Spinning Top Candlestick Pattern In Forex

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Spinning Top Candlestick Pattern In Forexٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

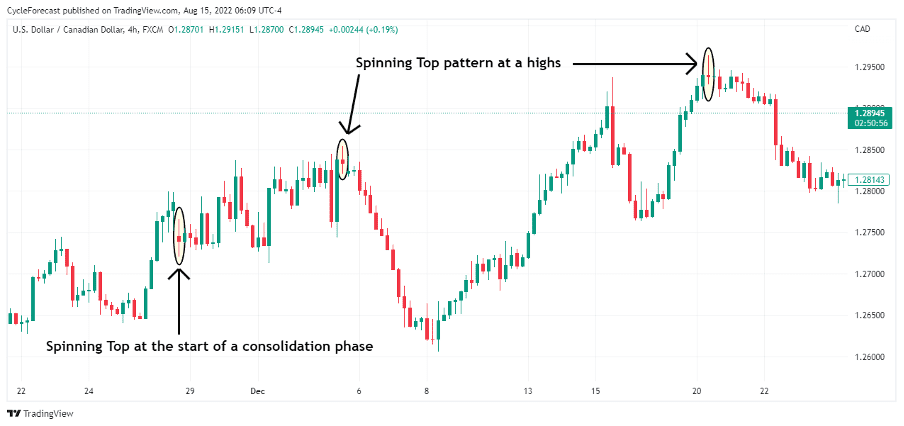

Spinning top candlestick pattern forex trading mein aik ahem aur pehchanay jane wale candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern ek neutral pattern hai, jo market mein shak-o-shubahat aur ghumao-phirao ko darust karta hai. Traders is pattern ko dekhtay hain taake wo market mein hone wale mukhtalif trend reversals ya continuations ko pehchan sakein. Aik spinning top candlestick ka chhota sa jism hota hai, jo darust karta hai ke opening aur closing prices mein kam farq hai. Dusri baat, spinning top ki pehchan is ke lambi upper aur lower wicks mein hoti hai, jo trading period mein reach karnay wale high aur low prices ko darust karte hain. Spinning top candlestick ka mojud hona yeh darust karta hai ke trading session mein na to bulls aur na hi bears control mein aaye thay. Yeh indecision mukhtalif wajohat ki bina par ho sakta hai, jese ke maali la-parwahi, khabar events, ya strong trend ke baad market ki thakan. Traders is pattern ko interpret karte hain ke market mein khareednay aur bechnay ki dabao mein taslees ka imtiaz hai, aur yeh hosakta hai ke market ka rukh badal jaye. Types Spinning Top Patterns Spinning top patterns ke do buniyadi types hoti hain: bullish spinning top aur bearish spinning top. Bullish Spinning Top

Types Spinning Top Patterns Spinning top patterns ke do buniyadi types hoti hain: bullish spinning top aur bearish spinning top. Bullish Spinning Top - Downtrend mein, bullish spinning top aik possible reversal ki taraf ishara kar sakta hai. Lambay sell pressure ke baad, bullish spinning top ka nazar ana yeh dikhata hai ke sellers momentum khota ja rahay hain, aur buyers shamil ho saktay hain.

- Candle ka chota jism indecision ko darust karta hai, lekin lambi lower wick yeh dikhata hai ke sellers ne price ko neechay dabaanay ki koshish ki lekin nakam reh gaye. Is kamiyabi mein lower prices ko barqarar nahi rakh sakanay ka ye ishara bullish signal ke tor par interpret kiya ja sakta hai.

- Traders amooman entry karne se pehle confirmatory signals ki talash mein hotay hain, jese ke bullish candlestick pattern ya spinning top ki high ke upar ki taraf price movement.

- Bearish spinning top trend mein kamzori ki taraf ishara kar sakta hai. Lambay buy pressure ke baad, bearish spinning top ka nazar ana yeh dikhata hai ke buyers control kho rahay hain, aur sellers momentum hasil kar saktay hain.

- Candle ka chhota jism phir se indecision ko darust karta hai, lekin lambi upper wick yeh dikhata hai ke buyers ne price ko upar dabaanay ki koshish ki lekin nakam reh gaye. Is kamiyabi mein higher prices ko barqarar nahi rakh sakanay ka ye ishara bearish signal ke tor par interpret kiya ja sakta hai.

- Traders amooman confirmatory signals ka intezar karte hain, jese ke bearish candlestick pattern ya spinning top ki low ke neechay price movement se pehle entry karne se.

Yaad rakhiye ke spinning top pattern ko sirf akele mein nahi istemal karna chahiye. Traders isay doosray technical indicators aur chart patterns ke sath istemal karte hain takay unhain sahi trading decisions lene mein madad milay. Is ke ilawa spinning top pattern ka mojud honay wala timeframe is ka relevance bohot zyada asar daal sakta hai. Aik daily chart par spinning top pattern ek possible reversal ya trend continuation ki taraf ishara kar sakta hai, jabke ek chhota timeframe jese ke 5-minute chart par woh sirf short-term market indecision ko darust karta hai. Overall mein spinning top candlestick pattern forex trading mein ek ahem tool hai jo market mein indecision aur trend reversals ya continuations ki possibility ko dikhata hai. Traders is pattern ko doosray technical analysis tools ke sath combine kar ke apni trading strategies ko behtar banate hain aur sahi trading decisions lene ki kamyabi ko barhane ki koshish karte hain. Yaad rakhiye, successful trading ke liye zaroori hai ke traders ko mukhtalif patterns, indicators, aur risk management strategies ka comprehensive understanding ho, sath hi careful analysis aur practice bhi zaroori hai.

Yaad rakhiye ke spinning top pattern ko sirf akele mein nahi istemal karna chahiye. Traders isay doosray technical indicators aur chart patterns ke sath istemal karte hain takay unhain sahi trading decisions lene mein madad milay. Is ke ilawa spinning top pattern ka mojud honay wala timeframe is ka relevance bohot zyada asar daal sakta hai. Aik daily chart par spinning top pattern ek possible reversal ya trend continuation ki taraf ishara kar sakta hai, jabke ek chhota timeframe jese ke 5-minute chart par woh sirf short-term market indecision ko darust karta hai. Overall mein spinning top candlestick pattern forex trading mein ek ahem tool hai jo market mein indecision aur trend reversals ya continuations ki possibility ko dikhata hai. Traders is pattern ko doosray technical analysis tools ke sath combine kar ke apni trading strategies ko behtar banate hain aur sahi trading decisions lene ki kamyabi ko barhane ki koshish karte hain. Yaad rakhiye, successful trading ke liye zaroori hai ke traders ko mukhtalif patterns, indicators, aur risk management strategies ka comprehensive understanding ho, sath hi careful analysis aur practice bhi zaroori hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:41 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим