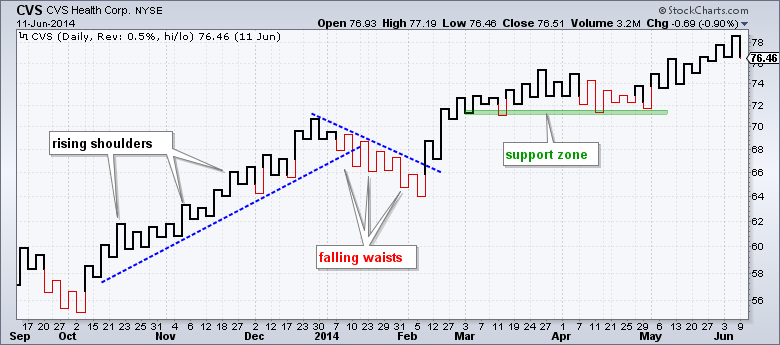

Kagi chart pattern

1. Tareef (Introduction):

Kagi Chart ek aisa technical analysis tool hai jo market trends ko visualize karne ke liye istemal hota hai. Is chart mein, price movements ko lines ke zariye darust taur par darust darust aur aam taur par color coding ke sath darust kiya jata hai.

2. Kagi Ka Matlab:

Kagi ka lafz Japani zaban se ata hai, jiska matlab hota hai "kuch cheez". Yeh is liye kyun ke har line ya "Kagi" market ki movement ko represent karti hai.

3. Kaise Kaam Karta Hai (How it Works):

Up Kagi (Upar Ki Taraf):

Agar market mein strong uptrend hai, to Kagi line upar ki taraf jati hai. Jab price ek mukarrar had tak pohanchti hai, to Kagi line lambi ho jati hai.

Down Kagi (Niche Ki Taraf):

Agar market mein strong downtrend hai, to Kagi line niche ki taraf jati hai. Jab price mukarrar had tak pohanchti hai, to Kagi line choti ho jati hai.

4. Rangin Kagi (Colored Kagi):

Kuch log Kagi lines ko color coding ke sath bhi use karte hain. Upar ki taraf jane wali Kagi lines ko white ya green se represent kia jata hai, jabke niche ki taraf jane wali Kagi lines ko black ya red se darust kiya jata hai.

5. Trading Strategies (Tijarat Ke Tareeqay):

Kagi Chart ko samajh kar traders market trends ko asani se samajh sakte hain. Isay istemal kar ke, woh entry aur exit points tay kar sakte hain. Agar Kagi line upar hai, to traders ko long positions lena ho sakta hai. Wahi agar Kagi line niche hai, to short positions lena ho sakta hai.

6. Khatima (Conclusion):

Kagi Chart ek powerful tool hai jo traders ko market ki trends ka pata lagane mein madad karta hai. Iski sahayata se, traders ko market ke mukhtalif phases mein tijarat karne mein asani hoti hai. Yeh ek visual aur effective tareeqa hai jisse market movements ko samjha ja sakta hai.

تبصرہ

Расширенный режим Обычный режим