Tweezer candle pattern

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

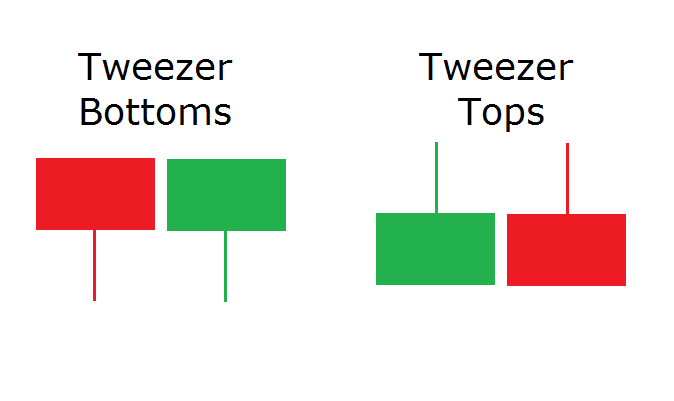

Tweezer candle pattern ek reversal pattern hai jo price chart par dikhta hai. Is pattern mein, ek pair of candlesticks ek dusre ke close levels ke kareeb hote hain, indicating a potential reversal in price direction. Tweezer candle pattern ki wazahat is tarah hai: 1. Formation: Tweezer candle pattern tab banega jab ek bullish candlestick (typically with a long upper shadow) ek bearish candlestick (typically with a long lower shadow) ke close level ke kareeb hota hai. Dono candlesticks ke close levels similar hote hain, indicating a battle between buyers and sellers. 2. Reversal Signal: Tweezer candle pattern ek reversal signal hai, yani ki yeh price direction ke reverse hone ka indication deta hai. Agar uptrend mein Tweezer candle pattern ban raha hai, toh yeh bearish reversal signal hai. Agar downtrend mein Tweezer candle pattern ban raha hai, toh yeh bullish reversal signal hai. 3. Confirmation Signals: Tweezer candle pattern par trade karne se pehle, traders confirmation signals ki talash karte hain. Ismein additional bearish or bullish candlestick patterns, volume, ya support/resistance level ka break dekhne se pehle trade karna consider kiya jata hai. Yeh confirmation signals traders ko aur bhi confidence dete hain, pattern ki validity ko confirm karte hain, aur false signals ko avoid karne mein madad karte hain. 4. Entry and Exit Points: Tweezer candle pattern traders ko entry aur exit points provide karta hai. Jab Tweezer candle pattern ban raha hai, traders uske formation ke baad sell (for bearish reversal) ya buy (for bullish reversal) position le sakte hain. Is pattern ke formation ke saath saath, traders stop loss aur target levels bhi set kar sakte hain. 5. Market Context: Tweezer candle pattern ko samajhne ke liye traders ko aur bhi analysis karna zaruri hai. Market trends, momentum, aur other technical indicators ka bhi analysis karna important hai. Tweezer candle pattern ek signal hai, lekin sirf is par rely karna sahi nahi hoga. Traders ko dusre factors ko bhi consider karna chahiye.Tweezer candle pattern ki wazahat aur fayde hote hain, lekin trading decisions lene se pehle aur bhi research karna aur dusre factors ka bhi dhyan dena zaruri hai. Price action, volume, aur confirmatory indicators ka bhi analysis karna important hai. -

#3 Collapse

Tweezer candlestick pattern:

Tweezer candlestick patterns ek reversal pattern hai, jo do candlesticks se banta hai. Ye pattern jab banta hai jab do candlesticks ek saath similar high ya low price level par form karte hain. Jab ek bullish tweezer pattern banta hai, toh pahli candlestick bearish hoti hai aur dusri candlestick bullish hoti hai. Iska matlab hai ki selling pressure kam ho rahi hai aur buying pressure badh rahi hai. Jab ek bearish tweezer pattern banta hai, toh pahli candlestick bullish hoti hai aur dusri candlestick bearish hoti hai. Iska matlab hai ki buying pressure kam ho rahi hai aur selling pressure badh rahi hai. Ye patterns reversal signals provide karte hain aur price direction ke change ki possibility indicate karte hain.

Characteristics of Tweezer candlestick Patterns:

Tweezer candlestick patterns ke saath trade karne ke kuch characteristics hain:

1. Entry point:

Aap entry point ko pahli candlestick ki high ya low price level ke paas set kar sakte hain, depending on the type of tweezer pattern.

2. Stop loss:

Stop loss aap dusri candlestick ki high ya low price level ke paas set kar sakte hain, to limit potential losses.

3. Target:

Target aap price action analysis aur support/resistance levels ke basis par set kar sakte hain.

4. Confirmation:

Aapko confirmation ke liye dusre indicators aur price patterns ka bhi istemal karna chahiye, toh aapko trade ki validity aur strength ka better idea ho.

5. Risk management:

Hamesha risk management ka dhyan rakhein aur apne trade size ko apne risk tolerance ke hisaab se set karein. Remember, hamesha apne trade plan ko follow karein aur market analysis par focus rakhein. -

#4 Collapse

What is Tweezer Candle Patterni? Introduction : Tweezer candle pattern ek aisa technical analysis tool hai jo ki forex trading mein use kiya jata hai. Is pattern ko candlestick charts ke zariye identify kiya jata hai. Design : Tweezer candle pattern mein do candlesticks hote hai jo ki ek doosre ke near hote hai. Ye candlesticks usually opposite colors mein hote hai aur ek hi price level ke near hote hai. Types : Tweezer candle pattern ke do types hote hai - bullish tweezer aur bearish tweezer. Bullish tweezer pattern mein pehle candlestick bearish hota hai aur doosre candlestick bullish hota hai. Iske alawa, bearish tweezer pattern mein pehla candlestick bullish hota hai aur doosra candlestick bearish hota hai. Significance : Tweezer candle pattern ka significance ye hai ki ye trend reversal ke signals deta hai. Agar bullish tweezer pattern market mein identify kiya jata hai toh ye bullish trend reversal ka signal hai aur agar bearish tweezer pattern market mein identify kiya jata hai toh ye bearish trend reversal ka signal hai. Trading Strategy : Tweezer candle pattern ki trading strategy ye hai ki ye pattern ke signals par trade kiya jata hai. Agar bullish tweezer pattern market mein identify kiya jata hai toh trader long position mein jata hai aur agar bearish tweezer pattern market mein identify kiya jata hai toh trader short position mein jata hai. Iske alawa, stop loss aur take profit levels bhi set kiye jate hai. Conclusion : Tweezer candle pattern ek bahut hi useful technical analysis tool hai jo ki forex trading mein use kiya jata hai. Ye pattern trend reversal ke signals deta hai aur iski trading strategy ko traders use karte hai. -

#5 Collapse

Tweezer candlestick pattern Hello dear buddies Tweezer Top aur Tweezer Bottom ko first time Steve Nison nami banda na invent kia. Steve Nison man Canslesticks chart k liye west man bhot famouse han. Tweezer candlesticks attern k bara man Steve Nison na apni book "Japanese Candlesticks Charting Techniques" man likhi ha."Tweezer Top sa morad ha k jab two candles pehli hamasha bullish aur second hamasha bearish ho aur bullish ka high taqreban ya bilkul bearish candle k high baraber ho. Is pattern k motabiq market jahan per close hoi waheb sa he nicha i. Tweezer top pattern strong signal tab hoga jab ye uptrend k bad ae."Tweezer Bottom sa morad ha k jab two candles pehli hamasha bearish aur dosri bulliish bana aur dono k low taqreban ya bilkul same ho. Iska motabiq jahan per market close hoi udher sa he oper chali gai. Tweezer Bottom candlesticks attern strong signal tab hoga jab ye bearish trend k bad bana to. Tweezer Top and Bottom candlestick pattern As salam o alaikum dosto Tweezer Top aur Tweezer bottom pattern k bad tweezer top new resistance aur Tweezer bottom new support hoga. Tweezer candlesticks pattern asal man ak Reversal candlesticks pattern ha. Tweezer top ki best examples Bullish Engulfing candlesticks pattern aur dark-cloud cover han. Tweezer bottom k foran bad ager hammer candlesticks patterh banna correctness k signal ha. Is man ha Buy ki trade lagaen. Tweezer bottom pattern k ke bad a candle Agar bullish Bane to agale candle mein Main aapane trade entry bike ki Le leni hai aur in case of the tweezer top pattern ke a Jab Bhi To Z top candle ki candle complete hone ke sath Agali candle complete ho to aapane Sel ki trade Le leni hai. Importance of Tweezer candlestick pattern Dear friends Bullish trend ma consistent bearish candles tweezer shape ma bnti hain to trend reversed predicted hota hai. trading market mein bahut sari baton different prediction dete hain aise hi tweezer top and bottom in date with the top and bottom candlestick chart patterns ko use karke decision liya ja sakta hai market ke reversal trend and continue trend ka.Forex trading market man candlestick chart patterns aapko diagram ke through tweezer top and bottom understand karne mein aapki help karta hun. Jab continue bearish candles banna shuru ho jaati hain air koi bhi candle bullish last candle ko cross kr ky close na ho to is ko tweezer bearish reversal trend kaha ja skta hai. Aisy he agr koi bhi three ye four candles continue bullish bn jain aor koi bhi candle bewrish camdle ko break kr ky below close na ho to us ko top tweezer oattern kaha ja skta hai jo bullish trend ki prediction deta hai aor ap intra day ma bullish trade open kr skty hain. -

#6 Collapse

What is Tweezer Chart Candles Pattern: Tweezer flame design ka importance ye hai ki ye pattern inversion ke signals deta hai. Agar bullish tweezer design market mein distinguish kiya jata hai toh ye bullish pattern inversion ka signal hai aur agar negative tweezer design market mein recognize kiya jata hai toh ye negative pattern inversion ka signal hai Tweezer light example ki exchanging procedure ye hai ki ye design ke signals standard exchange kiya jata hai. Agar bullish tweezer design market mein recognize kiya jata hai toh dealer long position mein jata hai aur agar negative tweezer design market mein distinguish kiya jata hai toh broker short position mein jata hai. Iske alawa, stop misfortune aur take benefit levels bhi set kiye jate hai.Tweezer candle design ek bahut hey valuable specialized examination apparatus hai jo ki forex exchanging mein use kiya jata hai. Ye design pattern inversion ke signals deta hai aur iski exchanging technique ko dealers use karte hai. Candle Chart pattern or Light Graph design ek aisa specialized investigation instrument hai jo ki forex exchanging mein use kiya jata hai. Is design ko candle outlines ke zariye recognize kiya jata hai Tweezer candle design mein do candles hote hai jo ki ek doosre ke close hote hai. Ye candles typically inverse tones mein hote hai aur ek greetings cost level ke close hote hai Tweezer candle design ke do types hote hai - bullish tweezer aur negative tweezer. Bullish tweezer design mein pehle candle negative hota hai aur doosre candle bullish hota hai. Iske alawa, negative tweezer design mein pehla candle bullish hota hai aur doosra candle negative hota hai. Identification Of Tweezer Chart Pattern: Entry point or Passage point ko pahli candle ki high ya low cost level ke paas set kar sakte hain, stop misfortune aap dusri candle ki high ya low cost level ke paas set kar sakte hain, target aap cost activity investigation aur support/obstruction levels ke premise standard set kar sakte hain.candlestick designs ek inversion design hai, jo do candles se banta hai. Ye design hit banta hai hit do candles ek saath comparative high ya low cost level standard structure karte hain. Hit ek bullish tweezer design banta hai, toh pahli candle negative hoti hai aur dusri candle bullish hoti hai. Iska matlab hai ki selling pressure kam ho rahi hai aur purchasing pressure badh rahi hai. Hit ek negative tweezer design banta hai, toh pahli candle bullish hoti hai aur dusri candle negative hoti hai. Iska matlab hai ki purchasing pressure kam ho rahi hai aur selling pressure badh rahi hai. Ye designs inversion signals give karte hain aur cost course ke change ki plausibility demonstrate karte hain.

Candle Chart pattern or Light Graph design ek aisa specialized investigation instrument hai jo ki forex exchanging mein use kiya jata hai. Is design ko candle outlines ke zariye recognize kiya jata hai Tweezer candle design mein do candles hote hai jo ki ek doosre ke close hote hai. Ye candles typically inverse tones mein hote hai aur ek greetings cost level ke close hote hai Tweezer candle design ke do types hote hai - bullish tweezer aur negative tweezer. Bullish tweezer design mein pehle candle negative hota hai aur doosre candle bullish hota hai. Iske alawa, negative tweezer design mein pehla candle bullish hota hai aur doosra candle negative hota hai. Identification Of Tweezer Chart Pattern: Entry point or Passage point ko pahli candle ki high ya low cost level ke paas set kar sakte hain, stop misfortune aap dusri candle ki high ya low cost level ke paas set kar sakte hain, target aap cost activity investigation aur support/obstruction levels ke premise standard set kar sakte hain.candlestick designs ek inversion design hai, jo do candles se banta hai. Ye design hit banta hai hit do candles ek saath comparative high ya low cost level standard structure karte hain. Hit ek bullish tweezer design banta hai, toh pahli candle negative hoti hai aur dusri candle bullish hoti hai. Iska matlab hai ki selling pressure kam ho rahi hai aur purchasing pressure badh rahi hai. Hit ek negative tweezer design banta hai, toh pahli candle bullish hoti hai aur dusri candle negative hoti hai. Iska matlab hai ki purchasing pressure kam ho rahi hai aur selling pressure badh rahi hai. Ye designs inversion signals give karte hain aur cost course ke change ki plausibility demonstrate karte hain.  Market patterns, energy, aur other specialized pointers ka bhi investigation karna significant hai. Tweezer candle design ek signal hai, lekin sirf is standard depend karna sahi nahi hoga. Merchants ko dusre factors ko bhi consider karna chahiye.Tweezer light example ki wazahat aur fayde hote hain, lekin exchanging choices lene se pehle aur bhi research karna aur dusre factors ka bhi dhyan dena zaruri hai. Cost activity, volume, aur corroborative markers ka bhi investigation karna significant hai.weezer flame design merchants ko section aur leave focuses give karta hai. Hit Tweezer light example boycott raha hai, merchants uske arrangement ke baad sell (for negative inversion) ya purchase (for bullish inversion) position le sakte hain. Is design ke arrangement ke saath, merchants stop misfortune aur target levels bhi set kar sakte hain. Formation And Types Of Tweezer Chart Pattern: Design ko sirf ek signal ke taur standard na lein. Isay affirm karne ke liye, doosre specialized pointers jaise ke RSI (Relative Strength File) ya MACD (Moving Normal Combination Dissimilarity) ka istemal karen.apne exchanges ke liye stop misfortune aur take benefit levels set karen. Tweezer Top Example ke istemal se aap market ke inversion ko to pehchan sakte hain, lekin cost activity kab badlega, iska pata lagana mushkil ho sakta hai. exchanging capital ko safeguard karne ke liye risk the executives ka istemal karen. Har exchange mein sirf aik chhota hissa apne absolute capital se exchange karen. Candle Example ek useful asset ho sakti hai, lekin yaad rahe ke kisi bhi ek pointer ya design standard pura bharosa na karen. Market investigation mein variety laane ke liye doosre specialized devices aur essential investigation ka bhi istemal karen.

Market patterns, energy, aur other specialized pointers ka bhi investigation karna significant hai. Tweezer candle design ek signal hai, lekin sirf is standard depend karna sahi nahi hoga. Merchants ko dusre factors ko bhi consider karna chahiye.Tweezer light example ki wazahat aur fayde hote hain, lekin exchanging choices lene se pehle aur bhi research karna aur dusre factors ka bhi dhyan dena zaruri hai. Cost activity, volume, aur corroborative markers ka bhi investigation karna significant hai.weezer flame design merchants ko section aur leave focuses give karta hai. Hit Tweezer light example boycott raha hai, merchants uske arrangement ke baad sell (for negative inversion) ya purchase (for bullish inversion) position le sakte hain. Is design ke arrangement ke saath, merchants stop misfortune aur target levels bhi set kar sakte hain. Formation And Types Of Tweezer Chart Pattern: Design ko sirf ek signal ke taur standard na lein. Isay affirm karne ke liye, doosre specialized pointers jaise ke RSI (Relative Strength File) ya MACD (Moving Normal Combination Dissimilarity) ka istemal karen.apne exchanges ke liye stop misfortune aur take benefit levels set karen. Tweezer Top Example ke istemal se aap market ke inversion ko to pehchan sakte hain, lekin cost activity kab badlega, iska pata lagana mushkil ho sakta hai. exchanging capital ko safeguard karne ke liye risk the executives ka istemal karen. Har exchange mein sirf aik chhota hissa apne absolute capital se exchange karen. Candle Example ek useful asset ho sakti hai, lekin yaad rahe ke kisi bhi ek pointer ya design standard pura bharosa na karen. Market investigation mein variety laane ke liye doosre specialized devices aur essential investigation ka bhi istemal karen.  Forex aur financial exchange mein exchanging karte waqt, specialized examination ka istemal karke brokers candle designs ki madad se market ka pattern aur cost development ka andaza lagate hain. Yeh designs cost diagrams standard aikhtiyar karti hain aur dealers ko potential exchanging amazing open doors ki pehchan mein madadgar hoti hain. Aaj murmur Tweezer Top Candle Example standard baat karain ge, jo ek ahem aur normal candle design hai.Tweezer Top Candle Example ek inversion design hai, jo negative inversion ko darust karti hai. Is design mein do candles hoti hain, jo ke ek dusre ke qareeb hoti hain aur market ke pattern mein tabdeeli ki taraf ishara karti hain. Is design ko samajhne ke liye, yeh zaroori hai ke aap candles ki fundamental comprehension rakhein. Tweezer Chart Pattern Trading: Pattern mein pehli candle bullish hoti hai, yani ke market mein purchasers overwhelm kar rahe hain. Is bullish light ki shutting cost pehle commotion ke high ke qareeb hoti hai. Yeh bullish light certain opinion ko darust karta hai market mein dobara se bullish opening hoti hai lekin phir se merchants aate hain aur market ko neeche le jate hain. Is commotion ki flame ki shutting cost pehle racket ki high ke qareeb hoti hai, jis se yeh samjha jata hai ke market mein selling pressure barh raha hai aur bulls ko control se bahar kar diya gaya hai.Tweezer Top example ko samajhna tijarat karne rib ke liye aham hai. Punch aap ise market mein dekhte hain, to aap samajh sakte hain ke market mein negative inversion sharpen ke chances hain.

Forex aur financial exchange mein exchanging karte waqt, specialized examination ka istemal karke brokers candle designs ki madad se market ka pattern aur cost development ka andaza lagate hain. Yeh designs cost diagrams standard aikhtiyar karti hain aur dealers ko potential exchanging amazing open doors ki pehchan mein madadgar hoti hain. Aaj murmur Tweezer Top Candle Example standard baat karain ge, jo ek ahem aur normal candle design hai.Tweezer Top Candle Example ek inversion design hai, jo negative inversion ko darust karti hai. Is design mein do candles hoti hain, jo ke ek dusre ke qareeb hoti hain aur market ke pattern mein tabdeeli ki taraf ishara karti hain. Is design ko samajhne ke liye, yeh zaroori hai ke aap candles ki fundamental comprehension rakhein. Tweezer Chart Pattern Trading: Pattern mein pehli candle bullish hoti hai, yani ke market mein purchasers overwhelm kar rahe hain. Is bullish light ki shutting cost pehle commotion ke high ke qareeb hoti hai. Yeh bullish light certain opinion ko darust karta hai market mein dobara se bullish opening hoti hai lekin phir se merchants aate hain aur market ko neeche le jate hain. Is commotion ki flame ki shutting cost pehle racket ki high ke qareeb hoti hai, jis se yeh samjha jata hai ke market mein selling pressure barh raha hai aur bulls ko control se bahar kar diya gaya hai.Tweezer Top example ko samajhna tijarat karne rib ke liye aham hai. Punch aap ise market mein dekhte hain, to aap samajh sakte hain ke market mein negative inversion sharpen ke chances hain.  Candle designs apne interesting tareeqe se market examination mein aik aham hissa hain. In designs ki madad se merchants aur financial backers market ke future patterns ko samajhne ki koshish karte hain. Aaj murmur ek aham candle design "Tweezer Top" standard baat karne ja rahe hain, jo ke exchanging aur contributing mein istemal hota hai. Is article mein, murmur Tweezer Top candle design ke exposed mein roman Urdu mein tafseel se baat karenge.Tweezer Top ek negative inversion candle design hai jo market ke pattern ke change ko darust karnay ki salahiyat rakhta hai. Is design mein do alag candles hoti hain jo ke kisi upswing ke baad ati hain aur show kartin hain ke market mein selling pressure barh raha hai. Yeh design major areas of strength for aksar signals give karta hai agar ise sahi tareeqe se samjha jaye.

Candle designs apne interesting tareeqe se market examination mein aik aham hissa hain. In designs ki madad se merchants aur financial backers market ke future patterns ko samajhne ki koshish karte hain. Aaj murmur ek aham candle design "Tweezer Top" standard baat karne ja rahe hain, jo ke exchanging aur contributing mein istemal hota hai. Is article mein, murmur Tweezer Top candle design ke exposed mein roman Urdu mein tafseel se baat karenge.Tweezer Top ek negative inversion candle design hai jo market ke pattern ke change ko darust karnay ki salahiyat rakhta hai. Is design mein do alag candles hoti hain jo ke kisi upswing ke baad ati hain aur show kartin hain ke market mein selling pressure barh raha hai. Yeh design major areas of strength for aksar signals give karta hai agar ise sahi tareeqe se samjha jaye.

-

#7 Collapse

Tweezer candle pattern introduction Tweezer candle pattern ek technical analysis concept hai jo stock market mein istemal hota hai. Yeh pattern traders ko price reversals ki indication deta hai. Tweezer candle pattern do candlesticks se banta hai: Bullish Tweezer: Yeh pattern downtrend ke baad aata hai aur ek reversal signal deta hai. Pehla candlestick red (bearish) hota hai, phir dusra candlestick green (bullish) hota hai, lekin dono ki closing prices ek doosre ke bohot kareeb hoti hain. Yeh bullish reversal signal hai. Bearish Tweezer: Yeh pattern uptrend ke baad aata hai aur ek reversal signal deta hai. Pehla candlestick green (bullish) hota hai, phir dusra candlestick red (bearish) hota hai, lekin dono ki closing prices ek doosre ke bohot kareeb hoti hain. Yeh bearish reversal signal hai. Tweezer candle pattern formation Tweezer candle pattern ek technical analysis chart pattern hai jo market me reversal ya trend change ki possibility ko darust karti hai. Tweezer candle pattern do specific candlesticks se banta hai jo ek dusre ke nazdeek close karte hain. Yeh pattern bearish tweezer top aur bullish tweezer bottom me aata hai. Bearish Tweezer Top: Isme pehla candle bullish hota hai aur doosra candle bearish hota hai. Dono candles ki opening aur closing prices ek dusre ke bohot nazdeek hoti hain, jaise ki ek tweezers ki tangon ki tarah. Bullish Tweezer Bottom: Isme pehla candle bearish hota hai aur doosra candle bullish hota hai. Dono candles ki opening aur closing prices bhi ek dusre ke bohot nazdeek hoti hain, jaise ki tweezers ki tangon ki tarah. How to trade Tweezer candle pattern Tweezer candlestick patterns Forex market mein trading ke liye istemal kiye ja sakte hain. Tweezer pattern ek reversal pattern hota hai aur yeh trader ko market ke direction mein hone wale possible changes ke bare mein hint deta hai. Is pattern ko trade karne ke liye aap ye kadam follow kar sakte hain: Identify the Tweezer Pattern: Pehle to aapko market chart par Tweezer pattern ko identify karna hoga. Tweezer pattern do candlesticks se banta hai, ek bullish aur ek bearish. Ye candlesticks ek dusre ke aas-pass hote hain aur similar high ya low par close hote hain. Confirm the Pattern: Tweezer pattern ko confirm karne ke liye, aapko dekhna hoga ki ye pattern kis tarah ke market conditions ke baad aata hai. Iske liye volume aur trend analysis bhi ki jaruri hoti hai. Entry Point: Agar aap ek bullish Tweezer pattern dekhte hain, to aap long position le sakte hain, matlab ki aap kharid sakte hain. Agar aapko bearish Tweezer pattern nazar aata hai, to aap short position le sakte hain, matlab ki aap bech sakte hain. Stop-Loss Aur Take-Profit Orders: Hamesha stop-loss aur take-profit orders set karein taki aapki trading position safe rahe. Ye aapko loss se bachane aur profit booking mein madadgar honge. Risk Management: Hamesha apne trading plan ke tahat risk management ka palan karein. Zyada risk lene se bachein aur apne trading account ko protect karein. Practice aur Learning: Tweezer pattern aur candlestick patterns ko samajhne ke liye practice aur learning ka samay nikalein. Demo account par trading karke apne skills ko improve karein.

- Mentions 0

-

سا0 like

-

#8 Collapse

Positive Volume Index (PVI) aur Negative Volume Index (NVI) dono technical indicators hain jo volume analysis ka istemaal karte hain. Ye indicators volume ke positive aur negative changes ko track karke price direction ke signals provide karte hain. Positive Volume Index (PVI): PVI volume ke positive changes ko track karta hai. Jab price bar previous price bar se upar close karta hai aur volume bhi previous volume se zyada hota hai, toh PVI increase hota hai. Ye indicate karta hai ki buying pressure zyada hai aur price ka uptrend continue hone ki sambhavna hai. PVI ka calculation previous PVI value aur current price change ke based par hota hai.Negative Volume Index (NVI): NVI volume ke negative changes ko track karta hai. Jab price bar previous price bar se neeche close karta hai aur volume bhi previous volume se kam hota hai, toh NVI increase hota hai. Ye indicate karta hai ki selling pressure zyada hai aur price ka downtrend continue hone ki sambhavna hai. NVI ka calculation previous NVI value aur current price change ke based par hota hai.PVI aur NVI ka istemaal karke traders volume changes ke trend ko analyze karte hain aur price direction ke signals dhoondhte hain. Agar PVI trend upar ki taraf hai aur NVI trend neeche ki taraf hai, toh ye bullish signal hai aur price ka uptrend hone ki possibility hai. Agar PVI trend neeche ki taraf hai aur NVI trend upar ki taraf hai, toh ye bearish signal hai aur price ka downtrend hone ki possibility hai.PVI aur NVI ko confirm karne ke liye, dusre technical indicators aur price action ka analysis bhi kiya jata hai. In indicators ka istemaal karne se pehle, traders ko inko samajhna zaroori hai aur apni trading strategy ke saath inko combine karna chahiye.Yeh indicators forex market mein bhi istemaal kiye jaate hain, lekin traders ko apni trading style aur risk tolerance ke hisaab se inka istemaal karna chahiye. Har trader ko apne knowledge aur experience ke saath inko samajhna aur test karna zaroori hai, taki unko sahi trading decisions lene mein madad mile. -

#9 Collapse

What is Analysis of Tweezers Top pattern karen.apne exchanges ke liye stop misfortune aur take benefit levels set karen. Tweezer Top Example ke istemal se aap market ke inversion ko to pehchan sakte hain, lekin cost activity kab badlega, iska pata lagana mushkil ho sakta hai. exchanging capital ko safeguard karne ke liye risk the executives ka istemal karen. Har exchange mein sirf aik chhota hissa apne absolute capital se exchange karen. Candle Example ek useful asset ho sakti hai, lekin yaad rahe ke kisi bhi ek pointer ya design standard pura bharosa na karen. Market investigation mein variety laane ke liye doosre specialized devices aur essential investigation ka bhi istemal karen.Forex aur financial exchange mein exchanging karte waqt, specialized examination ka istemal karke brokers candle designs ki madad se market ka pattern aur cost development ka andaza lagate hain. Yeh designs cost diagrams standard aikhtiyar karti hain aur dealers ko potential exchanging amazing open doors ki pehchan mein madadgar hoti hain. Aaj murmur Tweezer Top Candle Example standard baat karain ge, jo ek ahem aur normal candle design hai.Tweezer Top Candle Example ek inversion design hai, jo negative inversion ko darust karti hai. Is design mein do candles hoti hain, jo ke ek dusre ke qareeb hoti hain aur market ke pattern mein tabdeeli ki taraf ishara karti hain Treading pattern and Their Benefits market mein purchasers overwhelm kar rahe hain. Is bullish light ki shutting cost pehle commotion ke high ke qareeb hoti hai. Yeh bullish light certain opinion ko darust karta hai market mein dobara se bullish opening hoti hai lekin phir se merchants aate hain aur market ko neeche le jate hain. Is commotion ki flame ki shutting cost pehle racket ki high ke qareeb hoti hai, jis se yeh samjha jata hai ke market mein selling pressure barh raha hai aur bulls ko control se bahar kar diya gaya hai.Tweezer Top example ko samajhna tijarat karne rib ke liye aham hai. Punch aap ise market mein dekhte hain, to aap samajh sakte hain ke market mein negative inversion sharpen ke chances hain.Candle designs apne interesting tareeqe se market examination mein aik aham hissa hain. In designs ki madad se merchants aur financial backers market ke future patterns ko samajhne ki koshish karte hain. Aaj murmur ek aham candle design "Tweezer Top" standard baat karne ja rahe hain, jo ke exchanging aur contributing mein istemal hota hai. Is article mein, murmur Tweezer Top candle design ke exposed mein roman Urdu mein tafseel se baat karenge.Tweezer Top ek negative inversion candle design hai jo market ke pattern ke change ko darust karnay ki salahiyat rakhta hai. Is design mein do alag candles hoti hain jo ke kisi upswing ke baad ati hain aur show kartin hain ke market mein selling pressure barh raha hai. -

#10 Collapse

Tweezer candle pattern jasa ka ham baat krna wala ha tweezer chandle pattern ka bara ma buddies Tweezer Top aur Tweezer Bottom ko first time Steve Nison nami banda na invent kia jee ha ya baat bhot kam log janta ha ka Steve Nison man Canslesticks chart k liye west man bhot famouse han jee isi Tweezer candlesticks attern k bara man Steve Nison na apni book likhi jo Japanese ma Candlesticks Charting Technique ka bara me likhi ha Tweezer Top sa morad ha k jab two candlestick uper sa pehli hamasha bullish aur dosri hamasha bearish ho jee ha asa aur bullish ka high taqreban ya bilkul bearish candle k high baraber ho jee ha asa hi he hain. Is pattern k motabiq market jahan per close hoi wahi sa he nicha jati ha aur asa apko bhot hi zada si Tweezer top pattern strong signal tab hoga jab ye uptrend k bad aya to phr ap dakha Tweezer Bottom sa morad ha ka ap jab two candlestick pehla hamasha bearish aur aga ja kr dosri bulliish banah aur dono k kamm jasa ka low taqreban ya bilkul same ho to ap smj jaya ka Iska motabiq aga ja kr jahan per market close hoi udher sa he oper chali gai jee ha asa jb bi kbi aga sa Tweezer Bottom candlesticks attern strong signal tab hoga to zada tr asa hi kisi bi tarha sa ye bearish trend k bad bana to is sa paiso ka action aur volume aur confirmatory ya sab indicators ka bhi analysis karna important hain.'' What is Tweezer Candle Patterni...? jasa ka ham baat kr rha tha ka Tweezer candle pattern ko samajhne ke liye bhot aham ha ka traders ko aur bhi analysis karna zaruri hain' jasa meens Market trends momentum aur sara hi technical indicators ka bhi analysis karna important hai jee ha asa hi Tweezer candlestick pattern ek signal hai aur issa dakhna ha lekin sirf is par rely karna sahi nahi hoga'' jesa ka har baar Traders ko dusre factors ko bhi consider karna chahiye jee asa hi ha aur aga apko bhot sa Tweezer candlestick pattern ki wazahat aur fayde hote hain. lekin trading decijan lene se pehle aur bhi research karna aur dusre factors ka bhi dhyan dena zaruri hai jee asa aga ki Price action aur volume aur confirmatory ma indicators ka bhi analysis karna important hain. jee asa ap aga sa Is design mein do alag candlestick hoti hain. jee aga ap jo bi kisi upswing ke baad ati hain. unnah aga sa aur show kartin hain. isi liya ham aga ki market mein selling pressure dagh jata ha hain. Yeh design major areas pr aur of strength for aksar signals give karta hain.aur aham baat ya ha ka isa agar ise sahi tareeqe se samjha jaye to achi baat hain. -

#11 Collapse

Describe Tweezer Candle Pattern ? jasa ka ham baat krna wala ha tweezer candle pattern ka bara mama amigos Tweezer Top aur Tweezer Base ko first time Steve Nison nami banda na concoct kia jee ha ya baat bhot kam log janta ha ka Steve Nison man Canslesticks graph k liye west man bhot famouse han jee isi Tweezer candles attern k bara man Steve Nison na apni book likhi jo Japanese mama Candles Outlining Procedure ka bara me likhi ha Tweezer Top sa morad ha k hit two candle uper sa pehli hamasha bullish aur dosri hamasha negative ho jee ha asa aur bullish ka high taqreban ya bilkul negative flame k high baraber ho jee ha asa greetings he hain. Is design k motabiq market jahan per close hoi wahi sa he nicha jati ha aur asa apko bhot hey zada si Tweezer top areas of strength for example tab hoga hit ye upswing k awful aya to phr ap dakha Tweezer Base sa morad ha ka ap hit two candle pehla hamasha negative aur aga ja kr dosri bulliish banah aur dono k kamm jasa ka low taqreban ya bilkul same ho to ap smj jaya ka Iska motabiq aga ja kr jahan per market close hoi udher sa he oper chali gai jee ha asa jb bi kbi aga sa Tweezer Base candles areas of strength for attern tab hoga to zada tr asa greetings kisi bi tarha sa ye negative pattern k terrible bana to is sa paiso ka activity aur volume aur corroborative ya sab pointers ka bhi investigation karna significant hain. Consequence of Tweezer candle Patterns.... Dear companions Bullish pattern mama steady negative candles tweezer shape mama bnti hain to drift turned around anticipated hota hai. exchanging market mein bahut sari mallet different forecast dete hain aise hey tweezer top and base in date with the top and base candle outline designs ko use karke choice liya ja sakta hai market ke inversion pattern and proceed with pattern ka.Forex exchanging market man candle graph designs aapko chart ke through tweezer top and base comprehend karne mein aapki help karta hun. Punch proceed with negative candles banna shuru ho jaati hain air koi bhi flame bullish last candle ko cross kr ky close na ho to is ko tweezer negative inversion pattern kaha ja skta hai. Aisy he agr koi bhi three ye four candles proceed bullish bn jain aor koi bhi light bewrish camdle ko break kr ky beneath close na ho to us ko top tweezer oattern kaha ja skta hai jo bullish pattern ki expectation deta hai aor ap intra day mama bullish exchange open kr skty hain. Conculsion... Tweezer candle pattern ek bahut howdy helpful specialized examination instrument hai jo ki forex exchanging mein use kiya jata hai. Ye design pattern inversion ke signals deta hai aur iski exchanging methodology ko dealers use karte hai. Iska matlab hai ki buying pressure kam ho rahi hai aur selling pressure badh rahi hai. Ye plans reversal signals give karte hain aur cost course ke change ki credibility exhibit karte hain. -

#12 Collapse

What is Tweezer pattern? Introduction Dear friends Asalam o Alikum Tweezer candle pattern ek reversal pattern hai jo price chart par dikhta hai Is pattern mein ek pair of candlesticks ek dusre ke close levels ke kareeb hote hain indicating a potential reversal in price direction Define Tweezer pattern Dear friends Tweezer candle pattern tab banega jab ek bullish candlestick typically with a long upper shadow ek bearish candlestick typically with a long lower shadow ke close level ke kareeb hota hai Dono candlesticks ke close levels similar hote hain indicating a battle between buyers and sellers Tweezer candle pattern ek reversal signal hai yani ki yeh price direction ke reverse hone ka indication deta hai Agar uptrend mein Tweezer candle pattern ban raha hai toh yeh bearish reversal signal hai Agar downtrend mein Tweezer candle pattern ban raha hai toh yeh bullish reversal signal hai Dear friends Tweezer candle pattern par trade karne se pehle traders confirmation signals ki talash karte hain Ismein additional bearish or bullish candlestick patterns volume ya support resistance level ka break dekhne se pehle trade karna consider kiya jata hai Yeh confirmation signals traders ko aur bhi confidence dete hain pattern ki validity ko confirm karte hain aur false signals ko avoid karne mein madad karte hain Tweezer candle pattern traders ko entry aur exit points provide karta hai Jab Tweezer candle pattern ban raha hai traders uske formation ke baad sell for bearish reversal ya buy for bullish reversal position le sakte hain Is pattern ke formation ke saath saath traders stop loss aur target levels bhi set kar sakte hain Market Context Tweezer candle pattern ko samajhne ke liye traders ko aur bhi analysis karna zaruri hai Market trends momentum aur other technical indicators ka bhi analysis karna important hai Tweezer candle pattern ek signal hai lekin sirf is par rely karna sahi nahi hoga Traders ko dusre factors ko bhi consider karna chahiyeTweezer candle pattern ki wazahat aur fayde hote hain lekin trading decisions lene se pehle aur bhi research karna aur dusre factors ka bhi dhyan dena zaruri hai

Dear friends Tweezer candle pattern par trade karne se pehle traders confirmation signals ki talash karte hain Ismein additional bearish or bullish candlestick patterns volume ya support resistance level ka break dekhne se pehle trade karna consider kiya jata hai Yeh confirmation signals traders ko aur bhi confidence dete hain pattern ki validity ko confirm karte hain aur false signals ko avoid karne mein madad karte hain Tweezer candle pattern traders ko entry aur exit points provide karta hai Jab Tweezer candle pattern ban raha hai traders uske formation ke baad sell for bearish reversal ya buy for bullish reversal position le sakte hain Is pattern ke formation ke saath saath traders stop loss aur target levels bhi set kar sakte hain Market Context Tweezer candle pattern ko samajhne ke liye traders ko aur bhi analysis karna zaruri hai Market trends momentum aur other technical indicators ka bhi analysis karna important hai Tweezer candle pattern ek signal hai lekin sirf is par rely karna sahi nahi hoga Traders ko dusre factors ko bhi consider karna chahiyeTweezer candle pattern ki wazahat aur fayde hote hain lekin trading decisions lene se pehle aur bhi research karna aur dusre factors ka bhi dhyan dena zaruri hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

Aslamoalekum kesay hein ap sab members. Main umed krti hon ap sab thek hongay or apki posting behtreen ja rhi hogi isky sath apka trading session bhe acha ja raha hoga. Aj ka hmara discussion ka jo topic hay woh tweezer candlestick pattern ky baray mein hey isy dekhty hein ky yh kia hy or hmen kia malomat faraham karta hai. Tweezers Candlestick pattern Tweezer candle pattern mein do musalsal anay wali candles hote hain jin ka size barabar hota hai lekin ek candle upar jati hai aur dosri neeche. Yeh neshandahi karta hai ke market mein reversal ho sakta hai.Tweezer candle pattern ka dehan rakhna ahem ho sakta hai kyunkay yeh market mein mumkina trend reversal ko signal karta hai. Agar aap is pattern ko sahi tarah se samajh lete hain, toh aap market trends ko behter zahir kar sakte hain aur apne trading strategies ko behtreen kar sakte hain.Tweezer candle pattern us waqt hota hai jab do candles ek dosre ke barabar size ke hote hain is liye is bat ko zehn nasheen karty hain lekin ek candle upar jati hai aur dosri neeche. Isse alag, doosre patterns mein aksar ek candle ka size bada hota hai. Tweezer pattern market mein possible trend reversal ko darust karti hai, jabke baqi patterns alag tarah ke market conditions ko sahi tarah sy zahir karte hain. Application of pattern Tweezer candle pattern ka istemal market mein mumkina trend reversal ko zahir karne mein hota hai. Agar aap ise sahi tarah se pehchantay hain, toh aap samajh sakte hain ke market ka mood badalne wala hai aur aap apni trading strategy ko uss ke mutabiq adjust kar sakte hain. Yeh ek mazboot tareen tool ho sakta hai trend main tabdeelio ko zahir karne mein.Tweezer candle pattern ka istemal karne ke kuch faide hain, jese ke trend reversal ko pehchanna, lekin iske kuch nuksan bhi hote hain. Is pattern ki salahiyat market conditions par inhasar karti hai aur kabhi kabhi glat bhatkany walay isharay bhi de sakti hai. Isko samajhna mushkil ho sakta hai, aur sirf is par pura bharosa karke trading karna risky ho sakta hai. Hamesha, is pattern ko doosre market indicators aur tools ke saath milake istemal karna behtar hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:32 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим