Kagi Chart Pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

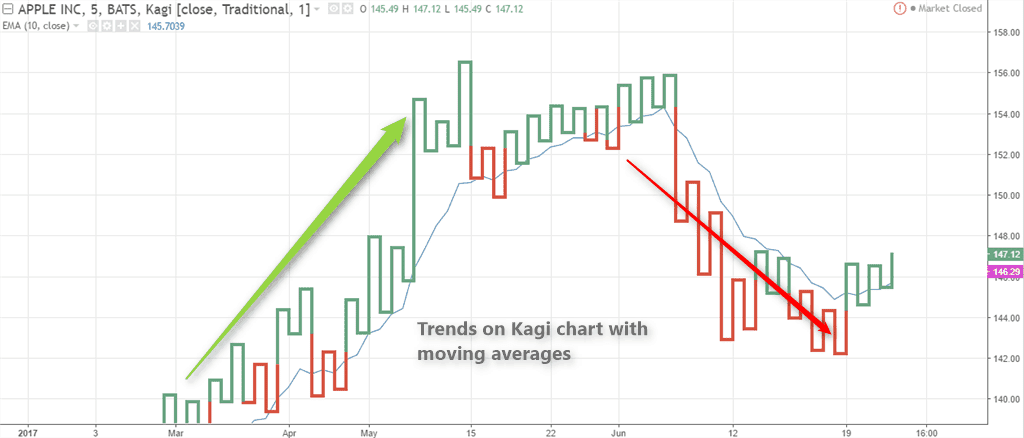

Introduction fex market mein estamal honay wallay zyda tar allat mein say ak hy forex Kagi chart ke ebtada 19-century mein hove hey en ko hook chart ya string chart kay naam say bhe jana jata hey Kdi L ke shekal ka chart pattern hota hey jo keh Japanese lafaz hota hey forex chart ka estamal demand ya supply ko wazah karnay kay ley estamal keya ja sakta hey trader lines ko khas mota karnay kay ley indicate karta hey ager price echle kaghzi direction ke taraf barhte hey to line ko barha dayte hey ager reversal jata hey to level pa opposite direction mein new kaghaz draw keya jata hey yeh candlestick kay opposite hota hey jo estamal shodah period kay lehaz say tabdel ho sakta hey Kagi chart pattern ke importance kagi chrt pattern ka aik dosra important pehlo yeh hota hey keh es ke motai os time tabdel ho sakte hey jab yeh pechlay den ke low ya high mein enter ho sakta hey trade mein mte line ko Yang line kay naam say bhe jana jata hey jabkeh patle line ko yin line kay naam say bhe jana jata hey Understanding Kagi Chart Pattern Kagi lines zyada tar trading platform mein pay jate hein es ke wajah yeh hote hey keh reality mein jadeed tareen trader en ko forex trading mein estamal kartay hein es ke bajay ager app MT4 ya MT5 ka bhe estamal kartay hein to ap es ko market mein daste tor par download kar saktay hein jo keh forex market mein aik kesam ka maqbol chart pattern hey es kay elawah jab aik highe darjay ke trade nahi kartay hein to ap ko forex market mein yeh jananay ke zaroorat nahi hote hey Trade example yeh candlestick chart pattern or bar chart pattern kay opposite ka chart pattern hota hey Kagi chart pattern trader ko batata hey koi trend reversal start honay wala hey mesal kay tor par jaisa keh zail mein batya ja choka hy apple stock es time moshkel mein tha jaisa keh hum nay zailmei batya hey Kagi aik kesam ka moshkel kesam ka chart pattern hota hey khas tor par industry mein trader estamal kartay hein yeh zyada tar support or resistance ke moshkel ko pehchan karta hey Conclusion forex market mein kagi chart pattern aik kesam ka mashhoor chart pattern hota hey jo keh moshkel kesam ka chart pattern hota hey es chart pttern ko forex market kay industry kay trader bhe estamal kar saktay hein yeh zyada tar support or resistance ke dushware ke wajah say he hota hey es say pehlay ap es ko estamal kar saken gay es ka achay say analysis karna chihayدیتے جائیںThanksحوصلہ افزائی کے لیے -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

FOREX ME KAGI CHART PATTERN:-Kagi Chart Pattern ek prakar ka technical analysis tool hai jo Forex market ya kisi bhi financial market mein price movements ko darust aur visual tarike se darust karne ke liye istemal hota hai. Kagi Charts Japan ke kisi traders ne develop kiye the aur ye ek unique tarike se price changes ko darust karti hain. Kagi Chart Pattern ki wazahat niche di gayi hai: FOREX ME KAGI CHART PATTERN K STEPS:-Line Changes (Reversals): Kagi Charts line changes (reversals) ko highlight karti hain. Price ke significant changes ko darust karne ke liye Kagi Chart Patterns ko istemal kiya jata hai. Box Size: Kagi Charts mein har ek line ek "box" ke size se represent ki jati hai. Ye box size trader ke pasand ke mutabik set kiya ja sakta hai aur ye price ke variations ko darust karne mein madadgar hota hai. Upward and Downward Lines: Kagi Charts mein, jab price ek specific threshold (box size) se zyada badh jata hai, to ek upward line draw ki jati hai. Jab price box size se kam ho jati hai, to ek downward line draw ki jati hai. Reversal Lines: Kagi Charts mein, jab price direction me reversal hota hai, to ek "reversal line" draw ki jati hai. Reversal lines ek trend ke ant me ya phir trend ke change hone ke bad dikhai deti hain. Color Coding: Kagi Charts mein lines ki color coding hoti hai jo price direction ko darust karti hai. Typically, green lines uptrend ko darust karte hain jabki red lines downtrend ko darust karte hain. Noise Reduction: Kagi Charts noise reduction ke liye istemal ki jati hain. Isme, chhoti price fluctuations ko ignore kiya jata hai aur sirf significant price changes ko darust kiya jata hai. Kagi Chart Patterns trading decisions ke liye istemal hoti hain, lekin inka istemal kafi samjhdari se karna chahiye. Ye patterns market ke changing dynamics ke sath change ho sakte hain, isliye traders ko anya technical indicators aur analysis tools ke sath Kagi Charts ka istemal karna behtar hota hai. Kagi Chart Patterns ka istemal trading strategy ka ek hissa ho sakta hai, lekin aapko hamesha market research aur risk management par dhyan dena chahiye jab aap Forex ya kisi bhi financial market mein trade karte hain.

FOREX ME KAGI CHART PATTERN K STEPS:-Line Changes (Reversals): Kagi Charts line changes (reversals) ko highlight karti hain. Price ke significant changes ko darust karne ke liye Kagi Chart Patterns ko istemal kiya jata hai. Box Size: Kagi Charts mein har ek line ek "box" ke size se represent ki jati hai. Ye box size trader ke pasand ke mutabik set kiya ja sakta hai aur ye price ke variations ko darust karne mein madadgar hota hai. Upward and Downward Lines: Kagi Charts mein, jab price ek specific threshold (box size) se zyada badh jata hai, to ek upward line draw ki jati hai. Jab price box size se kam ho jati hai, to ek downward line draw ki jati hai. Reversal Lines: Kagi Charts mein, jab price direction me reversal hota hai, to ek "reversal line" draw ki jati hai. Reversal lines ek trend ke ant me ya phir trend ke change hone ke bad dikhai deti hain. Color Coding: Kagi Charts mein lines ki color coding hoti hai jo price direction ko darust karti hai. Typically, green lines uptrend ko darust karte hain jabki red lines downtrend ko darust karte hain. Noise Reduction: Kagi Charts noise reduction ke liye istemal ki jati hain. Isme, chhoti price fluctuations ko ignore kiya jata hai aur sirf significant price changes ko darust kiya jata hai. Kagi Chart Patterns trading decisions ke liye istemal hoti hain, lekin inka istemal kafi samjhdari se karna chahiye. Ye patterns market ke changing dynamics ke sath change ho sakte hain, isliye traders ko anya technical indicators aur analysis tools ke sath Kagi Charts ka istemal karna behtar hota hai. Kagi Chart Patterns ka istemal trading strategy ka ek hissa ho sakta hai, lekin aapko hamesha market research aur risk management par dhyan dena chahiye jab aap Forex ya kisi bhi financial market mein trade karte hain. -

#4 Collapse

KAGI CHART PATTERN DEFINITION Kisi bhi financial asset ke short term trend Ka Pata Lagane ka kam task lag sakta hai specially Jab trader guidance ke liye asset ki price ke chart ko dekhne ki attempt karte hain chart per Nazar Aane Wale day to day prices main fluctuation kate hue Dikhai de sakte hain aur yah determine karna extremely difficult bana sakta hai ke price mein kaun si movement important hai aur yeh security ki direction ko significantly affect karegi luckily se trader ke liye Kai Charting aur technical analysis ki techniques taiyar ki gai hai Jo concentrate noise ko filter karne ki attempt karti hai aur asset ke Trend ke driver ke Taur per kam karne wale particular method per focus Marcos bhi hai kagi chart ke naam se known hain Agar chahie sabse common ya widely pimane per Jana Jaane wala technical tool Nahin Hai KAGI CHART CONSTRUCTION Kagi chart vertical lines ki ek series per mushtamil Hote Hain Jo asset ki price ke action ka reference Dete Hain Baja Iske ke zyada common chart Jaise line bar ya candlestick Karte Hain pahle thing Jo trader ko Nazar Aaegi voh yah Hai Ke Kagi chart per line is Baat per depending hain ke asset ki price kya kar rahi hai thickness mein vary Hoti Hai sometime lines bolded hoti hain Jab Ke dusri bar line thick aur hold hoti hain lines ke varying thick aur Unki direction aur kagi chart ka sabse important aspect hai Kyunke ye vahi chiz hai Jaise trader transaction signal Paida Karne ke liye istemal Karte Hain

KAGI CHART CONSTRUCTION Kagi chart vertical lines ki ek series per mushtamil Hote Hain Jo asset ki price ke action ka reference Dete Hain Baja Iske ke zyada common chart Jaise line bar ya candlestick Karte Hain pahle thing Jo trader ko Nazar Aaegi voh yah Hai Ke Kagi chart per line is Baat per depending hain ke asset ki price kya kar rahi hai thickness mein vary Hoti Hai sometime lines bolded hoti hain Jab Ke dusri bar line thick aur hold hoti hain lines ke varying thick aur Unki direction aur kagi chart ka sabse important aspect hai Kyunke ye vahi chiz hai Jaise trader transaction signal Paida Karne ke liye istemal Karte Hain  KAGIS AND CANDLESTICK Kagi chart per appearing Hone Wali different lines Pehli glance mein overwhelming sakti hai Hamen fully understand easier hai ke is interesting type ka chart kaise banaya jata hai Humne kagi chart mein se Kai ke sath Ek regular candlestick chart bhi attached Kiya Hai ta ke yah waze Kiya Ja sake ke underling asset ki price mein kagi chart Main Ek certain change laane ke liye kya kiya hai Hamare chart ki date start hone ke shortly after AAPL Ke share ki price kam Hona start ho gai hai Jaise hi price fell hai Ek vertical line ban gai hai aur is vertical line ka nichala hissa sabse lowest closing Hone Wali price ke equal tha

KAGIS AND CANDLESTICK Kagi chart per appearing Hone Wali different lines Pehli glance mein overwhelming sakti hai Hamen fully understand easier hai ke is interesting type ka chart kaise banaya jata hai Humne kagi chart mein se Kai ke sath Ek regular candlestick chart bhi attached Kiya Hai ta ke yah waze Kiya Ja sake ke underling asset ki price mein kagi chart Main Ek certain change laane ke liye kya kiya hai Hamare chart ki date start hone ke shortly after AAPL Ke share ki price kam Hona start ho gai hai Jaise hi price fell hai Ek vertical line ban gai hai aur is vertical line ka nichala hissa sabse lowest closing Hone Wali price ke equal tha

-

#5 Collapse

Crab and Shark Model Working and Benefits in Forex Dear mates Show up at Security Exchanging methodology aik aisi exchanging procedure hai jo ki vendor istemal Karte Hain hit market sideways mein progression kar rahi hoti hai iski madad se traders ko thought ho jata hai ki market kagla plan kaun sa ho ga partners range bound structure ka baday ghour say mushahida karna hota hai agar aap is related kuch immense data to stay away from Karte Hain To aap kabhi bhi is framework se appropriately fulfilled aur benefit Hasil nahin kar sakte . Prologue to Show up at Security Exchanging Strategy. Dear amigos Jaisa ke oopar Bhi zikr kiya ja chuka hai ki Show up at Security Exchanging system ko kis tarah merchant apni exchanging structure banate hain aur is say benefit lene Ki Koshish karte hain ya phir is circumstance mein isko use kesy karte hain companions Show up at Security Exchanging Approach head mother unreasonable cost basic resiatance k peak pae act karti hai or insignificant cost fundamental help ki tarha act karti hai or market en k bech mother he move karti rehti hai aur is tarha kee market ki type ko ham level sideway ya going business region kehty hain mates range bound focal market ki foran progression ka pata nahin chalta ki vo kis side per Move kar Jaaye to agar aapka ka take benefit Laga hoga to aap ko fayda to hoga. Exchanging at Show up at Security Exchanging Technique. Dear companions range Security exchanging strategy per exchanging karne ke liye sabse pahle aapko market ka latest thing pata Hona bahut hey zaruri hai market ki progression level ho chuki to us waqat range wali course boss ham exchange open ker ky proceed kerty hain tou phir agar market hamari open exchange ky against bhi improvement kerti hai tab bhi turn bearing fundamental reach kam hony ki waja sy market kuch time ky liay tou affliction focal run ker sakti hai lekin hit benefit fundamental improvement kerna start kerti hea. Extra Note. Dear mates exchanging procedure kuch bhi ho sabse pahle aapko Iske revealed mein learning aur experience Ka Hona bahut hello basic hota hai kyun kay agar aapko iske uncovered mein experience ya information nahin hoga to aap veritable tarike se exchanging nahin kar sakte isliye exchanging karne se pahle aapko range Security exchanging technique ko lajmi center karna hota hai exchanging start karne se pahl -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Relative force Record integrator k liye use krty hain. Relative Force record market mn kam karty howe aap ko ik pointer dia jata hai. Aap kisi bhi specialist mein is ko istemal kar skty hain aur aap is ky zariye market mein patterns ky bry mn valuable data lety howe isko investigation ka hisab bna skty hain aur apni exchanges is ko use kar k lgaty hain. Market mn dusry pointer ke trha RVI b bhut significant marker hai. Development: RVI k mutabiq market ik primary concern k uper or neechy move krti hai or disparity or combination dikhti hai jisko compute kr k pointer kaam krta hai. Relative energy file ko market mn ik equation k mutabik use kr k market ke signs ke gati hain. Yeh aapko market k pattern inversions k bary mn batata hai. Yeh ik muddled information base standard kam krta ha aur apko is kee legitimate examinations kar k iski practice krni chahiye. Relative life record sign of ko shutting esteem ki reason for various data give kar raha hota hai dear punch aap Kuchh candle ki shutting esteem ki premise per data Hasil kar rahe hote hain to ismein aapko bahut Thi amazing investigation dekhne ko Milte Hain aur aap apni exchanging ko bahut jyada beneficial kar sakte hain relative power file pointer Kaisa marker hota hai jismein aap bahut jyada sign Hasil karte shade Apne specialized examination ko wonderful banaa sakte hain. Exchanging: Relative force disparity or cost ke drmiyan uniqueness score batata Hai Ki next second ke undar market Pattern change ho rha hao or Agr market cost increment hona start or relative energy file pointer kam ho to ja merchant ke liye pattern inversion ka signal Hota Hai.premise that when a market is moving firmly, the end value will in general be higher than the initial cost. On the other hand, when a market is in a feeble pattern, the end value will in general be lower than the initial cost. By examining these cost developments, the RVI Pointer endeavors to distinguish the fundamental strength of a pattern and decide if it is probably going to proceed or reverse..Dear Forex explicit - is methods per exchange krny ka ik express tareka hota hai. Hit aap market mein Relative Power Record Marker ko apni exchanging rule shamil krty Hain, -

#7 Collapse

aayiyae kagi charts ko dekhte hain jo supply ki umomi sthon ko zahir karne ke liye istemaal hotay hain. aur munsalik patteren ki aik series ke zariye qeemat ki karwaiyon ka tasawwur karkay kisi khaas asasay ki maang kaki charts waqt se azad hotay hain aur is shore ko flutter karne mein madad karte hain jo dosray maliyati charts par ho sakta hai .candle stuck chart ki terhan yeh is liye hai taakay qeemat ki ahem harkatein ziyada wazeh tor par zahir hon kaghazi chart mein paye jane walay patteren ko samajhney ki kuleed hai. jab ke kaki charts har waqt tarikhon ko zahir karte hain un ke x mehwar yeh dar haqeeqat ahem qeemat action tarikhon ke markr hain aur is ka hissa nahi hain .time scale ke dayen taraf y mehwar ka istemaal kya jata hai qeemat ke pemanay ke tor par kaghazi chart mein line ibtidayi tor par qeemat ki harkat ki isi simt mein amoodi tor par harkat karti hai aur ulat jane wali raqam line you turn layte hai aur mukhalif simt mein jati hai lehaza chart par mojood har choti ufuqi lakeer is baat ki nishandahi karti hai ke ufuqi line ke jornay par qeemat ka inkishaaf kahan sun-hwa hai .doobnay wali lakeer ke sath aik barhti hui lakeer jisay kandhay ke naam se jana jata hai jabkay aik ufuqi lakeer jo doobnay wali lakeer ko ubharti hui lakeer se judte hai usay kamar ke tor par jana jata hai line ke tamam rangon ki motai qeemat ke ravayye par munhasir hai jab qeemat pichlle kandhay ke ulat jane se ziyada ho jati hai to line mouti aur tamam sabz ho jati hai aur usay yang ke naam se jana jata hai .is line ko asasa ke liye supply ke muqablay mein talabb mein izafay aur mutabadil tor par taizi ke rujhan ke tor par samjha ja sakta hai jab qeemat pichlle fazlay ke ulat jane se neechay toot jati hai to line patli ho jati hai aur allred aur usay yan line ke naam se jana jata hai yeh tezaab ki talabb se ziyada rasad mein izafay ki nishandahi karta hai aur qeematon mein mandi ke rujhan ke tor par tajir fan yan se vÙk yan lines ki taraf shift aur is ke bar aks kisi asasa ko kharidne ya baichnay ke signal ke tor par istemaal karte hain. yang shift ka link ishara karta hai .khareedna jab ke یانک lain ki shift kagi chart ki terhan chart farokht karne ki taraf ishara karta hai aik candle stuck chart open high lo close chart aur aik point hai. -

#8 Collapse

What is three inside up and inside down candle plan ? Candles plans Express three inside up and inside down light course of action hoti hai jo pichla red body's ki had ke Ansari Nagar make authentic associate Trad Len Gy. aakhri Candles last aik lambing longer coordinated sabz hai jo pichla additional genuine Candles sabz ke qareeb ke qareeb se oopar ki taraf dhkilti hai.bears ne qeemat mein kami ko unequivocally se pakar liya hai aur aik lambing longer surkh Candles bananay ke liye qeemat ko neechay Shakeel diya hai Dear Government Open Market Cautioning gathering (FOMC) dar asal ye ik public bank framework ki branch hai jo cash related plan ki bearing ko pick karti hai or ye esko explicitly open market ki course ko direct karny k lae use karti hai. Fomc board or governer sy mel kar banta hai jis k 7 district hain or 5 president hai public bank k yani esk persevering 12 piece hoty hain. Har sal es driving social affair of authentic heads ki 8 mystery get-togethers hoti hain or en mother financial framework standard conversation ki jati hai. What is three inside up and inside down light plan ? Ager Plan STRADGY Make legitimate colleague Three Inside down Candles mein dekhaya Gaya aik up guide ke Sourabh zahir hota hai. pehli Fire's aik lambing Greene hai, is ke baare aik choti red Candles hai jisay pichla green body ki had ke andar Ansari ghons a Chaheye. aakhri Candles plans last Extraordinary good tidings Adaptable Ho Gi Tu aik lambing longer red hai jo pichla chhotey red ke Warren ke Neechy dhkelti hai Tu ESS taraf taizi ke jazbaat focal alleviation ghalib hain aur Khtra apne kid around mein aik lambing sabz mother batii banday Crash tone beh jatay get entrance Hein. lekin is se un ki taaqat khatam ho sakti hai Tu Inside down Candles ho jay Gii..... Plan Formation..!!! Punch Ham Yeh Candle's Models kyun three inside up and inside down light kay aglay meeting mein bears aik chhotey sa faida uthany ke waybill ho jatay hain - Darmian mein choti surkh mother public subsequently made ho Jaye Gi th ESS Bears ki hosla afzai ki jati hai, aur aglay (Next Inside down Candles) Ka Sath greetings potential get-togethers mein, woh ghar ke faiday three inside up and inside down fire plan ko Shayd Changes berhate hain aur qeemat ko pichla Really genuine Make appropriate colleague Trad Faida Gain De Gii Aor hit ham Chart mein dekhaya gaya hai, Neechy ke rujhan ke douran zahir hota hai, aur pehli Fire's Organized aik lambi surkh rang ki hai, is ke baad aik Choto si sabz Candles hoti hai jo pichlle red body ki had ke Ansari ghonslay gi. aakhri Candles models and Fire's Design aik lambi sabz hai jo pichlle chhotey sabz ke qareeb se polar up level Inside Up Ho Hoti Hy Ess ki taraf dhkilti hai .bears ne qeemat on mein kami ko mazbooti se pakar liya hai aur aik lambing (longer) surkh Flame's banay gii.... -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is kargi chart patternKagi outline ke ebtada 19-century mein hove hello en ko snare graph ya string diagram kay naam say bhe jana jata hello Kdi L ke shekal ka outline design hota hello jo keh Japanese lafaz hota hello forex outline ka estamal request ya supply ko wazah karnay kay ley estamal keya ja sakta hello dealer lines ko khas mota karnay kay ley demonstrate karta hello ager cost echle kaghzi bearing ke taraf barhte hello to line ko barha dayte hello ager inversion jata hello to even out dad inverse bearing mein new kaghaz draw keya jata hello yeh candle kay inverse hota hello jo estamal shodah period kay lehaz say tabdel ho sakta hello how can understand kargi chart pattern ?Kagi Graphs line changes (inversions) ko feature karti hain. Cost ke tremendous changes ko darust karne ke liye Kagi Graph Examples ko istemal kiya jata hai. Box Size: Kagi Diagrams mein har ek line ek "box" ke size se address ki jati hai. Ye box size broker ke pasand ke mutabik set kiya ja sakta hai aur ye cost ke varieties ko darust karne mein madadgar hota hai. Up and Descending Lines: Kagi Graphs mein, punch cost ek explicit edge (box size) se zyada badh jata hai, to ek up line draw ki jati hai. Punch cost box size se kam ho jati hai, to ek descending line draw ki jati hai. Inversion Lines: Kagi Graphs mein, punch cost course me inversion hota hai, to ek "inversion line" draw ki jati hai. Inversion lines ek pattern ke subterranean insect me ya phir pattern ke change sharpen ke awful dikhai deti hain. Variety Coding: Kagi Graphs mein lines ki variety coding hoti hai jo cost bearing ko darust karti hai. Ordinarily, green lines upswing ko darust karte hain jabki red lines downtrend ko darust karte hain. Sound Decrease: Kagi Graphs sound decrease ke liye istemal ki jati hain. Isme, chhoti cost vacillations ko disregard kiya jata hai aur sirf critical cost changes ko darust kiya jata hai. Kagi Diagram Examples exchanging choices ke liye istemal hoti hain, lekin inka istemal kafi samjhdari se karna chahiye. Ye designs market ke changing elements ke sath change ho sakte hain, isliye brokers ko anya specialized pointers aur investigation apparatuses ke sath Kagi Outlines ka istemal karna behtar hota hai. Kagi Graph Examples ka istemal exchanging procedure ka ek hissa ho sakta hai, lekin aapko hamesha statistical surveying aur risk the executives standard dhyan dena chahiye punch aap Forex ya kisi bhi monetary market mein exchange karte hain. End result Trading market mein kagi graph design aik kesam ka mashhoor diagram design hota hello jo keh moshkel kesam ka outline design hota hello es outline pttern ko forex market kay industry kay dealer bhe estamal kar saktay hein yeh zyada tar backing or obstruction ke dushware ke wajah say he hota hello es say pehlay ap es ko estamal kar saken gay es ka achay say investigation karna chihay. -

#10 Collapse

Kagi Chart Pattern ek technical analysis tool hai jo price movements ko analyze karne aur trend ko samajhne ke liye istemal hota hai. Kagi charts primarily Japan mein develop ki gayi hain. Kagi Chart Pattern ek technical analysis tool hai jo price movements ko analyze karne aur trend ko samajhne ke liye istemal hota hai. Yeh ek unique charting technique hai, jo primarily Japan mein develop ki gayi hai.Kagi charts traditional line charts ki tarah hote hain, lekin inmein price changes ko vertical lines se represent kiya jata hai. Yeh vertical lines "kagi lines" kehte hain. Kagi charts mein price movements ko time-based intervals ki bajaye price-based intervals se represent kiya jata hai.Kagi charts mein trend identification kaafi mahatvapurna hota hai. Upar ki taraf kagi lines bullish trend ko represent karte hain, jabki neeche ki taraf kagi lines bearish trend ko represent karte hain. Kagi charts mein reversal points ko identify karne ke liye "reversal lines" ka istemal hota hai. Jab price trend direction change karta hai, tab kagi lines ke beech mein reversal line draw ki jati hai.Kagi charts mein support aur resistance levels ko bhi identify kiya ja sakta hai. Jab kagi lines reversal lines ko cross karti hain, tab support aur resistance levels ban sakte hain. Kagi charts ki ek aur fayda yeh hai ki yeh noise reduction ka bhi ek tarika hai. Yeh noise ko kam karke clear trend identification aur price movements ko samajhne mein madad karte hain.Kagi Chart Pattern ki wazahat yeh hai ki iska istemal trend identification, reversal points, support/resistance levels aur noise reduction ke liye kiya jata hai. Iske through traders price movements ko clear aur visual way mein analyze kar sakte hain. Wazahat (Explanation): 1. Line Chart: Kagi Chart Pattern line chart ki tarah hota hai, lekin ismein price changes ko vertical lines se represent kiya jata hai. Yeh vertical lines "kagi lines" kehte hain. 2. Trend Identification: Kagi charts ki madad se traders trend identification kar sakte hain. Upar ki taraf kagi lines bullish trend ko represent karte hain, jabki neeche ki taraf kagi lines bearish trend ko represent karte hain. 3. Reversal Points: Kagi charts mein reversal points ko identify karne ke liye "reversal lines" ka istemal hota hai. Jab price trend direction change karta hai, tab kagi lines ke beech mein reversal line draw ki jati hai. 4. Support and Resistance: Kagi charts mein support aur resistance levels ko bhi identify kiya ja sakta hai. Jab kagi lines reversal lines ko cross karti hain, tab support aur resistance levels ban sakte hain. 5. Noise Reduction: Kagi charts noise reduction ka bhi ek fayda provide karte hain. Yeh noise ko kam karke clear trend identification aur price movements ko samajhne mein madad karte hain. Kagi Chart Pattern ki wazahat yeh hai ki iska istemal trend identification, reversal points, support/resistance levels aur noise reduction ke liye kiya jata hai. Iske through traders price movements ko clear aur visual way mein analyze kar sakte hain. -

#11 Collapse

Introduction Forex trading mein chart patterns ka istemal ahmiyat rakhta hai. Kagi chart pattern bhi ek aham chart pattern hai jo traders ki madad karta hai forex market mein trading karne mein. Kagi chart pattern ek technical analysis tool hai jo traders ko market trend ke bare mein information deta hai. Is chart pattern mein price action ke saath trend lines ka istemal hota hai. Kagi chart pattern mein price action ka trend line se relation hota hai. Price upar jata hai to green line create hoti hai. Agar price down ja raha hai to red line create hoti hai. Kagi Chart Pattern Types Kagi chart pattern have 2 types : 1. Kagi Chart Pattern Bullish kagi chart pattern mein green lines zyada hoti hain. Yeh bullish trend ko indicate karta hai. Agar green line price action ke upar ja rahi hai to bullish trend confirm hota hai. 2. Bearish Kagi Chart Pattern Bearish kagi chart pattern mein red lines zyada hoti hain. Yeh bearish trend ko indicate karta hai. Agar red line price action ke neeche ja rahi hai to bearish trend confirm hota hai. Using the Kagi Chart Pattern :- Kagi chart pattern ka istemal market trend ke bare mein information hasil karne ke liye kiya jata hai. Is chart pattern se traders ko price action ke upar aur neeche jane ka trend pata chalta hai. Kagi chart pattern ka istemal karne se traders ko trading ke liye better decisions lene mein madad milti hai. Is chart pattern se traders ko market trend ko samajhne mein asani hoti hai. Conclusion Kagi chart pattern forex trading mein ek aham tool hai. Is chart pattern se traders market trend ke bare mein information hasil kar sakte hain. Kagi chart pattern se traders ko trading ke liye better decisions lene mein madad milti hai. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

اصل پيغام ارسال کردہ از: fidaa308What is kargi chart patternKagi outline ke ebtada 19-century mein hove hello en ko snare graph ya string diagram kay naam say bhe jana jata hello Kdi L ke shekal ka outline design hota hello jo keh Japanese lafaz hota hello forex outline ka estamal request ya supply ko wazah karnay kay ley estamal keya ja sakta hello dealer lines ko khas mota karnay kay ley demonstrate karta hello ager cost echle kaghzi bearing ke taraf barhte hello to line ko barha dayte hello ager inversion jata hello to even out dad inverse bearing mein new kaghaz draw keya jata hello yeh candle kay inverse hota hello jo estamal shodah period kay lehaz say tabdel ho sakta hello how can understand kargi chart pattern ?Kagi Graphs line changes (inversions) ko feature karti hain. Cost ke tremendous changes ko darust karne ke liye Kagi Graph Examples ko istemal kiya jata hai. Box Size: Kagi Diagrams mein har ek line ek "box" ke size se address ki jati hai. Ye box size broker ke pasand ke mutabik set kiya ja sakta hai aur ye cost ke varieties ko darust karne mein madadgar hota hai. Up and Descending Lines: Kagi Graphs mein, punch cost ek explicit edge (box size) se zyada badh jata hai, to ek up line draw ki jati hai. Punch cost box size se kam ho jati hai, to ek descending line draw ki jati hai. Inversion Lines: Kagi Graphs mein, punch cost course me inversion hota hai, to ek "inversion line" draw ki jati hai. Inversion lines ek pattern ke subterranean insect me ya phir pattern ke change sharpen ke awful dikhai deti hain. Variety Coding: Kagi Graphs mein lines ki variety coding hoti hai jo cost bearing ko darust karti hai. Ordinarily, green lines upswing ko darust karte hain jabki red lines downtrend ko darust karte hain. Sound Decrease: Kagi Graphs sound decrease ke liye istemal ki jati hain. Isme, chhoti cost vacillations ko disregard kiya jata hai aur sirf critical cost changes ko darust kiya jata hai. Kagi Diagram Examples exchanging choices ke liye istemal hoti hain, lekin inka istemal kafi samjhdari se karna chahiye. Ye designs market ke changing elements ke sath change ho sakte hain, isliye brokers ko anya specialized pointers aur investigation apparatuses ke sath Kagi Outlines ka istemal karna behtar hota hai. Kagi Graph Examples ka istemal exchanging procedure ka ek hissa ho sakta hai, lekin aapko hamesha statistical surveying aur risk the executives standard dhyan dena chahiye punch aap Forex ya kisi bhi monetary market mein exchange karte hain. [ATTACH]256231[/ATTACH] End result Trading market mein kagi graph design aik kesam ka mashhoor diagram design hota hello jo keh moshkel kesam ka outline design hota hello es outline pttern ko forex market kay industry kay dealer bhe estamal kar saktay hein yeh zyada tar backing or obstruction ke dushware ke wajah say he hota hello es say pehlay ap es ko estamal kar saken gay es ka achay say investigation karna chihay.

- Mentions 0

-

سا0 like

-

#13 Collapse

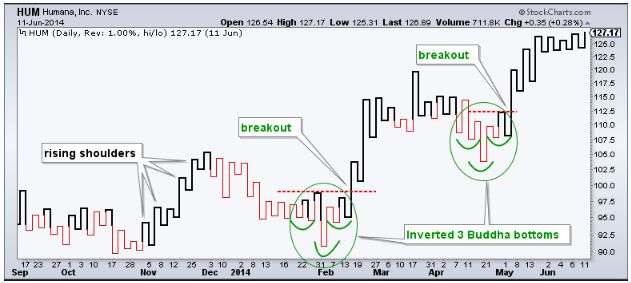

Kagi chart pattern introduction Aslaam o alaikum forex team members ummeed ha sb kheriyat sa ho gy aaj hum baat krein gy Kagi chart pattern k topic pr. Kagi chart ek technical analysis tool hai jo primarily price movements ko visualize karne ke liye istemal hota hai. Isme, kewal price changes ko represent kiya jata hai, volume ya time ke bina. Kagi chart pattern me, price movements ko lines or blocks se represent kiya jata hai jo upar neeche ya left-right direction me move karte hain. Ye lines ya blocks "reversal" aur "continuation" patterns ko show kar sakte hain, jisse traders price trends ko samajh sakte hain. Kagi charts me, kuch important components hote hain: Kagi Lines (Reversal Lines): In lines ko "Yin" aur "Yang" lines ke roop me bhi jaana jata hai. Jab price uptrend me hai, Yang line upar jati hai, aur jab price downtrend me hai, Yin line neeche jati hai. In lines ke direction changes ko reversal signals ke roop me istemal kiya jata hai. Price Breaks (Price Levels): Kagi chart me, price levels important hote hain. Jab price ek specific level ko cross karta hai, tab ek nayi Kagi line start hoti hai. Isse price movements ko clear taur par dekhne me madad milti hai. Horizontal Lines: Kagi chart me horizontal lines bhi hoti hain jo price consolidation aur trend ke direction ko indicate karte hain. Kagi chart pattern formation Kagi chart ek technical analysis tool hai jo stock prices ki movements ko represent karta hai. Kagi chart pattern banane ke liye, aapko kuch basic steps follow karne honge: Price Movements: Pehle, aapko stock ya financial instrument ke price movements ki data chahiye hoga. Yeh data typically daily, hourly, ya kisi specific time frame par available hota hai. Initial Line: Kagi chart pattern ki shuruaat ek initial line se hoti hai. Is line ko "base line" bhi kehte hain. Yeh line typically ek straight line hoti hai aur is par price ki movement ko represent karte hue points bante hain. Reversal Points: Kagi chart pattern mein price ke specific movements ko define karne ke liye reversal points ka use hota hai. In points ko "X" aur "O" se represent kiya jata hai. "X" (green) point tab banta hai jab price uptrend mein hai aur ek specific threshold ya criterion ko cross karta hai. "O" (red) point tab banta hai jab price downtrend mein hai aur us threshold ko cross karta hai. Connecting Lines: X aur O points ko connect karke trend lines banai jati hain. In trend lines se trend ki direction aur strength ko samjha ja sakta hai. Price Reversals: Jab price trend change karta hai aur threshold cross hoti hai, to ek naya X ya O point banta hai aur trend line direction change ho jata hai. How to trade Kagi chart pattern Forex market mein Kagi chart pattern ka istemal kisi trader ki trading strategy par depend karta hai. Kagi charts, price action ko visualize karne ke liye use hoti hain aur trend identification mein madadgar ho sakti hain. Yahan kuch steps hain jo aap Kagi charts ka istemal karke trading mein follow kar sakte hain: Kagi Chart Ki Understanding: Sabse pehle, Kagi charts ko samajhna hoga. Ye charts price swings aur trend changes ko darust taur par dikhati hain. Inmein "Reversal Lines" aur "Breakout Lines" hoti hain, jo trend reversals aur breakouts ko represent karte hain. Trend Identification: Kagi charts se trend ko identify karna important hai. Agar aapko uptrend ya downtrend dikh raha hai, toh us trend ke hisab se trade karna behtar hota hai. Entry Points: Kagi charts ke breakout lines ko dekh kar aap entry points tay kar sakte hain. Agar ek trend breakout hone wala hai, toh us point par trade entry kar sakte hain. Stop Loss Aur Take Profit: Jaise hi aap trade enter karte hain, stop loss aur take profit levels tay karein. Ye aapke risk ko manage karne aur profit ko lock karne mein madadgar hote hain. Risk Management: Hamesha yaad rakhein ki trading mein risk management mahatvapurn hai. Apne trading capital ko protect karne ke liye position size ko samajhdaari se chunna hoga. Practice: Kagi charts ko samajhne aur unka istemal karne ke liye demo trading ya backtesting karein. Isse aap apni strategy ko test kar sakte hain bina actual money invest kiye. Market Research: Forex market ke current events aur economic indicators ko bhi dhyan mein rakhein, kyunki ye bhi aapke trading decisions par asar daal sakte hain. -

#14 Collapse

Kagi Chart pattern and Development Asalam-o-alikum! Forex market ko samjhny ky Liye humein chart ko samjhna hota hy is Liye Kagi Chart pattern Exchanging system ko kis tarah merchant apni exchanging structure banate hain aur is say benefit lene Ki Koshish karte hain ya phir is circumstance mein isko use kesy karte hain companions Show up at Security Exchanging Approach head mother unreasonable cost basic resiatance k peak pae act karti hai or insignificant cost fundamental help ki tarha act karti hai or market en k bech mother he move karti rehti hai aur is tarha kee market ki type ko ham level sideway ya going business region kehty hain mates range bound focal market ki foran progression ka pata nahin chalta ki vo kis side per Move kar Jaaye to agar aapka ka take benefit Laga hoga. price trend direction change karta hai, tab kagi lines ke beech mein reversal line draw ki jati hai.Kagi charts mein support aur resistance levels ko bhi identify kiya ja sakta hai. Jab kagi lines reversal lines ko cross karti hain, tab support aur resistance levels ban sakte hain. Kagi charts ki ek aur fayda yeh hai ki yeh noise reduction ka bhi ek tarika hai. Explaination bullish trend ko represent karte hain, jabki neeche ki taraf kagi lines bearish trend ko represent karte hain. Kagi charts mein reversal points ko identify karne ke liye "reversal lines" ka istemal hota hai. Jab price trend direction change karta hai, tab kagi lines ke beech mein reversal line draw ki jati hai.Kagi charts mein support aur resistance levels ko bhi identify kiya ja sakta hai. Jab kagi lines reversal lines ko cross karti hain, tab support aur resistance levels ban sakte hain. Kagi charts ki ek aur fayda yeh hai ki yeh noise reduction ka bhi ek tarika hai. Analysis of Kogi Chart pattern trader guidance ke liye asset ki price ke chart ko dekhne ki attempt karte hain chart per Nazar Aane Wale day to day prices main fluctuation kate hue Dikhai de sakte hain aur yah determine karna extremely difficult bana sakta hai ke price mein kaun si movement important hai aur yeh security ki direction ko significantly affect karegi luckily se trader ke liye Kai Charting aur technical analysis ki techniques taiyar ki gai hai Jo concentrate noise ko filter karne ki attempt karti hai aur asset ke Trend ke driver ke Taur per kam karne wale particular method per focus Marcos bhi hai kagi chart ke naam se known hain Agr chahie sabse common ya widely pimane per Jana Jaane wala technical tool nahi Hai thanks -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Kagi chart, jo ke technical analysis mein istemal hone wala aik chart pattern hai, woh price movements ko visualize karne ke liye istemal hota hai. Is chart mein prices ke movement ko ek line se darust kiya jata hai, jo ke "Kagi line" ke naam se jani jati hai. Is chart pattern ko samajhne ke liye neeche diye gaye kuch mukhtasar tafseelat hain: 1. Kagi Line:Kagi chart ki pehli aur sabse ahem cheez hai Kagi line. Yeh line prices ke changes ko darust karti hai. Agar price upar ja rahi hai, to line upar ki taraf jayegi, aur agar price neeche ja rahi hai, to line neeche ki taraf jayegi. Jab price direction change hoti hai, to Kagi line ek khas pattern ko follow karti hai. 2. Reversal Points: Kagi chart par reversal points ya "X" aur "O" marks dekhe ja sakte hain. Jab price ek direction mein ja rahi hoti hai aur phir direction change hoti hai, to yeh reversal points darust kiye jate hain. 3. Box Size and Reversal Amount: Kagi chart par line ki movement ko control karne ke liye "Box size" aur "Reversal amount" ka istemal hota hai. Box size decide karta hai ke kitni zyada price movement hone par line direction change hogi, jabke reversal amount woh amount hoti hai jis par line reverse hogi. 4. Noise Reduction: Kagi chart ka maqsad price ke fluctuations ko kam karna hai aur trend ko samajhna hai. Is tarah se, yeh noise reduction mein madadgar hota hai. 5. Trading Signals: Kagi chart par dikhaye gaye reversal points aur line patterns traders ke liye trading signals provide kar sakte hain. Agar Kagi line ek uptrend mein hai aur phir neeche jati hai, to yeh sell signal ho sakta hai, aur agar neeche ja rahi line phir se upar jati hai, to yeh buy signal ho sakta hai. Kagi chart ek powerful tool ho sakta hai trend analysis aur trading ke liye, lekin iska istemal acchi tarah se samjhna aur practice karna zaroori hai. Traders ko is chart ke saath doosre technical indicators ka bhi istemal karna chahiye, taake unhe behtar trading decisions lena asaan ho.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:54 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим