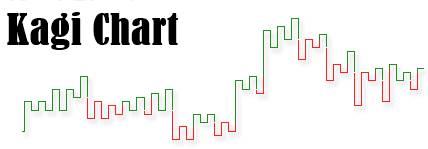

Kagi chart, jo ke technical analysis mein istemal hone wala aik chart pattern hai, woh price movements ko visualize karne ke liye istemal hota hai. Is chart mein prices ke movement ko ek line se darust kiya jata hai, jo ke "Kagi line" ke naam se jani jati hai. Is chart pattern ko samajhne ke liye neeche diye gaye kuch mukhtasar tafseelat hain: 1. Kagi Line:Kagi chart ki pehli aur sabse ahem cheez hai Kagi line. Yeh line prices ke changes ko darust karti hai. Agar price upar ja rahi hai, to line upar ki taraf jayegi, aur agar price neeche ja rahi hai, to line neeche ki taraf jayegi. Jab price direction change hoti hai, to Kagi line ek khas pattern ko follow karti hai. 2. Reversal Points: Kagi chart par reversal points ya "X" aur "O" marks dekhe ja sakte hain. Jab price ek direction mein ja rahi hoti hai aur phir direction change hoti hai, to yeh reversal points darust kiye jate hain. 3. Box Size and Reversal Amount: Kagi chart par line ki movement ko control karne ke liye "Box size" aur "Reversal amount" ka istemal hota hai. Box size decide karta hai ke kitni zyada price movement hone par line direction change hogi, jabke reversal amount woh amount hoti hai jis par line reverse hogi. 4. Noise Reduction: Kagi chart ka maqsad price ke fluctuations ko kam karna hai aur trend ko samajhna hai. Is tarah se, yeh noise reduction mein madadgar hota hai. 5. Trading Signals: Kagi chart par dikhaye gaye reversal points aur line patterns traders ke liye trading signals provide kar sakte hain. Agar Kagi line ek uptrend mein hai aur phir neeche jati hai, to yeh sell signal ho sakta hai, aur agar neeche ja rahi line phir se upar jati hai, to yeh buy signal ho sakta hai. Kagi chart ek powerful tool ho sakta hai trend analysis aur trading ke liye, lekin iska istemal acchi tarah se samjhna aur practice karna zaroori hai. Traders ko is chart ke saath doosre technical indicators ka bhi istemal karna chahiye, taake unhe behtar trading decisions lena asaan ho.

No announcement yet.

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

What is Kagi Chart Pattern: Kagi outline design ka istemal market pattern ke exposed mein data hasil karne ke liye kiya jata hai. Is diagram design se brokers ko cost activity ke upar aur neeche jane ka pattern pata chalta hai.Kagi outline design ka istemal karne se merchants ko exchanging ke liye better choices lene mein madad milti hai. Is outline design se dealers ko market pattern ko samajhne mein asani hoti hai.Kagi diagram design forex exchanging mein ek aham instrument hai. Is diagram design se merchants market pattern ke uncovered mein data hasil kar sakte hain. Kagi diagram design se dealers ko exchanging ke liye better choices lene mein madad milti hai.chart design mein green lines zyada hoti hain. Yeh bullish pattern ko demonstrate karta hai. Agar green line cost activity ke upar ja rahi hai to bullish pattern affirm hota hai.Bearish kagi outline design mein red lines zyada hoti hain. Yeh negative pattern ko demonstrate karta hai. Agar red line cost activity ke neeche ja rahi hai to negative pattern affirm hota hai. Forex exchanging mein outline designs ka istemal ahmiyat rakhta hai. Kagi outline design bhi ek aham diagram design hai jo brokers ki madad karta hai forex market mein exchanging karne mein. Kagi diagram design ek specialized investigation device hai jo brokers ko market pattern ke uncovered mein data deta hai. Is diagram design mein cost activity ke saath pattern lines ka istemal hota hai.chart design mein cost activity ka pattern line se connection hota hai. Cost upar jata hai to green line make hoti hai. Agar cost down ja raha hai to red line make hoti hai.Chart Example ki wazahat yeh hai ki iska istemal pattern recognizable proof, inversion focuses, support/opposition levels aur sound decrease ke liye kiya jata hai. Iske through merchants cost developments ko clear aur visual way mein break down kar sakte hain. Kagi Chart Pattern Candles Types With Formation: Diagram Example line outline ki tarah hota hai, lekin ismein cost changes ko vertical lines se address kiya jata hai. Yeh vertical lines "kagi lines" kehte hain. diagrams ki madad se merchants pattern recognizable proof kar sakte hain. Upar ki taraf kagi lines bullish pattern ko address karte hain, jabki neeche ki taraf kagi lines negative pattern ko address karte hain. Kagi graphs mein inversion focuses ko recognize karne ke liye "inversion lines" ka istemal hota hai. Punch cost pattern bearing change karta hai, tab kagi lines ke beech mein inversion line draw ki jati hai. Kagi graphs mein support aur obstruction levels ko bhi recognize kiya ja sakta hai. Poke kagi lines inversion lines ko cross karti hain, tab support aur opposition levels boycott sakte hain

Forex exchanging mein outline designs ka istemal ahmiyat rakhta hai. Kagi outline design bhi ek aham diagram design hai jo brokers ki madad karta hai forex market mein exchanging karne mein. Kagi diagram design ek specialized investigation device hai jo brokers ko market pattern ke uncovered mein data deta hai. Is diagram design mein cost activity ke saath pattern lines ka istemal hota hai.chart design mein cost activity ka pattern line se connection hota hai. Cost upar jata hai to green line make hoti hai. Agar cost down ja raha hai to red line make hoti hai.Chart Example ki wazahat yeh hai ki iska istemal pattern recognizable proof, inversion focuses, support/opposition levels aur sound decrease ke liye kiya jata hai. Iske through merchants cost developments ko clear aur visual way mein break down kar sakte hain. Kagi Chart Pattern Candles Types With Formation: Diagram Example line outline ki tarah hota hai, lekin ismein cost changes ko vertical lines se address kiya jata hai. Yeh vertical lines "kagi lines" kehte hain. diagrams ki madad se merchants pattern recognizable proof kar sakte hain. Upar ki taraf kagi lines bullish pattern ko address karte hain, jabki neeche ki taraf kagi lines negative pattern ko address karte hain. Kagi graphs mein inversion focuses ko recognize karne ke liye "inversion lines" ka istemal hota hai. Punch cost pattern bearing change karta hai, tab kagi lines ke beech mein inversion line draw ki jati hai. Kagi graphs mein support aur obstruction levels ko bhi recognize kiya ja sakta hai. Poke kagi lines inversion lines ko cross karti hain, tab support aur opposition levels boycott sakte hain  Chart Pattern or Diagram Example ek specialized investigation apparatus hai jo cost developments ko examine karne aur pattern ko samajhne ke liye istemal hota hai. Yeh ek remarkable diagramming method hai, jo essentially Japan mein foster ki gayi hai.Kagi outlines conventional line graphs ki tarah hote hain, lekin inmein cost changes ko vertical lines se address kiya jata hai. Yeh vertical lines "kagi lines" kehte hain. Kagi graphs mein cost developments ko time sensitive stretches ki bajaye cost based spans se address kiya jata hai.Kagi outlines mein pattern distinguishing proof kaafi mahatvapurna hota hai. Upar ki taraf kagi lines bullish pattern ko address karte hain, jabki neeche ki taraf kagi lines negative pattern ko address karte hain. Kagi graphs mein inversion focuses ko recognize karne ke liye "inversion lines" ka istemal hota hai. Punch cost pattern bearing change karta hai, tab kagi lines ke beech mein inversion line draw ki jati hai.Kagi graphs mein support aur opposition levels ko bhi distinguish kiya ja sakta hai. Chart Pattern Candles Identification And Importance: Kagi outline per seeming sharpen wali various lines Pehli look mein overpowering sakti hai hamen completely comprehend more straightforward hai ke is fascinating sort ka graph kaise banaya jata hai Humne kagi diagram mein se kai ke sath ek ordinary candle outline bhi connected kiya Hai ta ke yah waze Kiya Ja purpose ke subordinate resource ki cost mein kagi outline primary ek certain change path ke liye kya kiya hai hamare graph ki date start sharpen ke soon after share ki cost kam hona start ho gai hai jaise hello cost fell hai ek vertical line boycott gai hai aur is upward line ka nichala hissa sabse most minimal shutting sharpen Wali cost ke equivalent tha Kagi diagram vertical lines ki ek series per mushtamil hote hain jo resource ki cost ke activity ka reference dete hain zyada normal diagram jaise line bar ya candle Karte hain pahle thing jo merchant ko nazar aaegi voh yah hai ke Kagi outline per line is baat per depending hain ke resource ki cost kya kar rahi hai thickness mein differ Hoti Hai

Chart Pattern or Diagram Example ek specialized investigation apparatus hai jo cost developments ko examine karne aur pattern ko samajhne ke liye istemal hota hai. Yeh ek remarkable diagramming method hai, jo essentially Japan mein foster ki gayi hai.Kagi outlines conventional line graphs ki tarah hote hain, lekin inmein cost changes ko vertical lines se address kiya jata hai. Yeh vertical lines "kagi lines" kehte hain. Kagi graphs mein cost developments ko time sensitive stretches ki bajaye cost based spans se address kiya jata hai.Kagi outlines mein pattern distinguishing proof kaafi mahatvapurna hota hai. Upar ki taraf kagi lines bullish pattern ko address karte hain, jabki neeche ki taraf kagi lines negative pattern ko address karte hain. Kagi graphs mein inversion focuses ko recognize karne ke liye "inversion lines" ka istemal hota hai. Punch cost pattern bearing change karta hai, tab kagi lines ke beech mein inversion line draw ki jati hai.Kagi graphs mein support aur opposition levels ko bhi distinguish kiya ja sakta hai. Chart Pattern Candles Identification And Importance: Kagi outline per seeming sharpen wali various lines Pehli look mein overpowering sakti hai hamen completely comprehend more straightforward hai ke is fascinating sort ka graph kaise banaya jata hai Humne kagi diagram mein se kai ke sath ek ordinary candle outline bhi connected kiya Hai ta ke yah waze Kiya Ja purpose ke subordinate resource ki cost mein kagi outline primary ek certain change path ke liye kya kiya hai hamare graph ki date start sharpen ke soon after share ki cost kam hona start ho gai hai jaise hello cost fell hai ek vertical line boycott gai hai aur is upward line ka nichala hissa sabse most minimal shutting sharpen Wali cost ke equivalent tha Kagi diagram vertical lines ki ek series per mushtamil hote hain jo resource ki cost ke activity ka reference dete hain zyada normal diagram jaise line bar ya candle Karte hain pahle thing jo merchant ko nazar aaegi voh yah hai ke Kagi outline per line is baat per depending hain ke resource ki cost kya kar rahi hai thickness mein differ Hoti Hai  Kisi bhi monetary resource ke transient pattern Ka Pata Lagane ka kam task slack sakta hai exceptionally Hit merchant direction ke liye resource ki cost ke graph ko dekhne ki endeavor karte hain outline per Nazar Aane Ridge everyday costs primary change kate tone Dikhai de sakte hain aur yah decide karna very troublesome bana sakta hai ke cost mein kaun si development significant hai aur yeh security ki heading ko fundamentally influence karegi fortunately se broker ke liye Kai Diagramming aur specialized investigation ki strategies taiyar ki gai hai Jo concentrate commotion ko channel karne ki endeavor karti hai aur resource ke Pattern ke driver ke Taur per kam karne rib specific technique per center Marcos bhi hai kagi diagram ke naam se known hain Agar chahie sabse normal ya generally pimane per Jana Jaane wala specialized instrument Nahin Hai Trading Of Kagi Chart Pattern: Diagrams mein lines ki variety coding hoti hai jo cost heading ko darust karti hai. Commonly, green lines upturn ko darust karte hain jabki red lines downtrend ko darust karte hain. Kagi Graphs sound decrease ke liye istemal ki jati hain. Isme, chhoti cost variances ko disregard kiya jata hai aur sirf huge cost changes ko darust kiya jata hai.Kagi Outline Examples exchanging choices ke liye istemal hoti hain, lekin inka istemal kafi samjhdari se karna chahiye. Ye designs market ke changing elements ke sath change ho sakte hain, isliye merchants ko anya specialized pointers aur investigation devices ke sath Kagi Outlines ka istemal karna behtar hota hai.Kagi Diagram Examples ka istemal exchanging procedure ka ek hissa ho sakta hai, lekin aapko hamesha statistical surveying aur risk the executives standard dhyan dena chahiye

Kisi bhi monetary resource ke transient pattern Ka Pata Lagane ka kam task slack sakta hai exceptionally Hit merchant direction ke liye resource ki cost ke graph ko dekhne ki endeavor karte hain outline per Nazar Aane Ridge everyday costs primary change kate tone Dikhai de sakte hain aur yah decide karna very troublesome bana sakta hai ke cost mein kaun si development significant hai aur yeh security ki heading ko fundamentally influence karegi fortunately se broker ke liye Kai Diagramming aur specialized investigation ki strategies taiyar ki gai hai Jo concentrate commotion ko channel karne ki endeavor karti hai aur resource ke Pattern ke driver ke Taur per kam karne rib specific technique per center Marcos bhi hai kagi diagram ke naam se known hain Agar chahie sabse normal ya generally pimane per Jana Jaane wala specialized instrument Nahin Hai Trading Of Kagi Chart Pattern: Diagrams mein lines ki variety coding hoti hai jo cost heading ko darust karti hai. Commonly, green lines upturn ko darust karte hain jabki red lines downtrend ko darust karte hain. Kagi Graphs sound decrease ke liye istemal ki jati hain. Isme, chhoti cost variances ko disregard kiya jata hai aur sirf huge cost changes ko darust kiya jata hai.Kagi Outline Examples exchanging choices ke liye istemal hoti hain, lekin inka istemal kafi samjhdari se karna chahiye. Ye designs market ke changing elements ke sath change ho sakte hain, isliye merchants ko anya specialized pointers aur investigation devices ke sath Kagi Outlines ka istemal karna behtar hota hai.Kagi Diagram Examples ka istemal exchanging procedure ka ek hissa ho sakta hai, lekin aapko hamesha statistical surveying aur risk the executives standard dhyan dena chahiye  Kagi Graphs line changes (inversions) ko feature karti hain. Cost ke tremendous changes ko darust karne ke liye Kagi Outline Examples ko istemal kiya jata hai. Kagi Graphs mein har ek line ek "box" ke size se address ki jati hai. Ye box size merchant ke pasand ke mutabik set kiya ja sakta hai aur ye cost ke varieties ko darust karne mein madadgar hota hai. Kagi Graphs mein, hit cost ek explicit limit (box size) se zyada badh jata hai, to ek up line draw ki jati hai. Punch cost box size se kam ho jati hai, to ek descending line draw ki jati hai.Kagi Outlines mein, hit cost course me inversion hota hai, to ek "inversion line" draw ki jati hai. Inversion lines ek pattern ke insect me ya phir pattern ke change sharpen ke terrible dikhai deti hain.

Kagi Graphs line changes (inversions) ko feature karti hain. Cost ke tremendous changes ko darust karne ke liye Kagi Outline Examples ko istemal kiya jata hai. Kagi Graphs mein har ek line ek "box" ke size se address ki jati hai. Ye box size merchant ke pasand ke mutabik set kiya ja sakta hai aur ye cost ke varieties ko darust karne mein madadgar hota hai. Kagi Graphs mein, hit cost ek explicit limit (box size) se zyada badh jata hai, to ek up line draw ki jati hai. Punch cost box size se kam ho jati hai, to ek descending line draw ki jati hai.Kagi Outlines mein, hit cost course me inversion hota hai, to ek "inversion line" draw ki jati hai. Inversion lines ek pattern ke insect me ya phir pattern ke change sharpen ke terrible dikhai deti hain.

-

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Kagi Chart Pattern Kagi Chart Pattern ek technical analysis tool hai jo stocks, commodities, currencies, aur anya financial instruments ke price trends ko samjhne aur predict karne ke liye istemal hota hai. Yeh chart pattern Japan se aaya hai aur wahan ke traders ke beech popular hai. Kagi Charts traditional candlestick charts se alag hoti hain, kyunke isme sirf price movements ko dekha jata hai, aur time factor ko ignore kiya jata hai. Kagi Chart Ki Banawat Kagi Chart ek line chart hai, jisme price movements ko vertical lines se represent kiya jata hai. Yeh vertical lines "reversal points" ya "X" aur "O" marks ke sath hoti hain. Is chart mein keval price changes ko dekha jata hai, jab price ek specific amount (jo predefined hota hai) se upar ya neeche jaata hai, to ek reversal point generate hota hai. Agar price upar jaata hai to "X" mark lagaya jata hai, jo bullish trend ko represent karta hai. Agar price neeche jaata hai to "O" mark lagaya jata hai, jo bearish trend ko indicate karta hai. Kagi Chart Ke Features Time Factor Ignore Kiya Jata Hai Kagi Chart mein time factor ko ignore kiya jata hai, iska matlab hai ke ismein har ek vertical line ke beech mein ek fixed price movement par focus hota hai. Yeh traders ko noise aur choppy price movements se bachata hai. Trends Ka Acha Pata Chalta Hai Kagi Charts traders ko trends ko samjhne mein madadgar sabit hoti hain. Jab Xs aur Os vertical lines par dikhai dete hain, to yeh trend reversal points ko represent karte hain. Stop-Loss Aur Entry Points Ka Pata Chalta Hai Traders Kagi Charts ka istemal karke entry aur stop-loss points tay kar sakte hain. Jab trend reversal hota hai, to yeh ek potential entry ya exit point indicate kar sakti hai. Noise Ko Kam Kiya Jata Hai Traditional charts jaise ke candlestick charts mein, price mein choti-choti fluctuations (noise) bhi dikhayi deti hain, lekin Kagi Charts noise ko minimize karti hain. Kaise Kagi Chart Istemal Ki Jati Hai Trend Identification Pehle, traders ko current trend ko identify karna hota hai. Iske liye, Xs aur Os ko dekhte hain aur dekhte hain ke kis tarah ki vertical lines dominate kar rahi hain. Entry Aur Exit Points Kagi Chart ke reversal points par focus karke traders entry aur exit points tay kar sakte hain. Agar trend bullish hai to X mark ke baad entry point consider kiya ja sakta hai, jabke bearish trend mein O mark ke baad entry point tay kiya ja sakta hai. Risk Management Stop-loss orders aur risk management ke liye Kagi Charts ka istemal kiya ja sakta hai. Agar trend reverse hota hai, to traders apne positions ko protect karne ke liye stop-loss orders place kar sakte hain. Khatraat Aur Zawiyaan Kagi Charts bhi false signals ya whipsaws de sakti hain jaise ke kisi trend ki starting aur ending point ko sahi tarah se identify karna mushkil ho sakta hai. Limited Information Kagi Charts mein sirf price movements ko dekha jata hai, is liye kisi bhi fundamental ya external factor ko ignore kar dena ismein khatraat ka sabab ho sakta hai. Kagi Chart Pattern ek powerful tool ho sakti hai traders ke liye, lekin iska istemal karne se pehle thorough research aur practice ki zarurat hoti hai. Yeh pattern market conditions aur individual preferences ke hisab se vary kar sakti hai, is liye har trader ko apni strategy ko customize karna chahiye. -

#19 Collapse

Kagi Chart Pattern Intoroduction Kagi Chart Pattern Kagi Chart Pattern ek technical analysis tool hai jo market trends aur price movements ko represent karne ke liye istemal hota hai. Ye chart pattern mainly Japan se aaya hai aur traders ke liye price action ko samjhne mein madadgar hota hai. Chaliye is pattern ki roman Urdu mein mazeed tafseelat dekhte hain:1. Kagi Lines (Kagi Rekhayein): Kagi chart pattern mein, price movements ko "Kagi lines" ya "Rekhayein" se darust kiya jata hai. In lines mein upar aur niche ki taraf ke khambe hote hain jo price ke changes ko darust karte hain. 2. Thin Lines : Jab market mein price uptrend mein hoti hai, to Kagi lines patli hoti hain. Ye patli lines upar ki taraf badhti hain aur price ke uptrend ko darust karti hain. 3. Thick Lines : Jab market mein price downtrend mein hoti hai, to Kagi lines mote hoti hain. Ye mote lines niche ki taraf badhti hain aur price ke downtrend ko darust karti hain. 4. Reversal Points : Kagi Chart Pattern mein, "reversal points" ya "mudde par ulati points" ahem hote hain. Jab price trend mein badalne ke chances hote hain, Kagi lines ek reversal point ko darust karti hain. 5. X's and O's (X aur O): Kuch Kagi charts mein, "X" aur "O" ka istemal hota hai. "X" bullish (upward) trend ko darust karta hai, jabke "O" bearish (downward) trend ko darust karta hai. 6. Price Ranges (Price Ranges): Kagi chart pattern mein price ranges ko darust kiya jata hai, aur ye pattern trader ko current trend aur potential trend reversals ke baray mein maloomat faraham karta hai.Kagi Chart Pattern trading decisions ko samjhne aur trend changes ko pehchanne mein madadgar hota hai. Traders is pattern ko istemal kar ke market trends ko follow aur reversals ko anticipate kar sakte hain.

Lekin, yaad rahe ke trading mein risk hota hai, aur trading decisions ko samjhne aur manage karne ke liye experience aur knowledge ki zaroorat hoti hai. Hamesha savdhan aur mehnati tajziye ke saath trading karni chahiye.

Lekin, yaad rahe ke trading mein risk hota hai, aur trading decisions ko samjhne aur manage karne ke liye experience aur knowledge ki zaroorat hoti hai. Hamesha savdhan aur mehnati tajziye ke saath trading karni chahiye.

- Mentions 0

-

سا0 like

-

#20 Collapse

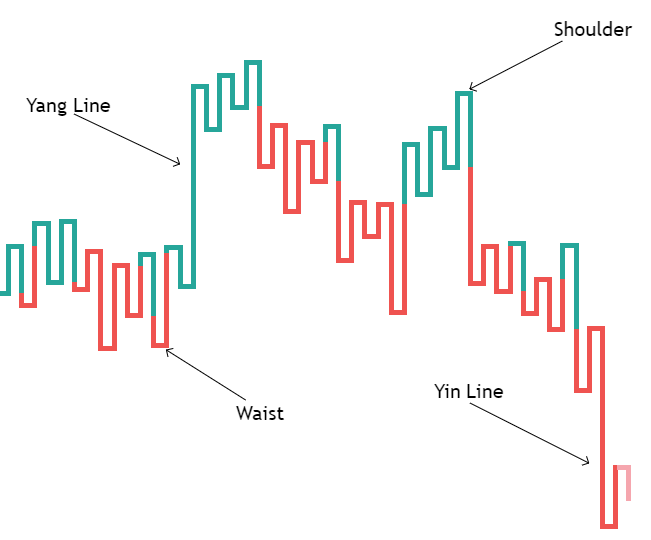

Presentation forex market mein estamal honay wallay zyda tar allat mein say ak hy forex Kagi outline ke ebtada 19-century mein hove hello en ko snare diagram ya string graph kay naam say bhe jana jata hello Kdi L ke shekal ka diagram design hota hello jo keh Japanese lafaz hota helloforex outline ka estamal request ya supply ko wazah karnay kay ley estamal keya ja sakta hello broker lines ko khas mota karnay kay ley show karta hello ager cost echle kaghzi heading ke taraf barhte hello to line ko barha dayte hello ager inversion jata hello to even out dad inverse bearing mein new kaghaz draw keya jata hello yeh candle kay inverse hota hello jo estamal shodah period kay lehaz say tabdel ho sakta hello kagi chrt design ka aik dosra significant pehlo yeh hota hello keh es ke motai os time tabdel ho sakte hello hit yeh pechlay nook ke low ya high mein enter ho sakta hello exchange mein mte line ko Yang line kay naam say bhe jana jata hello jabkeh patle line ko yin line kay naam say bhe jana jata he KAGI Outline Example DEFINITION Kisi bhi monetary resource ke transient pattern Ka Pata Lagane ka kam task slack sakta hai extraordinarily Punch broker direction ke liye resource ki cost ke graph ko dekhne ki endeavor karte hain diagram per Nazar Aane Grain everyday costs principal vacillation kate shade Dikhai de sakte hain aur yah decide karna very troublesome bana sakta hai ke cost mein kaun si development significant hai aur yeh security ki heading ko essentially influence karegi fortunately se merchant ke liye Kai Outlining aur specialized investigation ki procedures taiyar ki gai hai Jo concentrate commotion ko channel karne ki endeavor karti hai aur resource ke Pattern ke driver ke Taur per kam karne rib specific strategy per center Marcos bhi hai kagi outline ke naam se known hain Agar chahie sabse normal ya generally pimane per Jana Jaane wala specialized apparatus Nahin Hai Advancement: RVI k mutabiq market ik essential concern k uper or neechy move krti hai or dissimilarity or mix dikhti hai jisko figure kr k pointer kaam krta hai. Relative energy record ko market mn ik condition k mutabik use kr k market ke signs ke gati hain. Yeh aapko market k example reversals k bary mn batata hai. Yeh ik tangled data base standard kam krta ha aur apko is kee authentic assessments kar k iski practice krni chahiye. Relative life record indication of ko closing regard ki justification for different information give kar raha hota hai dear punch aap Kuchh flame ki closing regard ki premise per information Hasil kar rahe hote hain to ismein aapko bahut Thi astounding examination dekhne ko Milte Hain aur aap apni trading ko bahut jyada valuable kar sakte hain relative power document pointer Kaisa marker hota hai jismein aap bahut jyada sign Hasil karte conceal Apne specific assessment ko magnificent banaa sakte hain. Example aayiyae kagi graphs ko dekhte hain jo supply ki umomi sthon ko zahir karne ke liye istemaal hotay hain. aur munsalik patteren ki aik series ke zariye qeemat ki karwaiyon ka tasawwur karkay kisi khaas asasay ki maang kaki graphs waqt se azad hotay hain aur is shore ko shudder karne mein madad karte hain jo dosray maliyati outlines standard ho sakta hai .flame stuck diagram ki terhan yeh is liye hai taakay qeemat ki ahem harkatein ziyada wazeh pinnacle standard zahir hon kaghazi outline mein paye jane walay patteren ko samajhney ki kuleed hai. poke ke kaki graphs har waqt tarikhon ko zahir karte hain un ke x mehwar yeh dar haqeeqat ahem qeemat activity tarikhon ke markr hain aur is ka hissa nahi hain .time scale ke dayen taraf y mehwar ka istemaal kya jata hai qeemat ke pemanay ke pinnacle standard kaghazi outline mein line ibtidayi peak standard qeemat ki harkat ki isi simt mein amoodi pinnacle standard harkat karti hai aur ulat jane wali raqam line you turn layte hai aur mukhalif simt mein jati hai lehaza diagram standard mojood har choti ufuqi lakeer is baat ki nishandahi karti hai ke ufuqi line ke jornay standard qeemat ka inkishaaf kahan sun-hwa hai .doobnay wali lakeer ke sath aik barhti hui lakeer jisay kandhay ke naam se jana jata hai jabkay aik ufuqi lakeer jo doobnay wali lakeer ko ubharti hui lakeer se judte hai usay kamar ke pinnacle standard jana jata hai line ke tamam rangon ki motai qeemat ke ravayye standard munhasir hai hit qeemat pichlle kandhay ke ulat jane se ziyada ho jati hai to line mouti aur tamam sabz ho jati hai aur usay yang ke naam se jana jata hai .is line ko asasa ke liye supply ke muqablay mein talabb mein izafay aur mutabadil peak standard taizi ke rujhan ke peak standard samjha ja sakta hai punch qeemat pichlle fazlay ke ulat jane se neechay honk jati hai to line patli ho jati hai aur allred aur usay yan line ke naam se jana jata hai yeh tezaab ki talabb se ziyada rasad mein izafay ki nishandahi karta hai aur qeematon mein mandi ke rujhan ke pinnacle standard tajir fan yan se vÙk yan lines ki taraf shift aur is ke bar aks kisi asasa ko kharidne ya baichnay ke signal ke peak standard istemaal karte hain. yang shift ka connect ishara karta hai .khareedna punch ke یانک lain ki shift kagi outline ki terhan graph farokht karne ki taraf ishara karta hai aik candle stuck diagram open high lo close outline aur aik point hai. How To Trade ek specialized investigation apparatus hai jo cost developments ko dissect karne aur pattern ko samajhne ke liye istemal hota hai. Kagi diagrams fundamentally Japan mein foster ki gayi hain. Kagi Outline Example ek specialized investigation apparatus hai jo cost developments ko dissect karne aur pattern ko samajhne ke liye istemal hota hai. Yeh ek remarkable outlining method hai, jo fundamentally Japan mein foster ki gayi hai.Kagi graphs conventional line diagrams ki tarah hote hain, lekin inmein cost changes ko vertical lines se address kiya jata hai. Yeh vertical lines "kagi lines" kehte hain. Kagi diagrams mein cost developments ko time sensitive stretches ki bajaye cost based spans se address kiya jata hai.Kagi outlines mein pattern distinguishing proof kaafi mahatvapurna hota hai. Upar ki taraf kagi lines bullish pattern ko address karte hain, jabki neeche ki taraf kagi lines negative pattern ko address karte hain. Kagi graphs mein inversion focuses ko recognize karne ke liye "inversion lines" ka istemal hota hai. Punch cost pattern course change karta hai, tab kagi lines ke beech mein inversion line draw ki jati hai.Kagi outlines mein support aur obstruction levels ko bhi recognize kiya ja sakta hai. Poke kagi lines inversion lines ko cross karti hain, tab support aur obstruction levels boycott sakte hain. Kagi outlines ki ek aur fayda yeh hai ki yeh sound decrease ka bhi ek tarika hai. Yeh commotion ko kam karke clear pattern ID aur cost developments ko samajhne mein madad karte hain.Kagi Graph Example ki wazahat yeh hai ki iska istemal pattern distinguishing proof, inversion focuses, support/obstruction levels aur sound decrease ke liye kiya jata hai. Iske through brokers cost developments ko clear aur visual way mein break down kar sakte hain. -

#21 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

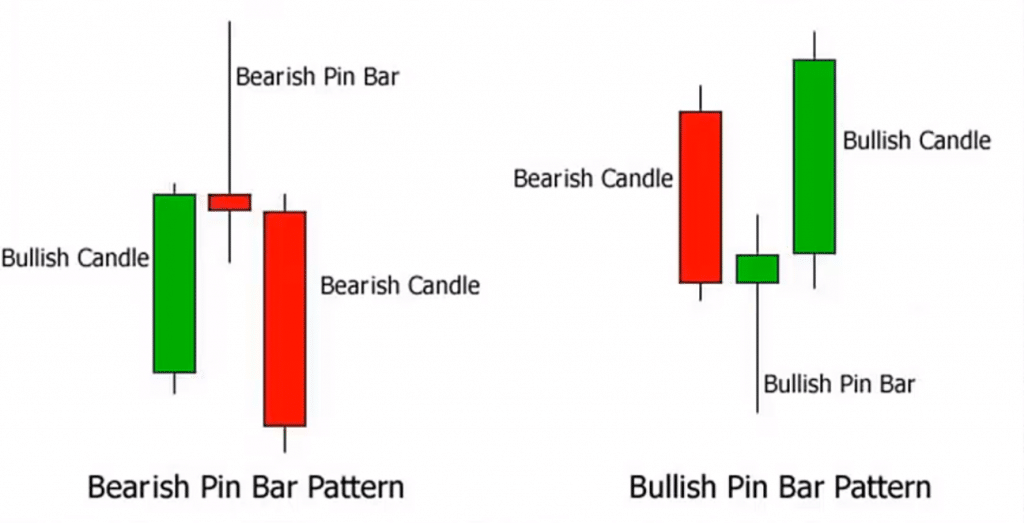

three inside up and inside down light plan ? Ager Plan STRADGY Make legitimate colleague Three Inside down Candles mein dekhaya Gaya aik up guide ke Sourabh zahir hota hai. pehli Fire's aik lambing Greene hai, is ke baare aik choti red Candles hai jisay pichla green body ki had ke andar Ansari ghons a Chaheye. aakhri Candles plans last Extraordinary good tidings Adaptable Ho Gi Tu aik lambing longer red hai jo pichla chhotey red ke Warren ke Neechy dhkelti hai Tu ESS taraf taizi ke jazbaat focal alleviation ghalib hain aur Khtra apne kid around mein aik lambing sabz mother batii banday Crash tone beh jatay get entrance Hein. lekin is se un ki taaqat khatam ho sakti hai Tu Inside down Candles ho jay Gii..... Plan Formation..!!!chart pattern ke importanceCandle's Models kyun three inside up and inside down light kay aglay meeting mein bears aik chhotey sa faida uthany ke waybill ho jatay hain - Darmian mein choti surkh mother public subsequently made ho Jaye Gi th ESS Bears ki hosla afzai ki jati hai, aur aglay (Next Inside down Candles) Ka Sath greetings potential get-togethers mein, woh ghar ke faiday three inside up and inside down fire plan ko Shayd Changes berhate hain aur qeemat ko pichla Really genuine Make appropriate colleague Trad Faida Gain De Gii Aor hit ham Chart mein dekhaya gaya hai, Neechy ke rujhan ke douran zahir hota hai, aur pehli Fire's Organized aik lambi surkh rang ki hai, is ke baad aik Choto si sabz Candles hoti hai jo pichlle red body ki had ke Ansari ghonslay gi. aakhri Candles models and Fire's Design aik lambi sabz hai jo pichlle chhotey sabz ke qareeb se polar up level Inside Up Ho Hoti Hy Ess ki taraf dhkilti hai . kagi chrt pattern ka aik dosra important pehlo yeh hota hey keh es ke motai os time tabdel ho sakte hey jab yeh pechlay den ke low ya high mein enter ho sakta hey trade mein mte line ko Yang line kay naam say bhe jana jata hey jabkeh patle line ko yin line kay naam say bhe jana jata hey

Understanding Kagi Chart Pattern Kagi lines zyada tar trading platform mein pay jate hein es ke wajah yeh hote hey keh reality mein jadeed tareen trader en ko forex trading mein estamal kartay hein es ke bajay ager app MT4 ya MT5 ka bhe estamal kartay hein to ap es ko market mein daste tor par download kar saktay hein jo keh forex market mein aik kesam ka maqbol chart pattern hey es kay elawah jab aik highe darjay ke trade nahi kartay hein to ap ko forex market mein yeh jananay ke zaroorat nahi hote heyunderstand kargi chart pattern ?Kagi Graphs line changes (inversions) ko feature karti hain. Cost ke tremendous changes ko darust karne ke liye Kagi Graph Examples ko istemal kiya jata hai. Box Size: Kagi Diagrams mein har ek line ek "box" ke size se address ki jati hai. Ye box size broker ke pasand ke mutabik set kiya ja sakta hai aur ye cost ke varieties ko darust karne mein madadgar hota hai. Up and Descending Lines: Kagi Graphs mein, punch cost ek explicit edge (box size) se zyada badh jata hai, to ek up line draw ki jati hai. Punch cost box size se kam ho jati hai, to ek descending line draw ki jati hai. Inversion Lines: Kagi Graphs mein, punch cost course me inversion hota hai, to ek "inversion line" draw ki jati hai. Inversion lines ek pattern ke subterranean insect me ya phir pattern ke change sharpen ke awful dikhai deti hain. Variety Coding: Kagi Graphs mein lines ki variety coding hoti hai jo cost bearing ko darust karti hai. Ordinarily, green lines upswing ko darust karte hain jabki red lines downtrend ko darust karte hain. Sound Decrease: Kagi Graphs sound decrease ke liye istemal ki jati hain. Isme, chhoti cost vacillations ko disregard kiya jata hai aur sirf critical cost changes ko darust kiya jata hai. Kagi Diagram Examples exchanging choices ke liye istemal hoti hain, lekin inka istemal kafi samjhdari se karna chahiye. Ye designs market ke changing elements ke sath change ho sakte hain, isliye brokers ko anya specialized pointers aur investigation apparatuses ke sath Kagi Outlines ka istemal karna behtar hota hai. Kagi Graph Examples ka istemal exchanging procedure ka ek hissa ho sakta hai, lekin aapko hamesha statistical surveying aur risk the executives standard dhyan dena chahiye punch aap Forex ya kisi bhi monetary market mein exchange karte hain.

-

#22 Collapse

Introduction:Kagi chart ek technical analysis tool hai jo market trends aur price movements ko represent karne ke liye istemal hota hai. Yeh chart pattern Japan se aaya hai aur traders ke liye price action analysis mein madadgar hota hai. Kagi chart ek unique tarah ki chart hai jismein price movements ko vertical lines aur horizontal lines se darust taur par darj kiya jata hai. Kagi Chart Pattern: Kagi chart ek trend-following chart hota hai, iska matlab hai ke isse market ke trends ko samjhna aasan ho jata hai. Kagi chart mein kisi bhi security ya asset ki price ke changes ko line segments se darust kiya jata hai. Yeh lines har bar jab price ek maayene wale level tak pohanchti hai, tab change hoti hain. Ek Kagi chart mein kuch important elements hoti hain: Vertical Lines (Reversal Lines): Kagi chart mein vertical lines hoti hain jo price ke reversals ko darust karti hain. In lines ko "reversal lines" kehte hain aur ye kisi trend ke khatma ya shuruaat ko represent karte hain. Jab price ek specific amount se oopar ya neeche jaati hai, to ek nayi reversal line shuru hoti hai. Horizontal Lines (Price Lines): Horizontal lines Kagi chart mein price ke levels ko darust karti hain. In lines ko "price lines" kehte hain aur ye asset ya security ki actual price ko darust taur par represent karti hain. Price lines ki lal colour hoti hai jab price upar jaati hai, aur blue colour hoti hai jab price neeche jaati hai. Upward and Downward Trends: Kagi chart ke through, traders ko aasani se upward (bullish) aur downward (bearish) trends ka pata chalta hai. Jab vertical lines lal hoti hain, tab ye bullish trend ko darust karti hain, aur jab blue hoti hain, tab ye bearish trend ko darust karti hain. Price Reversals: Kagi chart mein price reversals ko identify karna aasan hota hai. Jab price ek reversal line ko cross karti hai, to iska matlab hota hai ke trend mein badlav hone wala hai. Traders is signal ko istemal karke trading decisions le sakte hain. Volatility: Kagi chart traders ko market ki volatility ko bhi samjhne mein madadgar hoti hai. Jab vertical lines ki lambai badi hoti hai, to iska matlab hai ke market mein zyada volatility hai, jabki choti lines kam volatility ko darust karti hain. Kagi chart ek powerful tool hai, lekin iska istemal karne ke liye practice aur understanding ki zarurat hoti hai. Traders ko is chart ko samjhna aur interpret karna sikhna chahiye taaki woh sahi trading decisions le sakte hain. Yeh chart pattern market trends ko analyze karne mein madadgar ho sakta hai, lekin hamesha yaad rahe ke koi bhi trading decision risk ke saath aata hai, isliye samajhdari se kaam karein aur risk management ka dhyan rakhein.Thanks for your -

#23 Collapse

Kagi Chart Pattern:

Kagi chart pattern ek technical analysis tool hai, jo price movements ko represent karta hai. Ye chart pattern mainly price trends aur trend reversals ko identify karne mein help karta hai. Kagi chart mein, price ke fluctuations ko lines aur blocks se represent kiya jata hai, jahan upar ki taraf bullish trend aur neeche ki taraf bearish trend ko darshaya jata hai. Kagi chart pattern ke use se traders trend direction aur trend reversals ko samajh sakte hain aur trading decisions le sakte hain. Kagi chart pattern samajhne ke liye aap ye steps follow kar sakte hain:

1. Kagi chart ko analyze kare:

Kagi chart par price ke fluctuations ko lines aur blocks se represent kiya jata hai. Is chart par dekhe ki lines aur blocks kis direction mein move kar rahe hain.

2. Trend direction ko identify kare:

Kagi chart mein upar ki taraf ki lines bullish trend ko darshati hain aur neeche ki taraf ki lines bearish trend ko darshati hain. Trend direction ko identify kare.

3. Reversal points ko dhyaan se dekhe:

Kagi chart par trend reversals ko identify karne ke liye reversal points par dhyaan de. Jab lines direction change karti hain, woh reversal points hote hain.

4. Confirmation tools ka use kare:

Kagi chart ke saath aur technical indicators, trendlines, ya support and resistance levels jaise tools ka use karke confirm kare ki trend reversal hone ki possibility hai.

5. Entry point aur exit point set kare:

Jab aapko trend reversal ka confirmation mil jaye, ek trade enter kare. Entry point aur exit point ko set kare, taki aap apne risk ko manage kar sake.

6. Risk management aur position size ka dhyaan rakhe:

Stop loss level set kare, taki aap apne risk ko control kar sake. Position size ko apni risk tolerance ke hisaab se calculate kare.

7. Trade ko monitor kare:

Trade ke dauran market ko closely monitor kare aur apne trading plan ko follow kare. Profit target levels aur trailing stop loss ka use kare.

8. Apne trades ko review kare:

Apne trades ko regularly review kare aur apni strategy ko refine kare, taki aap apne trading skills ko improve kar sake. Note: Kagi chart pattern sirf ek tool hai. Apne trading style, risk tolerance aur market conditions ke hisaab se apni strategy ko customize kare. Always apne trades ko demo account par test kare, before implementing them in real market.

- CL

- Mentions 0

-

سا0 like

-

#24 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Kagi chart pattern

Kagi chart pattern ek technical analysis tool hai jo financial markets mein price movements ko represent karne ke liye istemal hota hai. Yeh chart pattern initially Japan se aaya hai, jahan ise rice traders ke liye develop kiya gaya tha. Kagi charts ka istemal trend identification ke liye hota hai aur isme price changes ka focus hota hai, time factor ko ignore karte hue.

Kagi charts mein, har ek vertical line ko "Kagi line" kehte hain. Jab bhi price mein significant change hota hai, Kagi line ki direction badal jati hai. Iska matlab hai ki Kagi charts mainly trend ke changes ko highlight karte hain. Reversals ko identify karne ke liye specific criteria hote hain, jaise predefined price movement.

Kuch mukhya features mein se ek hai thickness of lines. Kagi lines ka thickness trend ki strength ko darust karti hai. Agar price ek certain amount se upar badalti hai, to Kagi line thick hoti hai, jo ek strong trend ko darust karti hai. Jab price is amount se niche jaati hai, tab line thin hoti hai, jo ki weak trend ko darust karti hai.

Ek aur khaas baat yeh hai ki Kagi charts mein time axis nahi hota. Isse traders ko sirf price action ke details milti hain, aur time factor ko ignore karke trend analysis hoti hai.

Traders Kagi charts ka istemal karke market trends ko samajh sakte hain aur entry/exit points tay kar sakte hain. Yeh ek specific trading strategy ke saath istemal hota hai aur market conditions ke hisab se customize kiya ja sakta hai. Overall, Kagi chart pattern ek visual aur effective tool hai jo traders ko market trends ko samajhne mein madad karta hai.

-

#25 Collapse

Kagi chart pattern

Kagi chart ek prakar ka technical analysis tool hai jo market price movements ko visualise karne ke liye istemal hota hai. Yeh chart pattern Japan se aaya hai aur ek unique tareeqe se price changes ko darust karke dikhata hai. Ismein, price movements ko lines (ya kagi lines) ke zariye represent kiya jata hai, jo traditional candlesticks ya bar charts ke alag hote hain.

Kagi chart ka ek khaas feature ye hai ki yeh sirf price changes ko dekhta hai, jabki time factor ko ignore karta hai. Har kagi line ek specific price movement ko darust karne ke liye predetermined criteria ka istemal karta hai. Kagi lines upar jaane par green (bullish) aur niche jaane par red (bearish) hoti hain, jisse traders ko asani se trend direction ka pata chal sake.

Is chart ka istemal mainly trend identification aur trend reversals ke liye hota hai. Kagi charts, market volatility aur price movements ko ek clear aur systematic taur par dikhane mein madad karte hain. Traders ise price trends aur reversals ko samajhne ke liye istemal karte hain.

Kagi chart ke istemal se traders ko ek aisa visual perspective milta hai jo unhe market ke changes ko samajhne mein madad karta hai. Iske alawa, yeh ek alag tareeqe se market analysis karne ka mauka deta hai, jo traditional candlestick charts mein nahi hota. Lekin, iska istemal karne se pehle traders ko iske rules, patterns, aur limitations ko samajhna zaroori hai.

In conclusion, Kagi chart ek alternative approach hai traditional chart patterns ke liye, aur ise traders apni overall trading strategy ka ek hissa banane ke liye istemal kar sakte hain.

-

#26 Collapse

Kagi chart pattern

Kagi chart ek qisam ka maali chart hai jo takneeki tajziya mein istemal hota hai taakee maal-o-dawat ke bazaar mein keemat ki harkaton ko tasweer mein pesh kare. Yeh tareeka maal-o-dawat ke bazaar mein khaas kar stocks ya asbaab ke liye istemal hota hai. Kagi chart usoolan waqt ya muqarrar keemat ki bajaye keemat ki rukh par zor deta hai.

Kagi chart ke kuch ahem khaasusiyat hain:

- Keemat Ki Harkatein: Kagi chart, waqt ke bajaaye keemat ki harkaton par mushtamil hota hai. Yeh chart waqt ko nazar andaz karta hai aur ahem keemat ki tabdiliyon par tawajjuh deta hai. Is tareeqe se, yeh bazaar ki shor o gulo mein se saaf tasweer pesh karta hai aur asal trend ko zahir karta hai.

- Urooj o Zawal ki Khoj: Kagi chart mein istemal hone wale diwaron ki bunyad par keemat mein tabdiliyon ko zahir kiya jata hai. Jab keemat muqarrar had se guzar jati hai, nai diwar shuru hoti hai. Har diwar ki lambai aur rukh, keemat ke tajaweez par mabni hoti hai.

- Trend ki Zahir: Kagi chart trend ko asan taur par zahir karta hai. Agar keemat mein izafah hota hai to chart mein ek nai diwar shuru hoti hai, jabke agar keemat mein girawat hoti hai to chart mein koi diwar kamzor hoti hai. Is tareeqe se, traders ko asal aur muqarrar trend ka andaza hota hai.

- Zayada Inteshaar: Kagi chart market ki kisi bhi zayada tezi ya tez girawat ko zahir karta hai. Ismein aam taur par jo diwarein hain, woh ghair mamooli harkaton ko filter kar deti hain, jisse haqeeqat mein ahem trend ko asani se pehchana ja sake.

In tamaam khaasusiyat se guzarna, Kagi chart ek ahem tareeqa hai maali tajziya mein, jo keemat ki harkaton ko samajhne aur trendon ko pehchanne mein madad karta hai.

-

#27 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Kagi Chart Pattern

Kagi chart ek technical analysis tool hai jo ke financial markets, jaise ke stocks, commodities, ya currencies, ke price movements ko represent karne ke liye istemal hota hai. Yeh chart patterns ko visualize karne mein madad karta hai, jisse traders ko market trends aur price action ka better understanding ho.

Kagi chart ka use zyadatar Japani traders ne kiya hai, lekin ab yeh worldwide popular hai. Is chart mein, har ek price movement ko lines ya blocks se represent kiya jata hai. Kagi chart mein koi fixed time intervals nahi hote; instead, yeh price movements par based hota hai.

Kagi chart ke kuch important features hain:

Lines or Blocks:

Har ek price movement ko ek line ya block se represent kiya jata hai. Agar market up move kar raha hai, toh ek up block add hota hai, aur agar down move kar raha hai, toh ek down block add hota hai.

Thickness of Lines or Blocks:

Lines ya blocks ki thickness market volatility ko darust karte hain. Thicker lines high volatility ko represent karte hain, jabki thinner lines low volatility ko show karte hain.

Color Coding:

Lines ko different colors se code kiya ja sakta hai, jisse traders ko easy identification ho market trends ka.

Price Reversals:

Kagi chart mein price reversals ko bhi asani se identify kiya ja sakta hai. Jab market trend change hota hai, woh specific points par dikhayi dete hain.

Kagi chart ek alag tareeqe se market trends ko display karta hai aur traders ko quick insights provide karta hai. Yeh ek visual tool hai jo trend directions, strength, aur reversals ko analyze karne mein madad karta hai.

-

#28 Collapse

KAGI CHART PATTERN DEFINITION

Kisi bhi financial asset ke short term trend Ka Pata Lagane ka kam task lag sakta hai specially Jab trader guidance ke liye asset ki price ke chart ko looking ki koshish Karte Hain chart per Nazar Aane Wale Day to day prics fluctuation kate hue appear ho sakte hain determine karna extermely difficult banaa sakta hai ke price mein kaun si movement important hai and yah security ki direction ko significantly affect karegi luckily se trader ke liye Several charting and technical analysis ki technique developed ki gai hai Jo random noise ko filter karne ke attempt karti hai and asset ke Trend ke driver ke Taur per Kam Karne Wale important moves per tawaja concentrate karti hai is noise ko filter karne ka ek particular method Jo is article ka center bhi hai, Kagi chart Ke name se bhi Jante Hain although yah sabse common ya widely paimane per Jana Jaane wala technical tool Nahin Hai, But aapki tool kit mein add karne ke liye ek ho sakta hai

:max_bytes(150000):strip_icc()/KagiChart2-b7da08fb326349f392729d1aae26d3d7.png)

THE REVERSAL

bulls and bear next few weeks Apple ke fear ki direction per fighting karte hue spent kiye Jiski vajah se Kagi chart Kai bar direction Ko revers Kiya June and July Ke Darmiyan Hone Wali three high move chart ki low train level se 4% se greater thi Jiski vajah se Kagi chart ki direction reverse Ho Gaye yah moves increasingly bullish Ke sentiment ki represent Karti Hai Lekin vah itne strong nahi thi ke trend ko fully revers kar sake Many trader ki taraf se reversal ka welcomed Kiya Gaya Kyunki yah pahla Bullish kagi signal tha Jo may ke Shuru mein chart banane ke bad se generate hua tha however unfortunately, se bull ke liye yah move unsustainable Kyunki bear Ne responded Kiya and price ki kagi Line ki high se low pushed kiya Jo Ke Char percentage ki reversal amount Se Zyada hai

KAGIS AND CANDLESTICK

Kagi chart per appearing Hone Wali different lines first glance mein overwhelming lag sakti hain Hamen yakin hai ki example isase bahut Kuchh banaegi fully understand karna easier hai ki is interesting type ka chart kaise banaya jata hai Humne Kagi chart mein se Several ke sath regular candlestick chart attached Kiya take illustrate Kiya Ja sake ke underlying asset ki price Mein Kagi chart mein Ek certain change laane ke liye kya kiya

-

#29 Collapse

Introduction of the post.

Me Umeid karta ho ap sab khareyat say ho gay aj me ap ko Kagi chart, jo ke technical analysis mein istemal hone wala aik chart pattern hay, woh price movements ko visualize karne ke liye istemal hota hai. Is chart mein prices ke movement ko ek line se darust kiya jata hai, jo ke "Kagi line" ke naam se jani jati hai. Is chart pattern ko samajhne ke liye neeche diye gaye kuch mukhtasar tafseelat hay.

1. Kagi Line.

Kagi chart ki pehli aur sabse ahem cheez hai Kagi line. Yeh line prices ke changes ko darust karti hai. Agar price upar ja rahi hai, to line upar ki taraf jayegi, aur agar price neeche ja rahi hai, to line neeche ki taraf jayegi. Jab price direction change hoti hai, to Kagi line ek khas pattern ko follow karti hay..

2. Reversal Points.

Kagi chart par reversal points ya "X" aur "O" marks dekhe ja sakte hain. Jab price ek direction mein ja rahi hoti hai aur phir direction change hoti hai, to yeh reversal points darust kiye jate hay.

3. Box Size and Reversal Amount.

Kagi chart par line ki movement ko control karne ke liye "Box size" aur "Reversal amount" ka istemal hota hai. Box size decide karta hai ke kitni zyada price movement hone par line direction change hogi, jabke reversal amount woh amount hoti hai jis par line reverse hogi.

4. Noise Reduction.

Kagi chart ka maqsad price ke fluctuations ko kam karna hai aur trend ko samajhna hai. Is tarah se, yeh noise reduction mein madadgar hota hay.

5. Trading Signals.

Kagi chart par dikhaye gaye reversal points aur line patterns traders ke liye trading signals provide kar sakte hain. Agar Kagi line ek uptrend mein hai aur phir neeche jati hai, to yeh sell signal ho sakta hai, aur agar neeche ja rahi line phir se upar jati hai, to yeh buy signal ho sakta hai. Kagi chart ek powerful tool ho sakta hai trend analysis aur trading ke liye, lekin iska istemal acchi tarah se samjhna aur practice karna zaroori hai. Traders ko is chart ke saath doosre technical indicators ka bhi istemal karna chahiye, taake unhe behtar trading decisions lena asaan ho gay ho gay. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#30 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

?What is a Kagi Chart

Kagi Chart ek buhat specialized form hai jo technical chart ki aik khusoosi shakal hai jo maliyati tajzia mein depict price movements and trends ko unique manner hai or is mein zahir karne ke liye used hoti hai. yeh chart market ki dynamics, jaisay supply aur demand ke bare mein insights bhi offer karte hain. woh usually filter out insignificant fluctuations par mamooli utaar charhao ko flutter karte hain aur sirf ahem

rujhan ki significant trend changes and reversals par tawaja markooz karte hain

Unlike traditional charts jaisay candlestick or bar charts, Kagi charts primarily concerned ke sth price ko direction rather than time mutaliq hotay hain, or woh jb bhi offer krty distinct visual representation se hum supply and demand shifts karte hain .

For instance, imagine a stock ka gradually se rising krty hai price lekin is mai hume experience ko hum sudden or significant drop krty hai market ko, kagi chart ko k emphasize krty or isko notable hota price movement se disregarding krty smaller fluctuations qabil zikar harkat par zor day ga .

yeh chart ko hum constructed krty jb bhi hum using krty series ko vertical lines mai or hum referred krty isko "Kagi lines," or isko kaha jata hai, jo price scale ke connect pivotal points hain Kagi Charts dynamically adapt tor par market ke halaat ke mutabiq dhaltay hain, nai lakerain sirf is waqt khenchi jati hain jab specific price naqal o harkat hoti hai, jo aksar pehlay predefined threshold referred ko uboor karte hain jisay "reversal amount" ya" box size" kaha jata hai .

By considering only substantial price movements, Kagi Charts ka maqsad aik taweel arsay ke douran market ke clearer perspective par aik wazeh nuqta nazar faraham karna hai, disregarding minor fluctuations ko nazar andaaz karte hue jo false signals ki base ban satke hain .

- CL

- Mentions 0

-

سا0 like

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:54 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим