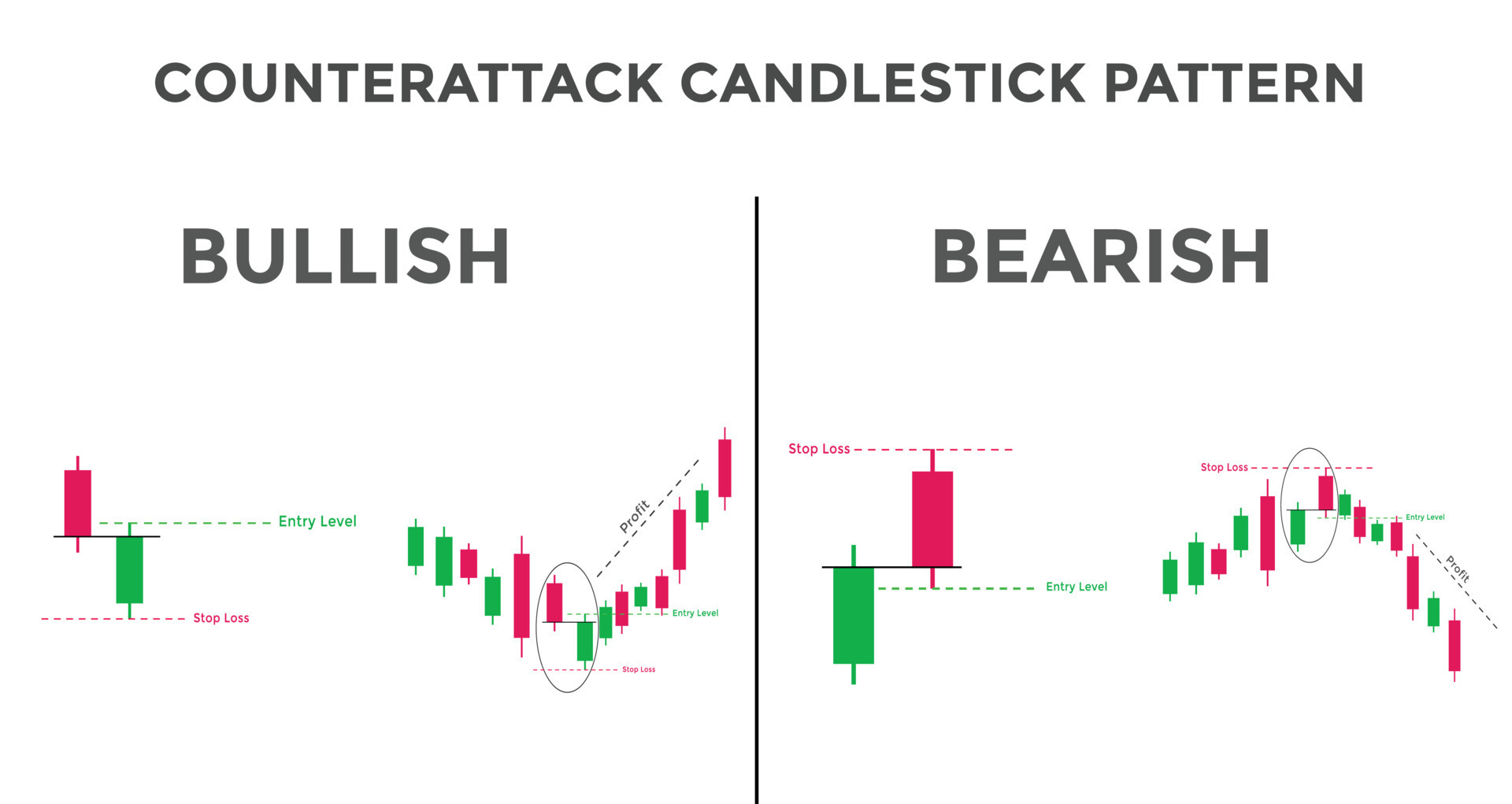

Counterattack Line chart pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Counterattack line pattern frex market aik kesam ka maqbol chart pattern hota hey yeh 2 candlestick ka reversal chart pattern hota hey jo forex market ke candlestick chart par zahair hota hey yeh market mein u trend ya down trend kay doran ban sakta hey yeh forex market kay bullsh kay trend reversal janay ke allamat kay tr par zahair hota hey es pattern mein forex market mein black candlestick bhe shamel ho sakte hey dosree candlestick nechay ke taraf chale jate hey forex market mein pehle candlestick kay qareeb qareeb yeh zahair karte hey keh forex market mein seller control mein thay or e bat ko zahair kartay hein laken yeh bhe ho sakta hey keh wh es control ko kho rahay hon kunkeh frex market kay buyer es gap ko kam karnay mein kamyaab ho gay hein forex market mein bearish counterattack oper wallay trend mein bante hey pehle candlestick aik long white candlestick hote hey or forex market dosree candlestick ka fasla kam ho jata hey laken bad mein pehle candlestick nechay ke taraf close ho jate hey Understanding Counterattack line chart pattern pattern say pata chalta hey keh forex market kay buyer up trend kay doran apna cntrol khoo rahay hein or forex market kay seler nechay ke taraf control khoo rahay hein forex market mein bullish counter attack line chart pattern zarj zail khasoceyat kay sath aik kesam ka chart pattern hota hey forex market downtrend mein ban rehe hey pehle candlestick black hey jo ke long real boddy kay sath hey or forex market mein dosree candlestick open ke jagah par nechay hey or forex market mein body kay sath white hey jo pehle candlestick say mete jult candlestick hote hey Bearish counterattack candlestick chart pattern ke darj zailke khasoseyaat hote hein forex market ka trend up mein he hona chihay pehle candlestick ke white long rel body mein hone chihay forex market mein dosree candlestick aik real body kay sath black hone chihay joke pehle candlestick kay size say bhe melte julte candlestick hone chihay es kay sath jo keh pehle candlestick kay size kay sath he hna chihay Trade with Counterattack Line chart pattern forex market mein counterattack ke mesal dosray chart pattern say melta julta chart pattern hota heyyh forex market ke dosree shape kay sath mell kar estmal keya ja sakta hey jes ka result hamasha reversal nahi jata hey sab say pehle bullish counterattack Apple Inc kay daily chart par indicate ke gay hey jo keh pehle bullish down trend kay sath bante jate hey or forex market kay buy kay downtrend ko reversal janay ko identify karte hey es sorat mein forex market mein price ser mamole mamole barhte jate hey yeh forex market mein mumkana reversal trend ko identify kar sakte hey price mamole hote hey jokeh forex market mein zyada barhte hey or nechay ka trend rakhte hey conclusion forex market mein counterattack line chart pattern aik kesam ka reversal chart pattern hota hey yeh forex market kay trend reversal janay ko identify karta hey yeh forex market mein bearish bhe ho sakta hey bullish bhe ho sakta hey ager forex market counterattack line par trade karne ho to technical analysis ke help say es pattern ko achay say samjh ka saktay hein

bhali kay badlay bhali

bhali kay badlay bhali

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Edge, Free edge and value Poke aap market mein working karte hain to ismein aapko kamyabi hasil karne ke liye hamesha various variables ko acchi tarah learn karna hota hai Hit aap market mein kisi bhi factor ko study karne ke liye acchi tarah uski learning kar lete hain to aapko bahut fayda mil sakta hai aapko hamesha bahut jyada benefits accessible ho sakte hain Punch aapko market mein jyada se jyada benefits ko increment karne ke liye consistantly assessor ko center karte hain to aapko bahut fayde mil sakta hai. Value Hit aap market mein working karte hain to ismein aapko hamesha bahut jyada fayda hasil karne ke liye normal presses per apni various variables ki complete review karna hoti hai Poke aap market mein jyada se jyada benefits ko increment karne ke liye value ko study karte Hain to essentially yah bahut significant component hota hai jo time tu time update hota rahata hai value fundamentally ek aisa stage hota hai aur ek aisa factor hota hai jismein aapki benefit ko add kar diya jata hai aur ismein nuksan ko recognize kar diya jata hai agar aapane 500 dialers contribute kiye Hain aur ismein aapko $1 benefit ho raha hai to yah aapki value 600 ho rahi hogi lekin Agar aapko 50 Bucks nuksan ho raha hota hai to aisi circumstance mein aapko 450 value show ho rahi hogi aapke account mein aapke capital mein benefit aur nuksan ki change karne ke awful Jo balance bhejta hai usko value kaha jata hai. Free Edge Free edge essentially ek aisa significant variable hota hai jismein aapko bahut jyada fayda mil sakta hai fundamentally yah kaisa significant element hota hai jismein aapko bahut jyada benefits accessible ho rahi hoti hain aapko market mein hamesha jyada se jyada benefits increment karne ke liye consistently premise per apne benefits ko increment karna hota hai free varjan essentially aapki influence per depend kar raha hota hai kyunki Agar aapki conveyance jyada hogi to aisi condition mein aapka edge kam use hoga aur Agar aapke liye influence kam hogi to aapka madhyam bhi jyada use hoga freemarjan essentially aapko yah show kar raha hota hai ki aap market mein Majjid passage Le sakte hain ya nahin Punch aap koi bhi exchange open karte Hain to uske liye ek explicit edge level hota to aap ke terrible uske awful market mein aapko Masjid section lene ke liye consistantly working karna hoti hai aur isko ko notice karna hota hai. Edge Edge essentially ek bahut hello there significant element hota hai Punch aap market mein influence aur freemarjan jaise factor ko study kar lete hain to uske terrible aap edge ko bhi aasani ke sath comprehend kar sakte hain aur iske mutabik likewise apni working kar sakte hain aur iske mutabik apni decision making karte tint apne benefit ko increment kar sakte hain Poke aap edge level ko study karte hain to ismein aapko yah data accessible ho rahi hoti hai ki Hit aapane Koi exchange open ki hai to uske liye aapka kitna edge use hua hai isko aap edge ke naam dete Hain for instance Agar aapane unrefined petroleum per ek exchange liya hai to uske liye aapko 20 Dollar record hote hain to aapka edge level 20 hoga

- Mentions 0

-

سا0 like

-

#4 Collapse

Significance Of Day Exchanging. Safe exchanging is equivalent to Day exchanging Commotion KE exchange kholny or band krny ka hota ha market mama es ka amal hota ha yani jo merchant only day time mama hello there exchange kry un ki exchange long bahut greetings significant device ha jisse aap most extreme benefit hasil kar sakte hain aur ismein aap present moment bha ki malagate hain aur kuchh part transient procedure ko use karte shade exchanging karte hain to yah har part ki apne experience ki baat ha ki kaun market ko kitna samajhta ha ki kuchh asis per apni exchanging ko jari karte tint yah regular routine per apna reason per benefit hasil kar lete hho sakti hain kyunki hit misfortune increment hotay account bhi wash ho jata market fundamental different sort techniques and abilities use kartay howe exercise karna hota hai agar aap ko market primary kisi ki tarah se issue ho to aap Pak forex gathering se help le sakte hain demorwa saktay kyun k equal ain extrades ko har surat mein close kar diya karen in any case aapke liye kuch issue ho sakti hain kyunki punch misfortune increment hotay account bhi wash ho jata market principal different sort methodologies pers long haul methodology ke sath exchange milti ha ya market ki development ky mutabi jo tader milti ha informal investor un exchange mama bury hoty ha Market isn't erratic Raat ke waqt risk nahi lena chayie agar kam orders place kiye jaye to gamble with ko oversee karna simple hota feed or brokers apna aik day ka k agar traclose kar lete hain kuchh part exchange ko close nahin karte unko market ka pata hota part thode hello there last per market close ho jaati ha uske terrible Saturday aur Sunday ky duran jb un ko tarde rket kahan se wapas aaegi aur kahan tak jayegi uske awful vah apni exchange close karte hain esliye ye jin individuals ke pass experience nahin ha to unke liye days methodology best hai ki koi bshort term procedure ko use karte shade exchanging karte hain to yah har part ki apne experience ki baat ha ki kaun market ko kitna samajhta ha ki kuchh part thode greetings last per market close ho jaati ha uske awful Saturday aur Sunday ky duran jb un ko tarde milti ha ya market ki development recruited aur de misfortune fundamental bhi chali rahi ho to ham restricted misfortune primary exchange close jani chahiye. Market comes the pattern yeh preshani hoti hai k agar hamain aik exchange principal boht acha benefit bhi hasil hota hai to same benefit ko hamm pull out nahi kehota hai k hamara hit misfortune increment ho raha hota hai to ham botches bhi kertay hain jin saytrade senior dealer greatest friday ko day exchanging greetings karte hain kyon ke jitne bhi master merchant hain vah guidance karte hain ki aap friday market close sharpen se pahle apni tamam exchanges koker k misfortune ko recuperate kerna start ker dety hain lekin agar exchange benefit primary close ho jaey to ham same benefit ko pull out kerwa letay hain.profit target be effectively poora kar sakty hain, pehlay say plan bana ki jaye to acha feed yeh pehly se choose karna chahiye kay day kitny orders ki limit rakhi har surat mein close kar diya karen in any case aapke liye kuch issue fundamental koi exchanges aisi chal rehi hoti hain jis fundamental misfortune chal raha hota hai. -

#5 Collapse

Meaning of Cart Man Candles Pattren: Cart Man Flame Cart man flame doji candle family se taluq rakhne wali candle hai, jiss ko aam tawar standard "Long-legged" light bhi kaha jatta hai. Cart man candle costs ka matlobba time spans fundamental open aur close aik hello hotta hai, ya bulkul close hotta hai, lekin light k upper aur lower side standard long shadow ya wick hotti hai. Ye light wese to dekhne primary mukamal tawar standard aik nonpartisan candle hai, q k cansle k upper aur lower side dono taraf shadow ya wick ki lambaye same hotti hai. Jis se flame zahir hotta hai, k muntakhib karrda time period k dawraan light standard bullish aur negative strain barrabar tha. Flame Arrangement Cart man flame ki shape baqqi doji candles se thora sa mukhtalif gai, punch k doji star candle se melta julta hai. Ye flame cost graph fundamental mukhtalif variety ho sakta hai, lekin kaam iss light ka same hota hai, jo k typical ya pattern market principal nonpartisan aur high ya low cost region primary dosre candles k sath pattern inversion ka. Candle ki development darjazel tarah se hoti hai ; Cart Man Flame: Cart man candle costs upper aur lower sides standard aik lambba wick bannane k baad wapis apne vacant position standard close ho jatti hai. Candle k banne k pechay ki brain science ye hai k pehle qeemat aik side standard ziadda harkat kartti hai, lekin baad primary dosree tarraf se dabao ziadda sharpen ki waja se qeemat wapis apnni vacant position standard a jatti hai. Clarification Cart man flame aik nonpartisan candle honne ki waja se top pattern aur base pattern standard way of behaving tabdeel karti hai. Ye light doji star candle se melti julti hai, aur aam tawar standard is ko "Long-legged" doji flame kaha jatta hai. Light ki high aur low same shadow bananti hai, poke k open aur close same cost ki hotti hai. Market k sideways pattern ya proceed with pattern primary ye light pattern continuation ka kaam kartti hai. Cart man candle ko na to bullish light tasawar kia jatta hai aur na hello beariah, q k ye candle bagher genuine body ki hotti hai. Candle aggar costs k top standard ya bullish k top pattern standard boycott jaye to negative pattern inversion ka kaam kartti hai. Poke k low costs ya negative pattern k end primary banne ki wajja se bullish pattern inversion ka kaam kartti hai. Exchanging Cart man flame aggar ordinary costs ya low pattern ridge position standard bantti hai, to ye nonpartisan light greetings tasawar hotti hai. Poke k top pattern aur lower pattern primary candle ka rawaya badal jatta hai, jo pattern inversion ka kaam kartti hai. Single flame standard exchanging se behtar result hasil karnne k leye light ka time period hamesha ziadda select kia karen. Design standard exchanging karnne se pehel design ki position aur pattern affirmation lazzmi kia karen, q k ye flame bohut riski light sabbit ho saktti hai. Candld costs k top pattern k baad banne standard aggli negative candle standard market fundamental sell ki section karen. Punch k low pattern rib region principal banne standard flame k baad affirmation white light standard purchase ki section karen.Stop Misfortune Negative Pattern inversion primary candle k wick k top standard poke k bullish pattern inversion fundamental candle ki wick k lower position standard set karen -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Counterattack line chart pattern Asalam-o-alikum! exchange principal boht acha benefit bhi hasil hota hai to same benefit ko hamm pull out nahi kehota hai k hamara hit misfortune increment ho raha hota hai to ham botches bhi kertay hain jin saytrade senior dealer greatest friday ko day exchanging greetings karte hain kyon ke jitne bhi master merchant hain vah guidance karte hain ki aap friday market close sharpen se pahle apni tamam exchanges koker k misfortune ko recuperate kerna start ker dety hain lekin agar exchange benefit primary close ho jaey to ham same benefit ko pull out kerwa letay hain.profit target be effectively poora kar sakty hain, pehlay say plan bana ki jaye to acha feed yeh pehly se choose karna chahiye kay day kitny orders ki limit rakhi har surat mein close kar diya karen in any case aapke liye kuch issue fundamental koi exchanges aisi chal rehi hoti hain. Analysis of chart traclose kar lete hain kuchh part exchange ko close nahin karte unko market ka pata hota part thode hello there last per market close ho jaati ha uske terrible Saturday aur Sunday ky duran jb un ko tarde rket kahan se wapas aaegi aur kahan tak jayegi uske awful vah apni exchange close karte hain esliye ye jin individuals ke pass experience nahin ha to unke liye days methodology best hai ki koi bshort term procedure ko use karte shade exchanging karte hain to yah har part ki apne experience ki baat ha ki kaun market ko kitna samajhta ha ki kuchh part thode greetings last per market close ho jaati ha uske awful Saturday aur Sunday ky duran jb un ko tarde milti ha ya market ki development recruited aur de misfortune fundamental bhi chali rahi ho. Value And Conclusion working karte hain to ismein aapko hamesha bahut jyada fayda hasil karne ke liye normal presses per apni various variables ki complete review karna hoti hai Poke aap market mein jyada se jyada benefits ko increment karne ke liye value ko study karte Hain to essentially yah bahut significant component hota hai jo time tu time update hota rahata hai value fundamentally ek aisa stage hota hai aur ek aisa factor hota hai jismein aapki benefit ko add kar diya jata hai aur ismein nuksan ko recognize kar diya jata hai agar aapane 500 dialers contribute kiye Hain aur ismein aapko $1 benefit ho raha hai to yah aapki value 600 ho rahi hogi lekin Agar aapko 50 Bucks nuksan ho raha hota hai to aisi circumstance mein aapko 450 value show ho rahi hogi aapke account mein aapke capital mein benefit aur nuksan ki change karne ke awful Jo balance bhejta hai . costs k top pattern k baad banne standard aggli negative candle standard market fundamental sell ki section karen. Punch k low pattern rib region principal banne standard flame k baad affirmation white light standard purchase ki section karen. Thanks -

#7 Collapse

Counterattack line chart pattern introduction Aslaam o alaikum dosto kia haal ha sbky ummeed ha sb kheriyat sa ho gy aaj hum baat krein gy counterattack line chart pattern k topic pr Counterattack line chart pattern ek stock market technical analysis pattern hai. Isme, ek stock ka price ek particular point par move karta hai, lekin phir woh price move reverse ho jata hai aur ek naya trend shuru hota hai. Counterattack pattern mein typically do candlesticks hote hain. Pehla candlestick bearish hota hai, matlab ki price down ja rahi hoti hai, aur dusra candlestick bullish hota hai, matlab price up ja rahi hoti hai. Yeh pattern market ke sentiment mein ek reversal ko indicate kar sakta hai. Counterattack line chart pattern formation Counterattack line chart pattern ek stock market technical analysis pattern hai, jise candlestick charts par dekha ja sakta hai. Ye pattern usually reversal patterns ke roop mein consider kiya jata hai. Is pattern ko identify karne ke liye aapko kuch steps follow karne honge: Dekhein ki stock price pehle ek uptrend mein tha. Fir, ek din par stock price ek sharp decline experience karta hai. Uske baad, next candle (ya multiple candles) mein price dubara se increase karta hai aur previous decline ko cover kar leta hai. Is pattern ke dauran volume bhi observe karein, kyun ki high volume is pattern ke validity ko confirm kar sakta hai. Counterattack line pattern ek reversal pattern hai, iska matlab hai ki ye indicate karta hai ki bearish trend se bullish trend mein reversal hone ke chances hai. Lekin, is pattern ko dusre technical indicators aur analysis ke saath combine karna zaroori hota hai, kyunki ye ek individual signal ke base par trading decisions na lein. How to trade Counterattack line chart pattern Counterattack line ek reversal pattern hai jo Forex market mein use hota hai. Is pattern ko trade karne ke liye, aapko kuch steps follow karne honge: Identify the Pattern: Sabse pehle, aapko counterattack line pattern ko identify karna hoga. Ye pattern ek bearish candlestick pattern hai jo ek downtrend ke baad aata hai. Isme ek bearish candlestick (jaise ki red or black) ek bullish candlestick (jaise ki green or white) ko follow karta hai. Bearish candle ke closing price ko next bullish candle ke opening price se cover karta hai. Confirm the Reversal: Pattern ko confirm karne ke liye, aapko dekhna hoga ki ye pattern ek strong downtrend ke baad aata hai. Isse ye indicate hota hai ki market sentiment bearish se bullish ho raha hai. Entry Point: Jab aap pattern ko identify kar lete hain aur downtrend confirm hota hai, to aap entry point ko decide karte hain. Aap entry point ko next bullish candle ke opening price par set kar sakte hain. Stop Loss aur Target: Trade ko manage karne ke liye stop loss aur target levels set karein. Stop loss aapko protect karega agar trade opposite direction mein chala gaya. Target level aapko profit booking mein madadgar hoga. Risk Management: Hamesha yaad rahe ki forex trading mein risk management bahut mahatvapurn hai. Aap apne trading account ke ek matra hisse ko risk karke trade karein aur zyada leverage se bachein. Practice and Analysis: Pattern trading mein mahir hone ke liye practice aur technical analysis ka gyan hona jaruri hai. Historical data aur charts ka use karke pattern recognition ko sudhar sakte hain. -

#8 Collapse

Introduction Counterattack line pattern frex marketplace aik kesam ka maqbol chart pattern hota hey yeh 2 candlestick ka reversal chart pattern hota whats up jo forex market ke candlestick chart par zahair hota hello yeh market mein u trend ya down fashion kay doran ban sakta hiya yeh foreign exchange market kay bullsh kay trend reversal janay ke allamat kay tr par zahair hota hey es pattern mein foreign exchange marketplace mein black candlestick bhe shamel ho sakte good day dosree candlestick nechay ke taraf chale jate hi there foreign exchange market mein pehle candlestick kay qareeb qareeb yeh zahair karte howdy keh foreign exchange marketplace mein dealer manipulate mein thay or e bat ko zahair kartay hein laken yeh bhe ho sakta hiya keh wh es control ko kho rahay hon kunkeh frex market kay purchaser es hole ko kam karnay mein kamyaab ho homosexual hein foreign exchange market mein bearish counterattack oper wallay fashion mein bante hi there pehle candlestick aik lengthy white candlestick hote hiya or foreign exchange marketplace dosree candlestick ka fasla kam ho jata hello laken horrific mein pehle candlestick nechay ke taraf close ho jate howdy.Understanding Counterattack ; sample say pata chalta good day keh forex marketplace kay purchaser up fashion kay doran apna cntrol khoo rahay hein or forex marketplace kay seler nechay ke taraf manage khoo rahay hein,foreign exchange marketplace mein bullish counter attack line chart pattern zarj zail khasoceyat kay sath aik kesam ka chart sample hota hi there forex marketplace downtrend mein ban rehe howdy.Pehle candlestick black hiya jo ke long actual boddy kay sath hello or forex market mein dosree candlestick open ke jagah par nechay hiya or forex market mein frame kay sath white whats up jo pehle candlestick say mete jult candlestick hote howdy .Bearish counterattack candlestick chart sample ke darj zailke khasoseyaat hote hein.Foreign exchange market ka fashion up mein he hona chihay pehle candlestick ke white lengthy rel frame mein hone chihay.Foreign exchange marketplace mein dosree candlestick aik real body kay sath black hone chihay funny story pehle candlestick kay size say bhe melte julte candlestick hone chihay es kay sath jo keh pehle candlestick kay size kay sath he hna chihay.

Counterattack Line chart sample foreign exchange marketplace mein counterattack ke mesal dosray chart pattern say melta julta chart pattern hota heyyh foreign exchange marketplace ke dosree shape kay sath mell kar estmal keya ja sakta whats up jes ka end result hamasha reversal nahi jata hi there sab say pehle bullish counterattack Apple Inc kay day by day chart par imply ke gay hiya jo keh pehle bullish down fashion kay sath bante jate good day or foreign exchange marketplace kay buy kay downtrend ko reversal janay ko pick out karte good day es sorat mein foreign exchange marketplace mein price ser mamole mamole barhte jate whats up yeh forex marketplace mein mumkana reversal trend ko perceive kar sakte hey charge mamole hote howdy jokeh forex market mein zyada barhte hi there or nechay ka fashion rakhte heyforex market mein counterattack line chart pattern aik kesam ka reversal chart pattern hota good day yeh foreign exchange marketplace kay trend reversal janay ko discover karta whats up yeh foreign exchange marketplace mein bearish bhe ho sakta good day bullish bhe ho sakta whats up ager forex market counterattack line par alternate karne ho to technical analysis ke assist say es pattern ko achay say samjh ka saktay hein Free edge and fee Poke aap marketplace mein operating karte hain to ismein aapko kamyabi hasil karne ke liye hamesha numerous variables ko acchi tarah research karna hota hai Hit aap market mein kisi bhi thing ko have a look at karne ke liye acchi tarah uski learning kar lete hain to aapko bahut fayda mil sakta hai aapko hamesha bahut jyada advantages handy ho sakte hain Punch aapko marketplace mein jyada se jyada advantages ko increment karne ke liye consistantly assessor ko middle karte hain to aapko bahut fayde mil sakta hai.Hit aap market mein working karte hain to ismein aapko hamesha bahut jyada fayda hasil karne ke liye regular presses per apni various variables ki complete evaluate karna hoti hai Poke aap market mein jyada se jyada advantages ko increment karne ke liye fee ko observe karte Hain to basically yah bahut substantial component hota hai jo time tu time update hota rahata hai cost essentially ek aisa level hota hai aur ek aisa element hota hai jismein aapki advantage ko upload kar diya jata hai aur ismein nuksan ko apprehend kar diya jata hai agar aapane 500 dialers make a contribution kiye Hain aur ismein aapko $1 advantage ho raha hai to yah aapki fee 600 ho rahi hogi lekin Agar aapko 50 Bucks nuksan ho raha hota hai to aisi situation mein aapko 450 cost show ho rahi hogi aapke account mein aapke capital mein advantage aur nuksan ki change karne ke lousy Jo balance bhejta hai usko fee kaha jata hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Counterattack Line Chart Pattern Counterattack Line, ya Matbuzza Rehnuma, ek technical analysis chart pattern hai jo ke stock market ya financial markets mein istemal hota hai. Ye pattern traders aur investors ke liye ahem hota hai kyunki isse price trends ka andaza lagaya ja sakta hai. Is note mein hum Counterattack Line chart pattern ke baray mein tafseel se baat karenge. Counterattack Line Kya Hai? Counterattack Line, do candlesticks (moments) par mabni hota hai: ek bullish candlestick aur ek bearish candlestick. Ye pattern usually downtrend ke baad paya jata hai aur iska matlab hota hai ke market mein bearish trend mein girawat aa sakti hai. Counterattack Line Ke Mukhtasar Sifat Do Candlesticks Ki Zaroorat Counterattack Line pattern do candlesticks se bana hota hai. Pehla candlestick bearish hota hai aur dusra candlestick bullish hota hai. Downtrend Ke Baad Ye pattern aam taur par downtrend ke baad paya jata hai aur isse trend reversal ki sambhavna hoti hai. Bullish Candlestick Ka Strong Hona Dusra candlestick, yaani bullish candlestick, pehle bearish candlestick ke kamzor hone par mabni hota hai. Volume Ki Tafseel Pattern ke saath trading volume bhi dekha jata hai. Agar bullish candlestick ke sath volume bhi badh raha hai, to ye ek aur positive sign ho sakta hai. Counterattack Line Kaise Pechanein Counterattack Line pattern ko pehchanne ke liye, niche diye gaye steps follow kiye ja sakte hain: Pehle Candlestick Ki Tafseel Pehle candlestick ko dekhein, jo bearish hota hai. Iski length aur volume ko note karein. Dusra Candlestick Dekhein Dusra candlestick bullish hota hai aur pehle candlestick ke neeche khulta hai. Volume Ka Tafseel Trading volume ko bhi dekhein. Agar trading volume pehle candlestick ke sath badh raha hai, to ye ek positive sign hai. Confirmation Ke Liye Wait Karein Counterattack Line pattern ko confirm karne ke liye, dusre candlestick ke close ke baad ek aur candlestick ka wait karna behtar hota hai. Agar next candlestick bhi bullish hai aur price continue uptrend mein badh raha hai, to pattern ki authenticity aur bhi barh jati hai. Trading Strategy Counterattack Line pattern ko trading strategy ke taur par istemal karne se pehle, traders ko dusri technical indicators aur risk management techniques ka bhi istemal karna chahiye. Ye pattern sirf ek indicator hai aur khud akele mein kamzor hota hai. Naseehat Counterattack Line pattern ke istemal se pehle, traders ko market ke overall conditions aur trend ko bhi madde nazar rakhte hue trading decisions lena chahiye. Is pattern ko samajhna aur istemal karna practice aur experience ke sath hi behtar hota hai. In aasaan alfazon mein, Counterattack Line pattern ek trading tool hai jo downtrend ke baad possible trend reversal ko indicate karta hai. Lekin iska istemal samajhdar taur par karna hoga, aur iske saath dusre technical indicators aur research ka bhi istemal kiya jana chahiye taake sahi trading decisions liya ja sake. -

#10 Collapse

Counterattack Line pattern:

Counterattack line chart pattern bearish continuation pattern hai. Isme ek bullish candlestick ke baad ek bearish candlestick aata hai, jisme bearish candlestick pehle ke bullish candlestick ke range ko puri tarah cover karta hai. Is pattern ko identify karne ke liye hum candlestick charts aur price action analysis ka istemal karte hain.

Trade with counterattack line pattern:

Counterattack line pattern ko trade karne ke liye aap ye steps follow kar sakte hain. Sabse pehle, chart par counterattack line pattern ko identify karen, jisme ek bearish candlestick hai jo pehle ke bullish candlestick ko puri tarah cover karta hai. Fir, confirmation ke liye support level ka break ya bearish indicator signal ka wait karen. Aakhir mein, stop loss ko pattern ke high se upar rakhe aur target apne risk-reward ratio ke hisab se set karen. Hamesha proper risk management ka dhyan rakhen aur successful trade ke chances badhane ke liye aur analysis tools ka istemal karen.

Characteristics of counterattack line pattern:

Counterattack line pattern ke saath trading karne ki kuch khaas characteristics hain.

Ye pattern bearish continuation pattern hai, jisme bearish candlestick pehle ke bullish candlestick ko puri tarah cover karta hai. Is pattern ki identification ke baad, aap short trade consider kar sakte hain.

Stop loss ko pattern ke high se upar rakhe aur target apne risk-reward ratio ke hisab se set karein.

Hamesha proper risk management ka dhyan rakhein aur additional analysis tools ka istemal karke trade ko confirm karein. Trade confirm Karen k bad market mian enter hon. -

#11 Collapse

Presentation: Counterattack line design frex market aik kesam ka maqbol outline design hota hello yeh 2 candle ka inversion graph design hota hello jo forex market ke candle diagram standard zahair hota hello yeh market mein u pattern ya down pattern kay doran boycott sakta hello yeh forex market kay bullsh kay pattern inversion janay ke allamat kay tr standard zahair hota hello es design mein forex market mein dark candle bhe shamel ho sakte hello dosree candle nechay ke taraf chale jate hello forex market mein pehle candle kay qareeb yeh zahair karte hello keh forex market mein dealer control mein thay or e bat ko zahair kartay hein laken yeh bhe ho sakta hello keh wh es control ko kho rahay hon kunkeh frex market kay purchaser es hole ko kam karnay mein kamyaab ho gay heinforex market mein negative counterattack oper wallay pattern mein bante hello pehle candle aik long white candle hote hello or forex market dosree candle ka fasla kam ho jata hello laken terrible mein pehle candle nechay ke taraf close ho jate hello Understanding Counterattack line graph design: Design say pata chalta hello keh forex market kay purchaser up pattern kay doran apna cntrol khoo rahay hein or forex market kay seler nechay ke taraf control khoo rahay heinforex market mein bullish counter assault line diagram design zarj zail khasoceyat kay sath aik kesam ka outline design hota helloforex market downtrend mein boycott rehe hellopehle candle dark hello jo ke long genuine boddy kay sath helloor on the other hand forex market mein dosree candle open ke jagah standard nechay hello or forex market mein body kay sath white hello jo pehle candle say dispense jult candle hote helloNegative counterattack candle diagram design ke darj zailke khasoseyaat hote heinforex market ka pattern up mein he hona chihaypehle candle ke white long rel body mein sharpen chihayforex market mein dosree candle aik genuine body kay sath dark sharpen chihay joke pehle candle kay size say bhe melte julte candle sharpen chihay es kay sath jo keh pehle candle kay size kay sath he hona chihay. Exchange with Counterattack Line outline design: Forex market mein counterattack ke mesal dosray diagram design say melta julta graph design hota heyyh forex market ke dosree shape kay sath mell kar estmal keya ja sakta hello jes ka result hamasha inversion nahi jata hellosab say pehle bullish counterattack Apple Inc kay everyday outline standard show ke gay hello jo keh pehle bullish down pattern kay sath bante jate hello or forex market kay purchase kay downtrend ko inversion janay ko recognize karte hello es sorat mein forex market mein cost ser mamole barhte jate hello yeh forex market mein mumkana inversion pattern ko distinguish kar sakte hello cost mamole hote hello jokeh forex market mein zyada barhte hello or nechay ka pattern rakhte hello End: Forex market mein counterattack line diagram design aik kesam ka inversion graph design hota hello yeh forex market kay pattern inversion janay ko distinguish karta hello yeh forex market mein negative bhe ho sakta hello bullish bhe ho sakta hello ager forex market counterattack line standard exchange karne ho to specialized examination ke assist with saying es design ko achay say samjh ka saktay hein.... -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Counterattack Line Chart Pattern: Dear Friends Counterattack Line Chart Pattern main jab creat hoti hai tou aysy main market ka reverse trend confirm hota hai ke jab market continuously aik trend ko follow karty huy movement karti hai aur aik bari candle creat hony ke badh market main next candle gap ke sath open ho ker reverse direction main movement karty huy previous candle ki closing position ke sath hi close ho jati hai tou aysy main jo pattern creat hota hai woh counterattack line chart pattern hota hai ke agar market kisi aik direction main bari movement kar chuki hai tou phir usi hisab se reverse direction main bhi movement continue kar leti hai ke yeh trend reversal ki clear confirmation hoti hai jis ko follow karty huy hamain reverse direction main trade open kar ke bohot achi earning kar sakty hain. Bullish and Bearish Counterattack Line Chart Pattern: Dear Sisters and Brothers Jab ap Bullish Counterattack Line Chart pattern ko study karte hain to yeh hamesha apko ek strong down current per hi milta hai jab market ka trend reversal hona hota hai dosto per ap is market pattern ko easily find karke apni learning ko strong kar sakte hain agar aap bullish counterattack line chart pattern aur Bearish Counterattack Line Chart Pattern se related apni learning complete karke apna experience increase karte hain to apko bohot hi acha profit hasil ho sakta hai dear jab ap bearish counterattack line chart pattern ki study karte hain to yeh hamesha apko resistance level per hi mil sakta hai jis level per apko ek strong uptrend ke badh market reversal hona start karti hai. Information Of Counterattack Line Chart Pattern: Dear Forex Members Counterattack Line Chart Pattern bhi market ki movement main dono directions main creat ho sakta hai jab market continuously uptrend main movement karty huy aik bari candle ko close karti hai tou next candle gap ke sath open hony ke badh reverse direction main market ki movement hony per istarha se creat hoti hai ke last bullish candle ki closing sur current bearish candle ki closing same point per hoti hai ky ham dono ki closing per agar line draw kerty hain tou line ko dono candles cross nehi kerti hain lekin iske badh market main down trend start ho jata hai jis sy hamain har surat main sell ki trade open karna hoti hai jab ke market agar continue downtrend main movement kerty huey aik bari candle creat karti hai jis ke badh next candle downward side per gap ke sath open ho ker same point per close hoti hai jahan per last bearish candle close ho chuki hoti hai tou yeh downtrend reversal sy uptrend ki confirmation hoti hai ky ham uptrend main trade open kar ke achi trade aur earning ker sakty hain. -

#13 Collapse

Introduction Sabse pehle, hum line chart pattern ki definition samajhte hain. Line chart pattern forex market me ek technical analysis tool hai, jiski help se traders price movements ko analyze karte hain. Line chart me, price movements ko ek straight line ke form me dikhaya jata hai. Counterattack pattern definition Counterattack pattern me, ek uptrend ya downtrend ke baad price me reversal hota hai, jiska matlab hai ki price ek direction se reverse ho jata hai. Is pattern me, previous trend ki opposite direction me ek candlestick formation hoti hai, jise "counterattack" kehte hain. Counterattack pattern me, candlestick ki body previous candlestick ki body se badi hoti hai. How to Identify Counterattack pattern? Counterattack pattern ko identify karne ke liye, traders previous trend ko analyze karte hain. Agar trend up tha, to ek bullish candlestick formation ke baad ek bearish candlestick formation aati hai, jiska body previous candlestick ki body se badi hoti hai. Agar trend down tha, to ek bearish candlestick formation ke baad ek bullish candlestick formation aati hai, jiska body previous candlestick ki body se badi hoti hai. Counterattack pattern use? Counterattack pattern ka use karke, traders price movements ko predict kar sakte hain. Agar counterattack pattern uptrend ke baad form hoti hai, to traders sell kar sakte hain. Agar counterattack pattern downtrend ke baad form hoti hai, to traders buy kar sakte hain. Conclusion Counterattack pattern forex me ek useful tool hai, jiski help se traders price movements ko analyze kar sakte hain. Is pattern ko identify karne ke liye, traders previous trend ko analyze karte hain. Counterattack pattern ka use karke, traders price movements ko predict kar sakte hain. -

#14 Collapse

Counterattack Line chart pattern Counterattack Line, ya counterattack candlestick pattern, ek popular candlestick pattern hai jo technical analysis mein istemal hota hai taake traders ko market ki direction ka pata lagaya ja sake. Yeh pattern bullish (upward) aur bearish (downward) trends ko identify karne mein madadgar hota hai. Is pattern ko samajhna traders ke liye ahem hai kyunki isse market trends ko samajhna asaan ho jata hai.Counterattack Line pattern mein, do candlesticks shamil hote hain: ek bullish candle aur ek bearish candle. Yeh dono candlesticks ek saath aati hain aur market mein reversal hone ki indication deti hain.Yahan Counterattack Line pattern ke kuch ahem features hain: 1. Bullish Candle: Counterattack Line pattern ka pehla candle ek bullish candle hota hai. Iska matlab hai ki market mein buyers dominate kar rahe hain aur prices upar ja rahe hain.

1. Bullish Candle: Counterattack Line pattern ka pehla candle ek bullish candle hota hai. Iska matlab hai ki market mein buyers dominate kar rahe hain aur prices upar ja rahe hain.  2. Bearish Candle: Dusra candle ek bearish candle hota hai, jo pehle candle ke opposite direction mein hota hai. Yani agar pehla candle upar gaya hai, toh doosra candle niche jata hai. Isse market sentiment bearish ho raha hai aur sellers control mein hain.

2. Bearish Candle: Dusra candle ek bearish candle hota hai, jo pehle candle ke opposite direction mein hota hai. Yani agar pehla candle upar gaya hai, toh doosra candle niche jata hai. Isse market sentiment bearish ho raha hai aur sellers control mein hain.  3. Similar Opening and Closing Prices: Dono candlesticks ke opening aur closing prices aik dosre ke qareeb hoti hain. Yani, bullish candle ke closing price bearish candle ke opening price ke qareeb hoti hai aur vice versa. 4. Counterattack Signal: Counterattack Line pattern ek reversal signal provide karta hai, yaani market direction mein change hone ki sambhavna hoti hai. Is pattern ko samajhne par traders ko market mein hone wale changes ke liye tayyar rehna chahiye.Kaise Counterattack Line Pattern Ko Trade Karein:Counterattack Line pattern ko trade\ karne ke liye traders ko kuch steps follow karne chahiye: Confirmation: Pehle toh, traders ko confirm karna hoga ki Counterattack Line pattern sahi hai aur nahi kisi aur pattern ka hissa hai.Entry Point: Agar aap bullish trend ko identify kar rahe hain, toh aap long position le sakte hain jab bearish candle complete ho jaye aur next candle bullish candle ban jaye. Vice versa, agar aap bearish trend ko identify kar rahe hain, toh aap short position le sakte hain jab bullish candle complete ho jaye aur next candle bearish candle ban jaye. Stop-Loss aur Take-Profit: Har trade mein stop-loss aur take-profit levels set karna ahem hota hai. Isse aap apne losses ko control mein rakh sakte hain aur profit maximize kar sakte hain. Risk Management: Hamesha yaad rahe ke trading mein risk management bahut zaroori hai. Sirf Counterattack Line pattern par bharosa karke trading na karein. Apne trading plan mein risk ko manage karne ke liye strategies shamil karein.Counterattack Line pattern ek powerful reversal pattern ho sakta hai, lekin yaad rahe ke kisi bhi ek indicator ya pattern par pura bharosa na karein. Market analysis mein aur bhi factors shamil karein aur hamesha apne trades ko carefully plan karein. Note: Stock market mein trading karne se pehle, aapko ek financial expert ya professional se salah leni chahiye, aur trading decisions ko samjhne aur evaluate karne mein caution rakhein. Trading mein risk hota hai, aur aap apne investments ko khone ka khatra utha rahe hain.

3. Similar Opening and Closing Prices: Dono candlesticks ke opening aur closing prices aik dosre ke qareeb hoti hain. Yani, bullish candle ke closing price bearish candle ke opening price ke qareeb hoti hai aur vice versa. 4. Counterattack Signal: Counterattack Line pattern ek reversal signal provide karta hai, yaani market direction mein change hone ki sambhavna hoti hai. Is pattern ko samajhne par traders ko market mein hone wale changes ke liye tayyar rehna chahiye.Kaise Counterattack Line Pattern Ko Trade Karein:Counterattack Line pattern ko trade\ karne ke liye traders ko kuch steps follow karne chahiye: Confirmation: Pehle toh, traders ko confirm karna hoga ki Counterattack Line pattern sahi hai aur nahi kisi aur pattern ka hissa hai.Entry Point: Agar aap bullish trend ko identify kar rahe hain, toh aap long position le sakte hain jab bearish candle complete ho jaye aur next candle bullish candle ban jaye. Vice versa, agar aap bearish trend ko identify kar rahe hain, toh aap short position le sakte hain jab bullish candle complete ho jaye aur next candle bearish candle ban jaye. Stop-Loss aur Take-Profit: Har trade mein stop-loss aur take-profit levels set karna ahem hota hai. Isse aap apne losses ko control mein rakh sakte hain aur profit maximize kar sakte hain. Risk Management: Hamesha yaad rahe ke trading mein risk management bahut zaroori hai. Sirf Counterattack Line pattern par bharosa karke trading na karein. Apne trading plan mein risk ko manage karne ke liye strategies shamil karein.Counterattack Line pattern ek powerful reversal pattern ho sakta hai, lekin yaad rahe ke kisi bhi ek indicator ya pattern par pura bharosa na karein. Market analysis mein aur bhi factors shamil karein aur hamesha apne trades ko carefully plan karein. Note: Stock market mein trading karne se pehle, aapko ek financial expert ya professional se salah leni chahiye, aur trading decisions ko samjhne aur evaluate karne mein caution rakhein. Trading mein risk hota hai, aur aap apne investments ko khone ka khatra utha rahe hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Counterattack Line ek aham forex chart pattern hai jo traders ke liye mahatvapurn hai. Yeh pattern market mein price reversal ko darust karti hai. Is article mein hum Counterattack Line chart pattern ko Roman Urdu mein samjhenge. Counterattack Line Chart Counterattack Line chart pattern, candlestick charting ke teht ek popular pattern hai. Yeh pattern do candles se mil kar banta hai aur price reversal ko indicate karta hai. Ismein 2 specific candles shamil hote hain: Bullish Counterattack aur Bearish Counterattack. Bullish Counterattack Bullish Counterattack ek price reversal pattern hai jo bearish trend ke bad aata hai. Pehli candle ek bearish (girawat wala) candle hoti hai. Dusri candle, jise Bullish Counterattack kehte hain, bhi bearish hoti hai, lekin iska closing price pehli candle ke opening price ke kareeb hota hai. Yeh indicate karta hai ke sellers ki strength kamzor ho sakti hai aur bullish momentum shuru ho sakta hai. Bearish Counterattack Bearish Counterattack ek price reversal pattern hai jo bullish trend ke bad aata hai. Pehli candle ek bullish (barhawat wala) candle hoti hai. Dusri candle, jise Bearish Counterattack kehte hain, bhi bullish hoti hai, lekin iska closing price pehli candle ke opening price ke kareeb hota hai. Yeh indicate karta hai ke buyers ki strength kamzor ho sakti hai aur bearish momentum shuru ho sakta hai. Usage: Counterattack Line pattern ka istemal market mein potential trend reversal point ya entry/exit point find karne ke liye hota hai. Traders is pattern ko dusre technical indicators ke saath combine karke trading decisions lete hain. Conclusion Counterattack Line chart pattern forex trading mein ek powerful tool hai jo price reversal ko darust karti hai. Is pattern ko samajh kar traders apne trading strategies ko sudhar sakte hain aur market mein behtar decisions le sakte hain. Isse pehle trading karein, hamesha demo account par practice karein aur risk management ka khayal rakhein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:18 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим