Matching Low Candlesticks Pattren.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

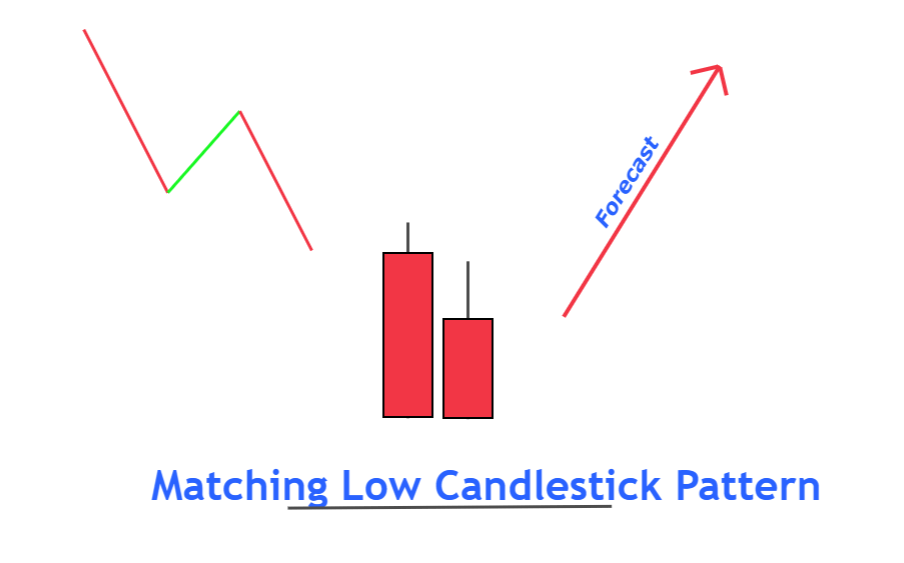

Assalamu Alaikum dear friend kaise hain Sab ummid Karti hun khairiyat se Honge aur Apna Achcha kam kar rahe Honge Jab aap is market Mein kam karte hain to aapko daily basis per Apna target complete karna hota hai aur acchi strategis ke sath kam karna hota hai agar aap is market Mein proper hard work ke sath kam Karenge aur Market ko acche tarike se judgement Karenge to aapko is market mein bahut hi fayda Milega aapko Hamesha Koshish Karna Hogi kya aap is market Mein successful trading karne ke liye Hamesha market ko time de aur Jyada Se Jyada hard work Karen Taki aapko is market Mein Achcha result Mile main aaj aapse bahut hi important information discuss karungi jo aapki trading ko Achcha result de sakti hai to Mera topic hai matching low candles take pattern kya hai. Matching Low Candlestick Pattren: Matching Low Candlestick Pattern ek technical analysis pattern hai jo traders istemal karte hain taake woh price trends ke baray mein behtar faislay kar saken. Yeh pattern jab aik downtrend mein hota hai toh banta hai aur ismein do mukhtalif consecutive candlesticks shamil hote hain. Formation Of Matching Low Candlestick Pattren: Is pattern ki khasoosiyat yeh hoti hai ke yeh downtrend ke daur mein aksar ata hai aur ismein do candlesticks hoti hain. Dono candlesticks ki khas baat yeh hoti hai ke dusri candle pehli candle ke sath barabar ya qareeb barabar closing karti hai. Iska matlab hai ke bearish traders ke dabaav mein kami aagai hai aur buyers ne koshish shuru ki hai ke price ko ooper le jayen. Trading Strategy: Trading strategy ke liye, traders aksar is pattern ki tasdeek ke liye intezaar karte hain, jaise ke Matching Low pattern ke baad aik bullish candle ki tasdeek. Iske ilawa, traders stop-loss orders pattern ke low ke neechay lagate hain aur price ke urooj hone par target set karte hain. Is pattern ko samajhna trading mein ahem hota hai kyunki yeh reversals ko pehchanne mein madadgar hota hai. Traders is pattern ki tasdeek ke liye aksar aik bullish candle ki tasdeek ka intezaar karte hain, jo Matching Low pattern ke baad aati hai. Iske ilawa, traders apne positions ko protect karne ke liye stop-loss orders istemal karte hain jo pattern ke low ke neechay lagte hain. Conclusion: Lekin yeh yaad rahe ke technical patterns hamesha 100% kaamyaab nahi hote aur kabhi-kabhi yeh galat signals bhi de sakte hain. Isliye, is pattern ki tasdeek karne se pehle aur trading karne se pehle mukhlis research aur risk management strategies istemal karna bohat ahem hai.yeh pattern bhi kabhi-kabhi galat signals de sakta hai, isliye mukhlis research aur risk management ka bhi istemal bohat ahem hai trading mein. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Negative Turning Top Candles Rket advance design premier hoti hain jaaab tak getting to know strong nhe hoti hain tu kamyabi b nhe hain kamyab honek liye unfamiliar trade trading ki makret fundamental assessment karna parta hain forex trading dominating assessment kare pratice kare ordinary pratice karna should hota hain unfamiliar trade chief outstanding learning kare agar learning powerful nhe hain tu kamyabi b nhe hain Negative Turning Top Candle Example principal aksar pattern advance ka hota hain ek trders advance ki access ko find karte hain market essential typical pratice kare forex exchanging significant misfortune and benefit hota rehna hain jaaab tak learning nhe hoti hain tu benefit kabi b nhe hota hain dominating karna partahow to change Negative Turning Top Candle Example krna . Ya hm as thra kahy skty hain aj commercial center negative hai. Aor turning ka matlb hai. GBearish Turning Top candle ka he ak design hai. Negative Turning Top ka call three 3 expressions sae mil kr bana hai. Negative , turning aor top sae mil kr bana hai. Negative ka that means to ap sb samjt hun gae. As alright matlb hai commercial center kow down feature moveool gool stream krna . Aor apex ka matlb hota ahi uper ki tarf ya sb sae oper. Negative Turning Top ka call japan OK logoo nae luto alright oper rkha hai.Ap sb nae dackha ho ga. Negative Turning Top candle test outline me khch asi thra dakhi data hai. Negative Turning Top ak negative candle design hai. As ka matlb ha market lamby arsy sae bullish thi. As pr purchaser energetic thy . Stomach muscle wo kamzoor ho gae hain. Stomach muscle commercial center pr seller dynamic ho gae hain aor wo market ko donw feature course krnan gae. Matlb commercial center negative ho jye pass. Stepping of Negative Turning Top Candle test ain opening down cost sae open ho to ap commercial center me selling kr skty hain. Ya phr agr Bearisasa smj lain ap day to day graph use kr rhy hain.Ap outline me dack rhy hun gae. Kha diagram me Negative Turning Top candle design tyar ho gia tha.Aor aj ki new candle thi wo whh Turning Top cnadle stick alright sath ak new light bnati hai yni hole down cost sae open nhi hoti . To ap nae as waket tak advancing nhi krna jb tak new flame ki cloisng cost Negative Turning Top alright low cost pr ho jye to ap selling kr skty hian.As thra hmin conformity ho jta hai. Advancing OK horrendous ap nae forestall misfortune ka lazmi use krna hai. Ap nae forestall misfortune Negative Turning Top ki extreme point pr lgana hai. Aor as ka proft ap nae support pr rkh dain . Ya jb markt ap ko dobra bullish ka signal dae to ap nae apna proft book kr lina hai. Ya thi Negative Turning Top ki stepping ka method. -

#4 Collapse

Relative Energy List Pointer ka Presentation Relative energy list ko use karaty rehna chahiay moreover Kam k challenge can likewise furthermore postingkartay feed to appko apni gettingto know gifts kogrowth kartay hoye posting karniparti hay.jab haum challenge canalso moreover am nai hotay roughage haumay postings kinice pay zayada discernment kartay hoyecontest can likewise also postskarni chahiye aur apnayinformation ko improve kartay rehna chahiyeThe RVI Marker is determined by contrasting the ongoing shutting cost and the past shutting cost, and afterward computing the distinction between the two. This distinction is then partitioned by the scope of the cost over a similar period, which is regularly a 10-day time frame. The outcome is a proportion that is then smoothed utilizing a remarkable moving normal (EMA) to give a more solid pattern marker. Relative Life File Pointer ki Explaination Relative Life File (RVI) aik specialized pointer roughage jo specialized examination karny fundamental use kia jata feed. Ye marker brokers ko pattern ki strength compute karny kay mawaqay daita roughage. Dealers current shutting cost ko exchanging range say think about kar kay iski computations karty hain aur isko pattern ki strength measure karny kay liye use karty hain aur achi exchanging kay liye use karty hain.RVI ki estimation aik troublesome and specialized kam roughage jiskay liye hamain bahut acha exchanging experience hona should feed. Q keh is principal kai values, kai codes, kai images ka istemal aur samjh zaroori roughage. Iski estimation numerically aur algebrically ki jati roughage. Relative Power File Marker kaisy kaam kerta hy Relative Power File Pointer aik measurable assessment device hai hy jo specialized investigation Mein Kafi gainful Hota Hai relative Life Record Pointer MT4 exchanging terminal mama to be had ik oscillator hai. Ye charge pass alright pechy ki energy ko find karny mama use hota hai. Mt4 mama bhot sary oscillator hai jin ka use karna broker OK lae bhot valuable hai. Ye es thought pae base karta hau k agr market ki expense high ya esk kareeb pass kary gi to phr ye upswing mama open ho gi. Or then again agr cost lower stream kary gi to phr ye down style mama open ho gi.Relative power record ko use karaty rehna chahiay furthermore Kam alright challenge additionally can besides postingkartay roughage to appko apni gettingto perceive capacities kogrowth kartay hoye posting karniparti hay.Jab haum challenge canalso also am nai hotay feed haumay postings kinice pay zayada mindfulness kartay hoyecontest can likewise besides postskarni chahiye aur apnayinformation ko finish kartay rehna chahiye

- Mentions 0

-

سا0 like

-

#5 Collapse

What is three inside up and inside down candle plan ? Candles designs Express three inside up and inside down light arrangement hoti hai jo pichla red body's ki had ke Ansari Nagar make appropriate associate Trad Len Gy. aakhri Candles last aik lambing longer organized sabz hai jo pichla more modest Candles sabz ke qareeb ke qareeb se oopar ki taraf dhkilti hai.bears ne qeemat mein kami ko unequivocally se pakar liya hai aur aik lambing longer surkh Candles bananay ke liye qeemat ko neechay Shakeel diya hai Dear Government Open Market Advised assembling (FOMC) dar asal ye ik public bank structure ki branch hai jo cash related diagram ki bearing ko pick karti hai or ye esko expressly open market ki course ko direct karny k lae use karti hai. Fomc board or governer sy mel kar banta hai jis k 7 region hain or 5 president hai public bank k yani esk steady 12 section hoty hain. Har sal es driving gathering of legal heads ki 8 secret gatherings hoti hain or en mother monetary system standard discussion ki jati hai. What is three inside up and inside down light arrangement ? Ager Outline STRADGY Make proper acquaintance Three Inside down Candles mein dekhaya Gaya aik up coach ke Sourabh zahir hota hai. pehli Flame's aik lambing Greene hai, is ke baare aik choti red Candles hai jisay pichla green body ki had ke andar Ansari ghons a Chaheye. aakhri Candles designs last Great news Customizable Ho Gi Tu aik lambing longer red hai jo pichla chhotey red ke Warren ke Neechy dhkelti hai Tu ESS taraf taizi ke jazbaat basic encouragement ghalib hain aur Khtra apne kid around mein aik lambing sabz mother batii banday Crash tone beh jatay get entrance Hein. lekin is se un ki taaqat khatam ho sakti hai Tu Inside down Candles ho jay Gii..... Plan Formation..!!! Punch Ham Yeh Candle's Models kyun three inside up and inside down light kay aglay meeting mein bears aik chhotey sa faida uthany ke waybill ho jatay hain - Darmian mein choti surkh mother public hence made ho Jaye Gi th ESS Bears ki hosla afzai ki jati hai, aur aglay (Next Inside down Candles) Ka Sath hi potential social events mein, woh ghar ke faiday three inside up and inside down fire plan ko Shayd Changes berhate hain aur qeemat ko pichla More unassuming Make proper acquaintance Trad Faida Gain De Gii Aor hit ham Outline mein dekhaya gaya hai, Neechy ke rujhan ke douran zahir hota hai, aur pehli Flame's Arranged aik lambi surkh rang ki hai, is ke baad aik Choto si sabz Candles hoti hai jo pichlle red body ki had ke Ansari ghonslay gi. aakhri Candles models and Fire's Blueprint aik lambi sabz hai jo pichlle chhotey sabz ke qareeb se polar up level Inside Up Ho Hoti Hy Ess ki taraf dhkilti hai .bears ne qeemat on mein kami ko mazbooti se pakar liya hai aur aik lambing (longer) surkh Flame's banay gii. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Matching Low Candlestick Chart Pattern: Graph design ko samajhna exchanging mein ahem hota hai kyunki yeh inversions ko pehchanne mein madadgar hota hai. Merchants is design ki tasdeek ke liye aksar aik bullish flame ki tasdeek ka intezaar karte hain, jo Matching Low example ke baad aati hai. Iske ilawa, brokers apne positions ko safeguard karne ke liye stop-misfortune orders istemal karte hain jo design ke low ke neechay lagte hain.technical designs hamesha 100 percent kaamyaab nahi hote aur kabhi yeh galat signals bhi de sakte hain. Isliye, is design ki tasdeek karne se pehle aur exchanging karne se pehle mukhlis research aur risk the executives systems istemal karna bohat ahem hai.yeh design bhi kabhi galat signals de sakta hai, isliye mukhlis research aur risk the board ka bhi istemal bohat ahem hai Matching Low Candle Example ek specialized investigation design hai jo dealers istemal karte hain taake woh cost patterns ke baray mein behtar faislay kar saken. Yeh design punch aik downtrend mein hota hai toh banta hai aur ismein do mukhtalif sequential candles shamil hote hain.Trading technique ke liye, brokers aksar is design ki tasdeek ke liye intezaar karte hain, jaise ke Matching Low example ke baad aik bullish flame ki tasdeek. Iske ilawa, dealers stop-misfortune orders design ke low ke neechay lagate hain aur cost ke urooj sharpen standard objective set karte hain. design ki khasoosiyat yeh hoti hai ke yeh downtrend ke daur mein aksar ata hai aur ismein do candles hoti hain. Dono candles ki khas baat yeh hoti hai ke dusri light pehli flame ke sath barabar ya qareeb barabar shutting karti hai. Iska matlab hai ke negative dealers ke dabaav mein kami aagai hai aur purchasers ne koshish shuru ki hai ke cost ko ooper le jayen. Matching low Chart Candles Formation: Matching Low" ek candle design hai jo ki specialized mein securities exchange aur monetary business sectors mein cost developments ko anticipate karne ke liye istemal hota hai. Ye design commonly bullish inversion signal give karta hai, iska matlab hai ki ek downtrend ke baad upswing ka prarambh sharpen ke chances hain. Matching Low example mein, do sequential candles hote hain jo ki specialty di taraf comparable or almost equivalent shutting costs standard close hote hain. In candles ka close cost ek dusre ke pas aata hai ya bahut greetings comparable hota hai. Yeh design ek downtrend ke subterranean insect mein dikhai dene ke baad aksar aata hai aur bullish inversion ko darust karta hai.candlestick design ek valuable instrument hai forex exchanging mein. Is design ko distinguish karke brokers apni exchanging technique improve kar sakte hain aur beneficial exchanges kar sakte hain. Is design ko sahi tareeke se samajhne ke liye candle designs aur cost activity ke baare mein information hona zaroori hai.

Matching Low Candle Example ek specialized investigation design hai jo dealers istemal karte hain taake woh cost patterns ke baray mein behtar faislay kar saken. Yeh design punch aik downtrend mein hota hai toh banta hai aur ismein do mukhtalif sequential candles shamil hote hain.Trading technique ke liye, brokers aksar is design ki tasdeek ke liye intezaar karte hain, jaise ke Matching Low example ke baad aik bullish flame ki tasdeek. Iske ilawa, dealers stop-misfortune orders design ke low ke neechay lagate hain aur cost ke urooj sharpen standard objective set karte hain. design ki khasoosiyat yeh hoti hai ke yeh downtrend ke daur mein aksar ata hai aur ismein do candles hoti hain. Dono candles ki khas baat yeh hoti hai ke dusri light pehli flame ke sath barabar ya qareeb barabar shutting karti hai. Iska matlab hai ke negative dealers ke dabaav mein kami aagai hai aur purchasers ne koshish shuru ki hai ke cost ko ooper le jayen. Matching low Chart Candles Formation: Matching Low" ek candle design hai jo ki specialized mein securities exchange aur monetary business sectors mein cost developments ko anticipate karne ke liye istemal hota hai. Ye design commonly bullish inversion signal give karta hai, iska matlab hai ki ek downtrend ke baad upswing ka prarambh sharpen ke chances hain. Matching Low example mein, do sequential candles hote hain jo ki specialty di taraf comparable or almost equivalent shutting costs standard close hote hain. In candles ka close cost ek dusre ke pas aata hai ya bahut greetings comparable hota hai. Yeh design ek downtrend ke subterranean insect mein dikhai dene ke baad aksar aata hai aur bullish inversion ko darust karta hai.candlestick design ek valuable instrument hai forex exchanging mein. Is design ko distinguish karke brokers apni exchanging technique improve kar sakte hain aur beneficial exchanges kar sakte hain. Is design ko sahi tareeke se samajhne ke liye candle designs aur cost activity ke baare mein information hona zaroori hai.  Candle design mein cost low standard rehta hai aur ek doosre se milte tint candles hote hain. Ye design negative market mein bhi dekha ja sakta hai, lekin generally ye bullish market mein dekha jaata hai.Matching Low candle design mein do candles hote hain jinmein cost ek doosre se milte tone hai. Ye design bullish inversion ka signal deta hai jabki negative pattern mein ye retracement ka signal deta hai.candlestick design ka matlab hai "milte tint specialty wala candle design". Is design ko forex exchanging mein istemaal kiya jaata hai apni exchanging system ko improve karne ke liye. candle designs ke baare mein jaan lete hain. Ye graphing procedure hai jo merchants ko cost activity ke uncovered mein bataata hai. Candle designs market opinion ke baare mein bataate hain. Matching low Chart Pattern Types And Identification: Ap Matching Low example ko pehchan lein, to aap long position (khareedari) standard consider kar sakte hain. Lekin, passage point aur stop-misfortune ko bhi madde nazar rakhte tone tijarat karna zaroori hai.risk the board ka khayal rakhein. Stop-misfortune request set karein taki nuksan se bacha ja purpose. Matching Low example ko dusre specialized pointers ke saath istemal karke affirm karein, jaise ki RSI, moving midpoints, ya pattern lines. Design ko distinguish karne ke liye aap apne exchanging time period ko mukhtalif time spans se mawafiq kar sakte hain Matching Low candle design ek incredible asset ho sakta hai exchanging ke liye, lekin hamesha yaad rahe ke kisi bhi system ko istemal karne se pehle acchi tarah se samajh lein aur risk ko oversee karein.

Candle design mein cost low standard rehta hai aur ek doosre se milte tint candles hote hain. Ye design negative market mein bhi dekha ja sakta hai, lekin generally ye bullish market mein dekha jaata hai.Matching Low candle design mein do candles hote hain jinmein cost ek doosre se milte tone hai. Ye design bullish inversion ka signal deta hai jabki negative pattern mein ye retracement ka signal deta hai.candlestick design ka matlab hai "milte tint specialty wala candle design". Is design ko forex exchanging mein istemaal kiya jaata hai apni exchanging system ko improve karne ke liye. candle designs ke baare mein jaan lete hain. Ye graphing procedure hai jo merchants ko cost activity ke uncovered mein bataata hai. Candle designs market opinion ke baare mein bataate hain. Matching low Chart Pattern Types And Identification: Ap Matching Low example ko pehchan lein, to aap long position (khareedari) standard consider kar sakte hain. Lekin, passage point aur stop-misfortune ko bhi madde nazar rakhte tone tijarat karna zaroori hai.risk the board ka khayal rakhein. Stop-misfortune request set karein taki nuksan se bacha ja purpose. Matching Low example ko dusre specialized pointers ke saath istemal karke affirm karein, jaise ki RSI, moving midpoints, ya pattern lines. Design ko distinguish karne ke liye aap apne exchanging time period ko mukhtalif time spans se mawafiq kar sakte hain Matching Low candle design ek incredible asset ho sakta hai exchanging ke liye, lekin hamesha yaad rahe ke kisi bhi system ko istemal karne se pehle acchi tarah se samajh lein aur risk ko oversee karein.  Designs mein ek candle ka shutting cost lower hota hai, jo ke past candles se neeche hota hai. light ka lower shadow (neeche wala hissa) bada hota hai, jo ke demonstrate karta hai ke selling pressure ke chalte costs neeche gaye the Candle ka genuine body (opening aur shutting costs ke beech ka hissa) chota hota hai aur by and large red (negative) hota hai.Matching Low example do candles se mil kar banta hai. Pehla flame negative hota hai aur dusra light usse mil kar ek bullish candle hota hai. Dono candles ki shutting cost ek dosre ke close cost ke buhat qareeb hoti hai.Pattern ko pehchanne ke liye, pehle negative flame ko dekhein. Fir dusre candle ki taraf tawajjo dein. Agar dusri candle ki shutting cost pehli candle ki shutting cost ke buhat qareeb hoti hai, to ye Matching Low example hai. Trading Of Chart Pattern Candles: Chart Pattern Candle designs ek specialized apparatus hain jo monetary business sectors, jaise ke stocks, items, aur forex, mein cost development ke designs ko samajhne aur foresee karne ke liye istemal hoti hain. Ye designs candle diagrams ke zariye dikhaye jate hain, jo ke cost activity ko visual structure mein address karte hain. Low candle designs merchants aur financial backers ke liye important hote hain, kyun ke ye unko market ke future bearing ka andaza lagane mein madadgar ho sakte hain.Matching Low candle designs woh explicit cost designs hote hain jo show karte hain ke market mein selling pressure predominant hai aur costs ne neeche jaane ka pattern banaya hua hai. Ye designs commonly momentary inversions ko signal karte hain, jahan market ke costs neeche jaane ke baad phir se upar ki taraf move karne lagte hain.

Designs mein ek candle ka shutting cost lower hota hai, jo ke past candles se neeche hota hai. light ka lower shadow (neeche wala hissa) bada hota hai, jo ke demonstrate karta hai ke selling pressure ke chalte costs neeche gaye the Candle ka genuine body (opening aur shutting costs ke beech ka hissa) chota hota hai aur by and large red (negative) hota hai.Matching Low example do candles se mil kar banta hai. Pehla flame negative hota hai aur dusra light usse mil kar ek bullish candle hota hai. Dono candles ki shutting cost ek dosre ke close cost ke buhat qareeb hoti hai.Pattern ko pehchanne ke liye, pehle negative flame ko dekhein. Fir dusre candle ki taraf tawajjo dein. Agar dusri candle ki shutting cost pehli candle ki shutting cost ke buhat qareeb hoti hai, to ye Matching Low example hai. Trading Of Chart Pattern Candles: Chart Pattern Candle designs ek specialized apparatus hain jo monetary business sectors, jaise ke stocks, items, aur forex, mein cost development ke designs ko samajhne aur foresee karne ke liye istemal hoti hain. Ye designs candle diagrams ke zariye dikhaye jate hain, jo ke cost activity ko visual structure mein address karte hain. Low candle designs merchants aur financial backers ke liye important hote hain, kyun ke ye unko market ke future bearing ka andaza lagane mein madadgar ho sakte hain.Matching Low candle designs woh explicit cost designs hote hain jo show karte hain ke market mein selling pressure predominant hai aur costs ne neeche jaane ka pattern banaya hua hai. Ye designs commonly momentary inversions ko signal karte hain, jahan market ke costs neeche jaane ke baad phir se upar ki taraf move karne lagte hain.  Chart pattern inversion design ka zarori nahi hai, k ye lazmi mukhtalif variety k candles standard mushtamil hoga, ya last candle ka pattern inversion formate ka hona chaheye, bulkeh ye design same variety k bhi ho sakte hen, jiss tarah k matching low example fundamental do negative candles hoti hai.candlestick design ki pehli flame aik negative light hoti hai, ye candle doji, little body, shadow ya shadow k bagher bhi ho sakti hai. Ye light variety principal dark ya red hoti hai, jo k costs k downtrend ya low costs ka ishara deti hai. candle design ki dosri candle bhi same pehli flame ki tarah negative hoti hai, jo k kisi bhi formate principal ho sakti hai. Dosri candle ka low cost same pehli flame k low cost se match hona lazmi hai, jo k candle ka shadow bhi ho sakta hai. Ye candle bhi dark ya red variety fundamental hoti hai.

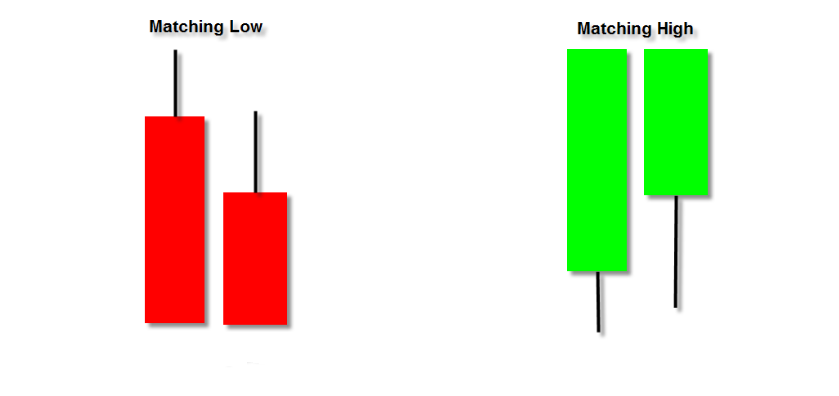

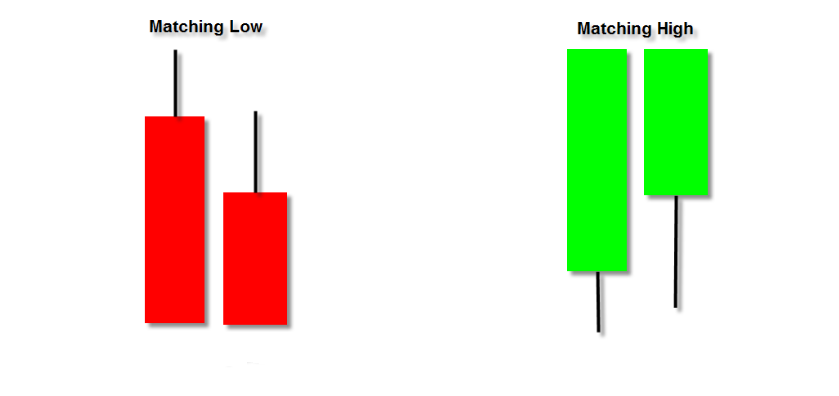

Chart pattern inversion design ka zarori nahi hai, k ye lazmi mukhtalif variety k candles standard mushtamil hoga, ya last candle ka pattern inversion formate ka hona chaheye, bulkeh ye design same variety k bhi ho sakte hen, jiss tarah k matching low example fundamental do negative candles hoti hai.candlestick design ki pehli flame aik negative light hoti hai, ye candle doji, little body, shadow ya shadow k bagher bhi ho sakti hai. Ye light variety principal dark ya red hoti hai, jo k costs k downtrend ya low costs ka ishara deti hai. candle design ki dosri candle bhi same pehli flame ki tarah negative hoti hai, jo k kisi bhi formate principal ho sakti hai. Dosri candle ka low cost same pehli flame k low cost se match hona lazmi hai, jo k candle ka shadow bhi ho sakta hai. Ye candle bhi dark ya red variety fundamental hoti hai.

-

#7 Collapse

Introduction of the post. Assalam u Alaikum My dear friend kaise hain Sab ummid Karti hun khairiyat se Honge aur Apna Achcha kam kar rahe Honge Jab aap is market Mein kam karte hain to aapko daily basis per Apna target complete karna hota hai aur acchi strategis ke sath kam karna hota hai agar aap is market Mein proper hard work ke sath kam Karenge aur Market ko acche tarike se judgement Karenge to aapko is market mein bahut hi fayda Milega aapko Hamesha Koshish Karna Hogi kya aap is market Mein successful trading karne ke liye Hamesha market ko time de aur Jyada Se Jyada hard work Karen Taki aapko is market Mein Achcha result Mile main aaj aapse bahut hi important information discuss karungi jo aapki trading ko Achcha result de sakti hai to Mera topic hai matching low candles take pattern kya hai. Matching Low Candlestick Pattren. Matching Low Candlestick Pattern ek technical analysis pattern hai jo traders istemal karte hain taake woh price trends ke baray mein behtar faislay kar saken. Yeh pattern jab aik downtrend mein hota hai toh banta hai aur ismein do mukhtalif consecutive candlesticks shamil hote hay. Formation Of Matching Low Candlestick Pattren: Is pattern ki khasoosiyat yeh hoti hai ke yeh downtrend ke daur mein aksar ata hai aur ismein do candlesticks hoti hain. Dono candlesticks ki khas baat yeh hoti hai ke dusri candle pehli candle ke sath barabar ya qareeb barabar closing karti hai. Iska matlab hai ke bearish traders ke dabaav mein kami aagai hai aur buyers ne koshish shuru ki hai ke price ko ooper le jayen. -

#8 Collapse

Matching Low Candlestick Pattern ek bullish reversal pattern hai jo candlestick charts mein dekha jata hai. Is pattern mein do consecutive candles hote hain, jinmein dono candles ki low price ek jaisi hoti hai. Matching Low Pattern ko samajhne ke liye, dono candles ke characteristics ko dhyan se observe karein. Matching Low Candlestick Pattern ki wazahat karte hain: 1. Pehli candle: Pehli candle ek downtrend ke dauran form hoti hai aur iski body red (bearish) color ki hoti hai. Iski closing price lower hoti hai. 2. Dusri candle: Dusri candle pehli candle ki low price se open hoti hai, lekin iski body green (bullish) color ki hoti hai. Iski closing price bhi pehli candle ki low price se near hoti hai. Yeh pattern indicate karta hai ki downtrend ke baad market mein buying pressure aa rahi hai aur bulls control me aa rahe hain. Ab hum Matching Low Candlestick Pattern ke wazahat par baat karte hain: 1. Reversal Signal: Matching Low Pattern bullish reversal signal provide karta hai. Jab pehli bearish candle ke baad dusri bullish candle form hoti hai, yeh indicate karta hai ki downtrend ki shakti kam ho rahi hai aur bullish pressure badh rahi hai. Is pattern ki wazahat se traders ko bullish trend ki shuruwat ki possibility ka pata chalta hai. 2. Support Level: Matching Low Pattern mein dono candles ki low price ek jaisi hoti hai. Yeh support level ko indicate karta hai, jahan se price bounce back kar sakti hai. Traders is level ko support level ke roop mein istemal karke apne entry points aur stop-loss levels decide kar sakte hain. 3. Entry and Exit Points: Matching Low Pattern ko dekh kar traders long positions enter kar sakte hain ya existing short positions ko exit kar sakte hain. Is pattern ke through traders ko entry aur exit points milte hain, jisse unhe trading decisions lene mein madad milti hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Matching Low Candlestick patterns:

Matching low candlestick pattern, bearish reversal pattern hai. Ismein do consecutive candles hote hain jinmein price similar ya almost similar levels par close hota hai. Ye pattern indicate karta hai ke bearish trend ke baad price ka reversal ho sakta hai. Is pattern ko identify karne ke liye aap candlestick charts par dhyaan se dekhe aur consecutive candles ke closing prices ko compare kare. Matching low candlestick patterns ko identify karne ke liye aap candlestick charts par dhyaan se dekh sakte hain. Is pattern mein do consecutive candles hote hain jinmein price similar ya almost similar levels par close hota hai. Aapko consecutive candles ke closing prices ko compare karna hoga. Agar aapko matching low candlestick pattern milta hai, toh ye bearish reversal ka indication ho sakta hai.

Trade with Matching low candlestick Pattern:

Matching low candlestick patterns ke saath trading karne ke kuch characteristics hain:

- Matching low candlestick pattern bearish reversal ka indication deta hai.

- Is pattern mein do consecutive candles hote hain jinmein price similar ya almost similar levels par close hota hai.

- Jab aap matching low candlestick pattern ko identify karte hain, aap ek buy trade place kar sakte hain, expecting ki price ka reversal hoga aur bullish trend shuru hoga.

- Stop loss aur target levels ko set karna important hai. Proper risk management ka dhyaan rakhe.

- Technical indicators aur other chart patterns ke saath combine karke trading decisions le, isse aapko confirmation aur better entry/exit points mil sakte hain.

- Always apne trading strategies ko test kare aur discipline maintain kare.

Matching Low Candlestick patterns Strategy:

Matching low candlestick patterns ki strategy banane ke liye aap ye steps follow kar sakte hain:

1. Identify Karen :

Candlestick charts par dhyaan se dekhe aur consecutive candles ke closing prices ko compare kare. Matching low candlestick pattern ko identify kare.

2. Confirmation :

Matching low pattern ke saath aur technical indicators, trendlines, ya support and resistance levels jaise tools ka use karke confirm kare ki reversal hone ki possibility hai.

3. Entry point:

Jab aapko matching low pattern aur confirmation mil jaye, ek buy trade enter kare. Entry point ko set kare, jaise ki next candle ke high ya breakout ke baad.

4. Stop Loss:

Hamesha stop loss level set kare, taki aap apne risk ko manage kar sake. Stop loss level ko pattern ke low ya support level ke below set kare.

5. Target:

Profit target level set kare, jaise ki previous high ya resistance level. Partial profit booking bhi consider kare.

6. Risk management:

Apni risk tolerance ke hisaab se position size aur risk-reward ratio ko calculate kare. Risk management ka dhyaan rakhe.

7. Monitor karen:

Trade ke dauran market ko closely monitor kare aur trailing stop loss ka use kare, agar price favorable direction mein move karta hai.

8. Review karen:

Apne trades ko regularly review kare aur apni strategy ko refine kare, taki aap apne trading skills ko improve kar sake. Note: Ye sirf ek general strategy hai. Apne trading style, risk tolerance aur market conditions ke hisaab se apni strategy ko customize kare. Always apne trades ko demo account par test kare, before implementing them in real market. -

#10 Collapse

Upward and Downward Management Asalam-o-alikum!! Market humesha hi aik taraf move nahi Karti hy balkeh ya upward aur downward bhi move Karti rehte hy es liye inhin ko dekh ky humein bhi samjhna chahiye aur trading Karne chahiye down Candles mein dekhaya gaya aik up coach ke saaf zahir hota hai. pehli Flame's aik lambing Greene hai, is ke baare aik choti red Candles hai jisay pichla green body ki had ke andar Ansari ghons a Chaheye. aakhri Candles designs last Great news Customizable Ho Gi Tu aik lambing longer red hai jo pichla chhotey red ke Warren ke Neechy dhkelti hai Tu es taraf taizi ke jazbaat basic encouragement ghalib hain aur Khtra apne kid around mein aik lambing sab mother batii banday Crash tone beh jatay ge entrance Hain. identification Matching Low Candle Example ek specialized investigation design hai jo dealers istemal karte hain taake woh cost patterns ke baray mein behtar faislay kar saken. Yeh design punch aik downtrend mein hota hai toh banta hai aur ismein do mukhtalif sequential candles shamil hote hain.Trading technique ke liye, brokers aksar is design ki tasdeek ke liye intezaar karte hain, jaise ke Matching Low example ke baad aik bullish flame ki tasdeek. Iske ilawa, dealers stop-misfortune orders design ke low ke neechay lagate hain aur cost ke urooj sharpen standard objective set karte hain. Conclusion technical patterns hamesha 100% kaamyaab nahi hote aur kabhi-kabhi yeh galat signals bhi de sakte hain. Isliye, is pattern ki tasdeek karne se pehle aur trading karne se pehle mukhlis research aur risk management strategies istemal karna bohat ahem hai.yeh pattern bhi kabhi kabhi galat signals de sakta hai jis se humein loss ho Sakta hy thanks . -

#11 Collapse

Matching Low Candlestick patterns: Matching low candlestick pattern, bearish reversal pattern hai. Ismein do consecutive candles hote hain jinmein price similar ya almost similar levels par close hota hai. Ye pattern indicate karta hai ke bearish trend ke baad price ka reversal ho sakta hai. Is pattern ko identify karne ke liye aap candlestick charts par dhyaan se dekhe aur consecutive candles ke closing prices ko compare kare. Matching low candlestick patterns ko identify karne ke liye aap candlestick charts par dhyaan se dekh sakte hain. Is pattern mein do consecutive candles hote hain jinmein price similar ya almost similar levels par close hota hai. Aapko consecutive candles ke closing prices ko compare karna hoga. Agar aapko matching low candlestick pattern milta hai, toh ye bearish reversal ka indication ho sakta hai.Matching low Chart Candles Formation: Matching Low" ek candle design hai jo ki specialized mein securities exchange aur monetary business sectors mein cost developments ko anticipate karne ke liye istemal hota hai. Ye design commonly bullish inversion signal give karta hai, iska matlab hai ki ek downtrend ke baad upswing ka prarambh sharpen ke chances hain. Matching Low example mein, do sequential candles hote hain jo ki specialty di taraf comparable or almost equivalent shutting costs standard close hote hain. In candles ka close cost ek dusre ke pas aata hai ya bahut greetings comparable hota hai. Yeh design ek downtrend ke subterranean insect mein dikhai dene ke baad aksar aata hai aur bullish inversion ko darust karta hai.candlestick design ek valuable instrument hai forex exchanging mein. Is design ko distinguish karke brokers apni exchanging technique improve kar sakte hain aur beneficial exchanges kar sakte hain. Is design ko sahi tareeke se samajhne ke liye candle designs aur cost activity ke baare mein information hona zaroori hai.

Lekin yeh yaad rahe ke technical patterns hamesha 100% kaamyaab nahi hote aur kabhi-kabhi yeh galat signals bhi de sakte hain. Isliye, is pattern ki tasdeek karne se pehle aur trading karne se pehle mukhlis research aur risk management strategies istemal karna bohat ahem hai.yeh pattern bhi kabhi-kabhi galat signals de sakta hai, isliye mukhlis research aur risk management ka bhi istemal bohat ahem hai trading mein.Matching Low Candlestick Pattern ki wazahat karte hain: 1. Pehli candle: Pehli candle ek downtrend ke dauran form hoti hai aur iski body red (bearish) color ki hoti hai. Iski closing price lower hoti hai. 2. Dusri candle: Dusri candle pehli candle ki low price se open hoti hai, lekin iski body green (bullish) color ki hoti hai. Iski closing price bhi pehli candle ki low price se near hoti hai. Yeh pattern indicate karta hai ki downtrend ke baad market mein buying pressure aa rahi hai aur bulls control me aa rahe hain. Ab hum Matching Low Candlestick Pattern ke wazahat par baat karte hain: 1. Reversal Signal: Matching Low Pattern bullish reversal signal provide karta hai. Jab pehli bearish candle ke baad dusri bullish candle form hoti hai, yeh indicate karta hai ki downtrend ki shakti kam ho rahi hai aur bullish pressure badh rahi hai. Is pattern ki wazahat se traders ko bullish trend ki shuruwat ki possibility ka pata chalta hai. 2. Support Level: Matching Low Pattern mein dono candles ki low price ek jaisi hoti hai. Yeh support level ko indicate karta hai, jahan se price bounce back kar sakti hai. Traders is level ko support level ke roop mein istemal karke apne entry points aur stop-loss levels decide kar sakte hain. 3. Entry and Exit Points: Matching Low Pattern ko dekh kar traders long positions enter kar sakte hain ya existing short positions ko exit kar sakte hain. Is pattern ke through traders ko entry aur exit points milte hain, jisse unhe trading decisions lene mein madad milti hai.

Lekin yeh yaad rahe ke technical patterns hamesha 100% kaamyaab nahi hote aur kabhi-kabhi yeh galat signals bhi de sakte hain. Isliye, is pattern ki tasdeek karne se pehle aur trading karne se pehle mukhlis research aur risk management strategies istemal karna bohat ahem hai.yeh pattern bhi kabhi-kabhi galat signals de sakta hai, isliye mukhlis research aur risk management ka bhi istemal bohat ahem hai trading mein.Matching Low Candlestick Pattern ki wazahat karte hain: 1. Pehli candle: Pehli candle ek downtrend ke dauran form hoti hai aur iski body red (bearish) color ki hoti hai. Iski closing price lower hoti hai. 2. Dusri candle: Dusri candle pehli candle ki low price se open hoti hai, lekin iski body green (bullish) color ki hoti hai. Iski closing price bhi pehli candle ki low price se near hoti hai. Yeh pattern indicate karta hai ki downtrend ke baad market mein buying pressure aa rahi hai aur bulls control me aa rahe hain. Ab hum Matching Low Candlestick Pattern ke wazahat par baat karte hain: 1. Reversal Signal: Matching Low Pattern bullish reversal signal provide karta hai. Jab pehli bearish candle ke baad dusri bullish candle form hoti hai, yeh indicate karta hai ki downtrend ki shakti kam ho rahi hai aur bullish pressure badh rahi hai. Is pattern ki wazahat se traders ko bullish trend ki shuruwat ki possibility ka pata chalta hai. 2. Support Level: Matching Low Pattern mein dono candles ki low price ek jaisi hoti hai. Yeh support level ko indicate karta hai, jahan se price bounce back kar sakti hai. Traders is level ko support level ke roop mein istemal karke apne entry points aur stop-loss levels decide kar sakte hain. 3. Entry and Exit Points: Matching Low Pattern ko dekh kar traders long positions enter kar sakte hain ya existing short positions ko exit kar sakte hain. Is pattern ke through traders ko entry aur exit points milte hain, jisse unhe trading decisions lene mein madad milti hai. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Matching Low Candlesticks Pattern:

Matching Low (Milte Julte) candlesticks pattern forex trading aur technical analysis mein ek ahem pattern hai. Ye pattern bearish trend ke doran dikhai deta hai aur usually trend reversal ka indication hota hai.

Milte Julte Candlesticks Pattern Kya Hai?

Milte Julte candlesticks pattern mein do consecutive (musalsal) bearish candles hote hain jin ki closing prices ek doosre se almost match karti hain. Yani, pehli aur doosri candle ki closing prices ek doosre ke qareeb hoti hain aur ideally, dono ki closing price same ya kafi similar hoti hai. Is pattern ke saath, pehli candle ki range bhi zyada hoti hai lekin doosri candle ki range choti hoti hai.

Milte Julte Candlesticks Pattern Ki Tashkhees:- Do consecutive bearish candles dekhein jin ki closing prices ek doosre ke qareeb hain.

- Ideal scenario mein, dono candles ki closing price ek doosre ke bilkul same hoti hai ya phir kafi similar hoti hai.

- Peeli candle ki range zyada hoti hai aur doosri candle ki range choti hoti hai.

- Milte Julte pattern usually bearish trend ke doran dikhai deta hai aur trend reversal ka indication hota hai.

Milte Julte Candlesticks Pattern Ka Istemal:

Milte Julte candlesticks pattern ko traders trend reversal ke indication ke tor par istemal karte hain. Agar market mein bearish trend hai aur do consecutive bearish candles ek doosre ke qareeb ki closing prices ke saath dikh rahe hain, to ye ek potential trend reversal ka sign ho sakta hai. Is pattern ke baad, traders ko price action ko closely monitor karna chahiye aur agar bullish signs nazar aayein to wo long positions enter kar sakte hain.

Conclusion:

Milte Julte candlesticks pattern ek bearish trend reversal pattern hai jo traders ko market trends aur reversals ke baray mein maloomat faraham karta hai. Is pattern ko samajhna traders ke liye zaroori hai taake wo sahi waqt par trading decisions le sakein aur market mein successful trading kar sakein.

-

#13 Collapse

Matching Low Candlesticks Pattren?

**Matching Low Candlesticks Pattern: Roman Urdu**

**1. Mukadma (Introduction)**

Matching low candlesticks pattern forex trading mein ek technical analysis tool hai jo price reversals ko identify karne mein madad deta hai. Is pattern mein do consecutive candles ki similar low price hoti hai.

**2. Pattern Ki Tareef**

Matching low pattern mein do consecutive candles ki low prices similar hoti hain. Pehli candle bearish hoti hai aur doosri candle bullish hoti hai, lekin dono ki low prices ek dosre ke bohot qareeb hoti hain.

**3. Bullish Reversal Ka Matlab**

Matching low pattern ek bullish reversal ka sign hota hai. Yeh pattern bearish trend ke khatam hone aur bullish momentum ke shuru hone ki indication deta hai jab doosri bullish candle pehli bearish candle ke low price ke paas close hoti hai.

**4. Pehchan (Identification)**

Matching low pattern ko pehchanne ke liye, traders ko do consecutive candles ki low prices ko dekhna hota hai. Agar doosri candle ki low price pehli candle ki low price ke bohot qareeb hoti hai, toh yeh pattern present hai.

**5. Confirmatory Signals**

Matching low pattern ki validity ko confirm karne ke liye, traders ko doosre technical indicators aur price action ko bhi dekhna hota hai. Agar confirmatory signals milte hain, jaise volume increase ya doji candlesticks, toh yeh pattern aur bhi valid ho jata hai.

**6. Trading Strategies**

Matching low pattern ko confirm karne ke baad, traders apni trading strategies ko implement karte hain. Ismein include hota hai entry aur exit points tay karna, stop-loss orders lagana, aur risk management ka dhyan rakhna.

**7. Risk Management**

Matching low pattern ke istemal mein, risk management ka ahem kirdar hota hai. Traders ko apne positions ke size ko control karna aur stop-loss orders lagana zaroori hota hai taake nuqsanat ko minimize kiya ja sake.

**8. Tafteesh Aur Analysis**

Matching low pattern ko tafteesh karne ke baad, traders market ke current sentiment aur potential trend reversals ko samajh sakte hain. Isse unki trading decisions aur performance ko enhance karne mein madad milti hai.

**Akhri Alfaaz**

Matching low candlesticks pattern forex trading mein price reversals ko detect karne mein madadgar hai. Iski samajh aur istemal se traders apni trading strategies ko improve kar sakte hain aur market ke movements ko behtar taur par anticipate kar sakte hain.

-

#14 Collapse

Matching Low Candlesticks Pattren?

Introduction Matching Low Candlesticks Pattren ya Lihazat ke Mawafiq Kamtiyaan ek ahem technical analysis tool hai jo share market mein istemal hota hai. Ye candlestick patterns ka aik qisam hai jo investors ko market trends aur price movements ka andaza lagane mein madad karta hai. Is blog mein, hum Matching Low Candlesticks Pattern ke mutaliq tafseel se guftagu karenge aur iske ahmiyat aur istemal ke bare mein baat karenge.

Kya Hai Matching Low Candlesticks Pattren? Matching Low Candlesticks Pattren ek mukhtalif qisam ka candlestick pattern hai jo do candlesticks se bana hota hai. Is pattren mein, pehla candlestick bearish hota hai (jismein price ghat rahi hoti hai) aur doosra candlestick bhi bearish hota hai lekin iska low pehle candlestick ke low ke qareeb hota hai. Yeh pattern trend reversal ko indicate karta hai.

Kis Tarah Se Matching Low Candlesticks Pattern Ka Istemal Kiya Jata Hai? Matching Low Candlesticks Pattern ko samajhne aur istemal karne ke liye, traders ko iske mukhtalif aspects ko samajhna zaroori hai. Kuch tafseelat is tarah hain:- Entry Point: Agar market mein uptrend hai aur Matching Low Candlesticks Pattern dikh raha hai, toh traders ko entry point ke taur par consider kar sakte hain jab doosra candle pehle candle ke low ke qareeb ho.

- Stop Loss: Har trade ke liye stop loss zaroori hota hai, Matching Low Candlesticks Pattern ki buniyad par traders stop loss level tay kar sakte hain.

- Target Price: Is pattern ke istemal se traders target price ko bhi tay kar sakte hain, jaise ke next support level ya resistance level.

Matching Low Candlesticks Pattern Ki Ahmiyat Matching Low Candlesticks Pattern ki ahmiyat niche di gayi wajahon par mushtamil hai:- Trend Reversal Indication: Ye pattern trend reversal ko point out karta hai, jise traders apne trading strategies mein incorporate kar sakte hain.

- Price Movement Prediction: Is pattern ke istemal se traders price movements ka andaza lagate hain, jo unhein trading decisions mein madad deta hai.

- Risk Management: Matching Low Candlesticks Pattern ko samajh kar traders apni trades ka risk manage kar sakte hain, jaise ke stop loss aur target price tay karke.

Conclusion Matching Low Candlesticks Pattern ek useful tool hai jo traders ko market trends aur price movements ko samajhne mein madad deta hai. Is pattern ko samajhne aur istemal karne ke liye, traders ko technical analysis ka acha ilm hona zaroori hai. Yeh pattern trend reversal aur price movement prediction ke liye istemal kiya ja sakta hai. Magar, jaise har technical tool ki tarah, iska bhi istemal careful aur proper risk management ke saath hona chahiye.

- CL

- Mentions 0

-

سا3 likes

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

matching lo candlesticks pattern kya hai.

matching lo candlesticks pattern kya hai. yah ek do-momebatti wala bullish reversal pattern hai jo candlestick charts per dikhai deta hai. yah ek downtrend ke bad hota hai aur, siddhant mein, matching band hone ke sath do lambi niche (kali ya lal) mombattiyon ke madhyam se bikri ke sambhavit ant ka sanket deta hai. yah pattern ke bad ek uchh mulya gatividhi dwara pushti ki jaati hai. vastav mein, matching lo aksar niche ki or ek nirantar pattern ke roop mein kam karta hai.

matching lo pattern do niche ki mombattiyon dwara banaya jata hai jinmen saman ya milati-julti band hone ki kimaten hoti hain. yah pattern ek mulya giravat ke bad hota hai aur ek sambhavit neeche ya yah sanket deta hai ki kimat ek sahayata star tak pahunch gai hai. vastav mein, pattern ke bad kimat kisi bhi disha mein ja sakti hai, aur aksar yah niche ki or jari rahti hai.

matching lo pattern ki pahchan karne ke liye, nimnalikhit charanon ka palan karen:- ek downtrend ki pahchan karen.

- do lambi niche ki mombattiyon ki talash karen jinmen saman ya milati-julti band hone ki kimaten hon.

- pattern ki pushti karne ke liye, pattern ke bad ek uchh mulya gatividhi ki talash karen.

yahan ek matching lo pattern ka ek udaharan diya gaya hai:

is udaharan mein, do lambi niche ki mombattiyan hain jinmen saman band hone ki kimaten hain. pattern ki pushti pattern ke bad ek uchh mulya gatividhi dwara ki jaati hai.

matching lo pattern ek upyogi takniki sanket ho sakta hai, lekin yah yad rakhna mahatvpurn hai ki yah 100% satik nahin hai. kisi bhi vyapar nirnay ko lene se pahle, anya takniki sanketkon aur mulya vishleshan per vichar karna mahatvpurn hai.

yahan kuchh atirikt sansadhan diye gaye hain jo aapko upyogi lag sakte hain:- Matching Low Candlestick Pattern - Investopedia:

- Matching Low Pattern - TradingView: [Invalid URL remove kiya gaya]

- The Matching Low Candlestick Pattern - Investopedia: [Invalid URL remove kiya gaya]

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:34 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим