lower tasuki gap candlestick pattern kea hota ha our es k components bataen ???

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

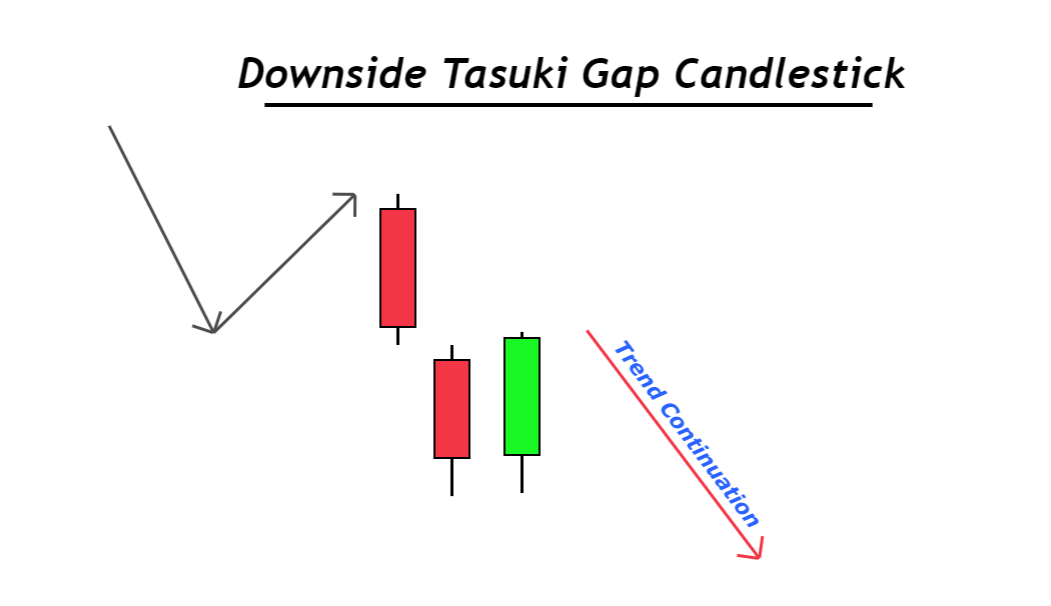

lower tasuki gap candlestick pattern:-Lower Tasuki Gap ek Japanese candlestick pattern hai jo trading aur technical analysis mein istemal hota hai. Is pattern mein kuch candlesticks ek specific sequence mein dikhte hain aur yeh traders ko market ke future direction ke liye hint provide kar sakta hai. Lower Tasuki Gap pattern bearish (girawat ki taraf) hota hai, iska matlab hai ki yeh ek downtrend ke beech aksar paya jata hai aur price ki girawat ki sambhavna ko darust karta hai. lower tasuki gap candlestick pattern k components:-Lower Tasuki Gap candlestick pattern, forex trading mein istemal hone wala ek bearish reversal pattern hai. Is pattern mein kuch components hote hain: Pehla Candlestick: Pehla candlestick ek bearish (girawat ki taraf) candlestick hota hai, jiska matlab hai ki opening price closing price se zyada hoti hai. Is candlestick se market mein selling pressure indicate hoti hai. Dusra Candlestick: Dusra candlestick bhi bearish hota hai, yani opening price closing price se zyada hoti hai. Yeh candlestick pehle candlestick ke neeche close hota hai, lekin pehle candlestick ke upper shadow ya body ke close ke beech mein ek gap hota hai. Is gap ko "Tasuki Gap" kehte hain. Teesra Candlestick: Teesra candlestick bullish (vridhi ki taraf) hota hai aur iska opening price dusre candlestick ke closing price ke qarib hota hai. Teesre candlestick mein buying pressure dikhata hai, lekin price pehle candlestick ke low se upar nahi jata. Price Confirmation: Lower Tasuki Gap pattern ka interpretation yeh hota hai ki market mein selling pressure bani rehti hai, lekin teesri candlestick mein buyers aa jate hain. Is pattern ko dekh kar traders bearish trend mein reversal ki possibility ka andaza laga sakte hain. Lekin, is pattern ki confirmation ke liye aur technical indicators ka istemal kiya jata hai, kyunki yeh ek matra indicator nahi hota. Stop Loss aur Take Profit: Lower Tasuki Gap pattern ko trade karte waqt, traders normally stop loss aur take profit levels set karte hain taaki risk ko manage kiya ja sake. Stop loss level pehle candlestick ke high se thoda upar rakha ja sakta hai, jabki take profit level aksar trading strategy aur market conditions par depend karta hai. Yad rahe ki candlestick patterns ke istemal mein risk management aur confirmatory indicators ka bhi mahatva hota hai. Is pattern ko samajhna aur istemal karna forex trading mein ek comprehensive approach ke sath kiya jata hai.

lower tasuki gap candlestick pattern k components:-Lower Tasuki Gap candlestick pattern, forex trading mein istemal hone wala ek bearish reversal pattern hai. Is pattern mein kuch components hote hain: Pehla Candlestick: Pehla candlestick ek bearish (girawat ki taraf) candlestick hota hai, jiska matlab hai ki opening price closing price se zyada hoti hai. Is candlestick se market mein selling pressure indicate hoti hai. Dusra Candlestick: Dusra candlestick bhi bearish hota hai, yani opening price closing price se zyada hoti hai. Yeh candlestick pehle candlestick ke neeche close hota hai, lekin pehle candlestick ke upper shadow ya body ke close ke beech mein ek gap hota hai. Is gap ko "Tasuki Gap" kehte hain. Teesra Candlestick: Teesra candlestick bullish (vridhi ki taraf) hota hai aur iska opening price dusre candlestick ke closing price ke qarib hota hai. Teesre candlestick mein buying pressure dikhata hai, lekin price pehle candlestick ke low se upar nahi jata. Price Confirmation: Lower Tasuki Gap pattern ka interpretation yeh hota hai ki market mein selling pressure bani rehti hai, lekin teesri candlestick mein buyers aa jate hain. Is pattern ko dekh kar traders bearish trend mein reversal ki possibility ka andaza laga sakte hain. Lekin, is pattern ki confirmation ke liye aur technical indicators ka istemal kiya jata hai, kyunki yeh ek matra indicator nahi hota. Stop Loss aur Take Profit: Lower Tasuki Gap pattern ko trade karte waqt, traders normally stop loss aur take profit levels set karte hain taaki risk ko manage kiya ja sake. Stop loss level pehle candlestick ke high se thoda upar rakha ja sakta hai, jabki take profit level aksar trading strategy aur market conditions par depend karta hai. Yad rahe ki candlestick patterns ke istemal mein risk management aur confirmatory indicators ka bhi mahatva hota hai. Is pattern ko samajhna aur istemal karna forex trading mein ek comprehensive approach ke sath kiya jata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:05 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим