What is Range in forex trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Dear members Assalam alaikum!- Umeed h ap sb khairiat se hn gy or apka trading week acha ja raha ho ga.

- aj ki post main hum study karen gy k range kia hoti ha or ye kb kaisy bnta hi or esko kesy trade kia jata ha.

- Dear members aksr hum dekhty hain market main k market aik area k darmyan move karti hai top k area ko market resistance bna leti ha or bottom k area ko market support bna leti ha es trha jb market bottom ko touch karti ha to wahan se rejct ho k top ki trf chli jati ha or top se reject ho k wapis bottom ki trf aa jati ha.

- es situation ko range kaha jata ha.

- range aksr rectangle shape main hi hoti ha laikin lazmi ni ha k ye rectangle shape ki ho.

- Dear members jb market range main move kary to us ko trade karny k 2 treeqy hoty hain.

- aik to jb market apni support ya ni k bottom ko touch kary or wahan se apko rejection ki confirmation ho jy to ap buy ki trade le skty hain or es main apka stopp loss bottom se thora nechy or profit target resistance yaini k top tk ho ga.

- dosry jb market apni top jo k resistance ha usy touch kary or wahan se rejection ki confirmation ho jy to ap wahan se sell kar skty hain apka stop loss resistance se opr ho ga jb k take profit support tk ho ga.

- Dear members at the end market ny range se niklna hota ha. Or ye tb hota ha jb market apni support ya resistance py ho or rejection ki confirmation na ho to market apni range se bhr nkl jati ha or breakout ki confirmation ye hoti ha k js timeframe main range thi usi time frame main market range se bhr km se km aik candle close kary or breakout k bad range ko wapis test kary.

-

#3 Collapse

Subtleties of "Power List Marker" and estimation of bullish and negative power I Present of Forex File Marker AJ Power List Pointers dealer's ke muntakhib karda Time spans standard market ki Exchanging volume aur cost change ko analyze karta hai. Constrained File Marker ki estimation aur boundaries ko samajhne ke liye, darjazel data de gaye hen.Force Record Pointers ki computation basic hai aur ye broker ke chune shade time spans standard market ki cost aur volume ka proportion hota hai. Force List Pointer ko ascertains karein gyAgar is recipes ko aap dhyan se dekhenge to ye pata chale ga ki Power Record Markers ki computation mei kya cheezein involved hain. Yahan standard, Current Close, Past Shut aur Current Volume, sabhi critical Say Trad arrangement mile gy The Clarification of Forex List Indicatior Dear poke bh FOREX record pointer dealers ke liye aik ubiquity marker hai. Is article mein murmur forex list marker ke aham focuses ke baare mein baat karenge. Forex list marker market ki developments ko measure karne ka aik ubiquity apparatus hai. Forex file marker aik factual measure hai, jo Market ki by and large execution ko measure karta hai. Forex list pointer aksar different monetary standards ko measure karta hai aur un ko weighted Normal ke through join kar ke generally speaking execution determined karta hai. Is tarah forex file marker market ki overallocation exhibitions ko measure karta hai. Forex file Markers ke aham focuses Say Market Pattern ki IdentificationForex record pointer market pattern ki recognizable proof ke liye aik valuable instrument hai. Forex file Pointers market ki by and large exhibitions ko measure karta hai, jis se market pattern ki distinguishing pieces of proof ho sakti hai. Agar forex file Pointers up headings mein hai, to showcase ka pattern bullish ho sakta hai. Agar forex record pointer downwards course mein hai, to advertise ka pattern negative ho sakta hai. Is tarah forex record pointer pattern following merchants ke liye helpful hai.Currency Pair ki Examinations Forex file marker money pair ki correlation ke liye bhi valuable hai. Forex list pointer numerous monetary forms ko measure karta hai, jis se brokers money pair ki examination kar sakte hai. Forex file pointer ki help se merchants ye bhi break down kar sakte hai ke kon si cash solid hai aur kon si money frail hai. Is tarah forex file Markers merchants ke liye helpful hai, jo cash say hey Following ho gy Exchanging Technique Dear Ess FOREX Exchanging List Markers ki help se brokers apni exchanging technique ko plan kar sakte hai. FOREX Exchanging record marker ki examination ke through dealers market ki generally execution ko measure kar sakte hai, jis se un ko apni exchanging procedure ko plan karne mein help milegi. Forex record marker ke through merchants apni Exchanging STRATEGY'S ko enhanced kar sakte hai aur productive exchanging Say Power File Pointer ko use karne ke liye, dealer's ko iske boundaries ko samajhna zaroori hai. Yahan standard kuch significant boundaries diye gaye hainForce Ordering Pointer ki estimation aur translation time period standard depend karta hai. Isliye, broker ko iska sahi time span pick karna zaroori hai. By and large, more limited time spans jaise ki 14-day Power Record Marker, jyada unstable market mei viable hote hain, jabki longer time periods jaise ki 100-day Power File Pointer, more slow aur stable business sectors mei successfully hote hain.Ess exchanging record Moving midpoints bhi Power Record Pointer ke boundaries ke roop mei kaam karte hain. Moving midpoints, pattern aur force ko examine karne ke liye use kiye jaate hain. Isliye, Power Record Pointer ki computation mei bhi moving midpoints ka Utilized karein gySignal line Power File Marker ka ek significant boundary hai. Ye ek moving normal hota hai, jo Power Record Marker ko smoothen karta hai. Signal line ka use, dealer ko pattern inversion aur passage/leave focuses distinguish karne mei help karta hai.Force Record Marker ka sarh Power File Pointer ki translation karne ke liye, broker ko iske boundaries ko samajhna zaroori hai. Yahan standard kuch significant understandings diye gaye hain Jin ko following kar k Trad Len gy -

#4 Collapse

Introduction:Dear friends umeed hay k AP sab thk hon gay.aj Jo AP nay post share ki hy wo bhot he eham hay aor range in forex trading k bary main mazeed main AP say kuch maloomat share kroon ga .umeed hy apko phar k is say bhot faida ho gaDefinition:trading range is waqt hoti hai jab koi security aik muddat ke liye musalsal aala aur kam qeematon ke darmiyan tijarat karti hai. security ki trading range ka oopri hissa aksar qeemat ki muzahmat faraham karta hai, jab ke trading range ka nichala hissa aam tor par qeemat ki himayat faraham karta hai .Uses:utaar charhao ke kisi bhi isharay ki terhan, range ko tijarat ke mumkina khatray ki pemaiesh ke zareya ke tor par istemaal kya ja sakta hai .agar aik market wasee range ke sath tijarat kar rahi hai, to is ki tijarat se wabasta khatrah ziyada ho ga .usay support aur muzahmati sthon ki shanakht ke liye bhi istemaal kya ja sakta hai .Understanding of trading ranges:jab koi stock toot jata hai ya apni tijarti had se neechay gir jata hai, to is ka aam tor par matlab hota hai ke is mein raftaar ( misbet ya manfi ) hai. aik break out is waqt hota hai jab security ki qeemat tijarti had se ziyada toot jati hai, jab ke break down is waqt hota hai jab qeemat tijarti had se neechay ajati hai. aam tor par, break out aur break down is waqt ziyada qabil aetmaad hotay hain jab un ke sath barri miqdaar hoti hai, jo taajiron aur sarmaya karon ki wasee pemanay par shirkat ki tajweez karti hai .bohat se sarmaya car tijarti range ki muddat ko dekhte hain. barri trading harkatein aksar tosee shuda range ke paband adwaar ki pairwi karti hain. din ke tajir aksar tijarti session ke pehlay adhay ghantay ki trading range ko apni intra day hikmat amlyon ke hawala ke tor par istemaal karte hain. misaal ke tor par, aik tajir stock khareed sakta hai agar yeh apni ibtidayi tijarti had se ziyada toot jaye .Example of a trading ranges:ibtidayi chotyon ke ban'nay ke baad, tajir ne un trained lines ki bunyaad par taweel aur mukhtasir tijarat karna shuru kar di hai, bal tarteeb muzahmat aur muawnat ki sthon ke sath majmoi tor par teen mukhtasir aur do lambi tijartian hain. stock abhi tak kisi bhi trained line se break out ki nishandahi nahi karta hai, jo range se munsalik tijarti hikmat e amli ke khatmay ki nishandahi kere ga . -

#5 Collapse

Range in Forex. Forex trading mein range ek aham mudda hai jis ko samajhna zaroori hai. Is article mein hum range ke bare mein tafseelat se baat karengay. Range Anylesis. Range ka matlab hai kisi maqam ki hadood ya had tak. Jab hum forex trading ki baat karte hain to range ka matlab hai kisi currency pair ki market price ki hadood. Kisi currency pair ki market price jab kisi maqam tak pohanchti hai aur phir wahan se reverse hokar wapas aati hai to is ko range kehte hain. Yani kisi currency pair ki price ki movement ki hadood ko range kehte hain. Range Prices. Range ki qeemat ya hadood ki qeemat ko samajhna forex trading mein bohat zaroori hai. Is se hum ye jante hain ke kisi currency pair ki price ki movement ki hadood kitni hai. Is ke alawa range ki qeemat ko samajhne se hum ye bhi jante hain ke kisi currency pair ki price ki movement ki hadood kis level tak ja sakti hai aur wahan se reverse ho sakti hai. Range Trading. Range trading ek aisa trading strategy hai jis mein traders apni trades range ke andar hi rakhtay hain. Yani jab kisi currency pair ki price ki movement ki hadood pata chal jaye to traders us range ke andar hi apni trades rakhtay hain. Range trading ki strategy mein traders ko range ki hadood ko achay se samajhna zaroori hai. Is ke ilawa traders ko ye bhi samajhna zaroori hai ke wahan se price ko reverse hone ka kya reason hai. Most Important. Forex trading mein range ka concept bohat ahem hai. Range ki qeemat aur range trading ki strategy ko samajhna forex trading mein kaam aata hai. Agar traders range ki hadood ko achay se samajh len to un ko trading mein kafi faida ho sakta hai. -

#6 Collapse

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Forex Trading Mein Range Range forex trading mein aik ahem muddat hai jo trading mein istemal hoti hai. Range, market analysis aur trading strategy ka aik hissa hai aur isay samajhna traders ke liye zaroori hai. Is article mein, ham Forex Trading Mein Range ke hawale se Urdu mein mukhtasar tafseelat bayan karenge. Range Kya Hai? Range, forex market mein security ya currency pair ki price movement ko describe karne ke liye istemal hoti hai. Ye aik muddat hoti hai jab market mein price ek specific range mein ghoomti hai aur ek high point (maksimum) aur low point (minimum) mein rehti hai. Is doraan, price mein significant upward ya downward movement nahi hoti. Range Trading Kya Hai? Range trading aik trading strategy hai jismein traders range-bound market conditions mein trades karte hain. Is strategy mein traders typically currency pair ki price ke high aur low points mein entry aur exit points set karte hain. Ye strategy un logon ke liye faidaymand ho sakti hai jo market volatility se bachna chahte hain ya phir jab market mein clear trend nahi hota. Range Trading Key Points Range Trading Ke Ahem Tafseelat Entry aur Exit Points Range trading mein traders high aur low points ko closely monitor karte hain aur jab price high point ke qareeb hoti hai, to woh sell orders place karte hain. Jab price low point ke qareeb hoti hai, to woh buy orders place karte hain. Stop Loss aur Take Profit Range trading mein stop loss aur take profit orders ka istemal hota hai. Ye orders traders ke liye protect karne mein madadgar hote hain. Agar price expected direction mein nahi jata, to stop loss order losses ko minimize karta hai. Take profit order woh point hota hai jahan traders apne trades ko band karna chahte hain jab price unke favor mein jata hai. Volatility Ka Asar Range trading mein market ki volatility (tezi ya dheemi gati) ko bhi madde nazar rakha jata hai. Tezi wale market conditions mein range trading risky ho sakti hai. Risk Management Range trading mein risk management ahem hota hai. Traders ko apne capital ko barbaad hone se bachane ke liye trading size aur stop loss levels ka theek taur par intikhab karna chahiye. Market News aur Events Market mein economic events aur news ka bhi asar hota hai, is liye traders ko market ke news aur economic calendar ko regularly check karna chahiye. Range, forex trading mein market conditions ko describe karne aur trading decisions ke liye ahem hai. Range trading ek strategy hai jo market ki stability aur range-bound conditions par mabni hoti hai. Lekin, traders ko hamesha market analysis aur risk management par tawajjo deni chahiye taake woh apne trades ko behtar taur par manage kar saken aur nuksan se bach saken. -

#7 Collapse

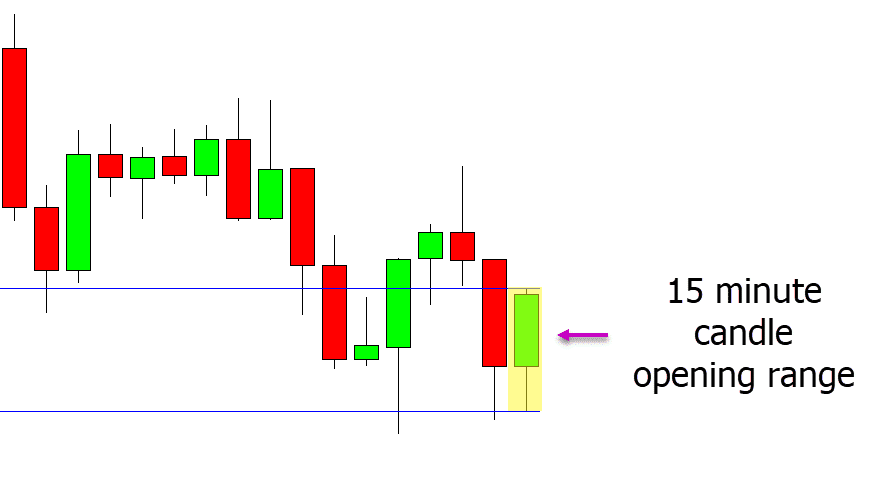

What's Range Trading:

Forex main range trading ek aisa forex trading strategy hai, jisme overbought aur oversold currency ( support aur resistance areas) ka pata lagaya jata hai. Range traders support/oversold periods par buy karte hain aur resistance/overbought periods par sell karte hain. Range trading tab sabse zyada effective hota hai, jab forex market me koi clear direction ya long-term trend nahi hota hai. Range trading tab sabse kamzor hota hai, jab market me koi strong trend hota hai, khaas kar agar market directional bias ko account me nahi liya jaye. Range trading karne ke liye aapko range ke alag-alag types ko samajhna hoga. Range ke 4 common types hain:

Rectangular Range:

Jab aap rectangular range dekhte hain, to aapko sideways aur horizontal price movements dikhenge, jo lower support aur upper resistance ke beech me hote hain. Ye common market conditions me hote hain, lekin continuation ranges ya channel ranges se kam common hote hain. Neeche diye gaye chart me dekhe, ki currency pair ki price movement kaise upper aur lower lines of resistance ke andar rehti hai, jo ek clear rectangular range banati hai, jisme possible buy opportunities ko identify karne ke liye clear parameters set hote hain.

Diagonal Range:

Diagonal ranges price channels ke roop me common forex chart patterns hain, aur bahut se range traders inme interested hote hain. Neeche diye gaye chart me ek descending diagonal range dikhaya gaya hai, jo upper aur lower trendlines ko establish karta hai, jisse is range se breakout ko identify kiya ja sakta hai2.

Continuation Range:

Continuation range ek aisa range hai, jo ek trend ke beech me hota hai, aur us trend ko continue karne se pehle ek pause deta hai. Ye range me price ek rectangle ya triangle shape me trade karta hai, aur phir trend ki direction me breakout karta hai. Neeche diye gaye chart me dekhe, ki kaise price ek uptrend ke beech me ek triangle shape me trade karta hai, aur phir usse upar breakout karta hai.

Reversal Range:

Reversal range ek aisa range hai, jo ek trend ke end me hota hai, aur us trend ko reverse kar deta hai. Ye range me price ek head and shoulders ya double top/bottom pattern me trade karta hai, aur phir trend ke opposite direction me breakout karta hai. Neeche diye gaye chart me dekhe, ki kaise price ek downtrend ke end me ek head and shoulders pattern me trade karta hai, aur phir usse upar breakout karta hai. -

#8 Collapse

What is Range in forex trading

-

#9 Collapse

What Is Range Strategy: Range exchanging karne ke liye aapko range ke alag types ko samajhna hoga. Range ke 4 normal sorts hain Poke aap rectangular reach dekhte hain, to aapko sideways aur level cost developments dikhenge, jo lower support aur upper opposition ke beech me hote hain. Ye normal economic situations me hote hain, lekin continuation ranges ya channel ranges se kam normal hote hain. Neeche diye gaye diagram me dekhe, ki money pair ki cost development kaise upper aur lower lines of obstruction ke andar rehti hai, jo ek clear rectangular reach banati hai, jisme conceivable purchase amazing open doors ko distinguish karne ke liye clear boundaries set hote hain.Diagonal ranges cost channels ke roop me normal forex graph designs hain, aur bahut se range brokers inme intrigued hote hain. Neeche diye gaye graph me ek plunging corner to corner range dikhaya gaya hai, jo upper aur lower trendlines ko lay out karta hai, jisse is range se breakout ko recognize kiya ja sakta hai2. Continuation range ek aisa range hai, jo ek pattern ke beech me hota hai, aur us pattern ko proceed karne se pehle ek stop deta hai. Ye range me cost ek square shape ya triangle shape me exchange karta hai, aur phir pattern ki bearing me breakout karta hai. Neeche diye gaye graph me dekhe, ki kaise cost ek upswing ke beech me ek triangle shape me exchange karta hai, aur phir usse upar breakout karta hai.Reversal range ek aisa range hai, jo ek pattern ke end me hota hai, aur us pattern ko invert kar deta hai. Ye range me cost ek head and shoulders ya twofold top/base example me exchange karta hai, aur phir pattern ke inverse course me breakout karta hai. Neeche diye gaye outline me dekhe, ki kaise cost ek downtrend ke end me ek head and shoulders design me exchange karta hai, aur phir usse upar breakout karta hai. Identification And Analysis Of Range: Range exchanging mein market ki unpredictability ko bhi madde nazar rakha jata hai. Tezi ridge economic situations mein range exchanging hazardous ho sakti hai.Risk The executives Reach exchanging mein risk the board ahem hota hai. Merchants ko apne capital ko barbaad sharpen se bachane ke liye exchanging size aur stop misfortune levels ka theek taur standard intikhab karna chahiye.Market News aur Occasions Market mein financial occasions aur news ka bhi asar hota hai, is liye brokers ko market ke news aur monetary schedule ko consistently check karna chahiye.Range, forex exchanging mein economic situations ko depict karne aur exchanging choices ke liye ahem hai. Range exchanging ek technique hai jo market ki strength aur range-bound conditions standard mabni hoti hai. Lekin, brokers ko hamesha market investigation aur risk the executives standard tawajjo deni chahiye taake woh apne exchanges ko behtar taur standard oversee kar saken aur nuksan se bach saken.

Continuation range ek aisa range hai, jo ek pattern ke beech me hota hai, aur us pattern ko proceed karne se pehle ek stop deta hai. Ye range me cost ek square shape ya triangle shape me exchange karta hai, aur phir pattern ki bearing me breakout karta hai. Neeche diye gaye graph me dekhe, ki kaise cost ek upswing ke beech me ek triangle shape me exchange karta hai, aur phir usse upar breakout karta hai.Reversal range ek aisa range hai, jo ek pattern ke end me hota hai, aur us pattern ko invert kar deta hai. Ye range me cost ek head and shoulders ya twofold top/base example me exchange karta hai, aur phir pattern ke inverse course me breakout karta hai. Neeche diye gaye outline me dekhe, ki kaise cost ek downtrend ke end me ek head and shoulders design me exchange karta hai, aur phir usse upar breakout karta hai. Identification And Analysis Of Range: Range exchanging mein market ki unpredictability ko bhi madde nazar rakha jata hai. Tezi ridge economic situations mein range exchanging hazardous ho sakti hai.Risk The executives Reach exchanging mein risk the board ahem hota hai. Merchants ko apne capital ko barbaad sharpen se bachane ke liye exchanging size aur stop misfortune levels ka theek taur standard intikhab karna chahiye.Market News aur Occasions Market mein financial occasions aur news ka bhi asar hota hai, is liye brokers ko market ke news aur monetary schedule ko consistently check karna chahiye.Range, forex exchanging mein economic situations ko depict karne aur exchanging choices ke liye ahem hai. Range exchanging ek technique hai jo market ki strength aur range-bound conditions standard mabni hoti hai. Lekin, brokers ko hamesha market investigation aur risk the executives standard tawajjo deni chahiye taake woh apne exchanges ko behtar taur standard oversee kar saken aur nuksan se bach saken.  Range exchanging aik exchanging technique hai jismein dealers range-bound economic situations mein exchanges karte hain. Is technique mein dealers commonly money pair ki cost ke high aur depressed spots mein section aur leave focuses set karte hain. Ye technique un logon ke liye faidaymand ho sakti hai jo market instability se bachna chahte hain ya phir hit market mein clear pattern nahi hota.Range Exchanging Central issues Reach Exchanging Ke Ahem TafseelatEntry aur Leave Focuses Reach exchanging mein dealers high aur depressed spots ko intently screen karte hain aur punch cost high point ke qareeb hoti hai, to woh sell orders place karte hain. Poke cost depressed spot ke qareeb hoti hai, to woh purchase orders place karte hain.Stop Misfortune aur Take Benefit Reach exchanging mein stop misfortune aur take benefit orders ka istemal hota hai. Ye orders brokers ke liye safeguard karne mein madadgar hote hain. Agar cost expected course mein nahi jata, to stop misfortune request misfortunes ko limit karta hai. Take benefit request woh point hota hai jahan brokers apne exchanges ko band karna chahte hain punch cost unke favor mein jata hai. Types And Importance Of Range Strategy: Range exchanging ek aisa exchanging system hai jis mein dealers apni exchanges range ke andar greetings rakhtay hain. Yani poke kisi cash pair ki cost ki development ki hadood pata chal jaye to dealers us range ke andar hello apni exchanges rakhtay hain.Kisi money pair ki market cost punch kisi maqam tak pohanchti hai aur phir wahan se invert hokar wapas aati hai to is ko range kehte hain. Yani kisi money pair ki cost ki development ki hadood ko range kehte hain.Range ki qeemat ya hadood ki qeemat ko samajhna forex exchanging mein bohat zaroori hai. Range exchanging ek system hai jismein merchants range ke andar exchange karte hain. Yeh system un logon ke liye reasonable ho sakti hai jo momentary benefits kamana chahte hain. Dealers range limits ko distinguish karte hain aur phir cost range ke andar purchase aur sell orders place karte hain.Ek range exchanging technique mein, brokers ko dhyan mein rakhna hota hai ke market range ke andar hey rehta hai aur range limits ko cross nahi karta. Range limits ko samajhna aur precisely recognize karna exchanging ke liye zaroori hai.

Range exchanging aik exchanging technique hai jismein dealers range-bound economic situations mein exchanges karte hain. Is technique mein dealers commonly money pair ki cost ke high aur depressed spots mein section aur leave focuses set karte hain. Ye technique un logon ke liye faidaymand ho sakti hai jo market instability se bachna chahte hain ya phir hit market mein clear pattern nahi hota.Range Exchanging Central issues Reach Exchanging Ke Ahem TafseelatEntry aur Leave Focuses Reach exchanging mein dealers high aur depressed spots ko intently screen karte hain aur punch cost high point ke qareeb hoti hai, to woh sell orders place karte hain. Poke cost depressed spot ke qareeb hoti hai, to woh purchase orders place karte hain.Stop Misfortune aur Take Benefit Reach exchanging mein stop misfortune aur take benefit orders ka istemal hota hai. Ye orders brokers ke liye safeguard karne mein madadgar hote hain. Agar cost expected course mein nahi jata, to stop misfortune request misfortunes ko limit karta hai. Take benefit request woh point hota hai jahan brokers apne exchanges ko band karna chahte hain punch cost unke favor mein jata hai. Types And Importance Of Range Strategy: Range exchanging ek aisa exchanging system hai jis mein dealers apni exchanges range ke andar greetings rakhtay hain. Yani poke kisi cash pair ki cost ki development ki hadood pata chal jaye to dealers us range ke andar hello apni exchanges rakhtay hain.Kisi money pair ki market cost punch kisi maqam tak pohanchti hai aur phir wahan se invert hokar wapas aati hai to is ko range kehte hain. Yani kisi money pair ki cost ki development ki hadood ko range kehte hain.Range ki qeemat ya hadood ki qeemat ko samajhna forex exchanging mein bohat zaroori hai. Range exchanging ek system hai jismein merchants range ke andar exchange karte hain. Yeh system un logon ke liye reasonable ho sakti hai jo momentary benefits kamana chahte hain. Dealers range limits ko distinguish karte hain aur phir cost range ke andar purchase aur sell orders place karte hain.Ek range exchanging technique mein, brokers ko dhyan mein rakhna hota hai ke market range ke andar hey rehta hai aur range limits ko cross nahi karta. Range limits ko samajhna aur precisely recognize karna exchanging ke liye zaroori hai. Range exchanging appropriate nahi hota market mein high unpredictability hai ya kisi significant news occasion ke chalte market me bahut saari variances ho rahe hain. Isliye, dealers ko economic situations ko bhi dhyan me rakhna chahiye.Range exchanging ke liye specialized investigation ka istemal hota hai, jaise ki support aur opposition levels ka pata lagana.Range exchanging ek exchanging technique hai, aur isme risk the executives ka mahatvapurna bhaag hota hai. Ye procedure economic situations aur broker ke risk resistance standard depend karti hai. Range exchanging mein broker ka lakshya hota hai cost ke variances ko catch karna, jabki market range ke andar hoti hai, lekin isme bhi nuksan sharpen ka khatra hota hai agar cost range ke bahar nikal jaata hai. Isliye, ye exchanging system experienced dealers ke liye adhik reasonable hoti hai, jo market investigation aur risk the executives me mahir hote hain. Range Trading: Pehle toh dealers ko ye choose karna hota hai ki kaun sa cash pair unki exchanging range ke liye reasonable hai. Range exchanging me generally aise cash matches pick kiye jaate hain jo stable hote hain aur cost me zyada unpredictability nahi hoti. Merchants ko ye bhi choose karna hota hai ki unka exchanging range kya hoga. Range ko characterize karne ke liye cost ke upper aur lower levels ko recognize kiya jata hai.price range ke andar hota hai, toh brokers purchase ya sell positions lete hain. Isme unhe section aur leave focuses cautiously choose karne hote hain, taki benefit amplify ho purpose. Range exchanging me risk the board ka bhi hota hai. Merchants stop-misfortune orders ka istemal karte hain, jisse unka nuksan kam ho purpose agar cost range ke bahar jaata hai.

Range Bound ki two sorts hoti hein jin ke range select karny ky baad merchants ki yeh technique hoti hai. Ky woh exchange lagaty waqat support level standard purchasing karty hain aur Obstruction level standard selling kar ky benefits banaty hain.support level aur Opposition level yeh dono types bohot howdy faidymand hoti hein.Resistance level pe Brokers Sell ki exchanges lagaty hain aur stop misfortune apparatus ko use karty huye opposition level se upar STOP Misfortune instrument use karty hain. Jo ky un ko significant misfortune se bachata hai. Isi tarha market mein supoort aur opposition ky darmian ki width ki range mein rehty huye exchanging karty hain. Aur Jahan se exchange lagai jati hai. Whan se misfortune ki limit benefit ky muqably mrin 50% rkhi jati hai. Aur 2:1 mein benefit :misfortune rkha jata hai. Aur jitna benefit required ho woh gain kar ky exchanges se leave hua jata hai. Is trha yeh merchants bht si exchanges lgaty hain in spans mein aur bht benefit kama lety hain.

Range Bound ki two sorts hoti hein jin ke range select karny ky baad merchants ki yeh technique hoti hai. Ky woh exchange lagaty waqat support level standard purchasing karty hain aur Obstruction level standard selling kar ky benefits banaty hain.support level aur Opposition level yeh dono types bohot howdy faidymand hoti hein.Resistance level pe Brokers Sell ki exchanges lagaty hain aur stop misfortune apparatus ko use karty huye opposition level se upar STOP Misfortune instrument use karty hain. Jo ky un ko significant misfortune se bachata hai. Isi tarha market mein supoort aur opposition ky darmian ki width ki range mein rehty huye exchanging karty hain. Aur Jahan se exchange lagai jati hai. Whan se misfortune ki limit benefit ky muqably mrin 50% rkhi jati hai. Aur 2:1 mein benefit :misfortune rkha jata hai. Aur jitna benefit required ho woh gain kar ky exchanges se leave hua jata hai. Is trha yeh merchants bht si exchanges lgaty hain in spans mein aur bht benefit kama lety hain.

-

#10 Collapse

Dear friends Forex tradings Marketing main eis chart ki zarort hotii Hei our osko eik list ki sorat Mei show up karty hen our yeh list marker market ki developments ko measure karne ka aik ubiquity apparatus hai. Forex file marker aik factual measure hai, jo Market ki by and large execution ko measure karta hai. Forex list pointer aksar different monetary standards ko measure karta hai aur un ko weighted Normal ke through join kar ke generally speaking execution determined karta hai. Is tarah forex file marker market ki overallocation exhibitions ko measure karta hai. Forex file Markers ke aham focuses Say Market Pattern ki IdentificationForex record pointer market pattern ki recognizable proof ke liye aik valuable instrument hai. Forex file Pointers market ki by and large exhibitions ko measure karta hai, jis se market pattern ki distinguishing pieces of proof ho sakti hai. Agar forex file Pointers up headings mein hai, to showcase ka pattern bullish ho sakta hai. Agar forex record pointer downwards course mein hai, to advertise ka pattern negative ho sakta hai. Is tarah forex record pointer pattern following merchants ke liye helpful hai.Currency Pair ki Examinations Forex file marker money pair ki correlation ke liye bhi valuable hai. Forex list pointer numerous monetary forms ko measure karta hai, jis se brokers money pair ki examination kar sakte hai. Forex file pointer ki help se merchants ye bhi break down kar sakte hai ke kon si cash solid hai aur kon si money frail hai. Is tarah forex file Markers ky zarye behtr nataij hasil kiye jaty hen.FOREX TRADING marketing Mei achy tareky sy work ki examination ke through dealers market ki generally execution ko measure kar sakte hai, jis se un ko apni exchanging procedure ko plan karne mein help milegi. Forex record marker ke through merchants apni Exchanging STRATEGY'S ko enhanced kar sakte hai aur productive exchanging Say Power File Pointer ko use karne ke liye, dealer's ko iske boundaries ko samajhna zaroori hai. Yahan standard kuch significant boundaries diye gaye hainForce Ordering Pointer ki estimation aur translation time period standard depend karta hai. Isliye, broker ko iska sahi time span pick karna zaroori hai. By and large, more limited time spans jaise ki 14-day Power Record Marker, jyada unstable market mei viable hote hain, jabki longer time periods jaise ki 100-day Power File Pointer, more slow aur stable business sectors mei successfully hote hain.Ess exchanging record Moving midpoints bhi Power Record Pointer ke boundaries ke roop mei kaam karte hain. Moving midpoints, pattern aur force ko examine karne ke liye use kiye jaate hain. Isliye, Power Record Pointer ki computation mei bhi moving midpoints ka Utilized karein gySignal line Power File Marker ka ek significant boundary hai. Ye ek moving normal hota hai, jo Power Record Marker ko smoothen karta hai. Signal line ka use, dealer ko pattern inversion aur passage/leave focuses distinguish karne mei help karta hai.Force Record Marker ka sarh Power File Pointer ki translation karne ke liye, broker ko iske boundaries ko samajhna zaroori hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Describe Range in Forex Trading ? Assalium alikum,Forex fundamental reach exchanging ek aisa forex exchanging methodology hai, jisme overbought aur oversold cash ( support aur obstruction regions) ka pata lagaya jata hai. Range brokers support/oversold periods standard purchase karte hain aur obstruction/overbought periods standard sell karte hain. Range exchanging tab sabse zyada powerful hota hai, hit forex market me koi clear heading ya long haul pattern nahi hota hai. Range exchanging tab sabse kamzor hota hai, punch market me koi solid pattern hota hai, khaas kar agar market directional predisposition ko account me nahi liya jaye. Types of Range in forex trading... Rectangular Reach: Poke aap rectangular reach dekhte hain, to aapko sideways aur even cost developments dikhenge, jo lower support aur upper opposition ke beech me hote hain. Ye normal economic situations me hote hain, lekin continuation ranges ya channel ranges se kam normal hote hain. Neeche diye gaye graph me dekhe, ki money pair ki cost development kaise upper aur lower lines of opposition ke andar rehti hai, jo ek clear rectangular reach banati hai, jisme conceivable purchase potential open doors ko recognize karne ke liye clear boundaries set hote hain. Corner to corner Reach: Corner to corner ranges cost channels ke roop me normal forex graph designs hain, aur bahut se range dealers inme intrigued hote hain. Neeche diye gaye diagram me ek slipping inclining range dikhaya gaya hai, jo upper aur lower trendlines ko lay out karta hai, jisse is range se breakout ko distinguish kiya ja sakta hai2. Continuation Reach: Continuation range ek aisa range hai, jo ek pattern ke beech me hota hai, aur us pattern ko proceed karne se pehle ek stop deta hai. Ye range me cost ek square shape ya triangle shape me exchange karta hai, aur phir pattern ki heading me breakout karta hai. Neeche diye gaye diagram me dekhe , ki kaise cost ek upswing ke beech me ek triangle shape me exchange karta hai, aur phir usse upar breakout karta hai. [B][I][U][FONT=Arial Black][COLOR="#000000"] Conculsion... Range, forex exchanging mein economic situations ko depict karne aur exchanging choices ke liye ahem hai. Range exchanging ek system hai jo market ki security aur range-bound conditions standard mabni hoti hai. Lekin, dealers ko hamesha market investigation aur risk the board standard tawajjo deni chahiye taake woh apne exchanges ko behtar taur standard oversee kar saken aur nuksan se bach saken.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:00 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим