Describe Kicker Candlestick Patters ? Assalam o Aalikum Kicker candle Pattern ek aham specialized investigation apparatus hai jo brokers aur financial backers ke liye market pattern aur inversion ko samajhne mein madadgar hota hai. Is design ka istemal market mein sharpen ridge pattern changes aur exchanging choices ke liye kiya jata hai. Yeh design dono bullish aur negative varieties mein aata hai, aur iski pehchan karnay se merchants ko market ke future developments ke exposed mein understanding milti hai. Elements of Kicker Candlestick Patterns.... i.Kicker candle design do types ke hote hain: 1. **Bullish Kicker: Bullish kicker design tab banta hai punch pehla candle ek downtrend ko dikhata hai, aur doosra candle serious areas of strength for ek ka signal deta hai. Yeh demonstrate karta hai ke market mein purchasers ne control le liya hai aur upswing shuru sharpen wala hai. 2. **Bearish Kicker: Negative kicker design tab banta hai punch pehla candle ek upswing ko dikhata hai, aur doosra candle major areas of strength for ek ka signal deta hai. Yeh demonstrate karta hai ke market mein dealers ne control le liya hai aur downtrend shuru sharpen wala hai. Conculsion... Kicker candle Pattern forex mein ek significant example hai. Is design ko samajhne ke liye merchants ko open cost aur pattern inversion ke idea standard center karna chahiye.

No announcement yet.

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

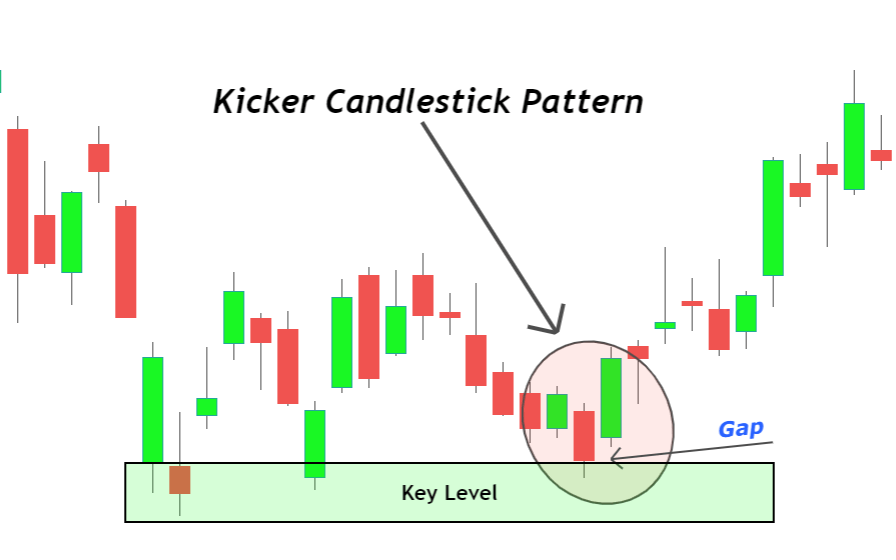

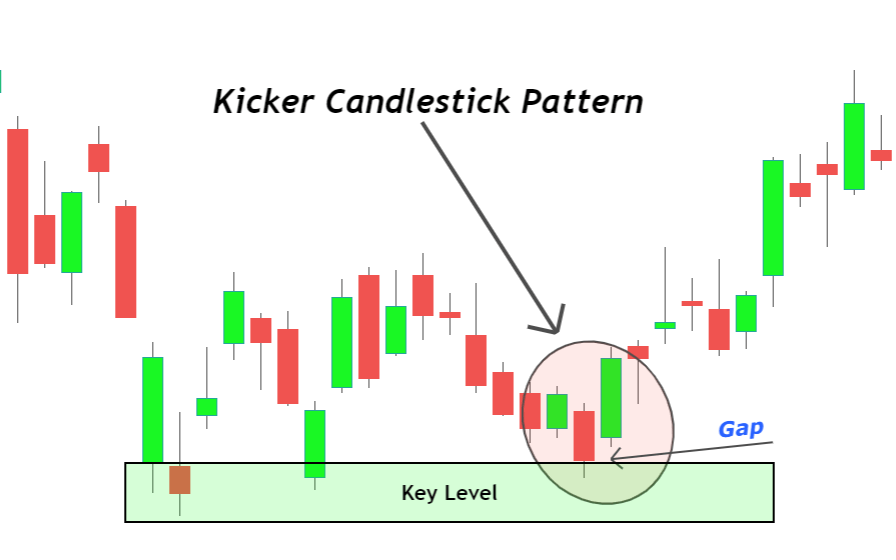

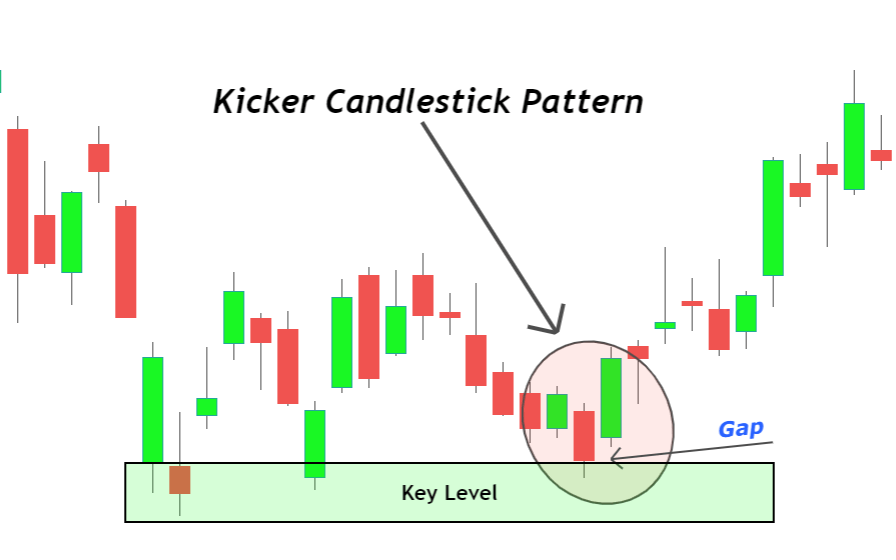

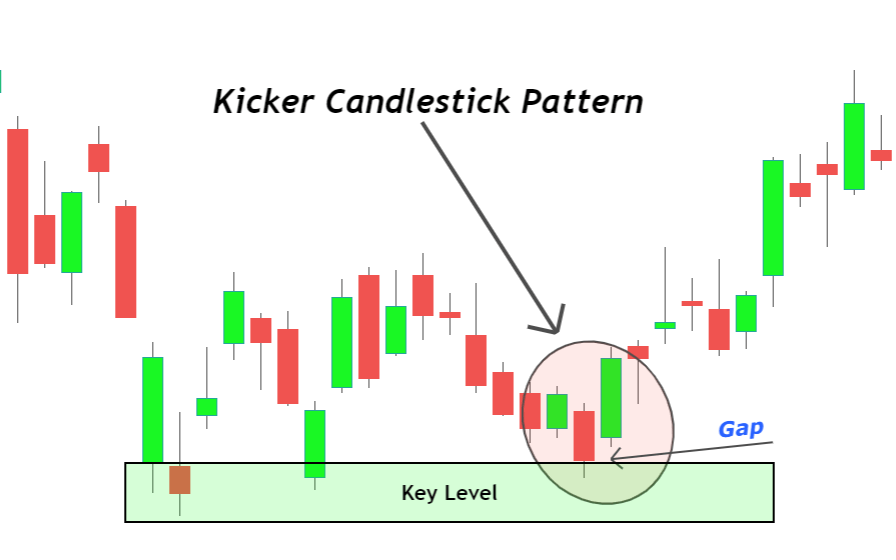

Kicker candlestick pattern forex market mein ek powerful reversal pattern hai, jo strong trend reversal ki indication deta hai. Is pattern mein do consecutive candlesticks hote hai, jahaan pehla candlestick ek direction mein move karta hai aur dusra candlestick opposite direction mein gap ke saath open hota hai. Kicker candlestick pattern ki wazahat ke liye, iske key points samjhein: 1. First Candlestick: Pehla candlestick existing trend ke accordance mein move karta hai. Yeh candlestick strong momentum aur price move ke saath close hota hai. 2. Gap: Dusra candlestick opposite direction mein gap ke saath open hota hai, jisse indicate hota hai ki market sentiment mein sudden shift hua hai. 3. Strong Reversal: Kicker pattern mein dusra candlestick pehle candlestick ke range ke bahar open hota hai aur strong momentum ke saath move karta hai. Yeh indicate karta hai ki market mein trend reversal hone ki sambhavna hai. Kicker candlestick pattern ek powerful trend reversal pattern hai, jo traders aur investors ko market mein quick and strong moves ki indication deta hai. Is pattern ka istemal karne se kuch fayde ho sakte hain: 1. Trend reversal indication: Kicker candlestick pattern market mein trend reversal ki strong indication deta hai. Jab is pattern ko observe kiya jata hai, jisme ek bearish candlestick followed by an immediately bullish candlestick hota hai (ya vice versa), toh iska matlab ho sakta hai ki market sentiment badal rahi hai aur trend reversal hone ki possibility hai.2. Entry point: Kicker candlestick pattern traders ko entry point provide karta hai. Jab ye pattern dikhai deta hai, traders buy ya sell karne ka decision le sakte hain, expecting ki market mein strong move shuru ho jayega. Isse traders ko entry point par entry karne ka opportunity milta hai.3. Confirmation of reversal: Kicker candlestick pattern ek strong confirmation deta hai ki trend reversal hone wala hai. Is pattern mein ek strong and immediate move hota hai, which indicates that the previous trend is likely to reverse.4. Stop loss placement: Kicker candlestick pattern ke istemal se traders apne stop loss levels ko set kar sakte hain. Agar previous candlestick ki high ya low ko break karta hai, toh traders apne stop loss levels ko usi level ke aas paas set kar sakte hain, jisse unka risk control ho jata hai.Lekin jaise ki har technical analysis tool ya pattern ki tarah, kicker candlestick pattern ka bhi apne limitations hai. False signals, market volatility, aur other factors ko bhi consider karna zaruri hai. Traders ko hamesha apne own research aur risk management ke saath trading decisions lena chahiye. Kicker candlestick pattern ko confirm karne ke liye, traders dusre technical tools aur analysis techniques ka istemal karte hai, jaise ki support aur resistance levels, moving averages, ya dusre reversal patterns. Isse more accurate aur reliable trading signals generate hote hai.Yeh important hai ki traders kicker candlestick pattern ko dusre indicators aur price action analysis ke saath combine karein, jisse unhe aur bhi strong trading signals mil sakein. Traders ko is pattern ko samajhna aur recognize karna zaroori hai, taaki woh potential trend reversals ko identify kar sakein aur apne trading decisions ko base kar sakein. -

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Candlestick Pattern current trend ke reversal ko show karta hai, ye bullish aur bearish dono tarah ka hota hai, ye bohot kam nazar anay wala pattern hai aur itna reliable be nhi, 2 opposite marubozu candles sa mil kar banta hai jo price gap ke sath open hoti hain, normaly ye pattern tab banta hai jab market ki moment aik perticular session ma one sided rahay, jis ma high ya low par close ho kar candles ki sirf real body reh jati hai our koi shadow nhi hota.Bullish Kicker Candlestick Pattern: pattern downtrend ma banta hai is ke badh trade open karny ke liye hamain next candle confirmation ke top par daikhni parti hai, is ma pehli candle long aur bearish hoti hai jis ko marubozu kahain gay, uske badh pehli aur dusri candle ma gap up ho ga, phir dusri candle long aur bullish ho gi, dono candles ko wicks nhi hon gi aur ye jitni long hon gi pattern ki utni hi reliability zyada ho gi.

Bearish Kicker Candlestick Pattern: Dear Trading Partners ye bullish pattern ke opposite hota hai aur uptrend ma banta hai, is ma be confirmation candle ki zarurat hoti hai, pehli candle long bullish hoti hai our phir pehli aur dusri candle ke darmian gap down hota hai, us ke badh dusri candle long bearish marubozu ho gi, is pattern ki reliabiliy be candles ki lambai par depend karti hai, lakin is signal sa trade open aur exit nhi karni chahiye ye sirf aik possible pending reversal ka sign ho sakta hai. Is ki tasdeek ke liye next candles ki shapes par depend karna parta hai.pattern inversion ke baad dikhta hai, jisme pehle negative pattern hota hai aur phir ek bullish flame banata hai. Phir agle racket ek aur candle hoti hai, lekin yeh bullish flame hoti hai aur pehle grain negative light ki body se upar ki taraf open hoti hai. Is tarah ye design dikhta hai ki bullish light ne negative pattern ko defeat kar diya hai aur naya upswing shuru ho gaya hai. Ye design pattern inversion ke liye bahut significant hai aur brokers isko apni exchanging methodology mein use karte hain.Kicker candle design negative pattern ke baad ek bullish flame banata hai. Ye flame negative pattern ko defeat karne ke liye kaafi solid hota hai.

-

#19 Collapse

Describe Kicker Candle stick Patters ? Assalam o Alikum:Dear companions umeed hy k AP sab thk hon gay.aj Jo AP nay post share ki hy wo bhot he eham feed aor kicker candle pattern k bary fundamental mazeed primary AP say kuch maloonat share kroon ga .umeed hy apko phar k is say bhot faida ho gaDefinition:Kicker design aik do baar wala candle stuck design hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mother btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai .Comprehension of kicker pattern:stock market musabiqati kharidaron ( bail ) aur baichnay walay ( balow ) ki khasusiyat rakhti hai. un khiladion ke darmiyan jung ki musalsal kashmakash wohi hai jo mother btyon ke namoonay banati hai. candle diagramming ki ibtida Japan mein 1700 ki dahai mein tayyar ki gayi aik taknik se hui jis mein chawal ki qeemat ka pata lagaya gaya. mother batian kisi bhi maya maliyati asasay jaisay stock, future aur ghair mulki cash ki tijarat ke liye aik mozoon taknik hain .Working of kicker candle pattern:Kicker design ko sab se ziyada qabil aetmaad inversion patteren mein se aik samjha jata hai aur aam peak standard organization ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karta hai. kukkar patteren aik ulat palat design hai, aur yeh aik expand design se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur is rujhan mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik ka matlab kuch mukhtalif hota hai .Kicker design ka mushahida karne walay taajiron ko, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir - apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay hit unhon ne asal mein kukkar patteren ki nishandahi ki ho .agarchay kicker design ko mazboot bail ya reechh ke jazbati isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se ziyada radd amal zahir nahi karte hain. Components of Kicker Candle stick Patterns... Kicker candle stick do components ke hote hain: 1. **Bullish Kicker: Bullish kicker design tab banta hai poke pehla candle ek downtrend ko dikhata hai, aur doosra candle areas of strength for ek ka signal deta hai. Yeh show karta hai ke market mein purchasers ne control le liya hai aur upswing shuru sharpen wala hai. 2. **Bearish Kicker: Negative kicker design tab banta hai punch pehla candle ek upturn ko dikhata hai, aur doosra candle areas of strength for ek ka signal deta hai. Yeh show karta hai ke market mein venders ne control le liya hai aur downtrend shuru sharpen wala hai. Agar pehli light negative hai (giravat ki taraf) aur downtrend ko darust karti hai. Dusra light tezi se shuru hoti hai aur upturn ki taraf move karti hai, pehli flame ko cover karte shade. Conculsion... Kicker candle stick ek aham device hai Forex dealers ke liye jo market ke inversions ko recognize karne mein madadgar hota hai. Is design ki understanding aur appropriate gamble the executives ke sath exchanging karne se brokers apne exchanging techniques ko improve kar sakte hain.Kicker candlestick pattern forex mein ek important pattern hai. Is pattern ko samajhne ke liye traders ko open price aur trend reversal ke concept par focus karna chahiye. -

#20 Collapse

Kicker candle Pattern: Presentation of Kicker candle design:Kicker Candle Example, yaqeenan, financial exchange investigation mein aik ahem aur mahir tareeqa hai jo merchants aur financial backers ke liye aham hota hai. Yeh design market meinpattern inversion ya pattern continuation ko show karne mein madadgar hota hai. Is article mein murmur Kicker Candle Example ke aghaz se lekar iske tafseelat tak parhenge. Kicker Candle Example Kya Hai? Kicker Candle Example aik specialized examination device hai jo securities exchange ke graphs aur cost developments ko samajhne ke liye istemal hota hai. Is design ko samajhna asaanhai. Ismein do candles (mumtazib candles) hoti hain, aur ye do candles inverse headings mein hoti hain, matlab pehli flame negative (girawat) hoti hai aur dosrilight bullish (barhawat) hoti hai, ya bad habit versa.Kicker Candle Example Ki Pechan Kaise Hoti Hai?Kicker Candle Example ki pehchan karne ke liye neeche di gayi chezein dekhiye: Pehli Candle (Negative Flame): Pehli candle, jo ke negative hoti hai, market mein ek downtrend ko darust karti hai. Is flame ki shutting cost, is candle ke opening cost se nichay ki taraf hoti hai .Dosri Candle (Bullish Candle): Dosri candle, jo ke bullish hoti hai, market mein ek upswing ko darust karti hai. Is candle ki shutting cost, pehli light ki shuttingcost se ooper hoti hai. Volume: Volume bhi is design mein aham hota hai. Dosri light ki exchanging volume, aksar pehli candle ki exchanging volume se ziada hoti hai. Kicker Candle Example Ke Types: Kicker Candle Example do tarah ke hote hain: Bullish Kicker Candle Example: Ismein pehli light negative hoti hai aur dosri flame bullish hoti hai. Yeh upswing ki shuruaat ko darust karta hai aur financial backers kokhareedne ki salahiyat deta hai.

Kicker Candle Example Kya Hai? Kicker Candle Example aik specialized examination device hai jo securities exchange ke graphs aur cost developments ko samajhne ke liye istemal hota hai. Is design ko samajhna asaanhai. Ismein do candles (mumtazib candles) hoti hain, aur ye do candles inverse headings mein hoti hain, matlab pehli flame negative (girawat) hoti hai aur dosrilight bullish (barhawat) hoti hai, ya bad habit versa.Kicker Candle Example Ki Pechan Kaise Hoti Hai?Kicker Candle Example ki pehchan karne ke liye neeche di gayi chezein dekhiye: Pehli Candle (Negative Flame): Pehli candle, jo ke negative hoti hai, market mein ek downtrend ko darust karti hai. Is flame ki shutting cost, is candle ke opening cost se nichay ki taraf hoti hai .Dosri Candle (Bullish Candle): Dosri candle, jo ke bullish hoti hai, market mein ek upswing ko darust karti hai. Is candle ki shutting cost, pehli light ki shuttingcost se ooper hoti hai. Volume: Volume bhi is design mein aham hota hai. Dosri light ki exchanging volume, aksar pehli candle ki exchanging volume se ziada hoti hai. Kicker Candle Example Ke Types: Kicker Candle Example do tarah ke hote hain: Bullish Kicker Candle Example: Ismein pehli light negative hoti hai aur dosri flame bullish hoti hai. Yeh upswing ki shuruaat ko darust karta hai aur financial backers kokhareedne ki salahiyat deta hai.  Negative Kicker Candle Example: Ismein pehli flame bullish hoti hai aur dosri light negative hoti hai. Yeh downtrend ki shuruaat ko darust karta hai aur financial backers kobechnay ki salahiyat deta hai.

Negative Kicker Candle Example: Ismein pehli flame bullish hoti hai aur dosri light negative hoti hai. Yeh downtrend ki shuruaat ko darust karta hai aur financial backers kobechnay ki salahiyat deta hai.  Kicker Candle Example Ke Istemal Ke Fayde:Kicker Candle Example ke istemal se dealers aur financial backers ko neeche diye gaye fawaid milte hain: Pattern Inversion Aur Continuation Ki Pechan: Kicker design, patterninversion aur pattern continuation ko darust karne mein madadgar hota hai. Passage Aur Leave Focuses Ki Tafseelat: Is design ke istemal se brokers ko behtar section aur leave focuseska andaza lagana asaan hota hai.Trading Procedure Ki Tashkeel: Kicker design ko dusri specialized pointers aur designs ke sath mila kar exchanging methodology tashkeel dene mein istemal kiya ja sakta hai.Ending part of kicker candle patternKicker Candle Example, securities exchange investigation mein aik ahem aur valuable instrument hai jo merchants aur financial backers ke liye accommodating ho sakta hai. Is design ko samajhna aur istemal, market ke cost developments ko samajhne mein madadgar ho sakta hai. Magar, yaad rahe ke sirf Kicker design standard bharosa kar ke exchanging nahi ki jati; dusre specialized aurmajor variables ko bhi madde nazar rakha jana chahiye. Exchanging mein hamesha apni research aur risk the executives ko ahmiyat dena chahiye.

Kicker Candle Example Ke Istemal Ke Fayde:Kicker Candle Example ke istemal se dealers aur financial backers ko neeche diye gaye fawaid milte hain: Pattern Inversion Aur Continuation Ki Pechan: Kicker design, patterninversion aur pattern continuation ko darust karne mein madadgar hota hai. Passage Aur Leave Focuses Ki Tafseelat: Is design ke istemal se brokers ko behtar section aur leave focuseska andaza lagana asaan hota hai.Trading Procedure Ki Tashkeel: Kicker design ko dusri specialized pointers aur designs ke sath mila kar exchanging methodology tashkeel dene mein istemal kiya ja sakta hai.Ending part of kicker candle patternKicker Candle Example, securities exchange investigation mein aik ahem aur valuable instrument hai jo merchants aur financial backers ke liye accommodating ho sakta hai. Is design ko samajhna aur istemal, market ke cost developments ko samajhne mein madadgar ho sakta hai. Magar, yaad rahe ke sirf Kicker design standard bharosa kar ke exchanging nahi ki jati; dusre specialized aurmajor variables ko bhi madde nazar rakha jana chahiye. Exchanging mein hamesha apni research aur risk the executives ko ahmiyat dena chahiye.

- Mentions 0

-

سا0 like

-

#21 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Asalam o Alikum Dosto ummid karta hun aap khairiyat Se Hon gy Aaj topic ko Ham discuss Karenge wah hai kkicker candlestick pattern yah pattern Ek trend reversal pattern hai aur yah kab aur kaise kam Karta Hai Ham iski detail aur es ke explanation ko hi sirf is topic Mein discuss Karenge Taki Ham isko understand kar saky Kicker Candlestick pattern: Dear friends Kicker Candlestick pattern ak strong reversal pattern hai jo trend ki direction ko change karta hai is pattern Mein 2 candlestick hoti hain jismein second candlestick first candle wale candlestick ki body ko Puri Tarah kicker kar deti hai Jab kicker agar understand Jaaye to isase reversal Ke Liye Hi ke liye ek strong signal Milta Hai Jab kicker candlestick pattern identify kiya jaaye to traders apne liye ek trend reversal ke ly taiyar kar sakte hain aur isliye yah kha Jata Hai strong technical indicator hai ya trading mein price chart pattern main use Kiya jata hai aur Aaj Bhi is technical analysis ke liye isko expect kya jata Hai Explanation of Kicker Candlestick: Dear friends Kicker candles pattern 2 candlestick ka combination Mana Jata Hai jismein second candlestick first wali ke body ko Puri Tarah Se kicker kar deti hai yah pattern tab Banta Hai Jab second candle ka open aur close donon first candle ki range ke bahar hote hain second candle ka opening aur closing price donon first candle ka opening aur closing prices se zada Hona Chahiye kicker candlestick pattern trend reversal ka zarya Hota Hai Dear friends Kicker candlestick pattern yah signal provide karta hai ki market ka trend Mein Momentum kam hone ke andar ho raha hai aur koi new trend aa sakta hai Jab Ek Long downtrend ya up trend kicker pattern appear ho to uska matlab yah hota hai ki market Mein sentiment mein ek strong position Ho Rahi Hai Isko zahan Mein Rakhna bahut zaruri hai ki pahla trend Kitna long tha uska matlab ye hai ke ye aik strong signal hai

Explanation of Kicker Candlestick: Dear friends Kicker candles pattern 2 candlestick ka combination Mana Jata Hai jismein second candlestick first wali ke body ko Puri Tarah Se kicker kar deti hai yah pattern tab Banta Hai Jab second candle ka open aur close donon first candle ki range ke bahar hote hain second candle ka opening aur closing price donon first candle ka opening aur closing prices se zada Hona Chahiye kicker candlestick pattern trend reversal ka zarya Hota Hai Dear friends Kicker candlestick pattern yah signal provide karta hai ki market ka trend Mein Momentum kam hone ke andar ho raha hai aur koi new trend aa sakta hai Jab Ek Long downtrend ya up trend kicker pattern appear ho to uska matlab yah hota hai ki market Mein sentiment mein ek strong position Ho Rahi Hai Isko zahan Mein Rakhna bahut zaruri hai ki pahla trend Kitna long tha uska matlab ye hai ke ye aik strong signal hai

-

#22 Collapse

Kicker Candle Example: Dear Companions kicker Candle Example latest thing ke inversion ko show karta hai, ye bullish aur negative dono tarah ka hota hai, ye bohot kam nazar anay wala design hai aur itna dependable be nhi, 2 inverse marubozu candles sa mil kar banta hai jo cost hole ke sath open hoti hain, normaly ye design tab banta hai poke market ki second aik perticular meeting mama uneven rahay, jis mama high ya low standard close ho kar candles ki sirf genuine body reh jati hai our koi shadow nahi hota. Bullish Kicker Candle Example: Hi Understudies ye design downtrend mama banta hai is ke badh exchange open karny ke liye hamain next flame affirmation ke top standard daikhni parti hai, is mama pehli light lengthy aur negative hoti hai jis ko marubozu kahain gay, uske badh pehli aur dusri candle mama hole up ho ga, phir dusri candle long aur bullish ho gi, dono candles ko wicks nhi hon gi aur ye jitni long hon gi design ki utni hello unwavering quality zyada ho gi. Bearish Kicker Candle Example: Dear Exchanging Accomplices ye bullish example ke inverse hota hai aur upswing mama banta hai, is mama be affirmation light ki zarurat hoti hai, pehli candle long bullish hoti hai our phir pehli aur dusri flame ke darmian hole down hota hai, us ke badh dusri candle long negative marubozu ho gi, is design ki reliabiliy be candles ki lambai standard depend karti hai, lakin is signal sa exchange open aur exit nhi karni chahiye ye sirf aik conceivable forthcoming inversion ka sign ho sakta hai. Is ki tasdeek ke liye next candles ki shapes standard depend karna parta hai. Kicker Candle Example Ko Samajna: Dear Sisters and Siblings Je kicker Candle Example ko samajna merchant ke liye bohot zaruri hai ye market mama punch seem hota hai to ye market ke opinions ko he change kar deta hai. Or then again ye itna strong hota hai ke pattern ko completly turn around kar deta hai. Merchant ko punch es design ki information ho gi to usko benefit hasil karny mama dair ni lagy gi. -

#23 Collapse

Introduction: Dear friends umeed hay k AP sab thk hon gay.aj Jo AP nay post share ki hy wo bhot he eham hay aor kicker candle stick pattern k bary main mazeed main AP say kuch maloomat share kroon ga .umeed hy apko phar k is say bhot faida ho ga Definition: Kicker pattern aik do baar wala candle stuck pattern hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. Yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. Understanding of kicker pattern: stock market musabiqati kharidaron ( bail ) aur baichnay walay ( balow ) ki khasusiyat rakhti hai. un khiladion ke darmiyan jung ki musalsal kashmakash wohi hai jo mom btyon ke namoonay banati hai. candle stick charting ki ibtida Japan mein 1700 ki dahai mein tayyar ki gayi aik taknik se hui jis mein chawal ki qeemat ka pata lagaya gaya. mom batian kisi bhi maya maliyati asasay jaisay stock, future aur ghair mulki currency ki tijarat ke liye aik mozoon taknik hain . Working of kicker candle stick pattern: Kicker pattern ko sab se ziyada qabil aetmaad reversal pattern mein se aik samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karta hai. kukkar patteren aik ulat palat pattern hai, aur yeh aik gape pattern se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur is rujhan mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik ka matlab kuch mukhtalif hota hai . Kicker pattern ka musahida karne walay taajiron ko, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir –apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay jab unhon ne asal mein kukkar patteren ki nishandahi ki ho . Agarchay kicker pattern ko mazboot bail ya reechh ke jazbati isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se ziyada radd amal zahir nahi karte hain. taham, agar aur jab kukkar patteren khud ko paish karta hai, to money manager fori notice letay hain. Kicker pattern takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hai. is ki mutabqat is waqt barh jati hai jab yeh ziyada kharidi hui ya ziyada farokht shuda marketon mein hoti hai. pattern ke peechay do mom batian nazar anay wali ahmiyat rakhti hain. Pehli mom batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mom batii pichlle din ke isi khulay par khulti hai ( aik khalaa khula sun-hwa ) aur phir pichlle din ki mom batii ke mukhalif simt mein jata hai. mom btyon ke jism bohat se tijarti plate forms par mukhalif rang ke hotay hain, jo sarmaya karon ke jazbaat mein dramayi tabdeeli ka aik rangeen display banatay hain. kyunkay kicker pattern sarmaya karon ke ravayye mein numaya tabdeeli ke baad hi hota hai. Isharay ka aksar market psychology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai . bearish kicker candle stick pattern for example: bearish kukkar candle stuck chart pattern ki is waqt ziyada hoti hai jab yeh up trained par bantaa hai ya ziyada khareeday hue ilaqay mein bantaa hai . din 1 par, aik candle stick oopar ka rujhan jari rakhti hai aur is wajah se fitrat mein taizi hai. jab up trained mein bantaa hai to is ki apni koi ahmiyat nahi hoti . din 2 par, aik bearish candle stick namodaar hoti hai. candle stick isi qeemat par khulti hai jis terhan pichlle din ( ya aik waqfa neechay ) aur phir din 1 candle ke mukhalif simt mein jata hai. is pattern ke durust honay ke liye, dosray din ki mom batii pehlay din ki mom batii se kam ya is se neechay khlni chahiye. tajir aam tor par tawaqqa karte hain ke dosray din ki mom batii se pehlay aik waqfa kam honay se dosray din honay ke baad qeematon mein kami ke imkanaat barh jayen ge . candle stick isi qeemat par khulti hai jis terhan pichlle din ( ya aik waqfa neechay ) aur phir din 1 candle ke mukhalif simt mein jata hai. is pattern ke durust honay ke liye, dosray din ki mom batii pehlay din ki mom batii se kam ya is se neechay khlni chahiye. tajir aam tor par tawaqqa karte hain ke dosray din ki mom batii se pehlay aik waqfa kam honay se dosray din honay ke baad qeematon mein kami ke imkanaat barh jayen ge . candle stick isi qeemat par khulti hai jis terhan pichlle din ( ya aik waqfa neechay ) aur phir din 1 candle ke mukhalif simt mein jata hai. is pattern ke durust honay ke liye, dosray din ki mom batii pehlay din ki mom batii se kam ya is se neechay khlni chahiye. tajir aam tor par tawaqqa karte hain ke dosray din ki mom batii se pehlay aik waqfa kam honay se dosray din honay ke baad qeematon mein kami ke imkanaat barh jayen ge . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#24 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction:Dear friends umeed hay k AP sab thk hon gay.aj Jo AP nay post share ki hy wo bhot he eham hay aor kicker candle stick pattern k bary main mazeed main AP say kuch maloomat share kroon ga .umeed hy apko phar k is say bhot faida ho gaDefinition:Kicker pattern aik do baar wala candle stuck pattern hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai .Understanding of kicker pattern:stock market musabiqati kharidaron ( bail ) aur baichnay walay ( balow ) ki khasusiyat rakhti hai. un khiladion ke darmiyan jung ki musalsal kashmakash wohi hai jo mom btyon ke namoonay banati hai. candle stick charting ki ibtida Japan mein 1700 ki dahai mein tayyar ki gayi aik taknik se hui jis mein chawal ki qeemat ka pata lagaya gaya. mom batian kisi bhi maya maliyati asasay jaisay stock, future aur ghair mulki currency ki tijarat ke liye aik mozoon taknik hain .Working of kicker candle stick pattern:Kicker pattern ko sab se ziyada qabil aetmaad reversal patteren mein se aik samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karta hai. kukkar patteren aik ulat palat pattern hai, aur yeh aik gape pattern se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur is rujhan mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik ka matlab kuch mukhtalif hota hai .Kicker pattern ka mushahida karne walay taajiron ko, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir –apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay jab unhon ne asal mein kukkar patteren ki nishandahi ki ho .agarchay kicker pattern ko mazboot bail ya reechh ke jazbati isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se ziyada radd amal zahir nahi karte hain. taham, agar aur jab kukkar patteren khud ko paish karta hai, to money manager fori notice letay hain .Kicker pattern takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hai. is ki mutabqat is waqt barh jati hai jab yeh ziyada kharidi hui ya ziyada farokht shuda marketon mein hoti hai. pattern ke peechay do mom batian nazar anay wali ahmiyat rakhti hain. pehli mom batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mom batii pichlle din ke isi khulay par khulti hai ( aik khalaa khula sun-hwa ) aur phir pichlle din ki mom batii ke mukhalif simt mein jata hai .mom btyon ke jism bohat se tijarti plate forms par mukhalif rang ke hotay hain, jo sarmaya karon ke jazbaat mein dramayi tabdeeli ka aik rangeen display banatay hain. kyunkay kicker pattern sarmaya karon ke ravayye mein numaya tabdeeli ke baad hi hota hai. isharay ka aksar market psycology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai .bearish kicker candle stick pattern for example:bearish kukkar candle stuck chart pattern ki is waqt ziyada hoti hai jab yeh up trained par bantaa hai ya ziyada khareeday hue ilaqay mein bantaa hai .din 1 par, aik candle stick oopar ka rujhan jari rakhti hai aur is wajah se fitrat mein taizi hai. jab up trained mein bantaa hai to is ki apni koi ahmiyat nahi hoti .din 2 par, aik bearish candle stick namodaar hoti hai. candle stick isi qeemat par khulti hai jis terhan pichlle din ( ya aik waqfa neechay ) aur phir din 1 candle ke mukhalif simt mein jata hai. is pattern ke durust honay ke liye, dosray din ki mom batii pehlay din ki mom batii se kam ya is se neechay khlni chahiye. tajir aam tor par tawaqqa karte hain ke dosray din ki mom batii se pehlay aik waqfa kam honay se dosray din honay ke baad qeematon mein kami ke imkanaat barh jayen ge .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:25 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим