Coppock curve indicator in forex trading

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Coppock curve indicator in forex trading -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Coppock Curve ek technical analysis indicator hai jo forex trading aur doosre maali market mein potential khareedari aur farokht ke mauqay pehchanne ke liye istemal hota hai. Edwin S. Coppock ne isay 1962 mein tayar kiya tha aur iska maqsad tijarat karne walay aur investors ko market mein lambi muddat ke trends pehchanne mein madadgar hona hai, khaas tor par woh situations mein jab choti muddat ke indicators kam aitmad karne wale ho sakte hain. Calculation of the Coppock Curve Coppock Curve primarily lambi muddat ke bullish ya bearish trends ko pehchanna ke liye istemal hota hai, is liye traders aur investors ke liye khaas ahmiyat rakhta hai jo market mein ziada muddat ke liye kaam karte hain. Coppock Curve ko hisaab lagane ke liye aapko do asooli data ki zaroorat hoti hai: short-term rate of change (ROC) aur long-term ROC. Step 1: Calculate Short-Term ROC Short-term ROC aam taur par aik 14 maheenay ke doraan calculate kiya jata hai. Aapko is calculation ke liye ye data points chahiye honge:

Step 1: Calculate Short-Term ROC Short-term ROC aam taur par aik 14 maheenay ke doraan calculate kiya jata hai. Aapko is calculation ke liye ye data points chahiye honge:- Asset ke current time par band hone wala price.

- Asset ke 14 maheenay pehle band hone wala price.

- 11-Month ROC = (Current Price - Price 11 Months Ago) / Price 11 Months Ago * 100

- 10-Month ROC = (Current Price - Price 10 Months Ago) / Price 10 Months Ago * 100

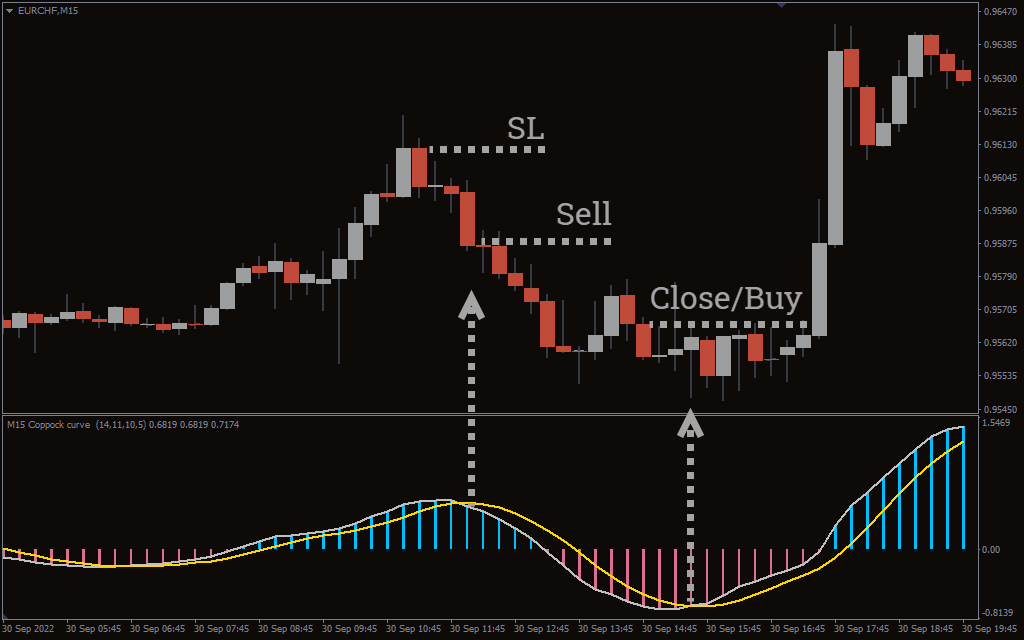

Interpreting the Coppock Curve Coppock Curve primarily buying aur selling signals pehchanne ke liye istemal hoti hai jisay is ke movement aur crossovers ke zariye tabeer kia jata hai. Isay is tarah se tabeer kia jata hai. 1. Buy Signal

Interpreting the Coppock Curve Coppock Curve primarily buying aur selling signals pehchanne ke liye istemal hoti hai jisay is ke movement aur crossovers ke zariye tabeer kia jata hai. Isay is tarah se tabeer kia jata hai. 1. Buy Signal- Jab Coppock Curve zero line se neeche se oopar chala jata hai, to ye aik khareedari signal generate karta hai.

- Ye crossover yeh ishara deta hai ke short-term momentum positive ho raha hai, aur asset aik uptrend mein aa sakta hai.

- Jab Coppock Curve zero line se oopar se neeche chala jata hai, to ye aik farokht signal generate karta hai.

- Ye crossover yeh ishara deta hai ke short-term momentum negative ho raha hai, aur asset aik downtrend mein aa sakta hai.

- Kuch traders, khareedari ya farokht signals ko tasdeeq karne ke liye Coppock Curve ko apne khud ke moving average (aam taur par 10 maheenay ka moving average) ke saath cross hone ka intezar karte hain.

- Aik khareedari signal ko ziada powerful samjha jata hai agar ye tab ho jab Coppock Curve apne moving average ke oopar hai, aur aik farokht signal ko ziada powerful samjha jata hai jab ye moving average ke neeche hota hai.

- Traders Coppock Curve aur asset ke price ke darmiyan divergences par bhi tawajjo dete hain. Aik bullish divergence tab hoti hai jab price lower low banata hai jab ke Coppock Curve higher low banata hai, is se upward momentum ke izharat hosakti hai.

- Ek bearish divergence tab hoti hai jab price higher high banata hai jab ke Coppock Curve lower high banata hai, is se downward momentum ke izharat hosakti hai.

Using the Coppock Curve in Forex Trading 1. Identifying Long-Term Trends Coppock Curve ka primary maqsad lambi muddat ke trends pehchanna hai. Traders ise istemal karke yeh tay karsakte hain ke currency pair ki overall trend bullish ya bearish hai. Ye swing traders aur lambi muddat ke investors ke liye khaas tor par useful ho sakta hai. 2. Filter for Entry and Exit Signals Traders Coppock Curve ko entry aur exit signals ko tasdeeq karne ke liye ek filter ke tor par istemal kar sakte hain jo doosre indicators ya trading strategies ke generate kiye gaye hain. Misal ke tor par, agar moving average crossover aik khareedari signal generate karta hai, to trader Coppock Curve ka intezar kar sakta hai ke woh trade mein shamil hone se pehle tasdeeq kar le. 3. Divergence Analysis Coppock Curve aur currency pair ke price ke darmiyan ki divergence aik powerful signal ho sakta hai. Traders potential reversals ya trend changes ke liye divergences ko pehchane ke liye dekhsakte hain, lekin isay tasdeeq karne ke liye doosre indicators aur analysis tools ka bhi istemal zaroori hai. 4. Long-Term Investment Decisions Forex market mein lambi muddat ke investors ke liye, Coppock Curve aik aham tool ho sakta hai jo unhain positions mein shamil hone ya farigh hone ke liye informaed faislon mein madadgar hota hai. Ye market ke lambi muddat ki raah dekhne mein madadgar hota hai, jisse investors choti muddat ke fluctuations mein phansne se bach sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Using the Coppock Curve in Forex Trading 1. Identifying Long-Term Trends Coppock Curve ka primary maqsad lambi muddat ke trends pehchanna hai. Traders ise istemal karke yeh tay karsakte hain ke currency pair ki overall trend bullish ya bearish hai. Ye swing traders aur lambi muddat ke investors ke liye khaas tor par useful ho sakta hai. 2. Filter for Entry and Exit Signals Traders Coppock Curve ko entry aur exit signals ko tasdeeq karne ke liye ek filter ke tor par istemal kar sakte hain jo doosre indicators ya trading strategies ke generate kiye gaye hain. Misal ke tor par, agar moving average crossover aik khareedari signal generate karta hai, to trader Coppock Curve ka intezar kar sakta hai ke woh trade mein shamil hone se pehle tasdeeq kar le. 3. Divergence Analysis Coppock Curve aur currency pair ke price ke darmiyan ki divergence aik powerful signal ho sakta hai. Traders potential reversals ya trend changes ke liye divergences ko pehchane ke liye dekhsakte hain, lekin isay tasdeeq karne ke liye doosre indicators aur analysis tools ka bhi istemal zaroori hai. 4. Long-Term Investment Decisions Forex market mein lambi muddat ke investors ke liye, Coppock Curve aik aham tool ho sakta hai jo unhain positions mein shamil hone ya farigh hone ke liye informaed faislon mein madadgar hota hai. Ye market ke lambi muddat ki raah dekhne mein madadgar hota hai, jisse investors choti muddat ke fluctuations mein phansne se bach sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

COPPOCK CURVE INDICATOR IN FOREX MARKET INTRODUCTION Coppock Curve Indicator ek ahem technical indicator hai jo forex trading mein price trends aur market momentum ko analyze karne ke liye istemal hota hai. Ye indicator aksar long-term trends ko samajhne mein madadgar hota hai. Coppock Curve Indicator, market ke long-term momentum ko measure karta hai. Iska maqsad traders ko trend changes ke asar ko pehchanna aur trading decisions lene mein madad karna hota hai. Ye indicator typically monthly aur weekly price data par based hota hai. INDICATOR CALCULATION Coppock Curve Indicator ka calculation do moving averages (moving averages) se hota hai. Yeh averages typically 11-month aur 14-month ka hota hai. Phir in dono averages ka weighted sum calculate kiya jata hai. Iska formula yun hota hai: Coppock Curve = WMA(14) + WMA(11) SIGNAL AND INTERPRETATION Coppock Curve Indicator ke signals long-term trend changes ko darust karne mein madadgar hote hain. Agar Coppock Curve positive se negative mein badal jata hai, to ye bearish signal hota hai aur traders ko selling positions par ghor karna chahiye. Jab Coppock Curve negative se positive mein badalta hai, to ye bullish signal hota hai aur traders ko buying positions par ghor karna chahiye. ANALYSIS AND PRACTICE OF COPPOCK CURVE INDICATOR Coppock Curve Indicator ko primarily long-term investors aur swing traders istemal karte hain. Ye unko help karta hai long-term trends ko capture karne mein. Short-term traders isay kam istemal karte hain kyun ke iska main maqsad long-term trends ka analysis hai. Coppock Curve Indicator ko samajhna aur istemal karne ke liye traders ko isay apni trading strategy mein shamil karne se pehle acchi tarah se samajhna chahiye. Isay apni practice trading accounts par istemal karke experience hasil kar sakte hain.Yeh tha Coppock Curve Indicator ke hawale se aik mukhtasar tafseel. Is indicator ka sahi tarike se istemal karne ke liye, traders ko market ki behavior ko samajhna aur risk management par bhi ghor karna hoga. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Introduction: Coppock Curve Indicator Forex trading mein aik technical indicator hai jo market ke trends aur reversals ko samajhne mein madadgar hota hai. Components Coppock curve indicator do main components par mushtamil hota hai: Weighted Moving Average Coppock curve WMA ka aik combination hota hai jo aik specific time period ke closing prices par mabni hota hai. Rate of Change : ROC indicator, prices ki tabdeeli ko measure karta hai aur ta'atil ki madad se un changes ko smooth banata hai. Coppock Curve Calculation Coppock curve calculate karne ke liye, WMA ke do alag alag time periods ka istemal hota hai. Commonly, short-term WMA aur long-term WMA ka combination liya jata hai. Phir isme ROC indicator ka istemal hota hai. Coppock Curve Interpretation Jab Coppock curve indicator upar se neeche jaata hai aur phir se upar badh jata hai, to ye aik bullish signal deta hai, aur traders long positions consider kar sakte hain. Agar Coppock curve indicator neeche se upar jata hai aur phir se neeche jaata hai, to ye bearish signal hai, aur traders short positions consider kar sakte hain. Coppock Curve Indicator Formula: Coppock Curve Indicator ka formula market ki price action ki base par calculate kiya jata hai. Is indicator ke calculation mein market ki price action ki base par 10 months ka simple moving average aur 14 months ka weighted moving average use hota hai. Formula is tarah hai: Coppock Curve = 10-period Simple Moving Average (SMMA) of (14-period Weighted Moving Average (WMA) of (ROC)) ROC = Rate of Change Trading Strategy Coppock curve indicator ko samajhne ke baad, traders iske signals par amal kar sakte hain. Long aur short positions lena consider kiya ja sakta hai, lekin risk management ko hamesha yaad rakha jana chahiye. Advantages : Coppock Curve Indicator ke kuch advantages hai, jo isko popular banate hai: 1. Long term trends ko identify karne mein madad karta hai. 2. Market ki trend ki analysis karne mein madad karta hai. 3. Volatility ke sath sath trend ki analysis karne mein madad karta hai. Disadvantages: Coppock Curve Indicator ke kuch disadvantages hai, jo isko use karne se pahle dhyan mein rakhna chahiye: 1. Short term trends ke liye yeh indicator effective nahi hai. 2. Is indicator ke calculation ke liye long term data ki requirement hoti hai. 3. Yeh indicator market ki trend ko identify karne ke liye effective hai, lekin market ki price levels ki prediction ke liye effective nahi hai. Conclusion: Coppock curve indicator Forex traders ke liye aik ahem tool hai jo market trends aur reversals ko pehchanne mein madadgar hota hai. Is indicator ko istemal kar ke traders apni trading strategies ko behtar bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:07 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим