Hammer and hanging man candlestick patterns:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

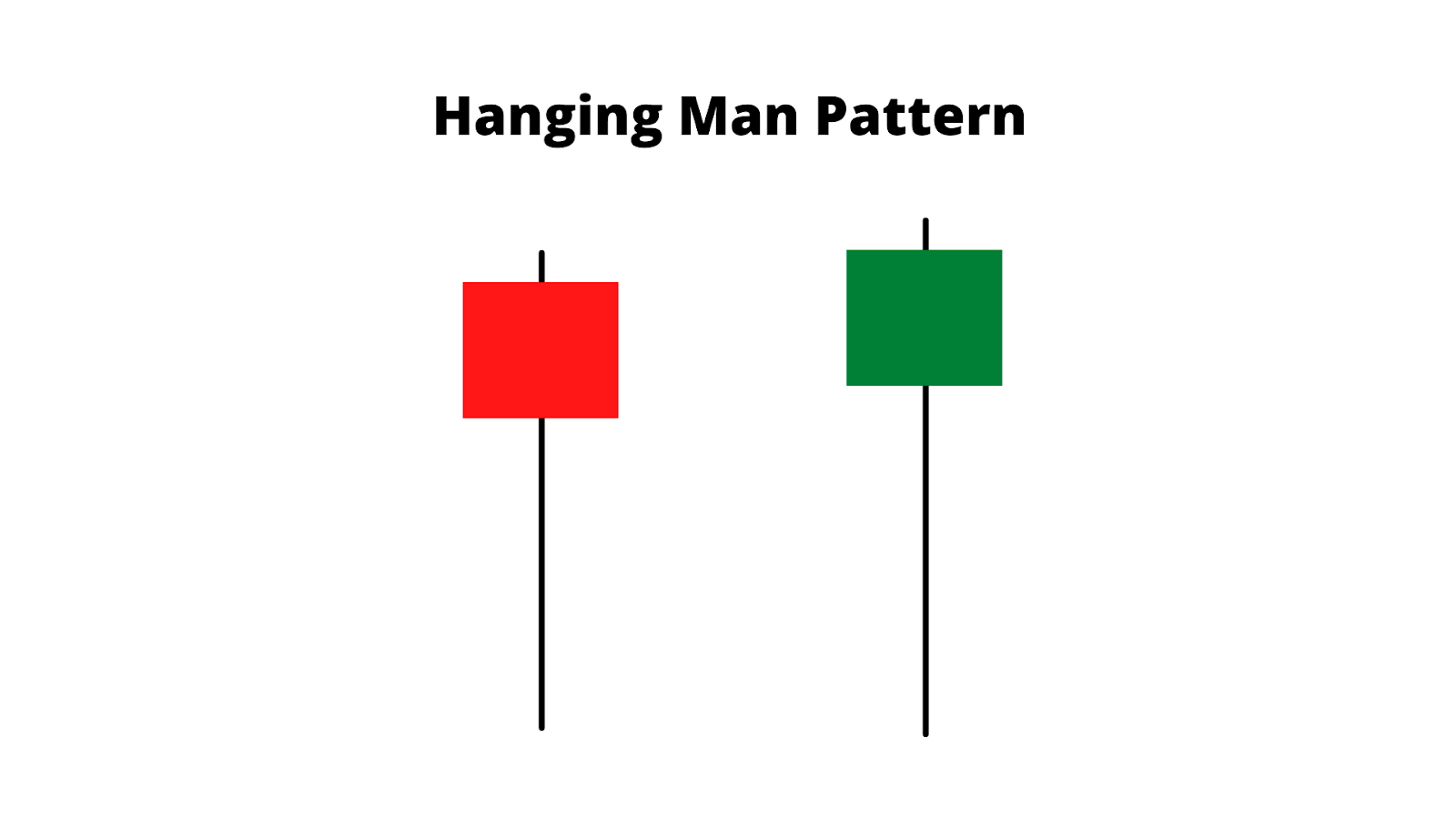

assalam alaikum dear forum members! subha bakhair! umeed karta hun aap sb khair khairiat se hn gy or apka trading week bahut acha ja raha ho ga dear members agr hum market ko seekh or smjh kr trade karento hmari kamyabi k chances barh jaty hain. or market main trade kart hovy candle sticks se hmara roz taluq hota ha es lye hamen inhen read karna ana chahye esi lye aj ki post main hum 2 main candle stick patterns ko detail se study karengy. What is Hanging man candlestick pattern? Dear members hanginh man es ko es lye kaha jata ha q k eski shakal latky hovy admi ki trha hoti ha. wo estrha k es ki nechy se lambi wich hoti ha jb k opr choti c bullish body hoti ha. ye candlestick bullish trend k end main banti ha or es k bad trend reversal expected hota ha. eski body k opr aksr koe wick ni hoti laikin kabhi kabhar choti c wick ho b skti ha. confirmation of hanging man: Dear members hanging man candle stick ki confirmation ye hoti ha k jis time frame main ye candle stick bny usi time frame main es se agli candlestick bearish close honi chahye agr aisa ho jy to ye hanging man ki confirmation hoti ha or market sell m jati ha. How to trade hanging man? Dear members hanging man pattern main trade leny k lye eski confirmation ka wait karen jb eski confirmation ho jy to ap yahan se sell ki entry le skty hain. or es main apka stop loss hanging man candle ki closing price tk ho ga. Agr ye pattern resistance muqam py bany to eski kafi value hoti ha or es py trust kia ja skta h. Hammer Candlestick Pattern: Dear members hammer candle stick esy es lye kaha jata ha k eski shakal hammer se milti julti hoti ha. Es ki nechy lambi wick hoti ha or opr short body hoti ha body k opr koe wick ni hoti js se proper hammer bnta ha. How to trade hammer candlestick? Dear members ye candle reversal pattern ki nishani hota ha or es k bad market reversa hoti ha es lye agr apko downtrend main support py ye candle dkhny ko mily to ap buy ki trade le skty hain. es main apka stop loss hammer k low py ho ga jb k tp next resistance tk ho skta ha. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hammer aur Hanging Man, dono Japanese candlestick patterns hain jo ki stock market aur financial markets mein price trends ko predict karne ke liye istemal hote hain. Ye patterns typically reversal signals provide karte hain, lekin inka istemal trend direction aur market context ke sath kiya jata hai. Niche main in dono patterns ke bare mein adhik jankari deta hoon: **Hammer:** 1. Hammer ek bullish reversal pattern hai jo ki downtrend ke baad aata hai. Iska arth hota hai ki ek downtrend ke baad uptrend ka prarambh hone ke chances hain. 2. Is pattern mein ek single candlestick hota hai, jiska upper shadow ya wick lamba hota hai aur lower shadow bahut chhota hota hai. 3. Candlestick ka close price upper side par hota hai, close price open price ke karib hota hai ya usse barabar hota hai. Yani, hammer ka body open price aur close price ke beech hota hai. 4. Hammer ko isliye "hammer" kaha jata hai kyun ki yah ek hammer ke handle aur head jaisa dikhta hai. **Hanging Man:** 1. Hanging Man ek bearish reversal pattern hai jo ki uptrend ke baad aata hai. Iska arth hota hai ki ek uptrend ke baad downtrend ka prarambh hone ke chances hain. 2. Is pattern mein bhi ek single candlestick hota hai, jiska upper shadow ya wick lamba hota hai aur lower shadow bahut chhota hota hai. 3. Candlestick ka close price upper side par hota hai, close price open price ke karib hota hai ya usse barabar hota hai. Yani, hanging man ka body open price aur close price ke beech hota hai. 4. Hanging Man ko isliye "hanging man" kaha jata hai kyun ki yah ek latki hui vyakti ya manushya ke jaisa dikhta hai. Dono patterns mein, jab hammer ya hanging man ek uptrend ya downtrend ke baad aata hai, to yah ek potential reversal signal provide karte hain. Lekin, traders ko in patterns ko dusre technical indicators aur market analysis ke sath milakar istemal karna behtar hota hai, aur confirmatory signals ka bhi dhyan rakhna chahiye. In patterns ko samjhne mein practice aur experience ki avashyakta hoti hai, aur iske istemal se pahle ek grishmaudghatit hui upasthiti ko confirm karna bhi mahatvapurna hota hai.

- Mentions 0

-

سا0 like

-

#4 Collapse

1. Introduction to Candlestick Patterns

Candlestick patterns trading ki duniya mein aik ahem hissah hain. Ye patterns market ki psychology aur price action ko samajhne mein madad dete hain. In mein se do mashhoor patterns hain: Hammer aur Hanging Man. In dono patterns ko samajhna aur inka istemal karna traders ke liye faida mand ho sakta hai.

2. Candlestick ki Pehchaan

Candlestick ek bar chart ka aik form hai jo kisi specific time frame mein price movement ko dikhata hai. Har candlestick ki do main components hoti hain: body aur wicks. Body price ke khuli aur band hone ki value ko dikhati hai, jabke wicks high aur low price ko.

3. Hammer Pattern ka Taaruf

Hammer pattern aik bullish reversal pattern hai jo tab banata hai jab price neeche aati hai aur phir aik strong bullish close ki taraf jaati hai. Is pattern ko dekhte hue yeh samajhna zaroori hai ke iski body choti hoti hai aur wick lambi hoti hai.

4. Hammer Pattern ki Shakal

Hammer pattern ki shakal mein aik choti body hoti hai jo neeche ki taraf hoti hai aur ek lambi wick hoti hai jo body ke upar se upar tak jaati hai. Ye pattern aksar downtrend ke baad banta hai aur iska matlab yeh hota hai ke sellers ki taqat kam ho rahi hai.

5. Hammer Pattern ki Confirmation

Hammer pattern ko confirm karne ke liye zaroori hai ke iske baad aik bullish candlestick aaye. Agar agla candlestick green ya bullish hai, toh yeh confirm karta hai ke market mein bullish momentum aa gaya hai.

6. Hammer Pattern ki Trading Strategy

Hammer pattern ko trade karne ke liye traders aksar stop loss ko body ke neeche rakhte hain. Is pattern ke aas paas support aur resistance lines ko dekhna bhi faida mand hai. Is se traders ko pata chalta hai ke market kis direction mein jaa sakta hai.

7. Hanging Man Pattern ka Taaruf

Hanging Man pattern bearish reversal pattern hai jo aksar uptrend ke baad banta hai. Yeh pattern bhi hammer ki tarah hota hai lekin iska context alag hota hai. Hanging Man ki body choti hoti hai aur lambi wick neeche ki taraf hoti hai.

8. Hanging Man Pattern ki Shakal

Hanging Man pattern ki shakal bhi hammer ki tarah hoti hai, lekin yeh uptrend ke dauran banta hai. Iski body ka rang red ya bearish ho sakta hai, jo yeh dikhata hai ke sellers ne market mein control hasil kar liya hai.

9. Hanging Man Pattern ki Confirmation

Hanging Man pattern ki confirmation ke liye zaroori hai ke iske baad aik bearish candlestick aaye. Agar agla candlestick red hai, toh yeh yeh confirm karta hai ke market mein bearish momentum hai.

10. Hanging Man Pattern ki Trading Strategy

Hanging Man pattern ko trade karne ke liye traders aksar stop loss ko body ke upar rakhte hain. Support aur resistance levels ko identify karna is pattern ke sath zaroori hai taake trade ko risk se bacha ja sake.

11. Hammer aur Hanging Man Patterns ki Ahamiyat

Hammer aur Hanging Man patterns traders ko market ke reversal points pe entry aur exit karne ka mauqa dete hain. In patterns ki madad se traders market ki sentiment aur trend ki direction samajh sakte hain.

12. Risk Management

Candlestick patterns ka istemal karte waqt risk management bohat zaroori hai. Stop loss ko zaroor implement karna chahiye taake kisi bhi unexpected market movement se bacha ja sake.

13. Technical Analysis aur Candlestick Patterns

Technical analysis mein candlestick patterns ka istemal traders ko market ki fluctuations ko samajhne mein madad karta hai. Iske ilawa, in patterns ko aur bhi indicators ke sath mila kar zyada effective strategies bana sakte hain.

14. Conclusion

Hammer aur Hanging Man candlestick patterns trading ke liye valuable tools hain. Inka samajhna aur sahi tarike se istemal karna traders ko profitable trades karne mein madad de sakta hai. Yeh patterns sirf aik indication hain, isliye inka istemal karte waqt hamesha market ki overall condition ko nazar mein rakhna chahiye. Risk management ka khayal rakhte hue in patterns ko apni trading strategy mein shamil karna behtar hota hai.

In patterns ko samajhne aur unki practice karne se traders apne trading skills ko enhance kar sakte hain aur market mein behter decision making kar sakte hain.

-

#5 Collapse

Candlestick patterns trading ke andar ek bohot hi important tool hain, jo price movements aur market sentiment ko samajhne mein madadgar hote hain. In patterns ke zariye traders potential reversals ya price direction ka اندازa lagate hain. Aaj hum do bohot aham candlestick patterns discuss karenge: Hammer aur HangingMan. Yeh dono patterns price action samajhne ke liye kaam aate hain aur trading decisions lene mein madad karte hain.

Hammer Candlestick Pattern

Hammer ek bullishreversalpattern hai, jo aksar downtrend ke end par banta hai. Yeh signal deta hai ke ab market bullish hone wali hai aur price upar ja sakta hai.

Hammer Pattern Ki Khasoosiyat- Chhoti Body:

Is pattern ki body chhoti hoti hai jo candlestick ke upar hoti hai. Iska rang green (bullish) ya red (bearish) ho sakta hai, lekin iski color itni zaroori nahi hoti. - Lambi Lower Wick:

Hammer ki lower wick body ke size se 2 ya 3 guna lambi hoti hai. Yeh dikhata hai ke price session ke dauraan neeche gir gaya tha, lekin wapas recover kar gaya. - Upper Wick Ka Na Hona:

Hammer candlestick mein ya toh upper wick hoti hi nahi ya bohot chhoti hoti hai.

Jab sellers price ko neeche push karte hain lekin session ke end tak buyers price ko wapas upar le aate hain, toh Hammer pattern banta hai. Yeh batata hai ke sellers ka pressure ab khatam ho raha hai aur buyers ka control barh raha hai.

Hammer Pattern Ke trade- Confirmation Zaroori Hai:

Sirf hammer pattern dekh kar trade enter karna galat hoga. Agle candlestick ka wait karein jo bullish close kare aur pattern confirm kare. - Support Level Ka Use:

Yeh pattern tab zyada kaam karta hai jab yeh kisi important support level par banta hai. - Stop Loss Ka Istemaal:

Hammer candlestick ke neeche jo low hota hai, usay stop-loss ke liye set karein.

Sochiye ke EUR/USD pair ek downtrend mein hai aur support level 1.1000 par hai. Ek hammer banta hai jo low 1.0950 ko touch karta hai lekin wapas 1.1005 par close hota hai. Agla candlestick bullish close karta hai, jo reversal ko confirm karta hai. Is point par buy karna ek acchi opportunity ho sakti hai.

Hanging Man Candlestick Pattern

Hanging Man ek bearishreversalpattern hai, jo aksar uptrend ke end par banta hai. Yeh signal deta hai ke market ab bearish hone wali hai aur price neeche gir sakta hai.

Hanging Man Pattern Ki Khasoosiyat- Chhoti Body:

Hanging Man ki body bhi hammer ki tarah chhoti hoti hai, lekin iska rang green ya red dono ho sakta hai. - Lambi Lower Wick:

Is candlestick ki lower wick bhi body se 2 ya 3 guna lambi hoti hai, jo dikhata hai ke price session ke dauraan neeche gir gaya tha. - Upper Wick Ka Na Hona:

Hanging Man pattern mein upper wick ya toh hoti hi nahi ya bohot chhoti hoti hai.

Jab buyers price ko upar push karte hain lekin session ke end tak sellers kaafi strong ho jate hain aur price neeche le aate hain, toh Hanging Man pattern banta hai. Yeh signal deta hai ke buying pressure kam ho raha hai aur selling shuru hone wali hai.

Hanging Man Pattern Ke trade- Confirmation Zaroori Hai:

Sirf hanging man pattern dekh kar trade lena risky ho sakta hai. Hamesha agle candlestick ka wait karein jo bearish close kare aur reversal ko confirm kare. - Resistance Level Ka Istemaal:

Hanging Man pattern zyada reliable hota hai jab yeh kisi strong resistance level par banta hai. - Stop Loss Ka Istemaal:

Hanging Man candlestick ke upar ka high point stop-loss ke liye use karein.

USD/JPY pair ek uptrend mein hai aur resistance level 150.00 par hai. Ek hanging man banta hai jo low 149.50 ko touch karta hai lekin 149.90 par close hota hai. Agla candlestick bearish close karta hai, jo reversal ko confirm karta hai. Yeh point short karne ka acha mauqa ho sakta hai.

Hammer Aur Hanging Man Ke Beech Fark

Dono patterns ki shakal milti julti hai, lekin unka context aur signal alag hota hai. Hammer aksar downtrend ke end par banta hai aur bullish reversal ka signal deta hai. Wahi Hanging Man uptrend ke end par banta hai aur bearish reversal ka signal deta hai.

Hammer Aur Hanging Man Patterns Ka Practical Use- Dusre Tools Ke Sath Combine Karein:

Yeh patterns tab zyada reliable hote hain jab inka use support/resistance levels, RSI, ya moving averages ke sath kiya jaye. - Volume Analysis:

Jab yeh patterns high volume ke sath bante hain, toh unka signal aur zyada strong hota hai. - Risk Management Ka Khayal Rakhein:

Stop-loss aur proper position sizing ka zaroor istimaal karein taake unexpected market movements ke against protection ho. - Confirmation Ka Wait Karein:

Yeh patterns sirf tabhi trade karne chahiye jab unka confirmation ho. Premature entries avoid karni chahiye.

Agar aap in patterns ko sahi technical analysis aur risk management ke sath use karte hain, toh yeh aapke trading decisions ko aur profitable bana sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Chhoti Body:

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hammer aur Hanging Man patterns candlestick chart analysis mein use hotay hain, jo market mein price movements ko samajhne aur future trends ko predict karne mein madadgar hote hain. Dono patterns visually ek jaise lagte hain, lekin inka meaning aur context alag hota hai.

1. Hammer Pattern

Bullish Reversal Signal

Structure:

Yeh pattern tab banta hai jab ek candle ka chhota upper body hota hai aur lamba lower shadow (wick).

Upper wick ya to hota hi nahi ya bohot chhota hota hai.

Yeh pattern usually downtrend ke end mein banta hai.

Indication:

Market initially neeche jaata hai lekin buyers strong comeback karte hain, jo price ko open ke aas-paas ya upar close kar dete hain.

Yeh pattern batata hai ke selling pressure khatam ho raha hai aur buyers control le rahe hain.

Confirmation:

Hammer ke baad agli bullish candle (green) banay to yeh pattern confirm hota hai.

Example:

Agar ek stock ka price 100 se gir ke 90 par aa gaya ho aur wahan Hammer pattern banta hai, toh yeh signal ho sakta hai ke price wapas upar jayega.

2. Hanging Man Pattern

Bearish Reversal Signal

Structure:

Iska structure Hammer ki tarah hota hai, lekin yeh pattern uptrend ke end mein banta hai.

Chhoti body aur lamba lower shadow.

Upper wick chhoti ya absent hoti hai.

Indication:

Yeh pattern batata hai ke buyers ab kamzor ho rahe hain aur sellers price neeche le jaane ki koshish kar rahe hain.

Market initially neeche girta hai lekin wapas recover karta hai, lekin yeh weakness dikhata hai.

Confirmation:

Hanging Man ke baad agli bearish candle (red) banay to yeh pattern confirm hota hai.

Example:

Agar ek stock ka price 150 se 160 tak chala gaya ho aur wahan Hanging Man pattern banta hai, toh yeh signal ho sakta hai ke price neeche girne wala hai.

Key Differences:

Context:

Hammer downtrend mein banta hai aur bullish signal deta hai.

Hanging Man uptrend mein banta hai aur bearish signal deta hai.

Signal:

Hammer recovery ya bounce indicate karta hai.

Hanging Man weakness ya potential reversal ka signal deta hai.

Trading Tips:

1. Volume Analysis:

Pattern ke saath volume ka analysis zaroori hota hai. High volume mein pattern zyada reliable hota hai.

2. Confirmation:

Dono patterns ko confirm karne ke liye agli candle ka wait karna zaroori hai.

3. Support aur Resistance:

Hammer support level par mile to stronger bullish signal hota hai.

Hanging Man resistance level par mile to stronger bearish signal hota hai.

Yeh patterns traders ko market ka trend samajhne mein help karte hain, lekin inka use other indicators ke saath milakar karna chahiye for better accuracy.

madad karte hain.

-

#7 Collapse

What is Hanging man candlestick pattern? Candlestick patterns trading ke andar ek bohot hi important tool hain, jo price movements aur market sentiment ko samajhne mein madadgar hote hain. In patterns ke zariye traders potential reversals ya price direction ka اندازa lagate hain. Aaj hum do bohot aham candlestick patterns discuss karenge: Hammer aur HangingMan. Yeh dono patterns price action samajhne ke liye kaam aate hain aur trading decisions lene mein madad karte hain. candle reversal pattern ki nishani hota ha or es k bad market reversa hoti ha es lye agr apko downtrend main support py ye candle dkhny ko mily to ap buy ki trade le skty hain. es main apka stop loss hammer k low py ho ga jb k tp next resistance tk ho skta ha.Technical analysis mein candlestick patterns ka istemal traders ko market ki fluctuations ko samajhne mein madad karta hai. Iske ilawa, in patterns ko aur bhi indicators ke sath mila kar zyada effective strategies bana sakte hain.

Risk Management . Lekin, traders ko in patterns ko dusre technical indicators aur market analysis ke sath milakar istemal karna behtar hota hai, aur confirmatory signals ka bhi dhyan rakhna chahiye.Hammer aur Hanging Man patterns traders ko market ke reversal points pe entry aur exit karne ka mauqa dete hain. In patterns ki madad se traders market ki sentiment aur trend ki direction samajh sakte hain. In patterns ko samjhne mein practice aur experience ki avashyakta hoti hai, aur iske istemal se pahle ek grishmaudghatit hui upasthiti ko confirm karna bhi mahatvapurna hota hai.Candlestick patterns ka istemal karte waqt risk management bohat zaroori hai. Stop loss ko zaroor implement karna chahiye taake kisi bhi unexpected market movement se bacha ja sake.

Trading Strategy. Is pattern mein ek single candlestick hota hai, jiska upper shadow ya wick lamba hota hai aur lower shadow bahut chhota hota hai. Candlestick ka close price upper side par hota hai, close price open price ke karib hota hai ya usse barabar hota hai.Hammer pattern ko trade karne ke liye traders aksar stop loss ko body ke neeche rakhte hain. Is pattern ke aas paas support aur resistance lines ko dekhna bhi faida mand hai. Is se traders ko pata chalta hai ke market kis direction mein jaa sakta hai.Hanging Man pattern bearish reversal pattern hai jo aksar uptrend ke baad banta hai. Yeh pattern bhi hammer ki tarah hota hai lekin iska context alag hota hai. Hanging Man ki body choti hoti hai aur lambi wick neeche ki taraf hoti hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Hammer aur Hanging Man candlestick patterns trading aur technical analysis mein kaafi mashhoor hain, aur dono almost ek jese lagte hain. Magar inki tafreeq unki position aur market ke trend ki wajah se hoti hai. Dono patterns price action ka istarah signal dete hain ke market mein buying ya selling ka pressure badal sakta hai.

1. Hammer Pattern:

Description:

Yeh ek bullish reversal pattern hai. Yeh aksar downtrend ke end par banta hai.

Is pattern mein ek choti body hoti hai (upar), aur neeche lambi tail (shadow) hoti hai. Upper shadow ya bilkul nahi hoti ya bohot choti hoti hai.

Kya signal deta hai?

Hammer is baat ka ishara karta hai ke sellers ne price neeche lekar jana chaha, lekin buyers ne market ko wapas upar push kiya. Yeh indicate karta hai ke buying pressure zyada ho raha hai.

Yeh pattern tab zyada strong hota hai jab volume zyada ho ya agle din price gap-up open ho.

Conditions:

Downtrend ke baad bane

Confirmation chahiye hoti hai (agle din ki green candle)

Neeche ka shadow body se do ya teen guna zyada lamba ho

Example:

Agar ek stock Rs. 100 se ghir kar Rs. 90 tak chala jaye, lekin din ka closing price wapas Rs. 98 ho jaye, toh Hammer ka pattern banta hai.

2. Hanging Man Pattern:

Description:

Yeh ek bearish reversal pattern hai, aur aksar uptrend ke end par banta hai.

Is pattern mein bhi choti body hoti hai (upar), aur neeche lambi shadow hoti hai. Upper shadow bohot choti hoti hai ya bilkul nahi hoti.

Kya signal deta hai?

Hanging Man yeh batata hai ke market mein sellers aa rahe hain. Price neeche gir kar recover zaroor hota hai, lekin selling pressure is baat ki nishani hai ke market neeche girne wala ho sakta hai.

Confirmation chahiye hoti hai ke agle din ki candle bearish ho.

Conditions:

Uptrend ke baad bane

Neeche wali shadow body se lambi ho

Confirmation chahiye hoti hai (agle din ki red candle)

Example:

Agar ek stock Rs. 150 tak upar gaya ho aur wahan se Rs. 140 tak gir jaye, lekin wapas recover ho kar Rs. 148 par close ho jaye, toh Hanging Man banta hi

Key Difference:

Hammer: Downtrend ke end par bullish reversal signal deta hai.

Hanging Man: Uptrend ke end par bearish reversal signal deta hai.

Trading Tips:

Confirmation ka intezar zaroor karein, kyun ke sirf pattern ke basis par trade lena risky hota hai.

Support aur resistance levels ko dekh kar analysis karen.

Volume ko bhi consider karein. Pattern ke saath high volume ho toh signal strong hota hai.

Yeh patterns short-term trading ke liye kaafi useful hain, magar hamesha aur indicators ke saath mila kar analysis karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:00 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим