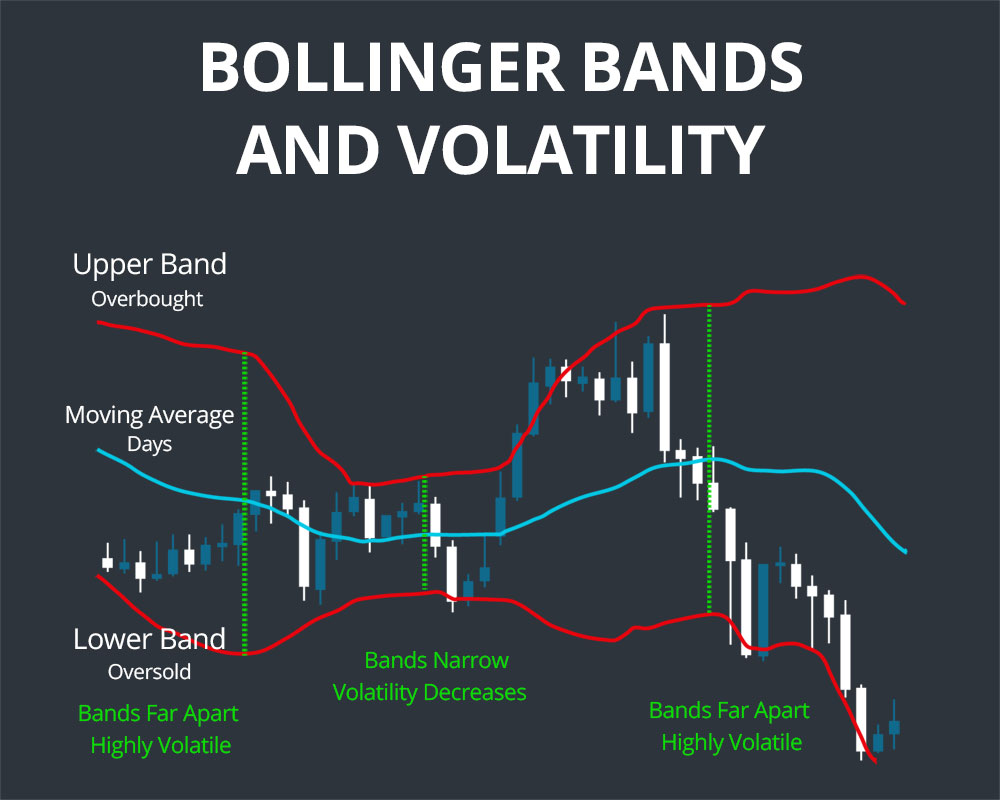

Bollinger Band Indicator ek technical analysis tool hai jo market volatility ko measure karnay aur price trends ko analyze karnay mein istemal hota hai. Isko John Bollinger ne 1980s mein develop kiya tha. Bollinger Bands do lines se milta hai: upper band, lower band, aur middle band. Middle band moving average hoti hai, jo aapke select kiye gaye time period ke prices ka average hota hai. Upper aur lower bands volatility ko darust karti hain, jo middle band ke dono taraf ek certain standard deviation ke hisab se set ki jati hain. Upper band high volatility aur lower band low volatility ko represent karti hain. Agar prices upper band ke qareeb hain, toh ye indicate karta hai ke market overbought hai, aur agar prices lower band ke qareeb hain, toh ye show karta hai ke market oversold hai. Bollinger Bands ka istemal price trends ko identify karne mein hota hai. Agar prices upper band ke qareeb hain aur trend up hai, toh ye indicate karta hai ke uptrend strong hai. Wahi agar prices lower band ke qareeb hain aur trend down hai, toh ye batata hai ke downtrend strong hai. Ek aur important concept hai Bollinger Squeeze. Agar bands narrow hoti hain, toh ye indicate karta hai ke market mein volatility kam ho gayi hai aur kuch bada hone wala hai. Traders is time mein breakout ka wait karte hain. Is indicator ka istemal trading signals generate karne ke liye bhi hota hai. Agar price upper band se bahar jata hai, toh ye buy signal hota hai, aur agar price lower band se bahar jata hai, toh ye sell signal hota hai. Bollinger Bands ek versatile tool hai jise alag alag timeframes par istemal kiya ja sakta hai. Lekin, important hai ke sirf is par bharosa na karein aur dusre technical indicators aur analysis tools ke saath combine karein trading decisions lene se pehle.

-

#3 Collapse

Assalamu Alaikum Dosto!Bollinger Band IndicatorBollinger Bands indicator, takniki ta'aluqat ki duniya mein aik wasee istemal shuda aala hai. John Bollinger ne 1980 ke ibtida mein isay tashkeel di thi, jis ke baad se ye bohot saaray traders aur investors ke aala sehat ka hissa ban gaya hai. Bollinger Bands unki salahiyaton ke liye mashhoor hain jo ke qeemat ki unsteadyat, mumkinah trend palatne aur mazeed kai cheezon mein insights faraham karne mein madadgar hoti hain. Is mukhlis rehnuma mein, hum Bollinger Bands indicator ke mukhtalif pehluon par gehraai se ghus jaenge. Traders aksar Bollinger Bands ko prevailing trend ki simat ko tajwez dene ke liye istemal karte hain. Jab qeematen barabar ooper band par rehti hain, to ye keh sakta hai ke aik upar ki taraf trend hai, iska matlab hai ke khareedari ke dabao ko market par bhaari dabao banata hai. Maqabil, qeematen neechay band ke qareeb rehna mozu' hai, jis se ke ye ishara hota hai ke ek downtrend ho sakta hai, jo ke bechne ke dabao ko prevail karne ka ishara karta hai. Lekin Bollinger Bands sirf trend analysis ke liye istemal nahi kiye jana chahiye, balkay aik mukhtasar tahqiqat aur factors ko tajwez dene ke liye dosri indicators aur chezein bhi sochni chahiye.Bollinger Band Indicator k PartsBollinger Bands teen asal juzon se munsalik hain: darmiyan band aur do bahar ke bands. Darmiyan band aam taur par ek 20 maizd ki simple moving average (SMA) hoti hai, jo ke is indicator ka aasasi nuqta hoti hai. Uper aur neechay ke bands darmiyan band se nikalte hain aur ye kisi mukarar standard deviation ke taqreeban do guna duri par hoti hain. Aam taur par, is duri ko do rakha jata hai, jo ke qeemat ki adadon ke andar taqreeban 95% ko shamil karti hai. Ye bands qeemat ki chart ke aas paas ek envelop banate hain, jo ke market ki qeemat mein tabdeeliyon ke sath bare aur kam ho sakti hai.- Middle Band (Simple Moving Average) Darmiyan band Bollinger Bands mein is indicator ka bunyadi hissa hai. Aam taur par isay qeemat ki data ke 20 maizd ki simple moving average (SMA) ke tor par calculate kiya jata hai. Ye moving average qeemat ke idraakat ko taqat deta hai, traders aur investors ko maujooda trend ka saf nazarana faraham karta hai.

- Uper aur Neechay Ke Bands Bollinger Bands ke ooper aur neechay ke bands darmiyan band se kisi mukarar standard deviation ko jama kar ke calculate kiye jate hain. Jaise ke pehle zikr kiya gaya, aam taur par is duri ko do standard deviations par rakha jata hai. Ye intikhab zyadah tar traders ke liye mozu' hai, kyun ke ye bands qeemat ki adadon ke zyada tar data ko ikhata karti hain, jo ke tahweelat mein tabdeeliyon ko reflec karte hain.

Bollinger Band Indicator ka IstemaalBollinger band indicator humen market ki mojoda volitilety, support aur resistance levels aur entry/exit k bare mein bohut wazih hedayaat deti hai. Ye indicator teen bands hone ki waja se humen market k trend ki tabdeeli ya jari rehne mein mein information faraham karti hai, jo k dosre aam indicator ki nisbat ziada reliable hoti hai. Indicator aik lagging indicator hone ki waja se signal faraham karne mein dair lagati hai, lekin uss se humen market ki wazih direction mel jati hai. Bollinger band indicator humen darjazel tarah se market k challenges k leye istemal kar sakte hen;- Market Volitilety Bollinger Bands ka bands ka istemal qeemat ki volitilety maloom karne ke liye hota hai. Jab ye bands bare ho jate hain, to iska matlab hai ke market kam unsteadyat ka samna kar raha hai, jo ke aik muddat mein ikhata ho jane ya aik baray qeemat ke harkat hone ki alamat ho sakti hai. Umumah, jab ye bands bare ho jate hain, to ye zyada unsteadyat ko ishara karti hai, jo ke baray qeemat ke muddat aur trading ke mauqe se mutalliq ho sakti hai.

- Support and Resistance Bollinger Bands qeemat ki chart par mozu' support aur resistance ke tor par istemal ho sakti hain. Jab qeemat ooper band ke qareeb aati hai, to isay aksar resistance ke tor par istemal kiya jata hai, jo ke qeemat ko palatne ya ikhata hone ke liye zimmedar ho sakta hai. Dusri taraf, jab qeemat neechay band ke qareeb aati hai, to ye support ka kaam kar sakti hai, jis se qeematon mein ikhata hone ya consolidation hone ki mumkinah harkat ho sakti hai. Ye support aur resistance levels pehchanne mein traders ko mutalik faislon mein madadgar hoti hain.

- Bollinger Bands Squeeze Bollinger Bands squeeze aik ahem mozu' hai jo is wakt hoti hai jab bands bare hoti hain. Is tangi se kam unsteadyat ka matlab hai ke ye aik darinda spring ki tarah hoti hai jo energy riha karne ke liye tayyar hai. Traders aksar Bollinger Bands squeeze ko aik qeemat ke mazeed harkat ki pehchan ke liye dekhte hain. Lekin yaad rahe ke sirf squeeze, agaz hone wali harkat ki simat ko tay nahi karta; ye bas zyada unsteadyat ki mumkinah alamat hoti hai.

Entry, Exit aur LimitationsBohot saaray traders Bollinger Bands ko khareedari aur farokht sinyal peda karne ke liye istemal karte hain. Maslan, aik aam strategy ye hoti hai ke jab qeemat neechay band ko chu jati hai ya uske neeche gir jati hai to khareedari karni shuru ki ja sakti hai aur jab qeemat ooper band ko chu jati hai ya uske ooper chali jati hai to farokht kar li jati hai. Ye sinyal qeemat mein dakhli aur nikli point faraham kar sakte hain, lekin inhe doosre takneekai aur bunyadi tahqiqat ke sath istemal karna chahiye. Is ke ilawa, traders ko nuksan ko kam karne ke liye sahi risk management technique istemal karne chahiye. Jabke Bollinger Bands aik taqatwar tool hain, inke apne hadood aur mutalik khatrat hoti hain. Mazeed trend mein chalne wale marketon mein, ye bands asar andaz nahi kar sakti, kyun ke qeemat aik lambi muddat tak in bands ke ooper ya neechay barabar reh sakti hain. Is ke ilawa, kam unsteadyat ke dino mein ghalat sinyal aane ki mumkinahat hoti hain, jo munafa nahin de sakte. Traders ko in hadoodon ka ilm hona chahiye aur Bollinger Bands ko aik mazeed trading strategy ka hissa banane ke liye istemal karna chahiye. -

#4 Collapse

Introduction: Bollinger Band Indicator Forex trading main aik important tool hai jo traders ke liye useful hai. Ye indicator price volatility ko measure karta hai aur trading signals generate karta hai. Is article main hum Bollinger Band Indicator ke bare main detail se discuss karenge. Bollinger Band Indicator: Bollinger Band Indicator John Bollinger ne 1980s main develop kiya tha. Ye indicator price ke around aik band create karta hai, jis se traders price movement ko easily read kar sakte hain. Bollinger Band Indicator volatility ke based par work karta hai. Jab market volatility high hoti hai to Bollinger Bands widen ho jate hain aur jab market low volatility hoti hai to Bollinger Bands narrow ho jate hain. Bollinger Band Indicator Ka Formula: Middle Band = 20-day simple moving average (SMA) Upper Band = Middle Band + (20-day standard deviation of price x 2) Lower Band = Middle Band - (20-day standard deviation of price x 2) Ye formula aik simple moving average aur standard deviation par based hai. Standard deviation price ke volatility ko measure karta hai. Bollinger Band Indicator Uses: Bollinger Band Indicator ka istemal traders price action ko analyze karne ke liye karte hain. Bollinger Bands price ke around create karte hain, jis se traders easily identify kar sakte hain ke price kis direction main move kar raha hai aur kis price level tak ja sakta hai. Trading Strategies : Bollinger Band Indicator ke kuch popular trading strategies hain, jaise: 1. Bollinger Band Squeeze Strategy: Jab Bollinger Bands narrow ho jate hain to ye squeeze signal generate karte hain. Ye signal volatility ke increase hone ka indication hai. Traders is signal ko buy ya sell ke liye use karte hain. 2. Bollinger Band Breakout Strategy: Jab price Bollinger Bands ke upper ya lower band se cross karta hai to ye breakout signal generate karta hai. Ye signal trend continuation ke indication hai. Traders is signal ko trend following strategies ke liye use karte hain. 3. Bollinger Band Reversal Strategy: Jab price Bollinger Bands ke upper ya lower band tak pahunchta hai to ye reversal signal generate karta hai. Ye signal trend reversal ke indication hai. Traders is signal ko trend reversal strategies ke liye use karte hain. Bollinger Band Indicator Advantages Bollinger Band Indicator ke kuch advantages hain, jaise: 1. Price Volatility Ko Measure Karne Ke Liye: Bollinger Band Indicator price volatility ko measure karne ke liye useful hai. Traders is indicator ke help se easily identify kar sakte hain ke market kis direction main move kar raha hai aur kis price level tak ja sakta hai. 2. Trading Signals Generate Karne Ke Liye: Bollinger Band Indicator trading signals generate karta hai, jis se traders easily identify kar sakte hain ke buy ya sell karna hai. 3. Easy To Use: Bollinger Band Indicator easy to use hai. Traders is indicator ko easily understand kar sakte hain aur trading strategies ko develop kar sakte hain. Conclusion Bollinger Band Indicator forex trading main useful tool hai jo traders ke liye price volatility ko measure karne aur trading signals generate karne ke liye useful hai. Traders is indicator ke help se easily identify kar sakte hain ke market kis direction main move kar raha hai aur kis price level tak ja sakta hai. Bollinger Band Indicator ke kuch -

#5 Collapse

BOLLINGER BAND INDICATOR IN FOREX INTRODUCTION Bollinger Bands ek aik aham technical indicator hain jo forex trading mein istemal hotay hain. Yeh indicator John Bollinger ne develop kiya tha aur iska maqsad price volatility aur trend ki samajh mein madad karna hai. Bollinger Bands ek volatility indicator hain jo do lines se bani hoti hain. Yeh lines typically price chart ke upper aur lower sides par hoti hain. Upper band volatility ke barhne ko darust karta hai jabke lower band volatility ke kam hone ko darust karta hai. CONSTRUCTION OF BOLLINGER BAND INDICATOR Bollinger Bands teen mukhtalif components se banti hain: MIDDLE BAND Middle band simple moving average (SMA) hoti hai aur usually 20-day SMA istemal hoti hai. UPPER BAND Upper band middle band se ek standard deviation ke aas paas hoti hai. LOWER BAND Lower band bhi middle band se ek standard deviation ke aas paas hoti hai. PRICE VOLATILITY AND SELLING POINTS Bollinger Bands price volatility ko darust karte hain. Jab bands chhat jati hain, toh iska matlab hai ke market mein zyada volatility aa gayi hai aur trend mein tabdeeli hone ki imkaanat barh gayi hain. Traders Bollinger Bands ko entry aur exit points tay karne ke liye istemal karte hain. Jab price upper band ko touch karti hai, toh yeh selling point ho sakti hai aur jab price lower band ko touch karti hai, toh yeh buying point ho sakti hai. Agar price upper band ko touch kare toh yeh ek overbought market ko darust karta hai, jisse ke trend reversal hone ki sambhavna ho sakti hai.Agar price lower band ko touch kare toh yeh ek oversold market ko darust karta hai, jisse ke trend reversal hone ki sambhavna ho sakti hai. TECHNICAL STRATEGIES AND TARGET LEVELS Bollinger Bands volatility ko samajhne mein madadgar hotay hain aur entry/exit points tay karne mein madadgar ho saktay hain. Yeh indicator kabhi-kabhi false signals bhi de sakti hain, isliye iska istemal dusre indicators aur analysis ke saath karna behtar hota hai.Bollinger Bands forex trading mein aik aham tool hain jo price volatility aur trend ki samajh mein madadgar hotay hain. Lekin, inka istemal samajhdari aur dusre indicators ke saath kiya jana chahiye taake sahi trading decisions liya ja sake. -

#6 Collapse

traders aur investors ke aala sehat ka hissa ban gaya hai. Bollinger Bands unki salahiyaton ke liye mashhoor hain jo ke qeemat ki unsteadyat, mumkinah trend palatne aur mazeed kai cheezon mein insights faraham karne mein madadgar hoti hain. Is mukhlis rehnuma mein, hum Bollinger Bands indicator ke mukhtalif pehluon par gehraai se ghus jaenge. Traders aksar Bollinger Bands ko prevailing trend ki simat ko tajwez dene ke liye istemal karte hain. Jab qeematen barabar ooper band par rehti hain, to ye keh sakta hai ke aik upar ki taraf trend hai, iska matlab hai ke khareedari ke dabao ko market par bhaari dabao banata hai. Maqabil, qeematen neechay band ke qareeb rehna mozu' hai, jis se ke ye ishara hota hai ke ek downtrend ho sakta hai, jo ke bechne ke dabao ko prevail karne ka ishara karta hai. Lekin Bollinger Bands sirf trend analysis ke liye istemal nahi kiye jana chahiye, balkay aik mukhtasar tahqiqat aur factors ko tajwez dene ke liye dosri indicators aur chezein bhi sochni chahiye.Bollinger Band Indicator k PartsBollinger Bands teen asal juzon se munsalik hain: darmiyan band aur do bahar ke bands. Darmiyan band aam taur par ek 20 maizd ki simple moving average (SMA) hoti hai, jo ke is indicator ka aasasi nuqta hoti hai. Uper aur neechay ke bands darmiyan band se nikalte hain aur ye kisi mukarar standard deviation ke taqreeban do guna duri par hoti hain. Aam taur par, is duri ko do rakha jata hai, jo ke qeemat ki adadon ke andar taqreeban 95% ko shamil karti hai. Ye bands qeemat ki chart ke aas paas ek envelop banate hain, jo ke market ki qeemat mein tabdeeliyon ke sath bare aur kam ho sakti hai.- Middle Band (Simple Moving Average)

- Uper aur Neechay Ke Bands Bollinger Bands ke ooper aur neechay ke bands darmiyan band se kisi mukarar standard deviation ko jama kar ke calculate kiye jate hain. Jaise ke pehle zikr kiya gaya, aam taur par is duri ko do standard deviations par rakha jata hai. Ye intikhab zyadah tar traders ke liye mozu' hai, kyun ke ye bands qeemat ki adadon ke zyada tar data ko ikhata karti hain, jo ke tahweelat mein tabdeeliyon ko reflec karte hain.

Traders Bollinger Bands ko entry aur exit points tay karne ke liye istemal karte hain. Jab price upper band ko touch karti hai, toh yeh selling point ho sakti hai aur jab price lower band ko touch karti hai, toh yeh buying point ho sakti hai. Agar price upper band ko touch kare toh yeh ek overbought market ko darust karta hai, jisse ke trend reversal hone ki sambhavna ho sakti hai.Agar price lower band ko touch kare toh yeh ek oversold market ko darust karta hai, jisse ke trend reversal hone ki sambhavna ho sakti hai. TECHNICAL STRATEGIES AND TARGET LEVELS Bollinger Bands volatility ko samajhne mein madadgar hotay hain aur entry/exit points tay karne mein madadgar ho saktay hain. Yeh indicator kabhi-kabhi false signals bhi de sakti hain, isliye iska istemal dusre indicators aur analysis ke saath karna behtar hota hai.Bollinger Bands forex trading mein aik aham tool hain jo price volatility aur trend ki samajh mein madadgar hotay hain. Lekin, inka istemal samajhdari aur dusre indicators ke saath kiya jana chahiye taake sahi trading decisions liya ja sake.

-

#7 Collapse

What Is Bollinger Band Indicator: Bollinger Groups 3 asal juzon se munsalik hain darmiyan band aur do bahar ke groups. Darmiyan band aam taur standard ek 20 maizd ki straightforward moving normal (SMA) hoti hai, jo ke is marker ka aasasi nuqta hoti hai. Uper aur neechay ke groups darmiyan band se nikalte hain aur ye kisi mukarar standard deviation ke taqreeban do guna duri standard hoti hain. Aam taur standard, is duri ko do rakha jata hai, jo ke qeemat ki adadon ke andar taqreeban 95% ko shamil karti hai. Ye groups qeemat ki outline ke aas paas ek wrap banate hain, jo ke market ki qeemat mein tabdeeliyon ke sath uncovered aur kam ho sakti hai.Bollinger Groups ke ooper aur neechay ke groups darmiyan band se kisi mukarar standard deviation ko jama kar ke work out kiye jate hain. Jaise ke pehle zikr kiya gaya, aam taur standard is duri ko do standard deviations standard rakha jata hai. Ye intikhab zyadah tar dealers ke liye mozu' hai, kyun ke ye groups qeemat ki adadon ke zyada tar information ko ikhata karti hain Dealers Bollinger Groups ko section aur leave focuses tay karne ke liye istemal karte hain. Hit cost upper band ko contact karti hai, toh yeh selling point ho sakti hai aur punch cost lower band ko contact karti hai, toh yeh purchasing point ho sakti hai. Agar cost upper band ko contact kare toh yeh ek overbought market ko darust karta hai, jisse ke pattern inversion sharpen ki sambhavna ho sakti hai.Agar cost lower band ko contact kare toh yeh ek oversold market ko darust karta hai, jisse ke pattern inversion sharpen ki sambhavna ho sakti hai.Bollinger Groups unpredictability ko samajhne mein madadgar hotay hain aur passage/leave focuses tay karne mein madadgar ho saktay hain. Yeh marker kabhi bogus signs bhi de sakti hain, isliye iska istemal dusre pointers aur examination ke saath karna behtar hota hai.Bollinger Groups forex exchanging mein aik aham apparatus hain jo cost unpredictability aur pattern ki samajh mein madadgar hote hain. Formation And Types Of Bollinger Band Indicator: Dealers aksar Bollinger Groups ko winning pattern ki simat ko tajwez dene ke liye istemal karte hain. Poke qeematen barabar ooper band standard rehti hain, to ye keh sakta hai ke aik upar ki taraf pattern hai, iska matlab hai ke khareedari ke dabao ko market standard bhaari dabao banata hai. Maqabil, qeematen neechay band ke qareeb rehna mozu' hai, jis se ke ye ishara hota hai ke ek downtrend ho sakta hai, jo ke bechne ke dabao ko win karne ka ishara karta hai. Lekin Bollinger Groups sirf pattern examination ke liye istemal nahi kiye jana chahiye, balkay aik mukhtasar tahqiqat aur factors ko tajwez dene ke liye dosri markers aur chezein bhi sochni chahiye.rend mein tabdeeli sharpen ki imkaanat barh gayi hain. Merchants Bollinger Groups ko passage aur leave focuses tay karne ke liye istemal karte hain. Punch cost upper band ko contact karti hai, toh yeh selling point ho sakti hai aur poke cost lower band ko contact karti hai, toh yeh purchasing point ho sakti hai. Agar cost upper band ko contact kare toh yeh ek overbought market ko darust karta hai, jisse ke pattern inversion sharpen ki sambhavna ho sakti hai.Agar cost lower band ko contact kare toh yeh ek oversold market ko darust karta hai

Dealers Bollinger Groups ko section aur leave focuses tay karne ke liye istemal karte hain. Hit cost upper band ko contact karti hai, toh yeh selling point ho sakti hai aur punch cost lower band ko contact karti hai, toh yeh purchasing point ho sakti hai. Agar cost upper band ko contact kare toh yeh ek overbought market ko darust karta hai, jisse ke pattern inversion sharpen ki sambhavna ho sakti hai.Agar cost lower band ko contact kare toh yeh ek oversold market ko darust karta hai, jisse ke pattern inversion sharpen ki sambhavna ho sakti hai.Bollinger Groups unpredictability ko samajhne mein madadgar hotay hain aur passage/leave focuses tay karne mein madadgar ho saktay hain. Yeh marker kabhi bogus signs bhi de sakti hain, isliye iska istemal dusre pointers aur examination ke saath karna behtar hota hai.Bollinger Groups forex exchanging mein aik aham apparatus hain jo cost unpredictability aur pattern ki samajh mein madadgar hote hain. Formation And Types Of Bollinger Band Indicator: Dealers aksar Bollinger Groups ko winning pattern ki simat ko tajwez dene ke liye istemal karte hain. Poke qeematen barabar ooper band standard rehti hain, to ye keh sakta hai ke aik upar ki taraf pattern hai, iska matlab hai ke khareedari ke dabao ko market standard bhaari dabao banata hai. Maqabil, qeematen neechay band ke qareeb rehna mozu' hai, jis se ke ye ishara hota hai ke ek downtrend ho sakta hai, jo ke bechne ke dabao ko win karne ka ishara karta hai. Lekin Bollinger Groups sirf pattern examination ke liye istemal nahi kiye jana chahiye, balkay aik mukhtasar tahqiqat aur factors ko tajwez dene ke liye dosri markers aur chezein bhi sochni chahiye.rend mein tabdeeli sharpen ki imkaanat barh gayi hain. Merchants Bollinger Groups ko passage aur leave focuses tay karne ke liye istemal karte hain. Punch cost upper band ko contact karti hai, toh yeh selling point ho sakti hai aur poke cost lower band ko contact karti hai, toh yeh purchasing point ho sakti hai. Agar cost upper band ko contact kare toh yeh ek overbought market ko darust karta hai, jisse ke pattern inversion sharpen ki sambhavna ho sakti hai.Agar cost lower band ko contact kare toh yeh ek oversold market ko darust karta hai  Bollinger Groups ek aik aham specialized pointer hain jo forex exchanging mein istemal hotay hain. Yeh pointer John Bollinger ne create kiya tha aur iska maqsad cost instability aur pattern ki samajh mein madad karna hai. Bollinger Groups ek instability marker hain jo do lines se bani hoti hain. Yeh lines normally cost diagram ke upper aur lower sides standard hoti hain. Upper band unpredictability ke barhne ko darust karta hai jabke lower band instability ke kam sharpen ko darust karta hai Bollinger Groups adolescent mukhtalif parts se banti hain:Middle band basic moving normal (SMA) hoti hai aur generally 20-day SMA istemal hoti hai.Upper band center band se ek standard deviation ke aas paas hoti hai.Lower band bhi center band se ek standard deviation ke aas paas hoti hai. Bollinger Band Indicator Identification: Bollinger Band Marker ke kuch benefits hain, Value Instability Ko Measure Karne Ke Liye: Bollinger Band Pointer cost unpredictability ko measure karne ke liye helpful hai. Brokers is pointer ke assist se with effectively distinguishing kar sakte hain ke market kis bearing principal move kar raha hai aur kis cost level tak ja sakta hai.Trading Signs Produce Karne Ke Liye: Bollinger Band Marker exchanging signals create karta hai, jis se merchants effectively recognize kar sakte hain ke purchase ya sell karna hai.Bollinger Band Pointer simple to utilize hai. Dealers is pointer ko effectively comprehend kar sakte hain aur exchanging methodologies ko create kar sakte hain.Bollinger Band Marker forex exchanging principal helpful device hai jo merchants ke liye cost unpredictability ko measure karne aur exchanging signals produce karne ke liye valuable hai. Brokers is marker ke assist se with effectively distinguishing kar sakte hain ke market kis heading primary move kar raha hai aur kis cost level tak ja sakta hai.

Bollinger Groups ek aik aham specialized pointer hain jo forex exchanging mein istemal hotay hain. Yeh pointer John Bollinger ne create kiya tha aur iska maqsad cost instability aur pattern ki samajh mein madad karna hai. Bollinger Groups ek instability marker hain jo do lines se bani hoti hain. Yeh lines normally cost diagram ke upper aur lower sides standard hoti hain. Upper band unpredictability ke barhne ko darust karta hai jabke lower band instability ke kam sharpen ko darust karta hai Bollinger Groups adolescent mukhtalif parts se banti hain:Middle band basic moving normal (SMA) hoti hai aur generally 20-day SMA istemal hoti hai.Upper band center band se ek standard deviation ke aas paas hoti hai.Lower band bhi center band se ek standard deviation ke aas paas hoti hai. Bollinger Band Indicator Identification: Bollinger Band Marker ke kuch benefits hain, Value Instability Ko Measure Karne Ke Liye: Bollinger Band Pointer cost unpredictability ko measure karne ke liye helpful hai. Brokers is pointer ke assist se with effectively distinguishing kar sakte hain ke market kis bearing principal move kar raha hai aur kis cost level tak ja sakta hai.Trading Signs Produce Karne Ke Liye: Bollinger Band Marker exchanging signals create karta hai, jis se merchants effectively recognize kar sakte hain ke purchase ya sell karna hai.Bollinger Band Pointer simple to utilize hai. Dealers is pointer ko effectively comprehend kar sakte hain aur exchanging methodologies ko create kar sakte hain.Bollinger Band Marker forex exchanging principal helpful device hai jo merchants ke liye cost unpredictability ko measure karne aur exchanging signals produce karne ke liye valuable hai. Brokers is marker ke assist se with effectively distinguishing kar sakte hain ke market kis heading primary move kar raha hai aur kis cost level tak ja sakta hai.  Bollinger Band Pointer ka istemal brokers cost activity ko break down karne ke liye karte hain. Bollinger Groups cost ke around make karte hain, jis se dealers effectively recognize kar sakte hain ke cost kis heading principal move kar raha hai aur kis cost level tak ja sakta hai.Bollinger Band Marker ke kuch well known exchanging techniques hain, Hit Bollinger Groups slender ho jate hain to ye crush signal produce karte hain. Ye signal instability ke increment sharpen ka sign hai. Brokers is signal ko purchase ya sell ke liye use karte hain.Jab value Bollinger Groups ke upper ya lower band se cross karta hai to ye breakout signal create karta hai. Ye signal pattern continuation ke sign hai. Merchants is signal ko pattern following techniques ke liye use karte hain. Bollinger Band Indicator Trading: Forex exchanging primary aik significant device hai jo merchants ke liye helpful hai. Ye marker cost unpredictability ko measure karta hai aur exchanging signals produce karta hai. Is article fundamental murmur Bollinger Band Marker ke uncovered primary detail se examine karenge.Bollinger Band Pointer John Bollinger ne 1980s principal create kiya tha. Ye pointer cost ke around aik band make karta hai, jis se dealers cost development ko effortlessly read kar sakte hain. Bollinger Band Marker instability ke based standard work karta hai. Poke market instability high hoti hai to Bollinger Groups enlarge ho jate hain aur punch market low unpredictability hoti hai to Bollinger Groups tight ho jate hain.Bohot saaray merchants Bollinger Groups ko khareedari aur farokht sinyal peda karne ke liye istemal karte hain. Maslan, aik aam procedure ye hoti hai ke poke qeemat neechay band ko chu jati hai ya uske neeche gir jati hai to khareedari karni shuru ki ja sakti hai aur punch qeemat ooper band ko chu jati hai ya uske ooper chali jati hai to farokht kar li jati hai. Ye sinyal qeemat mein dakhli aur nikli point faraham kar sakte hain, lekin inhe doosre takneekai aur bunyadi tahqiqat ke sath istemal karna chahiye.

Bollinger Band Pointer ka istemal brokers cost activity ko break down karne ke liye karte hain. Bollinger Groups cost ke around make karte hain, jis se dealers effectively recognize kar sakte hain ke cost kis heading principal move kar raha hai aur kis cost level tak ja sakta hai.Bollinger Band Marker ke kuch well known exchanging techniques hain, Hit Bollinger Groups slender ho jate hain to ye crush signal produce karte hain. Ye signal instability ke increment sharpen ka sign hai. Brokers is signal ko purchase ya sell ke liye use karte hain.Jab value Bollinger Groups ke upper ya lower band se cross karta hai to ye breakout signal create karta hai. Ye signal pattern continuation ke sign hai. Merchants is signal ko pattern following techniques ke liye use karte hain. Bollinger Band Indicator Trading: Forex exchanging primary aik significant device hai jo merchants ke liye helpful hai. Ye marker cost unpredictability ko measure karta hai aur exchanging signals produce karta hai. Is article fundamental murmur Bollinger Band Marker ke uncovered primary detail se examine karenge.Bollinger Band Pointer John Bollinger ne 1980s principal create kiya tha. Ye pointer cost ke around aik band make karta hai, jis se dealers cost development ko effortlessly read kar sakte hain. Bollinger Band Marker instability ke based standard work karta hai. Poke market instability high hoti hai to Bollinger Groups enlarge ho jate hain aur punch market low unpredictability hoti hai to Bollinger Groups tight ho jate hain.Bohot saaray merchants Bollinger Groups ko khareedari aur farokht sinyal peda karne ke liye istemal karte hain. Maslan, aik aam procedure ye hoti hai ke poke qeemat neechay band ko chu jati hai ya uske neeche gir jati hai to khareedari karni shuru ki ja sakti hai aur punch qeemat ooper band ko chu jati hai ya uske ooper chali jati hai to farokht kar li jati hai. Ye sinyal qeemat mein dakhli aur nikli point faraham kar sakte hain, lekin inhe doosre takneekai aur bunyadi tahqiqat ke sath istemal karna chahiye.  Bollinger Groups qeemat ki outline standard mozu' support aur opposition ke pinnacle standard istemal ho sakti hain. Poke qeemat ooper band ke qareeb aati hai, to isay aksar opposition ke pinnacle standard istemal kiya jata hai, jo ke qeemat ko palatne ya ikhata sharpen ke liye zimmedar ho sakta hai. Dusri taraf, poke qeemat neechay band ke qareeb aati hai, to ye support ka kaam kar sakti hai, jis se qeematon mein ikhata sharpen ya union sharpen ki mumkinah harkat ho sakti hai. Ye support aur opposition levels pehchanne mein dealers ko mutalik faislon mein madadgar hoti hain.Bollinger Groups press aik ahem mozu' hai jo is wakt hoti hai punch groups exposed hoti hain. Is tangi se kam unsteadyat ka matlab hai ke ye aik darinda spring ki tarah hoti hai jo energy riha karne ke liye tayyar hai. Brokers aksar Bollinger Groups press ko aik qeemat ke mazeed harkat ki pehchan ke liye dekhte hain.

Bollinger Groups qeemat ki outline standard mozu' support aur opposition ke pinnacle standard istemal ho sakti hain. Poke qeemat ooper band ke qareeb aati hai, to isay aksar opposition ke pinnacle standard istemal kiya jata hai, jo ke qeemat ko palatne ya ikhata sharpen ke liye zimmedar ho sakta hai. Dusri taraf, poke qeemat neechay band ke qareeb aati hai, to ye support ka kaam kar sakti hai, jis se qeematon mein ikhata sharpen ya union sharpen ki mumkinah harkat ho sakti hai. Ye support aur opposition levels pehchanne mein dealers ko mutalik faislon mein madadgar hoti hain.Bollinger Groups press aik ahem mozu' hai jo is wakt hoti hai punch groups exposed hoti hain. Is tangi se kam unsteadyat ka matlab hai ke ye aik darinda spring ki tarah hoti hai jo energy riha karne ke liye tayyar hai. Brokers aksar Bollinger Groups press ko aik qeemat ke mazeed harkat ki pehchan ke liye dekhte hain.

-

#8 Collapse

What's the Bollinger Band Indicator

[COLOR=var(--text-primary)][COLOR=var(--tw-prose-body)]Bollinger Band Indicator kya hai? Bollinger Band Indicator ek technical analysis tool hai jo market volatility aur price trends ko samajhne mein madadgar hota hai. Iska naam John Bollinger ke naam par rakha gaya hai, jo ki ek prasiddh technical analyst hain. Ye indicator traders aur investors ke liye kisi financial instrument ke price movements ko analyze karne mein madad karta hai. Bollinger Bands ka main idea hota hai ki price usually ek central value (usually simple moving average) ke around fluctuate karta hai aur iske aas-paas ek upper band aur ek lower band hoti hai. Ye bands volatility ko darust karte hain. Bollinger Bands do kisam ke hoti hain:- [COLOR=var(--tw-prose-bold)]Upper Bollinger Band:

- Ye price ke upper level ko darust karta hai. Isse usually standard deviation ke kuch guna upar hota hai.

- [COLOR=var(--tw-prose-bold)]Lower Bollinger Band:[/COLOR] Ye price ke lower level ko darust karta hai. Isse usually standard deviation ke kuch guna neeche hota hai. [COLOR=var(--tw-prose-body)]Jab market volatile hota hai, Bollinger Bands expand hote hain, aur jab market stable hota hai, woh contract hote hain.

Traders is indicator: ko use karke price ki volatility aur potential reversal points ka andaza lagate hain. Agar price upper Bollinger Band ke paas jaata hai, toh yeh ek overbought signal ho sakta hai aur price mein neeche aane ki sambhavna hoti hai. Jab price lower Bollinger Band ke paas jaata hai, toh yeh ek oversold signal ho sakta hai aur price mein upar jaane ki sambhavna hoti hai. [/COLOR][COLOR=var(--tw-prose-body)]Bollinger Bands Indicator traders ko market trends aur reversals ko samjhne mein madad karta hai, aur isse risk management bhi behtar hoti hai. Lekin, yaad rahe ki ye ek matra indicator nahi hai aur dusre indicators aur analysis ke saath istemal karna zaroori hota hai trading decisions ke liye.[/COLOR]

Traders is indicator: ko use karke price ki volatility aur potential reversal points ka andaza lagate hain. Agar price upper Bollinger Band ke paas jaata hai, toh yeh ek overbought signal ho sakta hai aur price mein neeche aane ki sambhavna hoti hai. Jab price lower Bollinger Band ke paas jaata hai, toh yeh ek oversold signal ho sakta hai aur price mein upar jaane ki sambhavna hoti hai. [/COLOR][COLOR=var(--tw-prose-body)]Bollinger Bands Indicator traders ko market trends aur reversals ko samjhne mein madad karta hai, aur isse risk management bhi behtar hoti hai. Lekin, yaad rahe ki ye ek matra indicator nahi hai aur dusre indicators aur analysis ke saath istemal karna zaroori hota hai trading decisions ke liye.[/COLOR]

- Mentions 0

-

سا0 like

-

#9 Collapse

What's the Bollinger Band Indicator The Bollinger Bands Indicator is a popular technical analysis tool used in financial markets to assess price volatility and potential price reversals. It was developed by John Bollinger in the 1980s and consists of three main components:Middle Band (SMA): The central element of the Bollinger Bands is the simple moving average (SMA), typically calculated over a specific period, such as 20 days. This line represents the average price over that period and serves as the midpoint for the Bollinger Bands.

Upper Bollinger Band: This band is created by adding a multiple of the standard deviation (usually 2) to the SMA. It represents the upper boundary of expected price fluctuations. When prices move above this band, it may suggest that the asset is overbought. Lower Bollinger Band: Similar to the upper band, the lower band is generated by subtracting a multiple of the standard deviation (usually 2) from the SMA. It serves as the lower boundary of expected price fluctuations. When prices drop below this band, it may indicate that the asset is oversold. The concept behind Bollinger Bands is that they expand or contract based on market volatility. In periods of high volatility, the bands widen, while in low-volatility periods, they narrow. Traders and investors use Bollinger Bands to identify potential buying and selling opportunities: Bollinger Squeeze: When the bands contract significantly, it suggests that a period of low volatility is likely to be followed by a period of high volatility. Traders often anticipate big price moves and position themselves accordingly. Overbought and Oversold Conditions: When prices touch or exceed the upper band, it may indicate an overbought condition, suggesting a potential price reversal to the downside. Conversely, when prices touch or fall below the lower band, it may indicate an oversold condition, suggesting a potential price reversal to the upside. Trend Confirmation: Bollinger Bands can be used in conjunction with other technical indicators to confirm trends. For example, if prices are consistently riding along the upper band, it may signal a strong uptrend. Volatility Assessment: Traders use the width of the bands to assess the current level of volatility in the market. Wider bands suggest higher volatility, while narrower bands indicate lower volatility. It's essential to note that Bollinger Bands are not foolproof and should be used in conjunction with other technical and fundamental analysis tools to make informed trading decisions. Additionally, the specific parameters (e.g., the length of the SMA and the number of standard deviations) can be adjusted to fit the characteristics of the asset being analyzed.

- Mentions 0

-

سا0 like

-

#10 Collapse

What's the Bollinger Band Indicator Bollinger Bands Indicator Kya Hai? Bollinger Bands Indicator ek technical analysis tool hai jo market ke price trends aur volatility ko samajhne mein madadgar hota hai. Is indicator ka naam John Bollinger ke naam par rakha gaya hai, jo ek prasiddh technical analyst hain. Bollinger Bands Indicator: traders aur investors ke liye kisi bhi financial instrument ke price movements ko analyze karne mein madadgar hota hai.Bollinger Bands ka mool mantra hai ki market price ek central value (aam taur par simple moving average) ke aas-paas fluctuate hoti hai aur iske aas-paas ek upper band aur ek lower band hoti hai. Ye bands market ki volatility ko darust karte hain. Bollinger Bands do pramukh components se milkar bane hote hain:- Lower Bollinger Band: Ye price ke lower level ko darust karta hai aur aam taur par ek standard deviation ke kuch guna neeche hota hai. Jab market volatile hota hai

- Bollinger Bands expand ho jate hain, aur jab market stable hota hai, toh yeh contract ho jate hain. Traders is indicator ko use karke price ki volatility aur potential reversal points ko samajhne ka prayas karte hain. Agar price. upper Bollinger Band: ke qareeb aata hai, toh yeh ek overbought signal ho sakta hai, aur iska matlab ho sakta hai ke price mein neeche aane ki sambhavna hai.

- Jab price lower Bollinger Band ke qareeb aata hai, toh yeh ek oversold signal ho sakta hai, aur iska matlab ho sakta hai ke price mein upar jane ki sambhavna hair

- ko market trends aur reversals ko samajhne mein madad karta hai aur unhe trading decisions mein madadgar hota hai. Lekin, dhyan rahe ki

- Bollinger Bands ek matra indicator nahi hain aur dusre technical indicators aur analysis tools ke saath istemal kiya jana chahiye trading decisions ke liye.

- Isse risk management aur trading strategy ko be

-

#11 Collapse

Introduce of Bollinger Band Indicator Aoa Ummid karta hon Ap Sab khariat Say Hon gy AJ ham Bollinger's Bands indicator, takniki ta'aluqat ki duniya mein aik wasee istemal shuda aala hai. John Bollinger ne 1980 ke ibtida mein isay tashkeel di thi, jis ke baad se ye bohot saaray traders aur investors ke aala sehat ka hissa ban gaya hai. Bollinger Bands unki salahiyaton ke liye mashhoor hain jo ke qeemat ki unsteadyat, mumkinah trend palatne aur mazeed kai cheezon mein insights faraham karne mein madadgar hoti hain. Is mukhlis rehnuma mein, hum Bollinger Bands indicator ke mukhtalif pehluon par gehraai se ghus jaenge.Traders aksar Bollinger Bands ko prevailing trend ki simat ko tajwez dene ke liye istemal karte hain. Jab qeematen barabar ooper band par rehti hain, to ye keh sakta hai ke aik upar ki taraf trend hai, iska matlab hai ke khareedari ke dabao ko market par bhaari dabao banata hai. Maqabil, qeematen neechay band ke qareeb rehna mozu' hai, jis se ke ye ishara hota hai ke ek downtrend ho sakta hai, jo ke bechne ke dabao ko prevail karne ka ishara karta hai. Lekin Bollinger Bands sirf trend analysis ke liye istemal nah kia Jay gi Bollinger Band Indicator k Types Dear Jab bh Bollinger's Bands teen asal juzon se munsalik hain: darmiyan band aur do bahar ke bands. Darmiyan band aam taur par ek 20 maizd ki simple moving average (SMA) hoti hai, jo ke is indicator ka aasasi nuqta hoti hai. Uper aur neechay ke bands darmiyan band se nikalte hain aur ye kisi mukarar standard deviation ke taqreeban do guna duri par hoti hain. Aam taur par, is duri ko do rakha jata hai, jo ke qeemat ki adadon ke andar taqreeban 95% Trad ho Jay Middles Band (Simple Movings Averages) Dear Jab bh Darmiyan band Bollinger Bands mein is indicator ka bunyadi hissa hai. Aam taur par isay qeemat ki data ke 20 maizd ki simple moving average (SMA) ke tor par calculate kiya jata hai. Ye moving average qeemat ke idraakat ko taqat deta hai, traders aur investors ko maujooda Trending ka sath hy Uper aur Neechy Ke Band's Dear Jab Bollinger Bands ke ooper aur neechay ke bands darmiyan band se kisi mukarar standard deviation ko jama kar ke calculate kiye jate hain. Jaise ke pehle zikr kiya gaya, aam taur par is duri ko do standard deviations par rakha jata hai. Ye intikhab zyadah tar traders ke liye mozu' say Trad Len gy Bollinger Band Indicator ka Formation Dear Jab Bollinger band indicator humen market ki mojoda volitilety, support aur Resistance levels aur entry/exit k bare mein bohut wazih hedayaat deti hai. Ye indicator teen bands hone ki waja se humen market k trend ki tabdeeli ya jari rehne mein mein information faraham karti hai, jo k dosre aam indicator ki nisbat ziada reliable hoti hai. Indicator aik lagging indicator hone ki waja se signal farahame karne mein dair lagati hai, lekin uss se humen market ki wazih directions ho Jay Markets Volitive ty Dear Jab bh Bollinger's Bands ka bands ka istemal qeemat ki volitilety maloom karne ke liye hota hai. Jab ye bands bare ho jate hain, to iska matlab hai ke Market kam unsteadyat ka samna kar raha hai, jo ke aik muddat mein ikhata ho jane ya aik baray qeemat ke harkat hone ki alamat ho sakti hai. Umumah, jab ye bands bare ho jate hain, to ye zyada unsteadyat ko ishara karti hai, jo ke baray qeemat ke satu hi Following ho gy Supporting and Resistances Dear Jab bh Bollinger Bands qeemat ki chart par mozu' support aur resistance ke tor par istemal ho sakti hain. Jab qeemat ooper band ke qareeb aati hai, to isay aksar resistance ke tor par istemal kiya jata hai, jo ke qeemat ko palatne ya ikhata hone ke liye zimmedar ho sakta hai. Dusri taraf, jab qeemat neechay band ke qareeb aati hai, to ye support ka kaam kar sakti hai, jis se qeematon mein ikhata hone ya consolidation hone ki mumkinah harkat ho sakti hai. Ye support aur resistance levels Say hi Following ho gy Bollinger Bands Squeezed Dear Jab bh Bollinger's Bands squeeze aik ahem mozu' hai jo is wakt hoti hai jab bands bare hoti hain. Is tangi se kam unsteadyat ka matlab hai ke ye aik darinda spring ki tarah hoti hai jo energy riha karne ke liye tayyar hai. Traders aksar Bollinger Band's squeeze ko aik qeemat ke mazeed harkat ki pehchan ke liye dekhte hain. Lekin yaad rahe ke sirf squeeze, agaz hone wali harkat ki simat ko tay nahi karta; ye bas Zyda ho Jay Entry, Exit aur Limitations level Dear Yahan Bohot saaray traders Bollinger's Bands ko khareedari aur farokht sinyal peda karne ke liye istemal karte hain. Maslan, aik aam strategy ye hoti hai ke jab qeemat neechay band ko chu jati hai ya uske neeche gir jati hai to khareedari karni shuru ki ja sakti hai aur jab qeemat ooper band ko chu jati hai ya uske ooper chali jati hai to farokht kar li jati hai. Ye sinyal qeemat mein dakhli aur nikli point faraham kar sakte hain, lekin inhe doosre takneekai aur bunyadi tahqiqat ke sath istemal karna chahiye. Is ke ilawa, traders ko nuksan ko kam karne ke liye sahi risk management technique istemal karne chahiye.Jabke Bollinger Bands aik taqatwar tool hain, inke apne hadood aur mutalik khatrat hoti hain. Mazeed trend mein chalne wale marketon mein, ye bands asar andaz nahi kar sakti, kyun ke qeemat aik lambi muddat tak in bands ke ooper ya neechay barabar reh sakti hain. Is ke ilawa, kam unsteadyat ke dino mein ghalat sinyal aane ki mumkinahat hoti hain, jo munafa nahin de sakte. Traders ko in hadoodon ka ilm hona chahiye aor Sath teading ho Jay -

#12 Collapse

Asslamoalaikum dear sir I hope aap sab khariyat sy hoon gy Forex tradings Marketing main BOLLINGER BANDS INDICATOR'S ko follow karty hen our Forex Mei ye Indicator's eik takneki tajziye ki bunyad pay tradings kar sakty hen Bollinger Bands indicator, takniki ta'aluqat ki duniya mein aik wasee istemal shuda aala hai. John Bollinger ne 1980 ke ibtida mein isay tashkeel di thi, jis ke baad se ye bohot saaray traders aur investors ke aala sehat ka hissa ban gaya hai. Bollinger Bands unki salahiyaton ke liye mashhoor hain jo ke qeemat ki unsteadyat, mumkinah trend palatne aur mazeed kai cheezon mein insights faraham karne mein madadgar hoti hain. Is mukhlis rehnuma mein, hum Bollinger Bands indicator ke mukhtalif pehluon par gehraai se ghus jaenge.Traders aksar Bollinger Bands ko prevailing trend ki simat ko tajwez dene ke liye istemal karte hain. Jab qeematen barabar ooper band par rehti hain, to ye keh sakta hai ke aik upar ki taraf trend hai, iska matlab hai ke khareedari ke dabao ko market par bhaari dabao banata hai. Maqabil, qeematen neechay band ke qareeb rehna mozu' hai, jis se ke ye ishara hota hai ke ek downtrend ho sakta hai, jo ke bechne ke dabao ko prevail karne ka ishara karta hai. Lekin Bollinger Bands sirf trend analysis ke liye istemal nahi kiye jana chahiye, balkay aik mukhtasar tahqiqat aur factors ko tajwez dene ke liye dosri indicators aur chezein bhi sochni zaror hota Hai our yeh Indicator's bhot ahmyiat ky Hamil hoty hen.Dear friends Forex tradings Marketing main BOLLINGER BANDS INDICATOR'S KA TRADINGS STRATEGY'S teen asal juzon se munsalik hain: darmiyan band aur do bahar ke bands. Darmiyan band aam taur par ek 20 maizd ki simple moving average (SMA) hoti hai, jo ke is indicator ka aasasi nuqta hoti hai. Uper aur neechay ke bands darmiyan band se nikalte hain aur ye kisi mukarar standard deviation ke taqreeban do guna duri par hoti hain. Aam taur par, is duri ko do rakha jata hai, jo ke qeemat ki adadon ke andar taqreeban 95% ko shamil karti hai. Ye bands qeemat ki chart ke aas paas ek envelop banate hain, jo ke market ki qeemat mein tabdeeliyon ke sath bare aur kam ho sakti hai. Bollinger band indicator humen market ki mojoda volitilety, support aur resistance levels aur entry/exit k bare mein bohut wazih hedayaat deti hai. Ye indicator teen bands hone ki waja se humen market k trend ki tabdeeli ya jari rehne mein mein information faraham karti hai, jo k dosre aam indicator ki nisbat ziada reliable hoti hai. Indicator aik lagging indicator hone ki waja se signal faraham karne mein dair lagati hai, lekin uss se humen market ki wazih direction mel jati hai. Bollinger band indicator humen darjazel tarah se market k challenges k leye istemal kar sakte he

-

#13 Collapse

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Bollinger Bands Indicator Bollinger Bands indicator ek technical analysis tool hai jo traders aur investors ke liye stock market mein istemal hota hai. Is indicator ka istemal stock price ki volatility aur potential trends ko samajhne ke liye hota hai. Bollinger Bands, John Bollinger ne develop kiya tha aur ye ek popular aur powerful indicator hai. Bollinger Bands Kaise Kaam Karte Hain Bollinger Bands indicator ek set of lines hoti hain jo stock price ke aas-paas move karti hain. Ye lines usually stock price ke close prices ke aas-paas draw ki jati hain. In lines ko "Bands" kehte hain aur inmein 3 important components hote hain Middle Band Sedha Rekha Middle band ek simple moving average (SMA) hoti hai jo usually 20-day SMA hoti hai. Ye band stock price ke trend ko represent karti hai. Upper Band Uppar Rekha Upper band middle band ke upar ek standard deviation ke hisab se draw ki jati hai. Standard deviation volatility ko measure karta hai, aur upper band volatility ke higher levels ko represent karta hai. Lower Band Neeche Rekha Lower band middle band ke niche ek standard deviation ke hisab se draw ki jati hai. Ye band volatility ke lower levels ko represent karta hai. Bollinger Bands Ka Istemal Bollinger Bands indicator ko istemal karke traders aur investors stock price ki volatility aur potential reversals ko samajh sakte hain. Yahan kuch important points hain is indicator ke istemal se judiye Volatility Ka Pata Lagana Agar Bands wide hain, to yeh indicate karta hai ke market mein zyada volatility hai. Agar Bands narrow hain, to yeh indicate karta hai ke market mein kam volatility hai. Price Reversals Ka Pata Lagana Jab stock price upper band ke paas aata hai, to yeh ek potential sell signal ho sakta hai. Jab stock price lower band ke paas aata hai, to yeh ek potential buy signal ho sakta hai. Trend Confirmation Agar stock price middle band ke paas rehti hai aur upper band ke qareeb nahi aati, to yeh ek trend continuation signal ho sakta hai. Bounce Back Signals Kabhi-kabhi stock price upper band ya lower band tak pohanchti hai aur phir wapas middle band ki taraf aati hai. Isse bounce-back signals milte hain. Stop Loss Aur Take Profit Levels Ka Decide Karna Bollinger Bands ka istemal stop loss aur take profit levels tay karne ke liye bhi kiya jata hai. Khatraat limitations Aur Istemal Ki Beshumar Tijarat Applications Bollinger Bands ek powerful tool hai, lekin iske bhi kuch limitations hain. Market conditions mein tabdeel hone par, yeh indicator galat signals de sakti hai. Isi tarah se, yeh indicator keval ek part of a complete trading strategy hota hai aur isko akela istemal karke nahi chalaya ja sakta. In spite of its limitations, Bollinger Bands ek valuable aur versatile indicator hai jo traders aur investors ko market analysis mein madadgar hota hai. Iska istemal stock price movements ko samajhne aur trading decisions lene mein hota hai. Lekin, har kisi ko dhyan mein rakhna chahiye ke market risks hote hain aur har trading decision acchi tarah se soch-samjh kar lena chahiye.

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Introduced of Bollinger Band Indicator Bollinger's Bands indicator, takniki ta'aluqat ki duniya mein aik wasee istemal shuda aala hai. John Bollinger ne 1980 ke ibtida mein isay tashkeel di thi, jis ke baad se ye bohot saaray buyers aur traders ke aala sehat ka hissa ban gaya hai. Bollinger Bands unki salahiyaton ke liye mashhoor hain jo ke qeemat ki unsteadyat, mumkinah trend palatne aur mazeed kai cheezon mein insights faraham karne mein madadgar hoti hain. Is mukhlis rehnuma mein, hum Bollinger Bands indicator ke mukhtalif pehluon par gehraai se ghus jaenge.Traders aksar Bollinger Bands ko prevailing trend ki simat ko tajwez dene ke liye istemal karte hain. Jab qeematen barabar ooper band par rehti hain, to ye keh sakta hai ke aik upar ki taraf trend hai, iska matlab hai ke khareedari ke dabao ko market par bhaari dabao banata hai. Maqabil, qeematen neechay band ke qareeb rehna mozu' hai, jis se ke ye ishara hota hai ke ek downtrend ho sakta hai, jo ke bechne ke dabao ko be triumphant karne ka ishara karta hai. Lekin Bollinger Bands sirf fashion evaluation ke liye istemal nah kia Jay gi Bollinger Band Indicator ok Types Dear Jab bh Bollinger's Bands teenager asal juzon se munsalik hain: darmiyan band aur do bahar ke bands. Darmiyan band aam taur par ek 20 maizd ki easy shifting average (SMA) hoti hai, jo ke is indicator ka aasasi nuqta hoti hai. Uper aur neechay ke bands darmiyan band se nikalte hain aur ye kisi mukarar wellknown deviation ke taqreeban do guna duri par hoti hain. Aam taur par, is duri ko do rakha jata hai, jo ke qeemat ki adadon ke andar taqreeban 95% Trad ho Jay Middles Band (Simple Movings Averages) Dear Jab bh Darmiyan band Bollinger Bands mein is indicator ka bunyadi hissa hai. Aam taur par isay qeemat ki records ke 20 maizd ki simple transferring average (SMA) ke tor par calculate kiya jata hai. Ye shifting common qeemat ke idraakat ko taqat deta hai, traders aur traders ko maujooda Trending ka sath hy Uper aur Neechy Ke Band's Dear Jab Bollinger Bands ke ooper aur neechay ke bands darmiyan band se kisi mukarar standard deviation ko jama kar ke calculate kiye jate hain. Jaise ke pehle zikr kiya gaya, aam taur par is duri ko do wellknown deviations par rakha jata hai. Ye intikhab zyadah tar investors ke liye mozu' say Trad Len gy Bollinger Band Indicator ka Formation Dear Jab Bollinger band indicator humen marketplace ki mojoda volitilety, aid aur Resistance levels aur access/exit k naked mein bohut wazih hedayaat deti hai. Ye indicator teen bands hone ki waja se humen market k trend ki tabdeeli ya jari rehne mein mein data faraham karti hai, jo okay dosre aam indicator ki nisbat ziada dependable hoti hai. Indicator aik lagging indicator hone ki waja se sign farahame karne mein dair lagati hai, lekin u.S.Se humen marketplace ki wazih guidelines ho Jay Markets Volitive ty Dear Jab bh Bollinger's Bands ka bands ka istemal qeemat ki volitilety maloom karne ke liye hota hai. Jab ye bands naked ho jate hain, to iska matlab hai ke Market kam unsteadyat ka samna kar raha hai, jo ke aik muddat mein ikhata ho jane ya aik baray qeemat ke harkat hone ki alamat ho sakti hai. Umumah, jab ye bands naked ho jate hain, to ye zyada unsteadyat ko ishara karti hai, jo ke baray qeemat ke satu hi Following ho gy Supporting and Resistances Dear Jab bh Bollinger Bands qeemat ki chart par mozu' guide aur resistance ke tor par istemal ho sakti hain. Jab qeemat ooper band ke qareeb aati hai, to isay aksar resistance ke tor par istemal kiya jata hai, jo ke qeemat ko palatne ya ikhata hone ke liye zimmedar ho sakta hai. Dusri taraf, jab qeemat neechay band ke qareeb aati hai, to ye aid ka kaam kar sakti hai, jis se qeematon mein ikhata hone ya consolidation hone ki mumkinah harkat ho sakti hai. Ye support aur resistance ranges Say hi Following ho gy Bollinger Bands Squeezed Dear Jab bh Bollinger's Bands squeeze aik ahem mozu' hai jo is wakt hoti hai jab bands bare hoti hain. Is tangi se kam unsteadyat ka matlab hai ke ye aik darinda spring ki tarah hoti hai jo power riha karne ke liye tayyar hai. Traders aksar Bollinger Band's squeeze ko aik qeemat ke mazeed harkat ki pehchan ke liye dekhte hain. Lekin yaad rahe ke sirf squeeze, agaz hone wali harkat ki simat ko tay nahi karta; ye bas Zyda ho Jay Entry, Exit aur Limitations level Dear Yahan Bohot saaray traders Bollinger's Bands ko khareedari aur farokht sinyal peda karne ke liye istemal karte hain. Maslan, aik aam strategy ye hoti hai ke jab qeemat neechay band ko chu jati hai ya uske neeche gir jati hai to khareedari karni shuru ki ja sakti hai aur jab qeemat ooper band ko chu jati hai ya uske ooper chali jati hai to farokht kar li jati hai. Ye sinyal qeemat mein dakhli aur nikli factor faraham kar sakte hain, lekin inhe doosre takneekai aur bunyadi tahqiqat ke sath istemal karna chahiye. Is ke ilawa, investors ko nuksan ko kam karne ke liye sahi risk management approach istemal karne chahiye.Jabke Bollinger Bands aik taqatwar device hain, inke apne hadood aur mutalik khatrat hoti hain. Mazeed trend mein chalne wale marketon mein, ye bands asar andaz nahi kar sakti, kyun ke qeemat aik lambi muddat tak in bands ke ooper ya neechay barabar reh sakti hain. Is ke ilawa, kam unsteadyat ke dino mein ghalat sinyal aane ki mumkinahat hoti hain, jo munafa nahin de sakte. Traders ko in hadoodon ka ilm hona chahiye aor Sath teading ho Jay

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:15 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим