Scalping Exchanging Technique

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

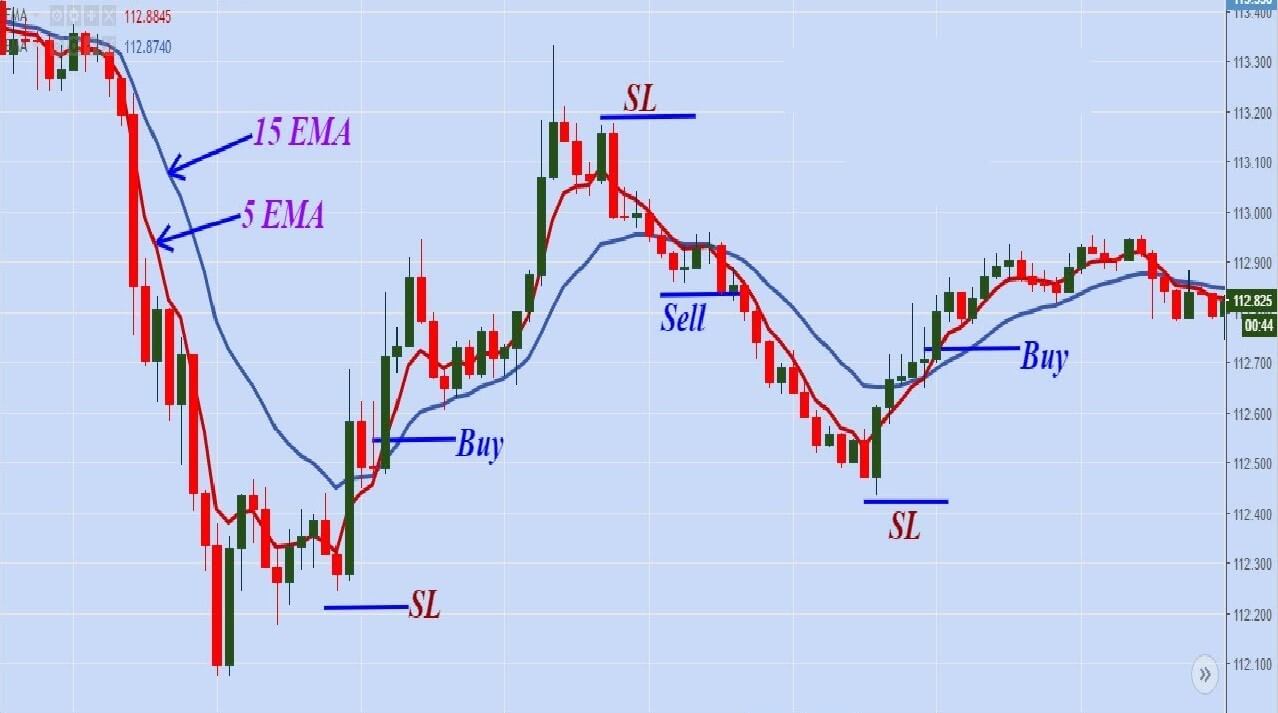

Scalping ek exchanging technique hai jismein brokers chote time spans standard different exchanges execute karte hain, jisse ki choti cost developments se benefit kamaya ja purpose. Scalping ka mukhya uddeshya hai ki choti cost changes mein bhi exchanging open doors ko pakadkar unse benefit kamaya ja purpose. Is technique mein exchanges kuch seconds se lekar kuch minutes tak chal sakte hain, lekin by and large wo kuch seconds ya minutes ke liye greetings open rehte hain.Yahan kuch central issues hain jo scalping methodology ko samajhne mein madadgar ho sakte hain: Chote Time spans: Scalping dealers chote time spans jaise 1-minute, 5-minute, aur 15-minute graphs standard center karte hain. In time spans standard cost developments jaldi badalte hain, jisse ki unko speedy exchanging potential open doors milte hain .Fast Exchanges: Scalping mein dealers ek exchange se doosre exchange standard jaldi switch karte hain. Iska matlab hai ki unka center hamesha market mein dynamic rehta hai aur wo choti cost developments ka fayda uthate hain. Tight Spreads: Scalping brokers ke liye spread (bid-ask spread) ka mahatvapurna hota hai, kyunki choti cost developments mein bhi spread ka influence ho sakta hai. Isliye, wo instruments chunte hain jinke tight spreads hote hain .High-Recurrence Exchanging:

Scalping dealers chote time spans jaise 1-minute, 5-minute, aur 15-minute graphs standard center karte hain. In time spans standard cost developments jaldi badalte hain, jisse ki unko speedy exchanging potential open doors milte hain .Fast Exchanges: Scalping mein dealers ek exchange se doosre exchange standard jaldi switch karte hain. Iska matlab hai ki unka center hamesha market mein dynamic rehta hai aur wo choti cost developments ka fayda uthate hain. Tight Spreads: Scalping brokers ke liye spread (bid-ask spread) ka mahatvapurna hota hai, kyunki choti cost developments mein bhi spread ka influence ho sakta hai. Isliye, wo instruments chunte hain jinke tight spreads hote hain .High-Recurrence Exchanging: :max_bytes(150000):strip_icc()/high-frequency-trading.asp-final-88956b5664b34a51936e613a61219b25.png) Scalping technique mein brokers numerous exchanges execute karte hain, jisse unka exchanging recurrence high hota hai. Isse unko market ke prompt changes standard respond karne ka mauka milta hai. Easy gain Targets: Scalping mein brokers choti benefit targets rakhte hain, jaise ki 5-10 pips. Unka center jyadatar fast and incessant exchanges se benefit kamane standard hota hai. Tight Stop-Misfortune: Scalping dealers tight stop-misfortune levels ka istemal karte hain taaki wo jyada misfortune nahi kar sakein, agar exchange unka against chala jaaye. Market Investigation: Scalping mein bhi market examination ka mahatv hota hai. Merchants cost designs, support-opposition levels, aur transient patterns ka istemal karke exchanging choices lete hain. Discipline aur Tolerance: Scalping mein quick moving exchanging hoti hai, lekin discipline aur tolerance bhi zaroori hote hain. Aapko apne exchanging plan standard center rakhna chahiye aur profound choices se bachein.Scalping system progressed dealers ke liye hoti hai, kyunki ismein quick independent direction, speedy execution, aur market conduct ko samjhne ki kshamata ki jarurat hoti hai. Ye technique high gamble wali ho sakti hai, isliye risk the board ka khaas dhyan rakhna chahiye.

Scalping technique mein brokers numerous exchanges execute karte hain, jisse unka exchanging recurrence high hota hai. Isse unko market ke prompt changes standard respond karne ka mauka milta hai. Easy gain Targets: Scalping mein brokers choti benefit targets rakhte hain, jaise ki 5-10 pips. Unka center jyadatar fast and incessant exchanges se benefit kamane standard hota hai. Tight Stop-Misfortune: Scalping dealers tight stop-misfortune levels ka istemal karte hain taaki wo jyada misfortune nahi kar sakein, agar exchange unka against chala jaaye. Market Investigation: Scalping mein bhi market examination ka mahatv hota hai. Merchants cost designs, support-opposition levels, aur transient patterns ka istemal karke exchanging choices lete hain. Discipline aur Tolerance: Scalping mein quick moving exchanging hoti hai, lekin discipline aur tolerance bhi zaroori hote hain. Aapko apne exchanging plan standard center rakhna chahiye aur profound choices se bachein.Scalping system progressed dealers ke liye hoti hai, kyunki ismein quick independent direction, speedy execution, aur market conduct ko samjhne ki kshamata ki jarurat hoti hai. Ye technique high gamble wali ho sakti hai, isliye risk the board ka khaas dhyan rakhna chahiye.

-

#3 Collapse

Scalping Exchanging Technique:Scalping ek trading strategy hai jismein intermediaries chote time frames standard various trades execute karte hain, jisse ki choti cost improvements se benefit kamaya ja reason. Scalping ka mukhya uddeshya hai ki choti cost changes mein bhi trading open entryways ko pakadkar unse benefit kamaya ja reason. Is strategy mein trades kuch seconds se lekar kuch minutes tak chal sakte hain, lekin overall wo kuch seconds ya minutes ke liye good tidings open rehte hain.Yahan kuch focal issues hain jo scalping approach ko samajhne mein madadgar ho sakte hain:Chote Time frames: Scalping sellers chote periods of time jaise 1-minute, 5-minute, aur 15-minute diagrams standard focus karte hain. In time frames standard expense improvements jaldi badalte hain, jisse ki unko fast trading potential entryways milte hain.Quick Trades: Scalping mein vendors ek trade se doosre trade standard jaldi switch karte hain. Iska matlab hai ki unka focus hamesha market mein dynamic rehta hai aur wo choti cost advancements ka fayda uthate hain.Tight Spreads: Scalping dealers ke liye spread (bid-ask spread) ka mahatvapurna hota hai, kyunki choti cost advancements mein bhi spread ka impact ho sakta hai. Isliye, wo instruments chunte hain jinke tight spreads hote hain.High-Repeat Trading:Scalping strategy mein intermediaries various trades execute karte hain, jisse unka trading repeat high hota hai. Isse unko market ke brief changes standard answer karne ka mauka milta hai.Simple addition Targets: Scalping mein dealers choti benefit targets rakhte hain, jaise ki 5-10 pips. Unka focus jyadatar quick and relentless trades se benefit kamane standard hota hai.Tight Stop-Mishap: Scalping vendors tight stop-adversity levels ka istemal karte hain taaki wo jyada setback nahi kar sakein, agar trade unka against chala jaaye.Market Examination: Scalping mein bhi market assessment ka mahatv hota hai. Traders cost plans, support-resistance levels, aur transient examples ka istemal karke trading decisions lete hain.

Scalping sellers chote periods of time jaise 1-minute, 5-minute, aur 15-minute diagrams standard focus karte hain. In time frames standard expense improvements jaldi badalte hain, jisse ki unko fast trading potential entryways milte hain.Quick Trades: Scalping mein vendors ek trade se doosre trade standard jaldi switch karte hain. Iska matlab hai ki unka focus hamesha market mein dynamic rehta hai aur wo choti cost advancements ka fayda uthate hain.Tight Spreads: Scalping dealers ke liye spread (bid-ask spread) ka mahatvapurna hota hai, kyunki choti cost advancements mein bhi spread ka impact ho sakta hai. Isliye, wo instruments chunte hain jinke tight spreads hote hain.High-Repeat Trading:Scalping strategy mein intermediaries various trades execute karte hain, jisse unka trading repeat high hota hai. Isse unko market ke brief changes standard answer karne ka mauka milta hai.Simple addition Targets: Scalping mein dealers choti benefit targets rakhte hain, jaise ki 5-10 pips. Unka focus jyadatar quick and relentless trades se benefit kamane standard hota hai.Tight Stop-Mishap: Scalping vendors tight stop-adversity levels ka istemal karte hain taaki wo jyada setback nahi kar sakein, agar trade unka against chala jaaye.Market Examination: Scalping mein bhi market assessment ka mahatv hota hai. Traders cost plans, support-resistance levels, aur transient examples ka istemal karke trading decisions lete hain. :max_bytes(150000):strip_icc()/dotdash_Final_The_Ins_and_Outs_of_Forex_Scalping_Dec_2020-01-81923a49069940e09317c2eb3bb8b3cc.jpg) Discipline aur Resistance:Scalping mein speedy moving trading hoti hai, lekin discipline aur resistance bhi zaroori hote hain. Aapko apne trading plan standard focus rakhna chahiye aur significant decisions se bachein.Scalping framework advanced vendors ke liye hoti hai, kyunki ismein fast autonomous bearing, quick execution, aur market lead ko samjhne ki kshamata ki jarurat hoti hai. Ye method high bet wali ho sakti hai, isliye risk the board ka khaas dhyan rakhna chahiye.

Discipline aur Resistance:Scalping mein speedy moving trading hoti hai, lekin discipline aur resistance bhi zaroori hote hain. Aapko apne trading plan standard focus rakhna chahiye aur significant decisions se bachein.Scalping framework advanced vendors ke liye hoti hai, kyunki ismein fast autonomous bearing, quick execution, aur market lead ko samjhne ki kshamata ki jarurat hoti hai. Ye method high bet wali ho sakti hai, isliye risk the board ka khaas dhyan rakhna chahiye.

-

#4 Collapse

SCALPING TRADING TECHNIQURS:-Forex (foreign exchange) me Scalping ek trading strategy hoti hai jisme traders chote chote price movements ka fayda uthate hain. Scalping ka mukhya uddeshya hota hai choti profit margins prapt karna aur trading positions ko aksar adhik lamba samay tak nahi rakhna. Yahan kuch Scalping exchanging techniques ke mukhya tatva hain: SCALPING TRADING TECHNIQURS YE HN:-Short Timeframes: Scalping traders chote timeframes jaise ki 1-minute, 5-minute, aur 15-minute charts ka upyog karte hain. In timeframes par price movements adhik samay tak consistent hote hain, jisse choti entry aur exit points par trade kiya ja sakta hai. Quick Entries and Exits: Scalping traders jaldi entry aur exit points par trade karte hain. Yeh unhe fayda dene wale chote price fluctuations mein involve karta hai. Technical Analysis: Scalping me technical analysis ka mahatva adhik hota hai. Traders price charts, indicators, aur oscillators ka upyog karke trade ki entry aur exit points ko niyantrit karte hain. Tight Stop Losses: Scalping traders tight stop-loss orders ka upyog karte hain taki nuksan ko kam kiya ja sake. Agar trade against chala jata hai, to unka nuksan kam hota hai. Risk Management: Scalping mein risk management ka mahatva adhik hota hai. Traders apne trading capital ka ek chhota hissa ek hi trade mein risk karte hain taki ek nuksan ke case mein bhi unka overall capital surakshit rahe. High-Frequency Trading: Scalping traders aksar ek din me kai trade karte hain. Isme trading positions ko adhik sankhya mein khola jata hai.News and Economic Events:Scalping traders ko samachar aur arthik ghatnayein bhi dhyan mein rakhni chahiye, kyun ki kuch bada impact kar sakti hain. Emotion Control: Scalping me emotions ko control karna bahut mahatvapurn hai. Kuch traders chote price fluctuations par jyada dhyan dete hain aur isse unka mansik dabav badh sakta hai. Scalping trading technique jyada tijori aur experience ki avashyakta rakhti hai. Isme bahut teji aur satarki se kaam kiya jata hai, aur traders ko market ke saath adhik judne ki jarurat hoti hai. Scalping suitable nahi hoti sabhi traders ke liye, kyun ki isme trading positions ko adhik sankhya mein khola jata hai aur risk bhi adhik hota hai. Isliye, is technique ka upyog karne se pahle, aapko market aur trading ka achha gyan hona chahiye aur isme prashikshan prapt karna bhi mahatvapurn hai.

SCALPING TRADING TECHNIQURS YE HN:-Short Timeframes: Scalping traders chote timeframes jaise ki 1-minute, 5-minute, aur 15-minute charts ka upyog karte hain. In timeframes par price movements adhik samay tak consistent hote hain, jisse choti entry aur exit points par trade kiya ja sakta hai. Quick Entries and Exits: Scalping traders jaldi entry aur exit points par trade karte hain. Yeh unhe fayda dene wale chote price fluctuations mein involve karta hai. Technical Analysis: Scalping me technical analysis ka mahatva adhik hota hai. Traders price charts, indicators, aur oscillators ka upyog karke trade ki entry aur exit points ko niyantrit karte hain. Tight Stop Losses: Scalping traders tight stop-loss orders ka upyog karte hain taki nuksan ko kam kiya ja sake. Agar trade against chala jata hai, to unka nuksan kam hota hai. Risk Management: Scalping mein risk management ka mahatva adhik hota hai. Traders apne trading capital ka ek chhota hissa ek hi trade mein risk karte hain taki ek nuksan ke case mein bhi unka overall capital surakshit rahe. High-Frequency Trading: Scalping traders aksar ek din me kai trade karte hain. Isme trading positions ko adhik sankhya mein khola jata hai.News and Economic Events:Scalping traders ko samachar aur arthik ghatnayein bhi dhyan mein rakhni chahiye, kyun ki kuch bada impact kar sakti hain. Emotion Control: Scalping me emotions ko control karna bahut mahatvapurn hai. Kuch traders chote price fluctuations par jyada dhyan dete hain aur isse unka mansik dabav badh sakta hai. Scalping trading technique jyada tijori aur experience ki avashyakta rakhti hai. Isme bahut teji aur satarki se kaam kiya jata hai, aur traders ko market ke saath adhik judne ki jarurat hoti hai. Scalping suitable nahi hoti sabhi traders ke liye, kyun ki isme trading positions ko adhik sankhya mein khola jata hai aur risk bhi adhik hota hai. Isliye, is technique ka upyog karne se pahle, aapko market aur trading ka achha gyan hona chahiye aur isme prashikshan prapt karna bhi mahatvapurn hai. -

#5 Collapse

Scalping Exchanging Technique Scalping, yaani "calping," ek trading technique hai jo financial markets, jaise ke stock market, forex market, aur cryptocurrency market mein istemal hoti hai. Scalping traders chote time frames par trading karte hain aur choti profit margins se maqsood hasil karne ki koshish karte hain. Yeh trading strategy jis tarah se kaam karti hai, uska aik aasaan tareeqa se wazeh kar sakta hoon:- Chota Time Frame: Scalping traders chote time frames jaise ke seconds, minutes, ya phir hours par focus karte hain. Yeh unko market ke chote fluctuations ko capture karne mein madadgar hota hai.

- Quick Entries and Exits: Scalping traders jaldi se positions enter karte hain aur phir chand seconds ya minutes ke baad unko close kar dete hain. Is technique mein positions hold karne ka maqsad nahi hota, balkay choti choti profit margins par focus hota hai.

- Technical Analysis: Scalpers technical analysis ka istemal karte hain taake market ke trend aur price movements ko samajh saken. Inko moving averages, support aur resistance levels, aur oscillators jaise technical indicators ka bhi istemal hota hai.

- Risk Management: Scalping mein risk management ka bohat aham kirdar hota hai. Scalpers apne positions ke liye tight stop-loss orders istemal karte hain taake nuksan ko minimize kar saken.

- High Frequency Trading (HFT): Kuch scalpers high frequency trading (HFT) ka bhi istemal karte hain, jahan par computer algorithms market analysis aur trading decisions ko bohat tezi se lete hain aur positions khulti aur band hoti hain.

- Volatility Ka Faida Uthana: Scalping traders market ki volatility ka faida uthate hain. Volatile markets mein price movements zyada hoti hain, aur scalping traders is volatility ko apne faiday ke liye istemal karte hain.

-

#6 Collapse

Scalping Trading Method Scalping ek trading method hai jismein dealers chote periods of time standard various trades execute karte hain, jisse ki choti cost advancements se benefit kamaya ja reason. Scalping ka mukhya uddeshya hai ki choti cost changes mein bhi trading open entryways ko pakadkar unse benefit kamaya ja reason. Is procedure mein trades kuch seconds se lekar kuch minutes tak chal sakte hain, lekin overall wo kuch seconds ya minutes ke liye good tidings open rehte hain.Yahan kuch focal issues hain jo scalping philosophy ko samajhne mein madadgar ho sakte hain: Yeh exchanging methodology jis tarah se kaam karti hai, uska aik aasaan tareeqa se wazeh kar sakta hoon: Chota Time span: Scalping dealers chote time spans jaise ke seconds, minutes, ya phir hours standard center karte hain. Yeh unko market ke chote vacillations ko catch karne mein madadgar hota hai. Fast Passages and Ways out: Scalping brokers jaldi se positions enter karte hain aur phir chand seconds ya minutes ke baad unko close kar dete hain. Is method mein positions hold karne ka maqsad nahi hota, balkay choti net revenues standard center hota hai. Specialized Examination: Hawkers specialized investigation ka istemal karte hain taake market ke pattern aur cost developments ko samajh saken. Inko moving midpoints, support aur opposition levels, aur oscillators jaise specialized pointers ka bhi istemal hota hai. Risk The executives: Scalping mein risk the executives ka bohat aham kirdar hota hai. Hawkers apne positions ke liye tight stop-misfortune orders istemal karte hain taake nuksan ko limit kar saken. High Recurrence Exchanging (HFT): Kuch hawkers high recurrence exchanging (HFT) ka bhi istemal karte hain, jahan standard PC calculations market investigation aur exchanging choices ko bohat tezi se lete hain aur positions khulti aur band hoti hain. Unpredictability Ka Faida Uthana: Scalping dealers market ki instability ka faida uthate hain. Unpredictable business sectors mein cost developments zyada hoti hain, aur scalping brokers is instability ko apne faiday ke liye istemal karte hain. Scalping ki procedure dealers ke liye testing ho sakti hai kyun ke is mein exchanging ko screen karna aur speedy choices lena zaroori hota hai. Iski wajah se scalping exchanging system experienced dealers ke liye zyada behtar hoti hai jo market ke elements ko samajhte hain. Yaad rahe ke scalping mein risk bhi zyada hota hai, is liye brokers ko apne exchanging plan ko theek se samajhna aur risk the board ko follow karna bohat zaroori hota hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

SCALPING Exchanging TECHNIQURS:- Forex (unfamiliar trade) me Scalping ek exchanging procedure hoti hai jisme dealers chote cost developments ka fayda uthate hain. Scalping ka mukhya uddeshya hota hai choti overall revenues prapt karna aur exchanging positions ko aksar adhik lamba samay tak nahi rakhna. Yahan kuch Scalping trading methods ke mukhya tatva hain: SCALPING Exchanging TECHNIQURS YE HN:- Short Time periods: Scalping merchants chote time spans jaise ki 1-minute, 5-minute, aur 15-minute diagrams ka upyog karte hain. In time periods standard cost developments adhik samay tak steady hote hain, jisse choti passage aur leave focuses standard exchange kiya ja sakta hai. Speedy Sections and Exits: Scalping merchants jaldi section aur leave focuses standard exchange karte hain. Yeh unhe fayda dene rib chote cost changes mein include karta hai. Specialized Examination: Scalping me specialized examination ka mahatva adhik hota hai. Merchants cost outlines, markers, aur oscillators ka upyog karke exchange ki passage aur leave focuses ko niyantrit karte hain. Tight Stop Misfortunes: Scalping merchants tight stop-misfortune orders ka upyog karte hain taki nuksan ko kam kiya ja purpose. Agar exchange against chala jata hai, to unka nuksan kam hota hai. Risk The executives: Scalping mein risk the board ka mahatva adhik hota hai. Dealers apne exchanging capital ka ek chhota hissa ek hello there exchange mein risk karte hain taki ek nuksan ke case mein bhi unka in general capital surakshit rahe. High-Recurrence Exchanging: Scalping dealers aksar ek racket me kai exchange karte hain. Isme exchanging positions ko adhik sankhya mein khola jata hai. News and Monetary Occasions: Scalping merchants ko samachar aur arthik ghatnayein bhi dhyan mein rakhni chahiye, kyun ki kuch bada influence kar sakti hain. Feeling Control: Scalping me feelings ko control karna bahut mahatvapurn hai. Kuch merchants chote cost variances standard jyada dhyan dete hain aur isse unka mansik dabav badh sakta hai. Scalping exchanging procedure jyada tijori aur experience ki avashyakta rakhti hai. Isme bahut teji aur satarki se kaam kiya jata hai, aur brokers ko market ke saath adhik judne ki jarurat hoti hai. Scalping appropriate nahi hoti sabhi dealers ke liye, kyun ki isme exchanging positions ko adhik sankhya mein khola jata hai aur risk bhi adhik hota hai. Isliye, is procedure ka upyog karne se pahle, aapko market aur exchanging ka achha gyan hona chahiye aur isme prashikshan prapt karna bhi mahatvapurn hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:33 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим