Relative strength index:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

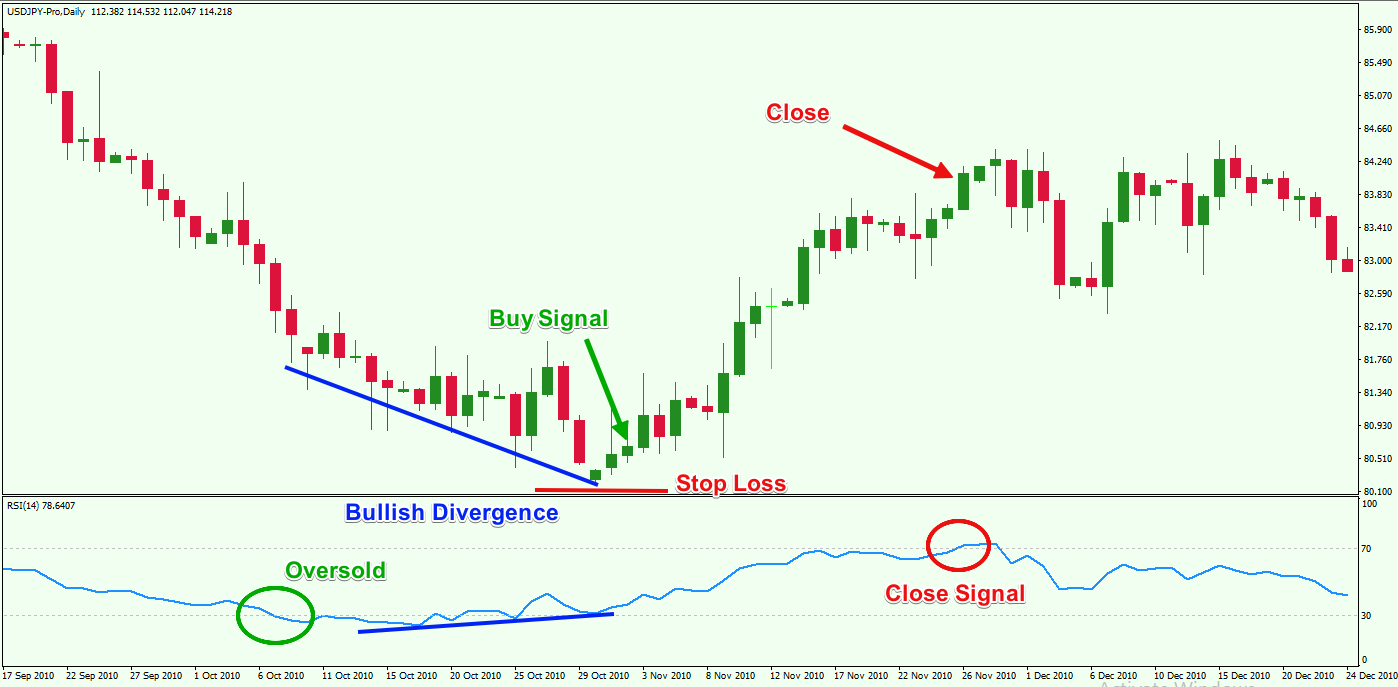

Assalam alaikum dear forum members! subha bakhair! Umeed karta hun aap sb khair khairiat se hn gy or apka trading week bahut acha jaa raha ho ga. dear members trading karty hovy aksr hum indicators use karty hain jo k trading main helpful hoty hain or in main se aik relative strength index ha jsko aj hum tafseel se study karen gy. What is relative strength index? Dear members relative strength index aik momentum indicator ha jo k hamen market k trend or eski strength k bary main btata ha. esko shortly RSI kaha jata ha. Or es main 3 levels hoty hain jo k market main trend ki strength ko indicate karty hain. Aik level 80-100 ka hota ha jo k bullish trend ki peak hota ha. Dosra level 0-20 ka hota ha jo k bearish trend ki peak hota ha. or in dono k darmyan 50 ka level hota ha jo k neutral level smjha jata ha. Jb market buy trend main ho or RSI 50 se opr ho to ye strong bullish trend ki nishani hota ha. or jb market downtrend main ho or RSI 50 se nechy ho to ye strong bearish trend ki nishani hota ha. es k ilawa RSI hamen sell or buy k signals bhi deta ha. Overbought RSI: Dear members jb market uptrend main kafi opr ja chUki ho Or RSI 80 ya es se opr ki values show kar raha ho to esko overbought kaha jata ha or es k bad market main reversal expect kia jata ha k buyers ab market se exit hn gy or sellers in hn gy. es wqt hm market main price action se confirmation k bad sell ki trade le skty hain. Oversold RSI: Dear members jb market downtrend main kafi nechy ja chuki ho or RSI 20 ya es se km values show kar raha ho to esko oversold RSI kaha jata ha or es k bad market main trend reversal expect kia hata ha or sellers ki strength km hoti ha markey main buyers in hoty hain. es time py hum price action se confirmation k bad buy ki trade le skty hain. RSI divergence: Dear members divergence us situation ko khty hain jb price action or RSI ki direction different ho jy. for example RSI higher lows or higher highs bnay jb k market lower lows or lower highs bnay esko divergence kaha jata ha or ye bhi market main trend reversel ki bishani hoti ha. Eski 2 types hoti hain. Bullish Divergence Bearish Divergence Bullish divergence k bad market buy main jati ha. jb k bearish divergence k bad market sell main jati ha. -

#3 Collapse

Assalamu Alaikum Dosto!

RSI Indicator

Relative Strength Index Indicator ya jaise aam alfaz mein RSI indicator bhi kaha jata hai, aik simple, payedar aur sab se ziada istemal hone wala indicator hai, jiss se taqreeban har aik analyst ya trader waqif hai, q k ye indicator na sirf forex trading mein istemal hota hai bulkeh stock exchange market mein bhi bati had tak use hota hai. J. Welles Wilder ka design karda RSI indicator traders ko markaat momentum aur potensial reversals ke signals provide karta hai. Relative Strength Index (RSI) ek technical analysis indicator hai jo market ki trend ki strength aur weakness ko evaluate karne mein madad deta hai. RSI market mein overbought aur oversold conditions ka pata lagane mein istemal hota hai aur traders ko potential reversals ki tafseelat faraham karta hai.

RSI ka asal maqsad market ki momentum ko quantitatively measure karna hai. Ye ek bounded oscillator hai jo typically 0 se 100 ke darmiyan fluctuate karta hai. RSI ka calculation recent price gains aur losses par mabni hota hai. Iski formula se pata chalta hai ke kis had tak price ek muddat ke doran upar ya neeche gayi hai, jo ke price ke tezi aur girenay ki dar ko natawar karne mein madadgar hota hai.

RSI ka ek aham tareeqa yeh hai ke wo ek security ke haliyat ko dekhta hai aur phir uski recent performance ko analyze karta hai. Agar RSI 70 ke upar hota hai, toh yeh indicate karta hai ke security overbought ho chuki hai aur prices ka jald se jald neeche aana mumkin hai. Isi tarah, agar RSI 30 ke neeche hai, toh yeh indicate karta hai ke security oversold hai aur prices ka uthna mumkin hai.

RSI ka istemal karte waqt, traders typically overbought aur oversold levels ko dekhte hain, jo ke 70 aur 30 hote hain, mukhtalif securities ke liye mukhtalif ho sakte hain. Jab RSI ek muddat ke doran ek extreme level tak pahunchta hai, jaise ke 70 ya 30, toh yeh ek potential reversal ka signal ho sakta hai. Agar RSI 70 se upar jaata hai aur phir neeche aata hai, toh yeh ek sell signal ho sakta hai, jabke agar RSI 30 se neeche jaata hai aur phir upar aata hai, toh yeh ek buy signal ho sakta hai.

Ek aur tareeqa jis se traders RSI ka istemal karte hain woh hai divergence. Divergence ka matlab hota hai ke price aur RSI mein koi farq hai. Agar price higher high banata hai lekin RSI lower high banata hai, ya phir price lower low banata hai lekin RSI higher low banata hai, toh yeh ek reversal signal ho sakta hai.

RSI ek versatile aur widely used indicator hai jo traders ko market ke dynamics ko samajhne mein madad deta hai. Magar, jaise har indicator ki tarah, iska istemal bhi sahi tajwezat aur dosri confirmatory tools ke sath karna zaroori hai. Isi tarah, RSI ko samajhne aur istemal karne ke liye practice aur experience bhi zaroori hai taake traders sahi aur munasib trading decisions le sakein.

RSI Indicator Formula

RSI ya Relative Strength Index ek popular technical indicator hai jo market momentum aur overbought ya oversold conditions ko identify karne mein istemal hota hai. RSI ka calculation formula traders ko market ke strength aur weakness ko samajhne mein madad deta hai. Neeche diye gaye tafseeli tajziye mein RSI ka calculation formula bayan kiya gaya hai:

RSI ka calculation 0 se 100 tak ka range hota hai aur typically 14 periods ke liye calculate kiya jata hai. RSI ki calculation ke liye neeche diye gaye steps follow kiye jate hain:

- Average Gain aur Average Loss Calculation:

- Sab se pehle, har period ke liye price change calculate kiya jata hai. Agar price increase hui hai to wo gain hoti hai, agar decrease hui hai to wo loss hoti hai.

- Average Gain aur Average Loss calculate karne ke liye, pehle 14 periods ke closing prices ke difference ko calculate karte hain.

- Phir, positive price changes ko add karke Average Gain aur negative price changes ko add karke Average Loss calculate kiya jata hai.

- Relative Strength Calculation:

- Relative Strength (RS) ko calculate karne ke liye, Average Gain ko Average Loss se divide kiya jata hai.

- RS = (Average Gain / Average Loss)

- RSI Calculation Formula:

- RSI ka final calculation formula RS ka use karte hue hota hai: RSI = 100 - [100 / (1 + RS)]

- Yahan, 1 add karke RS se divide karte hue 100 se subtract karte hain.

- Interpretation of RSI:

- RSI ka interpretation typically 70 aur 30 levels ke around hota hai. Agar RSI 70 se zyada ho jata hai to market overbought ho sakti hai aur agar 30 se kam ho jata hai to market oversold ho sakti hai.

- Traders RSI ke levels ko dekhte hue potential buy ya sell signals identify karte hain.

RSI indicator traders ko market momentum aur potential reversals ke signals provide karta hai. Iska sahi tareeqa se istemal karke traders apne trading decisions ko improve kar sakte hain aur market movements ko samajh sakte hain.

Explaination

Relative Strength Index ya jiss ko aam tawar par RSI indicator kaha jatta hai, ek mashahoor indicator hai. RSI indicator market ki changing ki assal buy ya sell ka signal detta hai. Stock markets main RSI indicator ka istemal prices k tops aur bottoms levels (ziadda tar ye 30 aur 70) ko maloom karnne k leyye kia jatta hai, jiss ka pemanna 0-100 hai.

RSI indicator up days k closing price k average ba-muqabela down days k closing price k average par mabni hai, jiss main aam tawar par 14-days ka time period ka istemal kia jatta hai. Lekin dosre time period bhi istemal keye ja sakte hen.

Technical analysis k dawraan charts pattern ko analyze karnne k leye, sab se ziadda mashahoor technical indicator RSI oscillator hai, jo k prices k mazboti main tabdeeli battati hai. RSI indicator aik sab se ziada maqbol aur assan tool samjha jatta hai, jiss ko aik basic graph par 0 se 100 tak dekhaya jatta hai. RSI "Stochastics Oscillator" ki tarah market main bohut ziada buy aur sell ki nishan-dahi kartti hai.

RSI indicator main bunyadi tawar par 30 ya us se kam ki reading ko oversold soratehall samjha jatta hai, jis ka matlab hai k market khareedari (buy) k leye tayar hai. Jab us k bar akas reading par 70 ya us se ziadda overbought sorratehal battati hai, jiss se market main ferokht kunendagan (sellers) k leye sell ki opportunity hoti hai.

RSI = 100 – (100 / 1+ U/D)

U = Average of upward price closes (EMA of gains)

D = Average of downward price closes (EMA of losses)

RSI Centre Line Crossover

- Rising centerline crossover: Rising centre crossover uss waqat hota hai, jab RSI indicator ki value 70 ki taraf barhte howe scale parr 50 line se upper chali jati hai. Is se zahir hota hai, k market main bullish trend main chal raha hai aur 70 tak ye trend barqarar rahegga.

- Falling centerline crossover: Falling centerline crossover uss waqat hota hai, jab bhi RSI indicator ki value 30 ki taraf barhte howe 50 k line ko cross karti hai. Is se zahher ho rahha hotta hai, k market ki trend taqqat main kamzor ho rahha hai, aur RSI k 30 k line tak pohuchne main ye bearish trend baqarar rahega.

Aisi movement jis ko aam candlestick ya bar charts par assani se maloom nahi kia ja saktta, wo RSI indicator ki madad se maloom ki ja sakti hai. RSI indicator par support aur resistance levels ziada wazeh dekhaye de saktte hen. RSI indicator par 30 nechay aur 70 se upper ki nakami reversal janne ka ishara detti hai. RSI indicator aur Prices k darmeyan divergence kamyab reversal indicator ho sakte hen.

Other Indicators se Differences

Relative Strength Index (RSI) dosray momentum oscillators se kuch khas taur par mukhtalif hai, jaise ke search results mein zahir hai:- Chande Momentum Oscillator (CMO) vs. RSI:

- CMO RSI ki tarah hai lekin iska asal bunyadi taur par closing prices par mabni hai, price movements ki tezi par nahi.

- RSI CMO ke muqable mein zyada purana aur zyada istemal hone wala hai.

- Jabke RSI price movements ki tezi par tawajjo deti hai, CMO closing prices par zyada wazehi deta hai.

- Stochastic Oscillator vs. RSI:

- Stochastic Oscillator aur RSI dono hi momentum oscillators hain lekin frequency aur reliable signals mein farq hota hai.

- Stochastic Oscillator do lines (%K aur %D) se bana hota hai jo 0 se lekar 100 tak fluctuate karte hain, jahan primary levels 20 aur 80 hote hain.

- Calculation Mein Farq:

- RSI momentum ko ek mukhtasir muddat par hali price ke faide aur nuqsanat ke hisab se hisaab karta hai, jo price fluctuations ki tezi aur mikdar ka measurement mein madadgar hota hai.

- Stochastic Oscillator hali closing price ko ek mukhtasir muddat ke doran ek range ke sath mawafiqi se muqabla karta hai taake momentum ka taayun kiya ja sake.

- Usage and Interpretation:

- RSI overbought aur oversold shorat, potential reversals, aur market ke am trends ko pehchane mein madadgar hoti hai.

- Stochastic Oscillator short-term price fluctuations ke liye zyada hassas ho sakta hai, jo ke RSI ke muqable mein short-term trades ke liye zyada munasib hota hai.

Mukhtasir Mein, jab ke mukhtalif momentum oscillators jaise ke Chande Momentum Oscillator aur Stochastic Oscillator RSI ke saath kuch khas taur par milte julte hain, lekin unmein hisaab ka tariqa, tabeer, aur mukhtalif trading strategies ke liye munasibgi mein farq hota hai. Traders apne khaas trading maqasid aur pasandeedgiyon ke mutabiq in indicators mein se kisi ek ko chun sakte hain.

Trading

RSI indicator trading k leye sab se asan tool bhi hai aur dosra ye bohut ziadda reliable bhi hai, jiss ki waja se ziadda tar trader ya analyst analysis main RSI indicator ka istemal zarrori samjhtte hen. RSI indicator k over-bought (70 and above) aur over-sold (30 and bellow) area bohut zarrori hai. Is area main trend k reversal hone k bohut ziada chances hote hen.

RSI indicator ko buy signal k tawar istemal karne se pehle indicator par reading lazmi 50 scale se upper side par honni chaheye, jab k down trend k leye indicator par reading 50 se below honi chaheye, jo k sell signal k leye perfect hongay.

RSI indicator reliable indicator to zaror hai lekin zarori nahi k har daffa indicator lazmi 100% positive signal hi deta rahega. Is waja se RSI indicator ka dosrre indicators k sath ya charts pattern aur price action k sath istemal karte rehna chaheye. Isi tarah se indicator ki accuracy main izafa hoga. - Average Gain aur Average Loss Calculation:

-

#4 Collapse

Relative Strength Index (RSI) aik technical indicator hai jo kisi asset ki price momentum aur overbought (zyada kharidari) ya oversold (zyada farokht) condition ko measure karta hai. Isay J. Welles Wilder ne develop kiya tha aur yeh 0 se 100 ke darmiyan value deta hai.

RS (Relative Strength) = Average Gain / Average Loss

RSI Ki Interpretation

70 se upar: Market overbought hai, yani price zyada barh gayi hai aur correction ya reversal ho sakta hai.

30 se neeche: Market oversold hai, yani price zyada gir chuki hai aur wapas barhne ka imkaan hai.

50 ke qareeb: Market neutral hai, yani na bullish aur na bearish trend clear hai.

RSI Trading Strategies:

Overbought & Oversold Zones: Jab RSI 70 se upar ho, sell ka signal mil sakta hai, aur jab 30 se neeche ho, buy ka signal ho sakta hai.

Divergence Strategy: Agar price aur RSI opposite directions mai ja rahe hain, to reversal ka imkaan barh jata hai.

RSI Trend Confirmation: Agar RSI 50 se upar ho aur upar ja raha ho, to bullish trend confirm hota hai. Agar 50 se neeche ho aur neeche ja raha ho, to bearish trend confirm hota hai.

RSI Ki Limitations:

Yeh false signals bhi de sakta hai, is liye doosray indicators (MACD, Moving Averages) ke sath use karna behtar hota hai.

Strong trends mai RSI bohot der tak overbought ya oversold reh sakta hai.

RSI aik powerful tool hai jo traders ko price trends aur potential reversal points samajhne mai madad deta hai. -

#5 Collapse

Relative Strength Index Indicator

Relative strength index indicator aik momentum indicator hota hey jo keh technical analysis mein he estamal hota hey RSI overbought or oversold level mein security ke price ko he identify kar sakte hey forex market mei security ke recently prices mein wosaat dayte hey market mein raftar or wasat mein tabdylion ko identify kar sakta hey

relative strength index indicator overbought or oversold karnay kay alawah security ke asi price ko bhe nashadahi karta hey jo trend ko tabdele karnay yaa price mein aslahi karnay kay ley paraim bhe ho sakti hey 70 say oper overbought ko identify karta hey or 30 say nechay oversold ko he identify karta hey

Relative Strength Index Indicator

forex market min aik momentum indicator hota hey en days mein security ke price ka mawazna keya jata hey jab prices min nechay janay wallay hote hein jab forex market ke prices mein gap aa jata hey jab forex market mein price action ka mowazana keya jata hey jes ka result trader ka analysis bhe ho sakta hey forex market min security ke tarah karkardge ke jate hey

es hasab mein estamal honay wale average faida ya loss pechay he nazar atta hey formula average loss kay ley positive he nazar atta hey prices mein kame kay period mein 0 kay tor par he shumar kya jata hey

RSI ka hasab laganay kay bad RSI indicator reversal chala jata hey assert ke price chart ka nechay he graph deya ja sakta hey forex market mein days ke tadad or size barah jay ga doun day ke tadad or sis bandhne kay sath yaa gar jaye ga

:max_bytes(150000):strip_icc():format(webp)/PlottingRSI-9a3be866248c44f59fbe05be58eb1706.png)

jisa keh aap oper wallay chart min daikh sakte hein RSI indicator overbought area mein tavel modat tak rah sakta hey jab keh stock market min trend hey indicator oversold area mein zyada modat tak rah sakta hey oper de gai mesal wazah kar de gai hey

bhali kay badlay bhali

bhali kay badlay bhali

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

Relative Strength Index yaani RSI aik bohat popular technical analysis ka tool hai jo traders ko market ka momentum samajhne aur potential reversal points identify karne mein madad deta hai. Ye indicator 1978 mein J. Welles Wilder ne introduce kiya tha aur us waqt se lekar aaj tak stocks, forex, commodities, aur cryptocurrencies jaise various markets mein extensively use hota aa raha hai. RSI aik oscillator hai jo 0 se 100 ke darmiyan values show karta hai, jisse market ki overbought ya oversold conditions ka andaza lagaya jata hai.

RSI Calculation

RSI ko calculate karne ka formula kuch is tarah hai:

RSI = 100 - (100 / (1 + RS))

Yahan RS, yaani Relative Strength, ko calculate karne ke liye humein ek specified period (commonly 14 periods) ke andar average gain aur average loss ka ratio nikalna hota hai. Calculation ka process ye hai:- Sab se pehle, aap price changes ko dekhen aur inhe “gain” aur “loss” mein divide karen.

- Phir aap average gain aur average loss calculate karte hain, jo ke period ke andar hone wale total gains aur losses ka average hota hai.

- RS nikalne ke liye aap average gain ko average loss se divide karte hain.

- Is RS value ko upar diye gaye formula mein rakh kar RSI calculate kiya jata hai.

Understanding the RSI Readings

RSI readings se traders ko bohat saari maloomat mil sakti hai. Aksar log in key points ko samajhne ki koshish karte hain:- Overbought Condition: Jab RSI ki value 70 se upar hoti hai, to is ka matlab hai ke market mein bohat zyada buying pressure ho chuka hai. Ye overbought condition indicate karti hai ke price temporarily overextended ho sakti hai aur reversal ya consolidation ka chance barh sakta hai. Lekin yeh zaroori nahi ke hamesha reversal ho, kyun ke strong trends mein yeh level sustain bhi ho sakta hai.

- Oversold Condition: Agar RSI 30 ke neeche jata hai, to iska matlab hai ke market mein excessive selling hui hai aur prices undervalued ho sakti hain. Is condition ko aksar reversal ke early signal ke tor par dekha jata hai, jahan traders buying opportunity dhoond sakte hain.

- Divergence: Kabhi kabhi price action aur RSI mein divergence nazar aata hai. Agar price higher highs bana raha ho lekin RSI lower highs dikhaye, to yeh ek bearish divergence ka signal hai. Isi tarah, agar price lower lows bana raha ho lekin RSI higher lows form kar raha ho, to yeh bullish divergence indicate karta hai. Divergence signals market ke momentum mein weakness ko highlight karte hain, jisse reversal ke chances barh jate hain.

RSI ka use trading mein bohat tarah se kiya jata hai. Yahan kuch common strategies aur examples diye gaye hain jo traders aksar follow karte hain:- Trend Identification: RSI se aap market ka overall trend determine kar sakte hain. Agar RSI consistently 50 ke upar rehta hai, to yeh indicate karta hai ke market mein upward momentum hai. Agar yeh 50 ke neeche ho, to downward trend ke chances hain.

- Entry and Exit Points: RSI overbought aur oversold levels ki wajah se precise entry aur exit points determine karne mein madad karta hai. For example, agar aap dekhte hain ke RSI oversold condition (30 se neeche) par hai aur phir ek bounce back aata hai, to yeh buying signal ho sakta hai. Usi tarah, agar RSI overbought condition (70 se upar) se niche gir raha hai, to yeh selling signal provide karta hai.

- Divergence Trading: Divergence signals advanced traders ke liye bohat aham hotay hain. Agar price aur RSI ke beech divergence nazar aaye, to yeh market ke momentum mein aane wali changes ka early warning de sakta hai. Lekin is signal ko confirm karne ke liye additional analysis aur indicators ka istemal karna zaroori hai.

- Combining with Other Indicators: RSI ko kabhi bhi akela rely karna thik nahi hota. Isliye, kai traders RSI ko doosray technical indicators jaise ke moving averages, MACD, aur Bollinger Bands ke saath combine karte hain. In combinations se aapko ek zyada comprehensive market view milta hai aur signal ki reliability barh jati hai.

RSI ka concept trading world mein bohat se developments ka hissa raha hai. J. Welles Wilder ne is indicator ko 1978 mein develop kiya tha jab unhone market momentum aur potential reversals ko samajhne ke liye ek tool design karne ka socha. Wilder ke mutabiq, har asset class mein repetitive price patterns hote hain jo traders ko market sentiment samajhne mein madad dete hain. Aaj kal RSI sirf stocks mein hi nahi balkay forex, commodities, aur cryptocurrencies jaise diverse markets mein bhi use hota hai. Iske simplicity aur effectiveness ki wajah se yeh indicator trading community mein ek must-have tool ban chuka hai.

Advantages and Limitations of RSI

Advantages:

RSI ke bohat se faide hain jo isay traders ke liye popular banate hain:- Simplicity: Iska calculation process simple hai, jis se beginners bhi asani se isay samajh aur implement kar sakte hain.

- Clear Signals: Overbought aur oversold conditions ke clear thresholds ki wajah se, RSI aapko timely entry aur exit signals provide karta hai.

- Versatility: Chahe aap short-term day trading kar rahe hon ya long-term investing, RSI ko alag-alag time frames par adjust kiya ja sakta hai.

- Divergence Analysis: RSI ke through divergence signals ko dekh kar aap market ke potential reversals aur trend weaknesses ko pehchan sakte hain.

Har indicator ki tarah RSI ki bhi kuch limitations hain:- False Signals: Kabhi kabhi, khas taur par strong trending markets mein, RSI false signals de sakta hai. Overbought conditions ko sustain karna bhi possible hota hai jab market mein bohat strong upward momentum ho.

- Lagging Indicator: RSI ek lagging indicator hai, kyun ke yeh past price data par base karta hai. Iska matlab yeh hai ke kabhi kabhi current market sentiment ko puri tarah se capture nahi kar pata.

- Period Sensitivity: RSI ke liye jo period select kiya jata hai (default 14) woh har asset aur market condition ke liye perfect nahi hota. Period ko customize karna zaroori hota hai, warna signal ki accuracy affect ho sakti hai.

Example 1: Overbought Condition

Maan lijiye ke aap aik stock chart par nazar daal rahe hain aur aapka RSI indicator 75 se upar chala jata hai. Is situation mein, yeh signal hai ke market overbought condition mein hai. Aksar is stage par traders apne positions ko lock karne, profit book karne, ya short selling ke liye sochte hain. Lekin, aise signals ko confirm karna zaroori hai, jaise ke price action aur volume analysis ke zariye, taake false signals se bachaa ja sake.

Example 2: Oversold Condition

Ek forex pair ka RSI agar 25 ke neeche jata hai to yeh oversold condition ko indicate karta hai. Iska matlab yeh hai ke market mein excessive selling ho chuki hai, aur shayad price undervalued ho sakta hai. Experienced traders is signal ko use karte hue entry points dhoondte hain, jahan unhein lagta hai ke price mein reversal aayega. Lekin, trading mein hamesha market context ko madde nazar rakhna chahiye, kyun ke sometimes oversold conditions mein price further decline bhi de sakta hai.

Example 3: Divergence Scenario

Agar price action higher highs bana raha ho lekin RSI lower highs show kar raha ho, to yeh bearish divergence ka signal hai. Iska matlab market ke momentum mein weakness aa rahi hai, jisse upcoming reversal ke chances barh jate hain. Divergence signals aksar early warning signs provide karte hain, lekin inhe validate karne ke liye additional confirmation tools ka istemal karna chahiye.

Combining RSI with Other Analysis Tools

RSI ko effective trading decision-making ke liye aksar doosray technical indicators ke saath use kiya jata hai. Kuch popular combinations ye hain:- RSI and Moving Averages: Moving averages market ke overall trend ko smooth out kar dete hain. Agar aap dekhte hain ke price moving average ke upar ya neeche consistently trade kar rahi hai aur saath hi RSI se confirmation mil raha ho, to yeh aapko ek strong signal deta hai.

- RSI and MACD: MACD trend direction aur momentum ko highlight karta hai, jabke RSI overbought aur oversold levels ko indicate karta hai. Dono indicators ka combination aapko detailed insight provide karta hai.

- RSI and Bollinger Bands: Bollinger Bands price volatility ko measure karte hain. Agar RSI overbought condition dikha raha ho aur price Bollinger Bands ke upper limit ke paas ho, to yeh reversal signal ho sakta hai. Aise combinations se signal ki reliability aur clarity barh jati hai.

Kisi bhi technical indicator ke sath risk hota hai, aur RSI bhi is se alag nahi hai. False signals aur sudden market reversals aise common challenges hain jinke liye proper risk management zaroori hai. Yahan kuch mitigation strategies di gayi hain:- Stop Loss Orders: Hamesha apni trade positions ke sath stop loss orders set karen. Is se agar market unexpected direction mein move kare to aapka loss limited rahega.

- Position Sizing: Apni portfolio ka ek chota hissa hi trade mein lagayen. Is se agar trade galat bhi jaye to aapka overall risk controlled rahega.

- Multiple Confirmations: RSI ke signals ko hamesha doosray indicators ya market analysis ke sath confirm karen. Agar multiple tools ek hi direction indicate kar rahe hon, to aapka decision zyada confident hoga.

- Regular Market Review: Market conditions continuously change hoti rehti hain, is liye regular review aur apne strategy ko adjust karna bohat zaroori hai.

Trading sirf technical analysis tak mehdood nahi hoti; is mein psychological factors ka bhi bohat aham kirdar hota hai. RSI ko use karte waqt, traders ko apne emotions ko control mein rakhna chahiye. Kabhi kabhi, jab RSI extreme levels dikhata hai, to traders impulsive decisions le lete hain. Discipline, patience, aur consistency se hi aap market ke signals ko effectively interpret kar sakte hain. Trading mein emotional control aapko impulsive losses se bachata hai aur long-term success ke liye critical hai.

Monitoring and Adjusting RSI Settings

RSI ka default period 14 hota hai, lekin har market aur asset class ke liye isay customize kiya ja sakta hai. Short-term trading ke liye kuch traders period ko chota (jaise 7 ya 9) rakhte hain, taake zyada responsive signals mil saken, jabke long-term traders ke liye lamba period (jaise 21 ya 30) zyada suitable hota hai. Aapko apne historical data ko dekh kar ye samajhna hoga ke konsa period aapke trading style aur asset ke liye best fit hai. Is process mein backtesting bohat madadgar sabit hoti hai.

Advanced Concepts: RSI Divergence and Failure Swings

RSI divergence ek advanced concept hai jo price movement aur indicator ke beech ke disconnect ko highlight karta hai. Agar price higher highs bana raha ho lekin RSI lower highs show kar raha ho, to yeh bearish divergence hai jo potential reversal ki taraf ishara karta hai. Iske ilawa, failure swings aik aur advanced concept hai jahan RSI extreme levels se phir se reverse hota hai bina price ke corresponding extreme movement ke. Yeh signals traders ko batate hain ke market mein momentum shift ho raha hai aur reversal ka waqt aa sakta hai. In advanced concepts ko effectively use karne ke liye extensive practice, continuous learning, aur historical market testing zaroori hai.

Future Trends and RSI

Aaj kal ki rapidly changing markets mein, technical indicators evolve ho rahe hain. RSI ne apni simplicity aur effectiveness ki wajah se apna maqam bana liya hai, lekin modern traders algorithmic trading aur high-frequency data ke zariye additional tools ka bhi istemal kar rahe hain. Aane wale waqt mein, RSI ko artificial intelligence aur machine learning models ke sath integrate karne ke chances hain jisse iska predictive power aur accuracy barh sake. Yeh integration traders ko zyada sophisticated aur adaptive trading strategies develop karne mein madad dega.Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:25 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим