Harmonic Patterns In Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

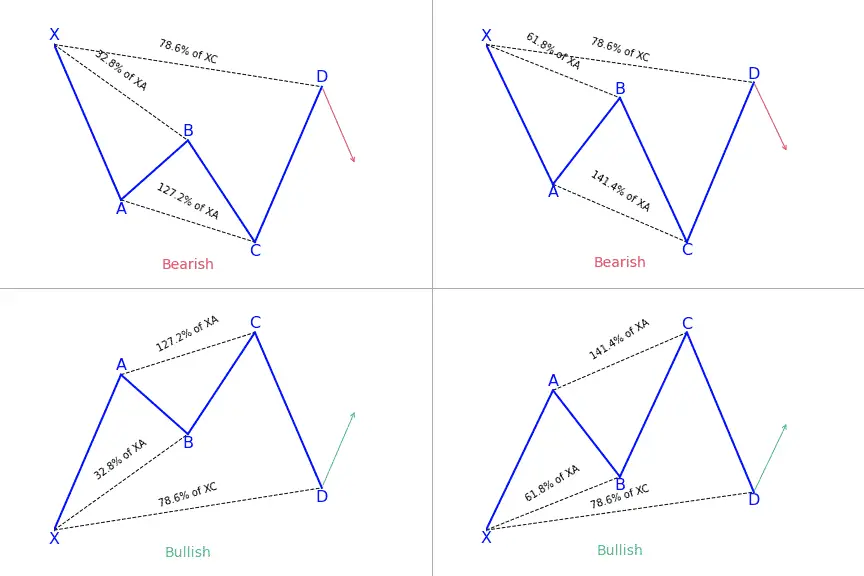

Harmonic patterns forex trading mein aik dilchasp aur advanced technical analysis ki qisam hain jo traders ko market mein mukhalif mein palatne ki mumkin wakaat ko pehchanne mein madadgar sabit ho sakti hain. Ye patterns price harmonics ke concept par mabni hain, jo yeh kehta hai ke finance market mein price movements aksar khas geometry patterns aur ratios ko manti hain. Traders jo harmonic patterns ko samajhte hain aur pehchan sakte hain, woh potential trend reversals ko pehchanne mein madadgar insights hasil kar sakte hain aur ziada soch samajh kar trading decisions le sakte hain. Origins of Harmonic Patterns Harmonic patterns pehli martaba trading ke dunia mein H.M. Gartley ke 1935 mein shaya kardah kitab Profits in the Stock Market se aaien. Gartley ki is kitab ne price movements aur geometric patterns ke darmiyan taaluqat samajhne ke liye bunyad rakhi. Saalon ke doran, mukhtalif traders aur analysts ne Gartley ke khayalat par izafa kia, jo forex aur doosre finance markets mein aaj istemal hone wale mukhtalif harmonic patterns ke vikas ka raasta banaya. The Nature of Harmonic Patterns Harmonic patterns asal mein price charts par aane wale complex geometry structures hain. Ye patterns khas Fibonacci ratios par mabni hote hain, jo Fibonacci sequence se hasil hote hain - ek mathematical sequence jahan har number do peechle numbers ka jama hota hai (for example, 0, 1, 1, 2, 3, 5, 8, 13, 21, aur isi tarah). Harmonic patterns mein istemal hone wale ahem Fibonacci ratios mein 0.618, 1.618, 2.618, 3.618, aur unke inverse, 0.382 shamil hain. Forex trading mein do primary types ke harmonic patterns hain, Gartley pattern aur Butterfly pattern. In patterns ko specific price levels ko jorne wale lines aur points ke concept par banaya jata hai. Upar diye gaye Fibonacci ratios un points ke darmiyan relationship ko determine karne mein istemal hote hain. Bat pattern, Crab pattern, aur Shark pattern jaise doosre harmonic patterns, Gartley aur Butterfly patterns ke variations aur extensions hain.

The Nature of Harmonic Patterns Harmonic patterns asal mein price charts par aane wale complex geometry structures hain. Ye patterns khas Fibonacci ratios par mabni hote hain, jo Fibonacci sequence se hasil hote hain - ek mathematical sequence jahan har number do peechle numbers ka jama hota hai (for example, 0, 1, 1, 2, 3, 5, 8, 13, 21, aur isi tarah). Harmonic patterns mein istemal hone wale ahem Fibonacci ratios mein 0.618, 1.618, 2.618, 3.618, aur unke inverse, 0.382 shamil hain. Forex trading mein do primary types ke harmonic patterns hain, Gartley pattern aur Butterfly pattern. In patterns ko specific price levels ko jorne wale lines aur points ke concept par banaya jata hai. Upar diye gaye Fibonacci ratios un points ke darmiyan relationship ko determine karne mein istemal hote hain. Bat pattern, Crab pattern, aur Shark pattern jaise doosre harmonic patterns, Gartley aur Butterfly patterns ke variations aur extensions hain.  Identifying Harmonic Patterns Harmonic patterns ko kamiyabi se pehchanne aur trade karna, traders ko samajhna hoga ke ye patterns kaise banaye jate hain aur unke khaas characteristics ko pehchanne ka tareeqa. Yahan pehchanne ke amal ki kuch steps diye gaye hain:

Identifying Harmonic Patterns Harmonic patterns ko kamiyabi se pehchanne aur trade karna, traders ko samajhna hoga ke ye patterns kaise banaye jate hain aur unke khaas characteristics ko pehchanne ka tareeqa. Yahan pehchanne ke amal ki kuch steps diye gaye hain:- Swing Points: Sab se pehle, traders ko price chart mein ahem swing points ko pehchan na hoga. Swing points price trend mein buland aur kam tarin points hote hain. Ye points harmonic patterns banane ke liye bunyad banate hain.

- Fibonacci Retracement: Swing points ko pehchanne ke baad, traders Fibonacci retracement levels ka istemal kar ke price move ki retracement ko napte hain. Sab se aam istemal hone wale retracement levels 0.618 aur 0.382 hain. Ye levels potential reversal zones ko determine karne mein madadgar hote hain.

- Fibonacci Extensions: Jab retracement levels establish ho jate hain, traders Fibonacci extension levels jaise ke 1.618, 2.618, aur 3.618 ko pehchanne mein madadgar hote hain. Ye levels potential reversal points ko pehchanne mein madad dete hain jahan price ki direction tabdeel hone ke imkanat hain.

- Pattern Ratios: Harmonic patterns ke alag alag components ke darmiyan specific ratios hote hain. For example, Gartley pattern mein AB leg XA leg ka 0.618 hona chahiye, jabke CD leg XA leg ka 0.786 hona chahiye. Traders in ratios ko ek harmonic pattern ke mojud hone ki tasdeeq ke liye istemal karte hain.

- Pattern Completion: Jab sari zaroori components maujood hain, traders pattern ko complete hone ka muntazir rehte hain jab price specific Fibonacci levels tak pohanchta hai. Jab price ye levels pohanchta hai, is se potential reversal point ki ishara hota hai.

Types of Harmonic Patterns Gartley Pattern Gartley pattern ek sab se mashhoor harmonic pattern hai. Is mein chaar mukhtalif legs hoti hain: XA, AB, BC, aur CD. Gartley pattern ke ahem ratios ye hain:

Types of Harmonic Patterns Gartley Pattern Gartley pattern ek sab se mashhoor harmonic pattern hai. Is mein chaar mukhtalif legs hoti hain: XA, AB, BC, aur CD. Gartley pattern ke ahem ratios ye hain:- AB XA ke 0.618 hona chahiye.

- BC AB ke 0.382 hona chahiye.

- CD XA ke 1.618 hona chahiye.

- Gartley pattern ek potential reversal ki ishara deta hai jab price CD leg ko XA leg ke 1.618 Fibonacci extension level par complete karta hai.

- AB XA ke 0.786 hona chahiye.

- BC AB ke 0.618 hona chahiye.

- CD XA ke 1.618 hona chahiye.

- EF CD ke 0.786 hona chahiye.

- Butterfly pattern ek potential reversal ki ishara deta hai jab price EF leg ko CD leg ke 0.786 Fibonacci extension level par complete karta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:13 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим