What is Wedge Pattern .

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Wedge Patterns: Main Wedge Patterns ek technical analysis ka hissa hain jo stock market aur forex trading mein istemal hota hai. Ye patterns price charts par paye jate hain aur traders ke liye price movement ka trend predict karne mein madadgar sabit hote hain. Symmetrical Wedge Pattern: Symmetrical Wedge Pattern ek aesa pattern hai jahan price apas mein high aur low ke beech mein consolidate hota hai. Yeh pattern aksar trend reversal ko darust karti hai, lekin traders ko isko sahi samajhna zaroori hai. Ascending Wedge Pattern: Ascending Wedge Pattern mein price higher highs aur higher lows banata hai. Ye pattern generally bearish trend ke doran aata hai aur price ka girawat darust kar sakta hai. Descending Wedge Pattern : Descending Wedge Pattern mein price lower highs aur lower lows banata hai. Ye pattern bullish trend ke doran aksar paya jata hai aur price ka barhna darust kar sakta hai. Trading Main Wedge Patterns Ka Istemal: Traders in wedge patterns ka istemal trend ki samajhne aur entry/exit points tay karne ke liye karte hain. Symmetrical wedge pattern mein breakout ka wait kiya jata hai, jabke ascending wedge pattern mein short positions li jati hain aur descending wedge pattern mein long positions. Trading Strategy: Wedge patterns ki interpretation mein ghalatfehmi hone ki khatra hoti hai. In patterns ko samajhne ke liye practice aur experience ki zaroorat hoti hai. Iske alawa, market mein unexpected events bhi ho sakte hain jo patterns ko invalid kar sakte hain. Main Wedge Patterns, trading mein ek powerful tool hote hain agar inko sahi tarah se samjha jaye aur risk management ka khayal rakha jaye. Traders ko hamesha cautious rehna chahiye aur patterns ki confirmation ke liye doosri technical analysis tools ka bhi istemal karna chahiye. -

#3 Collapse

What is Wedge Pattern?

Assalam O Alaikum dear Friends Fellows and forex forum ke members aj jis topic pe sawal kiya gya hy us ko "Wedge chart patteren Kaha jata hy Rising wedge se hamen ye samajh a rahi hy ke ek cheez neechy se uper ki taraf ja rahi ho bilkul isi tarah Rising wedge bhi nazar ata hy isa banny k liye hama 2 support or 2 resistance ki zarurart parti ha ham support or resistance line wick to body ya wick to wick bhi bna sakty hein suppose krein market upar jari ha or retrace krti hy fir market dobara se direction me jati ha or dobara sa retrace krti hy isi doran ham ek line support par trade lagaen ge downtrend sa uptrend or ek line resistance pa lagaye ge curved is tarah ham ya rising wedge ko bana lain ge agr koi bi candle rising wedge upr crossing da jae to ya pattern invalid ho jaen ge

How to work with Wedge Pattern?

Dear friends market me enter hony sy pehly hamen acha experience hasil krna ho ga hamen expert ban ky pasaia invest kar ky pattern ko or candles ko learn kar ky use kar ky kam karna ho ga phir he ham pasia kama sakty hein forex aik best business hy hum is me baghair balance account bana kar be kam kar sakty hein forex aik unique business hy.Jis tarah se tmam patterns important hein isi tarah Wedge Pattern bhi aik eham pattern hy is ke baary me bhi acha knowledge ho ga to ham achi trade ker sakty hein trend analysis krna achi tarah seekhna ho ga jab trend analysis krna a jaye to fir kisi bhi pattern me trading ki ja sakti hy

Trading with Wedge Pattern?

Dear fellows trading market me rising and falling market trend maloom karny ke liye apke pass candlestick chart pattern ki perfect situation aur phir site condition hy aap isko dekh Kar trading kar sakty hein aur apna profit bana sakty hein forex trading members apko doosry trading members ko bhi sath lekar chalna hy aur apne target ko focus karna hy aur goal achieve karny ke liye mehnat karna hogi trading market me moujud indicators aur tools ko use karny ke liye ap ke pass experience hy, reading karny ke liye humne doosry trading member ko bhi dekhna hy unko sath lekar chalna hy aur professional trading members ko follow karna hy senior trading member se help leni hy market me technical aur fundamental analysis ko deni hy aur usko use karte hue humne apne trading deposit course kyon karna hy aur banane ke liye bhi humne form me achcha kam karna hy

-

#4 Collapse

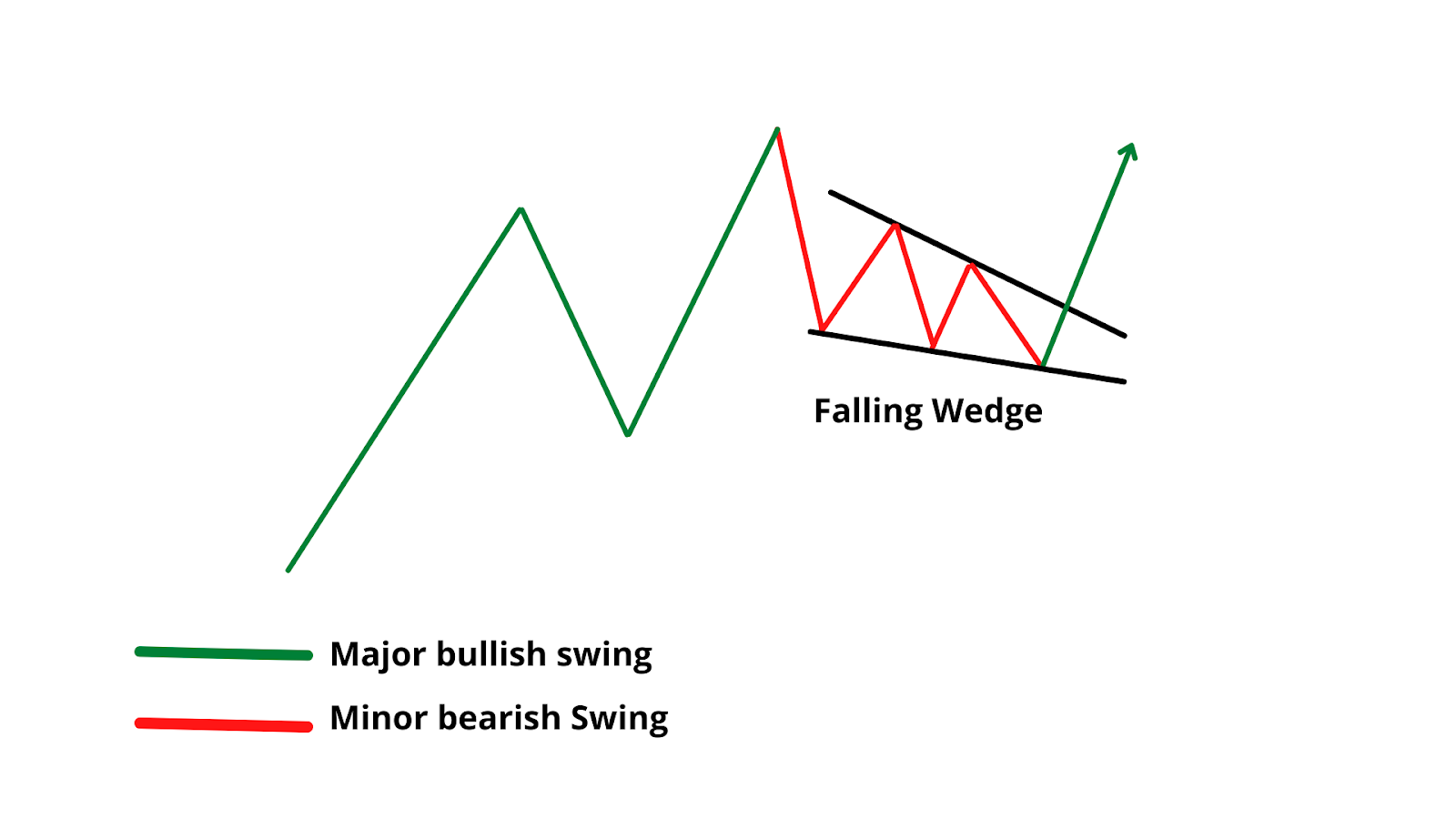

WEDGE PATTERNS IN FOREX INTRODUCTION Wedge patterns forex trading mein aik ahem technical analysis tool hain jo market trends aur price movements ko samajhne mein madadgar hotay hain. Ye patterns do qisam ke hotay hain: Rising Wedge (Uper Uthti Wedge) aur Falling Wedge (Neechay Girnay Wali Wedge).Yeh pattern market mein bearish trend ki shuruaat ko ishara karta hai aur traders ko sell karne ki salahiyat deta hai. RISING WEDGE Uper Uthti Wedge ek bearish reversal pattern hota hai. Is mein prices aik upward trend mein hoti hain, lekin phir gradually kam hokar aik triangle-like shape banti hai. Yeh pattern market mein bearish trend ki shuruaat ko ishara karta hai aur traders ko sell karne ki salahiyat deta hai. FALLING WEDGE Neechay Girnay Wali Wedge ek bullish reversal pattern hota hai. Is mein prices aik downward trend mein hoti hain, lekin phir gradually kam hokar aik triangle-like shape banti hai. Yeh pattern market mein bullish trend ki shuruaat ko ishara karta hai aur traders ko buy karne ki salahiyat deta hai. TRADING WEDGE PATTERNS Traders in patterns ko samajh kar market mein trading decisions lete hain. Uper Uthti Wedge mein, traders sell positions le sakte hain jab pattern complete hota hai aur price ne wedge ko break kia. Neechay Girnay Wali Wedge mein, traders buy positions le sakte hain jab pattern complete hota hai aur price ne wedge ko break kia. STOP LOSS AND TAKE PROFIT Trading mein safety ke liye stop loss orders aur profit booking ke liye take profit orders istemal kiye jate hain. Ye orders traders ko nuksan se bachate hain aur faida kamane mein madadgar hotay hain. PRACTICE AND LEARNING Wedge patterns ko samajhna aur sahi tijarat karne ke liye practice aur learning ahem hai. Demo accounts istemal karke aur education resources parh kar traders apni skills ko behtar banate hain.ye tha Wedge Patterns ke hawale se aik mukhtasar tafseel. Forex trading mein patterns ko samajhna aur istemal karna mahir traders ke liye ahem hai. -

#5 Collapse

Wedge Pattern in Forex Trading. Forex trading mein, wedge pattern ek aham chart pattern hai. Ye pattern price trend ke change hone ka indication deta hai. Is article mein hum wedge pattern ke baare mein roman urdu mein baat karenge. Wedge pattern ek aisa chart pattern hai jismein price trend upper or lower direction mein gradually narrow hota hai. Is pattern ko 2 types mein divide kiya ja sakta hai: 1. Rising Wedge: Ye pattern upper trend mein hota hai or price gradually narrow hota hai. Is pattern ko bearish reversal ke indication ke tor par dekha jata hai. 2. Falling Wedge: Ye pattern lower trend mein hota hai or price gradually narrow hota hai. Is pattern ko bullish reversal ke indication ke tor par dekha jata hai. Wedge Pattern Identification. Wedge pattern ko identify karne ke liye, aapko chart mein price ke upper or lower trend ko observe karna hoga. Agar price gradually narrow ho raha hai to ye wedge pattern ke indication hai. Aapko bhi is pattern ko identify karne ke liye aapke paas technical analysis tools hona chahiye. Wedge Pattern Trading Strategy. Wedge pattern ko trading strategy ke tor par use karne ke liye, aapko breakout ke wait karna hoga. Agar price wedge pattern ke andar hai to aapko wait karna hoga jab tak price pattern ke bahar nikal na jaye. Breakout ke baad, aapko apne trade ke liye stop loss aur take profit level set karna hoga. Wedge pattern forex trading mein ek aham chart pattern hai jo price trend ke change hone ka indication deta hai. Is pattern ko identify karne ke liye technical analysis tools ki zaroorat hoti hai. Agar aap sahi tareeke se wedge pattern ko identify kar lete hain to aapko trading mein fayda hoga. -

#6 Collapse

Wedge Pattern Trading: Wedge pattern trading, yaani kay "wedge pattern tijarat," forex aur stalk market mein aik aham technical analysis tool hai jo traders aur investors ke liye market ke future trends ko samajhnay mein madadgar hota hai. Ye pattern market mein price ke changing trends ko identify karne mein madadgar hota hai aur trading decisions ko improve karne mein madad deta hai. Is article mein, hum wedge pattern tijarat ke baray mein roman urdu mein 500 alfaz tak tafseel se batayenge. Wedge Pattern Kya Hai? Wedge pattern, ek tarah ka chart pattern hota hai jo trading charts par paya jata hai. Ye pattern market mein price ke movements ko represent karta hai. Wedge pattern do tarah ke hote hain: ascending wedge aur descending wedge. Ascending Wedge (Uthti Hui Wedge): Ye pattern market mein price ke upward trend ko darust karta hai. Ismein price higher highs aur higher lows banata hai. Iska matlab hota hai kay market mein bullish sentiment hai, lekin ye pattern ek point par aik triangle shape banata hai. Descending Wedge (Utarti Hui Wedge): Ye pattern market mein price ke downward trend ko darust karta hai. Ismein price lower highs aur lower lows banata hai. Iska matlab hota hai kay market mein bearish sentiment hai, lekin ye pattern bhi aik triangle shape banata hai. Wedge Pattern Kaise Kaam Karta Hai? Wedge pattern kaam kuch is tarah se karta hai: - Jab traders ya investors wedge pattern ko observe karte hain, to unka dhyan higher highs aur lower highs ki taraf hota hai (ascending wedge mein) ya lower highs aur higher lows ki taraf hota hai (descending wedge mein). - Jab price wedge ke andar hota hai, to iska matlab hota hai kay market consolidation phase mein hai aur traders uncertainty mein hote hain. - Jab price wedge ke bahar nikalta hai, to iska ek signal hota hai kay market mein trend change hone ke chances hain. - Agar ascending wedge break down hota hai, to ye bearish signal ho sakta hai aur traders selling positions le sakte hain. - Agar descending wedge break up hota hai, to ye bullish signal ho sakta hai aur traders buying positions le sakte hain. Wedge Pattern Ka Istemal Trading Mein: Wedge pattern trading ke liye istemal hota hai kyun kay ye market trends ko anticipate karne mein madadgar hota hai. Traders is pattern ko istemal karke entry aur exit points tay kar sakte hain. Yahan kuch zaroori points hain: - Entry Point:Jab price wedge ke bahar nikalta hai aur trend confirm hota hai, to traders entry points tay kar sakte hain. - Stop-Loss Aur Target:Traders stop-loss aur target levels tay kar sakte hain taakay nuksan se bacha ja sake. - Risk Management:Wedge pattern trading ke doran risk management ka aham hissa hota hai. Traders ko apni positions ko monitor karna chahiye aur trading plan follow karna chahiye. Akhir Mein: Wedge pattern trading aik powerful tool hai jo traders aur investors ko market trends ko samajhnay mein madadgar hota hai. Is pattern ko samajhna aur istemal karna tijarat mein maharat aur experience ka hissa hai. Lekin yaad rahe ke kisi bhi trading decision se pehle thorough research aur risk assessment zaroori hai. Trading mein nuksan ka khatra hota hai, isliye savdhani aur sahi tijarat ki strategy ka istemal karna zaroori hai. -

#7 Collapse

GuideLines About Wedge Pattern: Assalam o Alicom! Dear Sisters and Brothers Wedge Patterns bhi market mein overall usi market trend mei banty hain jin mein woh trend ki continuation ke signals dety hain. In me Wedges ki formation hoti hai jo ke ascending ya descending ho sakti hai aur wedges ke doran ap small trades laga sakty hain. Isi tarha major trend ko bhi follow kar sakty hain. Isi tarha is trend ki continuation ke badh ap market mein same trend ko follow karty huy trades kar sakty hain aur profits gain kar sakty hain. Is ke liye apko confirm signals ka wait karna parta hai. Strategy Of Wedge Pattern: Dear Forex Members Wedge Pattern ma waves ki strategy ko use kiya jata hai. Es ma minimum 8 waves hoti hy. Jin ma se 5 waves dominat hoti hai or 3 waves correction wave hoti hai. Es tarha wave ki madad se market ko judge kiya jata hai or es base par apny order ko adjust kiya jata hai. Jo trader stop loss or take profit ke liye waves ko use kary usko be kafi advantage hoti hai. Jo trader forex ma sirf pattern ki he help lety hain or kisi knowledge or experience ko trade ma use ni karty wo hamesha nakam hoty hain. Information About Wedge Pattern: Dear Friends and Fellows Dear jab ap forex trading mein Wedge Pattern ko study karte hain to ismein apko falling wedge pattern aur rising wedge pattern se related kuch information mil rahi hoti hai jismein market ki different movement is ki shape ko discuss karti hai aur ap market mein different important patterns ko different parts may divide kar sakte hain.

- Mentions 0

-

سا0 like

-

#8 Collapse

Wedge Chart Pattern: Wedge Example main waves ki procedure ko use kiya jata hai. Es main least 8 waves hoti hy. Jin main se 5 waves dominat hoti hai or 3 waves amendment wave hoti hai. Es tarha wave ki madad se market ko judge kiya jata hai or es base standard apny request ko change kiya jata hai. Jo broker stop misfortune or take benefit ke liye waves ko use kary usko be kafi advantage hoti hai. Jo merchant forex main sirf design ki he help lety hain or kisi information or experience ko exchange mama use ni karty wo hamesha nakam hoty hain.forex exchanging mein Wedge Example fundamental falling wedge design aur rising wedge design se related kuch data mil rahi hoti hai jismein market ki different development is ki shape ko examine karti hai aur ap market mein different significant examples ko various parts might partition kar sakte hain. Wedge design exchanging aik useful asset hai jo dealers aur financial backers ko market patterns ko samajhnay mein madadgar hota hai. Is design ko samajhna aur istemal karna tijarat mein maharat aur experience ka hissa hai. Lekin yaad rahe ke kisi bhi exchanging choice se pehle intensive examination aur risk appraisal zaroori hai. Exchanging mein nuksan ka khatra hota hai, isliye savdhani aur sahi tijarat ki technique ka istemal karna zaroori hai.Jab cost wedge ke bahar nikalta hai aur pattern affirm hota hai, to dealers passage focuses tay kar sakte hain.Traders stop-misfortune aur target levels tay kar sakte hain taakay nuksan se bacha ja sakeWedge design exchanging ke doran risk the executives ka aham hissa hota hai. Merchants ko apni positions ko screen karna chahiye aur exchanging plan follow karna chahiye. Formation Of Wedge Chart Pattern: Brokers ya financial backers wedge design ko notice karte hain, to unka dhyan better upsides aur worse high points ki taraf hota hai (rising wedge mein) ya worse high points aur more promising low points ki taraf hota hai cost wedge ke andar hota hai, to iska matlab hota hai kay market solidification stage mein hai aur merchants vulnerability mein hote hain.Jab cost wedge ke bahar nikalta hai, to iska ek signal hota hai kay market mein pattern change sharpen ke chances hain.Agar climbing wedge separate hota hai, to ye negative sign ho sakta hai aur dealers selling positions le sakte hain Agar diving wedge separate hota hai, to ye bullish sign ho sakta hai aur brokers purchasing positions le sakte hain.Wedge design exchanging ke liye istemal hota hai kyun kay ye market patterns ko expect karne mein madadgar hota hai. Dealers is design ko istemal karke passage aur leave focuses tay kar sakte hain. Yahan kuch zaroori focuses hain

Wedge design exchanging aik useful asset hai jo dealers aur financial backers ko market patterns ko samajhnay mein madadgar hota hai. Is design ko samajhna aur istemal karna tijarat mein maharat aur experience ka hissa hai. Lekin yaad rahe ke kisi bhi exchanging choice se pehle intensive examination aur risk appraisal zaroori hai. Exchanging mein nuksan ka khatra hota hai, isliye savdhani aur sahi tijarat ki technique ka istemal karna zaroori hai.Jab cost wedge ke bahar nikalta hai aur pattern affirm hota hai, to dealers passage focuses tay kar sakte hain.Traders stop-misfortune aur target levels tay kar sakte hain taakay nuksan se bacha ja sakeWedge design exchanging ke doran risk the executives ka aham hissa hota hai. Merchants ko apni positions ko screen karna chahiye aur exchanging plan follow karna chahiye. Formation Of Wedge Chart Pattern: Brokers ya financial backers wedge design ko notice karte hain, to unka dhyan better upsides aur worse high points ki taraf hota hai (rising wedge mein) ya worse high points aur more promising low points ki taraf hota hai cost wedge ke andar hota hai, to iska matlab hota hai kay market solidification stage mein hai aur merchants vulnerability mein hote hain.Jab cost wedge ke bahar nikalta hai, to iska ek signal hota hai kay market mein pattern change sharpen ke chances hain.Agar climbing wedge separate hota hai, to ye negative sign ho sakta hai aur dealers selling positions le sakte hain Agar diving wedge separate hota hai, to ye bullish sign ho sakta hai aur brokers purchasing positions le sakte hain.Wedge design exchanging ke liye istemal hota hai kyun kay ye market patterns ko expect karne mein madadgar hota hai. Dealers is design ko istemal karke passage aur leave focuses tay kar sakte hain. Yahan kuch zaroori focuses hain  Wedge design, ek tarah ka diagram design hota hai jo exchanging graphs standard paya jata hai. Ye design market mein cost ke developments ko address karta hai. Wedge design do tarah ke hote hain: rising wedge aur plummeting wedge. design market mein cost ke up pattern ko darust karta hai. Ismein cost better upsides aur more promising low points banata hai. Iska matlab hota hai kay market mein bullish opinion hai, lekin ye design ek point standard aik triangle shape banata hai.pattern market mein cost ke descending pattern ko darust karta hai. Ismein cost worse high points aur worse low points banata hai. Iska matlab hota hai kay market mein negative feeling hai, lekin ye design bhi aik triangle shape banata hai.attern exchanging, yaani kay "wedge design tijarat," forex aur tail market mein aik aham specialized examination apparatus hai jo merchants aur financial backers ke liye market ke future patterns ko samajhnay mein madadgar hota hai. Ye design market mein cost ke changing patterns ko distinguish karne mein madadgar hota hai Wedge Chart Pattern Types: Design ko distinguish karne ke liye, aapko outline mein cost ke upper or lower pattern ko notice karna hoga. Agar cost step by step thin ho raha hai to ye wedge design ke sign hai. Aapko bhi is design ko recognize karne ke liye aapke paas specialized examination instruments hona chahiye.Wedge design ko exchanging system ke peak standard use karne ke liye, aapko breakout ke stand by karna hoga. Agar cost wedge design ke andar hai to aapko stand by karna hoga punch tak cost design ke bahar nikal na jaye. Breakout ke baad, aapko apne exchange ke liye stop misfortune aur take benefit level set karna hoga. design upper pattern mein hota hai or cost progressively restricted hota hai. Is design ko negative inversion ke sign ke peak standard dekha jata hai.pattern lower pattern mein hota hai or cost continuously limited hota hai. Is design ko bullish inversion ke sign ke pinnacle standard dekha jata hai.

Wedge design, ek tarah ka diagram design hota hai jo exchanging graphs standard paya jata hai. Ye design market mein cost ke developments ko address karta hai. Wedge design do tarah ke hote hain: rising wedge aur plummeting wedge. design market mein cost ke up pattern ko darust karta hai. Ismein cost better upsides aur more promising low points banata hai. Iska matlab hota hai kay market mein bullish opinion hai, lekin ye design ek point standard aik triangle shape banata hai.pattern market mein cost ke descending pattern ko darust karta hai. Ismein cost worse high points aur worse low points banata hai. Iska matlab hota hai kay market mein negative feeling hai, lekin ye design bhi aik triangle shape banata hai.attern exchanging, yaani kay "wedge design tijarat," forex aur tail market mein aik aham specialized examination apparatus hai jo merchants aur financial backers ke liye market ke future patterns ko samajhnay mein madadgar hota hai. Ye design market mein cost ke changing patterns ko distinguish karne mein madadgar hota hai Wedge Chart Pattern Types: Design ko distinguish karne ke liye, aapko outline mein cost ke upper or lower pattern ko notice karna hoga. Agar cost step by step thin ho raha hai to ye wedge design ke sign hai. Aapko bhi is design ko recognize karne ke liye aapke paas specialized examination instruments hona chahiye.Wedge design ko exchanging system ke peak standard use karne ke liye, aapko breakout ke stand by karna hoga. Agar cost wedge design ke andar hai to aapko stand by karna hoga punch tak cost design ke bahar nikal na jaye. Breakout ke baad, aapko apne exchange ke liye stop misfortune aur take benefit level set karna hoga. design upper pattern mein hota hai or cost progressively restricted hota hai. Is design ko negative inversion ke sign ke peak standard dekha jata hai.pattern lower pattern mein hota hai or cost continuously limited hota hai. Is design ko bullish inversion ke sign ke pinnacle standard dekha jata hai.  Wedge Example ek aesa design hai jahan cost apas mein high aur low ke beech mein combine hota hai. Yeh design aksar pattern inversion ko darust karti hai, lekin dealers ko isko sahi samajhna zaroori hai. Wedge Example mein cost better upsides aur more promising low points banata hai. Ye design commonly negative pattern ke doran aata hai aur cost ka girawat darust kar sakta hai.Descending Wedge Example mein cost worse high points aur worse low points banata hai. Ye design bullish pattern ke doran aksar paya jata hai aur cost ka barhna darust kar sakta hai.Traders in wedge designs ka istemal pattern ki samajhne aur section/leave focuses tay karne ke liye karte hain. Even wedge design mein breakout ka stand by kiya jata hai, jabke rising wedge design mein short positions li jati hain Wedge Chart pattern Trading: Exchanging mein aik ahem specialized apparatus hain jo market patterns aur cost developments ko samajhne mein madadgar hotay hain. Ye designs do qisam ke hotay hain: Rising Wedge (Uper Uthti Wedge) aur Falling Wedge (Neechay Girnay Wali Wedge).Yeh design market mein negative pattern ki shuruaat ko ishara karta hai aur dealers ko sell karne ki salahiyat deta hai.Wedge ek negative inversion design hota hai. Is mein costs aik up pattern mein hoti hain, lekin phir continuously kam hokar aik triangle-like shape banti hai. Yeh design market mein negative pattern ki shuruaat ko ishara karta hai aur brokers ko sell karne ki salahiyat deta hai Wedge ek bullish inversion design hota hai. Is mein costs aik descending pattern mein hoti hain, lekin phir bit by bit kam hokar aik triangle-like shape banti hai. Yeh design market mein bullish pattern ki shuruaat ko ishara karta hai aur brokers ko purchase karne ki salahiyat deta hai.

Wedge Example ek aesa design hai jahan cost apas mein high aur low ke beech mein combine hota hai. Yeh design aksar pattern inversion ko darust karti hai, lekin dealers ko isko sahi samajhna zaroori hai. Wedge Example mein cost better upsides aur more promising low points banata hai. Ye design commonly negative pattern ke doran aata hai aur cost ka girawat darust kar sakta hai.Descending Wedge Example mein cost worse high points aur worse low points banata hai. Ye design bullish pattern ke doran aksar paya jata hai aur cost ka barhna darust kar sakta hai.Traders in wedge designs ka istemal pattern ki samajhne aur section/leave focuses tay karne ke liye karte hain. Even wedge design mein breakout ka stand by kiya jata hai, jabke rising wedge design mein short positions li jati hain Wedge Chart pattern Trading: Exchanging mein aik ahem specialized apparatus hain jo market patterns aur cost developments ko samajhne mein madadgar hotay hain. Ye designs do qisam ke hotay hain: Rising Wedge (Uper Uthti Wedge) aur Falling Wedge (Neechay Girnay Wali Wedge).Yeh design market mein negative pattern ki shuruaat ko ishara karta hai aur dealers ko sell karne ki salahiyat deta hai.Wedge ek negative inversion design hota hai. Is mein costs aik up pattern mein hoti hain, lekin phir continuously kam hokar aik triangle-like shape banti hai. Yeh design market mein negative pattern ki shuruaat ko ishara karta hai aur brokers ko sell karne ki salahiyat deta hai Wedge ek bullish inversion design hota hai. Is mein costs aik descending pattern mein hoti hain, lekin phir bit by bit kam hokar aik triangle-like shape banti hai. Yeh design market mein bullish pattern ki shuruaat ko ishara karta hai aur brokers ko purchase karne ki salahiyat deta hai.  Exchanging mein wellbeing ke liye stop misfortune orders aur benefit booking ke liye take benefit orders istemal kiye jate hain. Ye orders merchants ko nuksan se bachate hain.Wedge designs ko samajhna aur sahi tijarat karne ke liye practice aur learning ahem hai. Demo accounts istemal karke aur instruction assets parh kar brokers apni abilities ko behtar banate hain.ye tha Wedge Examples ke hawale se aik mukhtasar tafseel. Forex exchanging mein designs ko samajhna aur istemal karna mahir dealers ke liye ahem hai.Wedge design ek aisa diagram design hai jismein cost pattern upper or lower bearing mein slowly slender hota hai. Is design ko 2 sorts mein partition kiya ja sakta hai design upper pattern mein hota hai or cost steadily thin hota hai. Is design ko negative inversion ke sign ke peak standard dekha jata hai.pattern lower pattern mein hota hai or cost continuously limited hota hai. Is design ko bullish inversion ke sign ke pinnacle standard dekha jata hai.

Exchanging mein wellbeing ke liye stop misfortune orders aur benefit booking ke liye take benefit orders istemal kiye jate hain. Ye orders merchants ko nuksan se bachate hain.Wedge designs ko samajhna aur sahi tijarat karne ke liye practice aur learning ahem hai. Demo accounts istemal karke aur instruction assets parh kar brokers apni abilities ko behtar banate hain.ye tha Wedge Examples ke hawale se aik mukhtasar tafseel. Forex exchanging mein designs ko samajhna aur istemal karna mahir dealers ke liye ahem hai.Wedge design ek aisa diagram design hai jismein cost pattern upper or lower bearing mein slowly slender hota hai. Is design ko 2 sorts mein partition kiya ja sakta hai design upper pattern mein hota hai or cost steadily thin hota hai. Is design ko negative inversion ke sign ke peak standard dekha jata hai.pattern lower pattern mein hota hai or cost continuously limited hota hai. Is design ko bullish inversion ke sign ke pinnacle standard dekha jata hai.

-

#9 Collapse

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Wedge Pattern Aik Tarah Ka Grafai Tasveerat Wedge pattern ek grafai tasveerat (chart pattern) hai jo stock market aur forex trading mein istemal hota hai. Ye pattern market analysis mein aik ahem tool hai jo traders aur investors ke liye kisi security ya currency pair ke future movements ka andaza lagane mein madadgar hota hai. Wedge pattern ek prakar ki price consolidation pattern hoti hai jismein security ya currency pair ki trading range gradual taur par kam hoti hai aur ye usually trend reversal ya breakout ko indicate karti hai. Wedge pattern ko samjhne ke liye, nichay diye gaye key points par gaur kiya ja sakta hai Types of Wedge Patterns (Wedge Pattern Ke Qisim) Rising Wedge (Bharti Hui Wedge) Is pattern mein security ya currency pair ki price range ek line ke neechay se ooper ki taraf mazeed choti hoti hai. Ye usually bearish trend ke bad breakout hone par paya jata hai, aur future mein price ka girawat hone ki sambhavna hoti hai. Falling Wedge (Girte Hui Wedge) Is pattern mein security ya currency pair ki price range ek line ke ooper se neechay ki taraf mazeed choti hoti hai. Ye generally bullish trend ke bad breakout hone par hota hai, aur future mein price mein izafa hone ki sambhavna hoti hai. Kaise Kaam Karta Hai? Wedge pattern trading range mein hota hai, jahan par security ya currency pair ke buyers aur sellers ek dusre ke saath takkar kar rahe hote hain. Jab price range kam hoti hai aur wedge pattern banta hai, to yeh indicate karta hai ke market mein uncertainty badh rahi hai aur price mein breakout hone ke chances hain. Traders is pattern ko dekhte hue decision lete hain ke kis disha mein price breakout hone ki sambhavna zyada hai, upar ya neechay. Breakout ke baad, traders apne trades ko enter karte hain aur price ke movement ke hisab se buy ya sell karte hain. Wedge Pattern Ki Ahmiyat (Importance of Wedge Pattern) Wedge pattern market mein hone wale trend reversal ya trend continuation ke early indications provide karta hai. Traders is pattern ko apni trading strategy mein istemal karke risk management aur entry/exit points ko behtar taur par samajh sakte hain. Is pattern ki madad se traders apne trades ko stop loss aur take profit levels ke liye plan kar sakte hain. Zaroori Points Wedge pattern sirf ek indicator hai aur isko dusre technical analysis tools ke saath istemal karna behtar hota hai. Is pattern ko samajhna aur istemal karna practice aur experience ki zaroorat hai. Market volatility aur economic events ka bhi impact wedge pattern par hota hai, is liye market ki mukhtalif factors ko bhi madde nazar rakhte hue trading decisions leni chahiye. Wedge pattern ek powerful tool ho sakta hai agar ise sahi tarike se samjha jaye aur trading strategy mein shaamil kiya jaye. Lekin, market mein risk hamesha hota hai, isliye har trader ko apne trades ko samajhne aur manage karne ke liye cautious rehna chahiye. -

#10 Collapse

Wedge Pattern Wedge pattern, forex trading main aik chart pattern hai jo price action analysis main istemal hota hai. Is pattern ki shape triangle ki tarah hoti hai jis main price chart main bearish aur bullish trend lines hoti hain. Types of Wedge Pattern Wedge pattern do types main hota hai: 1. Rising Wedge Pattern: Yeh pattern bearish reversal trend ko indicate karta hai jis main price chart main high peaks aur low peaks hotay hain. 2. Falling Wedge Pattern: Yeh pattern bullish reversal trend ko indicate karta hai jis main price chart main low peaks aur high peaks hotay hain. How to Identify Wedge Pattern? Wedge pattern ko identify karnay ke liye traders ko price chart ke trend lines ko draw karna hota hai. Rising wedge pattern main bearish trend line ko draw kiya jata hai jis ki slope up hoti hai aur bullish trend line ko draw kiya jata hai jis ki slope down hoti hai. Falling wedge pattern main bullish trend line ko draw kiya jata hai jis ki slope up hoti hai aur bearish trend line ko draw kiya jata hai jis ki slope down hoti hai. Trading Strategy Wedge pattern ko use kar ke traders ko trading strategy develop karni hoti hai. Agar price chart main rising wedge pattern hai to traders sell positions enter karnay ki strategy develop karte hain aur agar price chart main falling wedge pattern hai to traders buy positions enter karnay ki strategy develop karte hain. Stop Loss Aur Take Profit: Trading karne ke waqt stop loss aur take profit levels ko tay karna zaroori hai taki aap apni investment ko protect kar saken. Ye levels aapko wedge pattern ke analysis ke hisab se tay karne chahiye. Conclusion Wedge pattern forex trading main aik important chart pattern hai jis ko identify kar ke traders trading strategy develop karte hain. Rising wedge pattern bearish reversal trend ko indicate karta hai jab ke falling wedge pattern bullish reversal trend ko indicate karta hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Rules About Wedge Example: Assalam o Alicom! Dear Siblings Wedge Examples bhi market mein by and large usi market pattern mei banty hain jin mein woh pattern ki continuation ke signals dety hain. In me Wedges ki development hoti hai jo ke climbing ya plunging ho sakti hai aur wedges ke doran ap little exchanges laga sakty hain. Isi tarha significant pattern ko bhi follow kar sakty hain. Isi tarha is pattern ki continuation ke badh ap market mein same pattern ko follow karty huy exchanges kar sakty hain aur benefits gain kar sakty hain. Is ke liye apko affirm signals ka stand by karna parta hai.Methodology Of Wedge Example: Dear Forex Individuals Wedge Example mama waves ki methodology ko use kiya jata hai. Es mama least 8 waves hoti hy. Jin mama se 5 waves dominat hoti hai or 3 waves amendment wave hoti hai. Es tarha wave ki madad se market ko judge kiya jata hai or es base standard apny request ko change kiya jata hai. Jo merchant stop misfortune or take benefit ke liye waves ko use kary usko be kafi advantage hoti hai. Jo broker forex mama sirf design ki he help lety hain or kisi information or experience ko exchange mama use ni karty wo hamesha nakam hoty hain. Data About Wedge Example: Dear Companions and Colleagues Dear hit ap forex exchanging mein Wedge Example ko study karte hain to ismein apko falling wedge design aur rising wedge design se related kuch data mil rahi hoti hai jismein market ki different development is ki shape ko talk about karti hai aur ap market mein different significant examples ko various parts might partition kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:57 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим