What is the advance block candlestick pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

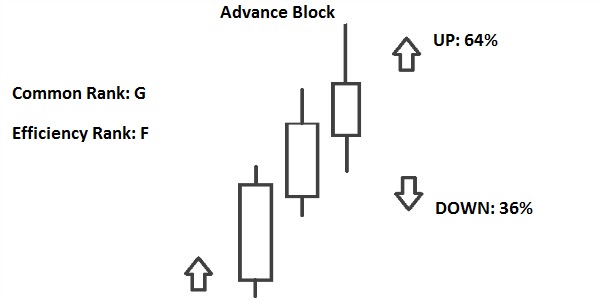

DEFINITION OF THE ADVANCE BLOCK CANDLESTICK PATTERN : Advance Block candlestick pattern aik aesa teen-candle pattern hai jo aam taur par uptrend ke ant mein nazar aata hai. Yeh bearish reversal pattern hai, jo yeh ishara karta hai ke uptrend ki buying pressure kamzor ho rahi hai aur sellers jald hi control le sakte hain. Is pattern ki khaas baat hai ke is mein teen mauti bullish mombatiyan hoti hain jin ki body narrow hoti hai aur higher highs hoti hain, phir ek choti bullish mombati hoti hai jis ki body narrow hoti hai aur range bhi narrow hoti hai. Final candle ki small body yeh batati hai ke buying pressure kamzor ho rahi hai aur bulls control ko sambhalne mein laga hua hai. Traders is pattern ko signal ke taur par istemal kar ke existing long positions ko sell kar sakte hain ya profit hasil kar sakte hain aur naye short positions khole sakte hain. HOW TO IDENTIFY THE ADVANCE BLOCK CANDLESTICK PATTERN : Advance Block candlestick pattern ki pehchan karne ke liye, traders ko yeh criteria dekhna hoga: 1. Teen mauti bullish candles: Pattern ki pehli teen mombatiyan lambi green mombatiyan honi chahiye, jo ek strong uptrend ko dikhati hain. In mombatiyon mein higher highs aur higher lows hone chahiye. 2. Narrowing bodies: Jab pattern jaari hota hai, har mombati ki body pichli mombati se narrow honi chahiye, jisse kamzor hoti buying pressure. 3. Final candle mein narrow range: Pattern ki antim mombati mein body choti honi chahiye aur range narrow honi chahiye, jisse samjha jaye ke momentum kamzor ho raha hai aur bulls ko price ko upar le jane mein struggle ho rahi hai. 4. Final candle mein higher high: Antim mombati mein higher high hona chahiye pichli mombati se, jisse samjha jaye ke bulls control ko sambhalne ki koshish kar rahe hain, lekin narrow body ishara karti hai ke unki koshishen kamzor ho rahi hain. In characteristics ko pehchan kar ke, traders Advance Block candlestick pattern ko pahchan sakte hain aur isko bearish reversal ka potential signal samajh sakte hain. INTERPRETATION AND SIGNIFICANCE OF THE ADVANCE BLOCK CANDLESTICK PATTERN : Advance Block candlestick pattern ki ahmiyat yeh hai ke isse samajha jata hai ke uptrend ki buying pressure kamzor ho rahi hai aur bulls jald hi control khodenge. Pattern dikhata hai ke price naye highs banane ki koshish kar rahi hai aur sellers profit lekar ya short positions kholekar samne aa sakte hain. Traders is pattern ko sell karne ke ya profit hasil karne ke liye aur naye short positions khole ke liye signal samajhte hain. Narrowing bodies aur final candle ki small range yeh dikhati hai ke bulls momentum kho rahe hain aur final candle ki high price yeh batati hai ke bulls control ko sambhalne ki koshish kar rahe hain. Lekin, buyers ki lack of conviction traders ke liye ek warning sign hoti hai. Yeh note karna zaruri hai ke Advance Block candlestick pattern ko akela mein trade na karen aur isko confirm karne ke liye dusre technical indicators ya patterns se saath mila kar istemal karen. Traders isko trendlines, support aur resistance levels aur dusre candlestick patterns ke saath combine karte hain taaki trade ki success probability badh sake. TRADING STRATEGIES AND ENTRY /EXIT TECHNIQUES FOR THE ADVANCE BLOCK CANDLESTICK PATTERN : Advance Block candlestick pattern ke saath traders kuch trading strategies aur entry/exit techniques istemal kar sakte hain: 1. Teesri mombati ke close par sell karen: Traders teesri mombati ke close par sell kar ke short position mein enter kar sakte hain, jisse Advance Block pattern ka ant signal hota hai. Yeh strategy samjhti hai ke buying pressure kamzor hone se bears control hasil karenge. 2. Pattern ki high se upar ek stop-loss rakhe: Risk ko manage karne ke liye, traders ko pattern ki last candle ki high se upar ek stop-loss order lagana chahiye. Is level ko breakout point ke roop mein mana jaega aur iska ishaara hai ki buyers fir se control hasil kar sakte hain. -

#3 Collapse

Advance Block candlestick pattern ek bearish reversal pattern hota hai jo generally uptrend ke baad aata hai aur market mein weakness ko signal karta hai. Yeh pattern tab banta hai jab market mein bullish momentum kamzor pad raha hota hai aur price action apne peak par pohanch kar neeche ki taraf shift hona shuru karta hai. Traders aur investors is pattern ka istimaal karte hain taake market ki direction ko samajh sakein aur apne trading decisions ko accordingly adjust kar sakein. Yeh pattern teen consecutive bullish candlesticks se mil kar banta hai, jisme har ek candle ka body chhoti hoti jati hai aur upper wicks zyada lambi hoti hain. Iska matlab yeh hota hai ke buyers ab market ko upar push karne mein successful nahi ho rahe, aur selling pressure badh raha hai.

Advance Block Pattern Ki Structure

Advance Block pattern mein 3 bullish candlesticks hoti hain jo progressively weak hoti jati hain. Is pattern ka structure kuch is tarah se hota hai:- Pehli Candle: Pehli candle ek lambi bullish candle hoti hai jo uptrend ko continue karti hai. Yeh candle strong buying momentum ko reflect karti hai aur market ko upper side ki taraf push karti hai. Is candle ke formation ke baad market ka overall sentiment abhi bullish hota hai.

- Dusri Candle: Dusri candle bhi bullish hoti hai lekin pehli candle se chhoti hoti hai. Is candle ka body size kam hota hai aur upper wick lambi hoti hai. Yeh signal deta hai ke market mein buyers ka pressure pehle ke muqable mein kam ho raha hai. Iska matlab hai ke sellers market mein enter ho rahe hain aur price ko neeche push kar rahe hain, jis wajah se candle ke upar ek long wick banti hai.

- Teesri Candle: Teesri candle aur bhi chhoti hoti hai, aur iski upper wick aur lambi hoti hai. Yeh candle strong selling pressure ka indication deti hai. Buyers ka momentum lagatar kamzor ho raha hota hai, aur sellers ka dominance barh raha hota hai. Yeh candle bearish reversal ke signal ko confirm karti hai, aur traders ke liye yeh waqt hota hai ke wo apne long positions ko exit karen aur short selling ke liye tayar ho jayein.

Is pattern ki psychology ko samajhna zaroori hai, kyunki candlestick patterns ka asal kaam yeh hota hai ke market participants ke emotional aur psychological states ko chart ke zariye dikhaya jaye. Jab Advance Block pattern banta hai, to us waqt market ek uptrend mein hota hai aur buyers market ko upar le ja rahe hote hain. Lekin jaise jaise pattern aage barhta hai, buyers ka strength kamzor padne lagta hai.- Pehli Candle: Pehli candle market mein existing bullish trend ko continue karti hai. Buyers confident hote hain aur price ko upar push karte hain. Sellers abhi tak zyada active nahi hote, isliye price ek lambi bullish candle banata hai.

- Dusri Candle: Dusri candle ke time tak market mein thodi hesitation aa jati hai. Buyers ka confidence pehle ke muqable mein thoda kam ho jata hai, isliye candle ka body chhota hota hai. Upar wali wick kaafi lambi hoti hai, jo is baat ka indication hota hai ke jab buyers ne price ko upar push kiya to sellers ne usko neeche push kar diya.

- Teesri Candle: Teesri candle ke time tak market mein clearly weakness aa jati hai. Buyers ka pressure ab bilkul kamzor ho jata hai aur sellers zyada dominant ho jate hain. Yeh candle kaafi chhoti hoti hai, aur iska upper wick lamba hota hai jo yeh signal deta hai ke ab price upar jaane ki bajaye neeche aane ke liye tayar hai. Yeh bearish reversal ka confirmation hota hai.

Advance Block pattern trading mein ek ahem bearish reversal signal hota hai. Is pattern ko samajhna aur pehchanna bohot zaroori hai, kyunki yeh aapko market ke momentum ke kamzor hone ka waqt pe signal de deta hai. Jab bhi aap ek uptrend ke baad Advance Block pattern ko dekhen, to yeh aapke liye indication hota hai ke market ab reversal ke liye tayar hai.

Is pattern ka faida yeh hai ke yeh aapko selling pressure ke barhne ka early warning de deta hai. Uptrend mein hamesha yeh sawal hota hai ke kab price apni peak ko pohanch kar wapas neeche aayegi. Advance Block pattern aapko yeh hint deta hai ke buyers ka control kamzor pad raha hai aur sellers ka control barh raha hai.

Advance Block Pattern Ki Trading Strategy

Advance Block pattern ka use karke trading karte waqt kuch basic strategies ko follow karna hota hai. Is pattern ka core purpose yeh hota hai ke aapko bearish reversal ka signal dena, to aapko apni positions ko adjust karna hota hai accordingly. Trading strategy ko do major parts mein divide kiya ja sakta hai:- Existing Long Positions Ko Exit Karna: Agar aap uptrend mein long positions hold kar rahe hain aur Advance Block pattern banta dekhte hain, to yeh waqt hota hai ke aap apni positions ko exit kar lein. Yeh pattern signal karta hai ke market ab neeche aane wala hai, isliye long positions ko hold karna risk badha sakta hai.

- Short Selling Ka Plan Banana: Advance Block pattern ko dekh kar aap short selling ka bhi plan bana sakte hain. Yeh pattern kehti hai ke ab market mein bearish sentiment aa raha hai, aur price neeche aane ka potential zyada hai. Isliye short sellers ke liye yeh ek acha entry point ban sakta hai jab teesri candle complete ho jati hai aur selling pressure confirm ho jata hai.

Advance Block pattern ko trade karte waqt stop-loss set karna bohot important hota hai taake aap apne risk ko manage kar sakein. Is pattern mein short selling positions open karte waqt stop-loss ko resistance level ke thoda upar set karna chahiye. Teesri candle ka high ya dusri candle ka high ek acha stop-loss point ban sakta hai, kyunki agar price wahan tak wapas jaati hai to iska matlab yeh hoga ke pattern invalid ho gaya hai.

Advance Block Pattern Ki Confirmation

Jab bhi aap candlestick patterns ko trade karte hain, to confirmation signals lena zaroori hota hai. Sirf ek pattern ko dekh kar bina confirmation ke trade karna risky ho sakta hai. Advance Block pattern ko confirm karne ke liye aap kuch aur indicators ka use kar sakte hain:- Volume Analysis: Jab Advance Block pattern banta hai to aapko volume ka analysis karna chahiye. Agar teesri candle ke sath volume mein kami dekhi jaye, to yeh is baat ka indication hota hai ke buyers ka interest khatam ho raha hai. Agar selling pressure ke sath volume increase hoti hai, to yeh bearish reversal ko aur zyada confirm kar deta hai.

- Moving Averages: Aap moving averages ka use karke pattern ki confirmation le sakte hain. Agar Advance Block pattern ke baad price moving average ke neeche close hota hai, to yeh ek strong bearish signal hota hai. Especially, agar price 50-period ya 200-period moving average ke neeche close kare to yeh long-term reversal ka indication hota hai.

- Relative Strength Index (RSI): RSI ek momentum indicator hai jo overbought aur oversold conditions ko measure karta hai. Agar Advance Block pattern ke time RSI overbought zone mein ho (70 ke upar), to yeh is baat ka indication hota hai ke market ab reverse hone ke liye tayar hai.

- Fibonacci Retracement: Fibonacci retracement levels ka use karke bhi aap confirmation le sakte hain. Agar Advance Block pattern ke baad price Fibonacci resistance levels ko break nahi kar pata aur neeche aata hai, to yeh bearish reversal ka confirmation hota hai.

Advance Block pattern ko effectively trade karne ke liye aapko ideal market conditions ka dhyan rakhna hota hai. Yeh pattern tab zyada effective hota hai jab market ek clear uptrend mein ho aur bullish momentum peak par ho. Market ka volume zyada hona chahiye, kyunki jab volume zyada hota hai to candlestick patterns zyada reliable hote hain.

Is pattern ka asar tab bhi zyada hota hai jab overall market sentiment bullish ho lekin overbought condition mein ho. Jab market overbought hota hai, to price reversal ka chance zyada hota hai, aur Advance Block pattern is reversal ka pehla sign hota hai.

Advance Block Pattern Ki Limitations

Jaise ke har technical analysis pattern ki apni limitations hoti hain, waisa hi Advance Block pattern ke sath bhi hota hai. Kuch main limitations yeh hain:- False Signals: Kabhi kabhi market mein Advance Block pattern banta hai lekin price uske baad bhi upar jaata rehta hai. Is wajah sepattern ka follow-up confirmation signals ka use karna zaroori hota hai.

- Short-Term Reversals: Yeh pattern short-term reversals ka signal deta hai, lekin har baar long-term trend change nahi hota. Isliye long-term positions open karne se pehle aapko doosre indicators ka bhi istimaal karna chahiye.

- Market Conditions: Yeh pattern har market condition mein kaam nahi karta. Sideways market ya low volume market mein is pattern ka impact zyada strong nahi hota.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Advance Block Candlestick Pattern

Advance block candlestick pattern aik technical analysis ka tool hai jo traders ko market ki bullish trend ki shanakht karne mein madad deta hai. Ye pattern teen consecutive candlesticks par mabni hota hai jo ek doosre ke upar close hote hain, is se yeh samajh aata hai ke market mein bullish momentum barh raha hai. Is article mein hum advance block pattern ki khasiyat, is ke maqsad aur is se trading kaise ki jati hai, is par roshni dalenge.

Advance Block Pattern ki Shanakht

Advance block pattern mein teen candlesticks hoti hain. Pehli candlestick ek strong bullish candle hoti hai jo ke achi volume ke sath banti hai. Dosri aur teesri candlestick bhi bullish hoti hain, lekin in ki body pehli candlestick ki body se chhoti hoti hai. Ye pattern aksar market ke peak par ya phir bullish trend ke dauran dekha jata hai.

Candlestick Analysis ka Ahmiyat

Candlestick analysis trading ka ek bht hi ahm hissa hai. Har candlestick price action ka ek aik pehlu dikhati hai. Candlestick patterns traders ko market sentiment aur possible price reversals ki soorat mein signals dete hain. Isliye, advance block pattern ko samajhna har trader ke liye zaroori hai.

Pattern ke Characteristics

Advance block pattern ki kuch khasiyat hain. Pehli, ye pattern bullish sentiment ko dikhata hai. Doosri, ye typically strong bullish trends ke doran banata hai. Teesri, is pattern ki candlesticks ke beech ki distance choti hoti hai, jo ke market ki consolidation ya bullish momentum ki nishani hoti hai.

Market Sentiment ka Asar

Market sentiment ko samajhna trading mein bht ahmiyat rakhta hai. Jab traders bullish hain, to wo kharidari karte hain, jisse price barhta hai. Advance block pattern is bullish sentiment ka ek nishan hai. Jab ye pattern banta hai, to is ka matlab hota hai ke market mein kharidari ka pressure hai, jo aage ja kar price ko aur barhane ki taraf le ja sakta hai.

Entry Points ka Taayun

Advance block pattern ke tamam hone par traders ko entry point ka taayun karna chahiye. Ye entry point usually teesri candlestick ke high par hota hai. Is waqt trader ko ye dekhna chahiye ke kya market ke fundamental ya technical factors bhi bullish trend ko support karte hain ya nahi. Is se trader ko risk ko kam karne aur profit banane mein madad milti hai.

Stop-Loss Orders ka Istemaal

Jab bhi koi trader kisi pattern ke zariye trade karta hai, stop-loss order ka istemaal zaroori hai. Advance block pattern ke saath, stop-loss usually pehli candlestick ke low ke neeche lagaya jata hai. Ye risk management ka ek zaroori hissa hai jo losses se bachne mein madad karta hai.

Profit Taking Strategies

Profit taking strategies ka hona bhi zaroori hai. Advance block pattern ke saath, traders ko sochna chahiye ke wo apne profits kaise capture karenge. Ye targets traders ke risk-reward ratio par mabni hota hai. Aam tor par, trader pehli candlestick ki height ka istemal kar ke ek target set karte hain.

Advanced Analysis Techniques

Jab advance block pattern ki analysis ki jaye, to kuch advanced analysis techniques ka istemal bhi kiya ja sakta hai. Ismein volume analysis, market trends aur momentum indicators shamil hain. Ye techniques traders ko market ki halat ko behter samajhne aur trade decisions lene mein madad karti hain.

Common Mistakes to Avoid

Har trader ko kuch aam ghaltiyan hoti hain jo wo karte hain jab wo advance block pattern ko trade karte hain. Sab se pehli ghalti hai confirmation ka intezar na karna. Jab traders bina kisi confirmation ke trade karte hain, to unka risk barh jata hai. Doosri ghalti hai stop-loss order na lagana, jo ke losses ko barhata hai.

Importance of Confirmation

Confirmation ka ahmiyat trading mein bht zyada hai. Jab advance block pattern banta hai, to traders ko is pattern ke baad ek bullish confirmation ka intezar karna chahiye, jaise ke higher volume ke sath ek breakout. Ye confirmation trader ko market ki asli direction samajhne mein madad karta hai.

Psychological Aspects of Trading

Trading mein psychological aspects ka bhi ahmiyat hota hai. Jab traders advance block pattern ka intezar karte hain, to unhe apne emotions par control rakhna hota hai. Fear aur greed aksar traders ko galat decisions lene par majboor karte hain. Isliye, discipline aur patience ka hona trading mein zaroori hai.

Conclusion

Advance block candlestick pattern aik powerful tool hai jo traders ko bullish trends ko samajhne aur unka faida uthane mein madad karta hai. Ye pattern teen consecutive bullish candlesticks par mabni hota hai aur market ke strong bullish momentum ki nishani hai. Lekin, is pattern ka istemal karte waqt traders ko risk management, confirmation aur psychological aspects ka khayal rakhna chahiye. Is tarah, wo is pattern se faida uthane mein kamyab ho sakte hain. -

#5 Collapse

Progress Piece candlestick design ek bearish inversion design hota hai jo by and large uptrend ke baad aata hai aur advertise mein shortcoming ko flag karta hai. Yeh design tab banta hai hit advertise mein bullish energy kamzor cushion raha hota hai aur cost activity apne crest standard pohanch kar neeche ki taraf move hona shuru karta hai. Dealers aur financial specialists is design ka istimaal karte hain taake advertise ki heading ko samajh sakein aur apne exchanging choices ko in like manner alter kar sakein. Yeh design high schooler successive bullish candlesticks se mil kar banta hai, jisme har ek candle ka body chhoti hoti jati hai aur upper wicks zyada lambi hoti hain. Iska matlab yeh hota hai ke buyers ab showcase ko upar thrust karne mein fruitful nahi ho rahe, aur offering weight badh raha hai.

Advance Square Design Ki Structure

Advance Square design mein 3 bullish candlesticks hoti hain jo dynamically powerless hoti jati hain. Is design ka structure kuch is tarah se hota hai:

Pehli Candle: Pehli candle ek lambi bullish candle hoti hai jo uptrend ko proceed karti hai. Yeh candle solid buying force ko reflect karti hai aur showcase ko upper side ki taraf thrust karti hai. Is candle ke arrangement ke baad showcase ka generally opinion abhi bullish hota hai.

Dusri Candle: Dusri candle bhi bullish hoti hai lekin pehli candle se chhoti hoti hai. Is candle ka body estimate kam hota hai aur upper wick lambi hoti hai. Yeh flag deta hai ke advertise mein buyers ka weight pehle ke muqable mein kam ho raha hai. Iska matlab hai ke venders advertise mein enter ho rahe hain aur cost ko neeche thrust kar rahe hain, jis wajah se candle ke upar ek long wick banti hai.

Teesri Candle: Teesri candle aur bhi chhoti hoti hai, aur iski upper wick aur lambi hoti hai. Yeh candle solid offering weight ka sign deti hai. Buyers ka energy lagatar kamzor ho raha hota hai, aur dealers ka dominance barh raha hota hai. Yeh candle bearish inversion ke flag ko affirm karti hai, aur dealers ke liye yeh waqt hota hai ke wo apne long positions ko exit karen aur brief offering ke liye tayar ho jayein.

Advance Square Design Ka Psychology

Is design ki brain research ko samajhna zaroori hai, kyunki candlestick designs ka asal kaam yeh hota hai ke showcase members ke passionate aur mental states ko chart ke zariye dikhaya jaye. Hit Development Square design banta hai, to us waqt showcase ek uptrend mein hota hai aur buyers advertise ko upar le ja rahe hote hain. Lekin jaise jaise design aage barhta hai, buyers ka quality kamzor padne lagta hai.

Pehli Candle: Pehli candle showcase mein existing bullish slant ko proceed karti hai. Buyers sure hote hain aur cost ko upar thrust karte hain. Venders abhi tak zyada dynamic nahi hote, isliye cost ek lambi bullish candle banata hai.

Dusri Cand Dusri candle ke time tak showcase mein thodi wavering aa jati hai. Buyers ka certainty pehle ke muqable mein thoda kam ho jata hai, isliye candle ka Dosre candle:body chhota hota hai. Upar wali wick kaafi lambi hoti hai, jo is baat ka sign hota hai ke poke buyers ne cost ko upar thrust kiya to venders ne usko neeche thrust kar diya.

Teesri Candle: Teesri candle ke time tak advertise mein clearly shortcoming aa jati hai. Buyers ka weight ab bilkul kamzor ho jata hai aur venders zyada overwhelming ho jate hain. Yeh candle kaafi chhoti hoti hai, aur iska upper wick lamba hota hai jo yeh flag deta hai ke ab cost upar jaane ki bajaye neeche aane ke liye tayar hai. Yeh bearish inversion ka affirmation hota hai.

Advance Piece Design Ka Significance Aur Importance

Advance Piece design exchanging mein ek ahem bearish inversion flag hota hai. Is design ko samajhna aur pehchanna bohot zaroori hai, kyunki yeh aapko advertise ke force ke kamzor sharpen ka waqt pe flag de deta hai. Poke bhi aap ek uptrend ke baad Progress Piece design ko dekhen, to yeh aapke liye sign hota hai ke showcase ab inversion ke liye tayar hai.

Is design ka faida yeh hai ke yeh aapko offering weight ke barhne ka early caution de deta hai. Uptrend mein hamesha yeh sawal hota hai ke kab cost apni crest ko pohanch kar wapas neeche aayegi. Progress Piece design aapko yeh indicate deta hai ke buyers ka control kamzor cushion raha hai aur venders ka control barh raha hai.

Advance Square Design Ki Exchanging Strategy

Advance Piece design ka utilize karke exchanging karte waqt kuch fundamental procedures ko take after karna hota hai. Is design ka center reason yeh hota hai ke aapko bearish inversion ka flag dena, to aapko apni positions ko alter karna hota hai in like manner. Exchanging methodology ko do major parts mein isolate kiya ja sakta hai:

Existing Long Positions Ko Exit Karna: Agar aap uptrend mein long positions hold kar rahe hain aur Development Square design banta dekhte hain, to yeh waqt hota hai ke aap apni positions ko exit kar lein. Yeh design flag karta hai ke advertise ab neeche aane wala hai, isliye long positions ko hold karna hazard badha sakta hai.

Short Offering Ka Arrange Banana: Progress Piece design ko dekh kar aap brief offering ka bhi arrange bana sakte hain. Yeh design kehti hai ke ab advertise mein bearish opinion aa raha hai, aur cost neeche aane ka potential zyada hai. Isliye brief venders ke liye yeh ek acha section point boycott sakta hai poke teesri candle total ho jati hai aur offering weight affirm ho jata hai.

Stop-Loss Placement

Advance Piece design ko exchange karte waqt stop-loss set karna bohot vital hota hai taake aap apne hazard ko oversee kar sakein. Is design mein brief offering positions open karte waqt stop-loss ko resistance level ke thoda upar set karna chahiye. Teesri candle ka tall ya dusri candle ka tall ek acha stop-loss point boycott sakta hai, kyunki agar cost wahan tak wapas jaati hai to iska matlab yeh hoga ke design invalid ho gaya hai.

Advance Square Design Ki Confirmation

Jab bhi aap candlestick designs ko exchange karte hain, to affirmation signals lena zaroori hota hai. Sirf ek design ko dekh kar bina affirmation ke exchange karna unsafe ho sakta hai. Development Square design ko affirm karne ke liye aap kuch aur markers ka utilize kar sakte hain:

Volume Investigation: Hit Development Square design banta hai to aapko volume ka examination karna chahiye. Agar teesri candle ke sath volume mein kami dekhi jaye, to yeh is baat ka sign hota hai ke buyers ka intrigued khatam ho raha hai. Agar offering weight ke sath volume increment hoti hai, to yeh bearish inversion ko aur zyada affirm kar deta hai.

Moving Midpoints: Aap moving midpoints ka utilize karke design ki affirmation le sakte hain. Agar Development Square design ke baad cost moving normal ke neeche near hota hai, to yeh ek solid bearish flag hota hai. Particularly, agar cost 50-period ya 200-period moving normal ke neeche near kare to yeh long-term inversion ka sign hota hai.

Relative Quality List (RSI): RSI ek energy marker hai jo overbought aur oversold conditions ko degree karta hai. Agar Progress Piece design ke time RSI overbought zone mein ho (70 ke upar), to yeh is baat ka sign hota hai ke showcase ab switch sharpen ke liye tayar hai.

Fibonacci Retracement: Fibonacci retracement levels ka utilize karke bhi aap affirmation le sakte hain. Agar Development Square design ke baad cost Fibonacci resistance levels ko break nahi kar pata aur neeche aata hai, to yeh bearish inversion ka affirmation hota hai.

Advance Square Design Ke Liye Perfect Advertise Conditions

Advance Square design ko viably exchange karne ke liye aapko perfect advertise conditions ka dhyan rakhna hota hai. Yeh design tab zyada successful hota hai hit advertise ek clear uptrend mein ho aur bullish energy top standard ho. Advertise ka volume zyada hona chahiye, kyunki hit volume zyada hota hai to candlestick designs zyada dependable hote hain.

Is design ka asar tab bhi zyada hota hai poke by and large advertise opinion bullish ho lekin overbought condition mein ho. Hit advertise overbought hota hai, to cost inversion ka chance zyada hota hai, aur Development Square design is inversion ka pehla sign hota hai.

Advance Square Design Ki Limitations

Jaise ke har specialized investigation design ki apni confinements hoti hain, waisa howdy Development Piece design ke sath bhi hota hai. Kuch primary impediments yeh hain:

False Signals: Kabhi kabhi advertise mein Development Square design banta hai lekin cost uske baad bhi upar jaata rehta hai. Is wajah sepattern ka follow-up affirmation signals ka utilize karna zaroori hota hai.

Short-Term Inversions: Yeh design short-term inversions ka flag deta hai, lekin har baar long-term drift alter nahi hota. Isliye long-term positions open karne se pehle aapko doosre pointers ka bhi istimaal karna chahiye.

Market Conditions: Yeh design har advertise condition mein kaam nahi karta. Sideways advertise ya moo volume showcase mein is design ka affect zyada solid nahi hota. -

#6 Collapse

Advanced Block Candlestick Pattern

Advanced Block aik bearish reversal candlestick pattern hai jo aksar uptrend mein appear hota hai. Is pattern ka matlab hota hai ke buying pressure kam ho raha hai aur market reversal ya slowdown kar sakti hai.

Pattern Ka Structure- First Candle: Aik strong bullish candle jiska real body bara hota hai, jo buying pressure ko show karta hai.

- Second Candle: Dusri bullish candle jo pehli se choti hoti hai aur upper wick hoti hai, jo sellers ki mojoodgi ko indicate karti hai.

- Third Candle: Aik aur bullish candle jo aur bhi choti hoti hai aur zyada lambi upper wick hoti hai, jo buyers ki weakness ko dikhati hai.

- Market Ki Psychology

Pehli candle strong buying momentum show karti hai.Dusri candle mein hesitation nazar - aata hai, kyunki iska real body chota hota hai aur upper wick bhi hoti hai.

- Teesri candle aur bhi kamzor hoti hai, aur iska real body sabse chota hota hai, jo buying pressure ke weak hone ka signal hai.

- Iska matlab hota hai ke buyers control lose kar rahe hain aur market mein sellers ka pressure barh sakta hai.

- Confirmation Signals

Bearish candle agar is pattern ke baad aajaye to reversal confirm hota hai.to signal aur strong ho jata hai. - Yeh pattern resistance level ya strong uptrend ke end par zyada reliable hota hai.

- Trading Strategy

Entry Point: Jab bearish candle confirm ho jaye, tab short (sell) trade lena safe hota hai. - Stop Loss: Recent high se thoda upar lagana chahiye.

- Profit Target: Support level ya previous swing low pe set karna best hota hai.

- Zyada volume bearish candle par aaye

- to signal aur strong ho jata hai.

- Yeh pattern resistance level ya strong uptrend ke end par zyada reliable hota hai.

- Trading Strategy

Entry Point: Jab bearish candle confirm ho jaye, tab short (sell) trade lena safe hota hai. - Stop Loss: Recent high se thoda upar lagana chahiye.

- Profit Target: Support level ya previous

- swing low pe set karna best hota hai.

- Yeh pattern professional traders use karte hain taake trend reversal ko pehchan sakein aur timely trades execute kar sakein

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Advanced candlestick pattern in Forex trading:

Advanced Block Candlestick Pattern ek bearish reversal pattern hai jo market ke bullish trend ke baad appear hota hai. Ye pattern indicate karta hai ke buyers ki strength weak ho rahi hai aur market reversal ya slowdown ka signal de raha hai.

Pattern Ki Pehchan:

Advanced Block pattern 3 bullish (green) candlesticks ka sequence hota hai jo gradually weak hoti hain. Inka structure kuch is tarah hota hai:

- First Candle: Strong bullish candle jo trend continuation ka signal deti hai.

- Second Candle: Pehli candle se chhoti hoti hai aur iska upper wick bara hota hai, jo resistance aur selling pressure ko show karta hai.

- Third Candle: Aur bhi chhoti hoti hai, jiska upper wick bara hota hai, jo dikhata hai ke buyers momentum lose kar rahe hain.

Agar Advanced Block pattern strong resistance level par form ho raha ho, to ye bearish reversal ka strong signal ho sakta hai. Is pattern ko doosre technical indicators (e.g., RSI, MACD) ke sath combine karna best strategy hoti hai taake confirmation mil sake.

Conclusion:

Confirmation:Advanced Block pattern ka confirmation lena zaroori hai taake false signals se bacha ja sake. Is pattern ko confirm karne ke liye following techniques use ki ja sakti hain:

Bearish Candlestick Formation (Strong Confirmation):

Agar Advanced Block pattern ke baad ek strong bearish candle form ho jaye (jaise ke Bearish Engulfing ya Dark Cloud Cover), to ye confirmation hoti hai ke trend reverse ho sakta hai.

Volume Analysis:

Advanced Block pattern ke douran volume gradually decrease hota hai, jo bullish momentum ke weaken hone ka signal deta hai Agar pattern complete hone ke baad bearish candle ke sath volume increase ho jaye, to bearish reversal ka confirmation strong ho jata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:06 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим